On November 30, Fluicell published the company’s quarterly report for Q3-23.

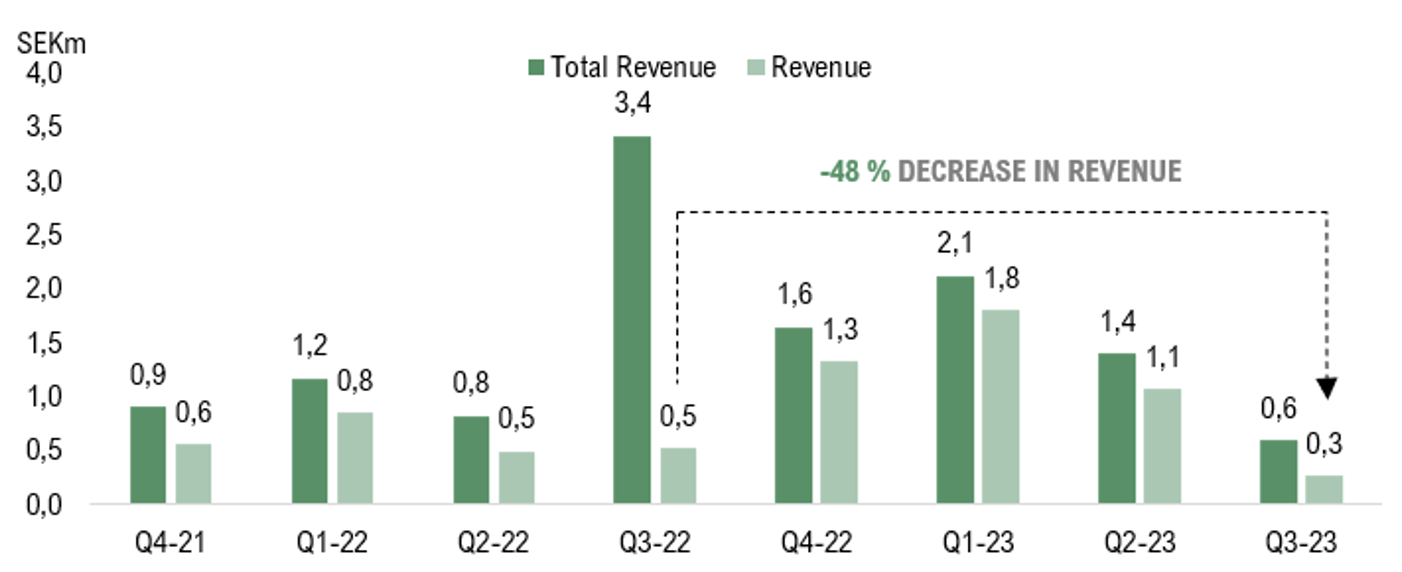

Development of Revenue During the Quarter

During Q3-23, the revenue amounted to SEK 0.3m, compared to SEK 0.5m in Q3-22, which corresponds to a YoY decrease of -48 %. Compared to the previous quarter of Q2-23, where the revenue amounted to SEK 1.1m, a decrease of -75 %. Total revenue amounted to SEK 0.6m (3.4), corresponding to a YoY decrease of -83 %. The top-line results were lower than our expectations, mainly attributed to a general slowdown in the research instruments market. The -83 % decrease in total revenue can be explained by a one-off compensation of SEK 2.5m that the company was attributed by the U.S. patent attorney in the third quarter of last year. Adjusted for the on-off payment, the total revenue decreased by -36 % YoY.

Operating Results

The operating result during Q3-23 amounted to SEK -6.1m, compared to SEK –2.8m in Q3-22, corresponding to an increased loss of SEK -3.3m. The increased operating loss is, similar to the total revenue, mainly impacted by the one-off compensation that was received in the corresponding quarter last year. In addition to this, the operating loss is slightly above the average operating loss observed in the last eight quarters, which amounts to SEK -5.8m, hence, the YoY discrepancy is not particularly notable when examining the operating losses over the past two years.

