The Björn Borg Group owns and develops the Björn Borg brand. The focus of the business is on underwear and sports apparel with additional product lines such as footwear, bags, eyewear, and home textiles through licensees. Björn Borg products are available in around twenty markets, with Sweden and the Netherlands being the largest. The Björn Borg Group has operations at every level from branding to consumer sales in its own Björn Borg stores and e-commerce. Operations comprise brand development and services for the network of licensees and distributors, as well as product development in the core underwear and sports apparel businesses. Björn Borg has been listed on Nasdaq Stockholm since 2007.

Pressmeddelanden

From Head to Toe: Sports Apparel and Footwear Fuel Growth

Björn Borg (“Björn Borg”, “the Company” or “the Group”) is a well-established and renowned company with a rich history spanning decades, earning the place as a favored brand among a broad consumer base. Nevertheless, the predominant association of Björn Borg with underwear presents a compelling challenge: to transition consumer perception from an underwear brand to a sports fashion brand. This strategic shift, central to the Company’s vision since 2014, has already yielded noteworthy progress, as amplified marketing investments and a strengthened brand have driven strong growth in Sports Apparel and Footwear. Analyst Group estimates an attractive growth trajectory on the horizon, supporting a gradual improvement in margins. The forecasted EBIT for 2025 stands at SEK 124m (131), and by applying a forward EV/EBIT multiple of 12.0x (12.0), this presents a potential value of SEK 58.4 (61.3) per share in a Base scenario.

- Maintains Strong Growth Trajectory

Net sales amounted to SEK 234.6m (197.6) during Q4-24, reflec-ting an 18.7% Y-Y growth (18.6% excl. FX). The outcome surpassed our estimate of SEK 228m by 2.9%, primarily driven by stronger-than-expected momentum in Footwear and Sports Apparel, which grew by 57% and 44%, respectively. Performance was strong across all focus categories, with Underwear expanding by 14% Y-Y, while Bags surged by 30%. From a channel perspective, Own-Ecom grew by 10%, while wholesale exhibited a 28% Y-Y growth, underscoring solid traction in both direct and indirect sales channels. Geographically, the strategic key market, Germany, recorded 13% Y-Y growth, while Sweden, stood out with a 43% increase. This quarter reaffirms Björn Borg’s consistent execution within the focus areas, reinforcing the positive growth trajectory observed in recent quarters, which we see as a validation that the strategic initiatives are translating into tangible results.

- Short-Term Margin Headwinds from Strategic Investments

The EBIT during the fourth quarter reached SEK 16.8m (20.2), correspondding to an EBIT margin of 7.2% (10.2). When adjusting for FX- effects, EBIT stood at SEK 17.2m (17.6). Analyst Group had estimated an EBIT of SEK 20.9m, with the deviation largely attributed to one-off costs related to the integration of the Footwear business, alongside elevated marketing investments aimed at reinforcing brand positioning and long-term growth. Although these factors have temporarily pressured margins, the underlying strategic logic remains intact. Footwear is poised to be a key contributor to margin expansion in the coming years. Consequently, Analyst Group does not view the temporary compression of operating margins as alarming. With a solid foundation for future growth and continued brand-enhancing marketing invest-ments, Björn Borg is laying the groundwork for sustained and profitable growth in the coming years.

- Revised Margin Outlook Reflected in the Valuation

In response to the report, Analyst Group has adjusted the top-line estimates, forecasting slightly stronger sales growth ahead. However, we expect the headwinds impacting the operating margin to persist in the short term, resulting in softer margin development. By applying a forward EV/EBIT multiple of 12.0x to the estimated EBIT of 124m for 2025E, a potential value of SEK 58.4 (61.3) per share is derived in a Base scenario.

6

Värdedrivare

6

Historisk lönsamhet

7

Ledning & Styrelse

3

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Solid Growth Across Key Focus Areas

Björn Borg (“Björn Borg”, “the Company” or “the Group”) is a well-established and renowned company with a rich history spanning decades, earning its place as a favored brand among a broad consumer base. Nevertheless, the predominant association of Björn Borg with underwear presents a compelling challenge: to transition consumer perception from an underwear brand to a sports fashion brand. This strategic shift, central to the Company’s vision since 2014, has already yielded noteworthy progress, driven by amplified investments in social media and successful launches of new sport collections. Analyst Group estimates an attractive growth trajectory on the horizon, which promises improved margins. The forecasted EBIT for 2025 stands at SEK 131m, and by applying a forward EV/EBIT multiple of 12.0x, this presents a potential value of SEK 61.3 (64.6) per share in a Base scenario.

- German Market Grew by 44% Y-Y

Net sales amounted to SEK 285.1m (262.1) during Q3-24, representing an 8.8% Y-Y growth (10.4% excl. FX). The outcome fell short of our estimate of SEK 312.0m, where we had anticipated stronger growth within Footwear following the in-house integration in Q1-24. Nevertheless, Footwear grew by 29% Y-Y, while Sports Apparel achieved robust growth of 25% Y-Y. Additionally, Underwear experienced a slight decline of 1% Y-Y, while Bags temporarily decreased by 14% Y-Y, following strong performance during H1-24. Own E-Commerce maintained its positive trajectory, with growth of 32% Y-Y, while Wholesale grew by 5%. Geographically, the key market of Germany delivered strong performance, with growth of 44% Y-Y. Analyst Group believes that the strong performance within Footwear, Sports Apparel, Own E-Commerce, and the German market serves as a testament to Björn Borg’s successful execution of the Company’s strategic initiatives.

- Increased Marketing Spend

The gross margin for Q3-24 stood at 52.1% (52.6%), with the FX-neutral margin at 51.2%. The decline was primarily attributable to a higher sales contribution from the Footwear category and increased sales to larger customers, which carried higher discounts. Nonetheless, Footwear is projected to enhance the Company’s overall profitability profile over the long term. Björn Borg reported an EBIT of SEK 42.0m (40.9), reflecting modest Y-Y growth of 2.8%, driven by a slightly compressed gross margin and elevated marketing expenses. Analyst Group views the increased marketing investments as a strategic initiative likely to support long-term growth by sustaining and strengthening brand momentum.

- Revised Valuation Range

In conclusion, Björn Borg’s Q3 report came in below our expectations both regarding revenue and profitability, primarily due to slower-than-expected growth within the Footwear category. However, it is encouraging to observe strong progress in the Company’s strategic focus areas, including Footwear, Sports Apparel, Own E-Commerce, and the German market. Nevertheless, Analyst Group revises the top-line estimates for 2024 and 2025. By applying a forward EV/EBIT multiple of 12.0x to the estimated EBIT of 131m for 2025E, a potential value of SEK 61.3 (64.6) per share is derived in a Base scenario.

6

Värdedrivare

6

Historisk lönsamhet

7

Ledning & Styrelse

2

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Strong Performance Across All Product Categories

Björn Borg (“Björn Borg”, “the Company” or “the Group”) is a well-established and renowned company with a rich history spanning decades, earning its place as a favored brand among a broad consumer base. Nevertheless, the predominant association of Björn Borg with underwear presents a compelling challenge: to transition consumer perception from an underwear brand to a sports fashion brand. This strategic shift, central to the Company’s vision since 2014, has already yielded noteworthy progress, driven by amplified investments in social media and successful launches of new sport collections. Analyst Group estimates an attractive growth trajectory on the horizon, which promises improved margins. The forecasted EBIT for 2025 stands at SEK 137m, and by applying a forward EV/EBIT multiple of 12.0x, this presents a potential value of SEK 64.6 (56.4) per share in a Base scenario.

- Footwear and Sports Apparel Fueled Sales Growth

The Q2 report highlights that Björn Borg’s increased focus on growth is bearing fruit, as evidenced by the 29% Y-Y increase in net sales (213.2) during the quarter, surpassing our estimates of SEK 179.1 by a wide margin. Footwear sales surged by an impressive 199% Y-Y, accounting for 18% of total sales during Q2-24. Sport Apparel increased by striking 43% Y-Y, while Bags (33% Y-Y) and Underwear (6% Y-Y) also recorded solid performance. Wholesale reinforced its position as the largest sales channel, with a 50% Y-Y growth, mainly driven by physical wholesale. Own E-Com experienced a slowdown in growth (9% Y-Y), attributed to reduced discounts on the Company’s Own E-Com platform, which, in turn, enhanced profitability.

