Huddlestock Fintech är verksamma inom IT-branschen. Bolaget är specialiserade mot digitala lösningar för finansmarknaden. Utbudet är brett och inkluderar exempelvis lösningar för finansiell rådgivning, rapportering och uppföljning av handel och utveckling. Kunderna består av små- och medelstora finansaktörer, runtom den nordiska marknaden.

Pressmeddelanden

Strong business momentum

Bricknode Holding AB (”Bricknode” or the ”Company”) is a leading supplier of SaaS solutions that enable financial companies and startups to design and launch their own digital investment, lending and savings products, or transform existing operations. The Company announced in August 2022 a savings plan to accelerate the path to profitability by reducing fixed and variable costs by approximately 40%. During December 2022 Bricknode signed three new clients, which in combination with existing customer portfolio, paves the way for higher growth and to achieve profitability going forward. Bricknode are estimated to reach a revenue of 26 MSEK in 2023 and based on an applied P/S target multiple of 5.4x, a potential fair value of 12.8 SEK (12.8) per share is justified in our Base scenario.

- Net Revenues In Line With Our Expectations

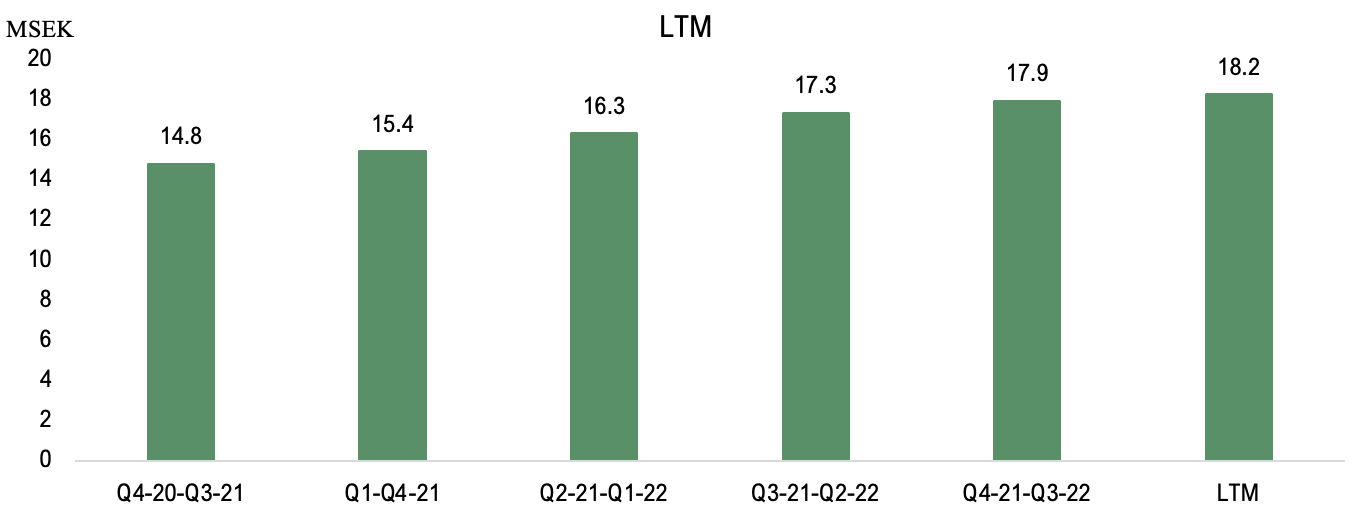

Net revenues amounted to 4.6 MSEK (4.2) during the fourth quarter, corresponding to a growth of 9%. Bricknode’s revenues for the Last Twelve Months (LTM), which thus corresponds to the full-year revenue for 2022, amounted to 18.2 MSEK (15.4), driven by new clients as well as growth among Bricknode’s existing clients. In our last equity research report our estimate was 18,4 MSEK for the full year 2022, which is marginally higher than the actual outcome. During the full year 2022 the NRR amounted to 101%, down from 115% in the full year 2021.

