Brain+ A/S (“Brain+” or “the Company”) is a Digital Therapeutic company with the mission to restore patients’ independence and quality of life by treating and detecting cognitive decline in Alzheimer’s disease and dementia through Digital Therapeutics (DTx), also known as software-as-a-medicine (SaaM) applications. Brain+ has developed a set of DTx technologies, which enable the Company to create a unique and differentiated product offering. These technologies, combined with a strong clinical pipeline, puts Brain+ in a strong position to grow towards a market leader position in the dementia DTx space. Brain+ is listed on First North Copenhagen since October 7, 2021.

Pressmeddelanden

Catalysts for Growth Ahead

During the first half of 2023, Brain+ has successfully built upon its initial commercial success with a Danish municipality by securing an extension to the first contract and a second sales contract with another municipality. Given the prolonged and seasonal sales cycles within municipalities, closing two sales contracts in H1-23 not only underscores Brain+’s immediate impact on the market but also sets a promising tone for the second half of 2023 and beyond. Moreover, looking ahead, Brain+ holds considerable triggers in the near term, with anticipated updates from its R&D pipeline in the upcoming quarters, a growing presence in Germany, and the imminent introduction of new product versions. Analyst Group estimates net sales of EUR 3.0m by 2025, and with an applied EV/S multiple, a potential present value per share of DKK 0.91 (1.12) is derived in a Base scenario.

- Steady Progress in H1-23

In the first half of 2023, Brain+ has further established its presence in the digital dementia care market by successfully closing two sales contracts for the first version of its flagship product, CST-Therapist Companion; one for a full municipality and another for use by a dementia care center in another Danish Municipality. This achievement is especially promising considering the typical municipal sales cycle, which spans between 12 to 24 months. Analyst Group views this early success as a strong indicator of Brain+’s potential for future growth. It’s important to note that the Danish municipal sales cycle is unique, with the first half primarily dedicated to exploration and identification of new solutions. Conversely, the latter half focuses on budgeting and executing purchase orders. Brain+’s go-to-market activities since its introduction in Denmark (Q4 2022) and Germany (Q2 2023) bode well for its ability to meet net sales estimates, considering the seasonality inherent in municipal sales cycles.

- Breakthroughs in Dementia Treatments

In July 2023, a transformative moment unfolded in dementia care as the FDA granted full approval to Lecanemab, a groundbreaking treatment for early Alzheimer’s disease. This milestone signifies a remarkable turning point in an industry that has grappled with challenges for decades in developing effective dementia treatments, reigniting interest and investments within the sector. As pharmaceutical companies increasingly acknowledge the potential of merging drugs with digital solutions, this resurgence in the field may position Brain+ and its digital dementia products even more favorably.

- Revised Share Price Range

While our financial forecasts for the forecast period remain unchanged following the H1-report, we have adjusted the share price range slightly downward due to a decreased target multiple. This adjustment is influenced by a contraction in multiples observed among peers and the persistently challenging environment faced by companies with promising future revenue but current incurring losses. The trajectory of Brain+’s share price, its low trading volume, and relatively muted acknowledge of recent achievements collectively suggest that the stock is operating below investors’ radar as of now, which poses an elevated risk. Notably, Brain+ have outstanding warrants set to expire in October 2023, and the capital injection is closely tied to the share price. A shortfall in capital injection may potentially impede planned commercial and R&D activities. Nonetheless, we are still seeing a great upside potential in Brain+ and if the company could secure additional non-dilutive funding through the already submitted grant applications, it would de-risk the case according to Analyst Group.

7

Värdedrivare

2

Historisk lönsamhet

8

Ledning & Styrelse

8

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Have Laid the Groundwork for Future Commercial Success

In 2022, Brain+ had a successful commercial introduction of its CST-Therapist Companion dementia product in Denmark and secured the first sales contract. Further, Brain+ attracted new talents within DTx and Alzheimer’s, made important advance-ments in R&D pipeline, received positive feedback on core technologies, and secured additional funding. With yet another contract secured in Q2-23, ongoing dialogues with other Danish municipalities and the upcoming market introduction in Germany, Brain+ is now on the path to becoming a commercial business. Analyst Group estimates net sales of EUR 3.0m by 2025, and with an applied EV/S multiple, a potential present value per share of DKK 1.12 is derived in a Base scenario.

- First (and second) B2B Sale to a Danish Municipality Secured

Shortly after Brain+ introduced its first dementia product CST-Therapist Companion to the Danish market for dementia care in November 2022, the first sales contract was established with the Danish municipality of Herning in late December 2022. The contract, worth DKK ~50,000, has since been expanded, both in terms of accessibility and length, which nearly doubled the contract value. As this on one hand illustrates the potential for contractual expansion once a first contract has been established, the first contract value, even after the expansion, fell below are expectations. Hence, we have revised our price assumptions for municipal sales. However, yet another important step was made during Q2-23 with the closing of the Company’s second sales contract for CST-TP with a dementia care center in the Danish municipality of Gladsaxe.