- Gross Margin Pressured by Temporary Factors

Currency headwinds, increased freight costs, and one-off discounts associated with the footwear segment all negatively impacted the gross margin in Q2-24, which stood at 51.8% compared to 55.6% in Q2-23. Despite the reduced gross margin and a substantial increase in marketing spend Y-Y, strong sales growth largely offset these impacts, resulting in an EBIT of SEK 9.4m (8.1) including FX and SEK 10.3m (7.8) when adjusted for FX, marking a 32% increase (adj. for FX). Short-term fluctuations in FX-rates and transportation costs, coupled with elevated marketing expenditures, may exert pressure on profitability in the near term. However, Analyst Group maintains a positive long-term outlook for improved profitability, with an estimated adj. EBIT margin of 12.2% in 2025E .

- Revised Valuation Range

Björn Borg has accelerated the growth pace in H1-24, demonstrating resilience in an environment where many peers are struggling, an indication that the Company’s clear focus on brand-enhancing activities have yielded results. In response to the report, Analyst Group has revised the top-line estimates, forecasting stronger sales growth across all products categories moving forward. However, we anticipate that the headwinds affecting the gross margin will persist in the short term, leading to a slightly softer margin development. All in all, by applying a forward EV/EBIT multiple of 12.0x to the estimated EBIT of 137m for 2025E, a potential value of SEK 64.6 (56.4) per share is derived in a Base scenario.

6

Värdedrivare

6

Historisk lönsamhet

7

Ledning & Styrelse

2

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Robust Underlying Growth Driven by Sports Apparel

Björn Borg (“Björn Borg”, “the Company” or “the Group”) is a well-established and renowned company with a rich history spanning decades, earning its place as a favored brand among a broad consumer base. Nevertheless, the predominant association of Björn Borg with underwear presents a compelling challenge: to transition consumer perception from an underwear brand to a sports fashion brand. This strategic shift, central to the Company’s vision since 2014, has already yielded noteworthy progress, driven by amplified investments in social media and successful launches of new sport collections. Analyst Group foresees an attractive growth trajectory on the horizon, which promises improved margins. The forecasted EBIT for 2024 stands at SEK 124m (127), and by applying a forward EV/EBIT multiple of 11.5x (10.7), this presents a potential value of SEK 56.4 (54.1) per share in a Base scenario.

- Footwear: Short-Term Challenges but Long-Term Potential

Net sales amounted to SEK 256.8m (246.9) during Q1-24, in line with our estimates of SEK 255.4m, representing a 4% Y-Y growth. Notably, footwear experienced a sharp sales decline of -46% due to the footwear partner’s bankruptcy. Adjusted for the negative impact of SEK -12m attributable to this, sales increased by 10% Y-Y. Hence, Björn Borg started the year with robust underlying growth, driven by an impressive 24% Y-Y growth in Sports Apparel and a 9% Y-Y growth in Underwear, demonstrating that the brand is gaining traction in all markets. The progress in Own E-Commerce was a further indication of strength, as evident by the Y-Y growth of 21%. Despite the short-term challenges of integrating the footwear business in-house, the category is expected to be a key growth driver in the long term.

- Profitability Development Falls Short of Expectations

The gross margin came in at 53.3% (52.2%), and the FX-neutral margin amounted to 53.1%. Hence, the outcome fell short of our estimates (55.8%), as we had anticipated a more significant positive margin impact from the strong growth of Own E-Commerce. Further down the P&L, Björn Borg reported an EBIT of 33.5 (31.4), corresponding to an operating margin of 13% (12.7% when including FX). Thus, the EBIT did not meet our expectations due to higher-than-expected SG&A. The EBIT margin within Own E-Commerce (14%) experienced a decline, both Y-Y (21%) and Q-Q (26%), partly due to higher logistic costs. The Wholesale business reported increased profitability during the quarter, which, coupled with reduced discounts in direct sales to consumers, compensated for the weaker profitability within Own E-Commerce.

- Revised Valuation Range

The strong underlying growth during Q1 serves as a testament to Björn Borg’s focus on driving growth and gaining further market share, fueled by the solid performance in Sports Apparel. Following the report, Analyst Group has revised the top-line estimates, expecting stronger development within Sports Apparel going forward. We have made slight adjustments to the estimated profitability projections, anticipating a more targeted focus on accelerating growth, which we believe will result in a somewhat increased cost base. All in all, the estimated EBIT of SEK 124m for 2024E, in combination with a multiple expansion among peers, has resulted in a new valuation range.

6

Värdedrivare

6

Historisk lönsamhet

7

Ledning & Styrelse

3

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

The E-Commerce Excellence Continues

Björn Borg (“Björn Borg”, the Company” or the Group) is a well-established and renowned company with a rich history spanning decades, earning its place as a favored brand among a broad consumer base. Nevertheless, the predominant association of Björn Borg with underwear presents a compelling challenge: to transition consumer perception from an underwear brand to a sports fashion brand. This strategic shift, central to the Company’s vision since 2014, has already yielded noteworthy progress, driven by amplified investments in social media and successful launches of new sport collections. Analyst Group foresees an attractive growth trajectory on the horizon, which promises improved margins. The forecasted EBIT for 2024 stands at SEK 127m (118), and by applying a forward EV/EBIT multiple of 10.7x (10.5), this presents a potential value of SEK 54.1 (47.8) per share in a Base scenario.

- Strong Momentum in The Company’s Own E-Commerce

The Q4-report served as a testament to the current macro environment, marked by a reduced purchasing power, with net sales falling short on our estimates (SEK 197.6m v.s. expected SEK 204.6m). It is evident that Björn Borg’s distributors are grappling with heightening inventory levels and diminishing household spending, resulting in decreased purchases and sales to customers. However, on a positive note, own E-commerce showcased great momentum and posed a robust 46% Y-Y increase, exceeding our estimates with a wide margin. Consequently, online sales grew to a 47% share in Q4-23, and 41% for FY2023, which surpassed our projections. Analyst Group views this development positively as it indicates that the Company’s investments in marketing and online strategies have yielded stronger brand recognition and online market penetration than predicted.

- Strong Surge in Operating Profit and Increased Dividend

The operating profit soared by an impressive 126% to SEK 20.2m in Q4-23 compared to the corresponding figure last year, surpassing our projections. The strong increase Y-Y in the operating result was driven by a stronger-than-expected gross margin of 56.8%, fueled by improvements in the channel mix. Given the Company’s strong balance sheet, Björn Borg announced alongside the Q4-report the Board’s proposal to increase dividends to SEK 3.00 for fiscal year 2024, marking a 50% increase from last year. The proposed dividend for 2024 exceeded our estimates of SEK 2.30, underscoring the Company’s confidence in its financial position going forward.

- Revised Valuation Range

Despite facing challenges such as inflation, rising interest rates, and geopolitical uncertainties, all of which inevitably impact household consumption, Analyst Group argue that Björn Borg has demonstrated resilience and adeptly navigated these hurdles. The Q4 report serves as the latest testament to this, highlighted by the stronger-than-expected operating result. The strong momentum in own E-commerce is a driving force to that outcome, hence, Analyst Group has revised the profitability projections upwards, as we e.g. anticipate a stronger development within the online channels going forward, which boosts the bottom line. The combination of a stronger expected EBIT for 2024 and a multiple expansion among peers, has resulted in a new valuation range.

