Huddlestock published on November 23, the company’s quarterly report for the third quarter 2023. The following are some key financial metrics that we have chosen to highlight in connection with the report:

- Net Revenue Amounted to NOK 21.7M (11.6)

- Strong value drivers going forward

- Improved EBITDA margin of 32% YoY

- Successful private placing

Net Revenue Growth of 87% YoY in the Third Quarter

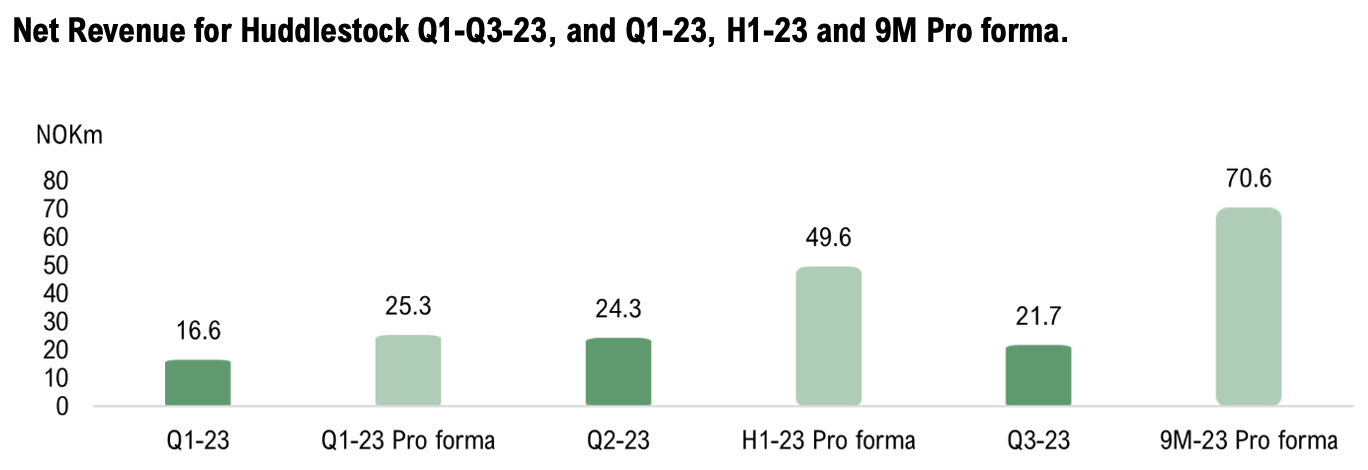

During the third quarter of 2023, net revenues amounted to NOK 21.7M (11.6), representing an 87% YoY growth compared to the same quarter the previous year. This increase in revenue amounts to approximately NOK 10.1M in absolute terms YoY. The revenue increase is attributed partly to Huddlestock’s acquisitions of Tracs Group, Dtech, and Bricknode, which were successfully consolidated during Q2-23 and is thus not included in the comparative figure of Q2-22. Additionally, revenue growth has been driven by new customers, as well as expansion among Huddlestock’s existing customers within the Technology business division, and extended new mandates within the Professional Service Division. During the previous quarter (Q2-23), net revenue amounted to NOK 24.3M, reflecting a QoQ decrease of 11%. The QoQ revenue decline is explained by a seasonal effect within the Professional Service Division. For the first nine months of 2023 (Q1-Q3), Huddlestock’s consolidated revenues reached NOK 62.6M (32.9), corresponding to a growth of 90%. While the proforma revenue, incorporating the acquired companies Tracs Group, Dtech, and Bricknode from the beginning of the year, the net revenue amounts to NOK 70.6M (45.4), corresponding to a proforma growth of 56%.

Huddlestock’s revenue mix comprises recurring revenue from the company’s technological Business Division and income from projects within the Professional Service Division. During the third quarter of 2023, recurring revenues amount to NOK 10.1M (2.5), reflecting an impressive growth of 313%. In comparison to the preceding quarter (Q2-23), which constitutes a more representative benchmark due to acquisitions in 2023, recurring revenues have increased by 5.4% QoQ, which amounted to NOK 9.6M. The company’s recurring revenues generates from various recurring fees, such as monthly licenses, Assets under Management (AuM), and transaction fees, indicating that Huddlestock has secure and stable recurring revenues that simultaneously grow with its customers. While Huddlestock does not explicitly disclose specific SaaS metrics such as ARR, NRR, or GRR, Analyst Group assumes a very low churn rate, attributed to the high MOAT and business-critical services Huddlestock provides. Recurring revenues for the third quarter correspond to an ARR exceeding NOK 40M, and the company’s modular offering indicate an NRR exceeding 100%. During the third quarter, recurring revenues accounted for 47% of the group’s total revenues, marking an increase from 40% in the previous quarter. Summing up the first nine months of 2023 (Q1-Q3), recurring revenues amount to NOK 29.2M (4.7), demonstrating a high growth of 620%.

