Eevia Health produces and distributes bioactive plant extracts in Finland and internationally. The product lines include extracts from elderberry, bilberry, lingonberry, chaga mushroom, pine bark, and other raw materials. Additionally, Eevia has new bioactive ingredient under development called Retinari which is aimed towards age-related macular degeneration. Eevia’s products are mainly used in dietary supplements, cosmetics, food & drinks, as well as veteran-ary products. The Company sells its products through small- and mid-sized distributors. Eevia was founded in 2017, is listed on Spotlight Stock Market since 2021, and is headquartered in Seinäjoki, Finland.

Pressmeddelanden

Unlocking Value Through a Strategic Turnaround

In Q4-24, Eevia Health Plc (publ) (“Eevia” or “the Company”) launched a transformational restructuring plan to become a specialized provider of high-margin, science-backed health solutions, focusing on gut, kidney, and urinary health. By divesting assets related to Retinari™ and berry extract manufacturing, Eevia aims to streamline operations, enhance profitability, and adopt a capital-light business model, leveraging the Company’s expertise in bioactive compounds. This turnaround plan allows investors to retain exposure to former operations without the financial risks of plant extract production. With a clear strategy set by the new and experienced board, Eevia is well-positioned to capitalize on the expanding gut health market and recover to profitable growth, thereby unlocking the underlying value within the Company. Overall, Analyst Group believes the ongoing rights issue presents an attractive entry point for investors at a Pre-Money valuation of SEK 6.0m.

Capital-Light Business Model

With the planned divestments, Eevia will adopt a leaner operational structure, allowing Eevia to focus resources on the Company’s core business, science-backed ingredients. The asset-light model will eliminate direct ownership of production facilities, instead leveraging strategic sourcing and partnerships. This enhances flexibility, reduces capital expenditures, and optimizes cost efficiency, positioning the Company for sustainable, high-margin growth.

Broad Commercial Exposure

Eevia’s turnaround plan enables investors to retain exposure to the former business operations without the financial risk associated with plant extract production. As Eevia shifts toward a higher-margin, science-backed product portfolio, these divestments offer option value, providing additional potential upside if the legacy businesses perform well. This strategic realignment enhances financial flexibility, allowing Eevia to focus more efficiently on the Company’s core growth areas.

Extensive and Growing Market

Medical professionals increasingly acknowledge the pivotal role of gut health in overall well-being. Eevia seeks to address the prevalent issues associated with gut dysbiosis by using high-strength bioactive blends that restore balance. The global gut health market, as estimated by Grand View Research, was valued at approx. USD 51.6bn in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 8.3%, reaching an estimated USD 90.2bn by 2030.

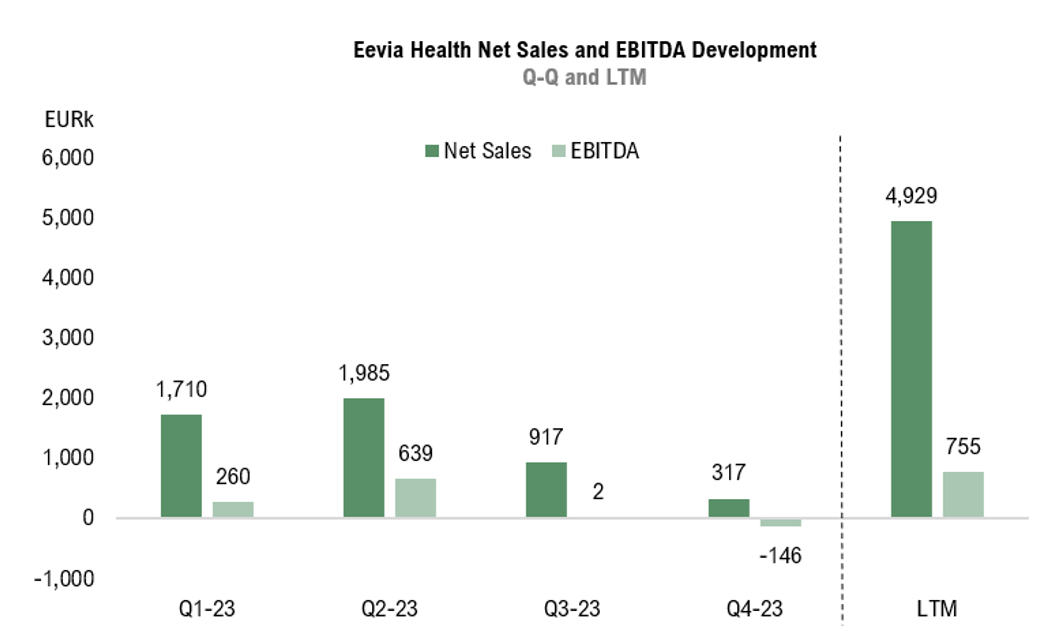

Navigating a Challenging H2-23 Through Enhanced Efficiency

Eevia Health Plc (publ) (”Eevia Health”, “Eevia” or “the Company”) concludes a transformative 2023, marked by a sharp decline in net sales during H2-23, mainly stemming from the shift away from heavy reliance on a single customer toward a more diversified customer base. Nonetheless, Eevia has demonstrated proof of efficiency, both in terms of production as well as the overall cost structure, underscored by the full year gross margin of 58% and a positive EBITDA result of EUR 0.8m. Based on current estimates and an applied EV/S multiple of 1.2x, a potential present value per share of SEK 2.0 (2.4) is derived in a Base scenario.

- The Reported Net Sales Fell Short of Our Estimates…

The reported net sales during Q4-23 amounted to EUR 0.3m, representing a significant decrease of -78% YoY and -65% QoQ compared to Q3-23. The repercussions of the major customer’s sudden cessation of order placements are clearly evident, compounded by temporary labeling issues on several batches, resulting in product returns and consequently, a negative impact on sales. The net sales did not meet our expectations of EUR 0.9m, as Analyst Group had anticipated a faster recovery from the loss of the major customer. Eevia’s ongoing marketing efforts have yet to yield results, and the Company could face a challenging H1-24 before these efforts materialize into actual sales contracts. However, Analyst Group remains confident that reducing customer concentration is vital in the long term and that the underlying momentum is not adequately reflected in the Q4 numbers.

- …Partially Offset by Robust Gross Margin Performance

Eevia delivered a gross profit of approx. EUR 0.2m, corresponding to a gross margin of 57% during the quarter, in line with the margin for the full year, and up from 38% in the last quarter. A change in product mix was the key factor behind the margin improvement. Looking at the full year, Eevia’s streamlined production and reduced OPEX cost base became apparent further down the P&L, as the full year EBITDA result amounted to EUR 0.8m, marking the Company’s first full year with positive EBITDA. Analyst Group believes that Eevia, with a more diversified customer base and leaner operations, is well positioned to leverage the underlying market trends and the Company’s robust product portfolio to regain historic growth.

- Updated Valuation Range in All Scenarios

Analyst Group estimates a prolonged recovery period to offset the loss of the major customer, resulting in downward revisions to our net sales estimates. However, the robust profitability demonstrated during 2023 instills confidence in Eevia’s scalable business model, suggesting improved operating margins as top-line growth returns. Consequently, we’ve raised the target multiple to EV/S 1.2x (1.0), reflecting the Company’s strong underlying profitability. Overall, the estimated increase in gross margins partially mitigates the impact of reduced sales in our forecasts, leading to an updated valuation range across all scenarios.

7

Värdedrivare

3

Historisk lönsamhet

7

Ledning & Styrelse

7

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

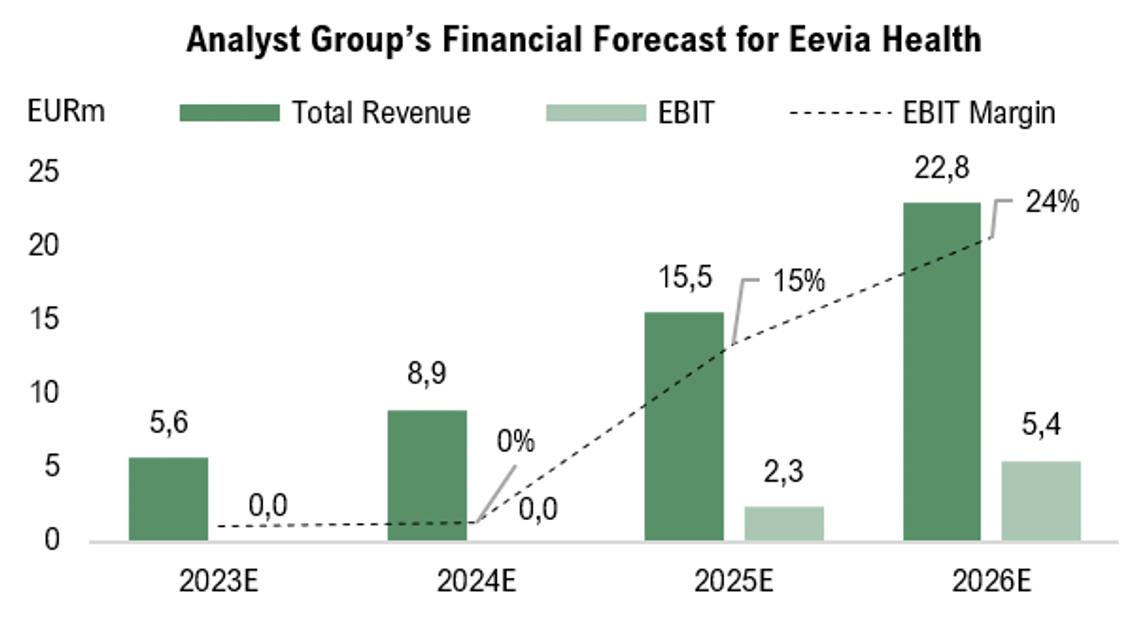

Transformative Journey to Diversify the Customer Base

Eevia Health Plc (publ) (”Eevia Health”, “Eevia” or “the Company”) has entered into a transformational phase, with a clear focus on diversifying the customer base through increased marketing and sales efforts. Looking ahead, this is estimated to result in a period of inhibited sales growth, however, Analyst Group sees this as vital in the long run, as the customer concentration risk is expected to decrease significantly. Analyst Group estimates a turnover of EUR 8.9m by 2024, and with an applied EV/S multiple of 1.0x, a potential present value per share of 2.4 (4.9) is derived in a Base scenario.