6

Värdedrivare

6

Historisk lönsamhet

7

Ledning & Styrelse

3

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

From Briefs to Activewear: The Transformative Journey Continues

Björn Borg (“Björn Borg”, the Company” or the Group) is a well-established and renowned company with a rich history spanning decades, earning its place as a favored brand among a vast consumer base. Nevertheless, the predominant association of Björn Borg with underwear presents a compelling challenge: to transition consumer perception from an underwear brand to a Sports Fashion Brand. This strategic shift, central to the Company’s vision since 2014, has already yielded noteworthy progress, driven by amplified investments in social media and successful launches of new sport collections. Analyst Group foresees an attractive growth trajectory on the horizon, which promises improved margins. The forecasted EBIT for 2024 stands at SEK 118m, and by applying a forward EV/EBIT multiple of 10.5x, this presents a potential value of SEK 47.8 per share in a Base scenario.

- From Couch to Catwalk: Athleisure’s Runway Revolution

The trend for athleisure had already gained significant momentum prior to the pandemic, but as remote work became the new normal, the demand for comfortable clothing for both working from home and leisure activities surged. This acceleration blurred the lines further between athletic wear and everyday fashion, aligning seamlessly with Björn Borg’s strategic focus since 2014; becoming the No 1 Sports Fashion Brand for those who wants to feel active and attractive. The integration of athleisure into consumers’ wardrobes is undeniable, marking a lasting trend. The athleisure wear market is poised to grow at a 5.8% CAGR until 2028, reaching an estimated value of USD 451bn, presenting favorable market dynamics for Björn Borg’s operations ahead.

- More Than Just a Dividend Company

Since its public listing in 2007, Björn Borg has consistently provided a lucrative dividend to its shareholders, with an average dividend yield of 5.6% over the past five years. The Company has exhibited moderate annual sales growth rate of approx. 4% over the past five years while maintaining stable operating margins averaging 8.7%. However, when looking under the surface, it is evident that the Sport Apparel business has garnered an increasing share of the total sales in recent years, showing a CAGR of 7.7% during 2018-2022, and an impressive 18% growth in 2022. Simultaneously, the larger underwear business has experienced flat revenue growth during the same period. With the Sport Apparel segment projected to gain further share of the Groups total sales, as Analyst Group forecast, Björn Borg is positioned to deliver stronger growth compared to its historical performance going forward.

- Enhanced Revenue and Channel Mix to Boost Margins

Between the start of 2021 and the end of Q3-23, Björn Borg’s gross margin has exhibited some volatility on a quarterly basis and been relatively unchanged during the period. However, the currency-neutral gross margin has shown substantial improvement during the same period, from about 51% to 55%. This development is attributed to an enhanced revenue and channel mix, coupled with reduced discounts to wholesale partners. As Björn Borg continues to scale its Sport Apparel business, with a projected 18% CAGR during 2023-2025, Analyst Group anticipates a higher underlying profitability within this segment. This, along with further improvements within its distribution, is expected to bolster the Group’s overall profitability and cash flow generation. With a relatively fixed cost structure, an attractive operational leverage is anticipated to be materialized, potentially leading to an EBIT margin exceeding 17% in the long term.

6

Värdedrivare

6

Historisk lönsamhet

7

Ledning & Styrelse

3

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Analytikerkommentarer

Comment on Björn Borgs Q3 Report for 2024

2024-11-15

Björn Borg (”Björn Borg” or ”the Company”) published its Q3 report for 2024 on the 15th of November, 2024. The following are key events that we have chosen to highlight from the report:

- Net Sales of SEK 285.1m – Equivalent to an increase of 8.8% Y-Y

- Solid Progress in Strategic Focus Areas

- Strong Momentum in Own-Ecom Continues

- Increased Marketing Spend Hampered EBIT-growth

- Solid Financial position

Strong Growth in the German Market

Björn Borgs net sales came in at SEK 285.1m (262.1) during the Company’s third quarter of fiscal 2024, marking a Y-Y increase of 8.8% when factoring in currency effects, and 10.4% when excluding these effects. The outcome fell short of our estimates (SEK 312.0m), where we had anticipated stronger growth within the Footwear category, following the takeover of the distribution from the previous third party that went bankrupt. Nevertheless, the main growth during the quarter stemmed from the Company’s two strategic focus categories, Footwear and Sports Apparel, presenting a Y-Y growth of 29% and 25%, respectively. Worth mentioning is that the Footwear category showed an impressive 110% growth Y-Y via Own-Ecom, a positive sign given that it constitutes a strategic important sales channel. Examining the other products categories, Underwear witnessed a slight decrease Y-Y (-1%), while Bags showed a temporary decrease of 14% Y-Y, following a strong development during H1-24.

Upon reviewing the channel mix for Q3-24, Own-Ecom continues to show solid momentum, as evident by the 32% growth rate Y-Y. Björn Borg’s largest channel, wholesale, grew by 5% Y-Y, where external e-tailers witnessed a growth of 21% compared to the same quarter last year, driven by robust performance in the German and Dutch markets. Own Retail Stores experienced a decline of 5% as a consequence of store closures, but when adjusting for the closure of stores, the development would have been slightly positive (1%). Distributors regained lost ground from the weaker development in H1-24, market by a Y-Y growth of 31% in Q3-24.

Concerning sales geography, the German market strands out positively, with an impressive growth of 44% Y-Y, primarily driven by strong sell-through at major retailers. The Company’s largest market, Sweden, declined with 3% Y-Y, with Own-Ecom contributing positively with a 34% growth, while sales to wholesalers hampered the overall growth within the market. Regarding the other markets, the Netherlands grew by 5%, Finland by 29%, Belgium by 23% and Denmark by 32%.

Increased Marketing Spend is Expected to Fuel Future Growth

During Q3-24, the Company achieved a gross margin of 52.1% (when including FX-effects) and 51.2% when excluding currency effects, which was slightly below our estimates of 52.2%. The gross margin exhibited a decrease from 52.6% in Q3-23 but an increase from the previous quarter (Q2-23), when the gross margin amounted to 51.8%. The lower gross margin Y-Y mainly stems from the Footwear category constituting a larger fraction of sales as well as increased sales to larger customers with higher discounts. While Footwear currently hampers the overall gross margin, the product category is projected to contribute positively to the gross margin in the long term.

Looking further down the P&L, Björn Borg reported an operating result (EBIT) of SEK 42.0m (40.9) for the third quarter, corresponding to an EBIT margin of 14.7%. Adjusting for currency, the operating result amounted to SEK 41.1 (37.0), corresponding to a currency-neutral EBIT margin of 14.4%. This outcome fell short of our estimates (SEK 46.2m), where the deviation from our estimates primary stems from lower-than-expected net sales growth. During Q3-24, the Company increased the marketing spend by SEK 7m, thereby amounting to SEK 23m during the quarter. The higher marketing spend is expected to support continued brand momentum, which is estimated to boost future growth.

Financial Position

Björn Borg reported SEK -88.8m (-61.5) in free cash flow (FCFF) during the third quarter, primarily due to changes in working capital. The FCFF generated in Q3-24 follows the usual seasonal trend seen in the industry, where Björn Borg typically ties up a significant portion of working capital in Q1 and Q3, and, conversely, working capital generally frees up during Q2 and Q4. The FCFF LTM of SEK 47.2m, which provides a more representative illustration of the underlying cash flow generation, shows a decrease compared to the same period last year where the FCFF amounted to SEK 52.8m, where one of the reasons is the footwear integration, which puts short term pressure on the working capital.

At the end of the quarter, Björn Borg net debt position (excl. leases) amounted to SEK 139m (94), which could be compared to SEK 51m at the end of last quarter (Q2-24), where the increase mainly stems from utilization of the overdraft facility. With the current EBITDA LTM of SEK 138m, the net debt/EBITDA ratio equals approx. 1.0x, indicating a continued healthy financial position moving forward.

Concluding Remarks About the Report

In conclusion, Björn Borg’s reported a Q3 report that fell short of our estimates regarding top-line and profitability, mainly as a consequence of slower than anticipated sales within Footwear. However, it is promising to see solid progression in the Company’s strategic focus areas, namely Footwear, Sport Apparel, Own-E-Com and the German market. The strong development within these key focus areas demonstrates that Björn Borg’s strategic initiatives are bearing fruit. Moreover, increased marketing spend is estimated to boost brand awareness and fuel future growth, thereby enabling Björn Borg to increase the market share further ahead.

