On February 14, 2025, Nosa Plugs published the company’s interim report for the fourth quarter of 2024. Below are some key highlights that we have chosen to emphasize in connection with the report:

- Continued strong revenue growth of 31%

- Record-high gross margin and solid cost control contributed to an improved result

- Significant investments made during 2024, laying the foundation for a lower burn rate in 2025

Another Sales Record

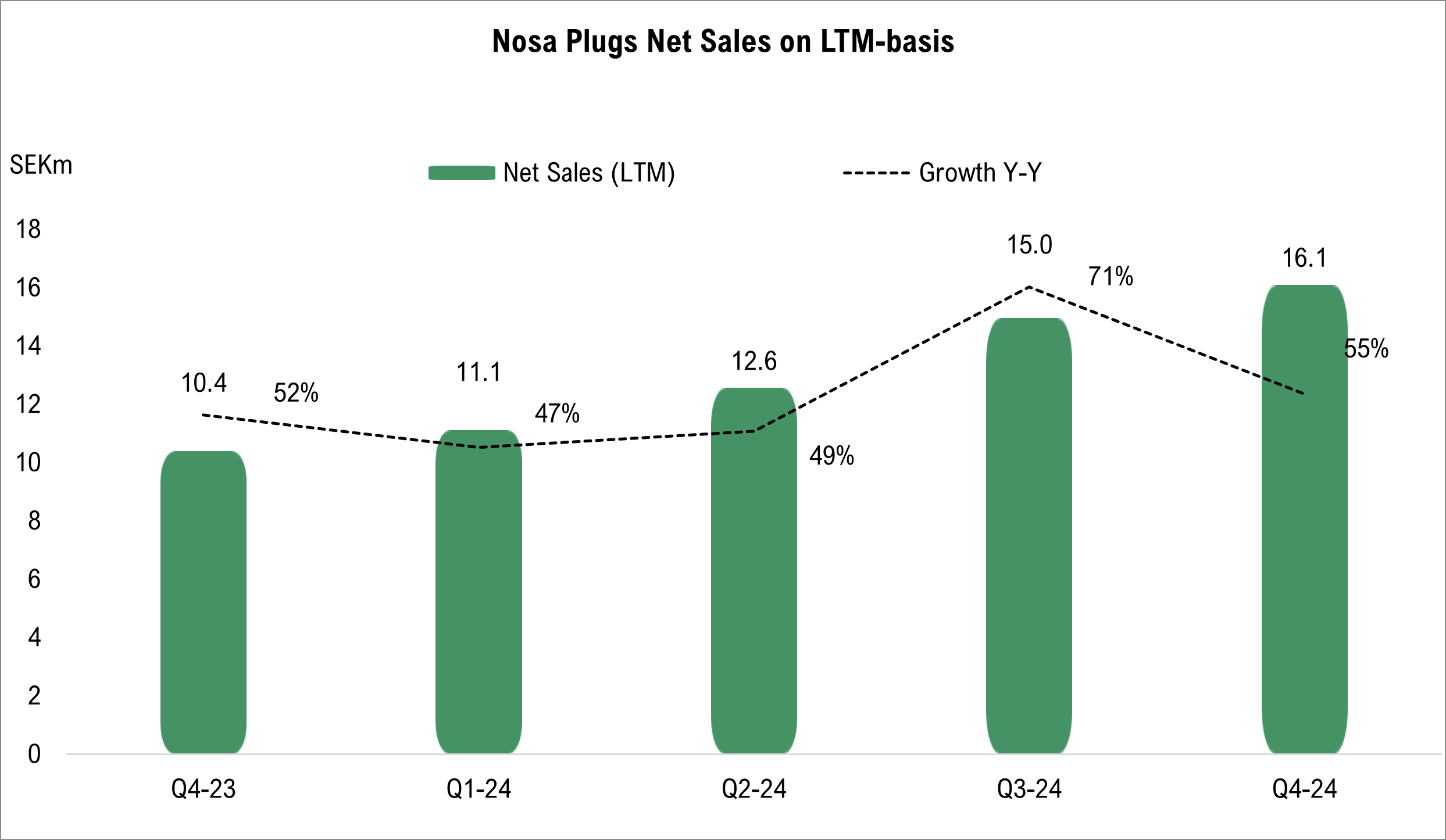

During Q4-24, Nosa Plugs’ revenue amounted to SEK 4.8m (3.6), representing a strong growth rate of 31%, although slightly below Analyst Group’s estimate of SEK 5.3m. Growth was driven by both new and existing healthcare customers as well as the rollout of Smell Training. The quarter thus marked yet another record period for Nosa Plugs in terms of revenue. On a full-year basis, revenue for 2024 reached SEK 16.1m (10.4), growing by 55% and exceeding Nosa Plugs’ target of 50%.

