OrderYOYO was founded in 2015 and is a leading European software provider within online ordering, payment and marketing solutions, that enables independent takeaway restaurants to build their own-branded online presence and grow their businesses. Following the merger between OrderYOYO and app smart as of July 2022 the Company’s offer has been expanded to also include POS (Point of sale) system. OrderYOYO currently supports ~10,000 takeaway restaurants, with a market leading position in the two largest takeaway markets in Europe, UK and Germany, as well as being market leader in Denmark, Ireland and Austria. OrderYOYO is listed on First North Copenhagen Stock Exchange since July 2021.

Pressmeddelanden

Strong Delivery in a Tough Market

OrderYOYO A/S (“OrderYOYO” or the “Company”) continued the Company’s strong performance in Q3-23, showing 38% ARR growth, amounting to DKK 256m and a net revenue growth of 44%, amounting to DKK 65m in Q3-23. Moreover, profitability continued to improve, and the EBITDA margin (before other extraordinary items) amounted to 11.5%, compared to 4.2% the same quarter last year, showcasing a continuing trend regarding profitability. By solving digital challenges for restaurants and a steady expansion of its product offerings, something that is expected to attract a greater number of restaurant partners and create upselling opportunities, OrderYOYO is estimated to continue to deliver profitable growth. Based on an EV/S-multiple of 3.9x on the 2023 forecast and adjusted for OrderYOYO’s net debt, a potential fair value of DKK 10.2 per share (10.2) is derived in a Base scenario.

- Continued Growth in Difficult Conditions

The ARR grew 38% and amounted to DKK 256m in September 2023 compared to DKK 185m in September 2022, showcasing a continued strong growth during Q3-23. Moreover, the Q3-23 net revenue reached DKK 65m, in contrast to DKK 45m in Q3-22, reflecting an increase of 44% Y-Y. Thus, OrderYOYO continues to exhibit robust top-line growth, notwithstanding persistent macroeconomic challenges. Restaurant partners in the Company’s second-largest market, the UK, continues to be affected by high inflation and a lack of supply of goods in the economy, while consumers continue to grapple with inflation and rising interest rates. Although inflation is now trending downward in several markets, OrderYOYO’s performance in the current climate is perceived as strong and indicative of the Company’s resilient value proposition.

- Economies of Scale are Increasing Profitability

EBITDA before other extraordinary items amounted to DKK 7.5m in Q3-23, in contrast to DKK 1.9m in Q3-22, corresponding to a growth of 295% and resulting in a margin of 11.5% (4.2%). Furthermore, OrderYOYO has been Cash EBITDA positive (defined as EBITDA before other extraordinary items minus capitalized R&D expenditures) in all months since June 2023, which means that the Company is self-sustaining and independent of external capital. The continued improved profitability is assumed to be a result of OrderYOYO being a market leader and increased economies of scale resulting from the Company’s consolidation strategy.

- Intact Valuation Range

As OrderYOYO developed in line with our expectations during Q3-23, we have only made small adjustments in our estimates, mostly regarding costs as we anticipate some investments regarding staff during Q4-23. However, we still consider OrderYOYO to be well positioned to continue to deliver profitable growth and thus we repeat our valuation range in a Base, Bull and Bear scenario.

7

Värdedrivare

6

Historisk lönsamhet

7

Ledning & Styrelse

4

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Positive Cash Flow Around the Corner

OrderYOYO A/S (“OrderYOYO” or the “Company”) delivered a strong H1-23, beating our expectations both regarding growth and profitability. Net revenue amounted to DKK 116m, corresponding to a growth of 33% compared to consolidated H1-22 proforma results, while the ARR grew 47% compared to June 2022, amounting to DKK 246m at the end of H1-23. By consistently diversifying the range of products, a strategy anticipated to draw in a larger number of restaurant partners while also presenting upselling opportunities, along with enhanced customer retention leading to reduced churn rates, OrderYOYO is projected to achieve a revenue of DKK 238 million in the year 2023. Based on an EV/S-multiple of 4x on the 2023 forecast and adjusted for OrderYOYO’s net debt, a potential fair value of DKK 10.2 per share (8.1) is derived in a Base scenario.

- Continued Increased Profitability

The EBITDA before extraordinary items amounted to DKK 9.0m in H1-23, compared to a loss of DKK -6m in H1-22 (proforma), corresponding to a margin of 8%, showcasing a great trend regarding in profitability. The last year has proven the scalability in OrderYOYO’s business model, where external costs and staff costs has decreased in relation to revenue. The staff costs represented 36% of revenue in H1-23, compared to 45% in H1-22, while external costs represented 37% of revenue compared to 51% in H1-22. This falling trend is expected to continue going forward, leading to further increased profitability. Moreover, as a result of the increased profitability, we expect positive free cash flow in H2-23.

- Acquisition of a Leading Online Ordering Company

In April OrderYOYO announced the acquisition of Kingfood, a vertical market leader within the Asian cuisine segment. Founded in 2017 in Dublin, Kingfood has built a strong market leading position within the market of online ordering software for the Asian cuisine takeaway vertical in Ireland and UK. The acquisition is according to OrderYOYO’s consolidation strategy, and Kingfoods +500 restaurant partners brought the total number of restaurant partners for OrderYOYO to over 10,000, which is a big milestone for the Company. The transaction was completed at approximately 1.3x Kingfood’s ARR in March 2023, which is lower than what OrderYOYO is valued at, which creates a multiple arbitrage.

- Updated Valuation Range

As OrderYOYO has delivered above our expectations so far in 2023 regarding both growth and profitability, we have updated our financial forecasts. Through a continued expanded product offering, which is expected to attract more restaurant partners, in combination with the scalability in the business model, OrderYOYO is expected to continue to deliver profitable growth. The updated financial forecasts has resulted in an updated valuation range in a Base, Bull and Bear scenario.