- Three New Significant Clients

During December 2022 Bricknode has signed three new significant clients, which is a result of the built-up relations in the market. Bricknode has also commented that the pipeline of new prospective clients is strong, and we assess that Bricknode have a good opportunity to continuing delivering new deals. The new clients consist of one wealth management company, one fund management company and the corporate finance firm Vator Securities. The new clients operate within three different wealth segments and can be seen as a proof of Bricknode Broker’s wide range of use. Bricknode has a strong momentum and Analyst Group expects a growing ARR from 2023 and going forward.

- Delayed Effects of the Savings Plan

The EBITDA result amounted to -6.2 MSEK (-5.2) in the fourth quarter, corresponding to an increased EBITDA loss of 1 MSEK Y-Y, which in part was due to an increase in other external costs, while the staffing costs decreased by approx. 0.5 MSEK. The effects of the layoffs in Bricknode is delayed due to notice periods, and therefore Analyst Group assumes the effects will be reflected in H1-23. In addition, Bricknode is working towards establishing its own regulated securities brokerage firm but has also completed a large technical upgrade and a move to Azure from Amazon Web Services. This factors are assumed to have driven the cost base during Q4-22, but are estimated to subside going forward and contribute to an optimizing of the organization. Full effects of the savings plan is therefore expected to be reflected during H1-23.

6

Värdedrivare

3

Historisk lönsamhet

9

Ledning & Styrelse

6

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Focusing on the Product Vision

Bricknode is a leading supplier of SaaS solutions that enable financial companies and startups to design and launch their own digital investment, lending and savings product, or transform existing operations. The Company announced in August 2022 a savings plan to accelerate the path to profitability by implementing a plan to reduce fixed and variable costs by approximately 40%. Bricknode has already decreased the EBITDA loss Q-Q by approximately 34 % to -4.5 MSEK (6.9). Bricknode are estimated to reach a revenue of 26 MSEK in 2023, and based on an applied P/S target multiple of 5.4x, a potential fair value of 12.8 SEK (13.8) per share is justified in our Base scenario.

- Net Revenues in Line With Our Expectations

Net revenues amounted to 4.5 MSEK (3.9) during the third quarter, corresponding to a growth of 16 % compared to the same quarter previous year. The net revenue was not only in line with our estimates, but also a marginal increase from the previous quarter (Q2-22), corresponding to a growth of 1% Q-Q. The increased revenues have been driven by new customers as well as growth among Bricknode’s existing customers. During the third quarter the NRR amounted to 104 %, down from 115 % in Q3-21, but in line with H1-22.

- New Partnership With Tuum

Bricknode presented in November 2022 a partnership with the next-generation core banking platform Tuum. Tuum is an API-first modular core banking platform that enables companies to quickly roll out new financial products, from accounts, deposits and lending to payments and cards. By partnering with Bricknode, Tuum is adding investments to its platform, to further expand its product portfolio. Tuum has already an extensive customer base, and the partnership expands the opportunities for Bricknode to reach new customers together with Tuum, as well as open up new product capabilities for Tuum’s existing customers.

- Finalizing the Biggest Core Update in Bricknode Broker

Bricknode are about to finalize a large upgrade to Bricknode Broker core, which both enables significant costs reductions and creates further value for existing customers and, as such, enables delivering new and future features faster. The upgrade and the extensive product portfolio pave the way for both closing more deals and partnerships going forward. The upgrades are estimated to be completed before the end of the fourth quarter. As well as it paves the way for future deals, it will also release time to advance in the brokerage license project. The regulatory permission allows Bricknode to operate as their own financial institution. The combination of a software platform, brokerage outsourcing and regulatory umbrella, offers firms an all-in-one solution and a one-stop-shop for launching new investing services.

7

Värdedrivare

2

Historisk lönsamhet

9

Ledning & Styrelse

5

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Building the future of financial software

Bricknode Holding AB (”Bricknode” or the ”Company”) is a leading supplier of SaaS solutions that enable financial companies and startups to design and launch their own digital investment, lending and savings product, or transform existing operations. The Company has developed a platform which is highly scalable and fully cloud based, Bricknode Core, which can be likened as an operating system for all financial applications. Bricknode are estimated to reach a revenue of 26 MSEK in 2023, and based on an applied P/S target multiple of 5.9x, a potential fair value of 13.9 SEK per share is justified in our Base scenario.