- Upcoming Capital Injection Enables Intensified Commercial Activities

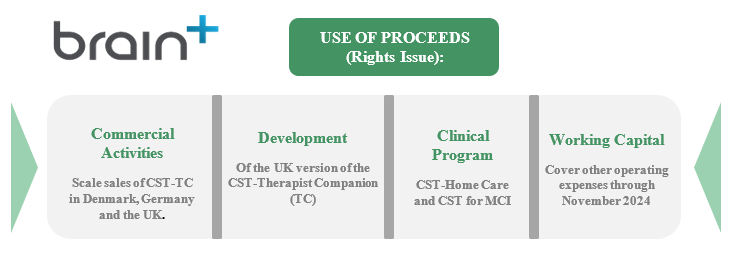

Brain+ announced on March 29, 2023, the intention to carry out a Rights Issue of units, consisting of shares warrants of series TO2 and TO3. Upon full subscription, Brain+ will receive gross proceeds of approx. DKK 15.7m, where accompanied warrants can, if fully subscription, provide additional funding of approx. DKK 15.7-62.9m in total during October 2023, and March 2024. The Rights Issue will provide Brain+ with important fundings to accelerate the commercialization of the CST-TC product as well as support the ongoing development of current pipeline products, CST-Home Care and CST for MCI.

- Revised Share Price Range

Based on the advancements in the R&D pipeline, enhanced validation and support for CST through recently published publications, the Company’s newly formed collaborations, as well as the two commercial deals that lays the groundwork for future commercial success, Analyst Group retains a bullish outlook on Brain+. However, due to a slight delay in the expected time to market for the CST-Home Care and CST for MCI products compared to our previous estimates, we have based our valuation on 2025 financial figures, instead of 2024 as previously. Analyst Group argues that 2025 is a more appropriate time period to value Brain+ because by that time, its product would have been on the market for at least two years, and thus reflect a more matured Brain+ that has started to generate meaningful revenues. We maintain our previous Enterprise Value valuation range for the target year; however, the share price range has been updated in all scenarios due to the capital injection from the rights issue and the subsequent dilution effect.

7

Värdedrivare

2

Historisk lönsamhet

8

Ledning & Styrelse

7

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Entering the commercialization phase

Since the IPO in November 2021, Brain+ has successfully scaled the management team, advanced in the R&D pipeline, attracted valuable collaborations, and, importantly, landed the Company’s first Big-Pharma partnership. Brain+ is now ready to enter the commercialization phase, roughly two years ahead of plan, with a launch in Denmark in Q4 2022 and Germany expected in Q2 2023. With the expected pipeline of product launches, Analyst Group estimates net sales of EUR 2.1m by 2024, and with an applied EV/S multiple, a potential present value per share of DKK 4.1 is derived in a Base scenario.

- Strong Momentum In The Commercialization Phase

In December 2021, Brain+ landed its first large pharma partnership deal with RoX Health (Roche) which gave increased momentum within the German market and enabled Brain+ to accelerate R&D and identify a faster route to the market. As a result, Brain+ has been able to advance the commercial launch for its first dementia product CST-Therapist Companion by approximately two years, with an expected launch in Denmark in Q4 2022 and Germany in Q2 2023. Germany has established itself as a leader in the adoption of digital medicine and is, therefore, a global reference market for DTx and succeeding there creates a strong springboard to other global markets for Brain+ going forward.

- Promising Strategic Collaborations

In addition to the already established partnership with RoX Health, Brain+ has reached other important milestones which lays the foundation for a successful commercial launch in Germany in 2023. In March 2022, Brain+ was selected to Biogen’s and EIT Health’s Neurotech-prize program, which gave access to world-class expertise within the German market as well as valuable support to shape the business model and go-to-market strategy for the Company’s products. Further, Brain+ partnered up with the German medical distributor Coopmed in August 2022, to work on the commercialization in Germany.

- A Material Funding Event Around The Corner

In conjunction with the capital rounds in 2021 (IPO and Pre-IPO), Brain+ issued shares, each including an accompanying warrant. Each of the warrants gives the holder the right to subscribe for a new Brain+ share in October 2022 at a 30% discount to the market price, which will be determined based on the VWAP during the 10-day period leading up to the Exercise window. The proceeds from the warrants will be used to fund further advancements in product development activities and for the projected launch and initial commercialization of Brain+ first dementia product on the Danish and German markets in 2023.