7

Värdedrivare

5

Historisk lönsamhet

7

Ledning & Styrelse

4

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Ending 2022 strong with profitability in sight

With the second half of the year 2022 presented, we can state that OrderYOYO A/S (“OrderYOYO” or the “Company”) has ended the year strongly, where the Company continues to grow sales to both new and existing customers within the European markets. In light of several successful data points in the annual report, OrderYOYO delivered a strong Annual Recurring Revenue (ARR) higher than our expectations, which amounted to DKK 212m, corresponding to a growth of 23% YoY. Through a continued expanded product offering, which is expected to attract more restaurant partners as well as provide significant upsell potential, in combination with a higher customer stickiness, and thus reduced churn rates OrderYOYO is estimated to reach a revenue of DKK 206m in 2023. Based on an EV/S-multiple of 3.6x on the 2023 forecast and adjusted for the estimated net debt, a potential fair value of DKK 8.1 per share (8.1) is derived, in a Base scenario.

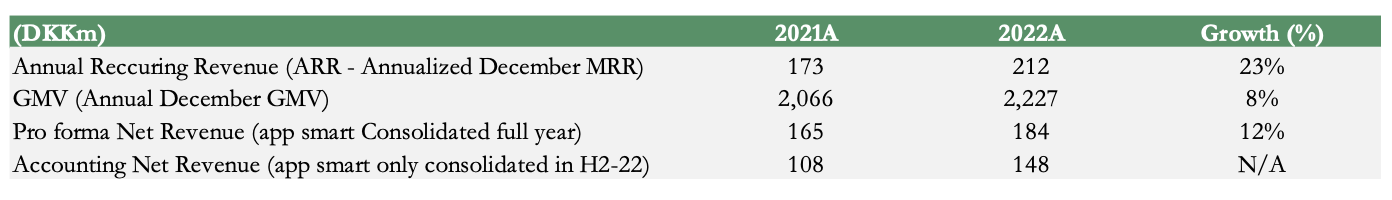

- FY 2022 Report Roughly in Accordance to Estimates

OrderYOYO’s net revenue amounted to DKK 149m in 2022 which was in line with our expectations (148), corresponding to an increase of 37% YoY. The proforma net revenue (app smart consolidated full year), which is considered to be a more comparable metric, increased to DKK 184m in 2022 (165) corresponding to a growth of 12%. Analyst Group considers this as a strong development since the restaurant partners are facing challenging market conditions with high inflation, which in turn affects OrderYOYO’s Gross Merchandise Value (GMV) and thereby topline growth. Furthermore, OrderYOYO has shown a positive profitability trend during the last six months, where the EBITDA before other non-recurring costs was positive in all months within the second half of 2022. This was a strong contributor to that operational EBITDA was only slightly negative during the full-year of 2022 and amounted to DKK -0.9m.

- The Positive Profitability Trend is Expected to Continue

OrderYOYO currently supports almost 10,000 takeaway restaurants and as the customer base matures supporting each one becomes cheaper, hence future sales are expected to show a stronger margin. This, in combination with OrderYOYO´s large restaurant partner base, which can be used to drive a flywheel effect of sign-ups, is expected to reduce the sales and marketing costs and thus result in a positive EBITDA margin of 7% in 2023.

- We Repeat our Valuation Range

Analyst Group believes that OrderYOYO is developing at a good pace with increased growth within the Company’s main markets. We take a particularly positive view of, as previously mentioned, OrderYOYO showing profitability regarding the Company’s operational EBITDA during all six months of H2-22, something that should be rewarded by investors. All in all, we repeat our valuation range where we still see that an investment in OrderYOYO offers a good risk-reward at current levels.

7

Värdedrivare

4

Historisk lönsamhet

7

Ledning & Styrelse

4

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Transformative Merger Paves the Way for Increased Growth

In July 2022, OrderYOYO completed the merger with app smart, which has created a twice as large company, with greater opportunities to liberate the independent takeaway restaurants in Europe. Through an expanded product offering, which is expected to attract more restaurant partners (RPs) as well as provide significant upsell potential, in combination with a higher customer stickiness, and thus reduce churn rates, OrderYOYO is estimated to reach a revenue of DKK 204m in 2023. Based on an applied 3.5x EV/S target multiple, a potential fair value of DKK 8.1 per share is derived today, in a Base scenario.

- ARR is Expected to Increase to DKK 266m

Following the merger, app smart will leverage OrderYOYO’s marketing solutions and OrderYOYO is to leverage app smart’s own POS system, which partly provides significant upsell potential, and by that is estimated to increase the Net Revenue Retention, as well as cost synergies in terms of that the companies can integrate an existing and functioning system instead of developing a new system from scratch. Furthermore, a POS system creates customer stickiness because once it is established with the customer, it is considered both time- and cost-consuming for the customer to change systems, which is estimated to reduce churn. Overall, this is estimated to yield an annualized ARR of approximately DKK 266m in 2024, according to Analyst Group’s forecasts.

- Increasing Profitability as the Customer Base Matures

Following the merger between OrderYOYO and app smart the combined company currently supports +9,500 takeaway restaurants, and as the customer base matures supporting each one becomes cheaper, hence future sales are expected to show a stronger margin. This, in combination with OrderYOYO´s large restaurant partner base, which can be used to drive a flywheel effect of sign-ups, is expected to reduce the sales and marketing costs and thus result in a positive EBITDA margin of 7% in 2023.

- Challenging Market Climate with High Inflation

OrderYOYO’s revenue model is partly based on commission from the restaurant partners, which means that the Company is dependent on the restaurant partner’s increasing their sales to end consumers in order for OrderYOYO’s sales to increase. Given the current economic situation with high inflation and rising interest rates, consumers have less money left over in their wallets, which may lead to consumers spending relatively less on takeaway food, which in such a case may negatively affect OrderYOYO’s development.

7

Värdedrivare

3

Historisk lönsamhet

6

Ledning & Styrelse

3

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

The Growth Journey Continues

During 2021 OrderYOYO has experienced solid growth in ARR from both existing and new Restaurant Partners, simultaneously as the Company has executed on its strategy through increased investments to drive growth forward. Owing to a substantial increase of restaurant partners (RP), a more significant focus on growing existing restaurant partners and the high scalability in the business model, OrderYOYO is estimated to reach a revenue of DKK 167m in 2023. Based on an applied 5.8x EV/S target multiple yields a potential fair value of DKK 17.9 per share in our Base scenario.

