Emission: Irisity

- Aktiekurs

- N/A

- Bransch

- Security

- Lista

- Nasdaq First North

- Emissionsvolym

- 70,6 MSEK

- Teckningskurs

- 1.20 SEK

- Teckningsperiod

- 13 - 27 nov

- Första handelsdag

- N/A

- Garanti- och teckningsåtagande

- 80 %

AKTIE 1.20 SEK

INVESTERING N/A

VALUATION 80,7 MSEK

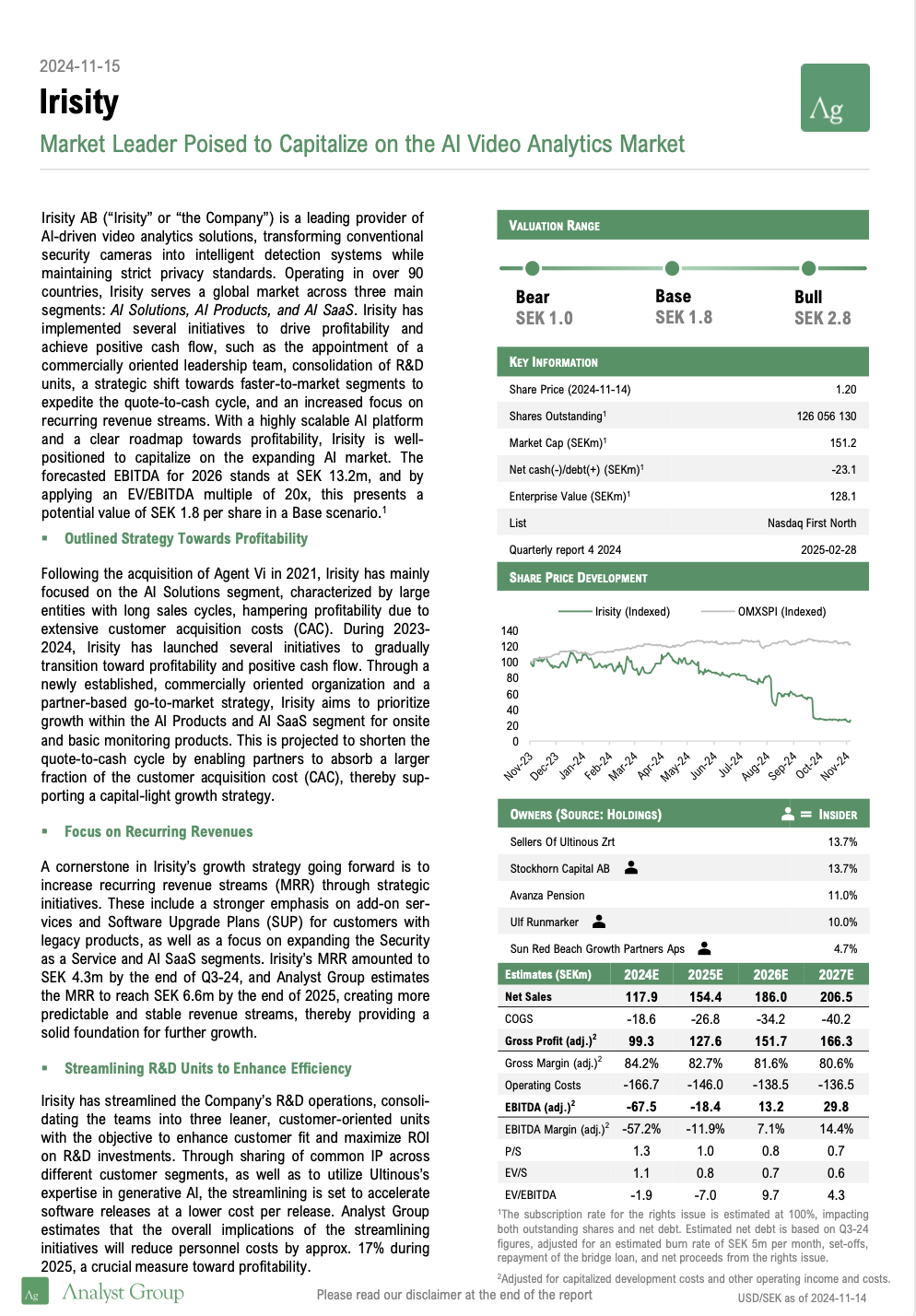

Irisity AB (”Irisity” or ”the Company”) is a leading provider of AI-driven video analytics solutions, specializing in advanced software that transforms conventional security cameras into intelligent detection systems, all while upholding stringent privacy standards. With a presence in more than 90 countries, Irisity addresses a global market through the Company’s three primary segments: AI Solutions, AI Products, and AI Software as a Service (SaaS). With the strategic acquisition of Ultinous in H1-24, Irisity has enhanced its AI capabilities, integrating cutting-edge generative AI technologies aimed at capturing opportunities in the mid-market segment, which paves the wave for substantial growth potential in the coming years, why Analyst Group sees favorable opportunities for Irisity to capitalize on a high-growth market with its proprietary technology. Overall, Analyst Group believe the ongoing rights issue constitute an attractive entry point for investors at a Pre-Money valuation of SEK 80.7m.

Irisity is a leading provider of AI-driven video analytics solutions, specializing in advanced software that transforms standard security cameras into intelligent detection systems, all while maintaining a strong commitment to privacy. With deployments across over 3,000 locations and a presence in more than 90 countries, Irisity supports clients globally, with active operations in Sweden, the US, Israel, Hungary, Singapore, the UAE, Australia, Argentina, Brazil, Mexico, Colombia, and the UK. The Company has 12 offices worldwide and three R&D-centers in Tel Aviv, Budapest, and Gothenburg, focusing on specific customer business segments which can share common IP:s. Irisity operates through an extensive network of resellers, partners, OEMs, central monitoring providers, and camera manufacturers worldwide, creating a broad reach globally.

Irisity’s technology enhances security by detecting critical incidents in real time, including intrusions, trespassing, flames, violence, falls, and unattended objects, as well as rapid search and analysis of recorded video, and extraction of statistical data. Importantly, Irisity prioritizes ethical surveillance, employing patented real-time anonymization technology to protect personal privacy across all functionalities.

