STENOCARE announced on May 25th, that a new medical cannabis oil product has received approval from the Federal Institute for Drugs and Medical Devices (BfArM) for prescription-based sales to German patients.

Germany will be the 6th market with products approved from STENOCARE, on the road to the company’s target of entering 8-10 markets by 2025. Given STENOCARE’s track record, with products approved in six countries, of which four have been entered during 2022 and 2023, we see a good potential that the company will reach this goal and continue the geographical expansion, hence get access to a larger patient population which is expected to drive the sales growth going forward. Furthermore, STENOCARE has proven that different kinds of markets can be entered; fully legalized (UK, Australia and Germany), pilot programs (Denmark) as well as not legalized markets (Sweden, Norway), which implies that any market is a potential market for STENOCARE.

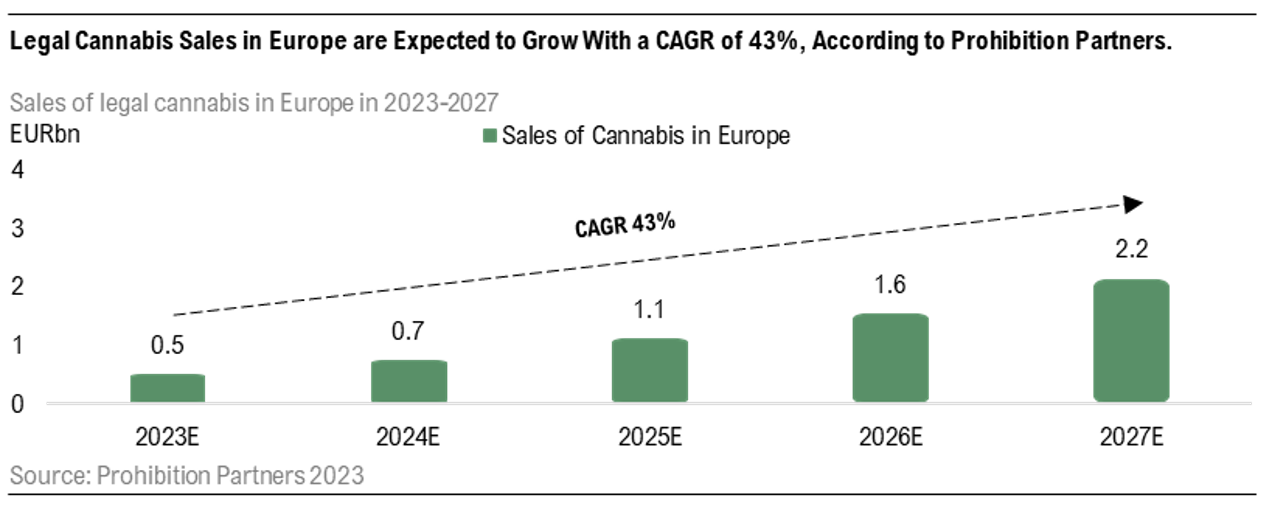

The German market for medical cannabis is by far the largest in Europe, with over 200,000 patients being treated with projected sales of EUR 1bn by 2027. This can be compared to the entire European market, where the total sales are expected to reach sales of EUR 2.2bn by 2027, thus the German market is expected to stand for almost half of the total sales on the European market, showcasing the potential of the market. Moreover, Germany is set to launch a pilot program regarding cannabis for recreational use, meaning allowance for people to cultivate cannabis at home or in social clubs and also allow pilot shops to sell recreational cannabis. Although this is not a market that STENOCARE addresses, Analyst Group believes this will have an impact on the general acceptance for the use of cannabis, which will also affect the medical cannabis market. In our recent equity research reports, we have argued that an important factor for STENOCARE’s future growth will be to convince doctors of the benefits with medical cannabis and improve the acceptance for cannabis as a medicine. A pilot program for recreational use is expected to be a driver of this acceptance, leading to more prescriptions of medical cannabis, especially in Germany.

As Germany is the most mature market for medical cannabis in Europe, this entails more competition. STENOCARE’s competitive advantage is expected to be that the company’s product on the German market will be reimbursed by insurance companies, which is not the case for all products. This allows more patients to get access to the product as medical cannabis can be an expensive investment for a patient suffering from chronic pain, multiple sclerosis, or epilepsy, why a reimbursement further supports the incentives for patients to use medical cannabis oils. The reimbursements are expected to entail a strong position for STENOCARE on the German market, which we estimate will have an impact on 2023’s figures, as it is expected that the new product will be available for patients during August 2023.

How Analyst Group sees STENOCARE as an investment.

After entering three new markets in 2022, STENOCARE delivered products to a total of five countries during Q4-22, leading to net sales amounting to DKK 2.8m. This is the best revenues presented since Q1-19, before the resolved issues with STENOCARE’s former supplier, CannTrust, started. The Company now has 10 products approved in six countries, after entering Germany during 2023, and are expected to continue the geographical expansion. Operating on a market with strong expected growth due to further deregulations throughout Europe, Analyst Group believes that the Company is in a great position to deliver strong revenue growth going forward.