7

Värdedrivare

2

Historisk lönsamhet

8

Ledning & Styrelse

8

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Analytikerkommentarer

Analyst Group Comments on Brain+’s Annual Report 2022

2023-05-02

Brain+ A/S (“Brain+’” or “the Company”) published its Annual Report for 2022 on April 28. The following are key events that we have chosen to highlight from the report:

- First commercial single institution contract was closed with a Danish municipality – worth DKK 50.000

- Gross profit in line with our estimates

- Positive results obtained in several clinical studies

- Continue to build on its track record of funding via grants

- In March 2023, a unit Right Issue has been announced to provide funding for the company’s commercial build-up and its clinical development programs

First Commercial Sale With a Danish Municipality Institution

On December 31, 2022, Brain+ announced that it had closed the first commercial sales contract for its CST-Therapist Companion dementia product with the Danish municipality of Herning. The contract, worth DKK 50.000, is for the use of one dementia care facility. Shortly after (on March 20), Herning Municipality decided to expand the agreement to a municipal-wide license, as well as extending the contract length from 1 to 1.5 years. The value of the initial contract nearly doubled as a result of the contractual extension, and Analyst Group claims that this clearly illustrates the potential for Brain+ to expand inside a municipality once the first contract has been established. Since the first commercial contract is always the most challenging during the commercialization phase, Brain+’s future contract sales will be somewhat easier now that they have reached this significant milestone. The company is currently in numerous ongoing discussions with more than 30 Danish municipalities that are currently using the non-digital version of CST (Cognitive Stimulation Therapy).

While it is important to consider the uncertainties and variations of pricing associated with introducing a new product in an unestablished market, the contract value of the first commercial sale in 2022 fell below Analyst Group’s expectations (DKK 155.000), even after accounting for the contractual expansion. Analyst Group will reassess prior price assumptions for municipal sales in the upcoming Equity Research Report update in order to account for these uncertainties as well as the pricing level of the Company’s first commercial sale.

An important business activity for Brain+ during 2023 is undoubtedly the commercial introduction of CST-Therapist Companion in Germany during Q2 2023. Brain+ has already made a market entry by partnering with the leading provider of dementia care services in Germany, Malteser Hilfsdienst (“Malteser”), in Q2 2023 through a two-month pilot use of the product. The pilot project covers use in one of Malteser dementia cafés, with the potential to expand CST-TC use across the organization´s 100 dementia cafés. The partnership with Malteser comes after Brain+ joined the Danish-German Care Alliance in Q1 2023 with the intention of developing regional lead customers and pilots, like the aforementioned pilot. The partnership will be an important step for the Company to raise awareness and gather feedback for CST-TC in order to improve its usefulness in the German market, and ultimately achieve the first commercial sale in the country going forward.

Delivers a Gross Profit in Line with Guidance and Our Estimates

Brain+ reported a gross profit of DKK 3.2m (EUR 0.42m) for the full year 2022, matching the upper limit of the previously outlined range of DKK 2-4m. Staff expenses and D&A amounted to DKK 12.7m (EUR 1.65m) and DKK 1.6m (EUR 0.21m), respectively, which resulted in an EBIT of DKK -11.1m. On a Y-Y basis, the gross profit decreased by approx. 19%, mainly due to lower capitalization of development costs during FY2022, and the staff expenses increased by approx. 31%, following the recruitment of new talent to support the Company’s accelerated business activities. The outcome was more or less in line with our estimates for the full year of 2022 on each operational IC-item, and we estimate that the gross profit is set to increase going forward following the advancements in current commercialization of CST-TC in the Danish and German market, while staff expenses are expected to increase as well due to key recruitments during 2022, albeit in a slower pace.

Positive Results in Clinical Studies

In 2022, Brain+ received early positive clinical results on its three core technologies (CST, CTT and Starry Night), and during Q1 2023, Brain’+ was provided with additional validation on its technologies, following promising clinical results for Brain+’s CCT technology for cognitive training, (which we followed up with a comment and an interview with CEO Kim Baden-Kristensen, read here.) With a maturing R&D and product pipeline, together with an increasing support as well as validation for CST (which is Brain+ most matured product technology) from recently published critical policy papers such as the World Alzheimer’s Report 2022, A Blueprint for Dementia (WHO) and a 2nd systematic Cochrane review, Brain+ is in a unique position to benefit from this positive momentum behind CST as a non-pharmaceutical therapy for Alzheimer’s dementia.

Currently, Brain+ is in two ongoing trials for the Company’s CCT and Starry Night Cognitive test products, with readouts expected in 2023 and 2024. Additionally, Brain+ has three planned trials for the CST product suite during 2023-2024, where the claims trial for the second iteration of CST-TC that Brain+ is developing, will be taking place in 2023. This trial is important, as with the other two planned trials, since a positive readout would not only enable reimbursement coverage of CST-TC, but also facilitate a UK market entry and pave the way for big pharma deals. The results of the aforementioned studies will therefore be closely monitored by Analyst Group moving forward, as they will serve as an indicator of the success of the Company’s commercialization.

Continue to Build on its Track Record of Funding via Grants

In 2022, Brain+ completed the two grant-funded projects Horizon and Eurostars AD Shield in collaboration with partners. The Company’s collaborative approach enables grant-funding of clinical trials, and strategic alliances have also greatly contributed to Brain+’s operations. This approach has provided Brain+ with access to resources and expertise, as well as non-dilutive funding, which increases efficiency and cost-savings. Since the inception of Brain+ in 2014, the Company has raised approximately DKK 100 million in funding, of which DKK 66 million is through innovation grant funded research.

