Pharma Equity Group A/S (“PEG” or “the Company”), listed on the Nasdaq Copenhagen Stock Exchange, places a strong emphasis on its subsidiary, Reponex Pharmaceuticals A/S (“Reponex”). Through the Company’s repositioning strategy, Reponex finds new uses for active substances that are being used in other treatments. Currently, Reponex has a pipeline of six product candidates in Phase II, targeting therapeutic areas such as Peritonitis, Chronic Wounds, IBD (Crohn’s Disease and Pouchitis), and Colorectal Cancer. PEG’s strategy is to out-license the clinical programs after the Phase II trial to a pharmaceutical company capable of bringing the drugs to market.

Pressmeddelanden

Successful Execution Hinges on Financing

With a new strategy announced in H1-25, Pharma Equity Group (“PEG” or “the Company”) is transitioning toward a diversified investment platform within life sciences , anchored by two Phase II assets with near-term commercialization potential: RNX-011 (peritonitis) and RNX-051 (colorectal cancer). Both are expected to enter pivotal trials in H2-25, with partnering discussions aimed at de-risking execution and securing co-funding. The strategy leverages a capital-light model of drug repositioning and out-licensing, enabling PEG to scale efficiently while maintaining a lean cost base. Supported by a strengthened leadership team and sharpened strategic focus, the Company is well-positioned to unlock meaningful shareholder value, contingent on securing adequate funding to capitalize on upcoming clinical and comercial catalysts. Reflecting the clear prioritization of RNX-011 and RNX-051, we have revised our estimates, resulting in a potential present value of DKK 0.6 (0.8) per share in our Base scenario, derived by a rNPV-model.

- Strategic Shift Aimed at Diversifying the Portfolio

During Q2-25, PEG launched a revised investment strategy, repositioning the Company as a diversified life science investment platform and expanding beyond pharmaceuticals into Medical Devices and MedTech-segments with shorter development timelines, lower capital intensity, and streamlined regulatory pathways. This marks a clear break from the historic pharma-centric model, aiming to diversify risk and capture value across multiple innovation cycles. However, Reponex remains a core portfolio company under this new framework. The strategy is reinforced by the appointment of Christian Tange as CEO, who brings more than 25 years of experience in financial transformation and transactions. We emphasize that a successful capital raise will be a critical prerequisite for realizing the long-term value potential embedded in this revised investment platform.

- Clinical Progress and Partnering Efforts

PEG has streamlined the focus to RNX-011 and RNX-051, the two programs with the clearest paths to commercialization. RNX-011 is expected to enter Phase II during Q3-25, with management simultaneously seeking a co-development partner for Phase IIb, which would materially reduce costs and pave the way for a licensing deal. RNX-051 is also advancing toward a Phase IIb trial, where a strategic partnership could de-risk execution and unlock significant licensing potential.

- Streamlined Focus Reflected in Our Forecasts

We have adjusted our forecasts to reflect PEG’s prioritization of RNX-011 and RNX-051, the candidates with the clearest near-term commercial potential. Consequently, revenue from RNX-041 and RNX-021-23 is deferred to 2027 and 2028, respecttively. While this reduces the breadth of near-term pipeline activity, it improves execution visibility and increases the likelyhood of reaching value-inflection points despite current funding constraints. The current share price contrasts sharply with our Base case valuation, underscoring the binary nature of the case where licensing agreements will be the decisive catalysts for unlocking shareholder value.

7

Värdedrivare

1

Historisk lönsamhet

7

Ledning & Styrelse

8

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Advanced Discussions with Prospective Licensing Partners

Pharma Equity Group (“PEG” or “the Company”) has recently refined the Company’s execution strategy, prioritizing resources toward three key candidates, RNX-051, RNX-011, and RNX-041, where the Company identifies the shortest path to market and strong interest from potential licensing partners. Discussions with prospective partners have advanced, particularly for RNX-051, with negotiations intensifying in Q1-25 and the Company anticipating formalizing agreements in H2-25. Supported by a solid financial foundation following the Q4-24 directed share issue, a cost-efficient operational model, and expected revenues in H2-25, PEG is estimated to be financed until Q2-26. With a newly appointed executive team bringing a proven track record in funding, strategic execution, and clinical acceleration, PEG is well-positioned to deliver on the Company’s new strategy. Analyst Group has made slight adjustments to the estimates for 2025-2027, resulting in a potential present market value of DKK 959m, corresponding to DKK 0.8 (0.8) per share in a Base scenario.

- Ongoing Discussions with Potential Licensing Partners

Interest from potential licensing partners has gained momentum in Q1-25 with PEG advancing discussions particularly regarding RNX-051, the Company’s candidate targeting Colon Adenomas and Colon Cancer. PEG expects to finalize agreements in H2-25, as reflected in the Company’s DKK 11m revenue guidance for 2025, primarily driven by upfront payments. Simultaneously, PEG’s focus on cost efficiency is expected to narrow the pre-tax loss to DKK 4–7m, which would mark a notable improvement from 2024. Enhanced financial flexibility strengthens PEG’s ability to capitalize on licensing opportuneities, which Analyst Group identifies as a pivotal catalyst for 2025.

- Financial Flexibility Supports Accelerated Development

During Q4-24, PEG strengthened the Company’s financial position through a directed share issue, raising DKK 51.1m in gross proceeds, including DKK 12.6m from convertible debt conversion. This non-cash transaction resulted in a net cash inflow of DKK 38.5m, with DKK 25.8m allocated to debt reduction, leaving DKK 12.7m in net proceeds. The shares were issued at DKK 0.25, a 19% premium, reflecting strong investor confidence in PEG’s prospects. In Q1-25, PEG secured additional financial headroom through loans and commitments totaling approx. DKK 13m, providing an estimated 12-month runway. Further funding discussions, primarily regarding convertible loans, are ongoing with both existing and new investors.

- Key Value Drivers Emerging in 2025

In light of the Q4 report, we have lowered our 2025-2027 revenue estimates. However, with a more streamlined cost structure expected, we anticipate an improved pre-tax loss (EBT) in the short term. Analyst Group reiterates the motivated potential present value of DKK 0.8 (0.8) per share in a Base scenario, as we see 2025 as a pivotal year for PEG, with substantial licensing triggers yet to be fully reflected in the Company’s valuation.

7

Värdedrivare

1

Historisk lönsamhet

7

Ledning & Styrelse

8

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Strengthened Balance Sheet Facilitates Continued Development

Following the end of Q3-24, Pharma Equity Group (“PEG” or “the Company”) secured additional funding through a directed share issue, with a significant portion allocated to debt reduction. This strengthens the Company’s financial position, providing increased flexibility to advance the development of PEG’s drug candidates while enhancing the Company’s negotiating leverage with potential licensing partners. Furthermore, PEG recently obtained patent protection in Japan, a key future market, for the treatment of colorectal cancer with RNX-051, valid until 2039. Following a reassessment of market conditions, an updated royalty rate has been applied, resulting in a potential present market value of DKK 950m, corresponding to DKK 0.8 (1.2) per share in a Base scenario.

- Successful Capital Increase Creates Financial Flexibility

In October, PEG successfully completed a directed share issue, issuing 204,592,776 new shares at a subscription price of DKK 0.25 per share, reflecting a premium of approx. 19% compared to the prior trading day’s closing price. The gross proceeds amounted to DKK 51.1m, which included the conversion of DKK 12.6m in convertible debt. Excluding the non-cash component from the debt conversion, the cash proceeds totaled DKK 38.5m, of which DKK 25.8m was allocated to the reduction of financial debt, resulting in net cash proceeds of DKK 12.7m. This capital raise has materially strengthened the Company’s financial position, improving the balance sheet and overall capital structure, thereby enhancing financial flexibility for continued clinical development and negotiations with potential licensing partners.

- Solid Cost Control

During Q3-24, the Company’s operating expenses totaled approx. DKK 5.2m (5.7), reflecting an 8% Y-Y decrease and a 5% Q-Q increase. A detailed analysis of OPEX shows that R&D expenses declined by 29% Y-Y and 3% Q-Q, while administrative expenses rose by 8% Y-Y and 10% Q-Q. The modest sequential increase in the cost base is a natural step as PEG advances its development efforts, taking strides toward securing lucrative licensing agreements. Analyst Group considers PEG’s cost management to be solid, as reflected in the maintained full-year 2024 guidance, which projects EBT in the range of approx. DKK -24m to -29m (excluding potential gains or losses related to the Portinho receivable).

- Revised Valuation Range

Following a reassessment of market conditions and comparable licensing agreements, adjusted royalty rates has been applied, resulting in a potential present market value of DKK 950m, equivalent to DKK 0.8 (1.2) per share. For a detailed explanation of the revised royalty rate, please see page 4. Analyst Group remains of the opinion that the substantial potential of PEG’s drug candidates is not fully reflected in the current valuation, presenting an attractive risk/reward profile. We believe that the low liquidity of the share is one of the key factors contributing to the compressed share price.

