Huddlestock published on February the 22nd, the company’s quarterly report for the fourth quarter 2023. The following are some key financial metrics that we have chosen to highlight in connection with the report:

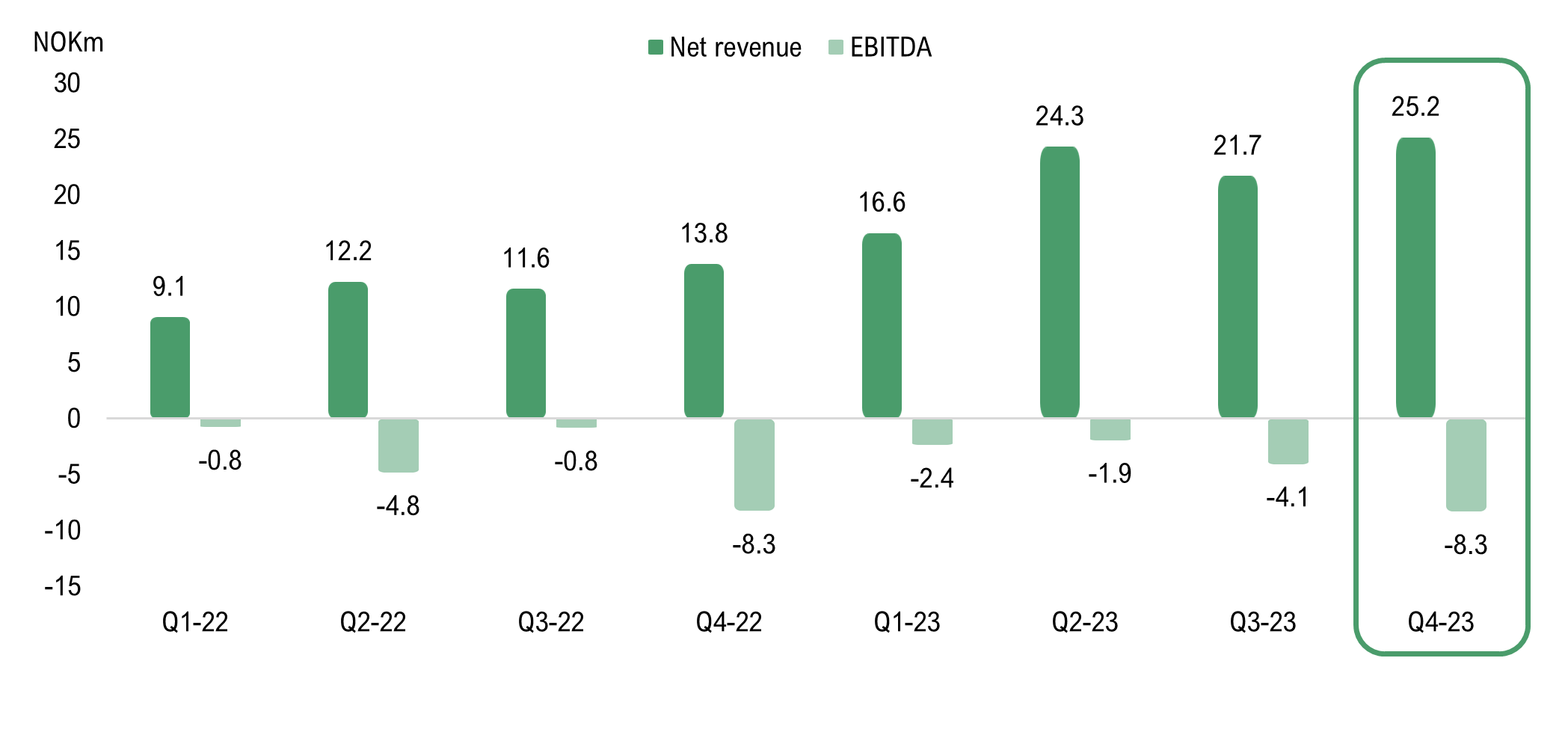

- Net Revenue amounted to NOK 25.2M (13.8) during Q4-23

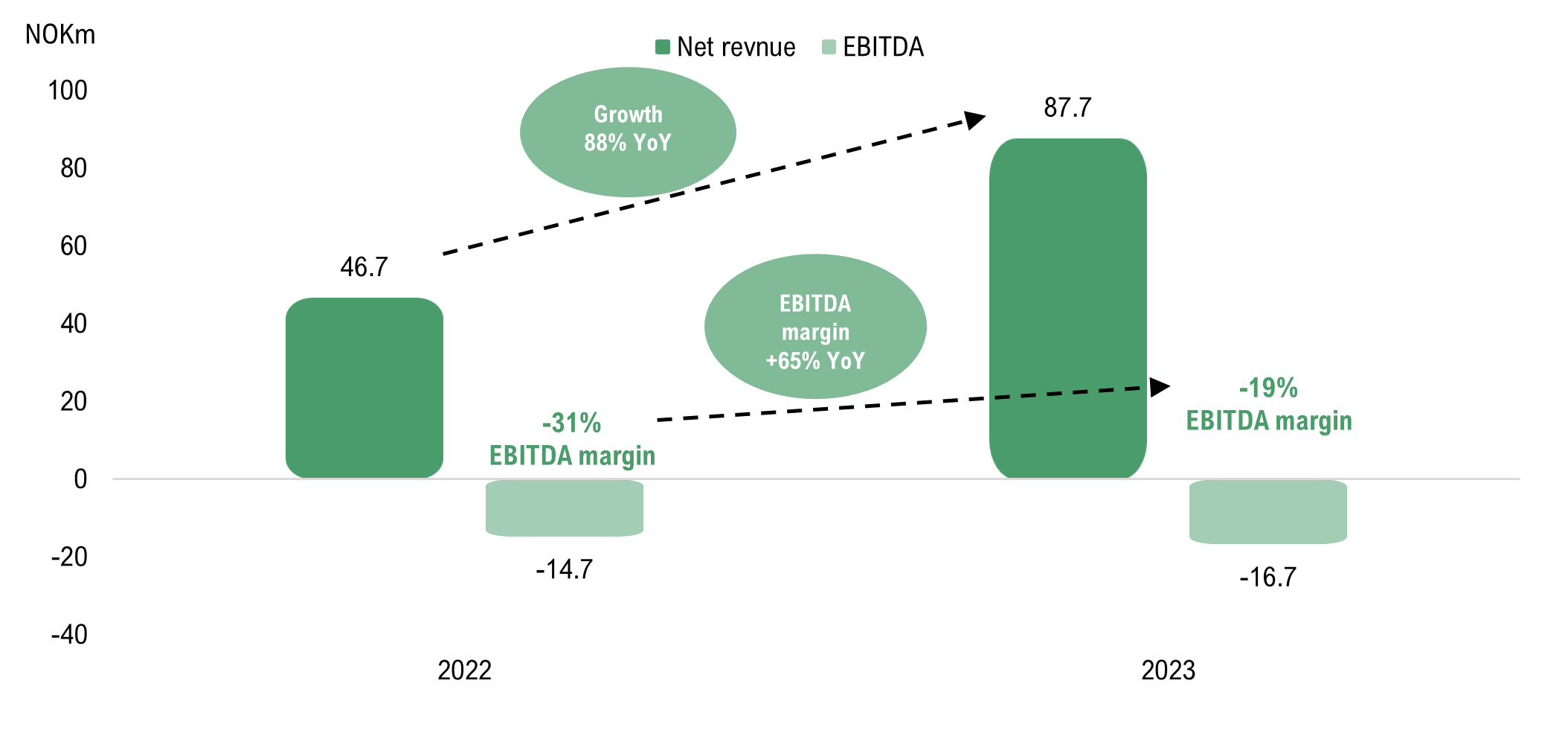

- Net Revenue growth of 88% during the full year 2023

- Demonstrates a strong value proposition

- Improved EBITDA margin

Net Revenue Growth of 88% YoY During the Full Year of 2023

During the fourth quarter of 2023, Huddlestock’s net revenue amounted to NOK 25.2M (13.8), representing a growth of 82% YoY. Revenues for the corresponding period of the previous year (Q4-22) were NOK 13.8M, however the YoY revenue increase is primarily attributed to Huddlestock’s acquisitions of Tracs Group, Dtech, and Bricknode, which have been consolidated since Q2-23 and are thus not included in the comparison period. Therefore, the previous quarter (Q3-23) provides a more accurate comparison, despite seasonal effects within the Professional service division, as net revenues amounted to NOK 21.7M, resulting in a 16% QoQ revenue growth for the fourth quarter.