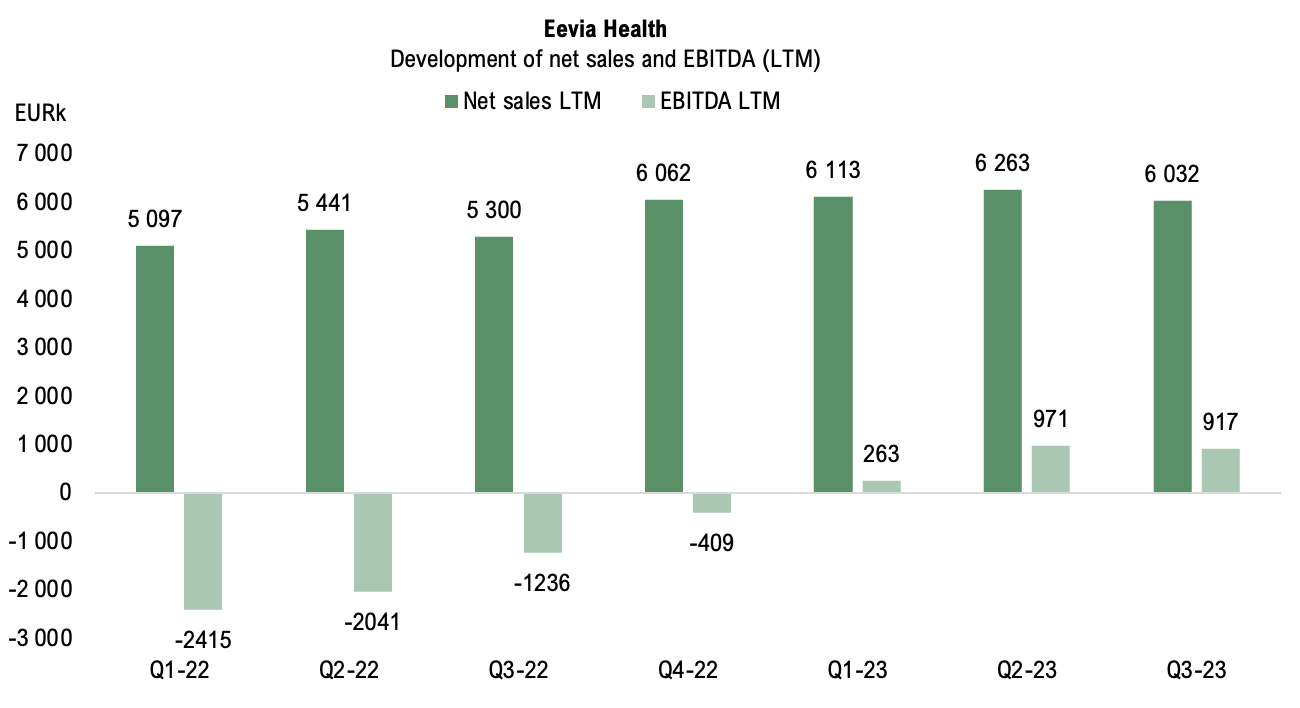

- Large Customer Dependency has Become Evident

The reported net sales during the third quarter amounted to EUR 0,9m, corresponding to a decrease of -20% YoY, and -54% QoQ compared to Q2-23. The reduction is primarily attributed to a major customer temporarily delaying order placements due to inventory buildup, which has had a significant impact, considering that this customer represented the majority of the net sales during H1-23. Eevia expects to receive recurring orders from this customer in late 2024 or early 2025. Hence, Eevia started Q3-23 with a reduced short-term sales order base, which led to a rapid escalation in marketing and sales activities, with the aim to broaden and diversify the customer base to mitigate the loss of sales and reduce Eevia’s dependence on a single customer.

- Shift in Product Mix Dampened the Gross Margin

The gross profit amounted to EUR 0.3m (0.7), corresponding to a gross margin of 38% during the quarter, which was down from 63% in Q3-22, and down from 68% in the previous quarter. The decrease in gross margin stems from a change in the product mix. Going into 2024, Analyst Group estimates a gross margin of 52.5%, where high-margin products, such as pine bark extract, are estimated to drive increased profitability.

- Increased Marketing Efforts Pave the Way for Growth

After the end of Q3, the Company attended Supply Side West, a premier nutraceutical tradeshow in Las Vegas. Following a successful exhibition, the Company is currently witnessing a surge in interest from potential new customers and is diligently working to convert these opportunities into actual sales contracts. The increased Customer Acquisition Costs (CAC) are estimated to show results during the latter part of H1-24.

- Updated Valuation Range

As Eevia Health is expected to experience a few bumpy quarters with declining growth, Analyst Group therefore lowers the top-line estimates for the coming years but anticipates a stronger margin development during this period. Additionally, we have switched the target year for our valuation to 2024 to account for a greater degree of uncertainty. This, in combination with the updated forecasts, results in an updated valuation range across all scenarios.

7

Värdedrivare

3

Historisk lönsamhet

7

Ledning & Styrelse

7

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Record-Level Margins Generate Substantial Bottom-Line Profits

Eevia Health Plc (publ) (”Eevia Health”, “Eevia” or “the Company”) is at a stage where the Company is scaling up the production capacity, focusing on higher margin extracts, and developing new proprietary ingredients targeting eye disorders, which constitute strong value drivers ahead. Having a broad product portfolio with a market demand, Eevia is estimated to enter a rapid growth phase where an EBIT of EUR 4.8m is forecasted. Based on an applied EV/EBIT multiple of 4.5x on the estimated EBIT of EUR 4.8m in year 2026, and a discount rate of 12%, this yields an implied value per share of SEK 4.9 (3.8) in a Base scenario. Given that Eevia takes steps in the right direction and is able to capitalise on the structural market trends, Analyst Group see a potential for the Company to reduce the valuation discount going forward.

- Riding on the ESG-Trend by Offering Organic and Sustainable Health Ingredients

The raw material that Eevia uses is sourced from nearby areas in Northern and Central Europe which minimizes the carbon footprint, the traceability of the products and allows for a more resilient supply chain that is less affected by global disruptions. Moreover, the wild organic raw material is taken from abundant resources that are either not utilized at all or underutilized which respects the natural ecosystem. Lastly, Eevia selects suppliers carefully in accordance with the Company’s quality and sustainability criteria. Having high-quality organic raw material close to the production site in Seinäjoki gives Eevia a competitive advantage to deliver and capitalise on the sustainability trends.

- Long-term Customers are Vital

In August 2023, Eevia reached an exclusive sales agreement with the Company’s long-term customer Select Ingredients for a new special formulation for a tart cherry extract which will be marketed under the tradename CherryMax®. The sales agreement has binding volumes and minimum sales volume per year. This cooperation is expected to generate a total sales value of over USD 1m in 2024, with additional growth in the following years. This is Eevia’s largest sales contract related to the tart cherry product line as of today, which Analyst Group sees as a positive sign as it validates the demand for the product line, increases Eevia’s future revenue potential, and is in line with the Company’s strategy to grow organically with existing customers.

- Reduced Risk

Given the directed share issue during August 2023, which resulted in a cash infusion of approximately SEK 11.5m before transaction fees, as well as strong operating results, we are of the opinion that Eevia will be able to lower the Company’s debt burden and find better sources of financing going forward. As a result, we lower our applied discount rate from 14% to 12% to reflect the reduced financing risk and improvement in the capital structure. Therefore, we increase our valuation range to SEK 4.9 (3.8) in a Base scenario, adjusted for the new share count.

7

Värdedrivare

3

Historisk lönsamhet

7

Ledning & Styrelse

6

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Improved Profitability and Strong Business Outlook

Eevia Health Plc (publ) (”Eevia Health”, “Eevia” or “the Company”) is at a stage where the Company is scaling up the production capacity, focusing on higher margin extracts, and developing new proprietary ingredients targeting eye disorders, which constitute strong value drivers ahead. Having a broad product portfolio with a market demand, Eevia is estimated to enter a rapid growth phase where an EBIT of EUR 4.8m is forecasted. Based on an applied EV/EBIT multiple of 4.5x on the estimated EBIT of EUR 4.8m in year 2026, and a discount rate of 14%, this yields an implied value per share of SEK 4.5 in a Base scenario. Given that Eevia takes steps in the right direction and is able to capitalise on the structural market trends, Analyst Group see a potential for the Company to reduce the valuation discount going forward.