In Q1 2023, Brain+ added to this early strong track record by receiving, along with a consortium of respected dementia experts, a grant worth approx. SEK 0.5m from the EU Joint Programmme – Neurodegenerative Disease Research, that covers the research into the Company’s two main therapeutic technologies (CST and CTT). The grant will also cover the examination of the hypothesized synergy effect of combining CST and CCT, which is a key research step for the third product in Brain+ CST-suite, CST for MCI. The project will be structured into three different groups, all contributing to the development of Brain+s pipeline. Analyst Group is optimistic about Brain+’s ability to secure grant after grant in order to fund the Company’s R&D, as this demonstrates not only the support and interest that exist for Brain+ from the stakeholders within the Alzheimer’s space but also validate the relevance of its offering.

Ongoing Rights Issue will Strengthen the Balance Sheet and Enable Brain+ to Proceed With Outlined Commercial Activities.

Brain+ has historically been largely funded by grants, and by entering the commercialization phase in late 2022, whilst still advancing the product pipeline via clinical trials, additional resources were expected to be required, according to Analyst Group. Hence, the announcement of the rights issue on March 29, came as a no surprise, and the proceeds are necessary for Brain+ to execute on the planned commercial activities to increase sales and make further advancements in R&D. For more information on the Rights Issue and our view on it, we refer to our previous comment on the rights issue here.

The Company’s cash balance at the end of 2022 amounted to DKK 6.4m, a decrease from approx. DKK 10m at the end of 2021, despite a capital injection (net) of approx. DKK 5.5m for warrants of series TO1 in Q4 2022. The ongoing rights issue has been secured to approx. 85%, hence providing Brain+ with sufficient capital to cover up for working capital needs and further investments in R&D, where accompanying warrants of series TO2 and TO3 will play a significant role going forward. Grant financing will continue to be a supplementary source of funding for the Company’s R&D pipeline, as well as allowing Brain+ to make existing cash levels and the upcoming cash injection from the rights issue last for a longer period of time. To summarize, Analyst Group maintains a positive view on Brain+ based on the pipeline’s maturation, improved validation and support for CST via recently published reports, the Company’s newly established partnerships, as well as the first commercial sale that lays the foundation for further commercial success.

We will return with an updated equity research report of Brain+.

Analyst Group Comments on Brain+’s Announcement of Rights Issue

2023-03-30

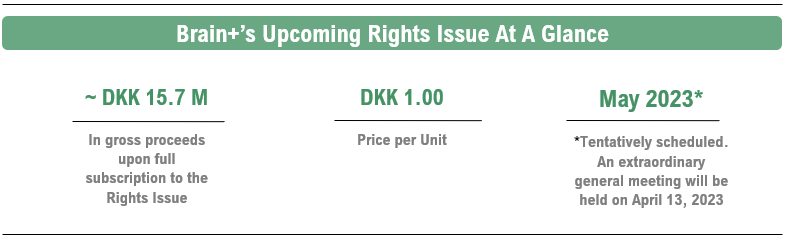

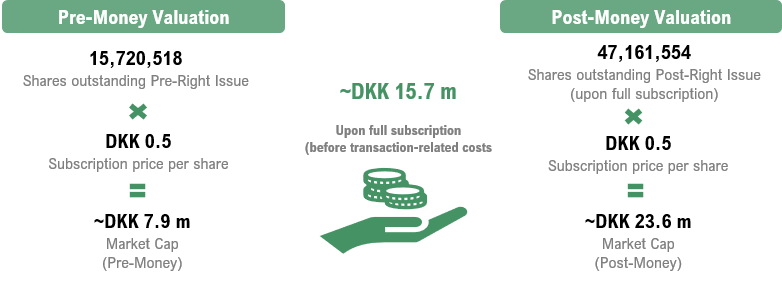

On March 29, 2023, Brain+ announced that the Company intends to carry out a preferential Rights Issue of shares and warrants of series TO 2 and TO 3. The Rights Issue compromises a maximum of 15,720,518 units where each unit consists of two (2) shares, two (2) warrants of series TO 2, and two (2) warrants of series TO 3. The subscription price is set to DKK 1.00 per unit, which corresponds to DKK 0.50 per share, and the warrants are issued free of charge. Given a full subscription of the Rights Issue, Brain+ will receive approx. DKK 15.7 million before transaction-related costs. Subsequently warrant exercise of TO 2 and TO 3 can, if fully subscribed, provide the Company with an additional amount of approx. DKK 6.3-25.2 million and DKK 9.4-37.7 million in gross proceeds. If the Rights Issue is fully subscribed, the Board of Directors has the option to resolve an Over-Allotment Issue of up to 5,821,544, which would correspond to additional issue proceeds (gross) of approx. DKK 5.8 million and thus enable a further acceleration in clinical and commercial activities.

