On November 22nd, Eevia Health published the company’s quarterly report for Q3-23.

Lower Net Sales Than Anticipated – Guides for a Similar Q4

During Q3-23, the net sales amounted to approx. EUR 0.9m (1.1), corresponding to a decrease of 20 % YoY, and a decrease of 54 % QoQ compared to Q2-23, where net sales amounted to EUR 2.0m. Although the company had guided for a weaker H2-23, net sales were below our estimates. The decrease is mainly attributed to a larger customer that has temporarily halted order placements due to inventory buildup.

Eevia Health delivered the final volumes of an order to one of its largest customers in the previous quarter (Q2-23), indicating that we most likely won’t see any recurring orders from this customer until late 2024 or early 2025, when they will need to replenish their stock. Due to Eevia’s concentrated customer base, where a few large customers constitute the majority of the sales, there is a possibility of lower production volumes throughout a significant portion of 2024. Consequently, the company has entered a transformational phase, aiming to broaden its customer base and move away from its historical reliance on a few large customers. Thus, the beginning of the third quarter was marked by a reduction in the short-term sales order base, leading to a significant increase in marketing and sales efforts. To illustrate this rapid increase in marketing, Eevia produced much more marketing “content” in Q3-23 than in the combined years of 2020, 2021, 2022, and H1-23.

One of the main marketing activities during the quarter was to attend the tradeshow, Supply Side West, in Las Vegas. This stands out as a pivotal event in the global nutraceutical industry, with over 18 000 industry professionals attending and with more than 84 % of the attendees expressing their primary goal as sourcing new ingredients and suppliers, thus the event serves as a crucial platform. According to the company, the exhibition at the event was successful, and the company is currently experiencing the highest level of interest to date from potential customers, with many new leads and a range of significant sales opportunities. Eevia is diligently working to convert these potential sales opportunities into actual sales contracts. Additionally, Eevia has strengthened the marketing and sales side during the quarter, especially in North America. The company expects to continue to strengthen competence and capacity in these fields and is utilizing the increased interest from the North American market.

In the CEO letter, Stein Ulve shed some guidance going forward, where he states:

“Revenues in Q4-23 itself will likely remain on par or below Q3-23. However, we expect gross margin to improve to over 50% going into 2024, We expect to announce significant orders as a result of our recent sales and marketing efforts in the latter half of Q4-23 and going into 2024.”

Change in Product Mix Put Short Term Pressure on the Gross Margin

The gross profit during Q3-22 reached EUR 0.3m (0.7), corresponding to a decrease of 52 % YoY, and 70 % QoQ compared to Q2-23, where gross profit amounted to EUR 1.4m. The gross margin was 38 % during the quarter, which was down from 63 % in Q3-22, and down from 68 % in the previous quarter. The decrease in gross margin stems from a change in product mix, where lower margin products constituted a larger part of the net sales during the quarter. The company highlights that side-stream products had no effect on the gross margin during Q3-23.

The EBITDA during Q3-23 amounted to EUR 2k (EUR 56k in Q3-22), which was below our expectations, and a substantial decline compared to the previous quarter, where the EBITDA amounted to EUR 0.6m. The decrease in EBITDA is attributed to lower turnover combined with a weaker gross margin. However, the decline was to a certain extent mitigated by significantly reduced personal and overhead costs during the quarter, which enabled the company to show a positive EBITDA-result, albeit close to zero.

During the year, the company has successfully improved its production efficiency, allowing the company to reduce the labor requirements by approx. 25 %, while maintaining the same output capacity. The production improvements are attributed to a new operational model that was implemented during August, where the company transitioned from a 24/7 (21 shift) to a 24/5 (14 shifts) operational model. Apart from this, additional temporary layoffs helped to further reduce the personnel costs during Q3-23.