- Riding on the ESG-Trend by Offering Organic and Sustainable Health Ingredients

The raw material that Eevia uses is sourced from nearby areas in Northern and Central Europe which minimizes the carbon footprint, the traceability of the products and allows for a more resilient supply chain that is less affected by global disruptions. Moreover, the wild organic raw material is taken from abundant resources that are either not utilized at all or underutilized which respects the natural ecosystem. Lastly, Eevia selects suppliers carefully in accordance with the Company’s quality and sustainability criteria. Having high-quality organic raw material close to the production site in Seinäjoki gives Eevia a competitive advantage to deliver and capitalise on the sustainability trends.

- Operating in Vast Markets with Strong Macro Trends

The global market for nutraceuticals is estimated to be worth USD 317bn in 2023 and is projected to reach USD 599bn in 2030 which represent a CAGR of 9.4% during the forecast period where the growth is attributed to changing consumer preferences and demographics along with increases in R&D activity. Regarding the plant extract market, it is estimated to be worth USD 50b in 2023 and is projected to reach USD 74b in 2030 which represents a CAGR of 5.9%. Growth drivers for the plant extract market include rising awareness of synthetic flavour side-effects and health benefits offered by plant-based medicine. As the awareness of Eevia’s product offerings and brand value grows over time, the Company is expected to benefit from market tailwinds.

- Business Outlook and Value Drivers

Although the demand from customers may slow down in the medium term, we see that Eevia has taken proactive measures, such as improving production to free up capacity and streamlining the cost structure to counteract an eventual slowdown in demand, which has also benefitted the Company’s operating results lately. Additionally, Eevia has a substantial order amounting to EUR 2.1m which is estimated to be invoiced during Q2-23, and thus constituting a strong value driver going forward, creating further sales momentum.

7

Värdedrivare

3

Historisk lönsamhet

7

Ledning & Styrelse

8

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Getting Closer to Black Numbers after Operating Improvements

Eevia Health Plc (publ) (”Eevia Health”, “Eevia” or “the Company”) is at a stage where the Company is scaling up the production capacity, focusing on higher margin extracts, and developing new proprietary ingredients targeting eye disorders, which constitute strong value drivers ahead. Based on current estimates as well as a slightly lower applied EV/EBIT multiple of 4.5x (5.0) due to revenue growing slower than our expectations in 2022, we lower our present valuation in terms of Market Cap to SEK 136m (140) in a Base scenario. Additionally, with respect to the new share count after the rights issue in November 2022, this corresponds to a value per share of SEK 4.5. This is lower in terms of value per share compared to our update in September, which is merely a technical adjustment due to an increase in shares outstanding.

- Riding on the ESG-Trend by Offering Organic and Sustainable Health Ingredients

The raw material that Eevia uses is sourced from nearby areas in Northern and Central Europe which minimizes the carbon footprint, the traceability of the products and allows for a more resilient supply chain that is less affected by global disruptions. Moreover, the wild organic raw material is taken from abundant resources that are either not utilized at all or underutilized which respects the natural ecosystem. Lastly, Eevia selects suppliers carefully in accordance with the Company’s quality and sustainability criteria. Having high-quality organic raw material close to the production site in Seinäjoki gives Eevia a competitive advantage to deliver and capitalize on the sustainability trends.

- Operating in Vast Markets with Strong Macro Trends

The global market for nutraceuticals was estimated to be worth USD 241bn in 2019 and is projected to reach USD 373bn in 2025 which represent a CAGR of 7.5% during the forecast period where the growth is attributed to changing consumer preferences and demographics along with increases in R&D activity. Regarding the plant extract market, it was estimated to be worth USD 24b in 2019 and is projected to reach USD 59b in 2025 which represents a CAGR of 16.5%. Growth drivers for the plant extract market include rising awareness of synthetic flavour side-effects and health benefits offered by plant-based medicine. As the awareness of Eevia’s product offerings and brand value grows over time, the Company is expected to benefit from market tailwinds.

- Maintaining the Valuation Range in Terms of Company Value

Given the shares from the rights issue during November 2022, which resulted in an additional 14.4m shares, the value per share in this update is not directly comparable to our last report since that was based on a lower share count. A better comparison is therefore to look at the valuation in absolute numbers, where we in this update have a valuation range of SEK 35m (39) – SEK 202m (206), with SEK 136m (140) in a Base scenario.

7

Värdedrivare

3

Historisk lönsamhet

7

Ledning & Styrelse

6

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Profitable Growth Ahead

Eevia Health offer organic plant extracts for food nutraceuticals, drinks, and cosmetics under different brands. The Company is at a stage where it aims to increase production capacity, focus on higher margin extracts, and develop new proprietary ingredients targeting eye disorders, which could be strong value drivers ahead. Having a broad product portfolio and high demand from customers, Eevia Health is entering a fast-growth phase, where an EBIT of EUR 4.8m is estimated in 2026. Based on an applied EV/EBIT multiple of 5x on estimated EBIT, and a discount rate of 14%, this yields an equity value per share of SEK 8.8 in a Base scenario. In conclusion, we see several drivers as well as market trends in Eevia’s favor, and where steps in the right direction should reduce the current valuation discount.

- Riding on the ESG-Trend by Offering Organic and Sustainable Health Ingredients

The raw material that Eevia uses is sourced from nearby areas in Northern and Central Europe which minimizes the carbon footprint, the traceability of the products and allows for a more resilient supply chain that is less affected by global disruptions. Moreover, the wild organic raw material is taken from abundant resources that are either not utilized at all or underutilized which respects the natural ecosystem. The harvesting is performed carefully through handpicking and the majority of the raw materials come from forests of the Finnish Lapland. Lastly, Eevia selects its suppliers carefully in accordance with its quality and sustainability criteria. Having implemented these actions, it displays that sustainability is a part of Eevia’s DNA, considering it at each stage of the supply chain.

- Operating in Vast Markets with Strong Macro Trends

Eevia Health is operating within the global markets for nutraceutical ingredients and plant extracts. The global market for nutraceuticals was estimated to be worth USD 241bn in 2019 and is projected to reach USD 373bn in 2025 which represent a CAGR of 7.5% during the forecast period where the growth is attributed to changing consumer preferences and demographics along with increases in R&D activity. Regarding the plant extract market, it was estimated to be worth USD 24b in 2019 and is projected to reach USD 59b in 2025 which represents a CAGR of 16.5%. Growth drivers for the plant extract market include rising awareness of synthetic flavor side-effects and health benefits offered by plant-based medicine.

- Triggers

Going forward, we see the following triggers potentially driving the value of Eevia: 1) continued sales growth by capitalizing on new orders from customers, 2) improved profitability by shifting sales to higher margin products and/or increased efficiency in operations, and 3) launch of new proprietary products. E.g., Retinari against the eye disease age-related macular degeneration (AMD).

6

Värdedrivare

3

Historisk lönsamhet

7

Ledning & Styrelse

8

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Fast-Grower in the Nutraceuticals & Herbal Medicine Markets

Eevia Health offer organic plant extracts for food nutraceuticals, drinks, and cosmetics under different brands. The Company is at a stage where it aims to increase production capacity, focus on higher margin extracts, and develop new proprietary ingredients targeting eye disorders, which could be strong value drivers ahead. Having a broad product portfolio and high demand from customers, Eevia Health is entering a fast-growth phase, where an EBIT of EUR 4.8m is estimated in 2026. Based on an applied EV/EBIT multiple of 5x on estimated EBIT, and a discount rate of 14%, this yields an equity value per share of SEK 8.8 in a Base scenario. In conclusion, we see several drivers as well as market trends in Eevia’s favor, and where steps in the right direction should reduce the current valuation discount.

- Riding on the ESG-Trend by Offering Organic and Sustainable Health Ingredients

The raw material that Eevia uses is sourced from nearby areas in Northern and Central Europe which minimizes the carbon footprint, the traceability of the products and allows for a more resilient supply chain that is less affected by global disruptions. Moreover, the wild organic raw material is taken from abundant resources that are either not utilized at all or underutilized which respects the natural ecosystem. The harvesting is performed carefully through handpicking and the majority of the raw materials come from forests of the Finnish Lapland. Lastly, Eevia selects its suppliers carefully in accordance with its quality and sustainability criteria. Having implemented these actions, it displays that sustainability is a part of Eevia’s DNA, considering it at each stage of the supply chain.

- Operating in Vast Markets with Strong Macro Trends

Eevia Health is operating within the global markets for nutraceutical ingredients and plant extracts. The global market for nutraceuticals was estimated to be worth USD 241bn in 2019 and is projected to reach USD 373bn in 2025 which represent a CAGR of 7.5% during the forecast period where the growth is attributed to changing consumer preferences and demographics along with increases in R&D activity. Regarding the plant extract market, it was estimated to be worth USD 24b in 2019 and is projected to reach USD 59b in 2025 which represents a CAGR of 16.5%. Growth drivers for the plant extract market include rising awareness of synthetic flavor side-effects and health benefits offered by plant-based medicine.