We will return with an updated equity research report of Björn Borg.

Comment on Björn Borgs Q2 Report for 2024

2024-08-16

Björn Borg (”Björn Borg” or ”the Company”) published its Q2 report for 2024 on the 16th of August, 2024. The following are key events that we have chosen to highlight from the report:

- Impressive Net Sales Growth of 28,7 % Y-Y – Driven by the Footwear Category

- Continued Strong Momentum within Sports Apparel (43 % Growth Y-Y)

- The Wholesale Channel Reported Strong Growth Driven by Physical Wholesale

- Short Term Pressure on the Gross Margin

- Strong Cash Flow Generation

Footwear Showed an Impressive Growth of 199 % Y-Y

Björn Borgs net sales came in at SEK 213.2m (165.6) in the Company’s second quarter of fiscal 2024, marking a Y-Y increase of 28.7% when factoring in currency effects, and 28.3% when excluding these effects. The outcome exceeded our estimates by a wide margin (SEK 179.1m), where all product categories surprised positively in regards to growth. Examining the different product areas, the main growth driver was the footwear category, presenting an impressive growth of 199% Y-Y, a testament to Björn Borgs solid execution of integrating the footwear business in-house. Another major highlight in terms of product areas was the performance in Sports Apparel, which grew by 43% Y-Y, continuing the strong momentum from previous quarters. Additionally, the product category Bags presented a growth of 33% Y-Y, and Underwear, the largest contributor to sales, witnessed a growth of 6% compared to the same period last year.

Upon reviewing the channel mix for Q2-24, the Company’s largest channel, wholesale, grew by an impressive 50% Y-Y, where the main contribution within the channel stems from physical wholesale, which increased by 72% Y-Y. Additionally, external e-tailers witnessed a growth of 20% compared to the same quarter last year, contributing positively to the strong growth within wholesale. The Company’s Own E-commerce increased by 9% Y-Y, which is a slowdown in growth rate compared to the last few quarters, where the Y-Y growth has varied in the range of approx. 20-50%. The somewhat slower growth pace is attributed to the increased focus on full-price sales, thereby reducing the sale rate on the Company’s Own E-commerce platform. Analyst Group believes that the growth within Own E-com is robust in the light of the reduced discounts, which shows that customers are willing to pay full price for the high quality products and the strong brand.

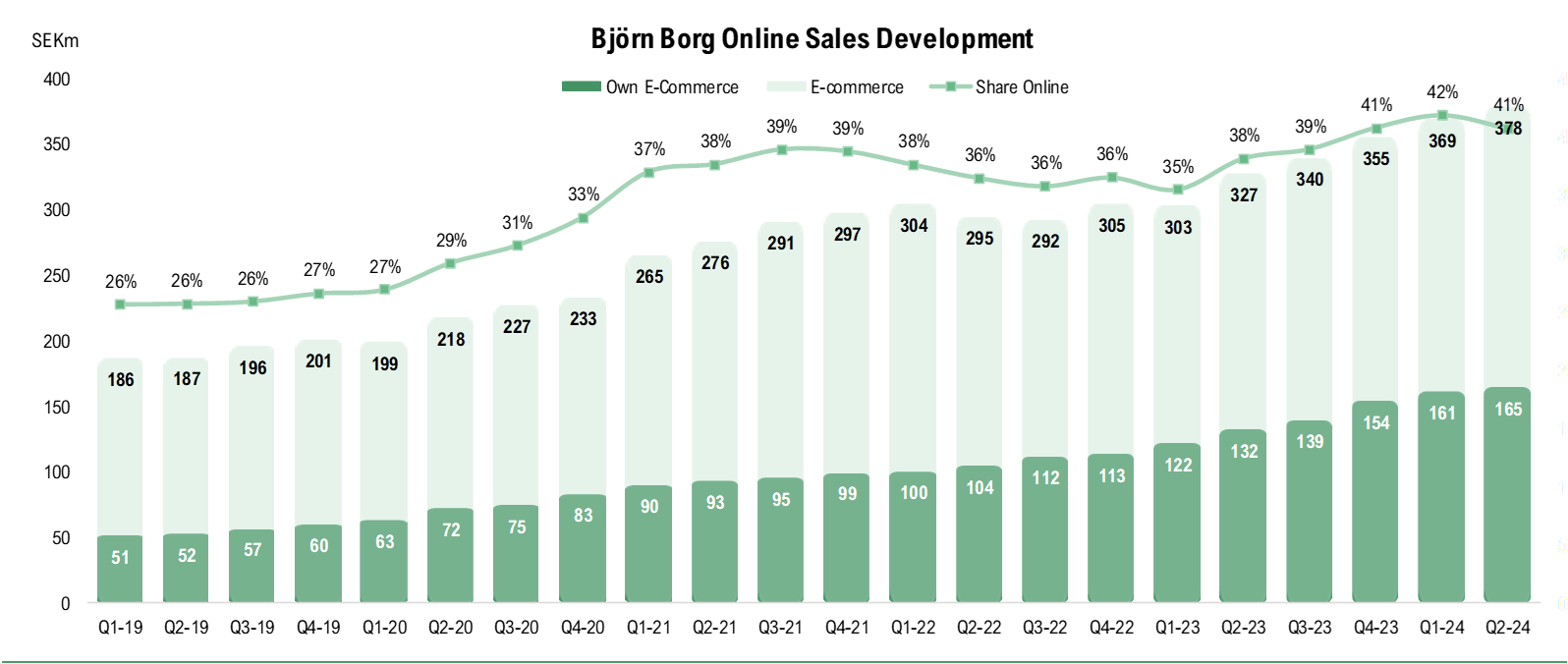

The graph below illustrates the growth in Own E-commerce since the end of 2018. This strong growth, despite the challenges faced by the broader e-commerce sector in recent years, attests to Björn Borg’s resilience and strength, and serves as a testament to the success of the initiatives aimed at boosting brand awareness.

Concerning sales geography, all markets performed well during Q2-24, with some geographies showing remarkable growth. The net sales in the Netherlands witnessed an impressive growth of 53% Y-Y, followed by robust growth of 42% and 40% Y-Y in Belgium and Sweden, respectively. Other important markets such as Germany, Finland and Denmark demonstrated double digit growth, while other smaller markets remained on par with the same period last year.

Short Term Factors Hampers the Gross Margin

During Q2-24, the Company achieved a gross margin of 51.8% (when including FX-effects) and 52.3% when excluding currency effects, which was lower than estimated (56.1%). The gross margin exhibited a decrease from 55.6% in Q2-23 and a decrease from the previous quarter (Q1-23), when the gross margin amounted to 53.3%. The lower gross margin mainly stems from currency effects, increased freight costs as well as one-off discounts linked to the integration of the footwear business, as the Company took over an orderbook of footwear late in the season. Analyst Group perceives the declining gross margin as a temporary issue, and that the Company has great potential to increase the profitability level going forward, for instance as Own E-com grows and thereby constitutes a larger fraction of the total sales.

Looking further down the P&L, Björn Borg reported an operating result (EBIT) of SEK 9.5m (8.1) for the second quarter, corresponding to an EBIT margin of 4.5%. Adjusting for currency headwinds in the quarter, the operating result amounted to SEK 10.3 (7.8), corresponding to a currency-neutral EBIT margin of 4.8%. This outcome fell short of our estimates (SEK 13.1m), where the largest deviation to our estimates, apart from the net sales and COGS, was attributed to the increased marketing spend, as reported in the other external costs (SEK 58.2m compared to estimated SEK 43.7m).

Strong Cash Flow Generation and Solid Financial Position

Björn Borg generated SEK 117.3m (74.9) in free cash flow (FCFF) during the second quarter, primarily due to a reduction in working capital, which amounted to approx. SEK 112m. The FCFF generated during Q2-24 aligns with the typical seasonal pattern observed in the industry, where Björn Borg tends to free up a substantial portion of working capital in Q2 and Q4, and, conversely, working capital generally gets tied up during Q1 and Q3. The FCFF LTM of SEK 74.6m, which provides a more representative illustration of the underlying cash flow generation, shows a substantial increase compared to the same period last year where the FCFF amounted to SEK 48.3m, a consequence of the stronger operating performance as well as efficient working capital management.