The revenues from the Professional Service Division are derived from consulting income within the financial market, where the company has clients such as SEB, Nordea, and the Danish central bank, to name a few. During the quarter, the business segment extended current mandates and secured new ones, with the company guiding towards a stable outlook, indicating a high utilization rate by the end of 2023 and into 2024. In the third quarter, revenues from the Professional Service Division amount to approximately NOK 11.5M (9.1), reflecting a growth of 26%. However, QoQ revenues have decreased by 21%, a decline attributed to seasonal effects, making the comparison less indicative of the overall performance.

High Business Activity and Strong Value Drivers Going Forward

After the quarter’s end, Huddlestock has demonstrated high business activity and strong momentum, signing two new clients in the month of October within the company’s technological Business Division, Investment-as-a-Service, as commented on here. The clients are within Wealth and Asset Management and Corporate Finance, consisting of Tind Asset Management and Norse Securities, showcasing the broad application of Huddlestock’s products and services within Investment-as-a-Service, and suggesting greater potential within the entire financial markets. Additionally, Huddlestock entered into a strategic partnership agreement with the Norwegian Block Exchange (NBX), where Huddlestock’s platform will provide investors access to various markets from traditional stocks to tokenized assets, while NBX’s secure digital asset exchange platform offers a safe and efficient way to trade digital assets.

Furthermore, in conjunction with the company’s conference call, Huddlestock reports having a strong pipeline of new prospects within Investment-as-a-Service, with significant prospects in the German, Norwegian, and Swedish markets. Despite high business activity during the initial months of Q4-23, Analyst Group assesses that Huddlestock has a good opportunity to continue delivering new deals, despite sales having a generally long sales cycle nature. Investment-as-a-Service and the growth opportunities the company has within this segment, especially in the German and Nordic markets, constitute clear and strong value drivers going forward.

Improved EBITDA Margin of 32% YoY (Consolidated 9M 2023)