- Pick-and-Shovel Business

Bricknode remove barriers for startups and established firms with its cloud-based software and technology solutions by enabling customers to take new propositions to market in a quick and cost-efficient manner, allowing customers to focus on end-consumer value creation. The Company is a part of the global fintech revolution and can be likened with a pick-and-shovel business, where the Company is gaining exposure to the global digitalization of the financial markets, without carrying the traditional company specific risk.

- Bricknode Offers An Extensive Product Portfolio

Bricknode has spent over a decade on developing its financial platform Bricknode Core which is highly scalable, as well as an extensive product portfolio. On top of Bricknode Core, the Company provides additional applications such as Bricknode Broker, Bricknode Lending, Bricknode Marketplace and Investment Manager. The applications offers complete flexibility in product design, regulatory umbrella services and outsourcing for back-office operations. In June 2022, the Company completed a core technology upgrade that enables customers to create new financial services, which is estimated to sustain Bricknode’s growth going forward.

- Sticky Business Model And A Strong Moat

Bricknode’s services, for example Bricknode Broker and Bricknode Lending, are crucial services for the customers and due to the complexity of products like e.g. Bricknode Broker, the Company is able to create a strong moat. Due to the provided flexibility and customization on the platform, Bricknode have been able to create long as well as valuable relationship with its customers. Services such as brokerage and lending also results in high switching costs for customers, given that the service can be seen as a core part of the customers offer to the end-users. Bricknode’s agreements have therefore a high Total Contract Value (TCV), which strengthen’s the moat around the business. As a result, the Company has a very low churn, leading to highly predictable recurring revenues.

7

Värdedrivare

2

Historisk lönsamhet

9

Ledning & Styrelse

5

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Analytikerkommentarer

Comment on Bricknode’s Year-end Report 2022

2023-02-23

Bricknode published on February 23, the company’s quarterly report for the fourth quarter 2022. The following are some key financial metrics that we have chosen to highlight in connection with the report:

- Net revenue amounted to 4.6 MSEK – in line with our expectations

- Signed three significant customers in December 2022

- Increased EBITDA loss

Net revenue growth 9% Y-Y

During the fourth quarter of 2022, the net revenues amounted to 4.6 MSEK (4.2), corresponding to a growth of 9% compared to the same quarter the previous year. The net revenue was in line with our estimates and Bricknode shows a marginal increase from the previous quarter (Q3-22), corresponding to a growth of 3% Q-Q. Bricknode revenues for the Last Twelve Months (LTM), which thus corresponds to the full-year revenue for 2022, amounted to 18.2 MSEK (15.4), driven by new customers as well as growth among Bricknode’s existing customers.

In our last equity research report our estimate was 18,4 MSEK for the full year 2022, which is marginally higher than the actual outcome. During the fourth quarter the NRR amounted to 98%, down from 115% in Q4-21, a NRR below 100% shows a negative growth among the company’s existing customers, which is the first time for Bricknode as a reported company. Despite an NRR below 100% Bricknode is delivering growth both on quarterly and yearly basis, which Analyst Group sees as a strong performance during the quarter and the strength in the revenue model. The long-term and stable growth that Bricknode delivers is clearly reflected on a LTM basis.

As we have previously highlighted, a new customer within Bricknode Broker often implies a long sales cycle, because it often constitutes as crucial or complex services to the customers, thus creating stickyness. On the other hand, a new customer within Bricknode Broker also implies a significantly higher Monthly Recurring Revenue (MRR) and a high Total Contract Value (TCV), due to the business-critical nature of Bricknode Broker. Despite the long sales cycles, Bricknode has signed three new significant customers in December 2022, which is a result of the built-up relations in the sales pipeline. The new customers consist of one wealth management company, which we commented on here, one fund management company, which we commented on here, and the corporate finance firm Vator Securities, which we commented on here. Where Vator Securities is also Bricknode’s first client within the corporate finance segment which can both be seen as a proof of Bricknode Broker’s wide range of use, while also implying a greater potential within the corporate finance segment.