Huddlestock’s revenues are derived from the Company’s technological offering, consisting of recurring revenues from Investment-as-a-Service, and from the Professional service division, comprising consultancy revenues from the subsidiary Visigon. During the fourth quarter, Huddlestock’s revenues from the technological business division amounted to NOK 10.7M (2.7), thus growing by 294% YoY and 4% QoQ. Huddlestock’s revenues from the technological offering consist of recurring revenues, such as monthly licenses, Assets under Management (AuM), and transaction fees, hence, ARR can be estimated to be close to NOK 25M. Consequently, the recurring revenues from the Technological business division accounted for 42% of the total revenues during the quarter, in line with Analyst Group’s expectations.

In Q4-23, revenues from the Professional business division (Visigon) amounted to NOK 14M (10.2), representing a 37% YoY increase and 67% QoQ increase. Despite the QoQ increase partly explained by seasonal effects, revenues from Visigon were the highest recorded for a quarter, indicating high utilization and activity within the Professional business division. Additionally, Huddlestock divested Huddlestock Solutions, formerly F5 IT AS, carried out through a management buyout, completed at the end of November. The divestment was aimed at maintaining Huddlestock’s sharp focus on its core activity, being an Investment-as-a-Service offering, however, it still entails a financial impact, which Huddlestock managed to compensate through high activity during the quarter.

Looking at the full year 2023, Huddlestock’s consolidated revenues amounted to NOK 87.7M (46.7), representing a high growth of 88%. The revenue increase is primarily attributed to acquisitions, but revenue growth has also been driven by new customers, as well as expansion among Huddlestock’s existing customers within the Technology business division, and extended new mandates within the Professional service division. The full-year revenues constitute a strong performance, considering the divestment of Huddlestock Solutions in November, and are slightly below Analyst Group’s earlier estimate of NOK 92.6M. The recurring revenues (Pro forma) from the Technological business division for the full year 2023 amounted to NOK 41.9M (7.4), representing an annual increase of 566%. Revenues from the Professional service division (Visigon) amounted to NOK 44.1M (37), representing an annual increase of 19%.

Demonstrates a Strong Value Proposition and Enhances Prospects Going Forward

During the fourth quarter, Huddlestock has delivered on the company’s previously communicated focus and pipeline, wherein the company signed an agreement with Norse, who selected Huddlestock’s Investment-as-a-Service for the digitalization of project financing & customer onboarding. Norse is a part of Norse Gruppen, whose main businesses include securities trading, corporate finance, fund management, and real estate. Norse has chosen Huddlestock’s core broker technology to enable the digitalization of Norse’s project financing and customer onboarding within the customer’s Corporate Finance business. Revenues are of a recurring nature, based on a combination of license fees and basis points (BPS) of Assets under Management (AuM).

After the end of the quarter, in early January, Huddlestock announced that the company has signed a Letter of Intent (LOI) with Germany-based AVL Finanzvermittlung Beteiligungen (AVL), which we previously commented on here. The purpose of the LOI is to establish cooperation between Huddlestock and AVL to offer trading in all types of financial instruments, initially planned for the German market.

Additionally, after the end of the quarter, Huddlestock has extended the agreement with the company’s existing client Garantum Wealth Management, where Garantum also expands the agreement with Huddlestock to now include fund trading.

The agreement with Norse during the quarter, along with the LOI with AVL and the extended collaboration with Garantum after the end of the quarter, confirms Huddlestock’s strong value proposition and strengthens the company’s position, as well as the prospects, within Investment-as-a-Service.

Within Huddlestock’s operations in the Professional business division, which consists of consultancy assignments within the financial sector through the subsidiary Visigon, Huddelstock states in the interim report that Visigon has shown strong development during the year 2023. The strong development and high activity are evident in Visigon’s revenues amounting to NOK 51M, where the subsidiary also demonstrates a positive EBITDA margin of 13%. Going forward, Huddlestock also guides that the prospects within the Professional Business Division look stable for the year 2024, noting that Visigon’s mandates in consulting are relatively long-term, which increases the visibility and stability of revenues.

Improved EBITDA Margin of 65% YoY (Full year 2023)

During the fourth quarter of 2023, Huddlestock’s total operating expenses (including cost of materials/subcontractors) amounted to NOK 33.5M (20.7), compared to the previous quarter (Q3-23) of NOK 25.7M. Breaking down Huddlestock’s total operating expenses, it shows that the company’s personnel costs amounted to NOK 18.6M, representing a decrease of approximately NOK 3M compared to the previous quarter, while the company’s other operating expenses have increased by approximately NOK 12M, primarily expected to be explained by one-time costs related to the company’s acquisition activities during the year 2023. As a result, the EBITDA for the fourth quarter of 2023 amounted to NOK -8.3M (-8.3), in line with the previous year and Analyst Group’s expectations.