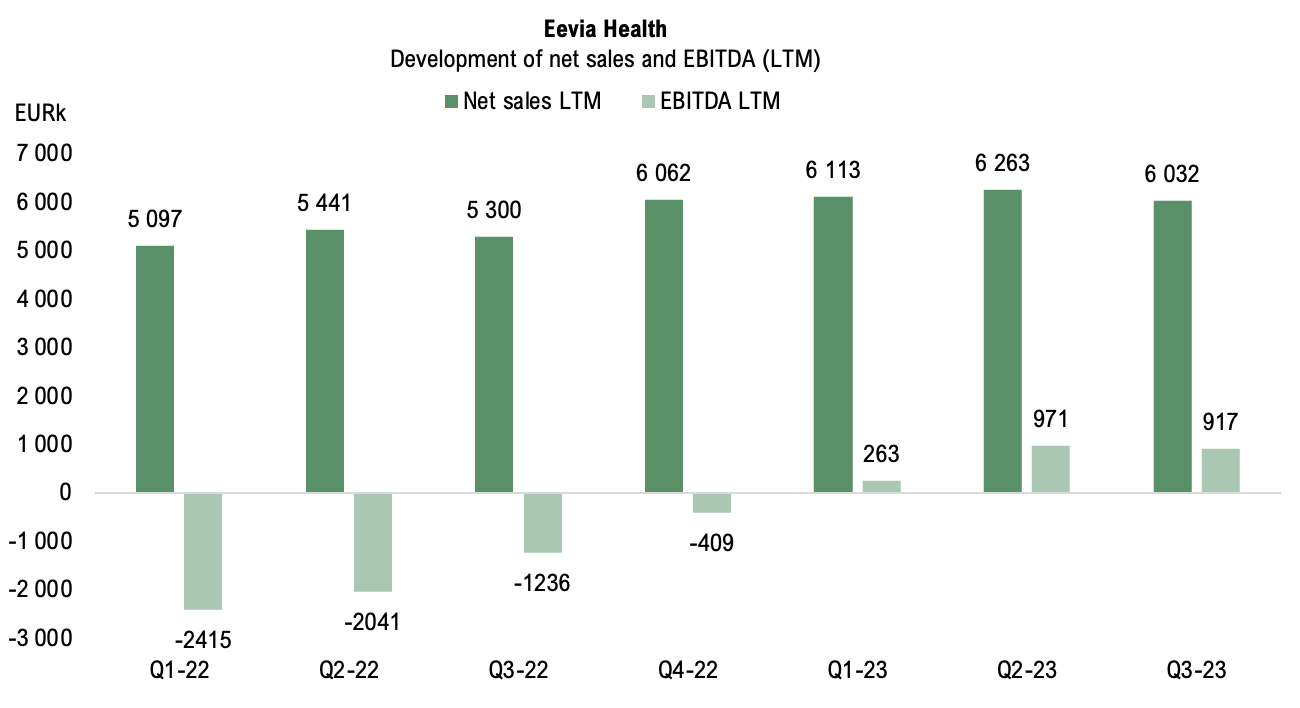

In summary, Eevia has reported positive EBITDA results over five consecutive quarters, albeit a substantial decrease during Q3-23 compared to previous quarter. When examining the EBITDA LTM, a significant improvement is observed in the first nine months of 2023 compared to 2022. As the company hints at a reduced short-term sales order base, it’s encouraging to see that efficiency improvements and the streamlining of operations are bearing fruit. This acts as a cushion for the company in case it experiences lower sales volumes going forward.