The company comments in both the report and the conference call that Bricknode has a strong pipeline of new prospective customers and possesses many prospectuses. Analyst Group assesses that Bricknode has a good opportunity to continuing delivering new deals, despite the long sales cycles. Three new customers within the wealth management area are of big meaning to further growth, for example one of the new customers, the Swedish wealth management firm, Bricknode projects that the client will increase Bricknode’s Annual Recurring Revenues (ARR) by approximately 7-10% within the next few years.

Increased EBITDA loss

The EBITDA result during the fourth quarter amounted to -6.2 MSEK (-5.2), corresponding to an increase EBITDA loss of -1.0 MSEK Y-Y, which is derived by an increase in other external costs, while the staffing decreased by approximately 0.5 MSEK. Bricknode is working towards establishing its own regulated securities brokerage firm but has also completed a large technical upgrade and a move to Azure from Amazon Web Services. These factors are assumed to have driven the other external costs, but also can be seen as efforts to optimizing both the organization and hosting costs going forward. Analyst Group therefore expects the fixed costs to reduce going forward, and that the increased cost base is a result of one-off costs and delays in the saving program.

For the full year 2022 the EBITDA result amounted to -23.6 MSEK (-11.9), corresponding to an almost doubled increased EBITDA loss. Bricknode launched an aggressive savings program in August of 2022, resulting in extensive layoffs. Analyst Group expects further effects of the implemented costs savings in the coming quarters during 2023, as well as we assess that Bricknode will continue to execute on the savings plan in order to reduce the burn rate significantly.

In conclusion, we are of the opinion that Bricknode has progressed well operatively during the fourth quarter, given the growth both quarterly and on a yearly basis, where Bricknode has signed three significant customers which enables a higher growth and reduced burn rate going forward. Bricknode has also completed a technology upgrade of Bricknode Broker to become a complete end-to-end solution. Bricknode has also taken big steps to both optimize the organization and to become a regulated securities firm, which paves the way to become cash flow positive and to act as a B2B securities broker, which strengthens the company’s offering significantly.

We will return with an updated equity research report of Bricknode.

Comment on Bricknode’s New Client

2023-01-03

Bricknode announced on Tuesday, January 3rd, that a fund management company (“the Client”) has chosen Bricknode’s digital investment management platform, Bricknode Broker, to be an integral part of the scaling up of its investment operations.

Bricknode has signed an award-winning Swedish fund manager to Bricknode Broker. The agreement will help facilitate a centralized hub for fund order routing and client account management for the Client. The name of the fund manager has not been made public due to commercial reasons. The Client chose Bricknode’s digital investment platform because they needed a function-rich and flexible investment operation software to support the operations team with the current workflows and where new markets and distribution channels can be added at a later date. Bricknode has also been chosen due to its comprehensive solution which provides automation and scalability to support the fund management company’s growth plans.

Bricknode also announced on December 30th, that they have secured a loan of 2.5 MSEK provided by Founder and co-CEO Stefan Willebrand, co-CEO Erik Hagelin and Chairman Robert Lempka. The loan will continue to support the company as it pursues its goal of reaching profitability. The loan term is on 1 year with an interest rate of 1.5% per month.

Analyst Group view on the agreement with the new Client and the secured loan

Bricknode has a strong momentum where Bricknode has signed its third client that have selected Bricknode Broker within the last month. As mentioned earlier, the sales cycles are long in regards to Bricknode Broker, where a new customer implies a significantly higher ARR and Bricknode has now announced three new wealth customers. The new customers sit within three different wealth segments, where the new customers are a wealth management firm, a corporate finance and advisory service provider (Vator) and now a fund management company. Bricknode Broker is a complete and comprehensive solution that enables securities firms to administer their financial operations. The new Clients within three different finance and wealth segments can be seen as a proof of Bricknode Broker’s wide range of use, and also imply a greater potential within the whole finance and wealth market to support and administer financial operations. Analyst Group consider the new Client to be a further significant achievement for Bricknode and expects, together with the earlier two announced customers, a great growing ARR from 2023 and going forward. Bricknode has a strong momentum and has been delivering on their strong pipeline, but also continuing to possess a great pipeline with over 50 prospects.