- Net Sales Above Our Estimates

For the full year 2021, OrderYOYO delivered net sales of DKK 108.5m (76.3), which corresponds to a growth of 42% compared to 2020. Despite less tailwind from Covid lockdowns in 2021, compared to 2020, OrderYOYO showed a growth in number of restaurants partners of 41%, which Analyst Group assumes is one factor of great importance behind the strong growth during the period. Annual Recurring Revenue (ARR), grew from DKK 104m by December 2020 to DKK 120m by December 2021 – equivalent to a growth of 15%.

- Developed With Good Cost Consciousness

Regarding the operating expenses, these amounted to approximately DKK -116m (-63) during 2021, corresponding to an increase of 84%. The increase is particularly due to IPO related staff costs including cash settlements of warrants and other non-recurring costs such as severance, which is why we do not make any major changes to our prognosis. The earnings of primary activities before financials, tax and depreciations & amortizations amounted to DKK 0.7m (9.7) in accordance to guidance. Considering that parts of the increase in the total operating costs are of a non-recurring nature, we view positively that OrderYOYO has developed with good cost consciousness.

- Acquisitions In the Pipeline

OrderYOYO has decided to strengthen its capital reserve through a private placement and a long term loan facility, which is estimated to bring the liquidity position above DKK 100m. With a strong capital reserve, Analyst Group expects that the Company will make more strategic acquisitions in the future to continue to strengthen its European market leading position and create shareholder value.

- We Remain Our Prognosis

Since OrderYOYO has developed in-line with our expectations, we have left our revenue forecast unchanged. As the number of shares has increased in connection with the Company’s private placement, the price per share has fallen slightly. However, the market cap, in terms of absolute numbers, remains the same as in the previous analysis.

7

Värdedrivare

3

Historisk lönsamhet

6

Ledning & Styrelse

3

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Fast Growing and Highly Scalable SaaS Company

OrderYOYO has over the past six years built a market leading position in the European market regarding white label online ordering, payment and marketing solutions for takeaway restaurants. Owing to a substantial increase of restaurant partners (RP), a more significant focus on growing existing restaurant partners and the high scalability in the business model, OrderYOYO is estimated to reach a revenue of DKK 167m in 2023. Based on an applied 5.8x EV/S target multiple yields a potential fair value of DKK 19.3 per share in our Base scenario.

- OrderYOYO’s Addressable Market is Valued at DKK +50bn

OrderYOYO holds a market leading position within the white-label software solution segment in Europe, with presence in Denmark, UK, Ireland and recently also in Germany. In Europe, where OrderYOYO is established, the addressable market corresponds to a Gross Merchandise Value (GMV) of more than DKK 50bn. Although the Company is a leader in Europe, there is still great potential to continue its growth in Denmark, Ireland and UK. Only 10% of the addressable UK market has been penetrated, whereas the market penetration is 38% for Denmark and 28% for Ireland.

- The Entry Into the German Market is Estimated to Enhance the Growth In the Number of RPs

OrderYOYO acquired Happz in Germany in August 2021, which further enabled the Company to enter the German market earlier than expected. The German market is the second largest market for OrderYOYO and is valued at DKK 19.3bn with 24,000 addressable takeaway restaurants, which poses great growth opportunities. According to Analyst Group’s estimates, the total number of RPs is expected to increase to approximately 10,000 corresponding to an annualized compound growth rate (CAGR) of 29% from 2020 to 2024 in a Base scenario.

- ARR of DKK ~300m in 2024E

Analyst Group estimates that the average churn rate will decrease in the future, as OrderYOYO will focus on securing end-user revenues for level 1 Partners2. This positive churn development along with a significant increase in the number of restaurant partner’s and a focus on growing existing RPs, is forecasted to lead to an ARR of approximately DKK 295m in 2024.

- OrderYOYO’s Future Depends on Further Successful Market Penetration

If the Company is unable to fully execute on the opportunities of the German market and/or unable to adjust its business model to fit the new market, there is a risk that the market penetration will not be sufficiently deep for the expansion to become successful. In that case, it could be difficult for OrderYOYO to reach our estimates.

7

Värdedrivare

3

Historisk lönsamhet

6

Ledning & Styrelse

3

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Analytikerkommentarer

Analyst Group Comments on OrderYOYO’s H1-23 Report

2023-08-22

OrderYOYO published today, August 22, its half year report of 2023. The following are some key points that we have chosen to highlight in connection with the report:

- Strong financial performance – ARR, revenue and EBITDA in line with trading update

- Fixed subscription contributes to a more stable cash flow and less seasonality in ARR

- Cash EBITDA positive in June – an important milestone to deliver positive cash flow

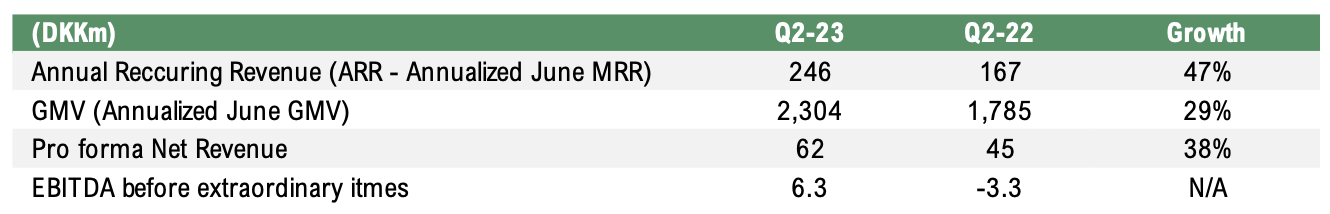

ARR, Net Revenue and EBITDA in line with Trading Update

OrderYOYO announced on Tuesday, July 18, the company’s financial performance during Q2-23 in a trading update, which showed a continued strong development. The ARR amounted to DKK 246m (167), corresponding to a growth of 47% compared to consolidated Q2-22 proforma results. Net revenue amounted to DKK 62m (45), corresponding to a growth of 38% Y-Y compared to proforma figures for Q2-22. Moreover, EBITDA before extraordinary items amounted to DKK 6.3m compared to a loss of DKK -3.3m in Q2-22, corresponding to a margin of 10%. OrderYOYO also raised its guidance for the full year 2023 regarding ARR, net revenue and EBITDA before other extraordinary items, where the biggest change is in EBITDA, which according to Analyst Group is mostly attributable to further efficiency and synergies from mergers, where the merger with app smart has entailed cost synergies that are now showing in the figures, as well as the acquisition of Kingfood, which was completed on April 28th 2023 and is expected to contribute to improved profitability. Read our comment on OrderYOYO’s trading update here.

