STENOCARE A/S (STENOCARE or the “Company”) published on October 22nd the Company’s Q3-report for 2025. The following are some key points that we have chosen to highlight in connection with the report:

- The growth trend continued – net sales increased 11% Q-Q

- Astrum 10-10 oil is being prescribed to patients in Germany

- Reaches positive EBITDA for the second consecutive quarter

- Positive operating cash flow

Continued Sales Momentum

Q3-25 marked another strong quarter for STENOCARE, where net sales amounted to DKK 1.9m, corresponding to a growth of 11% Q-Q. The third quarter last year was negatively affected by returns of expired products, leading to net sales amounting to DKK -0.9m, why net sales grew by DKK 2.8m in Q3-25. Excluding the expired products, gross sales amounted to DKK 1.1m in the comparison period, why the Q3-25 net sales marks a 71% growth compared to gross sales in Q3-24.

The growth points towards that the special situation with a competing magistral product being supported with 85% patient subsidy from the Danish Medicines Agency compared to STENOCARE’s 50%, that affected sales in H2-24, has been solved and market data suggests that STENOCARE has gained market share in Denmark during 2025, Denmark is assumed to be the main contributor to the growth in the last quarters. When comparing to Q3-24, it should also be noted that STENOCARE are using a new more conservative revenue recognition method, where revenues is now recognized when products are sold to the end-user. Previously, revenue was recognized when products were sold to distributors.

In terms of products, STENOCARE’s THC/CBD oil product, which has been available since Q2-24, and the new CBD100 oil product, which has been available since the end of Q1-25, are assumed to be the main drivers of the growth.

As Analyst Group has previously stated, the Company’s premium product, Astrum 10-10 oil, is viewed as a key growth driver throughout the coming years. The product differentiates STENOCARE as a first mover in the next generation of medical cannabis, providing improved, uniform, and faster uptake in the bloodstream. Astrum oil became available to patients in three countries during Q1-25: Germany, Australia, and Norway. The product is currently being prescribed to patients in Germany, where STENOCARE’s local partners are actively working to educate the market about its advantages. However, Astrum oil is not yet assumed to have contributed significantly to sales growth in 2025. The introduction of new products typically takes time, as the European medical cannabis market remains relatively young, and both the market and prescribing physicians require further education on the products’ benefits — an area in which STENOCARE is actively engaged.

Nevertheless, the product is now gaining traction, and STENOCARE has received encouraging feedback from the market. We therefore expect a gradual increase in sales over the coming periods, which, together with the strong momentum in Denmark, provides favorable conditions for continued growth in 2026.

