Bricknode published on February 23, the company’s quarterly report for the fourth quarter 2022. The following are some key financial metrics that we have chosen to highlight in connection with the report:

- Net revenue amounted to 4.6 MSEK – in line with our expectations

- Signed three significant customers in December 2022

- Increased EBITDA loss

Net revenue growth 9% Y-Y

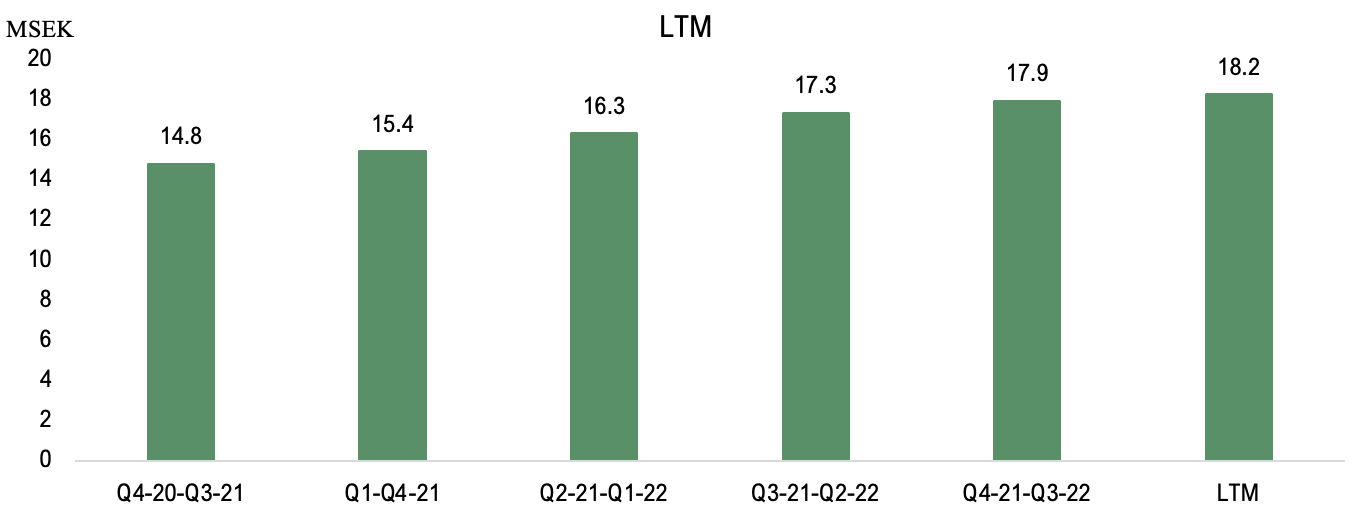

During the fourth quarter of 2022, the net revenues amounted to 4.6 MSEK (4.2), corresponding to a growth of 9% compared to the same quarter the previous year. The net revenue was in line with our estimates and Bricknode shows a marginal increase from the previous quarter (Q3-22), corresponding to a growth of 3% Q-Q. Bricknode revenues for the Last Twelve Months (LTM), which thus corresponds to the full-year revenue for 2022, amounted to 18.2 MSEK (15.4), driven by new customers as well as growth among Bricknode’s existing customers.

In our last equity research report our estimate was 18,4 MSEK for the full year 2022, which is marginally higher than the actual outcome. During the fourth quarter the NRR amounted to 98%, down from 115% in Q4-21, a NRR below 100% shows a negative growth among the company’s existing customers, which is the first time for Bricknode as a reported company. Despite an NRR below 100% Bricknode is delivering growth both on quarterly and yearly basis, which Analyst Group sees as a strong performance during the quarter and the strength in the revenue model. The long-term and stable growth that Bricknode delivers is clearly reflected on a LTM basis.

As we have previously highlighted, a new customer within Bricknode Broker often implies a long sales cycle, because it often constitutes as crucial or complex services to the customers, thus creating stickyness. On the other hand, a new customer within Bricknode Broker also implies a significantly higher Monthly Recurring Revenue (MRR) and a high Total Contract Value (TCV), due to the business-critical nature of Bricknode Broker. Despite the long sales cycles, Bricknode has signed three new significant customers in December 2022, which is a result of the built-up relations in the sales pipeline. The new customers consist of one wealth management company, which we commented on here, one fund management company, which we commented on here, and the corporate finance firm Vator Securities, which we commented on here. Where Vator Securities is also Bricknode’s first client within the corporate finance segment which can both be seen as a proof of Bricknode Broker’s wide range of use, while also implying a greater potential within the corporate finance segment.

The company comments in both the report and the conference call that Bricknode has a strong pipeline of new prospective customers and possesses many prospectuses. Analyst Group assesses that Bricknode has a good opportunity to continuing delivering new deals, despite the long sales cycles. Three new customers within the wealth management area are of big meaning to further growth, for example one of the new customers, the Swedish wealth management firm, Bricknode projects that the client will increase Bricknode’s Annual Recurring Revenues (ARR) by approximately 7-10% within the next few years.

Increased EBITDA loss

The EBITDA result during the fourth quarter amounted to -6.2 MSEK (-5.2), corresponding to an increase EBITDA loss of -1.0 MSEK Y-Y, which is derived by an increase in other external costs, while the staffing decreased by approximately 0.5 MSEK. Bricknode is working towards establishing its own regulated securities brokerage firm but has also completed a large technical upgrade and a move to Azure from Amazon Web Services. These factors are assumed to have driven the other external costs, but also can be seen as efforts to optimizing both the organization and hosting costs going forward. Analyst Group therefore expects the fixed costs to reduce going forward, and that the increased cost base is a result of one-off costs and delays in the saving program.

For the full year 2022 the EBITDA result amounted to -23.6 MSEK (-11.9), corresponding to an almost doubled increased EBITDA loss. Bricknode launched an aggressive savings program in August of 2022, resulting in extensive layoffs. Analyst Group expects further effects of the implemented costs savings in the coming quarters during 2023, as well as we assess that Bricknode will continue to execute on the savings plan in order to reduce the burn rate significantly.

In conclusion, we are of the opinion that Bricknode has progressed well operatively during the fourth quarter, given the growth both quarterly and on a yearly basis, where Bricknode has signed three significant customers which enables a higher growth and reduced burn rate going forward. Bricknode has also completed a technology upgrade of Bricknode Broker to become a complete end-to-end solution. Bricknode has also taken big steps to both optimize the organization and to become a regulated securities firm, which paves the way to become cash flow positive and to act as a B2B securities broker, which strengthens the company’s offering significantly.

We will return with an updated equity research report of Bricknode.