Huddlestock published on May the 30th, the company’s quarterly report for the first quarter 2024. The following are some key financial metrics that we have chosen to highlight in connection with the report:

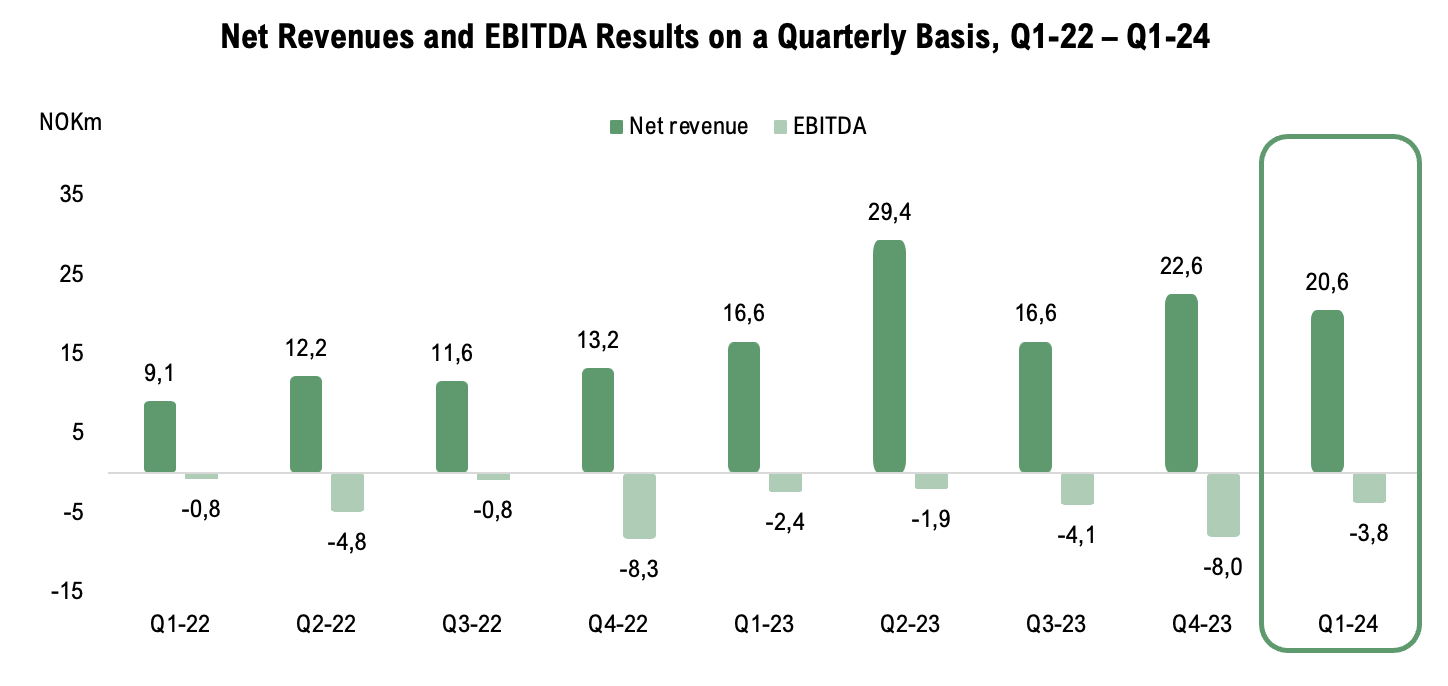

- Net revenue amounted to NOK 20.6M (16.6) – representing a growth of 24 % YoY

- High growth potential within Huddlestock’s Investment-as-a-Service (“Iaas)” offering

- Implemented cost plan starts to give effects and EBITDA improvements QoQ

- Securing financing of NOK 12.5M through convertible shareholder loan after the end of the quarter

