Genetic Analysis AS (“Genetic Analysis” or the “Company”) published on August 27th the Company’s Q2-report for 2025.

The following are some key points that we have chosen to highlight in connection with the report:

- Strong sales growth through reagent kit sales in USA

- Improved EBITDA-result through solid gross margin and cost control

- Strengthened cash position though rights issues for further commercial investments

- Launch of GA-map® MHI GutHealth in the USA

Sales Growth of 34%

The net sales grew strongly in Q2-25, amounting to NOK 5.9m (4.4), corresponding to a growth of 34% compared to the same quarter last year. The growth is primarily driven by strong sales of reagent kits on the US market, which accounted for 73% of the total sales and growing 49% compared to the comparison quarter. Meanwhile, Europe showed a stable growth amounting to 11%. Moreover, the report states that Genetic Analysis continues the commercial rollout of the GA-map® platform by increasing the number of partner laboratories, which is expected to generate recurrent sales of reagent kits going forward, hence contributing to further growth.

The growth validates the ongoing increased global focus on microbiome diagnostics, as we have argued in our equity research reports for Genetic Analysis. The primary growth driver on the market is assumed to be advances in research, which have revealed the microbiome’s potential in therapeutics. As therapeutics become more readily available, the need for reliable diagnostic tools is expected to grow in tandem, both for selecting which patients that should receive treatment and for tracking therapeutic response over time, including the potential requirement for repeated dosing. Genetic Analysis has an established first mover advantage within microbiome-based diagnostics through the patented platform GA-map®, why the Company is in a strong position to capitalize on growing interest in microbiome-guided diagnostics.

During Q2-25, Genetic Analysis announced the launch of a microbiome test for the Consumer Health (D2C) market in China in collaboration with Thalys Medical Technology Group Corporation (“Thalys”). Thalys is considered to be a strong partner for the launch, with expertise in China’s healthcare ecosystem. The risk-reward profile is seen as attractive for Genetic Analysis in a business model where the Company supplies Thalys with reagent kits, while the partner is expected to be responsible for commercialization. Thalys is currently working on the product to fit local requirements, after which a broader launch is expected. Hence, the product is not assumed to have contributed significantly to the growth in Q2-25, but should rather be seen as an extra potential growth driver going forward.

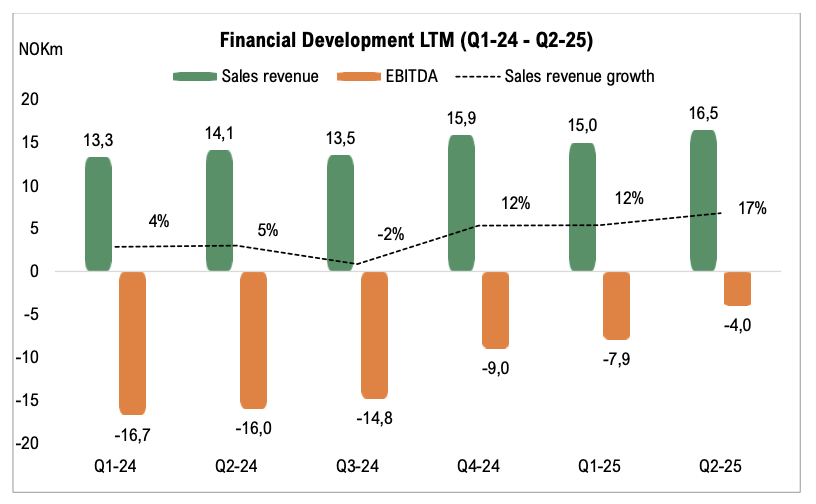

As we mentioned in our comment following Genetic Analysis Q1-report, when sales decreased by 27%, Genetic Analysis remains in an early stage of commercialization, and sales are therefore expected to fluctuate between quarters based on activities and inventory level at partners. As we now can summarize H1-25, the growth rate amounts to 8% and looking at the last twelve months (July 2024 – June 2025), the growth rate is at 17%, which has accelerated since Q1-24, showing a strong trend. Looking ahead, we see several growth drivers that is expected to further accelerate sales, including continued growth of reagent kits to laboratories, the D2C test in China and the recently launched GA-map® MHI GutHealth in the USA.