Restructuring of Operations With the Goal to Accelerate Activities in Tissue-Based Research Products

After the end of the third quarter, the company announced a reorganization, where Fluicell henceforth will exclusively focus on accelerating the development of tissue-based research products, particularly advanced therapies for treating type 1 diabetes (T1D). Simultaneously, the company informed that Carolina Trkulja, former Chief Innovation Officer, will take over the role as CEO of Fluicell. The reorganization is estimated to impact approximately half of the employees, with the expected annual savings amounting to a 50% reduction in regards to the current cost base. However, increased costs associated with the reorganization will impact the results of the fourth quarter this year; nevertheless, these should be considered as non-recurring expenses.

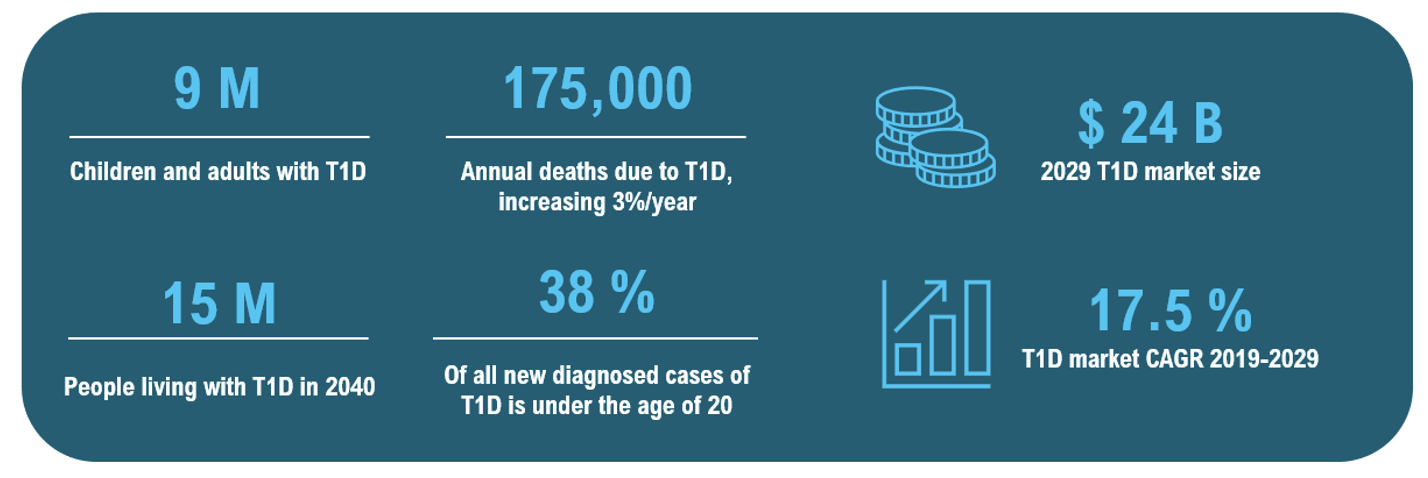

Fluicell assesses that the market for tissue-based research products is currently underserved, enabling the company to take advantage of the extensive potential in order to secure a leading position in the market, along with a competitive partnership offer. The rationale behind the strategic shift is motivated by Fluicell’s universal platform technology and expertise, enabling the company to create functional tissues that replicate the microscopic structure of human tissue in a unique way. The platform is not limited to a particular type of tissue or a specific type of cell but is a highly versatile technique with a focus on detailed functional tissues. Hence, the total addressable market for Fluicell’s platform technology is remarkably vast. Through its platform technology, Fluicell is not constrained to a single target or a specific disease, distinguishing the company from other biotech firms focused on specific drug development. This characteristic lowers the risk in case one program fails, a factor highly appreciated from an investor’s point of view. Below are some numbers to give a brief overview of the addressable T1D-market that Fluicell has set their focus on. Keep in mind, this is only one of the application areas for Fluicell’s platform technology.

Although Analyst Group estimates that this has the potential to be a lucrative step in the long term, where Fluicell, by capturing only a fraction of the total market share, could generate substantially higher revenues than today, the shift away from selling instruments will reduce the current revenue streams and its future prospects associated with these product sales. It’s worth pointing out that, while Fluicell won’t actively sell its products going forward, the development of these instruments will persist, as they play a crucial role in Fluicell’s future advancement of tissue-based therapies.