In August 2022 Bricknode implemented a plan to reduce costs and accelerate the path to profitability and the effects of the implemented plan could be seen already in the third quarter with a reduced EBITDA loss Q-Q of approximately 34% and a reduced staffing cost Q-Q of approximately 2 MSEK. Bricknode has as of December 30th secured a loan of 2.5 MSEK provided by the company’s co-CEOs (Stefan Willebrand and Erik Hagelin) and Chairman Robert Lempka. The loan will support the company as it continues its path to profitability and is a proof of Bricknode’s strong management. At the end of Q3-22 Bricknode’s cash and equivalents amounted to 7.7 MSEK.

In the third quarter we could see early effects of the implemented plan to reduce fixed and variable costs, and Analyst Group also expects further cost reductions going forward. As of today, Analyst Group consider that Bricknode has a stronger financial position with a lower risk of raising additional external capital and where Bricknode with three new clients to Bricknode Broker also possesses a great position to scale up the ARR from 2023 and beyond.

Comment on Bricknode’s New Client Vator

2022-12-23

Bricknode announced on Thursday, December 22nd, that Vator Securities (“Vator”), a leading corporate finance and advisory service provider, has chosen Bricknode’s digital investment management platform to administer share issues.

Bricknode has signed the first corporate finance client to Bricknode Broker. Vator can administer its share issues with a highly automated digital investment platform, maintaining share ownership records and fulfilling operational processes by choosing Bricknode. Vator has focused on financing growth companies through a range of issuance service since its launch in 2010. Vator is offering issuer services, as rights issues and directed share issues, Corporate Finance services, as Pre-IPO financing and IPOs and secondaries, and certified adviser services. Vator raises capital from local and global institutional investors, as well as a proprietary network of family offices and high net worth investors. Bricknode’s scalable cloud platform will enable Vator’s ambition to support the growth of many more innovative companies. Vator chose Bricknode’s digital investment platform, Bricknode Broker, in order to digitalize their processes and streamline their share issue operations. Vator is the first corporate finance company to use Bricknode Broker solution, and Bricknode sees a great deal of potential in supporting other corporate finance firms with Bricknode Broker.

Analyst Group view on the agreement with Vator

Last week, Bricknode signed an important client that selected Bricknode Broker solution to manage investment operations. Within two weeks, Bricknode have already signed a second client, Vator, that has selected Bricknode Broker as a platform to administer share issues. Vator is also Bricknode’s first client within the corporate finance segment which can be seen as a proof of Bricknode Broker’s wide range of use, and also imply a greater potential within the corporate finance segment, where other corporate finance firms can be supported by Bricknode Broker. Bricknode Broker supports the operations needs of banks, neobanks, asset managers, fintechs, and now also corporate finance firms. Analyst Group consider Bricknode to be delivering on their strong pipeline, with over 50 prospects, where it should also be mentioned that the sales cycles are long within Bricknode Broker. Bricknode commented that the new client last week has a projected deal value of increasing Bricknode’s annual revenues by around 7-10%, within a few years. Bricknode has not projected the deal value of the agreement with Vator, but an agreement within Bricknode Broker is expected to imply a significantly higher ARR going forward.

“We consider the two new customers to be a significant achievement for Bricknode with a great expected growing ARR in 2023 and beyond. In addition, Bricknode also grows with its customers for example when their usage or volume increases, both also when upgrading their functions on the platform with new add-ons. We repeat our expectation of rising sales going forward, with two new clients and a growing ARR from 2023. We therefore also repeat our valuation range based on our financial forecast for 2023, why Bricknode, at current levels, still trade at a very attractive risk / reward.”, says the analyst at Analyst Group covering Bricknode.