- Cash Position and Risks to Monitor

At the end of March 2022, cash amounted to EUR 0.4m, and the burn rate for the last six months was EUR -0.4m per month. Given the current cash position burn rate, and credit line of EUR 0.8m, Eevia has enough capital to operate the business until the end of the year, all else equal. Going forward, we assume that Eevia could obtain financing via a combination of loans, additional shareholder capital, sales from current operations, and/or investment grants.

6

Värdedrivare

3

Historisk lönsamhet

7

Ledning & Styrelse

8

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Analytikerkommentarer

Comment on Eevia Health’s Term Sheet Agreement with an International Partner and the Announced Insider Transactions

2025-02-12

On February 12th, Eevia Health Plc (publ) (“Eevia”) announced that the Company has signed a term sheet agreement with an international partner for a global supply agreement of a nutraceutical ingredient. Additionally, Stein Ulve, CEO of Eevia, has, through a family holding company, subscribed to his pro-rata portion of shares (5,892,334 shares), amounting to SEK 530k, in the ongoing rights issue. Moreover, he has purchased an additional 219,450 shares and 31,350 TO1 warrants outside the market, also through a family holding company.

Analyst Group’s View of the News

The signing of a Term Sheet Agreement (TSA) with a global partner marks a significant milestone, offering Eevia access to an extensive international sales network. Albeit no final agreement has been signed, the TSA outlines key commercial terms that lay the foundation for an exclusive global supply agreement, signaling strong progress in Eevia’s partnership with the international corporation. While management anticipates steady rather than dramatic revenue growth, the agreement is expected to enhance revenue predictability and drive long-term demand, positioning Eevia for sustainable growth from 2025 onwards.

Simultaneously, Stein Ulve’s participation in the ongoing rights issue through Orcator Oy, along with the additional purchase of shares and warrants, signals strong confidence in Eevia’s future prospects, highlighting his belief in the company’s strategic direction and financial outlook.

The Term Sheet for Global Supply Agreement

The international partner, which Eevia has signed a term sheet agreement with, is part of a corporation generating over EUR 36bn in revenue with more than 66,000 employees. This agreement outlines key commercial terms for an upcoming exclusive Global Supply Agreement related to a nutraceutical ingredient.

Since signing an NDA in October 2023, the two companies have collaborated on a feasibility study, safety audits, and regulatory reviews, confirming the product’s safety. Eevia has also provided industrial-scale production and technical support, alongside ongoing clinical studies.

The final agreement, expected in the coming months, will grant Eevia access to the partner’s global sales network, enhancing potential revenue growth from 2025 and onward. The deal allows Eevia to focus on manufacturing and supply chain operations, while the partner drives sales and market expansion.

Share Purchase and Increase in Total Guaranteed Subscriptions

Eevia Health’s CEO, Stein Ulve, has reorganized his shareholdings by selling 2,726,717 shares to Orcator Oy, a holding company jointly owned with his spouse. In return, Ulve received shares in Orcator Oy, with both holding 50% stakes. Orcator Oy is classified as a Person Closely Associated (PCA) and now holds 2,946,167 shares (4.39% of Eevia’s outstanding shares), after acquiring an additional 219,450 shares and 31,350 Warrants (TO1) through off-market transactions.

Orcator Oy also subscribed to its pro-rata share in Eevia’s ongoing rights issue, amounting to 5,892,334 new shares for an investment of SEK 530k. Orcator Oy had previously provided a EUR 200k guarantee commitment in the current rights issue. Together with today’s subscription, the underwriting commitments amount to 23.8% of the total offering in the rights issue. Including guarantee commitments from other investors, 31.8% of the rights issue is now secured.

In summary, Eevia Health’s recent developments signal strong strategic progress. The Term Sheet Agreement with a global partner has the potential to be converted into a concrete contract, potentially generating additional revenue streams from 2025 onwards. Additionally, CEO Stein Ulve’s increased ownership highlights his strong belief in Eevia’s strategic direction. The increase in total guaranteed subscriptions, totaling approx. 32% of the rights issue, reflects solid support for the capital raise and boosts confidence in Eevia’s ability to secure the necessary funding for its growth plans.

How Analyst Group views Eevia Health as an investment

In Q4-24, Eevia launched a transformational restructuring plan to become a specialized provider of high-margin, science-backed health solutions, focusing on gut, kidney, and urinary health. By divesting assets related to Retinari™ and berry extract manufacturing, Eevia aims to streamline operations, enhance profitability, and adopt a capital-light business model, leveraging the Company’s expertise in bioactive compounds. This turnaround plan allows investors to retain exposure to former operations without the financial risks of plant extract production. With a clear strategy set by the new and experienced board, Eevia is well-positioned to capitalize on the expanding gut health market and recover to profitable growth, thereby unlocking the underlying value within the Company. Overall, Analyst Group believes the ongoing rights issue presents an attractive entry point for investors at a Pre-Money valuation of SEK 6.0m.

Comment on Eevia Health’s New Sales Orders Totaling SEK 619k (EUR 54k) and Participation in leading trade fair BIOFACH

2025-02-11

On February 11th, Eevia Health Plc (publ) (“Eevia”) announced multiple new sales orders for products totaling EUR 54k, equivalent to SEK 619k, from various European and Asian customers. In addition, Eevia is currently participating in BIOFACH, the world’s leading trade fair for organic food, taking place in Germany.

Analyst Group’s View of the New Orders

The new orders following the opening day of BIOFACH 2025 highlight Eevia’s strong market position and the effectiveness of the Company’s distribution partnerships, particularly with BREKO in Germany. The total order value of EUR 54k, including repeat purchases from key markets such as Germany, Australia, and Taiwan, reflects consistent demand for Eevia’s product portfolio.

We would like to emphasize that the sale of berry extracts strongly indicates sustained demand for Eevia’s premium products, derived from wild-harvested bilberries from Finnish and Swedish forests. This is particularly encouraging as Eevia is currently progressing with the divestment of the Company’s berry-based extract manufacturing assets, valued at EUR 2.5–3.0m, highlighting the underlying value of these assets as the Company continues to generate repeat orders.

It is important to note that all products are in stock, enabling immediate delivery without additional production costs, which positively impacts working capital and cash flow. Consequently, the reduction in inventory is expected to further strengthen the Company’s financial position. Moreover, the recurring nature of these orders demonstrates strong customer retention, supporting sustained revenue growth moving forward.

Sales Orders and Participation at the leading trade fair BIOFACH

Eevia is currently participating in BIOFACH 2025, the world’s leading trade fair for organic food, taking place from February 11–14 in Nuremberg, Germany. The event brings together exhibitors and visitors from the organic and natural sectors worldwide. During last year’s edition (2024), BIOFACH saw impressive participation, with 2,561 exhibitors and 34,626 visitors from 128 countries.

Following the opening day of the trade fair, four customers placed sales orders totaling EUR 54k (equivalent to SEK 619k). These included two German customers through the Company’s distributor, BREKO, for the bilberry extract Feno-Myrtillus™ 36. One German order was for Fenoprolic™ Full Spectrum, a pine extract with a broad spectrum of oligomeric proanthocyanidins. Additionally, a small order for the tart cherry extract Feno-Ceraus™ 5 (containing 5% polyphenols) came from Australia, while an order from Taiwan for Feno-Myrtillus™ 25 amounted to approx. EUR 15k.

Eevia has all products in stock, enabling immediate delivery without the need for raw material purchases or production, which benefits cash flow. As these are repeat orders, further purchases from these customers are expected.

In summary, it is encouraging to see that Eevia’s current product portfolio continues to generate repeat orders from existing customers, validating the strong demand for its 100% organically certified plant extracts. Additionally, BIOFACH, the world’s leading trade fair for organic food, presents an excellent opportunity to showcase the Company’s robust product portfolio to prospective customers, potentially converting them into long-term, repeat clients.

How Analyst Group views Eevia Health as an investment

In Q4-24, Eevia launched a transformational restructuring plan to become a specialized provider of high-margin, science-backed health solutions, focusing on gut, kidney, and urinary health. By divesting assets related to Retinari™ and berry extract manufacturing, Eevia aims to streamline operations, enhance profitability, and adopt a capital-light business model, leveraging the Company’s expertise in bioactive compounds. This turnaround plan allows investors to retain exposure to former operations without the financial risks of plant extract production. With a clear strategy set by the new and experienced board, Eevia is well-positioned to capitalize on the expanding gut health market and recover to profitable growth, thereby unlocking the underlying value within the Company. Overall, Analyst Group believes the ongoing rights issue presents an attractive entry point for investors at a Pre-Money valuation of SEK 6.0m.