Net Revenue Growth of 24% YoY

During the first quarter of 2024, Huddlestock’s net revenue amounted to NOK 20.6M (16.6), representing a growth of 24% YoY and a decrease of 9% Q-Q, as the revenue in the previous quarter (Q4-23) amounted to NOK 22.6M. The YoY revenue increase is primarily supported by three acquisitions (Tracs Group, Dtech, and Bricknode), which were consolidated in Q2-23. It should also be noted that the revenue comparison has decreased as the comparison period includes the operations of Huddlestock Solutions (formerly F5IT), which was divested through a management buyout completed at the end of November 2023. In terms of the Last Twelve Months (LTM), Huddlestock’s revenue amounts to NOK 89.2M, indicating that Huddlestock has sequentially increased its revenue on an LTM basis, compared to the revenue for the full year 2023 of NOK 85.2M or NOK 53.7M at the same time the previous year. The LTM revenue increase is likewise primarily attributed to Huddlestock’s acquisitions of Tracs Group, Dtech, and Bricknode, despite the divestment of Huddlestock Solutions. However, revenue growth has also been driven by new customers, as well as expansion among Huddlestock’s existing customers within the Investment-as-a-Service offering (“IaaS”),and extended new mandates within the consulting services. Consequently, the proportion of recurring revenues related to the IaaS offering has also increased sequentially and amounts to 49% of the Company’s total revenue on an LTM basis. Analyst Group views it as a strong performance to have sequentially increased revenues on an LTM basis and that the share of the revenue base from recurring revenues from the IaaS offering constitutes an increasingly larger portion of the Company’s total revenue, making up approximately 50% on an LTM basis.

Huddlestock’s revenue mix is derived from recurring revenues from Investment-as-a-Service (IaaS) and project-based revenues from consulting services. The recurring revenues within the IaaS offering are based on monthly licenses, assets under management (“AuM”) or assets under administration (“AuA”), and transaction fees, where the IaaS offering provides access to investment tools and expertise without the need for extensive infrastructure or in-house resources. Revenues from IaaS are thus driven by the number of B2B customers and product offering, where a strong and expanded product offering contributes to a high net revenue retention rate (“NRR”), but is also fundamentally impacted by the stock market development. Within consulting services, Huddlestock offers customized strategic and technical solutions assisting clients in improving their operations, where revenues are project-based and generally build on multiyear relationships with large multinational institutions, with technology implementation within the whole financial market driving revenues within this business area.

During Q1-24, recurring revenues from IaaS accounted for 39% of the Company’s total revenue for the quarter, amounting to approximately NOK 8M, compared to 19% during the same period the previous year (Q1-23), which amounted to approximately NOK 3M, thus showing a growth of approximately 155%, primarily explained by the three acquisitions but also sequentially impacted by the divestment of Huddlestock Solutions. Consequently, revenues from consulting services accounted for 61% of the Company’s total revenue, amounting to approximately NOK 12.6M, compared to approximately NOK 13M during the same period the previous year. It should also be noted that, when compared to the previous quarter, revenues from each revenue stream showed a similar distribution, with recurring revenues from IaaS accounting for 39% and project-based revenues from consulting services accounting for 61%. However, it should be added that revenues from consulting services are affected by seasonal effects, leading to somewhat fluctuating revenues on a quarterly basis.

Thus, we conclude that Huddlestock has shown a solid start to 2024, with a growth of 24% YoY and sequential growth on an LTM basis with a continued increase in the proportion of recurring revenues from IaaS, which Analyst Group highlights as a strong data point from the report. However, the growth rate for the quarter is somewhat lower than Analyst Group’s estimate, which is partly explained by the divestment of Huddlestock Solution. Overall, the quarter shows that Huddlestock’s consulting services demonstrate good and stable profitable revenues, with revenues from this business area being relatively in line with the previous year, while the IaaS business consists of recurring revenues and represents a growing part of the company’s total revenue. Revenues from IaaS are estimated to have been affected by the divestment of Huddlestock Solutions but are still expected to show underlying growth due to the new customers Huddlestock signed during the full year of 2023. Analyst Group also considers this business area to be a significant and important growth driver going forward, possessing high growth potential due to the large serviceable market in the Nordic region and additional upside potential in the German market, where Huddlestock signed an LOI with AVL in January 2024, which we commented on here.

Implemented Cost Plan Starts to Show Effects

During the first quarter of 2024, Huddlestock’s total operating expenses (including cost of materials/subcontractors) amounted to NOK 24.4M (19), noting that the acquisitions have also resulted in a larger total cost base in the YoY comparison. Compared to the previous quarter (Q4-23), Huddlestock has reduced the cost base, as the total operating expenses amounted to NOK 30.6M, corresponding to a decrease of NOK 6M, and compared to Q3-23, total operating expenses decreased by approximately NOK 1.3M, which then amounted to approximately NOK 25.7M. The reduced cost base QoQ is particularly attributed to decreased other operating expenses, which decreased by NOK 7.4M, but also a reduction in the company’s largest cost item, personnel costs, which decreased QoQ by approximately NOK 1.5M. In total, Huddlestock’s EBITDA result during the first quarter of 2024 amounted to NOK -3.8M (-2.4), which represents an increase YoY, explained by the acquisitions and the increased cost base in the company, but a significant decrease QoQ, where Huddlestock showed a negative EBITDA result of NOK 8M during Q4-23. Additionally, it should be noted that the consultancy services show good profitability during the quarter, where Huddlestock highlights that the business area demonstrates an EBITDA margin of 26%, which is estimated to amount to approximately NOK 3.3M given that revenues from the business area amounted to approximately NOK 12.6M during the quarter. However, it should be noted that Huddlestock has not historically reported revenues and EBITDA results for each business area separately.