Irisity serves a diversified customer base across multiple sectors, such as government agencies, municipalities, educational institutions, healthcare and elder care facilities, and railway infrastructure. The product offering consist of IRIS+™, an open and scalable platform for video analytics that operates in any environment, both locally (air-gapped), in the cloud, or as a hybrid installation, thereby giving customers and partners the flexibility to design, operate, and manage their surveillance, security, and safety operations based on their unique needs. The Company’s AI software areas are divided into three distinct segments, each characterized by a unique business model and tailored to specific customer types with varying requirements for solution complexity and service offerings. The three segments—AI Solutions, AI Products, and AI SaaS—feature Irisity’s distinct platform solutions: IRIS+ Enterprise, IRIS+ Pro, and IRIS+ Central Monitoring, respectively.

Accelerating Quote-to-Cash

Through the acquisition of Ultinous in H1-24, Irisity expanded the product offering through the addition of the AI-products segment. With a partner-based go-to-market strategy, Irisity aims to prioritize growth in this area, thereby shortening the quote-to-cash cycle by allowing partners to absorb a larger portion of the customer acquisition cost (CAC). This approach is expected to enable a capital-light growth strategy, an essential step towards positive cash flow.

Recurring Revenue

The recurring revenue is derived from three primary sources: Software Up-grade Plans (SUP), the Security as a Service subsegment, and the remainder of the AI SaaS segment. The AI SaaS segment accounts for 35% of total sales and is a software only based offering. This cloud-connected solution requires no physical hardware deployment on-site enabling scalability and minimal operational friction with a recurring revenue stream from each camera connected.

Extensive and Growing Market

The global AI surveillance market, which currently represents around 10% of the broader security surveillance industry, is expected to grow at a notably higher rate than the overall market, contributing significantly to the sector’s expansion. The global AI in surveillance market is projected to witness a CAGR of 23.7%, reaching around USD 16.3bn by 2028, showcasing the markets robust estimated growth. Irisity is well positioned to capitalize on this expanding market.

As part of the segmentation mentioned before, Irisity offers a Security as a Service offering, which provides a comprehensive, End-to-End solution for clients, combining elements from Irisity’s AI Solutions, AI Products, and AI SaaS offerings. This segment is designed to outsource all aspects of security management for clients, from system deployment and camera installation to monitoring, problem identification, verification, and response which Analyst Group sees as a testament to the Company’s solutions broad applicability and thus large market potential. With deployments across over 3,000 locations and a presence in more than 90 countries, the Company has proven its solutions are viable for a broad clientele.