Comment on Eevia Health’s Q4-report

2025-02-06

On February 6th, Eevia Health Plc (publ) (“Eevia” or “the Company”) published the Company’s quarterly report for Q4-24. The following are some points that we have chosen to highlight from the report:

- Strategic Turnaround Plan Aimed at Streamlining Operations

- Rights Issue Enabling Eevia to Execute on the Turnaround Plan

- Planned Divestments Creates Broad Commercial Exposure

- Weaker Sales and Increased COGS Impacted Margins Negatively

- New Board Members with Experience

Comprehensive Turnaround Plan Aimed at Streamlining Operations

During Q4-24, Eevia initiated a strategic turnaround plan aimed at streamlining operations, by repositioning the Company to focus on higher-margin, science-backed health solutions, particularly addressing gut, kidney, and urinary health. This transition aims to enhance revenue traction, profitability, streamline operations, and align the Company with fast-growing consumer health trends, reducing reliance on price-sensitive standard extracts. As part of the streamlining initiatives, Eevia is planning on divesting assets to protect the value of market opportunities for Eevia’s shareholders. These divestments include the Company’s assets related to the eye health compound, Retinari™, and manufacturing assets related to berry-based extracts.

At the core of this transformation is the commercialization of proprietary, scientifically validated products, including MaxBIOME™, a gut health formulation utilizing concentrated proanthocyanidins from berry extracts, leveraging Eevia’s existing products experience. Preclinical research has demonstrated promising results, why Eevia is seeking non-dilutive R&D funding of EUR 570k to conduct a clinical study, with early results expected during Q3-25. Being able to show study results and demonstrating the positive impacts on humans are a crucial component in positioning the brand and attracting customers. The Company plans to introduce MaxBIOME™ to the market in Q4-25, with initial commercial agreements anticipated during summer and early fall of 2025.

Rights Issue of SEK 12.1m to Strengthen the Financial Position

Following the end of the fourth quarter, Eevia announced the Company’s intention to execute a rights issue of approx. SEK 12.1m, before deduction of transaction related costs, with preferential rights for existing shareholders. The purpose is to fund Eevia’s strategic reorientation and turnaround plan. The subscription price amounts to SEK 0.09 per share and EUR 0.0077 per share for shareholders through Euroclear Finland, reflecting a Pre-Money valuation of SEK 6m. All existing shareholders receive one (1) subscription right per share, where each right entitles them to subscribe for two (2) new shares. The subscription period runs from January 28 to February 18, 2025, in Sweden, while the corresponding period in Finland is from January 29 to February 20, 2025. The issue is secured in writing by external investors through top-down underwriting commitments covering 27%, from 100% down to 73%.

Upon full subscription, Eevia would receive approx. SEK 12.1m before deducting transaction costs of SEK 1.9m, including SEK 0.4m for underwriters. The net proceeds will be allocated to working capital (39%), repayment of bridge loan and other debt (32%), equity part in product R&D-projects (20%), as well as other purposes (10%), such as the sales organization.

Following the end of the quarter, the Company secured a bridge loan of EUR 200k in connection with the rights issue, which was crucial as the Company’s cash balance amounted to EUR 10k at the end of Q4-24. Following the end of the quarter, Eevia announced ten new sales orders of products totaling EUR 66k from various European and US customers, one of which is a new customer. A key highlight is that, except for the tart cherry extract, Feno-Ceraus 5, all products are currently in stock, positively impacting working capital and cash flow. All in all, the ongoing rights issue is set to strengthen the Company’s financial position, enabling Eevia to execute on the new turnaround strategy.

Divestments Set to Unlock Hidden Value

As part of the streamlining initiatives, Eevia is planning on divesting assets to protect the value of market opportunities for Eevia’s shareholders. The first divestment is for assets related to Retinari™, a potential game-changing prophylactic designed to prevent the onset and progression of age-related macular degeneration (AMD), a progressive eye disease that damages the macula and leads to central vision loss, primarily affecting older adults. Eevia has agreed to sell the assets to Havu Health Oy to an amount of EUR 800k, which will paid in shares that are planned to be distributed to Eevia Health’s shareholders as a tax-free dividend, subject to pre-approval from Finnish Tax authorities. The second divestment concerns Eevia’s berry-based extract manufacturing assets, which will be sold to Baccas Salus Oy for EUR 2.5-3.0m, a startup focused on cost-efficient and sustainable berry extract production. Similar to the priorly mentioned divestment, Eevia will receive shares in Baccas Salus as payment for the assets, which will be distributed to shareholders. A smaller fraction of the divestment will be paid in cash, which will be used to reduce Eevia’s debt, improving net working capital.

Sales and Profitability

During Q4-24, net sales amounted to EUR 263k (317), corresponding to a decrease of 17% YoY. Adjusting for product returns and credit notes, due to reorganization of distributor stock, which were credited and re-invoiced by other distributors, with some invoices going to 2025, the net sales were EUR 401k. Furthermore, other income boosted the total revenues during the quarter, as it includes a non-recurring net gain from the sale of fixed assets of EUR 677k (Retinari™). On a positive note, Eevia’s largest customer, paused on one key item, resumed orders in December after approving the Company’s high strength bilberry extract.

The gross margin, excluding the positive one-off effect from the sale of Retinari™, came in at 15.7% during Q4-24, and 37% when including the one-off effect. This was a drastic decrease both Q-Q and Y-Y, when the gross margin amounted to 47% (Q3-24) and 61% (Q4-23), respectively. The main reason for the reduction in gross margin was Eevia’s efforts to sell out the inventory by lowering prices, hence reducing the margins while raw material prices increased due to volatility stemming from foreign labor issues in Finland and Sweden. There was no effect on gross margin from side-stream products in Q4-24.

The EBITDA of Q4-24, amounted to EUR 257k (incl. one-off effect), compared to EUR -148k during the same period last year. However, the adjusted EBITDA, which gives a fairer view of the underlying profitability, amounted to EUR -267k during Q4-24. The improvement in adjusted EBITDA Q-Q (Q3-24) was EUR 32k, mainly stemming from lower operational- and personnel cost.

In reflection of the full year 2024, the EBITDA amounted to EUR -345k (753), excluding the non-recurring net gain from sale of fixed assets of EUR 677k, the adjusted EBITDA amounts to EUR – 1 022k. All in all, 2024 was a challenging year for Eevia in terms of sales and profitability, as the efforts in H1-24 to regain sales momentum through a “switch strategy” fell short. Additionally, the profitability was hampered by a shortage of foreign labor in Sweden and Finland which disrupted the wild berry harvest in Q3-24, which led to increased raw material costs, impacting margins negatively.

Looking ahead, the new turnaround plan will enable a more capital-light and streamlined business model, focusing on a new value proposition targeting a vast market opportunity, which has a great potential to generate solid revenue streams during the coming years.

New Experienced Board Members and Scientific Advisors

During Q4-24, the Board of Directors was significantly strengthened with the addition of Terry Virts as the new Chairman and Dr. Diane Clayton as a new member, adding new competence as well as a strong network to the Company. Furthermore, Dr. Diane Clayton will strengthen the science advisory board which is under formation. In January, Marinus Blaabjerg Sørensen joined the Board through the filling of a vacancy. Blaabjerg Sørensen is the founder and principal owner of New Nordic Healthbrands, a successful nutraceutical company listed on Nasdaq, Stockholm.

In conclusion, Eevia delivered a Q4 report without any surprises in terms of sales and profitability. The main highlight in the quarter is the new and comprehensive turnaround plan, aimed at streamlining operations. By divesting assets related to Retinari™ and berry extract manufacturing, Eevia aims to streamline operations, enhance profitability, and adopt a capital-light business model, leveraging the Company’s expertise in bioactive compounds. This turnaround plan allows investors to retain exposure to former operations without the financial risks of plant extract production. With a clear strategy set by the new and experienced board, Eevia is well-positioned to capitalize on the expanding gut health market and recover to profitable growth, thereby unlocking the underlying value within the Company. Overall, Analyst Group believes the ongoing rights issue presents an attractive entry point for investors at a Pre-Money valuation of SEK 6.0m.

Comment on Eevia Health’s Divestment of the Eye-Health Candidate Retinari™

2025-02-05

On February 4thth, Eevia Health Plc (publ) (“Eevia”) announced that the Company has agreed to sell IP related to the leading eye-health compound, Retinari™, to Havu Health Oy for EUR 800k, equivalent to approx. SEK 9.2m. Retinari™ is a promising compound in fighting Age-related Macular Degeneration (AMD), the primary cause of blindness.

Analyst Group’s View of the Divestment

As part of Eevia’s ongoing streamlining initiatives, the Company is planning to divest assets to maximize shareholder value and capitalize on market opportunities. The divestment of IP related to the Company’s leading eye-health compound, Retinari™, for approx. SEK 9.2m is a testament to the underlying value embedded in Eevia Health. While Havu Health Oy’s success will depend on securing adequate funding from grants and the Finnish venture fund, this divestment marks an important step in Eevia’s transformational restructuring plan, aimed at unlocking the Company’s intrinsic value.

About Retinari™ and the Divestment

Retinari™ is a stilbene extract derived from upcycled pine wood, developed over six years by Eevia. Preclinical studies, including biomarker analyses, mice trials, and human primary cell studies, have demonstrated its potential in preventing the onset and progression of Age-related Macular Degeneration (AMD), a leading cause of blindness among the elderly. The compound works by enhancing autophagy and cytoprotective capacity in retinal pigment epithelial cells. Despite promising results and recognition from the European Innovation Council’s Accelerator program, Eevia faced challenges in securing necessary funding for further development. Consequently, the Company decided to sell the IP to Havu Health Oy, aiming to ensure continued advancement of Retinari™ under new ownership.

