STENOCARE A/S (STENOCARE or the “Company”) published on August 21st the Company’s Q2-report for 2025. The following are some key points that we have chosen to highlight in connection with the report:

- Strong sales momentum in Denmark

- Astrum oil is now available in three countries

- Reaches positive EBITDA – above our expectations

- Stable cash position following capital raise

Net sales grew by 131%

STENOCARE reported net sales amounting to DKK 1.7m (0.7) during Q2-25, corresponding to a growth of 131% compared to the same period last year. The strong growth is reported despite the new more conservative revenue recognition method, where revenues is now recognized when products are sold to the end-user. Previously, revenue was recognized when products were sold to distributors. The updated accounting method is expected to minimize the risk of reversed revenue from expired products held in distributor warehouses.

The growth was driven by increased sales in Denmark of STENOCARE’s THC/CBD oil product and the new CBD100 oil product that has been available since the end of Q1-25, indicating a strong product launch. Moreover, the positive development in sales for the THC/CBD oil product suggests that earlier challenges on the Danish market has eased, where STENOCARE has met increased competition and price pressure, which was partly a result from a special situation with a competing magistral product being supported with 85% patient subsidy from the Danish Medicines Agency, compared to STENOCARE’s 50%. However, the strong growth during Q2-25 indicates that the problem has eased.

As Analyst Group has previously stated, the Company’s premium product, Astrum Oil, is viewed as a key growth driver throughout the coming years. The product differentiates STENOCARE as a first mover in the next generation of medical cannabis, providing improved, uniform, and faster uptake in the bloodstream. Astrum Oil became available to patients in three countries during Q1-25: Germany, Australia, and Norway. As sales in Q2-25 seems to have primarily been attributable to the Danish market, the Astrum oil is not expected to have contributed significant to sales in the second quarter, as market penetration is expected to take some time. Furthermore, the new revenue recognition method is expected to delay reported sales until the products are sold to patients. Hence, given the advantages with Astrum Oil, we estimate that the product will contribute to revenue growth throughout the rest of 2025.

Reports Positive EBITDA – Executes on STENOCARE 3.0

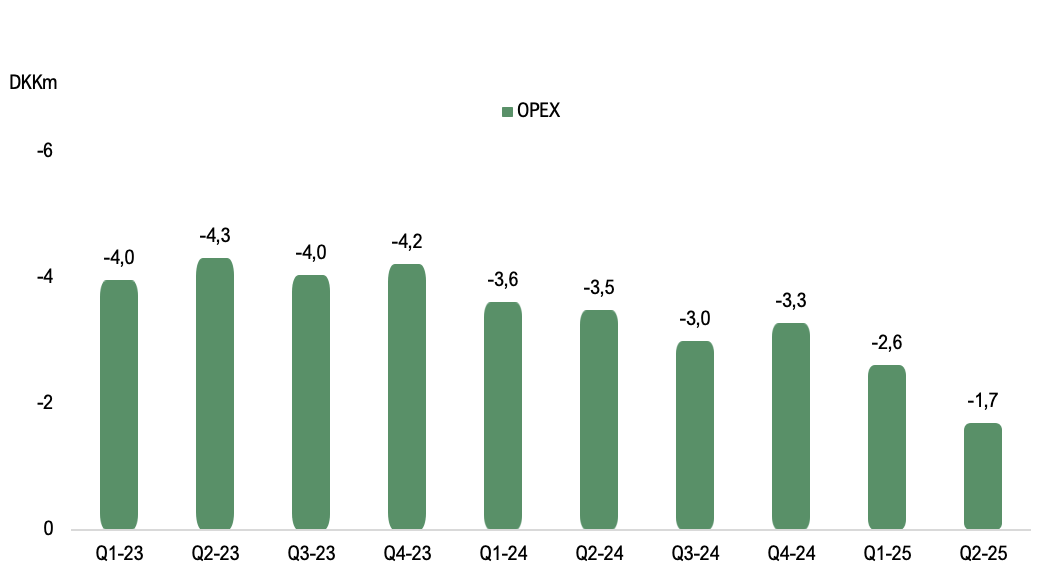

STENOCARE reached a positive EBITDA result of DKK 0.02m during Q2-25, the first quarter with positive EBITDA since Q1-19. The positive EBITDA is driven by strong sales growth combined with a significant cost reduction, achieved through the new STENOCARE 3.0 strategy, under which the Company has repositioned itself as a trading and product development business for medical cannabis and consequently exited its cultivation activities. Through the new strategy, operational expenses decreased by 51% Y-Y, amounting to DKK 1.7m (3.5). It should also be noted that STENOCARE records its cost of goods sold (COGS) under other external expenses, which are classified as operating expenses. Given the revenue growth during the quarter, we expect COGS to have increased accordingly. Adjusted for this effect, the underlying reduction in operating expenses is estimated to be even greater than the reported 51%.

Analyst Group had not estimated positive EBITDA in Q2-25, rather at the end of the year, why we view positively on the strong execution on STENOCARE 3.0 that has led to the better-than-expected result. With increased sales momentum in Denmark, Astrum Oil launched in three countries, of which two are the largest medical cannabis markets globally, and strong cost control, we view positively on STENOCARE’s ability to continue to improve profitability.

Stable Cash Position

The cash position at the end of Q2-25 amounted to DKK 4.9m compared to DKK 5.9m at the end of the last quarter. The negative cash flow of DKK 1m and discrepancy compared to the EBITDA result is almost entirely attributable to change in working capital, primarily related to increased accounts receivables, which we see as natural as the Company is growing. With the lower cost base and burn rate through the updated strategy STENOCARE 3.0, we view the current cash position as stable.

STENOCARE has a convertible debt instrument of DKK 2.8m, which has been exempt from repayment until July 2025. From that point, the loan will be repaid in equal monthly instalments over 18 months, corresponding to DKK 0.16m per month, thereby impacting cash flow in the coming quarters. The loan also carries the option to be converted into shares at a price of DKK 4.29 per share. In light of this obligation and the current cash position, maintaining strong sales momentum is considered essential to achieving positive cash flow, which Analyst Group expects to be supported by continued growth in Denmark and the previous launch of Astrum Oil in three additional markets during Q1 2025.

In summary, STENOCARE’s Q2 2025 report demonstrates strong progress, with net sales increasing by 131% despite a more conservative revenue recognition method and EBITDA turning positive for the first time since 2019. The growth was primarily driven by higher sales in Denmark, while the launch of Astrum Oil in Germany, Australia, and Norway provides additional long-term growth potential as market penetration advances. The successful execution of the STENOCARE 3.0 strategy, including a significant cost reduction and transition to a trading-based business model, has strengthened profitability faster than expected. Combined with a stable cash position and continued sales momentum, Analyst Group views positively on STENOCARE’s ability to further improve profitability and move towards sustained positive cash flow.

We will return with an updated equity research report of STENOCARE.