On February 14th, Eevia Health published the company’s quarterly report for Q4-23. The following are some points that we have chosen to highlight from the report:

- The reported net sales fell short of our estimates

- Strong gross margin contributed to the first full year with positive EBITDA

- Recent positive development bodes well for future growth

- Short-term financial position secured by credit facility

A Weak H2-23 Hampered the Net Sales for the Full Year 2023

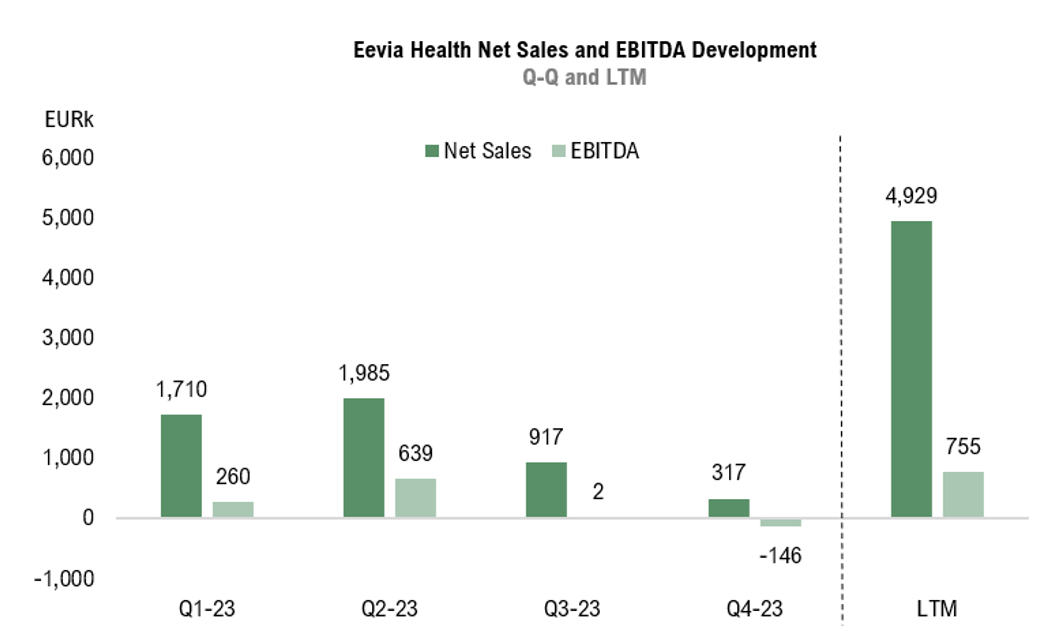

During Q4-23, the net sales amounted to approx. EUR 0.3m (1.4), corresponding to a decrease of 78% YoY, and a decrease of 65% QoQ compared to Q3-23, where net sales amounted to EUR 0.9m. The repercussions of the major customer’s temporary pause in order placements due to inventory buildup, as announced in the last report, are evident in the sharp revenue decline during the quarter. Although Analyst Group had anticipated lower net sales compared to the same period last year, the reported net sales fell well below our estimate of EUR 0.9m, as we did not foresee such a rapid decline.

It’s worth mentioning that the company was compelled to relabel several batches due to a global analytical service partner’s disclosure of erroneous lab reports, leading to product returns from some customers and negatively impacting net sales directly through credit notes by approx. EUR 0.2m. The indirect consequences of delayed sales are not quantified. To clarify, adjusted for credit notes from returns, net sales amounted to approx. EUR 0.6m during Q4-22, and Eevia confirms that the problem has since then been resolved.

Eevia has initiated several strategic initiatives during the quarter to mitigate the declining revenue, such as increased marketing activities, participation in a trade show exhibition, and appointing a new Commercial Director. Analyst Group believes that the outcomes of the company’s recent initiatives have yet to reach their full potential, and that Eevia’s efforts are crucial to diversify the customer base and thereby pave the way for future growth.

Regarding the full year of 2023, Eevias net sales amounted to EUR 4.9m (5.9), corresponding to a decrease of approx. 17% or EUR -1.0m in absolute terms, which fell short of Analyst Group’s estimates in our latest analysis, where we estimated net sales of EUR 5.5m for the full year. The decline in revenue for the full year can predominantly be ascribed to the same factor that affected sales this quarter: the major customer abruptly halted order placements starting in June 2023 and credit notes due to product returns. This action led to weak sales development in H2-23, given that the customer constituted a significant part of Eevia’s revenues. Eevia stated in the Q4-report that the company added EUR 1.2m in sales from other clients in H2-23, an increase of 64% from H2-22, which indicates that the large customer that halted order placements constituted approx. 70% of the net sales during H2-22.

Strong Gross Margin Compensated for the Major Net Sales Decline

The gross profit during Q4-23, adjusted for non-recurring items, reached EUR 0.2m (1.0), corresponding to a decrease of 81% YoY, and 48% QoQ compared to Q3-23, where gross profit amounted to EUR 0.3m. The gross margin was 57% during the quarter, which was down from 68% in Q4-22, but up from 38% in the previous quarter. The increase in gross margin compared to Q3-23 stems from a changing product mix, where higher margin products constituted a larger part of the revenue. Additionally, there was no effect on gross margin from side-stream products in Q4-23.

For the full year of 2023, the gross margin amounted to 58% (41%), which exceeds the company’s target of achieving a gross margin over 50% going into 2024. With increased focus on optimizing the product mix as well as utilizing side-stream products more efficiently, Analyst Group estimates that Eevia can continue this trend going into the new year and deliver a gross margin exceeding 50% in 2024.