The buyer is a start-up, Havu Health Oy, founded by Eevia’s CTO Petri Lackman. Eevia will receive shares in Havu Health as compensation for the assets, which is planned to be distributed to Eevia Health’s shareholders as a tax-free dividend, subject to pre-approval from Finnish Tax authorities. Havu Health Oy is in discussions with a Finnish venture fund for an equity investment and is submitting a EUR 800k Research and Development Loan application to Business Finland to finance the necessary safety studies. Additionally, Havu Health is preparing a EUR 2.5m grant application to the European Innovation Council’s Accelerator program, which would further accelerate the development process.

The book value of the intangible asset has been gradually written down over the years and, as of the end of Q4-24, it stood at approx. EUR 123k. Consequently, the sale generates an additional value of EUR 677k, and Eevia will withdraw the Company’s application to Business Finland to convert the loan into a grant. The loan, which currently amounts to approx. EUR 103k, does not require amortization until 2027 and will then be repaid over five years.

In summary, we view the divestment as a pivotal step in the Company’s ongoing restructuring plan, reinforcing the underlying value that the transformational strategy aims to unlock. Moving forward, Havu Health Oy’s ability to secure the necessary funding will be a key factor to monitor, as successful financing could unlock significant upside potential and accelerate the commercialization of Retinari™.

How Analyst Group views Eevia Health as an investment

In Q4-24, Eevia launched a transformational restructuring plan to become a specialized provider of high-margin, science-backed health solutions, focusing on gut, kidney, and urinary health. By divesting assets related to Retinari™ and berry extract manufacturing, Eevia aims to streamline operations, enhance profitability, and adopt a capital-light business model, leveraging the Company’s expertise in bioactive compounds. This turnaround plan allows investors to retain exposure to former operations without the financial risks of plant extract production. With a clear strategy set by the new and experienced board, Eevia is well-positioned to capitalize on the expanding gut health market and recover to profitable growth, thereby unlocking the underlying value within the Company. Overall, Analyst Group believes the ongoing rights issue presents an attractive entry point for investors at a Pre-Money valuation of SEK 6.0m.

Comment on Eevia Health’s New Orders of SEK 763k (EUR 66k) and Newly Acquired Customer

2025-01-29

On January 29th, Eevia Health Plc (publ) (“Eevia”) announced ten new sales orders for products totaling EUR 66k from various European and US customers, one of which is a new customer.

Analyst Group’s View of the New Orders and Customer

The repeat orders from ten customers, including a new Latvian client, reflect strong demand for Eevia’s high-quality, organically certified plant extracts, supplied B2B to global dietary supplement and food brands. These orders are particularly encouraging as Eevia progresses with the divestment of its berry-based extract manufacturing assets to Baccas Salus Oy for EUR 2.5–3.0m, reinforcing demand for premium plant extracts.

A key highlight is that, except for the tart cherry extract, Feno-Ceraus 5, all products are currently in stock, positively impacting working capital and cash flow. Given Eevia’s recent liquidity challenges, the reduction in inventory is expected to strengthen the company’s financial position.

Additionally, Eevia’s ability to attract new customers is noteworthy, particularly as the company currently lacks the resources to invest in dedicated sales and marketing staff. This suggests that new customer acquisition may be driven organically through distributors efforts and word-of-mouth, further reinforcing the strong reputation of Eevia’s high-quality plant extracts.

The Sales Orders

During the past week, Eevia secured sales orders totaling EUR 66k, equivalent to SEK 763k, from ten customers, including one new client. Notable orders included EUR 11k from a French partner and EUR 8k from a European customer for the bilberry extract Feno-Myrtillus 25. The European customer, utilizing bilberry extracts in animal feed applications, represents a promising high-volume opportunity. Additionally, a Finnish customer placed an order worth EUR 10k for bilberry products, while Select Ingredients submitted an order for a bilberry product intended for a U.S.-based organic brand.

Moreover, a Finnish customer ordered EUR 7k of Fenoprolic 70 Organic, while a German customer placed a EUR 10k order for the same product via distributor Breko. Additional orders included Feno-Chaga Organic in the U.S. through NutriOriginal, a small initial U.S. order for Feno-Ceraus 5 Organic (tart cherry extract), and a EUR 3k bilberry extract order from a new Latvian customer.

The majority of these orders were placed via distributors, supporting end-customers in developing high-quality natural brands. With the exception of Feno-Ceraus 5, all products are currently in stock, enabling immediate fulfillment without requiring additional raw material purchases, thereby positively impacting cash flow. Eevia also holds sufficient raw material for Feno-Ceraus 5, allowing for swift production. As these are primarily repeat orders, Eevia anticipates additional future orders from these customers.

In summary, we view the new sales orders as a positive step forward. With the planned divestment of berry extract manufacturing assets, these orders further validate the strong demand for Eevia’s high-quality plant extracts, highlighting the potential to unlock significant underlying value upon successful completion of the divestment.

How Analyst Group views Eevia Health as an investment

In Q4-24, Eevia launched a transformational restructuring plan to become a specialized provider of high-margin, science-backed health solutions, focusing on gut, kidney, and urinary health. By divesting assets related to Retinari™ and berry extract manufacturing, Eevia aims to streamline operations, enhance profitability, and adopt a capital-light business model, leveraging the Company’s expertise in bioactive compounds. This turnaround plan allows investors to retain exposure to former operations without the financial risks of plant extract production. With a clear strategy set by the new and experienced board, Eevia is well-positioned to capitalize on the expanding gut health market and recover to profitable growth, thereby unlocking the underlying value within the Company. Overall, Analyst Group believes the ongoing rights issue presents an attractive entry point for investors at a Pre-Money valuation of SEK 6.0m.

Comment on Eevia receiving a grant of approx. SEK 2.7m and multiple orders totaling approx. SEK 2.0m

2024-03-19

Eevia Health Plc (”Eevia” or “the Company”) announced on Tuesday, March 19th, that the Company has received a grant of approx. SEK 2.7m (EUR 243k) from Business Finland for finalizing a development project for the documentation of bioactivity on Eevia’s products. Eevia executed the project in 2023 and submitted the final report in Q1-24, which has now been approved.

A central activity in the project was a broad in vitro screening of Eevia’s top extracts on the Eurofins BioMAP phenotyping platform. The successful execution of the study provided Eevia with a collection of new insightful research data on the Company’s products, with especially promising bioactivity for one ingredient. Eevia is now seeking approx. EUR 0.8m in new non-dilutive funding from the continuation project named ”Global Vision”.

Additionally, Eevia announced on Monday, March 18th, that the Company has revised its information policy. This means that from now on, Eevia will only disclose orders or contracts with a sales value over EUR 50k, or when the accumulated value of several smaller orders exceeds that threshold, contrasting with the previous threshold of EUR 10k.

Yesterday’s announcement was closely followed by the news that Eevia has received a framework agreement of approx. SEK 1.5m (USD 142k) for the elderberry extract Feno-Sambucus™ 7 Organic from a distributor in the US. The order comes from Select Ingredients, a distributor located in San Diego, specialized in organic ingredients and high-quality natural plant extracts, serving branded customers in California and other large states across the US. The end customer is a company in the whole foods and drinks segment, which is experiencing rapid growth across North America.

On Tuesday, March 19th, Eevia announced that the Company has received multiple orders with an accumulated value of approx. SEK 0.5m (EUR 50k) from various European customers. The sales orders are for the products Feno-Chaga M (Chaga extract), Feno-Myrtillus 25 Organic, Feno-Myrtillus 36 Organic (both bilberry extracts) and Fenoprolic 70 Organic (Pine bark extract). Thus, Eevia has received sales orders totaling approx. SEK 2.0m during the last two days, and the Company expects further repeat orders in the future from the same customers.

Analyst Group’s view

“Given Eevia’s challenging H2-23, where the repercussions from the loss of the major customer became evident, Analyst Group is pleased to see signs of a strengthened business momentum, as highlighted by the multiple sales orders totaling approx. SEK 2.0m announced recently. To put this number in context, Eevia’s net sales amounted to approx. SEK 3.6m (EUR 317k) during Q4-23, hence, the sales orders from this week equals approx. 56 % of the net sales in the last quarter.

The large framework agreement of approx. SEK 1.5m marks the first order where Eevia offers free on board (FOB) prices from New Jersey. The Company’s recent reorganization of distribution in North America, announced in January 2024, is already yielding results. By maintaining buffer stock in New Jersey and thus reducing lead times, Eevia is poised to enhance the Company’s competitiveness in the North American market, which presents considerable growth opportunities ahead.

Additionally, the received grant of approx. SEK 2.7m is of major importance, given Eevia’s strained financial position at the end of Q4-23. A strengthened cash position enables Eevia to be more flexible in terms of marketing incentives to fuel future growth and broadening the customer base, which is an important task following the major customer loss last year.

Overall, Analyst Group views the recent news positively, as the sales orders demonstrate that Eevia has taken necessary actions towards regaining growth. This is exemplified by the reorganized distribution in the US, which is already bearing fruit. With a more diversified customer base, a strong product portfolio, promising growth prospects in North America, and a strengthened balance sheet, Eevia is taking the right steps toward returning to growth.”