“Irisity’s proven and versatile portfolio of solutions, combined with the Company’s global reach in a growing market driven by increasing integration of AI surveillance into security, indicates strong prospects for Irisity. Through newly implemented strategic initiatives, including a streamlined cost structure, more efficient R&D teams, and a clear partner-driven go-to-market strategy, makes the Company well positioned to leverage the scalable platform with a robust pipeline of potential deals toward profitability. With a broad and proven portfolio that serves a diverse customer base, together with a strong growth trajectory and pending inflection point, investors can take part of the ongoing rights issue at an attractive Pre-Money valuation of 80,7 MSEK”, according to Analyst Group.

In Q3-24, the Company announced its sales pipeline, including 650 opportunities with a total value exceeding SEK 180m. This KPI could be derived from potential deals that Irisity is currently processing, spanning various stages of the sales funnel. Analyst Group believes that the pipeline serves as a testament to Irisity’s strong customer offerings, indicating robust demand and a solid growth runway ahead

During the past few years, particularly following the acquisition of Agent Vi in 2021, Irisity has primarily focused on the AI Solutions segment, targeting large entities with long sales cycles and high customer acquisition costs (CAC). Although this segment offers long customer lifetimes, strong margins, and low churn due to the tailored and sticky nature of its offerings, it has contributed to weaker profitability and negative cash flow. In response, Irisity has launched several initiatives from 2023 to 2024 to gradually transition toward positive cash flow. The Company’s strategy centers around increasing sales and cutting costs through a newly established, commercially focused organization and a partner-based go-to-market strategy for onsite and basic monitoring products.

By leveraging an extensive partner network, Irisity aims to reduce the complexity of customer acquisition, shorten sales cycles, and allow partners to absorb the CAC. Recent advancements have leveraged generative AI to significantly accelerate the R&D process. Previously, developing customer-specific solutions took 3 to 9 months; with generative AI, Irisity has reduced this to just 1 to 4 weeks, drastically enhancing the speed and scalability of its offerings. To improve profitability, Irisity has also streamlined its R&D operations, consolidating teams into three leaner, customer-oriented units that share common intellectual property (IP) and draw on Ultinous’s expertise in generative AI to enhance customer fit and maximize ROI on R&D investments. Additionally, Irisity is working to increase the share of recurring revenue streams (MRR) as a foundational element of sustainable growth. Overall, these initiatives are expected to reduce personnel costs by approximately 20% during 2025. With a robust growth runway ahead, Analyst Group estimates that Irisity is at an impending inflection point to profitability.

With deployments across over 3,000 locations and a presence spanning more than 90 countries, Irisity has established a robust global footprint. The Company’s AI-driven video analytics solutions are highly versatile, serving the broader security surveillance market. Irisity’s offerings are applicable across critical sectors such as infrastructure, urban environments, transportation, healthcare, and education-areas particularly susceptible to risks like accidents, sabotage, and vandalism. The global security surveillance market, as estimated by Markets and Markets, is valued at approximately USD 54.4bn in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 8.5%, reaching an estimated USD 88.7bn by 2030. This growth trajectory underscores the expanding demand for advanced security solutions, positioning Irisity to benefit from favorable industry tailwinds.

By providing AI-driven video analytics solutions and specializing in advanced software, Irisity has established a strong global position in the AI in surveillance market. This market encompasses hardware, software, and services, with Irisity particularly focused on delivering advanced software and services for generative AI and deep-learning-based AI solutions in video analytics. The global AI surveillance market, which currently represents around 10% of the broader security surveillance industry, is expected to grow at a notably higher rate than the overall market, contributing significantly to the sector’s expansion. According to Markets and Markets, the global AI in surveillance market was valued at approximately USD 5.6bn in 2023 and is projected to witness a CAGR of 23.7%, reaching around USD 16.3bn by 2028, at which point it is expected to constitute about 20% of the total security surveillance market. Thus, the shift from traditional, non-intelligent cameras to AI-enabled, smart cameras is anticipated to accelerate significantly, driven by the demand for enhanced surveillance capabilities and real-time insights, further fueling growth within the AI surveillance market.

