Huddlestock published on August 24, the company’s quarterly report for the second quarter 2023. The following are some key financial metrics that we have chosen to highlight in connection with the report:

- Huddlestock has developed a strong value proposition

- Net revenue amounted to NOK 29.4M – strong revenue growth

- Initiation of cost reduction program

- Financial position and burn rate

Analyst Group view on Huddlestock

During the first half of 2023, Huddlestock has successfully completed the acquisitions of the companies Dtech, Bricknode, and Tracs Group. The combined offering that Huddlestock has developed represents a unique end-to-end solution that empowers Investment-as-a-Service. Huddlestock’s B2B offering is tailored to a broad target group within the financial market, ranging from wealth and asset managers to savings platforms and corporate pension providers, to mention a few. Huddlestock’s offering enables a comprehensive white-label solution that provides the client with, among other things, full control over the end clients’ holdings, trading and order management, safekeeping, and regulatory compliance. This, in combination with an end client user interface for desktop and smartphones, constitutes a strong value proposition for providers of investment services.

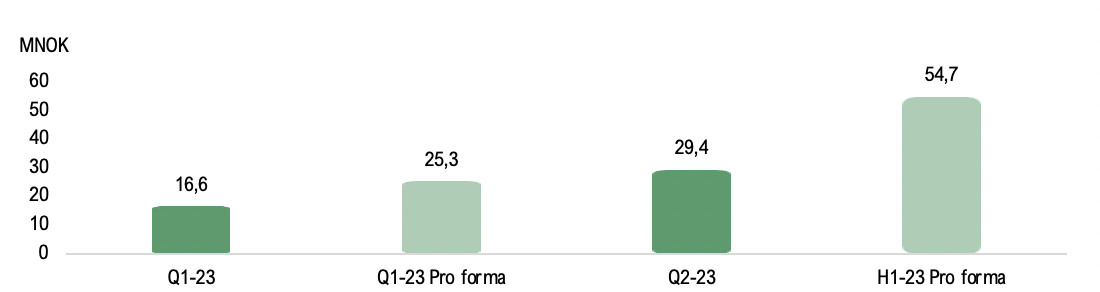

Net revenue growth 140% Y-Y and 77% Q-Q

During the second quarter of 2023, the net revenues amounted to NOK 29.4M (12.2), corresponding to a growth of 140% compared to the same quarter the previous year. During the previous quarter (Q1-23), the net revenue amounted to NOK 16.6M, reflecting a substantial growth of 77% Q-Q. This increase in revenue corresponds to approximately NOK 12.8M in absolute terms Q-Q. It is important to note, however, that Huddlestock has acquired the companies Tracs Group, Dtech, and Bricknode during the year 2023, and thus, they are not included in the comparable periods. When compared to the Proforma revenue for Q1-23, which amounted to NOK 25.3M, Huddlestock achieves a revenue growth of around 16%. For the first half of the year, Huddlestock’s consolidated revenues amounted to NOK 45.9M (21.3), corresponding to a growth of 116%, while the proforma revenue totals NOK 54.7M.

Huddlestock’s revenue can be derived from two main business areas: the Professional Service Division and recurring revenue from the Technology Business Division. Turning our attention to the recurring revenue from the Technology Business Division, which amounted to NOK 10.7M during the second quarter of this year, and in comparison to the previous quarter’s proforma figures, the recurring revenue reached NOK 9.5M. This represents a growth of approximately 13%. For the first half of the year Huddlestock’s proforma recurring revenues from the Technology Business amounted in a total of NOK 20.2M. As for the Professional Service Division, Huddlestock reports that several mandates have been extended throughout the period, and the outlook indicates a high capacity utilization with visibility extending until the year 2024. Taken together, we can conclude that both business areas have maintained a strong pace during the quarter, contributing to the growth achieved in this period.

Net revenue for Huddlestock Q1- and Q2-23, Q1-23 Pro forma and H1-23 Pro forma.

During the quarter, Huddlestock successfully consolidated the operations of Dtech, Bricknode, and Tracs Group into Huddlestock. Concurrently with this consolidation, Huddlestock has achieved operational advancements, including the successful product launch during the second quarter 2023 with a Swedish client. The client has more than 60.000 end-clients and is digitally processing approximately 15.000 trades per day through Huddlestock’s system. The fact that Huddlestock has gone live with the client marks a significant milestone for the company, simultaneously demonstrates the growth potential with the new customers, where Huddlestock generates revenues for example through monthly licenses, Assets under Management (AuM), as well as transaction fees. Furthermore, Huddlestock’s sales team has transitioned to a unified CRM system, which has improved efficiency and the combined prospects expands the sales pipeline. The group can now execute on sales synergies, such as cross-selling and engage with all of the Company’s prospects. After the end of the quarter, Huddlestock signed a Letter of Intent (LOI) regarding equity trading with Stack by.me. Stack by.me is a Norwegian provider of an investment app that can be likened to social media. The platform currently offered by Stack by.me to its numerous clients is a Software-as-a-Service (SaaS) solution operated by Huddlestock and will continue to be supported by Huddlestock Investor Services.

EBITDA result amounted to NOK -1.8M during Q2-23

The consolidated EBITDA result during the second quarter amounted to NOK -1.8M (-4.8), corresponding to a decreased EBITDA loss of NOK -3.0M Y-Y. The consolidated EBIT result during the quarter amounted to NOK -9.5M (7.6), corresponding to an increased EBIT loss of NOK 1.8M, which is derived by an increase in depreciation and amortization by approximately NOK 4.8M. As mentioned earlier, it should be noted that completed acquisitions were not consolidated in the comparable period of the previous year, making the comparison somewhat misleading. However, when comparing EBITDA and EBIT results on a proforma basis for Q1-23, which amounted to NOK -6.0M and NOK -14.3M respectively, Huddlestock’s EBITDA and EBIT results have improved by NOK 4.1M and NOK 4.9M respectively.