ARR Grew Both Through Existing and new Customers

OrderYOYO showed a growth of DKK 79m in ARR compared to June 2022, which was driven by both new and existing customers. Compared to ARR in December 2022, existing customers showed a decrease in ARR of DKK -2m which is attributable to a seasonality pattern where the average activity from restaurant partners is normally lower than in December. However, the development can be compared to the same period last year, when ARR from existing customers decreased by DKK 16m from December 2021 to June 2022. The improvement from last year is a result of a larger part of OrderYOYO’s ARR coming from fixed subscription rather than the usage-based subscription. In Q2-23 fixed subscription stood for 38% of the total ARR, compared to 36% at the end of December 2022, which results in a more stable recuring cash flow against more volatility in the usage-based subscription. However, as we have mentioned in previous updates, we see benefits with the usage-based revenue model, for instance the built-in incentive structure of a falling commission rate in return for higher order volumes are beneficial for both OrderYOYO and the Restaurant Partner as increased usage is far more powerful under the usage-based subscription model. Moreover, churn fell to 7.7%, compared to 8.8% in the full year 2022, despite a continued challenging market for OrderYOYO’s restaurant partners with challenging inflation and rising interest rates.

Positive Cash EBITDA in June – Positive Free Cash Flow Around the Corner

EBITDA before other extraordinary items amounted to DKK 9m in H1-23, compared to DKK -6m in H1-22, corresponding to an EBITDA margin of 8%. The positive development in profitability is, according to Analyst Group, a result of economies of scale through mergers, cost management as well as the acquisition of Kingfood. The general staff costs represented 36% of net revenue in H1-23, compared to 45% in the same period last year and external costs amounted to 37% compared to 51% in H1-22, which shows the underlying scalability in the business model and indicates that margins can continue to improve from these levels.

OrderYOYO’s cash flow from operations amounted to DKK -0.5m in H1-23 compared to DKK -21.7m in H1-22 and free cash flow, excluding the acquisition of Kingfood, amounted to DKK -15.2m compared to DKK -35.0m in the same period last year, which shows that the improvement in EBITDA also translates into improved cash flow. Furthermore, in the month of June OrderYOYO showed a positive cash EBITDA, defined as EBITDA before extraordinary items minus capitalized R&D expenditures, which means the organic operation before extraordinary items and costs related to M&A activities was cash flow positive in June. This development indicates that OrderYOYO are close to delivering positive free cash flow, which we expect in H2-23, and that the organic operations are self-sustaining, something that should be rewarded by investors.

In conclusion, OrderYOYO delivered a report with a strong ARR growth of 47% as well as revenue growth of 38%. Moreover, the company delivered an increased profitability and cash flow as a result of the underlying scalability in the business model, which is now materializing in the figures and expected to continue in the coming quarters.

We will return with an updated equity research report of OrderYOYO.

Analyst Group Comments on OrderYOYO’s Q2-23 Trading Update

2023-07-18

OrderYOYO announced on Tuesday, July 18th, the company’s performance during Q2-23. OrderYOYO’s ARR amounted to DKK 246m in June 2023, corresponding to a growth of 47% compared to June 2022 consolidated proforma figures of DKK 167m. The net revenue amounted to DKK 62m during Q2-23, compared to DKK 45m during Q2-22, corresponding to a growth of 38% Y-Y. EBITDA before other extraordinary items amounted to DKK 6.3m in Q2-23 compared to DKK -3.3m in Q2-22. Furthermore, the guidance for the full year 2023 was raised again.

”Q2-23 marked another strong quarter for OrderYOYO with 47% growth in ARR and continued improved profitability. Regarding net sales, the growth amounted to 38% Y-Y in Q2-23, which according to Analyst Group is a result of a growth in GMV but also through increased sales of POS systems, as revenues and ARR are growing faster than GMV, which implies that the fixed subscription fees are growing and the merger with app smart has been successful. Moreover, profitability continues to improve as the EBITDA-margin (before extraordinary items) amounted to 10% in Q2-23, compared to 5% during Q1-23 and a negative margin during Q2-22, which we expect is a result of economies of scale through mergers, cost management as well as the acquisition of Kingsfood. The once again raised guidance of ARR, net revenue and EBITDA implies that the strong development is expected to continue throughout the year, why we see continued very good potential in OrderYOYO as an investment”, says the analyst at Analyst Group covering OrderYOYO.

Continued Profitable Growth

In the second quarter of 2023 OrderYOYO’s ARR amounted to DKK 246m (167m), corresponding to a growth of 47% compared to consolidated Q2-22 proforma results. The company delivered an annualized GMV of DKK 2,304m in June 2023, compared to DKK 1,785m in June 2022. Net revenues amounted to DKK 62m, corresponding to a growth of 38% Y-Y. The EBITDA before extraordinary items amounted to DKK 6.3m compared to a loss of DKK -3.3m in Q2-22, corresponding to a margin of 10%. OrderYOYO has now been profitable on EBITDA-level (before extraordinary items) in every month of the year and with significantly improved margin during Q2-23 compared to Q1-23, which should be rewarded by investors.