The Company has received pre-subscription commitments amounting to approx. DKK 4.4 million, or ~28% of the initial part of the Rights Issue, and guarantee commitments amounting to approx. DKK 8.9 million, or ~57%. Hence, the Rights Issue is secured to approximately DKK 13.4 million, or ~ 85 %.

The dilution effect from the Rights Issue, assuming fully subscribed, amounts to approx. 66.7%, and in case of full subscription of the warrants of series TO 2 and series TO 3, additional dilution of approx. 40.0 % and approx. 28.6 % will occur.

Entering the commercialization phase for the Company’s first product – CST-Therapist Companion – whilst still advancing the Company’s project pipeline of trials is a costly process, and while upcoming commercial launches move Brain+ closer to a break-even point, it is at the same time subject to additional funding, which has been communicated in the Company’s financial reports and announcments. Hence, the announced Rights Issue comes as no major surprise for Analyst Group, however, the recent weak stock performance is resulting in a substantial stock dilution, given the current financial market environment, which is not a positive aspect for the shareholders in the short term Going forward, the proceeds are necessary for Brain+ to execute on planned commercial activities and further advancements in R&D, where the commercial launch in Germany is due in Q2 2023, which ultimately strengthens the revenue outlook for the Company.

Brain+ has showcased a strong operational momentum during the beginning of 2023, for example with the promising study results on the feasibility of the CCT-technology for cognitive training, an expanding sales contract with the Municipality of Herning, and the securing of an additional EU grant together with respected dementia experts. Together with increased market recognition of the benefits and relevance of CST as a non-pharmaceutical dementia therapy through recent studies and reports, and further market adoption of digital therapeutics through e.g. Germany’s newly established healthcare digitalization strategy “Gemeinsam Digital”, Brain+ is in a good position for not only executing on upcoming events but also to attract new strategic partnerships and grant fundings”, says the analyst at Analyst Group covering Brain+.

About Warrants of Series TO 2

The exercise price in the warrant exercise of series TO 2 will amount to 70% of the average volume-weighted price for the share according to Nasdaq First North Growth Market’s official price statistics during the period of 20 trading days ending two (2) banking days before the exercise period begins. The Company will publish the exercise price the day before the first day of the exercise period. The exercise price shall not exceed DKK 0.80. The exercise price shall not fall below DKK 0.20. One (1) warrant of series TO 2 gives the right to subscribe for one (1) new share in the Company during the exercise period that is planned to be from October 2 – October 16, 2023.

About Warrants of Series TO 3

The exercise price in the warrant exercise of series TO 3 will amount to 70% of the average volume-weighted price for the share according to Nasdaq First North Growth Market’s official price statistics during the period of 20 trading days ending two (2) banking days before the exercise period begins. The Company will publish the exercise price the day before the first day of the exercise period. The exercise price shall not exceed DKK 1.20. The exercise price shall not fall below DKK 0.30. One (1) warrant of series TO 3 gives the right to subscribe for one (1) new share in the Company during the exercise period that is planned to be from March 8 – March 22, 2024.

Brain+ expands its first sales contract, close to doubling it

2023-03-20

On March 20, 2023, Brain+ A/S (“Brain+” or “the Company”) announced that the Danish municipality Herning Municipality has decided to expand the already existing agreement, which almost doubles the initial contract value.

Brain+ closed the Company’s first municipal sale of its first CST-product – CST-Therapist Companion – on December 31, 2022, after launching the product on November 1, 2022. The contract covered the use of the “Basic Package” of the CST-Therapist Companion in one training facility for one year at an introductory price of 50.000 DKK. Herning Municipality has now decided to expand the existing contract to a municipal-wide license, which allows all therapist in Herning that works with people with dementia to get access to the basic package. The length of the contract has also been extended from 1 to 1,5 years, and the contract expansion as a whole nearly doubles the existing contract value.

“After roughly two months of market introduction, Brain+ closed the first municipal sale on December 31, 2022, and this contractual expansion clearly shows the potential for Brain+ to grow within a municipality after a first contract has been established, through higher tier packages that include services and broader geographic traction. Given that the municipal sales cycle usually varies between 6-18 months, Analyst Group considers that the fact that Brain+ has in four months not only closed the first sale of its CST-Therapist Companion-product but also expanded the contract value, is a sign of strength within Brain+’s DT-x offering and lays the foundation for further commercial traction going forward. Currently, Brain+ is in ongoing outreach and dialogues with the 30+ Danish municipalities that are using CST and this contractual expansion provides, according to Analyst Group, further commercial evidence and could enhance Brain+’s possibilities to close additional contracts with municipalities in coming quarters”, says the analyst at Analyst Group covering Brain+.

Comment on results from clinical study and interview with Brain+

2023-01-12

On January 11, 2023, Brain+ released the findings of a study conducted by Nottingham University as part of the Alzheimer’s Detect & Prevent European Horizon2020 project, which is led by Brain+.