Comment on Bricknode’s New Client

2022-12-13

Bricknode announced on Tuesday, December 13th, that a Swedish wealth management firm (“the Client”) has selected Bricknode Broker solution to manage investment operations. The deal is projected to increase Bricknode’s annual recurring revenues by around 7-10% within the next few years.

Bricknode has signed a new important client in their wealth segment where the Client has selected Bricknode Broker to consolidate their investment operations. The name of the Client is not public, which may be explained by the fact that the client is expected to launch its investment activities under a new brand in Q1 2023. The Client is a wealth management firm with an experienced team of financial advisors focusing on wealth management portfolios. Bricknode Broker enables securities firms to administer their financial operations when it comes to wealth products that they offer, such as mutual funds, equities, bonds, etc. The Client chose Bricknode’s digital investment platform in order to automate and administer its daily operations including accounts, transactions, and order management. Bricknode has also been chosen due to its capabilities in managing the Client’s investment operations safely, digitally and efficiently, but also because the platform is scalable.

Bricknode projects that the Client will increase Bricknode’s Annual Recurring Revenues (ARR) by approximately 7-10% within the next few years.

An illustrative example on Bricknode’s ARR

In Bricknode’s case, the recurring revenues accounted for ~94% over the time period Q2-2021 – Q1 2022, and if same the level would still apply for the last twelve months (LTM), the ARR would have amounted to 16.9 MSEK. Given this, the Client would illustratively increase Bricknode’s net revenues with approximately 1.2 MSEK – 1.7 MSEK annually, within a few years. Please note that this is an illustration made by Analyst Group, and has not been communicated by the Company.

As mentioned earlier, the sales cycles are long within Bricknode Broker and therefore we do not expect the business vertical to grow at an exponential rate in terms of acquired customers. But, on the other hand, a new customer, for example like the Client, implies a significantly higher ARR. Because of the business critical nature of Bricknode Broker, this implies a high Total Contract Value (TCV). Furthermore, Bricknode can grow with its customers, which is also the case for the new Client that expects to launch its new brand in Q1-23.

Analyst Group assesses that the new customer means a significant step for Bricknode with an expected growing ARR in 2023 and beyond. In the press conference in connection with the announcement, Bricknode also communicated that the sales pipeline is very strong, with 53 prospects in the pipeline, where three of them are in very late stage of negotiations and with a projected deal value that amounts to 3.6 MSEK in ARR, corresponding to approximately 20% of the current revenues. Bricknode trades as of today at a P/S multiple of 1.9x, which Analyst Group consider to be attractive to investors, given the current value drivers for Bricknode.

Comment on Bricknode’s Q3 Report 2022

2022-11-18

Bricknode published on November 17th, its quarterly report for the third quarter 2022. The following are some key financial metrics that we have chosen to highlight in connection with the report:

- Net revenue amounted to 4.5 MSEK – in line with our expectations

- Partnership with next-generation bank platform Tuum

- Reduces the EBITDA loss Q-Q – delivering on the announced savings plan

Net revenues growth with 16 % Y-Y

During the third quarter of 2022, the net revenues amounted to 4.5 MSEK (3.9), corresponding to a growth of 16 % compared to the same quarter previous year. The net revenue was not only in line with our estimates, but also a marginal increase from the previous quarter (Q2-22), corresponding to a growth of 1% Q-Q. The increased revenues have been driven by new customers as well as growth among Bricknode’s existing customers. During the third quarter the NRR amounted to 104 %, down from 115 % in Q3-21, but in line with H1-22. The NRR demonstrates how the company grows with existing customers, e.g., by customers upgrading their functionality and/or increases their volume, hence it is an important metric in regards to Bricknode. An NRR over 100% shows growth among the company’s existing customers, which thus constitutes as a positive metric. In addition, Stefan Willebrand comments in the conference call that the company has seen a record of usage in number of transactions and orders, which in combination with new releases of modules paves the way for a NRR rate over 100% henceforth. However, the company did also comment in the interim report that the market has been challenging, which has resulted in protracted deals. On the other hand, Bricknode are about to finalize a large upgrade to Bricknode Broker core, which creates further value for existing customers and, as such, enables delivering new and future features faster. The upgrade and the extensive product portfolio pave the way for both closing more deals and enables costs savings going forward.