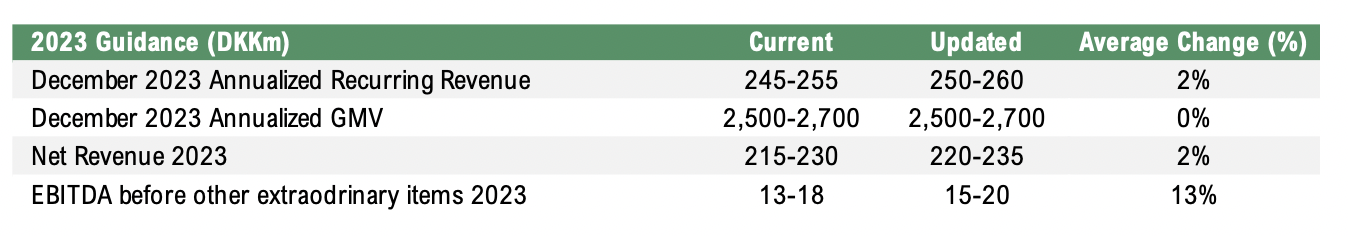

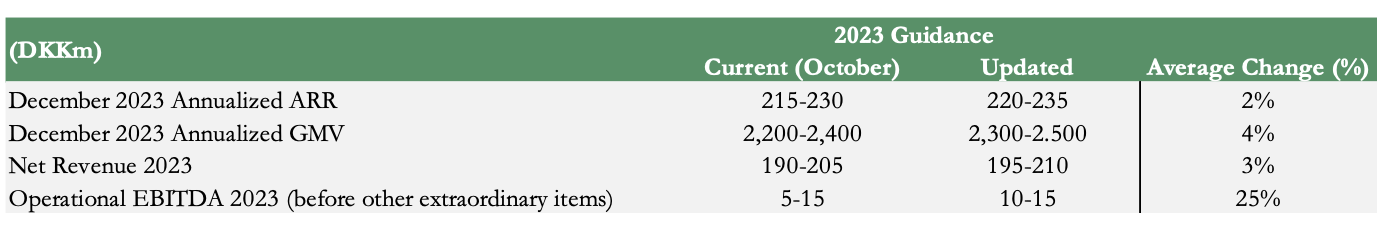

Consolidated 2023 Guidance Raised

Given that OrderYOYO showed a strong development during Q2-23, the company once again raised its consolidated guidance for FY2023, where the biggest change is in the operational EBITDA, which Analyst Group considers to be partly attributable to an increased net revenue, but mostly through further efficiency and synergies from mergers, where the merger with app smart has entailed cost synergies that are now showing in the figures, as well as the acquisition of Kingsfood, which was completed on April 28th 2023 and is expected to contribute to improved profitability.

We will return with an updated analysis in connection with the half-year report of 2023.

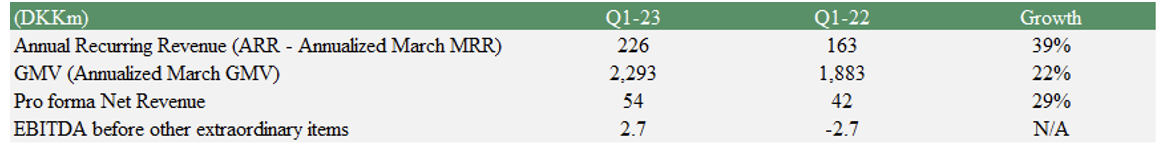

Analyst Group Comments on OrderYOYO’s Q1 Performance and Acquisition of Kingfood

2023-04-17

OrderYOYO announced on Monday, April 17th, the company’s performance during Q1-23. OrderYOYO’s ARR amounted to DKK 226m in March 2023, corresponding to a growth of 39% compared to 2022 consolidated proforma figures. Proforma net revenue amounted to DKK 54m and EBITDA before other extraordinary items was positive all months during Q1-23, which amounted to DKK 2.7m during the period. In connection to the Q1-23 trading update, the company announced the acquisition of Kingfood, a vertical market leader within the Asian cuisine segment serving more than 500 takeaway restaurants. Due to the strong Q1-23 performance and the acquisition of Kingfood the company raised its consolidated 2023 guidance.

“A few weeks ago, OrderYOYO published a full-year report that reflected a strong development, and through the recently presented Q1-23 development we can state that the company continues to show a strong momentum. Despite that the restaurant partners are facing challenging market conditions, with high inflation among other things, OrderYOYO delivered an ARR of DKK 226m in March, growing 39% compared to March 2022. Due to the strong ARR development, the company’s net revenue amounted to DKK 54m in Q1-23, which was slightly above our estimates of DKK 48-50m. Furthermore, OrderYOYO has shown profitability regarding operational EBITDA (EBITDA before other extraordinary items) during the last nine months, something that should be rewarded by investors”, says Analyst Group.

Delivered Profitable Growth During Q1-23

In the first quarter of 2023 OrderYOYO’s ARR amounted to DKK 226m (163), corresponding to a growth of 39% compared to consolidated Q1-22 proforma results. The company delivered an annualized GMV of DKK 2,293m (1,883) in March 2023, which contributed to a proforma net revenue of DKK 54m (42). EBITDA before other extraordinary items amounted to DKK 2.7m (-2.7), where all months in Q1-23 was EBITDA positive.

Acquisition of Kingfood – a Leading Online Ordering Company in Ireland and UK

In connection to the Q1-23 trading update, the company announced the acquisition of Kingfood, a vertical market leader within the Asian cuisine segment. Founded in 2017 in Dublin, Kingfood has built a strong market leading position within the market of online ordering software for the Asian cuisine takeaway vertical in Ireland and UK. Serving more than 500 Restaurant Partners generating more than DKK 150m in GMV (March 2023 annualized). Kingfood is expected to add more than DKK 10m to OrderYOYO’s ARR and contribute to further profitability.

OrderYOYO will acquire Kingfood in a transaction valuing Kingfood at DKK 13.4m, of which DKK 8.9m will be paid in newly issued OrderYOYO shares and the remaining DKK 4.5m will be paid in cash at closing. The issued shares correspond to less than 2% of OrderYOYO’s share capital. Closing is expected to occur on April 28, 2023.

“Following the acquisition of Kingfood, OrderYOYO takes the next step in the company’s consolidation strategy, bringing the number of restaurant partners to +10,000 while further strengthening the market position in UK and Ireland. The transaction is expected to be completed at approximately 1.3x Kingfood’s ARR in March 2023, which we consider to be an attractive ARR-multiple for a company that serves +500 takeaway restaurants generating more than DKK 150m in annualized GMV. Furthermore, we see positively that the acquisition takes place at a lower ARR multiple than what OrderYOYO is valued at, which creates a multiple arbitrage”, says Analyst Group.