The purpose of the study was to examine the efficacy of Brain+’ Computerized Cognitive Training (CCT) games for individuals with Subjective Cognitive Impairments (SCI). People with SCI are more likely to acquire dementia, making them an important market for Brain+. After an 8-week intervention, individuals who used CCT games to train demonstrated improved cognitive load and transfer effects to a task involving shopping, according to the study. The study is important for early validation of the CCT technology, which is a central ingredient in the company’s upcoming mild cognitive impairment (MCI) product. This MCI product will combine CCT, Starry Night, and Cognitive Stimulation Therapy (CST). MCI is a pre-stage to dementia and is affecting an estimated 150-200 million people worldwide.

In conjunction with the press release, Analyst Group contacted Brain+ to get additional color on the recent study results. The Q&A section can be found below:

Could you elaborate on the specific cognitive load improvements that the study participants experienced after playing the CCT games from Brain+?

The cognitive load improvements were measured using a complex working memory task while using brain imaging technology called near infrared spectroscopy. The brain imaging measures functional blood flow in the brain which is a proxy of mental workload. Brain imaging tests were conducted before and after the eight weeks of training, and the results revealed changes in blood flow that are indicative of a reduction in the amount of mental effort required to complete the challenging working memory task. The working memory task was in fact also a Brain+ technology called Starry Night that has been co-developed with the University of Oxford based on original work done by Oxford University, with a lab-based test which can pick up the very early subtle signs of cognitive decline in Alzheimer’s disease.

Can you elaborate on the pipeline product for Mild Cognitive Impairment that the company is currently developing and how the CCT games will be incorporated into it?

Brain+ is currently developing and researching the CST for MCI* (Mild Cognitive Impairment) product, which combines Cognitive Stimulation Therapy (CST) with our 2nd Generation Computerized Cognitive Training (CCT) technology for MCI. Our third technology, the Starry Night cognitive test, will be added to the product for the purpose of monitoring cognitive decline or improvements. The CCT games are the central ingredient in the product, and provide training aimed to counteract cognitive decline, the main symptom of MCI, and are design based on the specific pathology seen in Alzheimer’s Disease. The personalized and adaptive nature of the CCT games ensures that patients receive therapy that is tailored to their specific needs, helping to support continued cognitive improvement.

Can you discuss Brain+’ plans for further research or clinical trials to further validate the effectiveness of the CCT games and the pipeline product?

To further mature our 2nd Generation CCT technology, Brain+ has since 2021 led a €1.5 million Eurostars grant funded innovation project called ACTTDCS to develop a new mechanism of action for cognitive training targeting people-at-risk of dementia, especially MCI. This project enables collaborations with leading KOL’s such as the University of Gothenburg, the University of Oxford, the University of Nottingham, and game development and software engineering company Nurogames.

In connection with the project, we are currently progressing a pilot open label-controlled study with Århus University to assess cognitive abilities and patient-reported outcomes with MCI patients. The full ACTTDCS project ends in Q4 2023, and we expect the clinical results shortly after.

What distinguishes the adaptive game version from the non-adaptive version of the CCT games, and how are the games customized for each individual player?

The adaptive game version is constantly looking at player performance and adjusting difficulty parameters to optimize the level of challenge. The non-adaptive version is deliberately kept static in terms of difficulty levels to work as a placebo control.

* Science box: Mild Cognitive Impairment (MCI)

Dementia is a significant global health issue, with estimates suggesting that 5-8% of people over the age of 60 are affected by it. In recent years, researchers have been focusing on ways to delay or prevent the onset of dementia, particularly in its preclinical stages. One condition that is often a precursor to dementia is mild cognitive impairment (MCI), which is characterized by a decline in cognitive function that is more severe than normal age-related changes, but not severe enough to be classified as dementia. Studies have shown that 8-15% of individuals with MCI will develop dementia each year, and as many as 80% will progress to dementia within six years. And estimated 3-4 times as many people live with MCI as those with dementia, between 150-200million worldwide.

As the MCI indication often leads Dementia diagnosis, which frequently is not diagnosed until 1 year into dementia disease progression, Brain+ is working to extend therapeutic reach to leverage the benefits of early intervention.

Brain+ Completes The Implementation Of An ISO 13485 Quality Management System For Medical Devices

2022-12-15

On the 14h of December 2022, Brain+ A/S (“Brain+” or the ”Company”) announced that the Company has successfully completed the implementation of an ISO 13485-compliant Quality Management System (QMS). The latest WHO report also points to Cognitive Stimulation Therapy (CST) and digital solutions as means to help solve the global dementia burden, which gives Brain+ dementia products further attestation.