Import Tariffs Affected Gross Margin Negatively

The growth rate in the US comes in a macroeconomically turbulent quarter, with tariffs implemented, which also affected the COGS negatively by NOK 0.4m. As a result, the gross margin, adjusted for other operating income, decreased to 73.7% (81.7). When adjusting for the impact of tariffs, the gross margin was largely unchanged compared to the same quarter last year. Genetic Analysis has exited instrument sales in Europe, which is expected to have been a low-margin business, why the main contributor to revenues now are the high-margin reagent kits, leading to a stronger reported gross margin in the last one and a half year.

Continued Strong Cost Control

Genetic Analysis continued to show strong cost control during Q2-25, as operating expenses decreased 33% compared to the same period last year, amounting to NOK 5.1m (7.6), despite the growing revenues, showcasing impressive cost control and validation of the scalability in Genetic Analysis business model. The decrease is attributable to general cost savings and the fact that the IBD project is in a less costly phase. The increased revenues combined with the cost savings resulted in a positive EBITDA of NOK 0.5m, corresponding to a margin of 7.1%. When adjusting for other income, which amounted to NOK 1.3m during Q2-25 and primarily consists of research work and R&D grants, the EBITDA margin was slightly negative during the quarter.

Through estimated growing sales from reagent kits and new product launches, a high gross margin and strong cost control, we expect Genetic Analysis to be able to continue to strengthen profitability, even though results likely will fluctuate between quarters.

Strengthened Cash Position

During Q2-25, Genetic Analysis strengthened the cash position through a directed issue of NOK 12.8m and a following subsequent offering to existing shareholders, which provided gross proceeds of NOK 4.1m, corresponding to total gross proceeds of NOK 16.9m. As a result, the cash position increased to NOK 25m at the end of Q2-24, compared to NOK 10.7m at the end of Q1-25. As mentioned, Genetic Analysis operates with a lean cost base and is balancing new investments, leading to a FCF of NOK -0.3m in Q2-25. Through the strengthened cash position in the quarter as well as the positive trend in profitability, we asses the financial position for Genetic Analysis as strong and expects the Company to make balanced investments in commercial activities for the GA-map® platform, with an increased focus on the US market, which we consider a good strategic investment for the Company’s future growth.

Launch of GA-map® MHI GutHealth in the USA

After the end of Q2-25, Genetic Analysis announced the launch of the GA-map® MHI GutHealth as a Research Use Only (RUO) test in the USA. The launch will be carried out through a collaboration with Pangea Laboratory LLC (“Pangea”). In December 2024, Genetic Analysis first announced the collaboration with Ferring Pharmaceuticals to develop a new rapid microbiome diagnostic test, aiming to provide increased standardization in a quickly evolving field of microbiome life science. Analyst Group sees the collaboration with Ferring Pharmaceuticals as a validation of the anticipated market shift towards a more diagnostic approach on the rapidly growing human microbiome market, as the test initially is targeting patients with recurrent Clostridioides difficile (rCDI). The test will be launched as a Research Use Only (RUO) initially, but in the long-term, the test is expected to be used to follow-up on how individual patients respond to the Rebyota drug.

Analyst Group views the launch of GA-map® MHI GutHealth in the U.S. as a strategically important step for Genetic Analysis. While short-term financial impact may be limited due to a gradual sales ramp-up, the collaboration with Ferring Pharmaceuticals and the test’s application in addressing recurrent Clostridioides difficile infections underscore a strong long-term potential through a diagnostic approach on the human microbiome market. Moreover, we also asses the fact that Ferring has chosen GA-map® for this test is a validation of the platform.

In summary, Genetic Analysis delivered strong progress in Q2-25 with sales growth of 34%, primarily driven by strong demand for reagent kits in the U.S., validating the Company’s scalable business model and the growing global focus on microbiome diagnostics. The commercial rollout of the GA-map® platform through new partner laboratories, the launch of a consumer health test in China with Thalys, and the recent introduction of GA-map® MHI GutHealth in the U.S. provide multiple growth drivers going forward. Despite tariff-related headwinds temporarily affecting gross margins, underlying profitability remains supported by high-margin reagent kits and strong cost control, with operating expenses down 33% Y-Y, paving the way for further profitability improvements going forward.

We will return with an updated equity research report of Genetic Analysis.