AI-driven video analytics solutions provide substantial operational benefits and cost efficiencies for Security Operation Centers (SOCs). By automating video analysis, these solutions significantly reduce the burden of footage transmission and storage, cutting down data handling costs and freeing up storage capacity. They also streamline surveillance processes, allowing SOCs to save considerable time in monitoring activities and enabling staff to manage operations more efficiently. Moreover, AI solutions enhance the scope of security coverage, allowing more assets to be monitored effectively with the same personnel. Additionally, these systems minimize false alarms, focusing human intervention on actual threats, which improves response times and reduces unnecessary actions. In summary, AI-powered video analytics offer SOCs a scalable, efficient, and cost-effective approach to maintaining high levels of security and operational precision. As a result, Irisity’s platform offers an attractive total cost of ownership (TCO), encompassing expenses associated with purchasing, deploying, using, and retiring a product or piece of equipment. This creates a win-win situation, as the solution significantly reduces customers’ operating expenses.

The use of AI-driven video surveillance systems has raised concerns regarding privacy intrusion, potential misuse of collected data, and the ethical implications of constant monitoring. The trend of AI in video surveillance is increasingly shaped by regulatory impacts, as governments aim to balance the benefits of advanced surveillance with the need to protect privacy. Regulations have prompted providers to develop more privacy-preserving technologies and design systems that uphold security while adhering to privacy principles. In March 2024, the EU Parliament approved the AI Regulation, granting the Integritetsskyddsmyndigheten (IMY) new responsibilities to oversee AI systems. At the same time, the latest proposal in the surveillance camera investigation has suggested removing the requirement for surveillance camera permits starting from July 1, 2025. This means that entities wishing to conduct camera surveillance, who previously needed to apply for a permit, will instead be required to make a significant assessment balancing the interests of surveillance with the individual’s interest in not being surveilled. This shift will increase IMY’s role in providing guidance and oversight to ensure compliance with the regulations in the Surveillance Camera Act and the General Data Protection Regulation (GDPR).