Financial Position – Announced Rights Issue

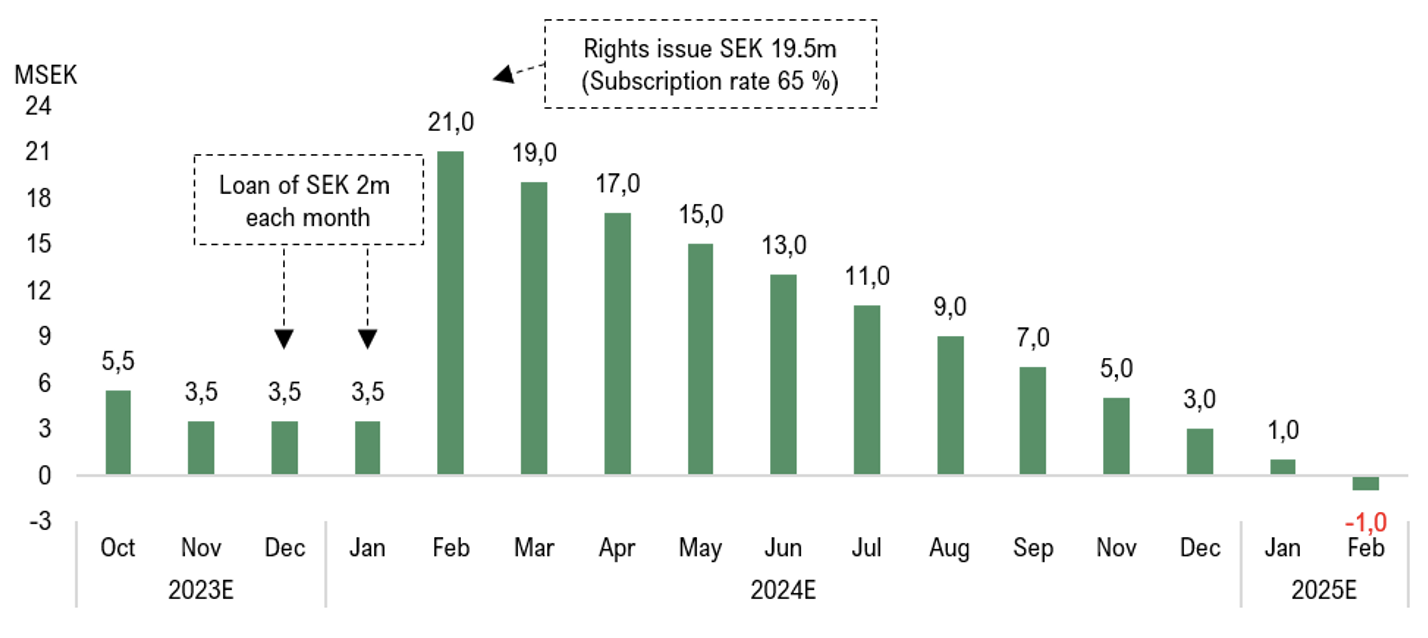

At the end of Q3-23, Fluicell’s cash balance amounted to SEK 7.5m, compared to SEK 14.4m at the end of Q2-23, corresponding to a net change in cash of SEK -6.9m. Fluicell burn rate during Q3-23 amounted to SEK –1.6m per month, compared to SEK -2.0m m in the previous quarter.