6

Värdedrivare

1

Historisk lönsamhet

7

Ledning & Styrelse

8

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Exploring Opportunities for a Capital Increase

Pharma Equity Group (“PEG” or “the Company”) presented a Q2-report characterized by further advancements in the clinical development (RNX-051), effective cost management, and an intensified focus on securing additional capital. The Company is evaluating options for a capital increase, which is essential for supporting further clinical advancements and for having the financial capacity to explore potential licensing agreements. In light of facing financial pressures, PEG demonstrated robust cost control, evidenced by a 1% increase in total operating expenses Y-Y and a -27% decrease Q-Q. Looking ahead, Analyst Group will monitor the continued clinical progression, the financial position, the EMA’s decision regarding orphan drug designation for RNX-041, the receivable from Portinho S.A., and potential discussions with licensing partners concerning PEG’s strong portfolio of product candidates in Phase II. Analyst Group has made minor adjustments to the discount rate and forecasts, resulting in a revised potential present value of DKK 1.2 (1.4) per share in a Base scenario.

- Improved Cost Control Q-Q

During the second quarter, PEG reported operating costs of approx. DKK 5m, up from DKK 4.9m in Q2-23, reflecting a 1% increase Y-Y and a -27% reduction Q-Q. A detailed breakdown of the cost base reveals a decrease in R&D-expenditures of -27% Y-Y and -28% Q-Q, while administrative costs increased by 30% Y-Y but decreased sequentially by -26% compared to Q1-24. PEG upholds the Company’s guidance for FY2024, with expected EBT in the range of DKK -24 to -29 million, excluding any potential gains or losses related to the Portinho receivable. Analyst Group views the improved cost control Q-Q as crucial given the current liquidity position. However, we anticipate that increased investments in R&D will be necessary in the coming years to achieve further clinical advancements going forward.

- Legal Actions to Redeem Receivable from Portinho S.A.

PEG filed a summons with the Maritime and Commercial High Court against Portinho S.A. during Q2-24 to recover the receivable. As of the end of June, the receivable amounted to EUR 11.0m, including agreed interest, which corresponds to DKK 82.1m. Although Analyst Group has not factored this receivable into PEG’s valuation, it could be crucial for sustaining the Company financially and providing additional upside to the valuation if successfully recovered.

- Revised Valuation Range

Following minor adjustments to the discount rate (WACC) to account for increased financial risk, as well as subtle revisions to the long-term forecast, a potential present market value of DKK 1,243m is derived using an rNPV model, equivalent to DKK 1.2 (1.4) per share. Analyst Group maintains that the substantial potential in PEG’s drug candidates is not currently reflected in the Company’s valuation.

6

Värdedrivare

1

Historisk lönsamhet

7

Ledning & Styrelse

8

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Aims to Strengthening the Company’s Financial Position

Pharma Equity Group (“PEG” or “the Company”) continues to make clinical progress, as demonstrated by the positive final results obtained from the Phase II clinical proof-of-concept trial (RNX-051). Additional highlights include the granted patents for RNX-051 and RNX-022 in the EU. The cost base remained consistent with Q4-23, and PEG maintains the Company’s guidance of an EBT in the range of DKK -24 to -29m for 2024E, which is in line with our estimates. The burn rate increased during the quarter, as did the need for capital to sustain operations, which is reflected in the additional convertible loans totaling DKK 8.4m during Q1-24. Looking ahead, we will monitor the clinical progress and the EMA’s decision on receiving approval for RNX-041 regarding orphan drug designation. Additionally, hiring the right personnel could accelerate licensing agreements, serving as a near-term catalyst. Analyst Group leaves the forecast unchanged and reiterates the motivated potential present value of DKK 1.4 (1.4) per share in a Base scenario.

- Clinical Progression and Granted Patents

During Q1-24, the Company obtained positive final results from the Phase II clinical proof-of-concept trial of the drug candidate RNX-051, known as the MEFO study. The results indicate a clear path forward to assess whether treatment with RNX-051, as a single or repeated dose, in patients with intestinal adenomas, will prevent the formation of adenomas. The IP portfolio is strengthened by the EPO’s approval of patents for colorectal cancer (RNX-051) as well as drug compositions for promoting the healing of wounds (RNX-022), with validity extending until 2035 and 2039, respectively. Analyst Group considers the clinical and IP developments as crucial operational steps, positioning the Company more favorably in terms of discussions with potential licensing partners.

- Changes in the Capital Structure

PEG is currently exploring the possibility of strengthening the Company’s balance sheet through a capital increase at market price, which, according to Analyst Group, is a necessary step to secure the financial headroom needed to act opportunistic, particularly regarding clinical development and exploring licensing agreements. The cash balance amounted to DKK 2.2m at the end of March, while net debt increased from DKK 25.5m at the end of Q4-23 to DKK 36.6m at the end of Q1-24. Moreover, the unused credit facility amounted to DKK 10m at the end of March.

- Valuation Remains Intact in a Base Scenario

Analyst Group’s forecast is unchanged but includes some adjustments to the LoA in the Bear scenario to reflect the uncertainty regarding the regulatory process and give a more realistic picture of the wide range of potential outcomes. However, Analyst Group maintains the opinion that the vast potential in PEG’s drug candidates is not reflected in today’s valuation and hence reiterates our motivated potential present value of DKK 1.4 (1.4) per share in a Base scenario.

6

Värdedrivare

1

Historisk lönsamhet

7

Ledning & Styrelse

8

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Clinical Development Progression and Strengthened IP-Portfolio

Pharma Equity Group (“PEG” or “the Company”) presented a Q4-report marked by advancements in the clinical development, the addition of two well-experienced board members, and a bolstered IP portfolio. As PEG’s broad Phase II-pipeline progresses further towards potential licensing agreements, the cost base and burn rate are on the rise, as evidenced by the R&D and administrative costs, marking a 26% and 15% increase Q-Q, respectively. PEG has taken critical measures to reinforce the balance sheet and to ensure a solid financial position going into 2024. These measures include the utilization of convertible loans and the securing of a new credit facility after the end of Q4-23. Analyst Group derives a potential present value of DKK 1,448, equivalent to DKK 1.4 (1.4) per share in a Base scenario.

- Clinical Progression Remains on Track

During Q4-23, the Company unveiled encouraging preliminary findings from the Phase II clinical trial of the drug candidate RNX-051, successfully achieving the trial’s primary endpoints. The comprehensive analysis of the study’s outcomes is anticipated to be disclosed in early 2024, marking a short-term value driver.

- Strengthened IP-Portfolio

Apart from clinical progression, protecting the IP-rights is a cornerstone in the pharmaceutical industry. During the quarter, PEG obtained a granted patent in the US for a method of treatment using its topical wound-healing composition, and following the end of Q4-23, the Company was granted EU patents for drug candidates RNX-051 and RNX-022. Both the US and the EU represent key markets for PEG, and Analyst Group considers these milestones pivotal in the Company’s IP-strategy. A reinforced IP-portfolio not only offers legal protection for the pipeline candidates but also serves as substantial assets during negotiations with potential licensing partners.

- Enhanced Financial Position

During Q4-23 and the beginning of 2024, PEG successfully issued convertible loans totaling DKK 16m and secured a new credit facility, expanding the available credit line to DKK 12.6m. The cash balance at the end of Q4-23 amounted to DKK 4.2m, and with an estimated monthly burn rate of DKK -2.0m, reflecting a period of increased R&D and administrative costs, Analyst Group estimates that PEG will be adequately financed throughout 2024, all else being equal. As PEG relies on external financing until potential licensing agreements materialize, the enhanced financial position is vital.

- Valuation Range Remains Intact

After making slight adjustments to the estimated cost base, Analyst Group maintains the opinion that the vast potential in PEG’s drug candidates is not reflected in today’s valuation. A potential present market value of DKK 1,448m is derived through a rNPV-model, equivalent to DKK 1.4 (1.4) per share.

6

Värdedrivare

1

Historisk lönsamhet

7

Ledning & Styrelse

7

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

A Pharma Company with Lower Risk but Equivalent Upside Potential

Pharma Equity Group (“PEG” or “the Company”), through the Company’s subsidiary, Reponex, employs a drug repositioning strategy, which involves finding new uses for active substances used in previous recognized treatments, thus allowing the Company to circumvent phase I trials. PEG has a pipeline of six candidates in Phase II, targeting therapeutic areas such as Peritonitis, Chronic Wounds, IBD, and Colorectal Cancer, where there is currently no adequate treatment. The business strategy involves out-licensing the programs after Phase II to a pharma company capable of bringing the drugs to the market. PEG’s strategy enables a capital-light and highly scalable business model, offering a shorter route to market with equivalent upside potential, yet mitigating the typical risks associated with the pharmaceutical industry. Based on an rNPV-model, a potential present value per share of DKK 1.4 is derived in a Base scenario.