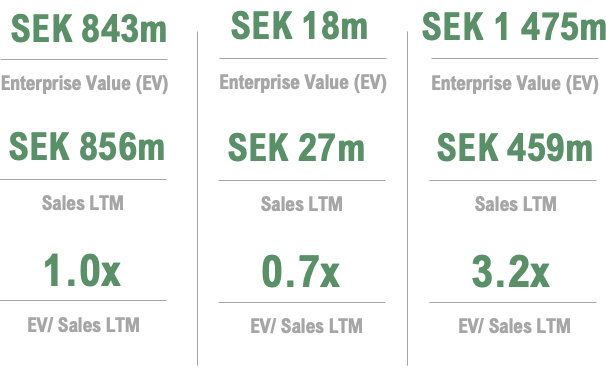

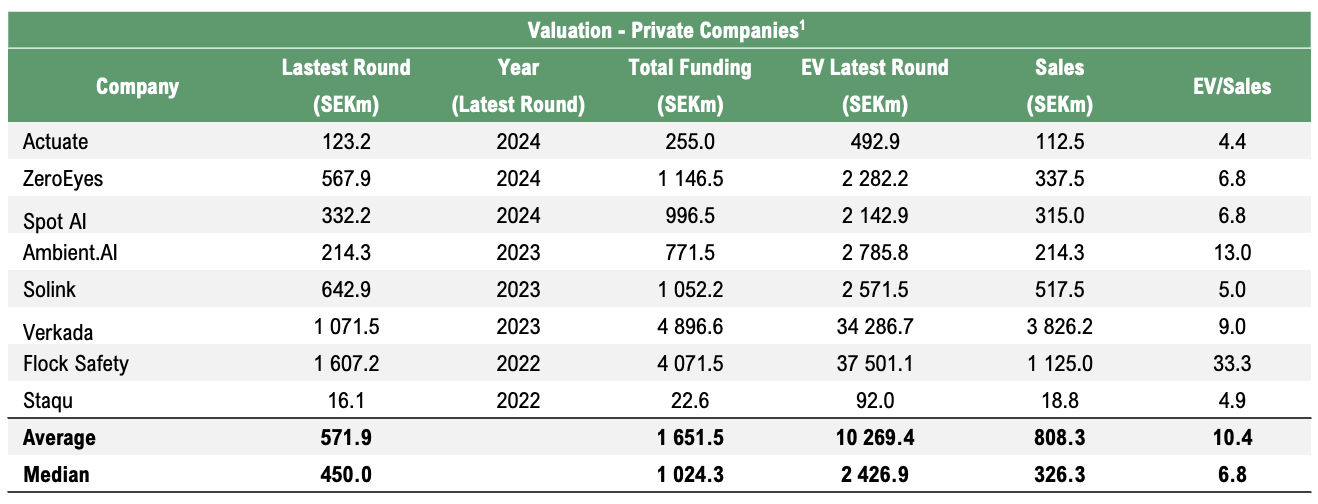

To provide perspective on the valuation, a comparison is made between Irisity and a peer group of companies operating in the security industry, offering AI-driven video analytics solutions and related hardware. Currently, there are a limited number of publicly traded peers to Irisity, which is why a peer group of private companies with competing software solutions is included in the comparison.

The publicly traded companies vary in geographical footprint, the degree of hardware sales, and focus within the security sector. Nevertheless, these peers address the same underlying market, which is experiencing a significant shift from ”dumb cameras” to smart solutions leveraging AI in video analytics. In terms of profitability, Gorilla Technology Group Inc. is the only listed peer reporting positive figures at the bottom-line.

The peer group of private companies consists of AI-focused firms offering similar solutions to Irisity, which have raised a substantial amount of capital over the last few years, as evident by the total funding (median > SEK 1 000m). As these companies are private, there is limited information available regarding historical growth rates and profitability, nevertheless, the valuations and magnitude of funding rounds illustrates the bright growth trajectory that the industry is facing.

Although many of the peers are facing similar profitability challenges that Irisity has faced historically, when examining the EV/Sales multiples (median 6.8x) and the large amounts of funding pouring into the sector, it becomes clear that market confidence in AI-based security solutions is vast. AI in video analytics is set to witness significant growth in the coming years, with an estimated CAGR of approximately 24% during the period. The global AI in surveillance market is set to witness significant growth in the coming years, with an estimated CAGR of approx. 24% during 2023-2028. The companies positioned to capitalize on this robust growth trend, with scalable SaaS solutions that leverage favorable market dynamics and exhibit gross margins approaching 100%, exemplify why the market assigns high valuation multiples to such attributes. Strong growth prospects, coupled with substantial margin expansion potential as sales volumes reach critical thresholds, are characteristics highly valued by the investment community.

Irisity has a promising growth runway over the coming years, focusing on the mid-market segment through a partner-based go-to-market strategy while streamlining its cost base. Consequently, Irisity is taking the necessary steps toward profitability and positive cash flow. With gross margins in the range of 85%, Irisity’s scalable SaaS solution should command a higher sales multiple, given the strong potential for margin expansion as the Company approaches breakeven.

In conclusion Irisity presents a compelling investment opportunity, driven by the Company’s strong positioning within the rapidly growing AI-driven video analytics sector. With the security industry undergoing a transformative shift from conventional to AI-powered solutions, Irisity is well-placed to capitalize on this trend. As Irisity has undergone a number of initiatives in order to increase the growth rate while simultaneously reducing the opex costume, Irisity demonstrates strong potential for sustainable profitability and positive cash flow during the coming years. All together, Analyst Group see that an investment in Irisity at a Pre-Money valuation of SEK 80.7m in conjunction to the rights issue offer investors an attractive Risk/Reward.

The analyses, documents, or other information originating from AG Equity Research AB (hereinafter ’AG’) are prepared solely for informational purposes, intended for broad distribution, and do not constitute investment advice. The information contained in the analyses is based on sources, data, and statements from individuals that AG considers reliable. However, AG does not guarantee, either expressly or implicitly, the accuracy, completeness, or correctness of such information. All forecasts and estimates presented are inherently subjective assessments that involve a degree of uncertainty and should therefore be interpreted with caution. AG provides no assurance that any projections or estimates will be realized.

Accordingly, any investment decisions made on the basis of material issued by AG or by persons affiliated with AG shall be made independently and at the sole discretion of the investor. The analyses, documents, and information provided by AG are intended to serve as one of several tools to support investment decision-making. Investors are strongly advised to consult additional sources of information and to seek advice from a qualified financial advisor prior to making any investment decisions.

AG expressly disclaims any and all liability for any loss or damage of whatever nature that may arise from the use of material originating from AG. Readers should assume that Analyst Group has received remuneration for the preparation of this material.

Nordnet and Avanza have not participated in the preparation of the offering and act solely as recipients and administrators of subscription applications.