ISO 13485 specifies requirements for a quality management system (QMS) where an organization needs to showcase the ability to provide medical devices and related services that ensure, on a consistent basis, patient safety and process quality along the product life cycle, as well as meet applicable regulatory requirements. The completed implementation of the ISO 13485 QMS provides Brain+ with an important quality stamp. However, ISO 13485 is effectively required for getting a medical device to market under the MDR framework and, as such, this implementation by Brain+ takes the company one step further into CE-marking and the ongoing commercialization. ISO 13485 is also important when attracting payers, including Germany´s DiGA and DiPA reimbursement schemes, as they are relying on this certification as proof of quality. The goal for Brain+ is to get their upcoming product launches of CST-Home Care and CST-Stand Alone reimbursement, which ISO 13485 certification enables. The QMS-certification means that Brain+ has incorporated a quality best practice that ensures that its software products meet all the general safety and performance requirements (GSPR), which not only assure regulatory compliance and enables product reimbursement at scale, but also attract large pharma partnership, which paves the way for a continued successful launch going forward.

World Health Organization (WHO) recently published a report – A Blueprint For Dementia Research – in which the specialized agency in international public health addressed dementia as one of the greatest health challenges of our generation. In the report, WHO points out that insufficient numbers and an under-skilled workforce are barriers to the provision of good-quality dementia care today on a global basis. At the same time, WHO validates that rehabilitative interventions such as Cognitive Stimulation Therapy (CST), among others, can improve cognition, function, stability, and/or the quality of life of people with dementia. Furthermore, WHO also mentions that some psychological interventions are effective tools when delivered digitally, for instance, through websites, apps, and telehealth. This report is the second of its kind* that has been released in 2022 that endorses CST which, in turn, gives not only increased validation for Brain+ digital dementia offerings, but also wider recognition for companies like Brain+, which paves the way for faster adoption of these types of DTx-products and improves the long-term outlook for Brain+ ongoing commercialization.

Read our latest equity report of Brain+ here.

*In October 7, 2022, the World Alzheimer Report was published, which highlighted CST as cost-effective evidence-based therapy for people with mild-to-moderate dementia that should be researched and implemented globally.

Brain+ Begins Early Activity and Brand Building in The US

2022-10-19

On the 19th of October 2022, Brain+ A/S (“Brain+” or the ”Company”) announced that the Company has been selected and featured as a 2022 TMC-Denmark Biobridge Partner in the new Texas Medical Center (TMC) new 2022 Biobridge e-book, hence building early traction within the US market.

Back in 2019, TMC – the world’s largest medical city – and the Danish Ministry of Health entered a collaboration and multi-faceted global life science Biobridge partnership to advance commercial and clinical innovation, to enable research collaborations and knowledge transfer. The Biobridge intends to serve as a marketplace for innovative life science technologies focused on digital & telehealth, medical devices, and operations.

By being a part of the TMC-Denmark Biobridge Partnership, Brain+ gains not only increased brand awareness at TMC and the US market as a whole, but also get access to valuable know-how and go-to-market research that opens up doors to explorative dialogues with American market participants within the healthcare space. Increased brand awareness within the US is of great importance for Brain+ in terms of future strategic partnerships and with the number of +USD 100m licensing/partnership deals that have been made during recent years, it is clear that life science participants are on the outlook for new partners, creating an opportunity for Brain+ going forward.

The US is the biggest healthcare market in the world and more than seven million people in the ages 65 or older had dementia in 2020. The price/reimbursement levels are also significantly higher than the rest of the world, roughly three times higher than in Europe, where prices could be beyond EUR 1,000 per treatment. Thus, the US market is highly attractive, and while Analyst Group has not explicitly modeled any revenues in the US within our forecast period, as the commercialization phase is estimated to be several years away, we consider the recent early signs of progress in the US as highly positive.

Read our latest equity report of Brain+ here.

Aktiekurs

0.01

Värderingsintervall

2023-09-11

Bear

0,27 DKKBase

0,91 DKKBull

1,40 DKKUtveckling

Huvudägare

Analyst Group Comments on Brain+’s Semi-Annual Report 2023

2023-09-01

Brain+ A/S (“Brain+’” or “the Company”) published its Semi-Annual Report for 2023 on August 31. The following are key events that we have chosen to highlight from the report:

Focus on Increasing Market Awareness in H1-23.

In the first half of 2023, Brain+ closed two sales contracts for the company´s digital dementia product, CST-Therapist Companion, which, considering the municipal sales cycle of between 12-24 months, is a promising sign for the future according to Analyst Group. Further, it’s crucial to understand the unique nature of the Danish municipal sales cycle. Typically, the first half is primarily a period of exploration, during which municipalities actively seek and identify new products or service solutions. In contrast, the latter half of the year is more intensive in budgeting and executing purchase orders. Our projected net sales for FY2023 stand at DKK 0.4m (EUR 0.06m), a forecast that considers this seasonality. Given Brain+’s amplified go-to-market efforts since its introduction in Denmark (Q42022) and Germany (Q22023), we remain optimistic in Brain+ meeting our net sales estimates, given the back-heavy sales cycle within municipalities.