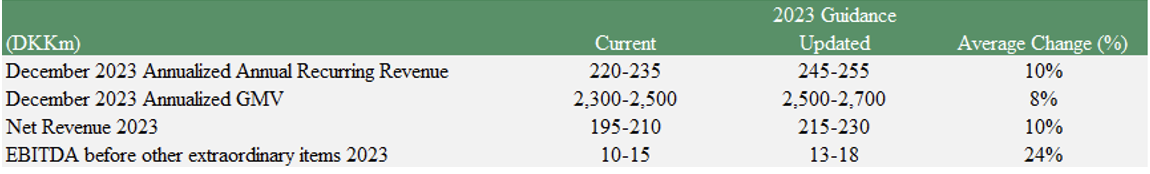

Consolidated 2023 Guidance Raised

Given that OrderYOYO showed a strong development during Q1-23 and due to the acquisition of Kingfood, the company raised its consolidated 2023 guidance. The biggest change in terms of the average on the range is in the operational EBITDA, which Analyst Group considers to be partly attributable to an increased net revenue, as well as economics of scale and cost-synergies.

We will return with an updated analysis in connection with the half-year report of 2023.

Analyst Group Comments on OrderYOYO’s Annual Report 2022

2023-03-21

OrderYOYO published, March 20, the company’s annual report of 2022. The following are some key financial metrics that we have chosen to highlight in connection with the report:

- Net Revenue amounted to DKK 149m – in line with our estimates

- Higher Annual Recurring revenue (ARR) than expected – ARR realized to DKK 212m, corresponding to a growth of 23% YoY

- Positive profitability trend during H2-22 – EBITDA before non-recuring costs amounted to DKK 5.1m and DKK -0.9m for the full-year 2022

OrderYOYO Delivers ARR Above our Expectations

For the full-year 2022, OrderYOYO’s ARR (annualized December MRR) amounted to DKK 212m, corresponding to o growth of 23%. The Company’s ARR was higher than our estimates of DKK 189m, which Analyst Group considers to be a result of that OrderYOYO has managed to grow both existing and new customers at the same time as the Company has delivered a churn at stable levels, despite challenging market conditions for the restaurant partners. Furthermore, due to the merger with app smart OrderYOYO has a larger share of fixed subscriptions, which amounted to 36% of the total December ARR. Analyst Group expects that the fixed subscription will contribute with more stable recurring cash flow against more volatility in usage-based subscription, especially in these difficult times where the restaurant partners are facing challenging market conditions. However, we see several benefits with the usage-based revenue model, for example, the built-in incentive structure of a falling commission rate in return for higher order volumes are beneficial for both OrderYOYO and the Restaurant Partner as increased usage is far more powerful under the usage-based subscription model.

OrderYOYO’s net revenue amounted to DKK 149m in 2022 which was in line with our expectations (148), corresponding to an increase of 37% YoY. Worth noting however is that the revenue of 2022 includes six months of former app smart revenue, which is not included in 2021. Looking at the proforma net revenue (app smart consolidated full year), which is considered to be a more comparable metric, the revenue increased to DKK 184m in 2022 (165) corresponding to a growth of 12%.

EBITDA Before Other Non-Recurring Costs in Accordance to Estimates

Regarding the total staff costs, these amounted to approximately DKK -60m (-63) during 2022, corresponding to a decrease of 5%. The decrease is particular due to that part of the total staff costs in 2021 relates to IPO cash settlements and other non-recuring staff costs, totaling DKK 17m. The general staff costs increased by approximately 30% due to the merger of app smart. However, in 2022 the staff costs in percentages of net revenue decreased to 40% compared to 42% in 2021 at the same time as the Company is growing its sales, which Analyst Group believes is a proof of the high scalability in the business model. The external costs increased mainly due to the integration of OrderYOYO South, which represented 43% (DKK 64m) of net revenue in 2022 compared to 42% in 2021 (DKK 45m). Adjusted for other external costs, which includes non-recurring consultancy and transactional costs attributable to the consolidation with app smart, we believe that OrderYOYO has developed with good cost consciousness during the period. OrderYOYO has shown a positive profitability trend during the last six months, where the EBITDA before other non-recurring costs was positive in all months within the second half of 2022. This was a strong contributor to the operational EBITDA was only slightly negative during the full-year of 2022 and amounted to DKK -0.9m.

In conclusion, our view is that OrderYOYO is progressing above our estimates regarding ARR, and more or less in line with our expectations regarding topline and the general operating costs. We take a particularly positive view of, as previously mentioned, OrderYOYO showing profitability regarding the Company’s operational EBITDA during all six months of H2-22, which is a trend that Analyst Group estimates will continue.

We will return with an updated equity research report of OrderYOYO.

Analyst Group Comments on OrderYOYO’s 2022 Commercial Update

2023-01-12

OrderYOYO announced on Thursday, January 12th, the company’s performance during Q4-22. OrderYOYO’s ARR amounted to DKK 212m in December 2022, corresponding to a growth of 23% compared to 2021 consolidated proforma figures. Unaudited net revenue, app smart only consolidated in H2-22, amounted to DKK 148m in accordance with the latest, increased, guidance of DKK 140-155m. Full-year EBITDA is to be released with the full report, however, OrderYOYO expects the EBITDA to be just below zero, hence in the upper end of the raised guidance range of DKK -5-0m. In connection to the announcement the company raised its consolidated 2023 guidance.

”Despite challenging market conditions and the current economic situation with high inflation and rising interest rates, where consumers presumably spends relatively less on takeaway food, OrderYOYO has managed to deliver an annualized GMV of DKK 2,227m in December, which is above the latest guidance of DKK 2,050-2,200m. Analyst Group considers this to be a proof of that the merger with app smart is progressing according to plan, where we still see significant upsell potential through the merger”, says Analyst Group.

Strong Performance during Q4-22

In the fourth quarter of 2022 OrderYOYO’s ARR amounted to DKK 212m (173m), corresponding to a growth of 23% compared to consolidated Q4-21 proforma results, which is above our estimates of DKK 189m. The company delivered an annualized GMV of DKK 2,227m in December 2022, which contributed to a net revenue (unaudited) of DKK 148m, in accordance with our estimates of DKK 148m. The EBITDA figures will be released in connection with the full-year report on March 20th 2023, however, OrderYOYO’s EBITDA in H2-22 amounted to approximately DKK 5m, hence Analyst Group anticipates that the full-year EBITDA will be in accordance to our estimates of approximately DKK -1.5m.