- Extensive Markets with Unmet Medical Needs

PEG targets vast markets with an estimated prevalence of approx. 12m patients in the Company’s key markets. These markets are forecasted to witness steady growth, fueled by factors such as an elderly population, rising preference for local treatments, and increased R&D investments. PEG’s solutions have great potential to capture significant market shares if they reach commercialization.

- Broad and Diversified Pipeline

PEG’s extensive pipeline comprises six candidates across four indication areas, potentially advancing through Phase II toward licensing agreements. The current treatment solutions for the Company’s targeted indications predominantly involve systemic treatments, whereas PEG is repositioning its compounds to local administration. Backed by a robust IP portfolio many candidates utilize the leading active substance, GM-CSF. This strategic utilization of the same compound across multiple candidates enables PEG to capitalize on collective results, leading to cost savings and a more streamlined path to market.

- Repositioning and Out-Licensing Model

The repositioning approach allows PEG to “reuse” established data and documentation concerning the drugs. As a result, it bypasses Phase I and significantly reduces the development risks. Additionally, PEG’s out-licensing model, which aims to transition directly from Phase II and there after to licensing agreements, enables a low-cost base by out-sourcing most business functions such as production and marketing, conse-quently reducing operational and execution risks.

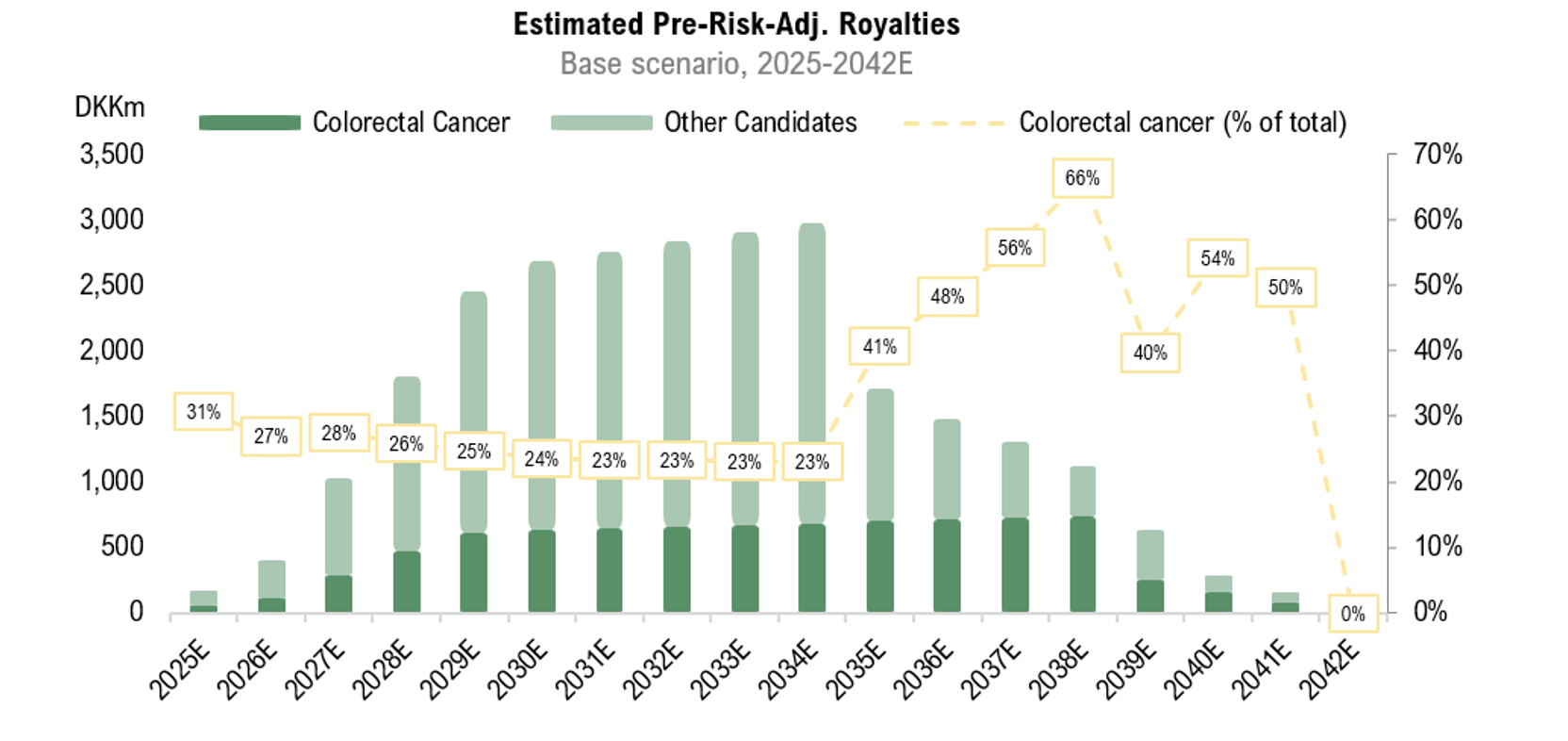

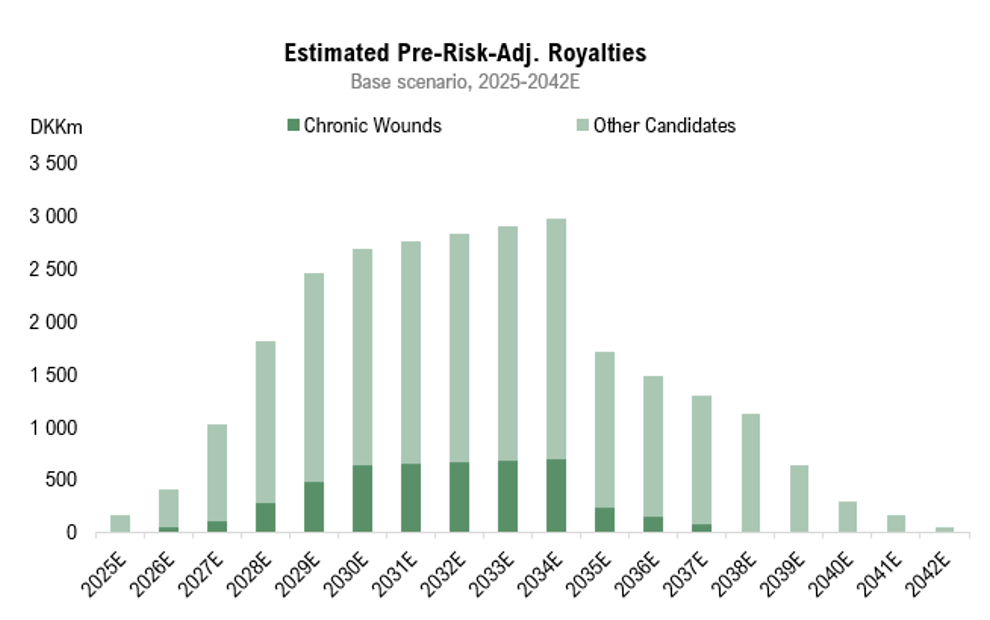

- Valuation

The valuation, determined through a risk-adjusted net present value model (rNPV), uses estimated royalties as the found-ation. By risk-adjusting for a 22% likelihood of approval and applying a discount rate of 13.1%, a potential market value of DKK 1,421m is derived, corresponding to DKK 1.4 per share.

6

Värdedrivare

1

Historisk lönsamhet

7

Ledning & Styrelse

7

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Analytikerkommentarer

Comment on PEG’s H1 Report for 2025

2025-08-14

Pharma Equity Group (“PEG” or “the Company”) published its H1 report for 2025 on the 14th of August 2025. The following are key events that we have chosen to highlight in the report:

- Strategic Shift Positions PEG as a Diversified Life Science Investment Platform

- Executive Management Change – Well Experienced CEO Joined April 1st, 2025

- Advancing RNX-011 and RNX-051 Toward Partnerships and Licensing Deals

- Receivable from Portinho S.A. Remains Valued at DKK 58m

- Strained Liquidity Position – Additional External Capital Expected

New Strategy Aimed at Driving Growth and Shareholder Returns

During Q2-25, PEG introduced a transformative investment strategy aimed at repositioning the Company as a focused investment platform within life sciences. The objective is to accelerate growth and expand the portfolio across pharmaceuticals and, notably, into Medical Devices and MedTech, areas that typically offer shorter development timelines, lower capital intensity, and more streamlined regulatory pathways compared to traditional drug development. This strategic shift represents a clear change from PEG’s historic pharma-centric model and reflects an ambition to diversify the risk-return profile while capturing value across multiple innovation cycles.

