STENOCARE announced on Monday, January 9th, that products were delivered to its five markets during Q4-22, corresponding to net sales of DKK 2.8m.

During the first days of 2023, STENOCARE announced that a new CBD oil was delivered and available for patients in Denmark, as well as the first delivery of three products in Norway. On January 9th, STENOCARE announced that the company has delivered products to five markets during Q4-22, reaching net sales of DKK 2.8m in the same period. This means that net sales for the full year 2022 amounted to DKK 4.4m, closely in line with Analyst Group’s estimated net sales of DKK 4.8m. With 11 approved products in five markets, Analyst Group believes STENOCARE is in a great position to deliver strong revenue growth going forward.

We see good potential regarding the company reaching our estimated sales of DKK 20.8 in 2023, driven by growth in prescriptions from doctors, which is expected to happen due to the advantages that medical cannabis oil products have compared to alternative solutions, like opiates. Furthermore, the medical cannabis industry in Europe has an exciting 2023 ahead, with Germany’s potential legalization of recreational use as a potential highlight. Even though this is not something STENOCARE can capitalize on directly, as the company only deliver products for medical use, we see this as a driver for more countries to ease regulations for medical use, creating overall growth in the European medical cannabis market.

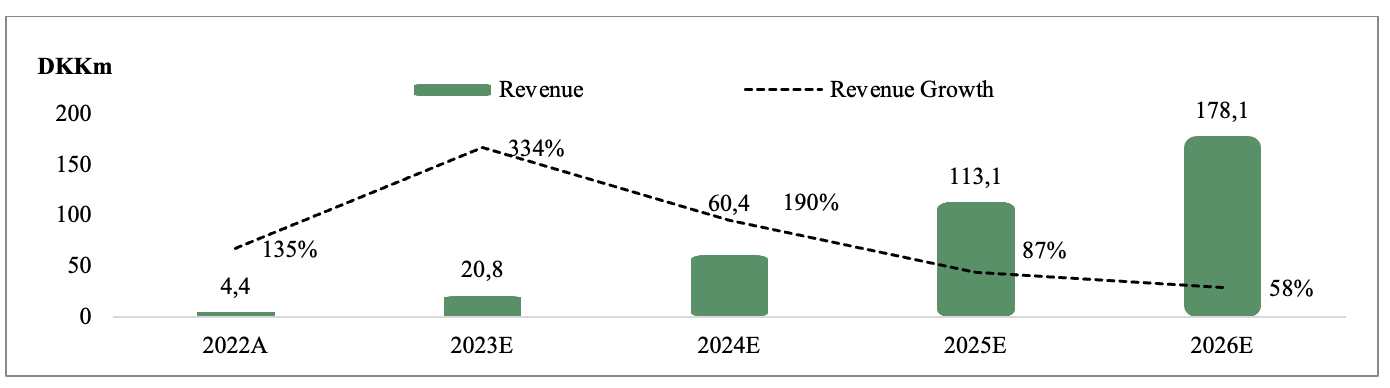

Below is a summary of our revenue forecast for STENOCARE in a Base scenario.

Analyst Groups Summary of STENOCARE as an Investment Case

After several years of work ensuring a good supply chain and getting products approved on five different markets, STENOCARE is now ready to launch 11 full spectrum medical cannabis oil products in five regulated countries. Operating in an industry with strong expected growth and considering the future launch of STENOCARE’s own premium products, which are expected to have several benefits compared to competing products, Analyst Group estimates exponential revenue growth going forward. With estimated net sales of DKK 60.4m by 2024, and with an applied P/S multiple of 7x, a potential present value per share of DKK 21.4 is derived in a Base scenario.