During the quarter, Björn Borg reduced the Company’s debt position from SEK 175m at the end of Q1-24 to SEK 145m at the end of June, primarily due to repayment of the overdraft facility. Taking into account the cash position of SEK 9.4m at the end of Q2-24, the net debt stands at 135m, and SEK 51m when excluding leases and deferred tax liabilities. With the current EBITDA LTM of SEK 136.5m, the net debt/EBITDA ratio equals 0.99x (including leasing liabilities and deferred tax liabilities) and approx. 0.38x when excluding the abovementioned, indicating a continued healthy financial position moving forward.

Concluding Remarks About the Report

In conclusion, Björn Borg’s Q2 report demonstrates the successful integration of the footwear category, evident by the remarkable 199% Y-Y growth within the footwear segment and 29 % Y-Y growth for the Company as a whole. The Sport Apparel category also maintained its strong momentum during the quarter, with a solid increase of 43% Y-Y. While the gross margin faced pressure due to currency headwinds, elevated transportation costs, and one-off discounts tied to the footwear business, Analyst Group assesses that the factors contributing to the hampered gross margin are of transitory nature. The Q2 results highlight Björn Borg’s agility in adapting to market conditions and underscore the effectiveness of the Company’s brand-enhancement initiatives. Additionally, the substantial growth potential within the footwear segment could further help to change the perception of Björn Borg as a sports fashion brand, serving as an important growth driver ahead.

We will return with an updated equity research report of Björn Borg.

Comment on Björn Borgs Q1 Report for 2024

2024-05-17

Björn Borg (”Björn Borg” or ”the Company”) published its Q1 report for 2024 on the 16th of May, 2024. The following are key events that we have chosen to highlight from the report:

- Revenues in line with our estimates (SEK 256.8m vs. 255.4)

- E-commerce shows continued strong momentum, representing a 21% Y-Y growth

- Integrates footwear In-House

- Profitability fell short of our estimates

- Footwear integration puts pressure on the FCFF

Revenues Grew 10% Y-Y when Excluding Footwear Sales

Björn Borgs net sales came in at SEK 256.8m (246.9) in the Company’s first quarter of fiscal 2024, marking a Y-Y increase of 4.0% when factoring in currency effects, and 3.7% when excluding these effects. The outcome exceeded our estimates by a slight margin (SEK 255.4m or 0.5%). Looking at the product areas, sales from Sports Apparel witnessed a strong growth of 24% compared to the same period previous year, constituting 27% of total sales during the quarter. During Q1-23, the aforementioned share equaled 23%, showcasing that Björn Borg’s strategic shift in strengthening the perception as a sports fashion brand is bearing fruit. The Underwear area grew 9% Y-Y, where the solid development was attributed to both women’s and men’s underwear. During Q1-24, Björn Borg’s licensing partner for the footwear category went bankrupt, which had a significantly negative impact on the footwear sales, as evident by the sharp decline of 46% in sales. The decline mainly stemmed from disruptions in the supply chain and was further impacted by weak sales from the former partner. Worth highlighting is that sales increased by 10% when excluding footwear, which illustrates that Björn Borg has started the year of 2024 on a strong note, albeit the Company is facing short term headwinds with regards to the footwear area.

Reviewing the channel mix for the current quarter, it is notable that the Company’s Own E-commerce is continuing its strong momentum and gaining notable traction in the overall channel strategy. Sales from the Company’s E-commerce platform amounted to SEK 40.6m (33.4) in the first quarter, reflecting a solid 21% increase Y-Y. The performance of online sales maintained strong momentum, comprising 40% of total sales in Q1-24 and 42% LTM.

