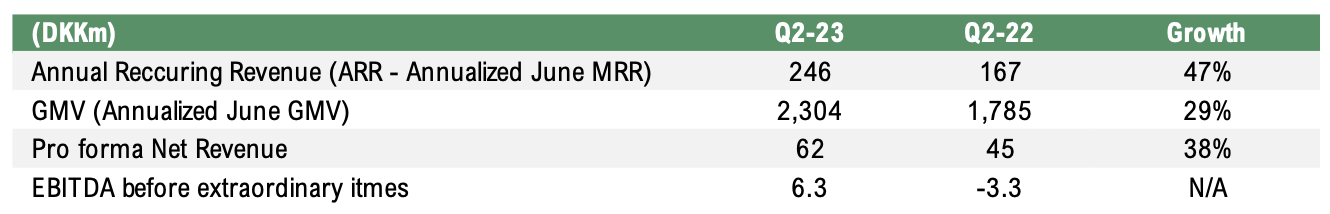

OrderYOYO announced on Tuesday, July 18th, the company’s performance during Q2-23. OrderYOYO’s ARR amounted to DKK 246m in June 2023, corresponding to a growth of 47% compared to June 2022 consolidated proforma figures of DKK 167m. The net revenue amounted to DKK 62m during Q2-23, compared to DKK 45m during Q2-22, corresponding to a growth of 38% Y-Y. EBITDA before other extraordinary items amounted to DKK 6.3m in Q2-23 compared to DKK -3.3m in Q2-22. Furthermore, the guidance for the full year 2023 was raised again.

”Q2-23 marked another strong quarter for OrderYOYO with 47% growth in ARR and continued improved profitability. Regarding net sales, the growth amounted to 38% Y-Y in Q2-23, which according to Analyst Group is a result of a growth in GMV but also through increased sales of POS systems, as revenues and ARR are growing faster than GMV, which implies that the fixed subscription fees are growing and the merger with app smart has been successful. Moreover, profitability continues to improve as the EBITDA-margin (before extraordinary items) amounted to 10% in Q2-23, compared to 5% during Q1-23 and a negative margin during Q2-22, which we expect is a result of economies of scale through mergers, cost management as well as the acquisition of Kingsfood. The once again raised guidance of ARR, net revenue and EBITDA implies that the strong development is expected to continue throughout the year, why we see continued very good potential in OrderYOYO as an investment”, says the analyst at Analyst Group covering OrderYOYO.

Continued Profitable Growth

In the second quarter of 2023 OrderYOYO’s ARR amounted to DKK 246m (167m), corresponding to a growth of 47% compared to consolidated Q2-22 proforma results. The company delivered an annualized GMV of DKK 2,304m in June 2023, compared to DKK 1,785m in June 2022. Net revenues amounted to DKK 62m, corresponding to a growth of 38% Y-Y. The EBITDA before extraordinary items amounted to DKK 6.3m compared to a loss of DKK -3.3m in Q2-22, corresponding to a margin of 10%. OrderYOYO has now been profitable on EBITDA-level (before extraordinary items) in every month of the year and with significantly improved margin during Q2-23 compared to Q1-23, which should be rewarded by investors.

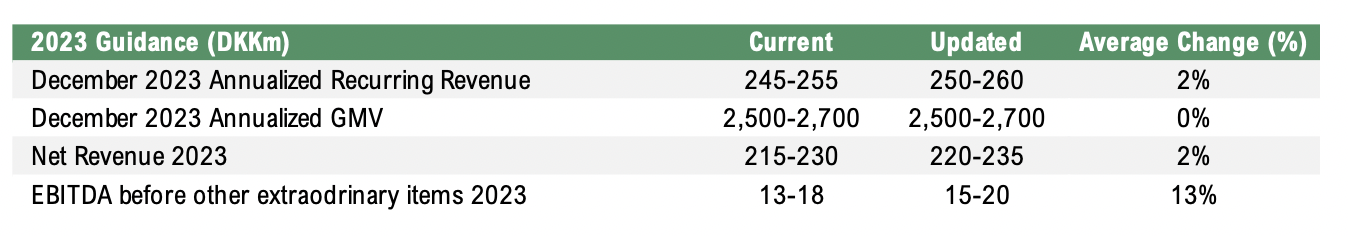

Consolidated 2023 Guidance Raised

Given that OrderYOYO showed a strong development during Q2-23, the company once again raised its consolidated guidance for FY2023, where the biggest change is in the operational EBITDA, which Analyst Group considers to be partly attributable to an increased net revenue, but mostly through further efficiency and synergies from mergers, where the merger with app smart has entailed cost synergies that are now showing in the figures, as well as the acquisition of Kingsfood, which was completed on April 28th 2023 and is expected to contribute to improved profitability.

We will return with an updated analysis in connection with the half-year report of 2023.