The EBITDA during Q4-23 amounted to EUR -146k (17k), corresponding to a YoY decrease of EUR -163k in absolute terms and a decrease of EUR -148 compared to the previous quarter, where the EBITDA amounted to EUR 2k. The decrease in EBITDA was mainly attributed to lower sales. Looking at the company’s operating expenses, excluding COGS and depreciation, these amounted to approx. EUR -0.5m (-0.9), which corresponds to a decrease of 46% and EUR 0.4m in absolute terms Y-Y, in line with Analyst Group’s estimates. The decrease in the cost mass compared to the same quarter 2022 is derived from a reduction in both personnel- and overhead costs, signaling Eevia’s ability to adapts the cost costume as the circumstance’s changes, which became evident when the large customer abruptly disappeared from the order book.

In reflection of the full year 2023, the EBITDA amounted to EUR 0.8m (-0.6), equivalent to an EBITDA margin of 15%, and marks the first full year with positive EBITDA in the company’s history. Despite a 17% decline in net sales compared to 2022, the improved EBITDA result of EUR 1.3m in absolute terms shows that Eevia’s efforts to enhance production efficiency and reduce the company’s cost base are paying off. This is evidenced by the impressive gross margin development (58% in 2023 vs. 41% in 2022) and the reduction in personnel and overhead costs. These improvements are promising for the coming years, as Analyst Group estimates that the top-line development will improve dramatically.

Communicated Several Positive Updates Recently

Eevia has demonstrated significant operational developments unfolding in the first weeks of 2024. For example, the company has announced a reorganized distribution in North America, initial negotiations for a potential sales contract for 2025, a secured credit line of approx. EUR 0.6m, evaluation of a collaboration with a global market leader in eye health regarding a novel ingredient Eevia developed over the last 4 years, as well as a number of communicated sales orders.

Analyst Group has previously commented on the reorganized distribution, which you can find here. The new local distributor in New Jersey will not only lower logistical costs, a crucial consideration given the current financial situation, but it will also bolster Eevia’s value proposition by enabling more competitive prices and fulfilling the rising demand with quicker deliveries and increased supply reliability.

After the end of the quarter, Eevia revealed negotiations with a European food manufacturer whose annual revenue exceeds EUR 500m, with the potential for significant contribution to Eevia’s topline and profits in 2025. A more comprehensive comment from Analyst Group can be found here. While no contracts have been confirmed, this indicates an increasing demand for Eevia’s products. Securing such a substantial sales contract could affirm Eevia’s capabilities and set the stage for sustained long-term growth. Eevia expect to finalize the discussions by the end of Q1-24, which serves as a trigger in the near term.

One notable aspect of an order announced in early January (EUR 46k) is its origin from side streams of Eevia’s primary berry extract production. The company highlighted, with an example, that producing EUR 50k worth of berry extract could generate an additional EUR 35k in side-stream revenue. Despite costs associated with processing side-stream products, this underscores significant potential to 1) increase future revenues and 2) contribute to an increased gross margin. This is due to lower COGS for valorizing non-utilized side streams compared to berry extracts.

The announcement of a possible collaboration with a leading eye health player in early February highlights how investments in studies, such as the BioMAP study concluded in Q3-23, can pave the way for potential collaborations. Eevia can demonstrate herbal equivalence or superiority against market leaders’ products, and such data is crucial in securing sales contracts with major brands. In the report, Eevia’s CEO, Stein Ulve, emphasized that the data from the study could potentially be a game-changer for the company’s revenue growth.

Constrained Financial Position Despite Positive Operating Cash Flow During the Quarter

At the end of Q4-23, Eevia had a cash balance of approx. EUR 0.1m, compared to EUR 0.5m at the end of Q3-23, resulting in a net cash of approx. EUR -0.4m. This decline was primarily driven by investments in intangible and tangible assets, as well as loan repayments. Following the quarter’s end, Eevia secured a credit line of EUR 640k to enhance working capital flexibility. Eevia reported a positive operating cash flow (OCF) of approx. EUR 0.1m during the quarter, compared to EUR -0.9m in Q4-22, marking a substantial improvement from the previous quarter’s OCF of EUR -1.0m. The positive OCF was mainly due to changes in working capital during the period. Despite facing declining revenues and increased efforts to compensate for this decline, Eevia has exhibited stable cost control.

However, the free cash flow (FCF) for the quarter was negative (EUR -0.2m), impacted by investments totaling EUR -0.3m. According to Analyst Group, Eevia is facing the challenge of balancing investments needed to maintain operations and fuel further growth while managing a constrained liquidity position. This could potentially hinder the company’s pursuit of necessary growth activities to return to historical growth levels in the coming quarters. Therefore, it’s worth considering that Eevia may need to explore external capital-raising avenues to strengthen the company’s balance sheet moving forward.

In conclusion, Eevia delivered a Q4 report that fell short of our estimates, particularly in net sales, as Analyst Group did not anticipate such a drastic decline. The company surprised positively on the upside concerning the gross margin, and coupled with a reduction in the OPEX base, Eevia demonstrated an impressive cost control. Despite the significant drop in net sales this quarter, Analyst Group believes that the marketing and sales efforts seen in recent months have yet to fully materialize. With a more efficient and streamlined organization, Eevia is well positioned to capitalize on its strong product portfolio. Nevertheless, the company’s liquidity needs careful monitoring going forward, as acquiring customers requires resources that may strain the cash balance.

We will return with an updated equity research report of Eevia Health.