The updated strategy builds on structural changes initiated during Q1-25, including the appointment of Christian Tange as CEO. Execution of the new strategy is underpinned by a governance-led investment framework centered around a cross-functional Investment Committee (IC), which will evaluate new opportunities, oversee portfolio development, and guide capital deployment, with the aim to maximize risk-adjusted returns.

That said, successful execution remains contingent on PEG’s ability to secure external financing, which Analyst Group believes will be a critical prerequisite for unlocking the long-term value embedded in the revised investment platform. Moreover, Reponex will continue to operate as a portfolio company and remains a strategic cornerstone, with its main focus on developing RNX-051 and RNX-011, the two programs identified as having the shortest paths to market and existing partner interest. Additionally, PEG’s current focus remains on advancing the abovementioned candidates toward licensing agreements, making the new strategy more of a long-term commitment.

Executive Management Change

As communicated in the Q1-25 report comment, Christian Henrik Tange assumed the role of CEO of PEG on April 1st, 2025. He brings over 25 years of experience in financial transformation, capital raising, and strategic transactions across both listed and private companies in Europe and the US. His background includes senior roles at Karolinska Development, a Nasdaq Stockholm-listed investment company, where he served as CFO and Investment Manager, focusing on corporate strategy, funding, and M&A. With a broad international investor network and a track record of raising over DKK 500 million, we consider Tange well-positioned to lead PEG’s transition into a governance-driven investment platform. In parallel, Sebastian Bo Jakobsen was appointed CEO of PEG’s subsidiary Reponex. Having served as Manager of Scientific Development since 2022, Jakobsen brings in-depth knowledge of the pipeline assets. His role is focused on driving clinical execution and accelerating licensing dialogues, currently with the main focus centered around RNX-051 and RNX-011. Analyst Group maintains a positive view of both appointments, given their respective alignment with PEG’s updated strategy and near-term execution priorities.

Clinical Advancements and Ongoing Discussions with Potential Licensing Partners

At the start of H1-25, PEG submitted trial applications for RNX-011 in multiquadrant peritonitis, seeking approval to initiate a Phase 2 clinical trial in Q3-25, with the primary endpoint of improving 30-day survival and resolving sepsis in high-risk patients. In parallel, management aims to secure a co-development partner for a Phase 2b trial by Q4-25, with execution planned alongside the partner. If PEG secures a co-development partner, the associated study costs are expected to be covered by the partner, effectively mitigating the impact on PEG’s operating expense base. A successful Phase 2b study is expected to pave the way for an exit or licensing agreement, positioning RNX-011 as a potential near- to medium-term value inflection point in PEG’s portfolio.

Regarding RNX-051, PEG is targeting the establishment of a major international partnership to co-fund and co-develop a Phase 2b study for RNX-051, with initiation planned for Q3-25. The trial’s primary objective will be to confirm proof-of-concept in a larger patient cohort and demonstrate a statistically significant reduction in adenoma recurrence. Execution of the study alongside a strategic partner is expected to significantly de-risk both the clinical and financial profile of the program. A successful outcome from the Phase 2b trial could act as a key value inflection point, enabling an exit or licensing transaction and advancing RNX-051 toward commercialization in a large, underserved market.

Finally, while PEG had previously highlighted RNX-041 as a focus area, the promising outlook for RNX-051 and RNX-011 has led to all resources being allocated toward advancing these two candidates toward lucrative agreements. Nevertheless, RNX-041 still holds significant potential but is currently on hold.

Receivable from Portinho S.A.

At the end of H1-25, the receivable from Portinho S.A. remained valued at DKK 58m on the balance sheet, consistent with end of December 2024. As noted in earlier reports, PEG filed a summons with the Maritime and Commercial High Court in Q2-24 against Portinho S.A. to recover approx. EUR 9.6m plus interest. PEG stated in the Q4-24 report that a decision in this case is not expected in 2025. However, the work to recover the receivable has been further intensified since 31 December 2024. Additionally, arbitration proceedings against Interpatium, the real estate developer on Madeira Island, are ongoing before the Danish Institute of Arbitration (DIA) concerning the sale of shares in Portinho. The receivable amount as per the end of H1-25, including agreed interest, amounts to EUR 11.5m, corresponding to DKK 88.8m.

Solid Cost Control

During H1-25, the Company’s operating costs totaled approx. DKK -8.6m (-11,8), a decrease of 27% compared to H1-24. Breaking down the OPEX more in detail, R&D costs have decreased by 38% Y-Y, while the administrative costs have witnessed a Y-Y decrease of 21%. The sharp drop in R&D spending is primarily due to a higher cost base in H1-24, when PEG conducted a Phase II clinical proof-of-concept trial for RNX-051, leading to significantly lower related expenditures in the first half of 2025. Nevertheless, we view PEG’s continued cost discipline as positive. Looking ahead, we anticipate a moderately higher OPEX base, driven by the ramp-up in clinical activities for RNX-051 and RNX-011. PEG maintains the Company’s guidance for the full year 2025, with DKK 11m in revenue and an expected EBT loss in the range of DKK 4-7m (excl. potential gains/losses related to the Portinho receivable).

Strained Liquidity Position

The Company’s cash balance at the end of June 2025 amounted to approx. DKK 0.7m, a decrease of DKK 3.5m compared to approx. DKK 4.2m at the end of Q4-24. PEG has shown an operational burn rate of approx. DKK -11.8m (-11.7) during H1-25, equivalent to approx. DKK -2.0m/month.

PEG’s liquidity is highly strained, with a cash balance of only DKK 0.7m at the end of H1-25 despite raising approx. DKK 6.8m in convertible loans during the period. At the start of H2-25, the Company secured an additional DKK 5.8m through new convertible loans; however, these proceeds are earmarked for the repayment of DKK 4.8m in existing convertible debt and a DKK 1.0m utilized credit facility, resulting in no material net cash inflow. Analyst Group therefore considers it likely that PEG will seek additional capital in the near term to reinforce the Company’s liquidity position.

In summary, PEG’s H1-25 represents a period of strategic transformation, clinical advancement, and continued financial pressure in terms of liquidity. The Company is repositioning itself as a diversified life science investment platform, expanding beyond pharmaceuticals into Medical Devices and MedTech. This strategic shift is underpinned by the appointment of an experienced CEO and the implementation of a governance-driven investment framework. The primary operational focus remains on advancing RNX-011 and RNX-051 toward Phase 2b trials in parallel with active licensing discussions, where the signing of agreements would represent significant value-creating triggers.

Cost discipline has been maintained, with operating expenses down 27% Y-Y in H1-25. Nevertheless, liquidity remains constrained, with a cash position of only DKK 0.7m at the end of June and early H2 financing fully allocated to debt repayment. With commercial revenue not expected until late 2025 and a sustained operational burn rate, Analyst Group considers additional capital raising in the near term to be highly likely.

We will return with an updated equity research report of PEG.

Comment on Pharma Equity Group’s New Strategy to Drive Growth and Shareholder Returns

2025-05-30

Pharma Equity Group (“PEG” or “the Company”) announced on Wednesday, May the 28th, the launch of a transformative investment strategy aimed at accelerating growth, broadening the Company’s portfolio across Pharma and, notably, into Medical Devices and MedTech, with the objective of enhancing long-term shareholder value. Building on recent organizational changes, including the appointment of a new CEO and the designation of Reponex Pharmaceuticals A/S as a standalone drug development entity, the strategy positions PEG as a focused investment platform targeting early-stage innovations.

Analyst Group’s view of the updated strategy

In our view, PEG’s updated strategy represents a logical and forward-looking shift toward becoming a structured investment vehicle within life sciences. The inclusion of MedTech within PEG’s strategic scope represents a clear shift from the Company’s historical focus on pharmaceuticals. MedTech projects typically offer shorter development timelines, lower capital requirements, and more streamlined regulatory pathways compared to traditional drug development. While pharmaceutical assets carry long-term upside, they also involve costly, prolonged trials and higher binary risk. In contrast, MedTech solutions, particularly those involving hardware, software, or AI, can reach key milestones faster, enabling earlier value inflection and quicker monetization through licensing or trade sales. This diversification broadens PEG’s opportunity set and strengthens portfolio resilience by balancing long-cycle pharmaceutical assets with medium-term, commercially viable MedTech ventures.

We also note the expertise brought by the new CEO, Christian Henrik Tange, who has an extensive background in financial transformation and transactions, well aligned with PEG’s shift toward a portfolio-driven investment model. He holds a broad network of Nordic, European, American, and Chinese investors and has successfully raised over DKK 500 million for various companies. Among his previous roles, he served as CFO and Investment Manager at Karolinska Development, a Nasdaq Stockholm-listed investment company. Hence, we assess that he is the right person in the right place, with the necessary experience and investor reach to steer PEG through the Company’s next phase of strategic execution.