Consolidated 2023 Guidance Raised

Given that OrderYOYO showed a strong development during Q4-22, the company raised its consolidated guidance for FY2023, where the biggest change in terms of the average on the range is in the operational EBITDA, which Analyst Group considers to be partly attributable to an increased net revenue, but also that the merger enables the combined company to deliver its offering in a cost-effective manner. The updated guidance is close to our estimates.

We will return with an updated analysis in connection with the full-year report of 2022.

Comment on OrderYOYO’s merger with German app smart

2022-06-20

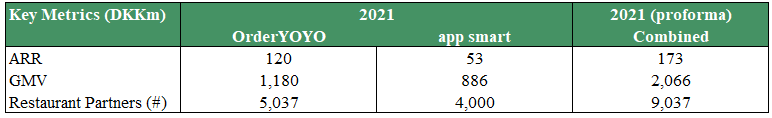

OrderYOYO announced on Friday, June 17th, that the company is joining forces with app smart GmbH (“app smart”), a fast-growing market leader within shop systems, POS-systems and digital infrastructure addressing delivery restaurants in Germany and Austria. The transaction values the share capital of app smart DKK 222m (based on last closing price per share of 6.75 DKK of OrderYOYO 2022-06-16), which will be financed via issuance of new shares in OrderYOYO to the sellers and a cash payment of DKK 22.3m. Closing of the transaction is expected to occur on July 1, 2022.

”Through the transaction, OrderYOYO extends the number of market leading positions in European countries from three to five, servicing more than 9,000 restaurant partners. Furthermore, the transaction creates several potential synergy effects, for example upsell potential, since app smart will leverage OrderYOYO’s marketing solutions and OrderYOYO intends to leverage app smart’s own POS system and create customer stickiness via combined offerings. The transaction is expected to be completed at 4.2x app smart’s reported ARR in 2021, which we consider to be an attractive ARR-multiple for a company that has a market-leading position in Germany and Austria and has delivered an average growth in ARR of 81% per year since 2019”, says Analyst Group.

The transaction

OrderYOYO and app smart have reached an agreement to combine the two companies in a transaction where OrderYOYO will acquire app smart, in which the app smart shareholders will become shareholders in OrderYOYO. OrderYOYO will acquire certain shares in app smart by way of a share transfer, and the remaining shares in app smart will be contributed in-kind into OrderYOYO in exchange for new shares in OrderYOYO. Payment to the sellers consists of 29,608,901 shares in OrderYOYO and DKK 22.3m in cash. Worth noticing is that the app smart shareholders will enter into lock-up agreements with OrderYOYO, meaning that 50% of the locked-up shares will be released January 2023, additionally 25% of the locked-up shares will be released July 2023 and the remaining 25% of the locked-up shares will be released January 2024, which instills confidence from current shareholders in app smart. The transaction is expected to result in a dilution of 34% for existing shareholders in OrderYOYO.

About app smart

app smart was founded in 2014 and has more than 120 employees located in Wiesbaden, Frankfurt. In addition to the company having a market-leading position in Germany and Austria, app smart has initiated a market entry into Switzerland and also has a minor position in Poland, which are new markets for OrderYOYO. As per May 2022, the company had more than 4,000 Restaurant Partners, app smart delivered annualized December 2021 ARR of DKK 53m and annualized December 2021 GMV of DKK 886m.

“OrderYOYO has updated the company’s outlook for 2022, subject to closing of the transaction. The combined company will target an annualized December 2022 ARR of DKK 175-190m (140-170m previously communicated). By using the midpoint in guidance, to illustrate a forward-multiple, and based on OrderYOYO’s market cap today (included the new shares), the combined company is trading at 3.5x ARR 2022E. This forward-multiple is lower than the average ARR-multiple in the Danish SaaS-sector (5.5), despite the fact that the combined company has a high historical ARR growth and has a market-leading position in five markets, we therefore believe that an investment in the combined company invites to an attractive risk-reward.

In connection with the announcement of the transaction, we have interviewed management and considering that app smart has grown its ARR with a CAGR of approximately 81% (2019-2021), it is our belief that the current guidance is conservative and leave room for focusing on the integration of the two companies”, says Analyst Group.

Comment on OrderYOYO’s Annual Report 2021

2022-03-22

OrderYOYO published today, March 22, its annual report of 2021. The following are some key financial metrics that we have chosen to highlight in connection with the report:

- Net sales grew by 42%

- ARR realized at DKK 120m – corresponding to 15% YoY growth

- Number of Restaurant Partners by the end of 2021 amounted to 5,037 (3,567)

- EBITDA before non-recuring costs realized to DKK 0.7m

OrderYOYO Delivers Net Sales Above Our Estimates

For the full year 2021, OrderYOYO shows net sales of DKK 108.5m (76.3), which corresponds to a growth of 42% compared to 2020. Despite less tailwind from Covid lockdowns in 2021, compared to 2020, OrderYOYO delivers a growth in number of Restaurants partners of 41%, which Analyst Group assumes is one factor of great importance behind the strong growth during the period. Annual Recurring Revenue (ARR), measured as the annualized value of Monthly Recurring Revenue (MRR), i.e. MRR in a given month times twelve, grew from DKK 104m by December 2020 to DKK 120m by December 2021 – equivalent to a growth of 15%.

“OrderYOYO’s stock, like many other growth companies, has been severely punished as a result of increased geopolitical tensions and higher risk premiums. That the share (YTD) is down approximately 20% is, in our opinion, due to the cold climate in the stock market where investors choose less risky investments, e.g. companies that have a longer history of already positive cash flows. Nevertheless, in view of the fact that the company continues to develop well, it is remarkable that the market cap does not follow. OrderYOYO is today valued at approximately 4.5x ARR, for a company that has grown its ARR by ~60x from mid 2016 and continues to deliver, which is why we believe that an investment in OrderYOYO invites to a great risk-reward”, says Analyst Group.