The deviation from our estimate is primarily attributed to a delayed follow-up order to Australia, as Australian regulatory authorities have prolonged the approval process. Additionally, growth in the UK stalled during the quarter largely due to distributor Mediq consolidating multiple companies into a single entity, which negatively impacted Nosa Plugs’ sales. We have previously emphasized the importance of securing product listings and procurement agreements with hospitals to drive growth, as seen in Denmark, where sales accelerated significantly following procurement during the summer of 2024. In the UK, Odor Control was procured by the National Health Service (NHS) in June 2024 and given that distributor-related challenges are now expected to be resolved, the UK market is estimated to become a strong growth driver in 2025.

Furthermore, the accelerated rollout of Odor Control is expected to continue across large parts of Europe, with the product launched in Italy during the quarter. Given the advantages Odor Control is perceived to have over competing products, continued strong revenue growth is anticipated, supported by recurring sales both in key markets such as Sweden and Germany and in markets currently representing a smaller share of revenue, including the UK and France, where the product was listed in 2024.

Odor Control accounted for 88% of sales in 2024 and remains Nosa Plugs’ most important product, while Smell Training represented 9%, despite sales primarily commencing in the second half of 2024. This indicates a strong market launch. The product is currently available in Sweden, Germany, and Switzerland, and PR initiatives are expected in Germany during 2025, similar to those that drove successful sales in Sweden in the latter half of 2024.

Strong Gross Margin and Reduced Costs Contributed to Results in Line with Estimates

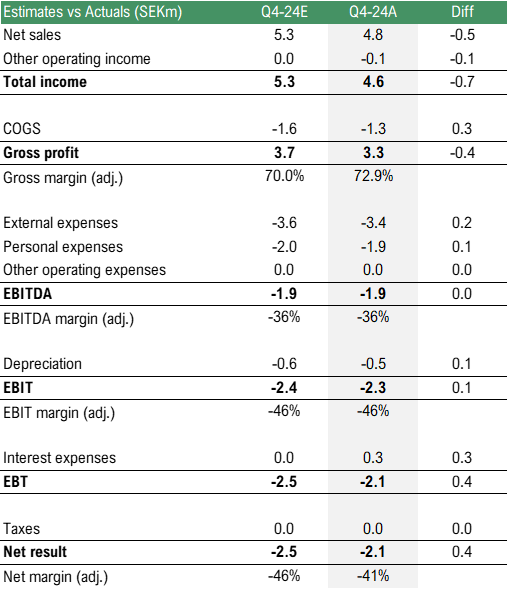

The gross margin, adjusted for other operating income, was 72.9%, marking a record high since Nosa Plugs’ public listing in 2023 and exceeding our estimate of 70%, significantly surpassing the company’s target of over 65%. The strong development in gross margin over the past year is primarily attributed to increased production efficiency, with a new production line in operation from the end of Q4-24.

Operating expenses remained stable during the quarter, decreasing by 23% compared to Q4-23, underscoring the company’s current cost awareness in relation to the target of achieving positive cash flow by the end of Q1-25. However, it is worth noting that costs in the comparison quarter were abnormally high due to investments in product development. Overall, the higher-than-expected gross margin and lower-than-estimated costs resulted in earnings aligned with our expectations, with an improved operating result of SEK -2.3m (-5.0). A summary of our estimates compared to actual results is presented below.

Lower Investment Rate Expected in the Coming Year

Nosa Plugs made several investments in 2024 to ensure future growth, including initiatives related to Drug Delivery, where a patent application was submitted at the end of Q4-24 Furthermore, investments were directed at production capacity, with a new production line operational since the end of Q4-24. Given this, Analyst Group estimates a reduced investment rate in 2025.

Analyst Group estimates that the company’s current production capacity will be sufficient to meet potentially increasing demand in the coming years. The next step in Drug Delivery is expected to involve securing a partnership with a pharmaceutical company, with the ambition of having the partner finance the subsequent steps in the process.

Investments in product development for Drug Delivery amounted to SEK -1.6m in 2025, while cash flow from investing activities in Q4-24 was SEK -2.1m, primarily related to the new production capacity. Following these investments, cash holdings stood at SEK 4.3m at the end of Q4-24, down from SEK 10m at the end of Q3-24. The company has set a goal of achieving positive cash flow by the end of Q1-25 but has also emphasized that investments in future growth may be prioritized if deemed advantageous, which means profitability could fluctuate between quarters. In such a scenario, and given the current cash position, Analyst Group does not rule out the possibility of additional external financing being required in the future. However, we believe that prioritizing growth investments is the right strategy for a company like Nosa Plugs, which is experiencing strong sales momentum.

To summarize, Analyst Group considers Nosa Plugs to have delivered a strong report that was largely in line with our expectations, although delays in Australia and weaker-than-expected development in the UK slightly impacted sales. However, the gross margin was robust, and in combination with strong cost control, earnings met our expectations. We see strong prospects for continued growth in 2025, with investments in Odor Control and Smell Training expected to yield results, alongside the launch of a new product, NOSA Nozoil. Additionally, we look forward to updates regarding Drug Delivery throughout the year.

We will return with an updated equity research report of Nosa Plugs.