Positive EBITDA result and Operating Cash Flow

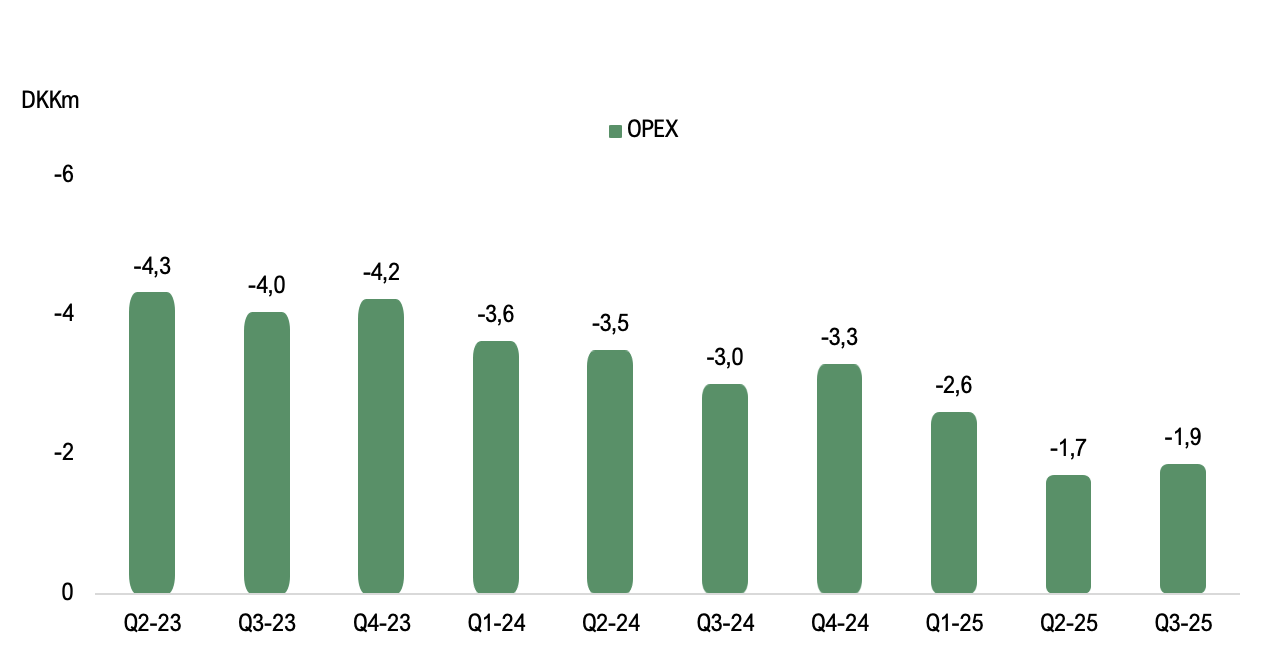

For the second consecutive quarter, STENOCARE reported a positive EBITDA result, amounting to DKK 60k, compared to DKK 20k during Q2-25 and DKK -3.6m during Q3-24. The positive EBITDA is driven by strong sales growth combined with a significant cost reduction, achieved through the new STENOCARE 3.0 strategy, under which the Company has repositioned itself as a trading and product development business for medical cannabis and consequently exited its cultivation activities. Through the updated strategy, operating expenses decreased by -38% during Q3-25, amounting to DKK 1.9m (3.0). It should also be mentioned that cost of goods sold (COGS) is included in the operating expenses, which is assumed to have grown Y-Y in line with the sales growth, suggesting that the underlying cost reduction is even greater than the reported 38% decline. The cash flow from operations amounted to DKK 0.06m (-1.9), in line with the improved result.

Stable Cash Position

The cash position at the end of Q3-25 amounted to DKK 4.5m, which can be compared to DKK 4.9m at the end of Q2-25, where the negative cash flow of DKK -0.4m is entirely attributable to repayment of STENOCARE’s convertible debt. From July 2025, the convertible debt, originally amounting to DKK 2.8m (DKK 2.4m at the end of Q3-25), will be repaid in equal monthly instalments over 18 months, corresponding to approximately DKK 0.16m per month. The loan also carries the option to be converted into shares at a price of DKK 4.29 per share.

In light of this obligation and the current cash position, maintaining the sales momentum and cost control is considered essential to achieving positive cash flow, which Analyst Group expects to be supported by continued growth in Denmark and the previous launch of Astrum oil in three additional markets during Q1-25.

However, continued growth could come at a cost, both in terms of marketing investments, such as ongoing education of the industry, and increased working capital, which, in addition to a slower growth rate, could have a negative impact on cash flow. STENOCARE is now considered to be in a position where the Company can choose to accelerate or hold back on investments depending on market opportunities and available capital. Given this, as well as the expected amortization of the loan, it cannot be ruled out that STENOCARE may require additional capital to boost the Company’s growth journey. Such a need is, however, expected to be limited and could likely be managed through, for example, raising a new loan, as the Company remains debt-free apart from the mentioned convertible debt instrument.

Strong Growth Momentum in the Australian Medical Cannabis Market…

Recently published data in Australia shows continued rapid expansion during last year, where total cannabis imports increased 77.4 tons, a 74% growth Y-Y, making it one of the fastest-growing markets globally. Like many other countries growth has been largely driven by telemedicine prescriptions. Prescription data from the Therapeutic Goods Administration (TGA) shows chronic pain as the leading indication, followed by anxiety and sleep disorders. THC-dominant products remain the most prescribed category, while CBD-based treatments are gaining traction for mental health-related conditions. STENOCARE are present in Australia with a balanced THC/CBD-oil since 2022 and during 2025, the Astrum 10-10 oil has been launched in the country. STENOCARE’s sales in Australia have progressed more slowly than initially anticipated. However, the launch of Astrum oil is expected to create new opportunities for the company to capitalize on the rapid market growth through a differentiated product offering compared to competitors.

…but Stricter Prescription Rules may Hinder Growth in the German market

Germany’s medical cannabis imports have surged to record levels in 2025, but growth may slow as the government introduces stricter prescription rules. The proposed law would limit telemedicine by requiring initial in-person consultations and uphold the ban on mail-order delivery, forcing patients to collect prescriptions at pharmacies. Authorities argue that import growth is driven by excessive online prescribing, and the reform aims to tighten control over the market. Nevertheless, STENOCARE are focusing on a pharmaceutical approach and educating doctors regarding medical cannabis and even though the overall market growth is expected to slow down, this is expected to primarily harm competitors and be an opportunity for STENOCARE to gain market share, primarily through the Astrum oil as well as focusing on a pharmaceutical approach.

Nevertheless, STENOCARE’s expansion in Germany has progressed more slowly than initially expected since entering the market in 2023, reflecting the high level of competition. However, with the Astrum oil launched in January 2025, the Company is now positioned as a first mover in the next generation of medical cannabis products. The oil’s improved consistency and faster absorption are expected to differentiate STENOCARE from competitors and serve as a key driver for renewed growth in the German market, where the product has been prescribed for patients during Q3-25.

In conclusion, Analyst Group views STENOCARE’s Q3-25 report as another confirmation of the Company’s operational momentum and successful execution of the STENOCARE 3.0 strategy. The continued growth in Denmark demonstrates sustained market demand and recovery following previous market challenges. Meanwhile, Astrum oil, launched across three international markets, is expected to become an increasingly important growth driver in 2026 as market adoption advances. Moreover, the second consecutive quarter of positive EBITDA and operating cash flow highlights the improved cost structure and scalability of the business model. With expanding international presence and a differentiated product portfolio, STENOCARE is well positioned for continued profitable growth going forward.

We will return with an updated equity research report of STENOCARE.