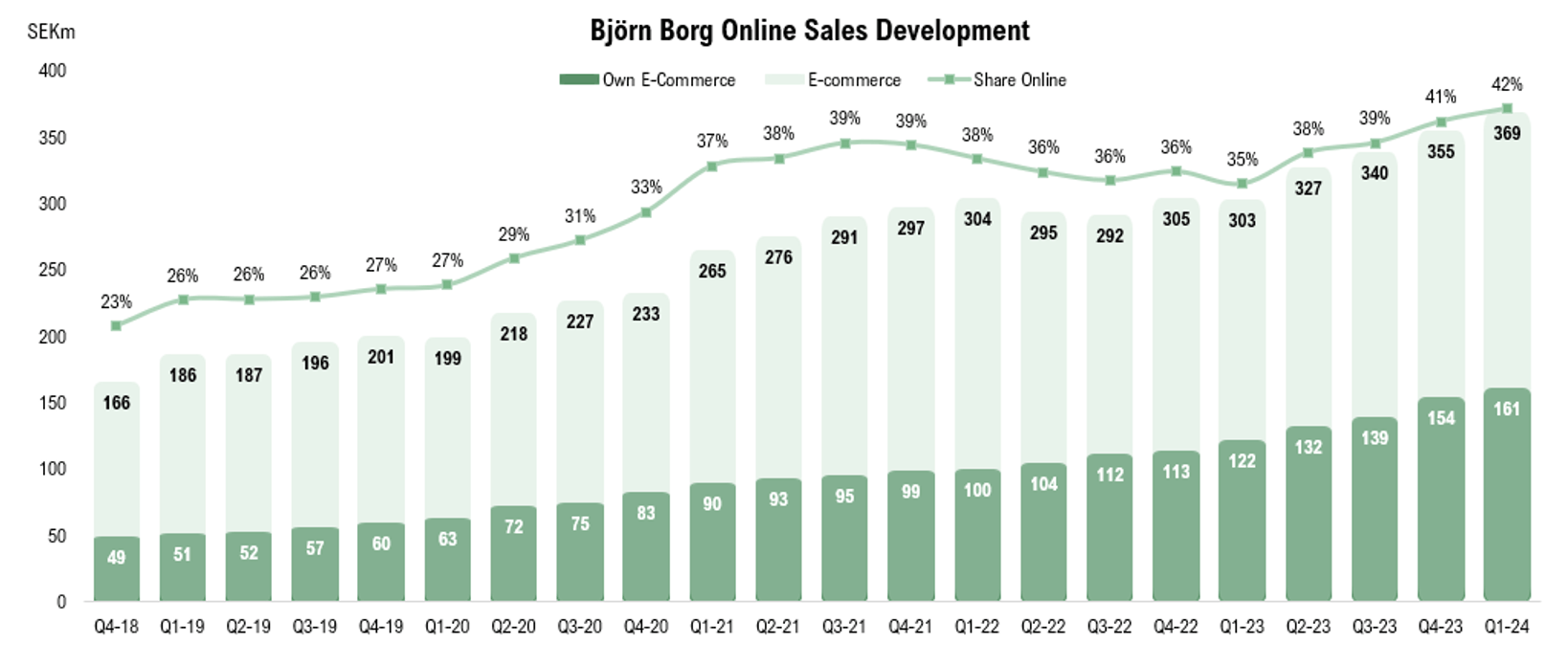

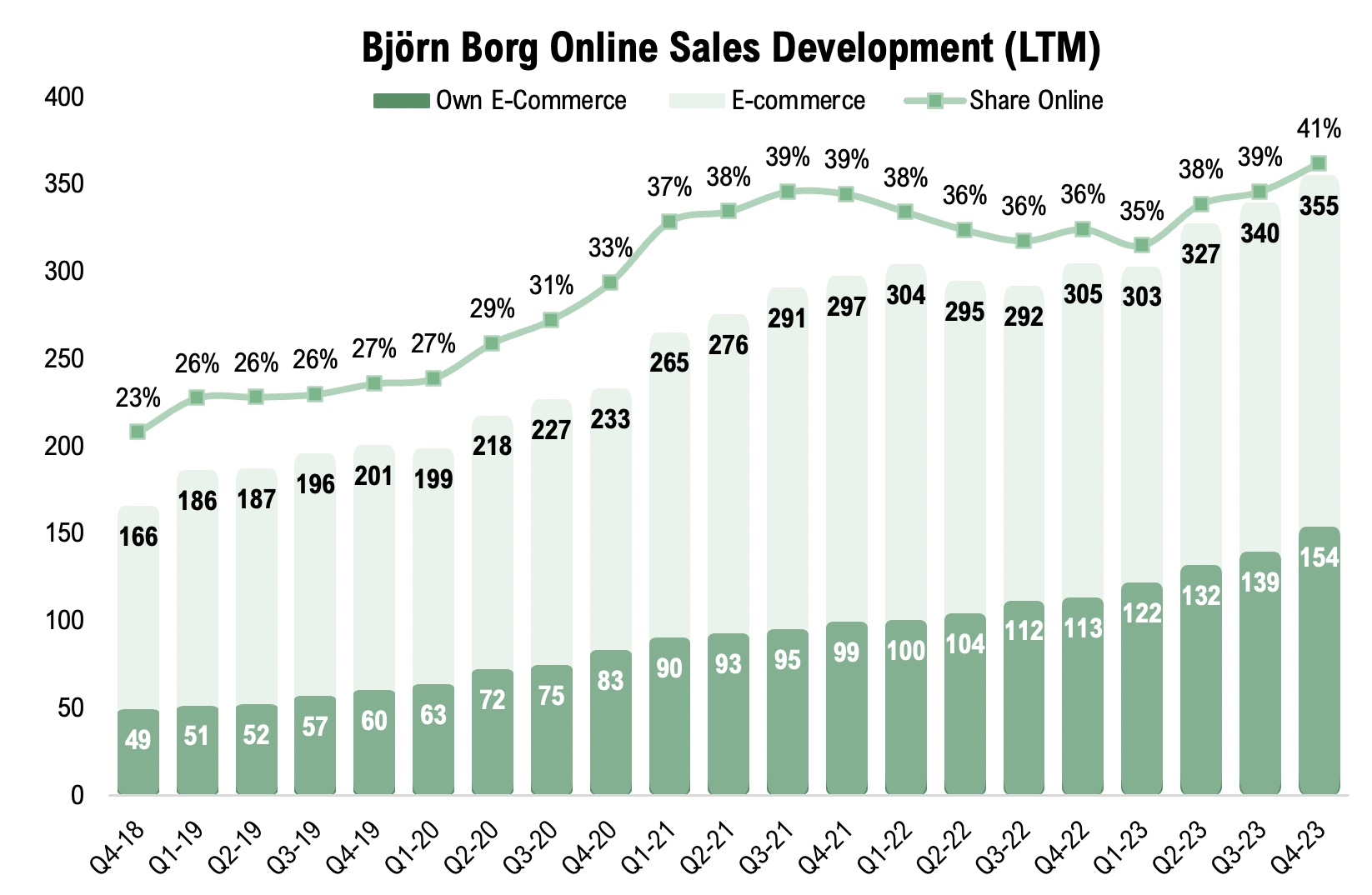

The graph below demonstrates the robust growth in own E-commerce since the end of year 2018, which, according to Analyst Group, indicates that activities to bolster brand awareness have yielded significant results throughout the years, thereby directing a growing inflow of traffic to the Company’s own homepage. The robust growth, despite the challenges faced by the general e-commerce sector in recent years, is a testament to Björn Borg’s strength.

In regards to the sales geography, the Netherlands, Germany and Denmark showed good progression, with growth of 10%, 14% and 6%, respectively. However, other Nordic markets exhibited contrary performances, with sales in Sweden and Finland declining Y-Y, entirely attributed to the weak development in the footwear area.

Björn Borg Integrates Footwear In-House

In February, Björn Borg announced that its distribution partner for footwear, Serve&Volley, has entered into restructuring. Shortly thereafter, on March 11th, Björn Borg announced plans to fully integrate the footwear product category into its own operations. This integration means that the Company will handle the design, product development, and distribution of footwear in all markets. Apart from enabling Björn Borg to enhance control over quality, innovation and design, the integration will create synergies with other product categories in distribution. Since the distribution of footwear is already integrated in Sweden, Finland, and Denmark, and considering Björn Borg’s extensive experience in developing and manufacturing high-performance products in underwear, sportswear, and bags, Analyst Group believes that the Company possesses all the necessary prerequisites to leverage the strong brand and achieve significant growth within the footwear segment. The risk of the Company’s former licensee adversely affecting Björn Borg’s sales and delivery opportunities is evident, and Björn Borg’s assessment is that this could negatively impact EBIT for 2024E by up to SEK 5m where we estimate a result of SEK 126m for the full year. Although the first quarter demonstrates that transitioning from a licensing model to in-house integration can negatively impact operating results in the short term, Analyst Group believes that the long-term net effect will be positive, and that the footwear business could serve as a solid growth engine in the coming years.

Lower Profitability Development than Expected

During Q1-24, the Company achieved a gross margin of 53.3% (when including FX-effects) and 53.1% when excluding currency effects, which was lower than estimated (55.8%). The gross margin increased from 52.2% in Q1-23 but exhibited a decline from the previous quarter (Q4-23), when the gross margin amounted to 56.8%. The improvement Y-Y was primarily attributed to greater profitability within the wholesale business, as well as reduced discounts within the direct sales to consumer. Analyst Group estimated a stronger gross margin development in the first quarter, expecting a more significant impact from the robust performance of Own E-Commerce, which has a higher profitability profile compared to other sales channels.

Moving forward, the Company is expected to further strengthen its online presence through continued investments in marketing and other activities that enhance brand visibility, particularly via Own E-commerce. Analyst Group forecasts a sustained rise in online sales, which is projected to set the stage for a gross margin within the range of 55-57% range in the coming years.

Björn Borg reported an operating result (EBIT) of SEK 33.5m (31.4) for the first quarter, corresponding to an EBIT margin of 13%. Adjusting for currency tailwinds in the quarter, the operating result amounted to SEK 32.7 (33.6), corresponding to a currency-neutral EBIT margin of 12.7%. This outcome fell short of our expectations (SEK 46.7m), and the worse-than-expected result was primarily attributed to higher other external costs (SEK 60m compared to SEK 54m) than estimated, as well as higher personnel costs (SEK 37m compared to SEK 34m).

The Integration of the Footwear Business Increased the Capital Tie-up During Q1-24

The Company tends to tie up a significant portion of its working capital in the first quarter, which was also evident in Q1-24, but the quarter was heavily impacted by the integration of the footwear business in-house. Björn Borg generated SEK -107.7m (-29.8) in free cash flow (FCFF) during Q1-24, primarily due to an increase in working capital, which amounted to approximately SEK 129.9m. Thus, cash flow from operating activities in Q1 amounted to SEK -103.2m (-27.1). Given the nature of the industry, Björn Borg normally experiences fluctuations in working capital, with the most significant change in accounts receivable and accounts payable during the first and third quarters. However, the significant deterioration compared to the previous year is explained by a higher capital tie-up, attributed to the short-term headwinds following the integration of the footwear business, as the distribution partner went bankrupt. Analyst Group had not anticipated such a large impact from the integration of the footwear business. At the same time, we emphasize that this is a short-term effect, which, as previously mentioned, we expect to result in a positive net effect in the longer term.

Looking at FCFF for the last twelve months (LTM), which usually provides a more representative view of the underlying cash flow generation as it smooths out the seasonal variations and sharp quarterly swings, Björn Borg generated SEK 58.8m in FCFF LTM, representing a decrease of 28% compared to the same period last year, where the decrease is also attributed to the negative impact from the integration of the footwear business.

Given the current EBITDA LTM of SEK 135.1m and a net debt position of SEK 175.4m at the end of March, the net debt/EBITDA ratio stands at 1.25x (including leasing liabilities), and 0.95x when excluding leases. Consequently, Björn Borg increased the Company’s debt position in Q1, primarily due to short-term interest-bearing liabilities, as a result of the negative FCFF created by the high capital tie-up in the quarter.