However, while the strategic intent is clear, we emphasize that PEG’s current liquidity position limits the Company’s ability to fully execute on this roadmap in the short term. In light of this, we expect PEG to approach the market for external financing, most likely through equity or hybrid instruments, to secure the necessary capital to 1) complete ongoing clinical studies within Reponex and 2) initiate investments aligned with the new strategic direction. Hence, Analyst Group assess that a successful capital raise will be a prerequisite for building momentum behind the updated strategy.

Moreover, we continue to see strong underlying value in Reponex’s portfolio, particularly as PEG has focused the resources on three key candidates: RNX-051, RNX-011, and RNX-041. These have been identified by PEG as having the shortest path to market, along with notable interest from potential licensing partners. Continued development and the potential to formalize agreements remain key catalysts, although access to financing will be critical to unlocking this value.

The New Strategy for Growth and Shareholder Returns

PEG has announced the launch of a transformative investment strategy aimed at accelerating growth, broadening the Company’s portfolio across Pharma and Medical Devices (including MedTech), and enhancing long-term shareholder value.

The strategy builds on PEG’s organizational restructuring earlier this year, during which Christian Henrik Tange was appointed CEO, bringing over 25 years of experience in financial transformation and transactions. This transition marked PEG’s shift toward becoming a focused investment vehicle. As part of the new structure, the Company’s subsidiary, Reponex Pharmaceuticals A/S (“Reponex”), was designated as a standalone drug development portfolio company. The restructuring provided strategic clarity, sharpened operational focus, and laid the groundwork for PEG’s new investment direction.

Under the updated strategy, PEG seeks to position itself as a leading consolidator in the life sciences sector by identifying and developing high-potential early-stage innovations, particularly from Scandinavian research institutions. Leveraging the existing strengths, including Reponex, PEG intends to build a diversified portfolio that combines long-term, high impact Pharma investments with medium-term MedTech and device projects offering shorter time-to-value and clearer exit optionality. To reinforce investment diligence, the IC may also engage external experts to complement internal capabilities and support PEG’s ability to form targeted advisory committees.

As part of the Company’s strategic transformation, PEG intends to establish an investment committee (IC) to formalize and strengthen investment governance. Comprised of cross-functional experts in finance, pharma, MedTech, and commercialization, the IC will operate under a Board mandate and be tasked with evaluating new opportunities, overseeing portfolio performance, and refining the Company’s risk-return profile. The initiative is expected to improve transparency, reduce execution risk, and promote more disciplined capital allocation.

Framework for Maximizing Risk-Adjusted Returns

This newly introduced strategy, underpinned by the strengthened governance framework provided by the IC, is expected to serve as a key pillar in PEG’s efforts to unlock long-term shareholder value. The following set of investment principles is intended to guide capital deployment with a clear focus on maximizing risk-adjusted returns:

- High-Quality Investments: By relying on thorough evaluations conducted by experienced professionals, the IC will prioritize opportunities that demonstrate the strongest prospects for success and ROI.

- Efficient Use of Capital: The IC will guide funding decisions to ensure that resources are allocated toward initiatives with the greatest alignment to PEG’s strategic goals within Pharma and MedTech.

- Faster Path to Value Creation: With a systematic process for identifying and advancing investments, PEG aims to bring portfolio companies towards critical value-inflection points, such as clinical progress, regulatory approvals, or market adoption, in an efficient and timely manner.

- Improved Risk Management: By diversifying investments across different sectors, technologies, and development stages, coupled with ongoing expert oversight, PEG seeks to minimize reliance on any single project and build a more robust, balanced portfolio.

- Strategic Exit Planning: The IC will develop customized plans to unlock value through well-timed exits, which may include licensing deals, trade sales, or initial public offerings (IPOs), depending on what best maximizes return on investment.

In summary, Analyst Group views PEG’s updated strategy as a well-calibrated and forward-looking step toward building a diversified, value-driven investment platform within life sciences. The strategic expansion into MedTech introduces a complementary return profile to the Company’s Pharma exposure, offering shorter development cycles, faster commercialization, and enhanced portfolio balance. Backed by experienced leadership and a clear governance framework, PEG is well-positioned to identify and develop high-potential early-stage assets. However, we underline that successful execution will depend on the Company’s ability to secure external financing. Provided that capital is raised, we believe PEG has the structural and strategic foundations to unlock meaningful long-term shareholder value.

Comment on PEG’s Year-End Report for 2024

2025-03-20

Pharma Equity Group (“PEG” or “the Company”) published its Year-End report for 2024 on the 20th of March 2025.

The following are key events that we have chosen to highlight in the report:

- Execution Strategy Refocused to Maximize Market Opportunities

- Submitted Trial Applications Marks Continued Clinical Development

- Ongoing Discussions with Potential Licensing Partners

- FY 2025 Guidance Indicates Revenue Generation and Reduced Operating Loss

- Robust Cost Control

- Receivable from Portinho S.A. – Court Decision not Expected During 2025

- Enhanced Financial Flexibility Through Premium-Priced Directed Share Issue

- Newly Appointed CEO with Extensive Expertise

New Execution Strategy Set to Accelerate the Road to Licensing Agreements

During the fourth quarter, the board approved a new execution strategy and a refined prioritization of clinical focus areas within the Company’s subsidiary, Reponex Pharmaceuticals A/S (“Reponex”). As part of PEG’s evaluation of Reponex’s clinical pipeline, several key commercial factors were assessed, including medical need, patient recruitment feasibility, regulatory pathways, probability of success, and resource allocation in terms of both human and financial capital. Based on these considerations, Reponex has prioritized the following development programs, which have demonstrated clinically relevant data and hold patent protection in key geographical markets, reinforcing the Company’s strategic positioning in the sector:

- RNX-051 for Colon Adenomas and Colon Cancer

- RNX-011 for the Treatment of Peritonitis

- RNX-041 for the Treatment of IBD (Pouchitis)

Recent Clinical Advancements

At the beginning of Q1-25, PEG submitted trial applications for RNX-011 to the authorities, aiming to initiate a Phase 2 clinical trial with two distinct treatment arms: a placebo group and a treatment group receiving RNX-011. The trial is set to enroll 32 patients, evenly distributed between the two arms. Furthermore, the Company expects to submit trial applications for RNX-051 in late Q1-25 or early Q2-25. This trial, conducted in collaboration with SUH Køge and its international research network, will be a larger, placebo-controlled Phase 2 study involving approx. 400 patients, focusing on individuals with colon adenomas. Regarding RNX-041, the drug candidate is actively included in Part 2 of the ongoing Phase 2 proof-of-concept clinical study for the treatment of pouchitis. The Company is actively pursuing strategic partnerships to support larger clinical trials, which could further accelerate the clinical development process.

While PEG has adopted a new execution strategy and refined the Company’s clinical priorities, PEG’s drug candidates for chronic leg ulcers (RNX-022, RNX-023) and Crohn’s Disease (RNX-041) remain of significant clinical and commercial interest. These programs will continue through strategic clinical and industrial collaborations.

Analyst Group assesses that the streamlined focus area strengthens PEG’s ability to allocate resources efficiently, prioritize high-potential drug candidates, and accelerate clinical progress. By concentrating efforts on targeted therapeutic areas, PEG enhances the Company’s prospects for securing strategic partnerships, optimizing trial outcomes, and ultimately increasing the likelihood of a successful commercialization through lucrative licensing agreements.

Guidance for FY 2025 – Ongoing Licensing Discussions are Expected to Convert to Revenue

The Company is currently in dialogue with potential licensing partners, and PEG anticipates entering license agreements by the end of Q3-25 and Q4-25. This is reflected in the estimated FY 2025 revenue of DKK 11m, primarily driven by forecasted upfront payments. Moreover, PEG projects a significant reduction in the cost base for 2025 compared to both 2023 and 2024, with cost-cutting measures and the conversion of fixed to variable costs playing a key role in lowering capital requirements. Overall, the Company expects a pre-tax loss (EBT) of DKK 4–7m, including revenue from licensing agreements. The total expected cash outflow for 2025 is approx. DKK 14.5m, representing a significant improvement from 2024, when operating cash flow (OCF) stood at DKK -22.8m. Analyst Group believes that the ongoing licensing discussions serve as key triggers for 2025, as PEG takes critical steps toward securing lucrative agreements and generating cash flow.

