STENOCARE published on February 22nd its year-end report for 2023. The following are some key points that we have chosen to highlight in connection with the report:

- Slightly lower net sales than expected – large product return from Norway again

- Gross sales reached DKK 6.9m – the best annual result in the company’s history

- The cost-base remains stable – operating result in line with our expectations

- Strengthened cash position – estimated to be enough towards anticipated break even

Financial Development During the Period

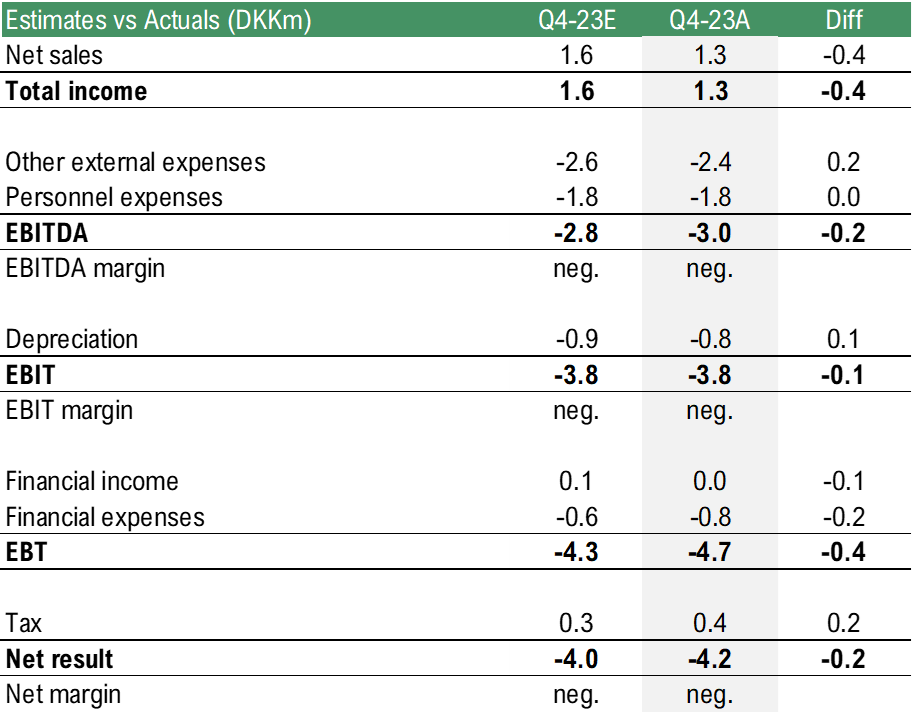

In the fourth quarter of 2023, net sales amounted to DKK 1.3m (2.8), corresponding to a decrease of 56% compared to the same period last year. Q4-22 included a significant delivery to the Norwegian market, which is why sales in the comparative quarter were exceptionally strong. The net sales of DKK 1.3m was lower than our estimate of DKK 1.6m for the fourth quarter. However, gross sales, excluding product returns, amounted to DKK 1.7m, thus above our estimates. The difference between gross sales and net sales is assumed to be attributable to a special one-time product return from the Norwegian market, just like in Q3-23. The product returns in Norway are not desirable, but we expect returns of this size to be a one-off occasion and procedures to avoid similar situations has been implemented. Hence, we expect minor differences between the gross sales and net sales going forward.

STENOCARE continued to operate with a stable cost base during Q4-23, where the total operating expenses, including depreciation, amounted to DKK -5.1m compared to DKK -6m in the same period last year. However, it should be noted that STENOCARE’s COGS are included in the operating expenses, which is anticipated to have been higher in Q4-22 due to the higher net sales. Nevertheless, the operating expenses were lower than our estimates, resulting in an operating result in line with our expectations, despite the lower sales.

TO1 and Directed Rights Issue Strengthened the Cash Position

In December, STENOCARE strengthened the company’s cash position through the exercise of TO1 warrants, issued in connection with the unit rights issue in May/June 2023. A total of 76.7% or 1,313,601 warrants were subscribed at a price of DKK 2.11 per share, which added approximately DKK 2.8m in gross proceeds to STENOCARE. Moreover, the Board of Directors of STENOCARE resolved on a directed rights issue to the existing shareholder HHTM ApS, represented by its sole shareholder, Henrik Elbæk Pedersen. Later, two of STENOCARE’s founders joined the directed issue at DKK 2.25 instead of exercising their TO1 warrants at DKK 2.11. Hence, the directed issue consisted of a total of 1,968,590 new shares at DKK 2.25 per new share, which strengthened STENOCARE’s cash position with approximately DKK 4.4m before transaction related costs. The issuance resulted in a dilution of approximately 11.5% for the existing shareholders. Prior to the directed issue, HHTM ApS held 175,000 shares, corresponding to 1.2% of the total number of shares. After acquiring 196,000 shares through exercising TO1 warrants and 1,900,000 shares through the directed issue, HHTM ApS owns 2,271,000 shares in STENOCARE, which corresponds to 12.4% of the shares and makes Henrik Elbæk Pedersen the second largest shareholder in STENOCARE.

In connection with STENOCARE’s Q3-report, we highlighted the importance of the capital injection from the warrants of series TO1 to address the company’s capital needs during 2024, towards the anticipated break-even by the end of 2024. With the addition of DKK 2.8m from the series TO1 warrants and DKK 4.4m from the directed share issue, before transaction costs, Analyst Group estimates that STENOCARE is funded until positive cash flow which is expected to be achieved at the end of 2024. However, the dilution effect for existing investors, as mentioned, amounts to approximately 11.5%, and for investors who chose not to subscribe to series TO1 warrants, the total dilution effect, including the directed share issue, is approximately 18%. However, Analyst Group believes that the fact that two of the company’s founders chose to participate in the directed share issue at a subscription price of DKK 2.25 rather than subscribing to series TO1 options at a price of DKK 2.11 demonstrates confidence in the company and instills trust.

As a result of the capital injections, the cash position amounted to DKK 9.5m at the end of Q4-23 while the convertible debt instruments amounted to DKK 8.3m. After the end of the period, STENOCARE reached a refinancing agreement which included partial repayment, renegotiation and/or prolongation. As a result, the total debt remaining on the balance sheet amounts to DKK 5.4m, why repayment is estimated to have amounted to DKK 2.9m, affecting the cash position to amount to DKK 6.6m. Based on an estimated burn rate of DKK -0.7m per month, STENOCARE would be financed until September 2024, based on the estimated cash position at the end of December, everything else equal.

However, STENOCARE is expected to strengthen the growth in 2024, resulting in a lower burn rate throughout the year. Moreover, STENOCARE could strengthen the company’s cash position through exercise of warrants of series TO2 in June. All in all, Analyst Group estimates, after the capital injection from TO1 and directed issue, refinancing agreement, and estimated sales growth in 2024, that the current cash position will be enough to reach the anticipated break even at the end of 2024.

To summarize, STENOCARE delivered results closely in line with our estimates. We still see several strong value drivers in 2024, including growth in Europe’s largest market Germany, where STENOCARE delivered the company’s first products in Q4, growth in the vast Australian market where a new product has been introduced and continued patient growth in Denmark. Moreover, STENOCARE’s balance sheet has been strengthened through a capital injection and refinancing of debt, where Analyst Group estimates that the current cash position will be enough towards the estimated break even at the end of 2024.

We will return with an updated equity research report of STENOCARE.