Despite the high capital tie-up, Analyst Group considers that Björn Borg has built up a solid and healthy financial position, where the Company’s debt position increased to SEK 175m (146) and SEK 136m (98) excluding leasing liabilities, which is an increase both Y-Y and Q-Q.

Concluding Remarks About the Report

In conclusion, Björn Borg delivered a Q1 report that came in line with our estimates regarding top-line but fell short of our estimates in terms of profitability. However, the development during the quarter further demonstrates the Company’s strong momentum within Own E-Commerce, which exhibited strong growth. Furthermore, Analyst Group is pleased to see the solid progress within the Sports Apparel area, illustrating that the strategy to transition consumer perception from an underwear brand to a sports fashion brand has yielded notable results.

While the footwear business put short term pressure on the sales, Analyst Group believes that the product area carries substantial potential in the long term, and that the Company’s previous experience in developing and manufacturing high-performance products in underwear, sportswear, and bags, will pave the wave for a promising performance within footwear sales.

We will return with an updated equity research report of Björn Borg.

Analyst Group Comments on Björn Borgs Year-End Report for 2023

2024-02-23

Björn Borg (” Björn Borg” or ”the Company”) published its Year-End report for 2023 on February 23, 2024. The following are key events that we have chosen to highlight from the report:

- Revenues amounted to SEK 197.6m (-3.4% lower than estimates) – Currency-neutral, net sales fell -3% Y-Y

- Own E-commerce amounted to SEK 45.8m, representing a 46% Y-Y growth

- Footwear Partner Enters into Restructuring

- Enhanced Channel Mix Boosted Higher-Than-Expected Margins

- Strong Cash Flow Generation Resulted in a Reduced Net Debt Position.

Own E-Commerce Grew 46% Y-Y

Björn Borg reported net sales of SEK 197.6m in the Company’s fourth quarter of fiscal 2023, marking a Y-Y decrease of 0.4% when factoring currency effects, and -3% when excluding these effects. The outcome fell short of our estimates (SEK 204.6m or -3.4%), primarily driven by lower-than-expected sales from the Sport Apparel (-5.4%) and Underwear business (-3.8%). Conversely, the development in the product category “Other”, exceeded our expectations (SEK 43m vs SEK 35m), where Analyst Group had estimated a carryover of the negative growth from the third quarter into the fourth quarter, but the actual development proved otherwise.

Given prevailing challenges such as high inflation and reduced purchasing power, the recorded negative growth in Q4 is not alarming, but rather viewed as a temporary setback by Analyst Group.

Examining the current quarter’s channel mix, it’s noteworthy that the Company’s Own E-commerce is gaining significant traction in the overall channel strategy. Sales from the Company’s E-commerce platform amounted to SEK 45.8m in the fourth quarter, reflecting a robust 46% Y-Y increase and surpassing our forecasts by a substantial margin (SEK 34.6m).

The online sales performance concluded 2023 on a more robust note than anticipated, with online sales comprising 47% of total sales in the fourth quarter and 41% for the full fiscal year 2023, surpassing our projections of 39% for both Q4-23 and the entire fiscal 2023. This indicates potential for upward adjustments in the updated research report, as Björn Borg’s significant marketing investments have yielded even greater brand strength and online market penetration than initially predicted.

In the graph below, we can clearly see how consistent the growth in own E-commerce has been since the end of Q4-18, despite previous and current challenges, indicating that made investments on marketing has spurred increased activity within Björn Borg own homepage and strengthened the brand, according to Analyst Group.

On the other hand, the Q4 report underscores the ongoing challenges faced by Björn Borg’s distributors, characterized by elevated inventory levels and diminishing household consumption. We anticipate sustained weakness in this sales channel in the forthcoming quarter.

In terms of sales geography, the Netherlands and Belgium outperformed expectations, partially attributable to the stronger performance in Own E-commerce. Meanwhile, the Swedish market maintained its positive momentum, registering a Y-Y growth of 7% in the fourth quarter and 8% for the full fiscal year 2023. However, other Nordic markets displayed a mixed performance, with Finland experiencing a 6% decline compared to the previous year, while Denmark witnessed a noteworthy 24% Y-Y increase.

Björn Borg’s Footwear Partner Enters into Restructuring

Shortly before the Q4-report, Björn Borg announced that its partner for the footwear business, Serve&Volley, has entered restructuring. For Björn Borg, the financial effect in the short term is limited, as orders placed for the spring collection are currently in Europe, ready to be delivered to customers. In the press release, Björn Borg revealed that the Company had, before this event, initiated a strategic review regarding overtaking the footwear operations under own authority. As the distribution of footwear is already an integrated part in the Nordic business (Sweden, Finland, and Denmark), Analyst Group believes that the probability for Björn Borg to overtake the footwear business is high. The financial impact of this transition would, according to Analyst Group, all else equal, result in a higher working capital need, in terms of increasing inventory and account receivables, for the end of 2024 and onwards. At the same time, the Company would get re-access to the markets that previously were omitted to Serve&Volley, resulting in higher footwear sales volumes in its own authority. However, it’s worth noting that Björn Borg previously received royalties on sold footwear, yielding 100% margins. Therefore, while the net effect on a percentage basis may appear negative, the move to bring the footwear business under its own authority has resulted in a positive absolute impact.

Enhanced Channel Mix Supported a Strong Gross Margin…

During Q4-23, the Company achieved a gross margin of 56.8% (when including FX-effects) and 56.2 % when excluding currency effects, which was higher than estimated (54.1%). This strong performance can be attributed to ongoing efforts to reduce discounts and optimize the channel mix, with a notable contribution from the expanding share of Own E-commerce.

Looking ahead, continued investments in marketing and other brand-enhancing activities are expected to further bolster the company’s online presence, particularly through Own E-commerce. Analyst Group forecasts a continued increase in online sales, laying the groundwork for sustaining a gross margin in the range of 55-57%. This outlook remains resilient even as the Sport Apparel segment, which typically carries lower margins, is projected to account for a larger share of revenues in the future.

… as well as the Operating Result

For the fourth quarter, Björn Borg reported an operating result (EBIT) of SEK 20.2m, corresponding to an EBIT margin of 10.2%. Adjusting for currency tailwinds in the quarter, the operating result amounted to SEK 19m, corresponding to a currency-neutral EBIT margin of 9.6%. This outcome exceeded our expectations (SEK 11.5m) by 64%. Apart from the factors that positively influenced the gross margin, such as the aforementioned factors, the better-than-expected result was mainly attributed to lower other external costs (SEK 53m compared to SEK 57m) than estimated, as well as somewhat lower personnel costs (SEK 34m compared to SEK 35m). The quarter’s channel mix played a role in this deviation from our estimates, alongside with reduced reserves for doubtful accounts receivables.

The quarter’s profitability thus came as a positive surprise, indicating that Björn Borg has gained stronger momentum within its Own E-commerce than previously anticipated as of the end of 2023. Moving forward, we are inclined to adjust our estimates regarding the channel mix, which is likely to support a stronger operating result than previously forecasted.

Strong Cash Conversion during the Quarter

In the fourth quarter, Björn Borg tends to free up a significant portion of its working capital, which also was the case for Q4-23. The company generated SEK 126.5m in free cash flow (FCFF) during Q4-23, with a substantial portion attributed to a reduction in working capital amounting to approximately SEK 106m. Although inventory increased by SEK 34m, reaching 21.1% of net sales for the quarter, this aligns with the Company’s established business cycle and was largely consistent with our estimates. It’s typical for Björn Borg’s inventory levels to peak in the second and fourth quarters, while reaching their lowest points in the first and third quarters.

The cash flows generated in the fourth quarter surpassed projections, underscoring a high level of efficiency in working capital management. This bodes well for the upcoming quarters, particularly amidst an increasingly uncertain macroeconomic environment.

