Eevia Health Plc (”Eevia” or the “Company”) announced on Friday, January 12th, that the Company has entered into negotiations with a European food manufacturer, with annual revenue amounting to approx. EUR 500m, to manufacture a new plant extract (the “Product”) with the potential to significantly contribute to Eevia’s topline and profits in 2025. The manufacturing would start earliest in December 2024 and will require 20% to 40% of Eevia’s annual production capacity for 2025, with an option to extend both annual volumes and the contract period till 2027. The parties expect to finalize negotiations by the end of Q1-24.

The customer is a listed and well-established medium-sized European branded food corporation, and Eevia has executed five (5) pilot test productions for the customer during 2023. The Product is an innovative extract from a plant material and the starting material for Eevia will be pre-manufactured and provided to the Company by the customer, free of charge. Additionally, part of the contract volume will be “take and pay,” which will guarantee a minimum sales volume for Eevia.

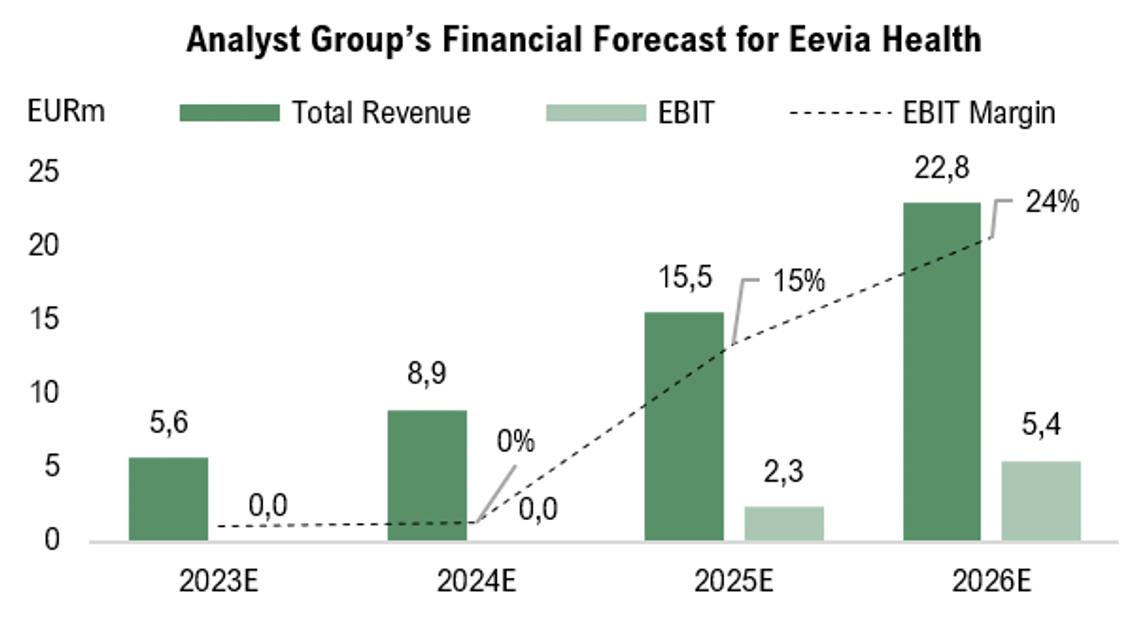

“This project is a welcome opportunity for Eevia to lock in significant revenues for 2025, and potentially for 2026 and 2027. This and similar opportunities we have in our pipeline provide traction towards achieving our long-term revenue target of EUR 25 million,” says Stein Ulve, Eevia’s CEO.

Analyst Group’s view

In our last equity research report, we mentioned that the ramp-up in sales had fallen short of our expectations, primarily attributed to a larger customer temporarily halting order placements due to inventory buildup. In the Q3 report, Eevia communicated that the Company expected to announce significant sales orders in the latter part of Q4-23 and going into 2024, following the drastic increase in sales and marketing efforts in Q3-23. Consequently, Analyst Group views the news of a potential sales contract positively, anticipating a significant impact on top-line development in the coming years, given that the negotiations succeed.

The fact that a well-established company of that size is choosing to negotiate with Eevia regarding the production of a new innovative extract is not only crucial for Eevia in reaching the Company’s long-term financial goal of EUR 25m in revenue, but if executed properly, it would also validate Eevia’s capabilities. This could demonstrate that the Company has the necessary infrastructure, resources, and expertise to handle substantial demands, thereby creating ripples in the water and setting the stage for further long-term growth.

Another crucial factor to consider if the negotiations materialize is that Eevia is guaranteed a minimum sales volume, and that the Company won’t have to bear the costs of the starting material. This lowers the project risk for Eevia, a significant aspect given that it could potentially require up to 40% of Eevia’s annual production capacity for 2025.