Solid Cost Control Supports Accelerated Development

During Q4-24, the Company’s operating costs totaled approx. DKK 4.2m (6.5), a decrease of 36% Y-Y and 19% Q-Q, a testament to the cost-cutting measures bearing fruit. Breaking down the OPEX more in detail during Q4-24, the R&D costs have decreased by 3% Y-Y and increased by 57% Q-Q, as the Company continues to progress with the development of the pipeline candidates. Furthermore, the administrative costs have witnessed a Y-Y and Q-Q decrease of 61% and 59%, respectively, a solid indication of robust cost control. Overall, the EBT for 2024 came in at DKK -26.2m, in line with the Company’s guidance for the full year (loss of DKK 24-29m).

It is worth noting that the current management has assessed that the capitalized development costs related to projects and patents did not meet the criteria set by IAS 38. Consequently, the Company has reduced Development Projects (intangible assets) from approx. DKK 13.6m to zero, a technical adjustment that lowers opening equity but does not impact financial results or taxes for 2023–2024.

Receivable from Portinho S.A.

At the end of Q4-24, the receivable from Portinho S.A. remained valued at DKK 58m on the balance sheet, consistent with the previous quarter. As noted in earlier reports, PEG filed a summons with the Maritime and Commercial High Court in Q2-24 against Portinho S.A. to recover approx. EUR 9.6m plus interest. PEG states in the Q4 report that a decision in this case is not expected in 2025. Additionally, arbitration proceedings against Interpatium, the real estate developer on Madeira Island, are ongoing before the Danish Institute of Arbitration (DIA) concerning the sale of shares in Portinho.

Enhanced Financial Flexibility Through Directed Share Issue

At the beginning of the fourth quarter, PEG successfully strengthened the Company’s financial position through a directed share issue, generating gross proceeds of approx. DKK 51.1m. This includes the conversion of convertible debt amounting to DKK 12.6m, which, as a non-cash transaction, resulted in a net cash inflow of DKK 38.5m. Of this amount, the Company allocated DKK 25.8m to reduce financial debt, further reinforcing the Company’s balance sheet, leaving a net cash proceed of DKK 12.7m post-debt reduction.

Notably, the shares were issued at a price of DKK 0.25 per share, representing a 19% premium to the closing price on October 3rd, a strong indication of investor confidence in PEG’s future prospects. The capital injection not only strengthens PEG’s financial resilience but also enhances the Company’s strategic flexibility, positioning the Company to actively pursue potential licensing agreements and advance the clinical development pipeline.

In early 2025, PEG strengthened the Company’s financial flexibility further through loans and loan commitments totaling approx. DKK 13m. Given the Company’s expected burn rate, this provides a runway exceeding 12 months. The financial headroom is expected to improve further throughout 2025 via convertible loans or similar financing, with ongoing discussions underway with both existing and new investors for short- and long-term funding.

PEG has shown an operational burn rate of approx. DKK -6.7m (-3.8) during Q4-24, equivalent to DKK -2.2m/month, marking an increase from the previous quarter’s monthly burn rate of DKK -1.5m. The increase is driven by changes in working capital and higher interest expenses. With a more streamlined strategy, an improved financial position following the directed share issue, a strong focus on efficiency measures, and expected licensing revenues in 2025, Analyst Group believes PEG is well-positioned to execute the Company’s strategy and advance toward licensing agreements.

Executive Management and Organizational Changes

Following the end of the quarter, the Company announced the appointment of Christian Henrik Tange as the new CEO of PEG, effective April 1st, 2025. Tange brings over 25 years of experience in financial transformation and transactions, including IPOs, equity and debt financing, and M&As across both listed and private companies in Europe and the US. With an extensive network of Nordic, European, American, and Chinese investors, Tange has successfully raised over DKK 500 million for various companies. He has held key positions in international firms and possesses deep expertise in making companies attractive to investors. Among his previous roles, he served as CFO and Investment Manager at Karolinska Development, a Nasdaq Stockholm-listed investment company. Most recently, he was CEO of Capiital, where he specialized in refining corporate strategies and operations, as well as providing tailored advisory, funding, and M&A services.

The current CEO, Thomas Kaas Selsø, will step down from his position on March 31, 2025, to focus on his consulting business. He will continue to support PEG as a consultant, specializing in accounting, finance, and reporting.

In conjunction with these changes, Sebastian Bo Jakobsen has been appointed CEO of PEG’s subsidiary, Reponex. Jakobsen, who holds a master’s degree in cognitive science from Aarhus University, has been with Reponex as Manager of Scientific Development since September 2022. This appointment aims to provide a focused approach to Reponex’s clinical development activities and to intensify efforts in establishing strategic collaborations with potential licensing partners.

Analyst Group assesses that both Christian and Sebastian appear to be strong candidates for their respective roles, possessing qualifications well-suited to the Company’s strategic objectives. Christian’s extensive background in financial transformation and transactions, combined with his broad investor network and prior experience in the pharma industry, represents key strengths in driving PEG’s next phase of financing and, ultimately, licensing agreements for the Company’s pipeline candidates. Having been with Reponex since Q3-22, Sebastian has developed a deep understanding of the current drug candidates, a crucial asset in successfully executing the new strategy and advancing clinical development.

In summary, PEG enters 2025 with ongoing discussions with potential licensing partners, a key driver for unlocking the Company’s hidden value. Simultaneously, PEG has strengthened the Company’s financial position following a directed share issue executed at a 19% premium, alongside a refined execution strategy focused on the most commercially promising market opportunities. Pipeline candidates RNX-051, RNX-011, and RNX-041 constitute the core priorities, supported by a more cost-efficient approach and expected revenues toward the end of 2025 stemming from licensing agreements, which Analyst Group believes will serve as key triggers that could further accelerate value realization in 2025.

With a newly appointed executive management team bringing expertise in securing funding, driving strategic initiatives, and accelerating clinical advancements, PEG is well-positioned to advance the Company’s pipeline and secure licensing agreements. Building on the foundation established under the previous leadership, the strengthened management structure enables PEG to transition more swiftly from early-stage discussions with potential licensing partners to formalized commercial agreements, paving the way for significant long-term value creation.

We will return with an updated equity research report of PEG.

Comment on Pharma Equity Group’s New Execution Strategy

2024-12-13

Pharma Equity Group (“PEG” or “the Company”) announced on Friday, December the 13th, the board of directors’ decision on a new execution strategy and prioritization of clinical areas regarding the Company’s subsidiary Reponex Pharmaceuticals A/S (“Reponex”).

PEG conducts continuous evaluation of the clinical pipeline in regards to Reponex based on several fundamental commercial criteria, including medical need, patient recruitment, regulatory requirements, likelihood of success, and requirements for both human and monetary capital. Based on this evaluation, Reponex has prioritized the following development programs going forward:

- RNX-051 for Colon Adenomas and Colon Cancer

- RNX-011 for the Treatment of Peritonitis

- RNX-041 for the Treatment of IBD (Pouchitis)

The abovementioned drug candidates have demonstrated relevant, informative, and clinical data, with patent protection secured in the most critical geographical regions for the Company.

Development of RNX-051 and RNX-011

In recent months, PEG and the Company’s clinical partners have allocated significant resources to finalize study protocols in preparation for the submission of Phase 2 clinical trial applications to regulatory authorities. The trial applications for RNX-011 and RNX-051 are expected to be submitted at the beginning and end of Q1-25, respectively. During Q1-25, Reponex will implement laboratory models using blood samples from patients with peritonitis to confirm the disease mechanisms affected by RNX-011. These results will help to determine the correct dosage of the drug and generate an ongoing data package. This initiative will not only support clinical studies but also enable the individualization of treatment for patients with peritonitis.

Development of RNX-041

Regarding RNX-041, the drug candidate is actively included in Part 2 of the ongoing Phase 2 proof-of-concept clinical study for the treatment of pouchitis. The studies are conducted as investigator-initiated trials (IITs), designed in compliance with FDA and EMA guidelines, as well as anticipated requirements from future industrial licensing partners. Furthermore, the study design enables continuous analysis and timely data release.

Recent activities

The Company is also working to establish strategic partnerships, a process that will continue throughout the completion of the abovementioned studies. Additionally, Reponex has unblinded the proof-of-concept study with RNX-021 for the treatment of chronic venous leg ulcers. As anticipated, data from the study have provided significant and valuable insights for further formulation work, with a focus on optimizing drug candidates regarding future clinical studies involving RNX-022 and RNX-023. Moreover, the Company’s drug candidates for the treatment of chronic leg ulcers (RNX-022, RNX-023) and Crohn’s Disease (RNX-041) remain of great clinical and commercial interest. These programs will continue to advance through strategic clinical and industrial collaborations.

Analyst Group’s view of the new execution strategy and prioritization of clinical areas

“Analyst Group views the new execution strategy and prioritization of clinical areas as a positive step, enabling the Company to allocate resources to drug candidates with the shortest routes to market. Prioritizing these programs, supported by robust clinical data and patent protection, enhances the regulatory and commercial potential, which may accelerate the path to licensing agreements and cash flows.