Comment on Eevia Health’s Q4-report

2024-02-15

On February 14th, Eevia Health published the company’s quarterly report for Q4-23. The following are some points that we have chosen to highlight from the report:

- The reported net sales fell short of our estimates

- Strong gross margin contributed to the first full year with positive EBITDA

- Recent positive development bodes well for future growth

- Short-term financial position secured by credit facility

A Weak H2-23 Hampered the Net Sales for the Full Year 2023

During Q4-23, the net sales amounted to approx. EUR 0.3m (1.4), corresponding to a decrease of 78% YoY, and a decrease of 65% QoQ compared to Q3-23, where net sales amounted to EUR 0.9m. The repercussions of the major customer’s temporary pause in order placements due to inventory buildup, as announced in the last report, are evident in the sharp revenue decline during the quarter. Although Analyst Group had anticipated lower net sales compared to the same period last year, the reported net sales fell well below our estimate of EUR 0.9m, as we did not foresee such a rapid decline.

It’s worth mentioning that the company was compelled to relabel several batches due to a global analytical service partner’s disclosure of erroneous lab reports, leading to product returns from some customers and negatively impacting net sales directly through credit notes by approx. EUR 0.2m. The indirect consequences of delayed sales are not quantified. To clarify, adjusted for credit notes from returns, net sales amounted to approx. EUR 0.6m during Q4-22, and Eevia confirms that the problem has since then been resolved.

Eevia has initiated several strategic initiatives during the quarter to mitigate the declining revenue, such as increased marketing activities, participation in a trade show exhibition, and appointing a new Commercial Director. Analyst Group believes that the outcomes of the company’s recent initiatives have yet to reach their full potential, and that Eevia’s efforts are crucial to diversify the customer base and thereby pave the way for future growth.

Regarding the full year of 2023, Eevias net sales amounted to EUR 4.9m (5.9), corresponding to a decrease of approx. 17% or EUR -1.0m in absolute terms, which fell short of Analyst Group’s estimates in our latest analysis, where we estimated net sales of EUR 5.5m for the full year. The decline in revenue for the full year can predominantly be ascribed to the same factor that affected sales this quarter: the major customer abruptly halted order placements starting in June 2023 and credit notes due to product returns. This action led to weak sales development in H2-23, given that the customer constituted a significant part of Eevia’s revenues. Eevia stated in the Q4-report that the company added EUR 1.2m in sales from other clients in H2-23, an increase of 64% from H2-22, which indicates that the large customer that halted order placements constituted approx. 70% of the net sales during H2-22.

Strong Gross Margin Compensated for the Major Net Sales Decline

The gross profit during Q4-23, adjusted for non-recurring items, reached EUR 0.2m (1.0), corresponding to a decrease of 81% YoY, and 48% QoQ compared to Q3-23, where gross profit amounted to EUR 0.3m. The gross margin was 57% during the quarter, which was down from 68% in Q4-22, but up from 38% in the previous quarter. The increase in gross margin compared to Q3-23 stems from a changing product mix, where higher margin products constituted a larger part of the revenue. Additionally, there was no effect on gross margin from side-stream products in Q4-23.

For the full year of 2023, the gross margin amounted to 58% (41%), which exceeds the company’s target of achieving a gross margin over 50% going into 2024. With increased focus on optimizing the product mix as well as utilizing side-stream products more efficiently, Analyst Group estimates that Eevia can continue this trend going into the new year and deliver a gross margin exceeding 50% in 2024.

The EBITDA during Q4-23 amounted to EUR -146k (17k), corresponding to a YoY decrease of EUR -163k in absolute terms and a decrease of EUR -148 compared to the previous quarter, where the EBITDA amounted to EUR 2k. The decrease in EBITDA was mainly attributed to lower sales. Looking at the company’s operating expenses, excluding COGS and depreciation, these amounted to approx. EUR -0.5m (-0.9), which corresponds to a decrease of 46% and EUR 0.4m in absolute terms Y-Y, in line with Analyst Group’s estimates. The decrease in the cost mass compared to the same quarter 2022 is derived from a reduction in both personnel- and overhead costs, signaling Eevia’s ability to adapts the cost costume as the circumstance’s changes, which became evident when the large customer abruptly disappeared from the order book.

In reflection of the full year 2023, the EBITDA amounted to EUR 0.8m (-0.6), equivalent to an EBITDA margin of 15%, and marks the first full year with positive EBITDA in the company’s history. Despite a 17% decline in net sales compared to 2022, the improved EBITDA result of EUR 1.3m in absolute terms shows that Eevia’s efforts to enhance production efficiency and reduce the company’s cost base are paying off. This is evidenced by the impressive gross margin development (58% in 2023 vs. 41% in 2022) and the reduction in personnel and overhead costs. These improvements are promising for the coming years, as Analyst Group estimates that the top-line development will improve dramatically.

Communicated Several Positive Updates Recently

Eevia has demonstrated significant operational developments unfolding in the first weeks of 2024. For example, the company has announced a reorganized distribution in North America, initial negotiations for a potential sales contract for 2025, a secured credit line of approx. EUR 0.6m, evaluation of a collaboration with a global market leader in eye health regarding a novel ingredient Eevia developed over the last 4 years, as well as a number of communicated sales orders.

Analyst Group has previously commented on the reorganized distribution, which you can find here. The new local distributor in New Jersey will not only lower logistical costs, a crucial consideration given the current financial situation, but it will also bolster Eevia’s value proposition by enabling more competitive prices and fulfilling the rising demand with quicker deliveries and increased supply reliability.

After the end of the quarter, Eevia revealed negotiations with a European food manufacturer whose annual revenue exceeds EUR 500m, with the potential for significant contribution to Eevia’s topline and profits in 2025. A more comprehensive comment from Analyst Group can be found here. While no contracts have been confirmed, this indicates an increasing demand for Eevia’s products. Securing such a substantial sales contract could affirm Eevia’s capabilities and set the stage for sustained long-term growth. Eevia expect to finalize the discussions by the end of Q1-24, which serves as a trigger in the near term.

One notable aspect of an order announced in early January (EUR 46k) is its origin from side streams of Eevia’s primary berry extract production. The company highlighted, with an example, that producing EUR 50k worth of berry extract could generate an additional EUR 35k in side-stream revenue. Despite costs associated with processing side-stream products, this underscores significant potential to 1) increase future revenues and 2) contribute to an increased gross margin. This is due to lower COGS for valorizing non-utilized side streams compared to berry extracts.

The announcement of a possible collaboration with a leading eye health player in early February highlights how investments in studies, such as the BioMAP study concluded in Q3-23, can pave the way for potential collaborations. Eevia can demonstrate herbal equivalence or superiority against market leaders’ products, and such data is crucial in securing sales contracts with major brands. In the report, Eevia’s CEO, Stein Ulve, emphasized that the data from the study could potentially be a game-changer for the company’s revenue growth.

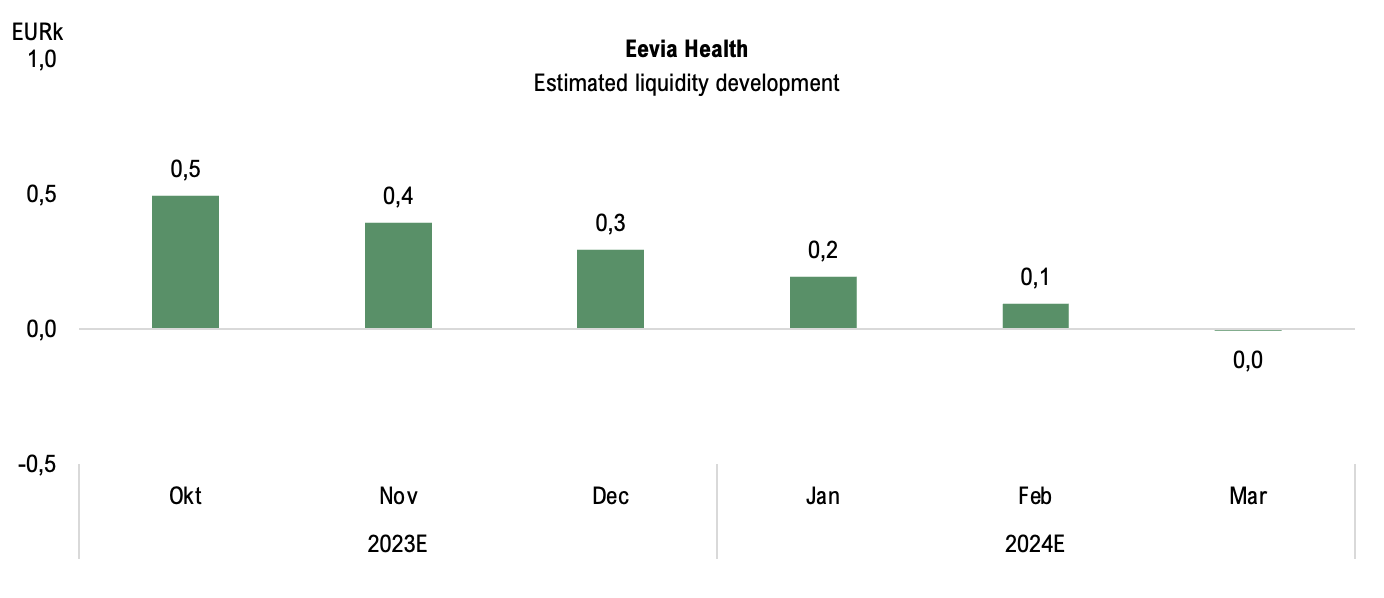

Constrained Financial Position Despite Positive Operating Cash Flow During the Quarter

At the end of Q4-23, Eevia had a cash balance of approx. EUR 0.1m, compared to EUR 0.5m at the end of Q3-23, resulting in a net cash of approx. EUR -0.4m. This decline was primarily driven by investments in intangible and tangible assets, as well as loan repayments. Following the quarter’s end, Eevia secured a credit line of EUR 640k to enhance working capital flexibility. Eevia reported a positive operating cash flow (OCF) of approx. EUR 0.1m during the quarter, compared to EUR -0.9m in Q4-22, marking a substantial improvement from the previous quarter’s OCF of EUR -1.0m. The positive OCF was mainly due to changes in working capital during the period. Despite facing declining revenues and increased efforts to compensate for this decline, Eevia has exhibited stable cost control.

