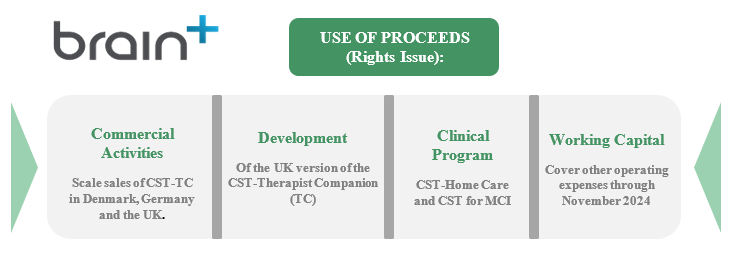

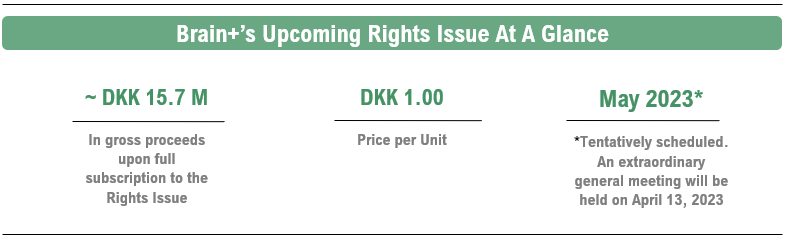

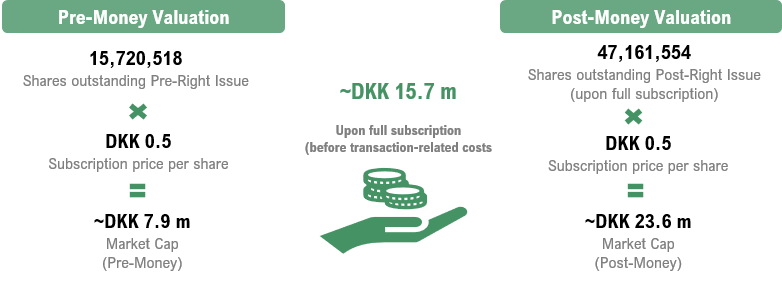

On March 29, 2023, Brain+ announced that the Company intends to carry out a preferential Rights Issue of shares and warrants of series TO 2 and TO 3. The Rights Issue compromises a maximum of 15,720,518 units where each unit consists of two (2) shares, two (2) warrants of series TO 2, and two (2) warrants of series TO 3. The subscription price is set to DKK 1.00 per unit, which corresponds to DKK 0.50 per share, and the warrants are issued free of charge. Given a full subscription of the Rights Issue, Brain+ will receive approx. DKK 15.7 million before transaction-related costs. Subsequently warrant exercise of TO 2 and TO 3 can, if fully subscribed, provide the Company with an additional amount of approx. DKK 6.3-25.2 million and DKK 9.4-37.7 million in gross proceeds. If the Rights Issue is fully subscribed, the Board of Directors has the option to resolve an Over-Allotment Issue of up to 5,821,544, which would correspond to additional issue proceeds (gross) of approx. DKK 5.8 million and thus enable a further acceleration in clinical and commercial activities.

The Company has received pre-subscription commitments amounting to approx. DKK 4.4 million, or ~28% of the initial part of the Rights Issue, and guarantee commitments amounting to approx. DKK 8.9 million, or ~57%. Hence, the Rights Issue is secured to approximately DKK 13.4 million, or ~ 85 %.

The dilution effect from the Rights Issue, assuming fully subscribed, amounts to approx. 66.7%, and in case of full subscription of the warrants of series TO 2 and series TO 3, additional dilution of approx. 40.0 % and approx. 28.6 % will occur.

Entering the commercialization phase for the Company’s first product – CST-Therapist Companion – whilst still advancing the Company’s project pipeline of trials is a costly process, and while upcoming commercial launches move Brain+ closer to a break-even point, it is at the same time subject to additional funding, which has been communicated in the Company’s financial reports and announcments. Hence, the announced Rights Issue comes as no major surprise for Analyst Group, however, the recent weak stock performance is resulting in a substantial stock dilution, given the current financial market environment, which is not a positive aspect for the shareholders in the short term Going forward, the proceeds are necessary for Brain+ to execute on planned commercial activities and further advancements in R&D, where the commercial launch in Germany is due in Q2 2023, which ultimately strengthens the revenue outlook for the Company.

Brain+ has showcased a strong operational momentum during the beginning of 2023, for example with the promising study results on the feasibility of the CCT-technology for cognitive training, an expanding sales contract with the Municipality of Herning, and the securing of an additional EU grant together with respected dementia experts. Together with increased market recognition of the benefits and relevance of CST as a non-pharmaceutical dementia therapy through recent studies and reports, and further market adoption of digital therapeutics through e.g. Germany’s newly established healthcare digitalization strategy “Gemeinsam Digital”, Brain+ is in a good position for not only executing on upcoming events but also to attract new strategic partnerships and grant fundings”, says the analyst at Analyst Group covering Brain+.

About Warrants of Series TO 2

The exercise price in the warrant exercise of series TO 2 will amount to 70% of the average volume-weighted price for the share according to Nasdaq First North Growth Market’s official price statistics during the period of 20 trading days ending two (2) banking days before the exercise period begins. The Company will publish the exercise price the day before the first day of the exercise period. The exercise price shall not exceed DKK 0.80. The exercise price shall not fall below DKK 0.20. One (1) warrant of series TO 2 gives the right to subscribe for one (1) new share in the Company during the exercise period that is planned to be from October 2 – October 16, 2023.

About Warrants of Series TO 3

The exercise price in the warrant exercise of series TO 3 will amount to 70% of the average volume-weighted price for the share according to Nasdaq First North Growth Market’s official price statistics during the period of 20 trading days ending two (2) banking days before the exercise period begins. The Company will publish the exercise price the day before the first day of the exercise period. The exercise price shall not exceed DKK 1.20. The exercise price shall not fall below DKK 0.30. One (1) warrant of series TO 3 gives the right to subscribe for one (1) new share in the Company during the exercise period that is planned to be from March 8 – March 22, 2024.