In terms of total operating costs (including cost of materials/subcontractors), they amounted to NOK 31.2M, reflecting a decrease of NOK 0.1M compared to proforma Q1-23 (31.3), while it should be noted that revenues in the same comparison have increased by approximately 16%. Thus, the interim report serves as evidence that Huddlestock has successfully consolidated the newly acquired companies, all the while maintaining effective cost control.

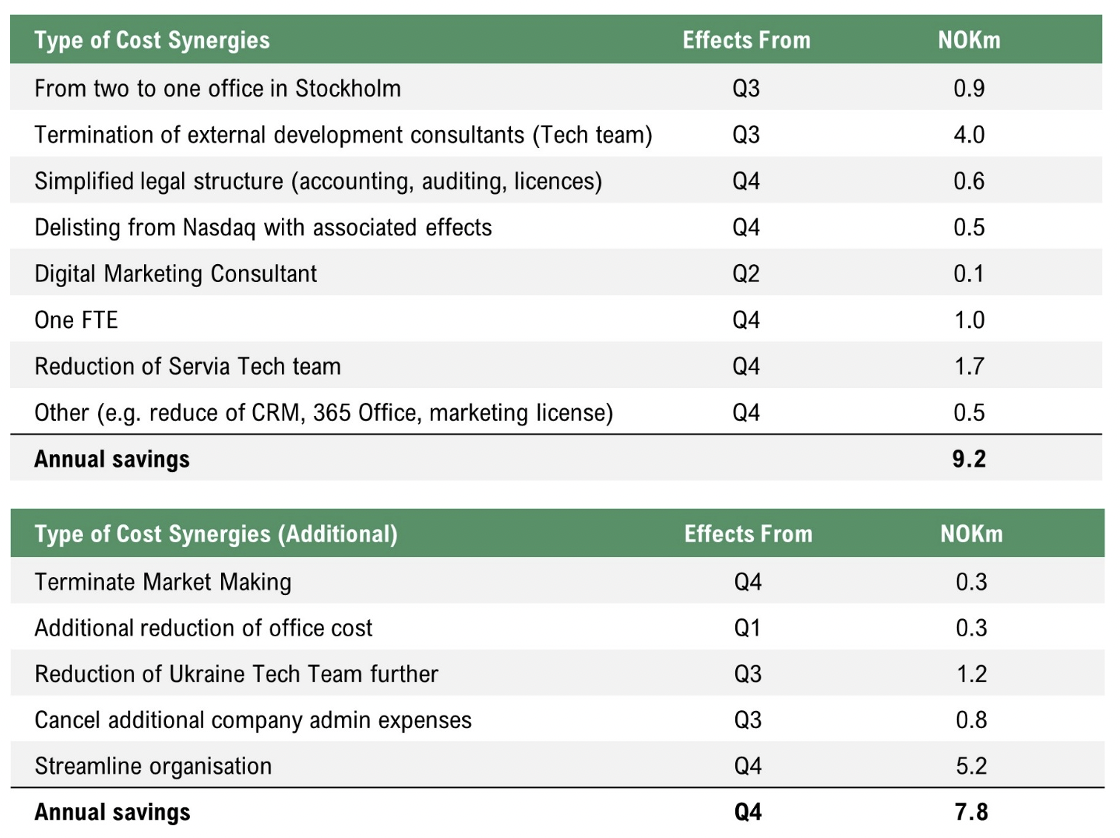

Huddlestock presented in both the report and the conference call a cost reduction program, enabled in part by cost synergies among the acquired operations and built upon the previously communicated cost synergy initiatives. The first part of the cost reduction program was initiated during the second quarter, before the summer, which Huddlestock anticipates will yield an impact of approximately NOK 9.2M in cost savings starting from Q3-23. Huddlestock has also initiated an additional part of the cost reduction program, estimated to amount to NOK 7.8M, with effects expected to materialize in the early part of year 2024. Below outlines Huddlestock’s cost reduction program and the additional part, detailing the nature of the intended savings, the expected date implemented effects from, and the corresponding sum.

At the end of Q2-23, Huddlestock’s cash and equivalents amounted to NOK 10.8M, compared to NOK 1.7M at the end of March (Q1-23), corresponding to a net change in cash of + NOK 9.1M. The increase in cash and equivalents during the quarter can be attributed to a capital injection of NOK 5M from Njord Group AS, as well as from the acquisition of subsidiaries, net of acquired cash. As for the net cash flow from operating activities from continuing operations, it amounted to NOK -11.6M during the first half of 2023, equating to an operational burn rate of NOK 1.9M per month over the period.

In conclusion, we are of the opinion that Huddlestock has progressed well operatively and has successfully consolidated the acquired companies during the second quarter, considering both the net revenue growth and the development of the total operating costs. Analyst Group views the developments during the quarter positively, as well as the initiation of the cost reduction program, which is anticipated to gradually be materialized in the figures over the upcoming quarters. Furthermore, Huddlestock holds a strong position with a robust prospect pipeline, significant upcoming product deliveries in both 2023 and 2024, and stable prospects for Visigon (part of the Professional Service Division). These factors are expected to drive growth in the other half of 2023. It should be noted, however, that the forthcoming quarters are projected to be somewhat weaker, attributed to seasonal effects, a point emphasized by Huddlestock’s CEO, John E. Skajem, during the conference call.

We will return with an updated equity research report of Huddlestock.