Overall, Analyst Group is of the opinion that Huddlestock has successfully implemented cost synergies and maintained stable cost control, which is a result of the implemented cost plan starting to show effects and is evident in the QoQ comparison where total operating expenses decreased by NOK 6M. At the same time, Huddlestock highlights that the company continues to execute on the roadmap to an EBITDA-positive result, which is based on a continued focus on recurring IaaS sales, continued profitable growth within consultancy services, increased efficiency and enhanced structures, as well as continued focus on cost control and cost reduction. Analyst Group therefore assesses that Huddlestock will continue to focus on reducing the cost base, where the full effect of the cost savings is estimated to be realized in H2-24, while we highlight the high growth potential within the IaaS business, as well as a solid utilization rate within consultancy services, which we consider to position the company well to achieve a neutral EBITDA result for the full year of 2024.

Securing Financing in the Short- and Mid-Term Perspective

At the end of Q1-24, Huddlestock’s cash and equivalents amounted to NOK 9.9M, compared to NOK 10.2M at the end of December (Q4-23), representing a decrease in net cash and equivalents of NOK 0.3M. During the quarter, the net cash flow from operating activities from continuing operations amounted to NOK -7M, equivalent to an operational burn rate of approximately NOK 2.3M per month over the period. However, the quarter was negatively affected by changes in working capital, and the net cash flow from operating activities before changes in working capital amounted to NOK -4M during the quarter, equivalent to a burn rate of approximately NOK 1.4M per month over the period, which is in line with the average of the previous year. As a result of increased debt of NOK 9M during the quarter, the cash balance is relatively unchanged compared to the end of the previous quarter.

In line with Huddlestock’s previous communication that the company’s key priorities going forward are to explore and identify financing alternatives, to support Huddlestock’s strategy and to maximize execution on the company’s strong position and product offering, Huddlestock has secured additional funding through a convertible loan to existing shareholders of NOK 12.5M after the quarter. On May 29, after the end of the quarter, Huddlestock announced that the company has successfully completed a private placement of convertible debt, raising NOK 12.5M, securing financing in the short and mid-term. The convertible loan carries an interest rate of 10% and the conversion date is set for 18 months from the date of settlement of the private placement (May 30, 2024), meaning the convertible loan matures in December 2025, with a conversion rate of NOK 1 per share in the company. Additionally, it should be noted that several members of the company’s management and board participated in the private placement of the convertible loan, including Willebrand Group AB, associate of board member Stefan Willebrand, which subscribed for NOK 200K, Untie Group AB, associate of board member Stefan Willebrand and board member Erik Hagelin, which subscribed for NOK 600K, and Investor Relations and Corporate Development Officer John Egil Skajem, who subscribed for NOK 150K.

Analyst Group views positively that Huddlestock has secured financing in the short to mid-term, which also enables Huddlestock to further execute on the roadmap to EBITDA positive and maximize execution on the company’s strong position to achieve high growth. Securing financing also indicates strong confidence from existing shareholders, and we view positively that several members of the company’s management and board participated in the private placement of convertible debt, which instills confidence in creating shareholder value moving forward.

In conclusion, Huddlestock has reported a solid quarter, showing YoY growth primarily explained by acquisition activity, while also driven by new customers and extended mandates. However, revenues decreased by 9% QoQ, primarily explained by the divestment of Huddlestock Solutions. At the same time, we see that Huddlestock has executed on the implemented cost plan, thereby reducing the cost base by NOK 6M QoQ, which also contributes to a reduced EBITDA loss QoQ. After the quarter, Huddlestock secured necessary capital primarily in the short-term perspective, but also in the mid-term perspective, enabling Huddlestock to execute on the company’s well-established position and to drive growth. In addition, the interim report demonstrates the good profitability in consultancy services, which we view positively, while Huddlestock possesses strong growth potential in IaaS. We emphasize the importance of Huddlestock continuing to execute on the implemented cost plan and the roadmap towards EBITDA positive to ensure a sustainable gowth path while seizing opportunities going forward, particularly within the IaaS offering.

We will return with an updated equity research report of Huddlestock.