The diagram below shows the development of the company’s net revenues on a LTM basis.

In the beginning of November 2022 Bricknode presented a partnership with the next-generation core banking platform Tuum. Tuum is an API-first modular core banking platform that enables companies to quickly roll out new financial products, from accounts, deposits and lending to payments and cards. By partnering with Bricknode, Tuum is adding investments to its platform. Tuum has already an extensive customer base, and the partnership expands the opportunities for Bricknode to reach new customers together with Tuum, as well as open up new product capabilities for Tuum’s existing customers.

Reduces the EBITDA loss Q-Q

The EBITDA result during the third quarter amounted to -4.5 MSEK (-2.6), corresponding to an increase EBITDA loss of 1.9 MSEK Y-Y, which is mainly derived by an increase in employees. Since the IPO in November 2021 Bricknode has embarked on a more aggressive investment journey to increase efforts in sales and marketing, as well as development of the extensive product platform. In August 2022, Bricknode announced that the company is undertaking a series of measures to accelerate the path to profitability and implemented a plan to reduce fixed and variable costs by approximately 40%. When comparing the EBITDA result with the previous quarter (Q2-22), Bricknode has already decreased the EBITDA loss by approximately 34 % from -6,9 MSEK. Further, the staff costs amounted to 6.5 MSEK, down from 8.5 MSEK in Q2-22 when the company announced that the number of employees will be cut to 25 by December, from today’s 35. Analyst Group therefore expects further cost reductions and assesses that Bricknode will continue to execute on the savings plan in order to reduce the burn rate significantly going forward, as we can clearly state that the company’s implemented cost savings has shown results already.

Financial Position and Burn Rate

At the end of Q3-22, Bricknode’s cash and equivalents amounted to 7.7 MSEK, compared to 8.7 MSEK at the end of June (Q2-22), corresponding to a net change in cash of -1.0 MSEK. The company’s burn rate per month amounted to -0.2 MSEK (cash flow from operating activities). The low burn rate and the cash and equivalent balance is a result of the increase in the changes in current liabilities, where Bricknode secured a loan of 5 MSEK in August 2022. The loan is meant to be used to support the company’s plan of establishing a licensed brokerage subsidiary. For the three quarters of 2022 (Q1-Q3 2022) the average burn rate per month amounted to -1.5 MSEK. Given the present cash position and an assumed burn rate of -1.5 MSEK/month, Bricknode is financed until the end of February 2023, all else equal. Bear in mind that Bricknode has implemented the earlier mentioned savings plan, where Bricknode expects to significantly reduce the burn rate going forward.

In conclusion, we are of the opinion that Bricknode has progressed well operatively during the third quarter, given the net revenue growth of 16 % Y-Y and the cost savings that has been implemented. Bricknode is now finalizing the upgrade of Bricknode Broker which both creates greater value for the existing customers and paves the way for closing more deals and partnerships.

We will return with an updated equity research report of Bricknode.

Sep

Intervju med Bricknodes VD Stefan Willebrand

Aktiekurs

N/A

Värderingsintervall

2023-09-01

Bear

1,4 NOKBase

3,2 NOKBull

4,6 NOKUtveckling

Huvudägare

2023-06-30

Comment On Bricknode’s Operational Assets Acquired by Huddlestock Fintech

2023-03-17

Bricknode announced on Tuesday, March 15th, that all of Bricknode’s operational assets are to be acquired by Huddlestock Fintech AS (“Huddlestock”). Bricknode and Huddlestock entered into a purchase agreement on March 15th regarding a transfer of all operational assets of Bricknode to Huddlestock in exchange for 41,138,911 consideration shares in Huddlestock, with a value of approx. SEK 107M. Completion of the transaction is conditional upon, among other things, approval by a general meeting of Bricknode.