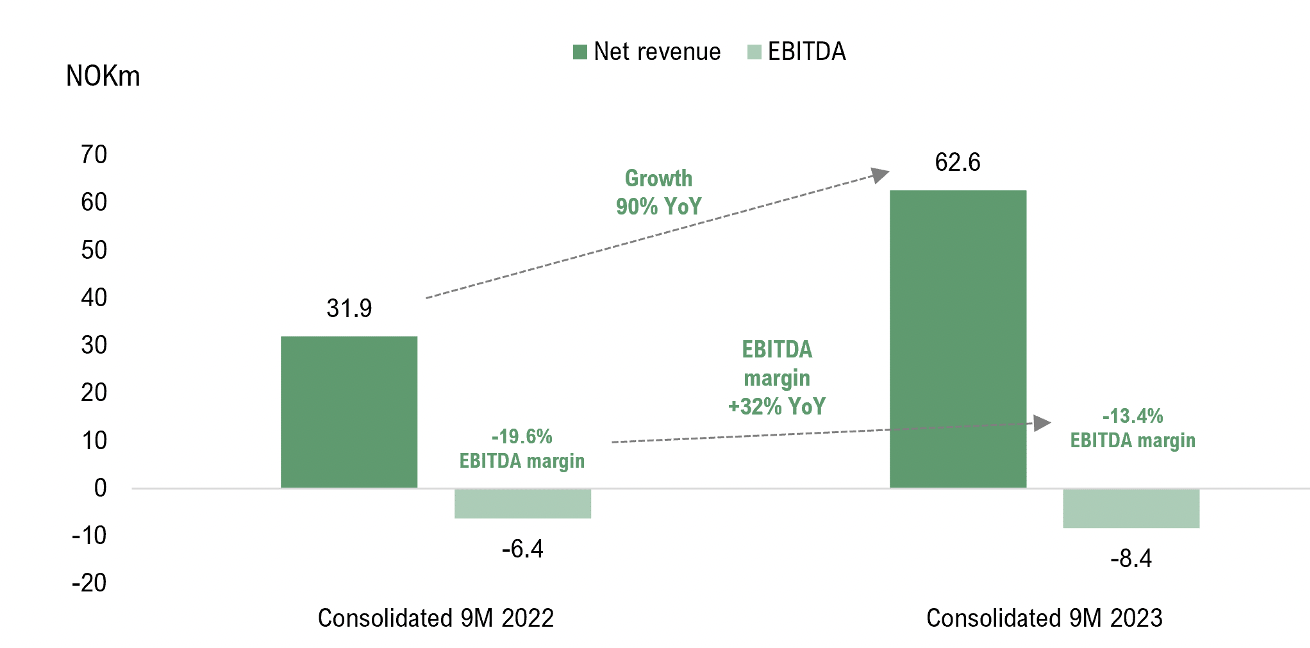

Considering the total operating expenses (incl. cost of materials/subcontractors), these amounted to NOK 25.7M (12.4) during the third quarter of 2023. In the preceding quarter, the total operating expenses amounted to NOK 26.2M, representing a decrease of NOK 0.5M and in comparison, to proforma Q1-23 (31.3) the decrease amounts to NOK 5.5M. Huddlestock has continued to demonstrate effective cost control and execution of previously stated cost synergies since the acquisitions were completed. The consolidated EBITDA result during the third quarter amounted to NOK -4.1M (-0.8), indicating an increased EBITDA loss of NOK -3.0M YoY. The consolidated EBIT result for the quarter amounted to NOK -20.1M (4.4), where the increase in depreciation and amortization is particularly explained by accounting write-downs from the acquisitions, having no impact on the company’s cash flow.

Looking at the nine-month period in 2023 (Q1-Q3), the consolidated EBITDA result amounted to NOK -8.4M (-6.4), corresponding to an EBITDA margin of -13.4% (-19.6%). Compared to the same period the previous year, the consolidated EBITDA margin has improved by 32% YoY. However, a more accurate comparison is pro forma for the first nine months of 2023, where the EBITDA result amounted to NOK -10.5M (-8.4), corresponding to an EBITDA margin of -14.8% (-18.3%) and indicating an EBITDA margin improvement of 23% YoY.

Huddlestock has a strong focus on continuing to demonstrate high growth, while also achieving a positive EBITDA and positive cash flow in 2024. In conjunction with the report, the company highlights a roadmap to achieve a positive EBITDA result for the full year 2024. This includes, among other things, a strict focus on Investment-as-a-Service, prioritizing the most financially attractive deals, ensuring that product development deliveries support the positive EBITDA objective for 2024, and maintaining a focus on cost/benefit through effective cost control. Given that Huddlestock has already executed on several stated cost synergies from the acquisitions, with the effects of some of these synergies expected to fully materialize in 2024, and has demonstrated a reduced cost base in 2023, along with possessing high scalability in the business model, Analyst Group estimates that Huddlestock will achieve a positive EBITDA result for the full year 2024, particularly with continued acquisition of new customers.

Financial Position and Completed Private Placement

At the end of Q3-23, Huddlestock’s cash and equivalents amounted to NOK 6.5M, compared to NOK 10.8M at the end of June (Q2-23), corresponding to a net change in cash of – NOK 4.3M. Regarding the net cash flow from operating activities from continuing operations, it amounted to NOK -13.6M during the first nine months of 2023, equating to an operational burn rate of NOK 1.5M per month over the period. In comparison with the first half of 2023 (Q1-Q2 2023), the operational burn rate was approximately NOK 1.9M per month, signifying a significant improvement during the third quarter of 2023. Subsequent to the quarter’s end, Huddlestock successfully completed a private placement, raising NOK 17.5M in gross proceeds, as commented on last week, read the comment here. The private placement strengthens Huddlestock’s working capital and supports the company’s growth opportunities in Germany, as well as expediting sales and onboarding activities related to new customers in the Nordic region.

In conclusion, Huddlestock has delivered a stable quarter, where revenue and operating results align closely with Analyst Group estimates. Recurring revenues constitute an increasing portion of the total revenues, which, however, during the quarter is a result of a seasonally weaker effects from the Professional Business Division. Huddlestock maintains a strict focus on Investment-as-a-Service, as confirmed by the divestment of Huddlestock Solutions, formerly F5 IT AS, carried out through a management buyout during the quarter. The company has also during the quarter signed a Letter of Intent with Stack by.me and went live with Garantum Wealth Management, followed by two new clients in Investment-as-a-Service and a new strategic partnership after the quarter’s end. Thus, Huddlestock demonstrates high business activity and continues to take operational steps towards becoming a European B2B Investment-as-a-Service provider. With a strengthened financial position after the end of the quarter, Huddlestock can advance its position in the German and Nordic markets, where the company already holds a strong position and currently has a robust pipeline of new prospects.

We will return with an updated equity research report of Huddlestock.