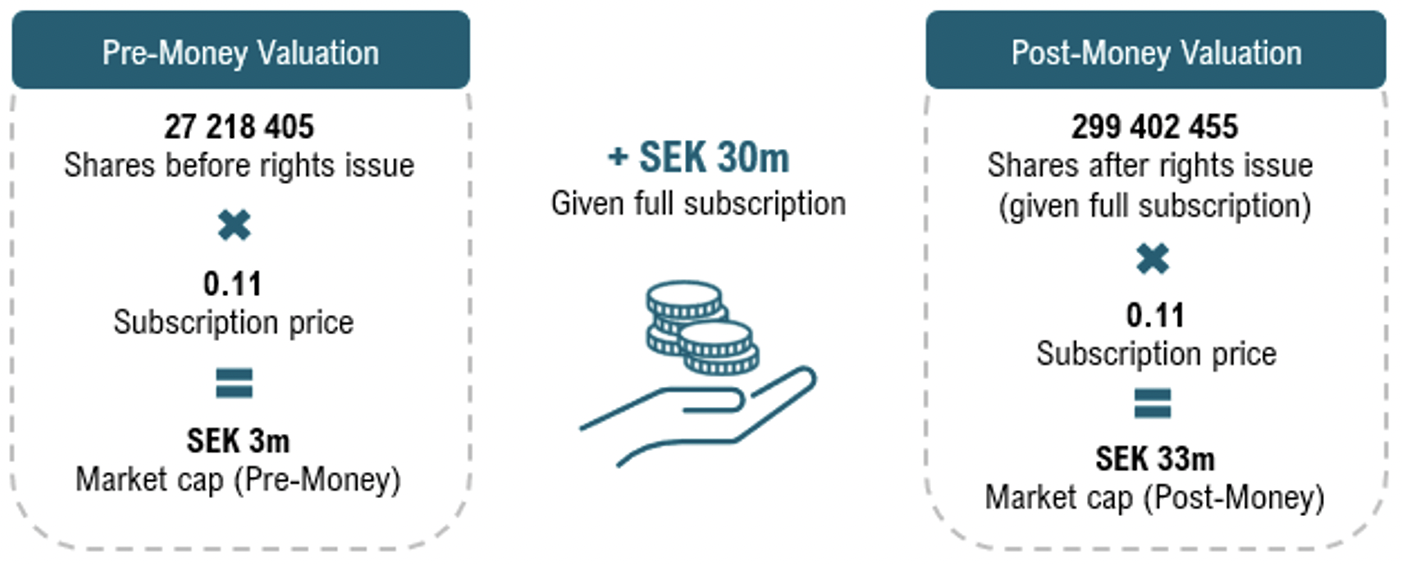

Following the Q3-report, the company announced the proposal for an extraordinary general meeting to decide on a rights issue, aiming to strengthen the company’s financial position by approximately SEK 30m before issue costs, given full subscription. Additionally, the company has entered into an agreement with Formue Nord for a loan facility of up to SEK 4m, with SEK 2m scheduled to be disbursed in December 2023 at market conditions. The subscription price for the rights issue amounts to SEK 0.11 per share, which, compared to yesterday’s closing price (0.74), corresponds to a discount of approximately 85 %. Given the current market cap, the rights issue seems attractively priced, with a pre-money valuation of approximately SEK 3m, given full subscription. However, given that the subscription period starts in over six weeks (15 Jan), it remains to be seen whether it is an attractive offer at the time. The rights issue is guaranteed up to approximately SEK 15m, and given the current market climate, and depending on where the stock is trading during the subscription period, Analyst Group takes a conservative approach and estimates a subscription rate of 65 %. Given full subscription, the dilution effect corresponds to 91 %.

Given the current cash position of SEK 7.5m, the estimated rights issue along with the loan, and an assumed burn rate of SEK -2.0m per month – which Analyst Group believes is fair to assume going forward, especially considering the increased costs associated with the reorganization – Fluicell is estimated to be financed until Q1-25, all else being equal.

The ongoing reorganization, which will henceforth reduce the revenue streams associated with the sales of instruments is also estimated to cut OPEX by approximately 50%, which is estimated to decrease the negative operating loss going forward, however not in Q4-23, where non-recurring costs associated with the reorganization will have a negative impact on the result. Analyst Group sees the estimated reduction in operating losses, as well as a reduced burn rate, as positive for the solvency risk profile of the company in the long term.

In conclusion, we believe that Fluicell’s unique technology holds long-term potential in the tissue-based market for use in regenerative medicine and drug screening, and with the company’s heightened focus on accelerating the development of tissue-based research products, particularly advanced therapies for T1D, Fluicell is entering an interesting phase ahead. Hence, the current reorganization is viewed positively in the long term, and as the company now aims to strengthen its financial position, triggers await in 2024, where the company, for example, has an ambition to reach a commercial partnership during the year. However, Analyst Group assesses that the short-term prospects for the stock development looks challenging, and that the rights issue is estimated to put pressure on the company’s stock in the coming months until the rights issue is completed.

Analyst Group will publish an updated analysis following the report. However, due to the company’s reorganization, the updated analysis will be published later than usual.