The Transaction in Brief

Huddlestock in Brief

Huddlestock is a provider of innovative technology and professional investor services. In 2022, Huddlestock Group delivered consolidated revenues of NOK 46.1 million, +97% YoY, after including F5 IT since the acquisition the 1st of May 2022. The EBITDA was NOK -14.0 million, as the group is scaling up the organization and continuing to invest in their technology suite, adding talent and preparing for growth in future client deliveries. Pro forma revenues for the full year of 2022 were NOK 61.6 million +48% YoY. Huddlestock’s shares are listed on Euronext Growth Oslo.

Purpose Of the Transaction

The purpose of the transaction is a strategic move for both Bricknode and Huddlestock, where Bricknode’s investment operations software and technology combining with Huddlestock’s trading technology and investment banking license create a leader in wealth-tech solutions. Together with Huddlestock, Bricknode forms a strong group of companies with over SEK 80 million in annual revenue on a pro forma basis (based on FY2022 figures). The transaction is expected to generate significant cost synergies and an accelerated revenue growth from both upselling opportunities amongst the combined customer base and an expanded target market with the complete end-to-end solution.

Interview with Bricknode’s co-CEO Stefan Willebrand

You’ve announced that Huddlestock acquires all of Bricknode’s operational assets, could you give us a brief summary of the transaction with Huddlestock?

The acquisition is a strategic move for both companies, offering substantial synergies. Bricknode has continuously evaluated various strategic and structural alternatives to drive growth and maximize shareholder value, and we believe this transaction will provide accelerated growth and significant value for Bricknode and Huddlestock’s shareholders.

The Transaction is subject to approval of a general meeting in Bricknode on 31 March 2023. Shareholders in Bricknode representing approx. 68% of the shares and votes have committed to vote in favor of the approval of the transaction, which is then expected to complete in April 2023.

The consideration of 41,138,911 shares in Huddlestock corresponds to a value of the Subsidiaries of approx. SEK 107 million using a reference price of 2.6 NOK per share for Huddlestock.

Bricknode and Huddlestock expects to have significant synergies and together have the possibility to creating a unique European fintech company. What do you see as the key benefits of joining forces with Huddlestock?

We will be able to achieve significant cost synergies and accelerated revenue growth as a result of the deal. In 2022, Bricknode launched an initiative to establish its own securities company in order to meet demand from its customers to operate under the regulatory umbrella of an authorised firm. Huddlestock owns licenced securities companies that will enable us to provide this offering instantly, in addition to real-time trading capabilities. Huddlestock has a broad customer network with offices in several European countries that will provide upsell opportunities and faster expansion across different regions.

The combined offering of Bricknode and Huddlestock creates a true end-to-end solution for our customers, with technology that’s been developed over the course of 13 years. That can’t be replicated easily and gives us a major competitive advantage.

The deal structure is based on consideration shares in Huddlestock which will be issued in three separate tranches of consideration shares, can you briefly give us the background to this deal structure?

Consideration shares in Huddlestock are being issued in three tranches to ensure the company does not hold more than 9.9% of the capital or votes in Huddlestock on each occasion, which would trigger a need for regulatory filings and approvals.

It is our intention to distribute the majority of the consideration shares to Bricknode shareholders without undue delay following receipt of each tranche.

As an investor and shareholder in Bricknode, this deal highlights and actualize the underlying value in Bricknode, as well as giving an opportunity to participate in this promising journey together with Huddlestock. What can an investor in Bricknode expect from this transaction going forward?

We will be aiming to capitalize fairly quickly on the revenue synergies identified, where our combined solution can benefit existing customers of both companies. At the same time, we will be able to communicate the value of our joint proposition to an expanded market throughout Europe and beyond. Bricknode has already demonstrated the broad use cases for its software across the capital markets with customers in new segments recently being signed. The transaction paves the way for us to expand our reach even further and establish ourselves as a market leader.