Lower Capitalized Costs Caused a Decline in Gross Profit

The gross profit reached DKK 1.6m (corresponding to EUR 0.21m) in H1-23, which on a Y-Y comparison means a 15 % decline, primarily due to lower capitalized costs. Staff expenses stood at DKK 6.1m (EUR 0.8m), corresponding to a Y-Y decrease of approx. 6 %, reflecting Brain+’s increased cost consciousness and the fact that most of the recruitments for the near- and medium-term were made during 2022. D&A increased with DKK 1.2 m (EUR 0.16m) on a Y-Y-basis to DKK 2.0m (EUR 0.26m). In 2022, Brain+ completed several grant funded innovation projects, which increased the value of completed development projects on the balance sheet and correspondingly decreased the value of development projects in progress by the same amount. The increase in D&A reflects this and has been modeled for in our estimates, given higher amortizations. Due to higher D&A, EBIT came in at DKK 6.6m (EUR -0.9m), which is lower than H1-22 (EUR -0.7m), however, on an EBITDA-basis, the results were more or less flat Y-Y (EUR -0.59m vs EUR 0.60m).

In general, the financial performance aligns well with our FY2023 estimates, as we anticipate more business activities and commercial milestones in H2-22 as a result of the seasonality.

Cash at hand and Upcoming Funding Events Equip Brain+ for Commercial and R&D Pursuits

By the close of June 2023, Brain+’s cash and cash equivalents totaled DKK 5.3m (EUR 0.69). This represents a minor decline of DKK 1.1m (EUR 0.144m) from the figures reported in 2022’s Annual Report. During Q2-23, Brain+ executed a rights issue, which infused the company with DKK 14.3m before accounting for transaction-related expenses. An encouraging development post the completion of the rights issue was the decision made by some of the guarantors in the offering to receive their guaranteed compensation in new units (new shares and warrants) instead of cash. This strategic move resulted in a 2.2% dilution. However, it has a silver lining: it allowed Brain+ to preserve more of the proceeds in cash, DKK 0.42m to be precise, ensuring that these funds can be allocated and utilized more effectively in other crucial areas of the business.

Furthermore, it’s essential for investors to note the upcoming funding event with the warrants of series TO 2. These can be traded in the market until 12 October 2023 and be exercised between 2 and 16 October 2023. The exercise price will be set at 70% of VWAP over 20 trading days, ending two days before the exercise starts and will be announced a day before the exercise period begins. Each TO 2 warrant offers the chance to subscribe for one new Brain+ share.

Breakthrough-Moment in the Dementia-space

In July 2023, the US FDA granted full approval to Lecanemab, a groundbreaking treatment for early Alzheimer’s disease. This significant development, coming after decades of pharmaceutical setbacks in dementia treatments, marks a potential turning point in the industry. The approval of Lecanemab is expected to rejuvenate interest and investments in dementia treatment, paving the way for a more comprehensive approach that combines pharmaceuticals with digital therapeutics.

For a DTx-company like Brain+, this evolving landscape presents a great opportunity. As pharmaceutical companies increasingly recognize the potential of combining drugs with digital solutions, Brain+ is uniquely positioned to offer its evidence-based digital products. These products not only complement the emerging drug treatments but also enhance their efficacy, offering a holistic solution to dementia care. The growing acknowledgment of digital solutions by policymakers and pharmaceutical giants further amplifies the potential for Brain+ to forge strategic partnerships and co-development opportunities, solidifying its role in the future of dementia treatment.

Recent Grant Applications Emerges as a Promising Catalyst for Future Growth

Brain+ has a long and successful history of receiving grants for its R&D activities, with over DKK 70 million raised through innovation grant funded research. During August 2023, Brain+ has taken new ambitious steps to further its commitment to better dementia care. The company submitted new public grant applications aiming to raise up to DKK 67 million to further develop and scale its digital dementia products. These applications include:

Public grant financing will continue to be a supplementary source of funding for the Company’s R&D pipeline, as well as allowing Brain+ to make existing cash levels and the upcoming cash injection from the issued warrants last for a longer period of time. Further, it is not only positive for the shareholders, as soft funding is non-dilutive, but it also allows Brain+ to partner with experts within the industry and potential future customers. The responses from the applications are expected during Q4 and will be interesting events to keep an eye on for investors.

Brain+ Gears Up for a Noteworthy H2-23 and 2024

At present, Brain+ is actively engaged in pilot studies for its CCT and Starry Night Cognitive test offerings, with results anticipated in 2023 and 2024. Furthermore, the company has charted out three clinical trials for its CST product suite for 2023-2024. Notably, the claims trial for Brain+’s enhanced version of CST-TC is scheduled to start in the fourth quarter of 2023. A successful conclusion would not only pave the way for reimbursement of the product but would also pave the way for a push into the UK market and prospective cooperation with big pharmaceutical firms. The results of these studies will continue to be closely monitored by Analyst Group, as they are pivotal in gauging the company’s commercial trajectory.

To summarize, Analyst Group maintains a positive view on Brain+ based on the pipeline’s maturation, the advancements made in the dementia field, the company’s ongoing efforts to increase market awareness, and recent grant applications, all of which make the second half of 2023 particularly interesting to watch.

We will return with an updated equity research report of Brain+.