ODI Pharma published on August 29th the company’s Q4-report for 2023/2024, which showed a continued strong momentum. The following are some key points that we have chosen to highlight in connection with the report:

- Another strong quarter – net sales amounted to SEK 7.5m (0.0)

- Continued stable cost base

- Stable financial position

- Enters the Swiss market to diversify geographically

Continued Strong Momentum

The Q4-report marked another strong quarter for ODI Pharma where the net sales amounted to SEK 7.5m (0.0) in Q4-23/24, 9% above Analyst Group’s estimates of SEK 6.9m. The increased sales are assumed to be mainly attributable to, like in the previous quarter, the collaboration agreement with Synoptis Pharma and sales on the polish market. Moreover, ODI Pharma are actively seeking more European markets to diversify the geographical footprint. The collaboration agreement with Synoptis Pharma includes 23 countries in Eastern Europe, why Analyst Group believes that there are still strong growth opportunities within the framework of the collaboration. Additionally, ODI Pharma completed a first product delivery to the Swiss market at the end of the fourth quarter, which is considered a strategically important milestone. Therefore, Analyst Group believes there is still ample room for growth, both through increased sales in the Polish market and through geographic expansion. The company’s competitive advantage is assumed to be Synoptis strong brand in Eastern Europe, where we expect Synoptis to sell the products under its own brand. Doctors and patients in Poland are anticipated to prioritize a well-known local brand over other international brands, especially as the pricing for the products is expected to be similar.

The gross margin, adjusted for other operating income, amounted to 20.1%, in line with our expectations of 20.5%. The operating expenses, excluding depreciation, amounted to SEK 2.7m (1.9), corresponding to an increase of 44%. The operating expenses was affected by a one-off cost of SEK 0.35m related to the sale of the Kandol brand which occurred in December 2023. Adjusted for this one-off cost, the operating expenses amounted to SEK 2.3m, corresponding to an increase of 25%. The increased cost base is assumed to be attributable to shipping costs for the products sold. Nevertheless, Analyst Group reiterates the view of ODI Pharma’s scalable business model, where operating costs can be kept low even with a rapid increase in sales. Moreover, the business model is asset light with limited or no investments needed, which is expected to lead to a good cash conversion ratio.

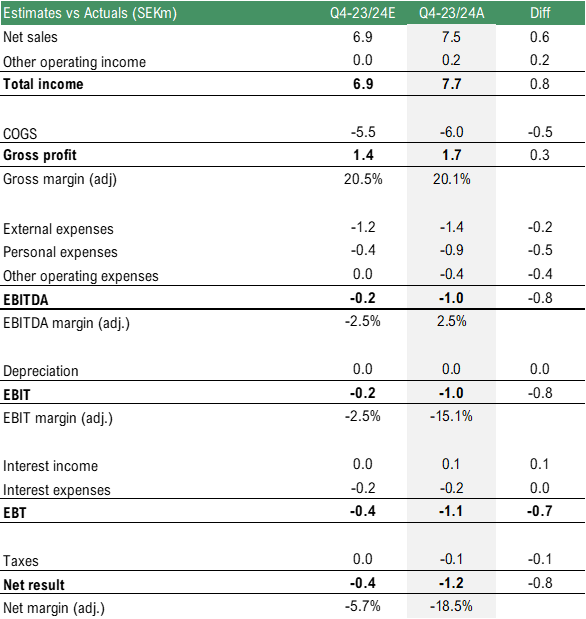

Adjusted for the one-off cost of SEK 0.35m, the EBIT result amounted to amounted to SEK -0.6m. With the scalable business model, we expect the estimated sales growth to lead to improved and positive results going forward, in combination with a good cash conversion ratio. Below is a summary of the quarterly results and a comparison with our estimates.

Stable Financial Position

The cash position at the end of the quarter amounted to SEK 2.6m, compared to SEK 5.9m at the end of the previous quarter. The cash flow during Q4-23/24 was affected by a negative development in net working capital of SEK 4.2m. Given that we estimate a positive result and cash flow in the upcoming fiscal year, in combination with the asset light business model with no estimated investments needed, we see ODI Pharma’s financial position as solid. Additionally, the company has no long-term debt on the balance sheet, which allows for financing through loans if needed.

New Strategic Market Entry to Switzerland

At the end of the quarter, ODI Pharma announced that the company has completed a first delivery of products to the Swiss market, a new market for ODI Pharma. The delivery is the first one outside of the collaboration agreement with Synoptis Pharma, which includes 23 countries in Eastern Europe, why it marks an important strategic milestone for ODI Pharma and in line with the company’s goal to widen the company’s market footprint and adapt to changing market dynamics. Analyst Group views positively on the entry to the Swiss market which marks a first step in this direction to increase revenue diversification and hence the reliance on the agreement with Synoptis.

To summarize, Analyst Group sees the results as further proof of concept regarding the collaboration with Synoptis as a game changer for ODI Pharma in terms of scaling up sales and commercializing the company’s products. We expect the scale up to continue throughout the upcoming fiscal year, thus resulting in substantial growth, further supported by geographical expansion, with a positive result and cash flow because of the scalable and asset light business model.

We will return with an updated equity research report of ODI Pharma.