Financial position

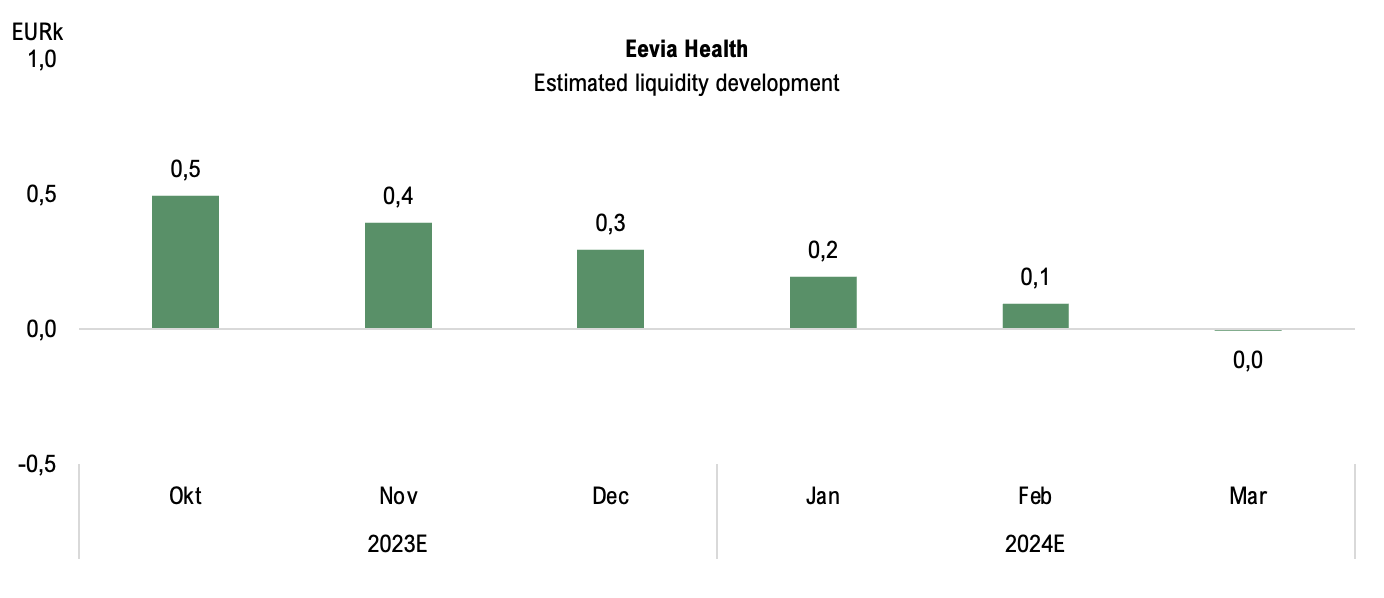

At the end of Q3-23, Eevia’s cash balance amounted to EUR 0.5m, compared to EUR 0.3m at the end of Q2-23, resulting in a net cash of EUR 0.2m. The increase in cash was mainly attributable to a capital injection following the direct share issue in August, which resulted in gross proceeds before fees of approx. EUR 1m (SEK 11.5m). Additionally, a commercial bank loan of EUR 0.5m was entered with Nordea during the quarter, which further strengthened the liquidity. Eevia’s operational burn rate amounted to EUR -1m during Q3-23, equivalent to EUR -0.3m per month, compared to a positive operating cash flow of EUR 0.1m per month during the previous quarter. The negative change is attributed to the lower operating result, investments in R&D, as well as a negative effect of changes in working capital, including an increased receivables balance following shipment of volumes in the latter part of the quarter. The FCF during the quarter amounted to EUR -1.3m, reflecting an increase in investments, which amounted to approx. EUR -0,2m during Q3-23. Going forward, assuming a burn rate of EUR -0.1m per month, which we believe is reasonable given the transformative phase that the company is entering with increased customer acquisition costs (CAC), Eevia’s cash balance of EUR 0.5m is estimated to be sufficient to finance the company until the end of Q1-24, all else equal. Analyst Group believes that the current financial position is strained, and the increased burn rate has rapidly diminished the capital injection from the directed share issue and the loan. Thus, considering the current situation, we cannot rule out the possibility that Eevia may need to pursue some form of external capital raise in the near future.

In conclusion, all though Eevia had guided for a weaker second half of 2023, the company delivered a Q3-report that fell short of our estimates, both on top-line as well as profitability. Analyst Group views the transformative phase the company is entering as positive in a long-term perspective. The increased CAC is expected to lead to a more diversified customer base, reducing the dependence on a single customer and thereby lowering customer concentration risk in the long term. However, the negative aspect of this is that it will most likely exert pressure on the company’s growth plans for 2024, resulting in lower revenue growth than previously guided. Finally, the liquidity of the company must be closely monitored going forwards, since the increased burn rate has put pressure on the cash balance. Analyst Group cannot rule out the possibility that the company must pursue some form of external capital raise to strengthen the financial position further.

We will return with an updated equity research report of Eevia Health.