However, the free cash flow (FCF) for the quarter was negative (EUR -0.2m), impacted by investments totaling EUR -0.3m. According to Analyst Group, Eevia is facing the challenge of balancing investments needed to maintain operations and fuel further growth while managing a constrained liquidity position. This could potentially hinder the company’s pursuit of necessary growth activities to return to historical growth levels in the coming quarters. Therefore, it’s worth considering that Eevia may need to explore external capital-raising avenues to strengthen the company’s balance sheet moving forward.

In conclusion, Eevia delivered a Q4 report that fell short of our estimates, particularly in net sales, as Analyst Group did not anticipate such a drastic decline. The company surprised positively on the upside concerning the gross margin, and coupled with a reduction in the OPEX base, Eevia demonstrated an impressive cost control. Despite the significant drop in net sales this quarter, Analyst Group believes that the marketing and sales efforts seen in recent months have yet to fully materialize. With a more efficient and streamlined organization, Eevia is well positioned to capitalize on its strong product portfolio. Nevertheless, the company’s liquidity needs careful monitoring going forward, as acquiring customers requires resources that may strain the cash balance.

We will return with an updated equity research report of Eevia Health.

Comment on Eevia entering negotiations for a significant sales contract for 2025 with an option to extend until 2027

2024-01-12

Eevia Health Plc (”Eevia” or the “Company”) announced on Friday, January 12th, that the Company has entered into negotiations with a European food manufacturer, with annual revenue amounting to approx. EUR 500m, to manufacture a new plant extract (the “Product”) with the potential to significantly contribute to Eevia’s topline and profits in 2025. The manufacturing would start earliest in December 2024 and will require 20% to 40% of Eevia’s annual production capacity for 2025, with an option to extend both annual volumes and the contract period till 2027. The parties expect to finalize negotiations by the end of Q1-24.

The customer is a listed and well-established medium-sized European branded food corporation, and Eevia has executed five (5) pilot test productions for the customer during 2023. The Product is an innovative extract from a plant material and the starting material for Eevia will be pre-manufactured and provided to the Company by the customer, free of charge. Additionally, part of the contract volume will be “take and pay,” which will guarantee a minimum sales volume for Eevia.

“This project is a welcome opportunity for Eevia to lock in significant revenues for 2025, and potentially for 2026 and 2027. This and similar opportunities we have in our pipeline provide traction towards achieving our long-term revenue target of EUR 25 million,” says Stein Ulve, Eevia’s CEO.

Analyst Group’s view

In our last equity research report, we mentioned that the ramp-up in sales had fallen short of our expectations, primarily attributed to a larger customer temporarily halting order placements due to inventory buildup. In the Q3 report, Eevia communicated that the Company expected to announce significant sales orders in the latter part of Q4-23 and going into 2024, following the drastic increase in sales and marketing efforts in Q3-23. Consequently, Analyst Group views the news of a potential sales contract positively, anticipating a significant impact on top-line development in the coming years, given that the negotiations succeed.

The fact that a well-established company of that size is choosing to negotiate with Eevia regarding the production of a new innovative extract is not only crucial for Eevia in reaching the Company’s long-term financial goal of EUR 25m in revenue, but if executed properly, it would also validate Eevia’s capabilities. This could demonstrate that the Company has the necessary infrastructure, resources, and expertise to handle substantial demands, thereby creating ripples in the water and setting the stage for further long-term growth.

Another crucial factor to consider if the negotiations materialize is that Eevia is guaranteed a minimum sales volume, and that the Company won’t have to bear the costs of the starting material. This lowers the project risk for Eevia, a significant aspect given that it could potentially require up to 40% of Eevia’s annual production capacity for 2025.

Comment on Eevia’s reorganized distribution in North America and New Order

2024-01-10

Eevia Health Plc’s (”Eevia” or ”the Company”) announced on the 10th of January 2024 that the Company has reorganized distribution in North America with the objective to have a more transparent value chain beyond the distributors, which will result in shortened delivery time to end clients as well as reduced logistic costs for Eevia.

Eevia implemented a new policy in early 2023, requiring transparency with distributors regarding the end clients of sales in all markets. Moving into 2024, Eevia is working with Select Ingredients as a distributor in the US, while the distribution agreement with Barrington has been terminated, thereby transferring Barrington’s client relationships to Eevia’s new Commercial Director, Erik Eide, who joined the Company in December 2023.

Eevia is initiating collaboration with a local New Jersey company specializing in forwarding dietary ingredients under the USDA NOP program, which facilitates the import of products to the US, allowing Eevia to maintain buffer stock in New Jersey with all transaction certificates issued (including the NOP organic certificate) ready for customers.

The agreement enables cost-effective transportation of larger volumes from Finland to the US via sea freight, avoiding the more expensive air freight. This approach not only reduces transportation costs but also streamlines handling, customs procedures, and certification efforts on larger volumes with less time pressure.

In addition to the abovementioned news, Eevia communicated today that the Company received an extension of EUR 11k (SEK 115k) to the sales order of EUR 22k (SEK 228k) which was announced on the 20th of December 2023. The initial order as well as the extra order is from a German customer for Feno-Myrtillus® 36 organic, an organically certified bilberry extract, which the Company has in stock for immediate delivery.

Analyst Group’s view of the news

Analyst Group has an optimistic view of the new distribution partner with a local presence in the US, as it is expected to improve the Company’s value proposition by enabling faster delivery, higher reliability of supply, and simultaneously reducing logistic costs. In light of Eevia’s announcement in the Q3 report regarding the Company’s intent to diversify the customer base and reduce dependence on a few major customers, the reorganized distribution strategy in North America is seen as an initial stride toward broadening the Company’s presence in the North American market. This could potentially serve as a strong growth catalyst in the years to come, given the substantial market potential.

With a reorganized distribution system in place and a new, experienced Commercial Director based in North America, Eevia has laid a solid foundation to capitalize on the increased demand from the North American market. The Company communicated that this increased demand was observed during the Supply Side West tradeshow in Las Vegas in Q3-23, and Analyst Group expects the Company to convert some of this into actual sales contracts going forward.

Additionally, as one of Eevia’s major clients temporarily suspended order placements in Q3-22 due to inventory buildup, creating short-term pressure on revenue growth, it’s imperative for Eevia to uphold effective cost control. Reducing logistics costs by reorganizing distribution is a vital step in maintaining a healthy cost base, while simultaneously paving the way for future growth and is well-positioned to capitalize on the growing demand from the North American market.

Regarding the additional order of Feno-Myrtillus® 36 Organic that Eevia communicated today, Analyst Group is encouraged to observe continued demand from the German customer for Eevia’s concentrated bilberry extract. Eevia has communicated several sales orders since the publication of the Q3 report in late November, ranging from EUR 11k to EUR 69k, totalling EUR 218k. Despite the challenging market conditions, the steady sales momentum reinforces the market interest in the Company’s products, indicating that Eevia meet the markets demand.

Comment on Eevia Health’s Q3-report

2023-11-22

On November 22nd, Eevia Health published the company’s quarterly report for Q3-23.

Lower Net Sales Than Anticipated – Guides for a Similar Q4

During Q3-23, the net sales amounted to approx. EUR 0.9m (1.1), corresponding to a decrease of 20 % YoY, and a decrease of 54 % QoQ compared to Q2-23, where net sales amounted to EUR 2.0m. Although the company had guided for a weaker H2-23, net sales were below our estimates. The decrease is mainly attributed to a larger customer that has temporarily halted order placements due to inventory buildup.

Eevia Health delivered the final volumes of an order to one of its largest customers in the previous quarter (Q2-23), indicating that we most likely won’t see any recurring orders from this customer until late 2024 or early 2025, when they will need to replenish their stock. Due to Eevia’s concentrated customer base, where a few large customers constitute the majority of the sales, there is a possibility of lower production volumes throughout a significant portion of 2024. Consequently, the company has entered a transformational phase, aiming to broaden its customer base and move away from its historical reliance on a few large customers. Thus, the beginning of the third quarter was marked by a reduction in the short-term sales order base, leading to a significant increase in marketing and sales efforts. To illustrate this rapid increase in marketing, Eevia produced much more marketing “content” in Q3-23 than in the combined years of 2020, 2021, 2022, and H1-23.