Looking at the full year of 2023, Huddlestock’s total operating expenses (incl. cost of materials/subcontractors) amounted to NOK 104.5M (61), representing an increase of NOK 43M in absolute terms, explained by Huddlestock’s acquisition of several companies and thus inheriting their cost structures. However, we can ascertain that Huddlestock’s total cost base has increased at a lower rate than its revenues, indicating that the company has successfully implemented cost synergies. The EBITDA result for the full year of 2023 amounted to NOK -16.7M (-14.7), corresponding to an EBITDA margin of -19%, compared to the previous year’s EBITDA margin of -31%, signifying that Huddlestock has improved its EBITDA margin by approximately 65%. With a high level of acquisition activity during the year 2023, Huddlestock has acquired Goodwill, which is amortized and increases the financial item of depreciation and amortization during the year 2023. Consequently, Huddlestock’s EBIT result amounts to NOK -79M (-30), where depreciation and amortization increased by NOK 48M during the year 2023 due to the amortization of developed technologies and goodwill from acquired companies. Overall, Analyst Group believes that Huddlestock has successfully implemented cost synergies and maintained stable cost control, evident in the fact that while Huddlestock increased the company’s revenues by 88%, the company’s cost base increased by 70% during the full year of 2023. Additionally, Analyst Group wants to emphasize that we estimate continued cost-saving measures expected to take further effect during the first half of 2024.

Huddlestock continues to maintain a strong focus on profitable growth, estimated to be achieved by building and executing on the company’s pipeline of profitable products, increasing internal efficiency, enhancing cost control, and increasing profitable revenues in the short term. Despite the increase in total operating expenses during the fourth quarter of 2023, we can see the company reducing personnel costs, indicating a decreased cost base adjusted for one-time costs during the quarter. During the year 2023, Huddlestock communicated both the high priority of increasing cost control and the goal of achieving a positive EBITDA and positive cash flow in 2024. As previously mentioned, Huddlestock has successfully implemented cost synergies, but Analyst Group assesses that the full effect of the cost savings has not yet been achieved and is expected to have a greater impact during 2024.

Financial Position

At the end of Q4-23, Huddlestock’s cash and equivalents amounted to NOK 9.7M, compared to NOK 6.5M at the end of September (Q3-23), representing an increase in net cash and equivalents of NOK 3.2M. The increase in cash and equivalents is explained by Huddlestock successfully completing a private placement of NOK 17.5M during the quarter. The capital raise was conducted to strengthen Huddlestock’s working capital and support the company’s growth opportunities in Germany, as well as expedite sales and onboarding activities related to new customers in the Nordic region. Regarding the net cash flow from operating activities from continuing operations, it amounted to NOK -16.6M for the full year of 2023, equivalent to an operational burn rate of approximately NOK 1.4M per month over the period. This operational burn rate can be compared to the first half of 2023 (Q1-Q2 2023), when the operational burn rate was approximately NOK 1.9M per month, indicating a significantly lower operational burn rate during the second half of 2023. Additionally, Huddlestock announces that one of the company’s key priorities going forward is to explore and identify long-term financing partners to support Huddlestock’s strategy and to maximize execution on the company’s strong position and product offering, which also includes potential non-organic growth, i.e., further acquisition activities.

In conclusion, Huddlestock has reported a quarter, and year, with high activity and strengthened market outlooks. It is clear that Huddlestock delivers total revenues of NOK 88M, driven by both acquired and organic growth. Huddlestock has developed in line with Analyst Group’s expectations for the full year 2023, demonstrating high business activity, with a new agreement with Norse during the quarter, as well as an LOI with AVL and an expanded collaboration with Garantum. Huddlestock has thereby strengthened its prospects as a B2B Investment-as-a-Service provider in the European market and also guides for stable prospects within the Professional Business Division. Additionally, Leif Arnold Thomas has assumed the role of the company’s new CEO as the company enters the next phase, aiming for profitable growth. Depreciations and other operating expenses were higher than in previous quarters, partly expected to consist of one-time items, as the quarter marks the first with Leif Arnold Thomas as the group’s new CEO. Therefore, Leif Arnold Thomas is expected to have made necessary write-downs during the quarter to clean up the balance sheet, which is common practice and viewed positively by Analyst Group in building a strong position to achieve profitable growth going forward.

We will return with an updated equity research report of Huddlestock.