The colorectal cancer market, which PEG addresses through RNX-051, was valued at USD 19bn in 2022 and is estimated to witness a 4.0% CAGR from 2022 to 2030, reaching USD 26bn by 2030.1 In the year 2020, approximately 12.7% of new cancer diagnoses and 12.4% of cancer-related deaths were attributed to colorectal cancer in EU-27 countries – this positioning marks it as the second most prevalent cancer, following breast cancer, and the second leading cause of cancer-related mortality, after lung cancer.2 Hence, the need of new innovative treatment methods in regards to colorectal cancer can be included in effective cancer treatment is more urgent than ever.

Looking at the market that RNX-011 targets, secondary peritonitis poses an increasing challenge and burden for individuals as well as the healthcare system, constituting 1% of urgent hospital admissions and ranking as the second most common cause of sepsis (blood poisoning).3 The global peritonitis treatment market is expected to grow at a CAGR of 6.1% from 2020 to 2028, driven by a rising prevalence and increased investments in R&D to develop permanent and adequate treatment options, originating from both public and government sectors.4

Additionally, the need adequate treatment methods for pouchitis speaks in favor of RNX-041, where a heightened preference for effective yet less invasive symptomatic therapeutics and biologics are fueling the market growth. The global inflammatory bowel disease (IBD) market had, according to ReportLinker, an estimated value of USD 21.3b in 2023 and is expected to experience a 4.8% CAGR during 2023-2027, thereby reaching USD 25.7bn by 2027.5

In summary, Analyst Group believes that focusing on drug candidates with the most favorable near-term outlook and efficiently allocating time and capital is the right approach. With a strengthened balance sheet following the recent directed share issue of.. , a more streamlined focus, and several potential triggers anticipated in early 2025, PEG is well positioned to make significant progress toward licensing agreements in the coming year.”

1. https://www.databridgemarketresearch.com/reports/global-colorectal-cancer-treatment-market

2. https://ecis.jrc.ec.europa.eu/sites/default/files/2023-12/Colorectal_cancer_en-Mar_2021.pdf

3. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6889898/?report=printable

4. https://www.databridgemarketresearch.com/reports/global-peritonitis-treatment-market

5. https://www.reportlinker.com/p06317616/Inflammatory-Bowel-Disease-Treatment-Global-Market-Report.html?utm_source=GNW

Comment on PEG’s Q3 Report for 2024

2024-11-15

Pharma Equity Group (“PEG” or “the Company”) published its Q3 report for 2024 on the 15th of November 2024. The following are key events that we have chosen to highlight in the report:

- Patent Protection in Japan (RNX-051)

- Solid Cost Control

- Receivable from Portinho S.A. – Valued at DKK 58m

- Directed Share Issue Strengthens the Balance Sheet

Obtained Patent Protection in Japan for RNX-051

Following the end of the third quarter, the Company’s subsidiary Reponex obtained patent protection in Japan for the treatment of colorectal cancer with RNX-051, valid until 2039. The granting of a patent covering the Japanese market is a significant milestone for Reponex, which has now obtained patent protection for the RNX-051 treatment method in both Europe and Japan – two of the Company’s primary focus markets. Analyst Group assess that the patent protection is an important milestone, given that the patent not only offers legal protection for the Company’s drug candidate but also strengthens PEG’s position as a valuable asset in negotiations with prospective licensing partners.

Robust Cost Control

During Q3-24, the Company’s operating costs totaled approx. DKK 5.2m (5.7), a decrease of -8% Y-Y and an increase of 5% Q-Q. Breaking down the OPEX more in detail, it’s evident that the R&D costs have decreased by -29% Y-Y and -3% Q-Q, while the administrative costs have witnessed a Y-Y increase of 8%, and a sequential increase of 10% Q-Q. Hence, PEG demonstrates a solid cost control Y-Y, and the increased cost base Q-Q is in line with the Company’s maintained guidance for the full year 2024, with EBT expected to be in the range of DKK -24 to -29m (excl. potential gains/losses related to the Portinho receivable).

Receivable from Portinho S.A.

At the end of Q3-24, the receivable from Portinho S.A. was valued at DKK 58m on the balance sheet, similar to the end of the previous quarter. As commented in previous reports, PEG filed a summons with the Maritime and Commercial High Court against Portinho S.A. for the recovery of the receivable of EUR 9.55m plus interest in Q2-24. Analyst Group has excluded the receivable from PEG’s valuation, considering it as an option. If successfully redeemed, this could play a crucial role in supporting the Company’s financial stability and adding further upside to the Company’s valuation, serving as a trigger ahead.

Directed Share Issue Strengthens the Financial Position

After the end of the third quarter, PEG issued 204,592,776 new shares in a directed issue, with gross cash proceeds of approx. DKK 51.1m, including the conversion of convertible debt of approx. DKK 12.6m. Given that the conversion of convertible debt does not involve an actual cash inflow, DKK 38.5m was received in cash. PEG used DKK 25.8m to reduce financial debt and strengthen the balance sheet, thereby resulting in a net cash proceed of DKK 12.7m following the rights issue. The subscription price was DKK 0.25 per share, which corresponded to a premium of approx. 19% in relation to the closing price of the previous trading day, DKK 0.21 on October 3rd. Through the capital increase, the Company achieves a strengthened and more robust capital structure, including an enhanced capital base.

PEG has shown an operational burn rate of approx. DKK -4.5m (-2.7) during Q3-24, equivalent to DKK -1.5m/month, marking an increase from the previous quarter’s monthly burn rate of DKK -1.3m. The increased burn rate stems from a somewhat higher cost base, a natural step as PEG progresses in development, taking further steps towards lucrative licensing agreements. Although PEG reports a slightly increased burn rate, Analyst Group believes PEG manages the operational cost on a good level. With the reported cash balance at the end of Q3-24 (DKK 3.8m), net cash proceeds of DKK 12.7m and a reduced debt burden following the capital raise in October, PEG’s enhanced balance sheet creates more financial flexibility, a key pillar to pursue potential licensing agreements and continue with clinical development.

In summary, the directed share issue was a crucial milestone for PEG, ensuring the continuation of the promising development of the Company’s drug candidates. It also allows PEG to expedite the transition from early discussions with potential licensing partners to formal commercial agreements, which could significantly drive value in the future. Furthermore, we regard the terms of the share issue as highly favorable, particularly the 19% premium on the subscription price, which demonstrates strong confidence from the investors involved in the capital raise. With a strengthened financial position, solid cost control and patent obtained in a key market, PEG has a robust foundation for further clinical progress for the Company’s strong pipeline of candidates.

We will return with an updated equity research report of PEG.

Comment on Pharma Equity Group’s Obtained Patent Protection in Japan for RNX-051

2024-10-23

Pharma Equity Group (“PEG” or “the Company”) announced on Wednesday, October the 23rd, that the Company’s subsidiary Reponex Pharmaceuticals A/S (“Reponex”) has obtained patent protection in Japan for the treatment of colorectal cancer with RNX-051, valid until 2039.

The granting of a patent covering the Japanese market is a significant milestone for Reponex, which has now obtained patent protection for the RNX-051 treatment method in both Europe and Japan – two of the Company’s primary focus markets. Patent protection is seen as a key value driver and a crucial parameter in the future negotiations on the conditions for a potential license agreement.

Colorectal cancer is a significant public health problem in Japan, with both incidence and prevalence increasing in recent decades. It’s the most common cancer type in Japan, driven by an aging population, lifestyle changes, including changes in dietary habits, such as increased consumption of red meat and processed foods, as well as limited physical activity.

”We are very pleased that the Japan Patent Office has granted a patent for our innovative treatment method covering the Japanese market, which will thus be included as a significant positive parameter in our investment rationale of continued clinical development and our dialogue with future license partners,” says Thomas Kaas Selsø, CEO of PEG.

Internationally, there is increasing scientific recognition of the link between the presence of biofilms and the development of colorectal cancer. The biofilm has a major negative impact on the immune system’s ability to detect and fight cancer cells. To give a deeper context, PEG announced positive final results from the Phase II clinical proof-of-concept trial of the drug candidate RNX-051 in Q2-24. In connection to receiving the positive results, Reponex’s management concluded that its patented medicinal product RNX-051 appears to be highly effective for its intended purpose, and just a single local application drastically reduces tumor-associated biofilm. Additionally, a single local application can even totally eliminate the cancer-promoting Fusobacterium nucleatum in the tumor one week after the treatment.

Analyst Group’s view of the obtained patent

“Analyst Group views the approval of the patent application as a significant milestone in PEG’s IP and out-licensing strategy. The patent not only offers legal protection for the Company’s drug candidate but also strengthens PEG’s position as a valuable asset in negotiations with prospective licensing partners.