EBITDA Before Other Non-Recurring Costs In Accordance to Guidance

Regarding the total staff costs, these amounted to approximately DKK -62.9 (-34.2) during 2021, corresponding to an increase of 80%. The increase is particular due to IPO related staff costs including cash settlements of warrants and other non-recurring costs such as severance, which is why we do not make any major changes to our prognosis. Adjusting for non-recuring staff costs, the general staff costs in 2021 represented 42% (DKK 45.9) of net revenue, compared to 42 % in 2020 (DKK 31.8), which is slightly better than we expected. Considering that parts of the increase in the total staff costs are of a non-recurring nature, we view positively that OrderYOYO has developed with good cost consciousness. The external costs amounted to 45.9 in 2021 compared to 22.7 in 2020, corresponding to an increase by 102%. In 2021 the company has invested heavily in its product offering and improved the value proposition for the Restaurant Partners by increasing the marketing efforts and digital presence, which is the main contributor to the increase in external costs. The earnings of primary activities before financials, tax and depreciations & amortizations amounted to DKK 0.7m in accordance to guidance compared to DKK 9.7m in 2020, due to increased investments in OrderYOYO’s Restaurant Partners and markets.

Our View of OrderYOYO’s future

During 2021 OrderYOYO has experienced solid growth in ARR from both existing and new Restaurant Partners. Equally important, MRR churn per quarter has been falling through the last year, proving that once Restaurant Partners implement and receive orders through the Company’s solution, the churn rate decreases. In 2022 and forward, Analyst Group believes that OrderYOYO will continue to execute on its current road map through increased investments in product offering to drive end-user lifetime value, and continue investing in market leadership within its current markets UK, Denmark and Ireland, simultaneously as the Company scales up its market expansion in Germany. Analyst Group expects OrderYOYO to continue to increase the number of Restaurant Partners in all main markets and pursue its focus on securing end-user revenues for new Restaurant Partners, which is estimated to yield a positive churn development and thus also a higher ARR.

OrderYOYO has decided to strengthen the company’s capital reserve and bring the liquidity position above DKK 100m. OrderYOYO will thus increase its share capital through a private placement securing DKK 40m and through an additional long term loan facility of DKK 40m. Vækstfonden Damgaard Company (owned by Preben Damgaard, chairman of OrderYOYO), is one of the investors in the private placement and provides the loan facility, which sends an important signal and instills confidence. With a strong capital reserve, Analyst Group expects that the company will make more strategic acquisitions in the future to continue to strengthen its European market leading position and create shareholder value.

We will return with an updated equity research report of OrderYOYO.

Aktiekurs

N/A

Värderingsintervall

2023-10-23

Bear

5,8 DKKBase

10,2 DKKBull

13,2 DKKUtveckling

Huvudägare

2023-06-30

Analyst Group Comments on OrderYOYO’s Q3-23 Trading Update

2023-10-18

OrderYOYO announced on Wednesday, October 18th, the company’s performance during Q3-23 and shows a continued strong performance.

OrderYOYO’s ARR amounted to DKK 256m in September 2023, corresponding to a growth of 38% compared to September 2022 figures of DKK 185m. The net revenue amounted to DKK 65m during Q3-23, compared to DKK 45m during Q3-22, corresponding to a growth of 44% Y-Y. EBITDA before other extraordinary items amounted to DKK 7.5m in Q3-23 compared to DKK 1.9m in Q3-22, corresponding to a growth of 295% and a margin of 11.5% (4.2%). The company delivered an annualized GMV of DKK 2,438m in September 2023, compared to DKK 1,868m in September 2022. As mentioned in connection with the H1-23 report, OrderYOYO showed a positive Cash EBITDA in June (defined as EBITDA before other extraordinary items minus capitalized R&D expenditures), something that has continued all months in Q3-23, meaning that the organic operations are now self-sustaining and independent of external capital.

Consolidated 2023 Guidance Raised again

Given that OrderYOYO continued to show a strong development during Q3-23, the company raised its consolidated guidance for FY2023 for the fourth time this year, where the biggest change is in the operational EBITDA, where OrderYOYO is guiding for and EBITDA margin of 8-10% for the full year. The significant rise in guidance for EBITDA again proves the scalable business model that OrderYOYO possesses.

Consolidated 2024 guidance released

In connection with the trading update for Q3-23, OrderYOYO also released guidance for the full year 2024. The company guides for ARR to reach DKK 300-310m by December 2024, compared to DKK 260-270m in December 2023, which corresponds to a growth of 15%, given the mid-range of guidance. Moreover, EBITDA before other extraordinary items is expected to grow 19%, given the mid-range of guidance, where the stronger expected growth in EBITDA than ARR and revenue demonstrates continued margin expansion. The full guidance for 2024 can be found in the table below.

”OrderYOYO continues the strong growth during the third quarter and are continuing to gain market shares despite a tough market, which proves the company’s strong value proposition to its restaurant partners. The strong growth in ARR and revenue is attributable to a strong growth in GMV, which are estimated to be derived from both existing and new restaurant partners. In addition, OrderYOYO released a new, entirely cloud-based, POS system which offers several advantages for restaurant partners, including, among other things, an intelligent delivery system and a CRM system, which is expected to strengthen OrderYOYO’s offer and the fixed subscription fees. Furthermore, the margin expansion continues as the EBITDA margin amounted to 11.5%, compared to 4.2% in Q3-22 and 8% during H1-23, which continues to prove the scalable business model and increased economies of scale.

The strong development should be seen in the light of the current challenging macroeconomic situation with continued high inflation and rising interest rates. The combination of high input prices for restaurants and reduced purchasing power for consumers impacts restaurants significantly, why OrderYOYO’s ability to grow both through existing and new customers proves the company’s strong value proposition regarding solving digital challenges for the restaurant partners. However, there are bright spots regarding inflation, which is tapering down in most economies worldwide. The UK, OrderYOYO’s second-largest market, recently released data for the month of September, indicating a 0.2% month-over-month decrease in prices for food and non-alcoholic beverages compared to August, marking the first monthly decline since September 2021. However, the year-over-year price increase for food and non-alcoholic beverages remains high at 12%, indicating persistent high inflation. As macroeconomic factors continue to improve, Analyst Group estimates that OrderYOYO’s churn, which amounted to 7.7% in H2-22 – H1-23, will decrease further, which we view as an important driver for continued ARR growth going forward”, says the analyst at Analyst Group covering OrderYOYO.

We will return with an updated equity research report of OrderYOYO.