Moreover, the Company significantly reduced its debt position in Q4, primarily driven by robust cash conversion during the quarter. This enabled Björn Borg to repay its overdraft facility of SEK 104m. Consequently, the net debt position (including leasing liabilities) stood at SEK 56m at the end of Q4-23, down from SEK 180m in the previous quarter. This implies a solid and healthy financial position moving forward.

Another favorable aspect highlighted in the report, particularly from a shareholders’ perspective, was the Board’s proposal to increase dividends to SEK 3.00 for fiscal year 2024. This marks a significant 50% increase from 2023, amounting to a total of SEK 75.4m. This move underscores the Company’s confidence in its balance sheet and its commitment to returning value to shareholders.

Notably, the proposed dividend for the next fiscal year exceeded our forecasts, which initially was estimated toSEK 2.30. Originally, a distribution of SEK 3.00 was expected to occur in 2025, making this announcement a positive surprise for investors.

Concluding remarks about the report

In conclusion, Björn Borg’s performance in Q4-23 underscores its continued robust growth trajectory within Own E-commerce, signaling that investments in marketing and brand enhancement initiatives have yielded tangible results. Despite prevalent macroeconomic challenges such as inflation, increased interest rates, and geopolitical uncertainties, Analyst Group believes that Björn Borg has effectively navigated these obstacles, as evidenced by the stronger-than-expected operating result.

Moving forward, monitoring the performance of the Company’s distributors, and tracking organic growth will be crucial factors. While sales growth may have fallen short of estimates, Analyst Group was impressed by the notable improvement in operating results during the quarter. As a result, upward adjustments tied to profitability are anticipated in the upcoming Equity Research Report.

We will return with an updated equity research report of Björn Borg.

Feb

Interview with Björn Borg’s CEO Henrik Bunge

Aug

Intervju med Björn Borgs VD Henrik Bunge

Feb

Intervju med Björn Borgs VD Henrik Bunge

Aktiekurs

N/A

Värderingsintervall

2025-02-28

Bear

44,6 SEKBase

58,4 SEKBull

68,1 sekUtveckling

Huvudägare

2024-12-31

Comment on Björn Borg’s Year-End Report for 2024

2025-02-21

Björn Borg (” Björn Borg” or ”the Company”) published its Year-End report for 2024 on February 21, 2025. The following are key events that we have chosen to highlight from the report:

Solid Growth in All Focus Areas

Björn Borg reported net sales of SEK 234.6m (197.6) in the Company’s fourth quarter of fiscal 2024, marking a robust Y-Y increase of 18.7% when factoring currency effects, and 18.6% when excluding these effects. The outcome exceeded our estimates slightly (SEK 228m or 2.9%), primarily driven by stronger-than-anticipated growth in Footwear and Sports Apparel. These product areas were the main growth drivers during the fourth quarter, although all major product categories contributed to the strong performance. Footwear and Sports Apparel demonstrated Y-Y growth of 57% and 44%, respectively, while the largest category, Underwear, grew by a solid 14%, and Bags increased by 30%. Analyst Group views the broad-based growth as encouraging, particularly within the Company’s core product segments, where the Company has identified the most significant growth opportunities ahead.

Upon reviewing the channel mix for the quarter, Björn Borg’s largest channel, wholesale, witnessed an impressive 28% Y-Y growth, with external e-tailers up 15%, driven by strong performance in the German and Dutch markets. The Company’s Own-Ecom maintained solid momentum, albeit at a lower growth rate than in previous quarters, posting a 10% Y-Y growth. However, this compares to a strong 46% increase in Q4-23, presenting tough comps. Own Retail Stores declined by 2% due to planned closures, but when adjusting for the closure of stores, the comparable stores grew by 5%. Additionally, distributors continued to recover from H1-24 weakness, recording a 13% Y-Y growth in Q4-24.

In terms of sales geography, the Company’s largest market, Sweden, grew by 43%, while the Company’s strategic focus market, Germany, recorded a 13% Y-Y growth. The Netherlands saw a modest 2% increase, whereas Belgium and the UK posted slight declines of 4% and 2%, respectively. The other Nordic markets showed mixed performance: Finland grew by 5%, Denmark by a solid 10%, and Norway posted a notable 51% Y-Y increase.

For the full year 2024, Björn Borg’s net sales amounted to SEK 989.7m (872.3), representing a growth of 13.5%. Similar to the fourth quarter, the main growth drivers for the full year were the Footwear (+36% Y-Y) and Sports Apparel (+32% Y-Y) segments, driven by the takeover of distribution from a third party that went bankrupt.

Increased Marketing Spend and One-off Effects Put Pressure on the EBIT-margin

During Q4-24, the Company achieved a gross margin of 53.3% (when including FX-effects) and 53.5% when excluding currency effects, which was slightly lower than estimated (53.7%). The outcome stems from the distribution of Footwear in newly entered markets, which initially had temporarily lower gross margins. However, a stronger focus on profitability within the wholesale business, along with reduced discounts in direct-to-consumer sales, had a positive offsetting effect.

Looking further down the P&L, Björn Borg reported an operating result (EBIT) of SEK 16.8m (20.2) for the fourth quarter, corresponding to an EBIT margin of 7.2%. Adjusting for currency, the operating result amounted to SEK 17.2 (17.6), corresponding to a currency-neutral EBIT margin of 7.3%. Thus, the outcome fell short of our estimate (SEK 20.9m), primarily due to higher-than-expected SG&A costs. The Company attributes the weaker EBIT development in Q4-24 entirely to one-off costs related to the full integration of the Footwear business, as well as increased marketing investments, both aimed at sustaining brand momentum and ensuring future growth.

The full year operating profit landed at SEK 101.8m (100.6), representing a modest growth of 1.3%, and adjusting for currency-headwinds, the operating profit amounted to SEK 94.5m, a decrease of 6%.

Solid Cash Conversion and a Healthy Balance Sheet

In the fourth quarter, Björn Borg tends to free up a significant portion of its working capital, which also was the case in Q4-24. The Company generated SEK 141.2m of free cash flow (FCFF) during Q4-24, with a substantial portion attributed to a reduction in working capital amounting to approx. SEK 121.4m. The increase of SEK 69m in inventory is noteworthy, reaching 26.2% of net sales for the quarter. Although it’s typical for Björn Borg’s inventory levels to peak in the second and fourth quarters, while reaching their lowest points in the first and third quarters, the inventory level in Q4-24 stands out compared to historical levels. The FCFF for the full year 2024 amounted to SEK 62m, compared to 2023 where the FCFF amounted to SEK 110.1m. The decrease is mainly attributed to changes in working capital, as a consequence of the Footwear integration.

Moreover, Björn Borg significantly reduced the Company’s debt position in Q4-24, primarily driven by robust cash conversion during the quarter. This enabled Björn Borg to repay SEK 125.2m of the Company’s overdraft facility, which at the end of the quarter stood at SEK 17.3m. Hence, the net debt position (excl. leases) amounted to SEK 9m, and with the current EBITDA LTM of SEK 134m, the net debt/EBITDA ratio equals approx. 0.1x, which implies a solid and healthy financial position moving forward. The Board has proposed a dividend of SEK 3.0 (3.0) for fiscal year 2025, amounting to a total of SEK 75.4m.

Concluding remarks about the Q4 report

In conclusion, the performance in Q4-24 underscores Björn Borg’s ability to successfully execute on the Company’s strategic focus areas, as evidenced by strong growth in the Footwear and Sports Apparel segments, the Own-Ecom sales channel, as well as the German market. Net sales in the fourth quarter slightly surpassed our estimates, but higher marketing investments and one-off costs from Footwear integration pressured the EBIT margin. However, as both initiatives are expected to be key drivers of long-term growth, laying the groundwork for sustained profitability in the years ahead, Analyst Group views the lower EBIT-margin as a temporary effect. All in all, we consider that Björn Borg has navigated 2024 in a solid way, particularly in light of the in-house integration of the Footwear segment, and we believe that the Company is well-positioned to further strengthen the brand and expand Björn Borg’s market presence ahead.

We will return with an updated equity research report of Björn Borg.