The colorectal cancer market was valued at USD 19bn in 2022 and is estimated to witness a 4.0% CAGR from 2022 to 2030, reaching USD 26bn by 2030.1 In the year 2020, approximately 12.7% of new cancer diagnoses and 12.4% of cancer-related deaths were attributed to colorectal cancer in EU-27 countries – this positioning marks it as the second most prevalent cancer, following breast cancer, and the second leading cause of cancer-related mortality, after lung cancer.2 Hence, the need of new innovative treatment methods in regards to colorectal cancer can be included in effective cancer treatment is more urgent than ever.

In summary, the indication area targeted by RNX-051 presents immense potential, offering PEG a substantial market share opportunity. A granted patent not only strengthens PEG’s IP portfolio but also opens doors to strategic partnerships, potential royalty streams, and consequently, profitability.”

Analyst Group’s View of Pharma Equity Group

Pharma Equity Group (“PEG” or “the Company”), through the Company’s subsidiary, Reponex, employs a drug repositioning strategy, which involves finding new uses for active substances used in previous recognized treatments, thus allowing the Company to circumvent phase I trials. PEG has a pipeline of six candidates in Phase II, targeting therapeutic areas such as Peritonitis, Chronic Wounds, IBD, and Colorectal Cancer, where there is currently no adequate treatment. The business strategy involves out-licensing the programs after Phase II to a pharma company capable of bringing the drugs to the market. PEG’s strategy enables a capital-light and highly scalable business model, offering a shorter route to market with equivalent upside potential, yet mitigating the typical risks associated with the pharmaceutical industry.

1https://www.databridgemarketresearch.com/reports/global-colorectal-cancer-treatment-market

2https://ecis.jrc.ec.europa.eu/sites/default/files/2023-12/Colorectal_cancer_en-Mar_2021.pdf

Comment on Pharma Equity Group’s Directed Share Issue to a Premium

2024-10-07

Pharma Equity Group (“PEG” or “the Company”) announced on Friday, October 4th, that the Company’s board of directors has resolved to issue 204,592,776 new shares in a directed issue, with expected gross cash proceeds of approx. DKK 51.1m, including the conversion of convertible debt of approx. DKK 12.6m. As a result, the expected net cash proceeds are approx. DKK 38.5m before issue costs, given that the conversion of convertible debt does not involve an actual cash inflow. The subscription price is DKK 0.25 per share, which corresponds to a premium of approx. 19% in relation to the closing price of DKK 0.21 on October 3rd, and the new shares are subscribed by a limited group of new investors and existing shareholders. The dilutive effect following the issuance of new shares amounts to approx. 17% for existing shareholders. Through the capital increase, the Company achieves a strengthened and more robust capital structure, including an enhanced capital base.

Analyst Group’s View of the Capital Increase

“We view the directed issue as a highly positive sign, as it strengthens PEG’s balance sheet substantially, thereby creating financial flexibility and more room for pursuing the development of the Company’s drug candidates. What stands out in particular is that the issue is being conducted at a 19% premium compared to the closing price on October 3rd, which is uncommon in the current market climate and sends a strong signal, as it indicates robust confidence in PEG’s future by the investors participating in the directed issue.

With gross cash proceeds of approx. DKK 51.1m, of which approx. DKK 12.6m stems from the conversion of convertible debt, PEG not only reduces the debt substantially but also has net cash proceeds of approximately DKK 38.5 million before issue costs, resulting in an enhanced financial position and a stronger balance sheet. Considering PEG’s total debt at the end of Q2-24, which amounted to approx. DKK 43.5m, the Company could potentially, with the gross proceeds of approx. DKK 51.1m, diminish the debt and still have net proceeds of approx. DKK 7.6m, all else being equal. Analyst Group views it as likely that PEG will use part of the proceeds to further strengthen the balance sheet by paying the outstanding debt. However, we also deem it likely that a portion of the net proceeds will be used to support further clinical advancements of the Company’s drug candidates in Phase II, as well as to provide the financial capacity to explore potential licensing agreements.

To summarize, Analyst Group views the capital increase as a vital step in enabling PEG to continue the development of the promising studies of the Company’s drug candidates. Additionally, it enables PEG to accelerate the conversion of initial discussions with potential licensing partners into commercial licensing agreements, which could serve as a substantial value driver going forward. Moreover, we view the terms of the directed share issue as favorable, particularly the 19% premium of the subscription price, which sends strong signals from investors participating in the capital raise. This is especially notable in light of the fact that many other small-cap companies are being forced to offer issues at substantial discounts, often coupled with lower subscription commitments, which results in costly underwriting guarantees.”

Analyst Group’s View of Pharma Equity Group

Pharma Equity Group (“PEG” or “the Company”), through the Company’s subsidiary, Reponex, employs a drug repositioning strategy, which involves finding new uses for active substances used in previous recognized treatments, thus allowing the Company to circumvent phase I trials. PEG has a pipeline of six candidates in Phase II, targeting therapeutic areas such as Peritonitis, Chronic Wounds, IBD, and Colorectal Cancer, where there is currently no adequate treatment. The business strategy involves out-licensing the programs after Phase II to a pharma company capable of bringing the drugs to the market. PEG’s strategy enables a capital-light and highly scalable business model, offering a shorter route to market with equivalent upside potential, yet mitigating the typical risks associated with the pharmaceutical industry.

You can access our latest analysis of Pharma Equity Group here, and also watch a recent interview with the CEO, Thomas Kaas Selsø here.

Comment on PEG’s Q2 Report for 2024

2024-08-16

Pharma Equity Group (“PEG” or “the Company”) published its Q2 report for 2024 on the 16th of August 2024. The following are key events that we have chosen to highlight in the report:

- Positive Final Results from Phase II Clinical PoC Trial (RNX-051)

- Robust Cost Control

- Update Regarding the Receivable from Portinho S.A.

- Evaluating Options for a Capital Increase

Continued Advancement of the Clinical Development

During the quarter, PEG announced that the Company’s subsidiary, Reponex Pharmaceuticals A/S (“Reponex”) has received positive final results from the Phase II clinical proof-of-concept trial of the drug candidate RNX-051, also referred to as the MEFO study. Reponex’s management concludes that its patented medicinal product RNX-051 is highly effective for its intended purpose. Just a single local application drastically reduces tumor-associated biofilm and can even totally eliminate the cancer-promoting Fusobacterium nucleatum in the tumor one week after the treatment. Analyst Group believes that the positive results obtained from the Phase II study are a further demonstration from Reponex that the clinical development is progressing according to plan.

Improved Cost Control Compared to Previous Quarter

During Q2-24, the Company’s operating costs totaled approx. DKK 5m (4.9), an increase of 1% Y-Y and a reduction of -27% Q-Q. Breaking down the OPEX more in detail, it’s evident that the R&D costs have decreased by -27% Y-Y and -28% Q-Q, while the administrative costs have witnessed a Y-Y increase of 30%, but a sequential decrease of -26% Q-Q. Hence, PEG maintains a costbase on par with the same period last year and a substantial improvement compared to the previous quarter (Q1-24). As mentioned in the report, PEG maintains the Company’s guidance for the full year 2024, with EBT expected to be in the range of DKK -24 to -29m (excl. potential gains/losses related to the Portinho receivable).

Legal Actions to Redeem the Receivable from Portinho S.A.

At the end of Q2-24, the receivable from Portinho S.A. was valued at DKK 58m on the balance sheet, similar to the end of the previous quarter. As of April 15th, PEG filed a summons with the Maritime and Commercial High Court against Portinho S.A. for the recovery of the receivable of EUR 9.55m plus interest, equivalent to EUR 10.8m or DKK 80.5m. The receivable amount, as per the end of Q2-24, including agreed interest, is EUR 11.0m corresponding to DKK 82.1m. Interest rate is agreed to 2% per quarter and amounts to DKK 3.2m for H1-24, which has not recognized as income in the report as it is considered appropriate to defer income recognition of interest until interest has been paid. Analyst Group has not factored in the receivable in the valuation of PEG and views this as an option which, if redeemed successfully, could be of significant importance to sustaining the Company financially and providing additional upside to the valuation.

Exploring Options Regarding Capital Increase

The Company’s cash balance at the end of June 2024 amounted to approx. DKK 0.9m, a decrease of DKK -1.3m compared to approx. DKK 2.2m at the end of Q1-24. PEG has shown an operational burn rate of approx. DKK -3.9m during Q2-24, equivalent to DKK -1.3m/month, marking a substantial decrease from the previous quarter’s monthly burn rate of DKK -2.6m. However, it’s worth mentioning that the working capital cycle has a fluctuating pattern, and the effect often smooths out over the year. Regardless of that, Analyst Group see it as important to keep the burn rate as low as possible until the Company has secured additional financing, which PEG managed to do during Q2-24.