Bricknode announced on Tuesday, March 15th, that all of Bricknode’s operational assets are to be acquired by Huddlestock Fintech AS (“Huddlestock”). Bricknode and Huddlestock entered into a purchase agreement on March 15th regarding a transfer of all operational assets of Bricknode to Huddlestock in exchange for 41,138,911 consideration shares in Huddlestock, with a value of approx. SEK 107M. Completion of the transaction is conditional upon, among other things, approval by a general meeting of Bricknode.

The Transaction in Brief

- The acquisition of all of Bricknode’s operational assets by Huddlestock will be exchanged for 41,138,911 consideration shares in Huddlestock, where Huddlestock’s shares are listed on Euronext Growth Oslo, corresponding to approx. 21.3% of the total number of shares and votes in Huddlestock.

- All of Bricknode’s operational assets corresponds to a sale of 100% of the shares in Bricknode Software AB; Bricknode Platform AB and Bricknode Ltd (collectively the “Subsidiaries”) to Huddlestock.

- The total consideration of 41,138,911 shares in Huddlestock corresponds to a value of the subsidiaries of approx. SEK 107M, based on a reference price of 2.6 NOK per share in Huddlestock. The current outstanding loans, including accrued interest, amounts to approx. SEK 9.6M and Bricknode intends to loan an additional SEK 5.3M in order to capitalize the subsidiaries and to fund the Company’s operations, while the subsidiaries have a total net cash position of SEK 4M as of 2023-03-01.

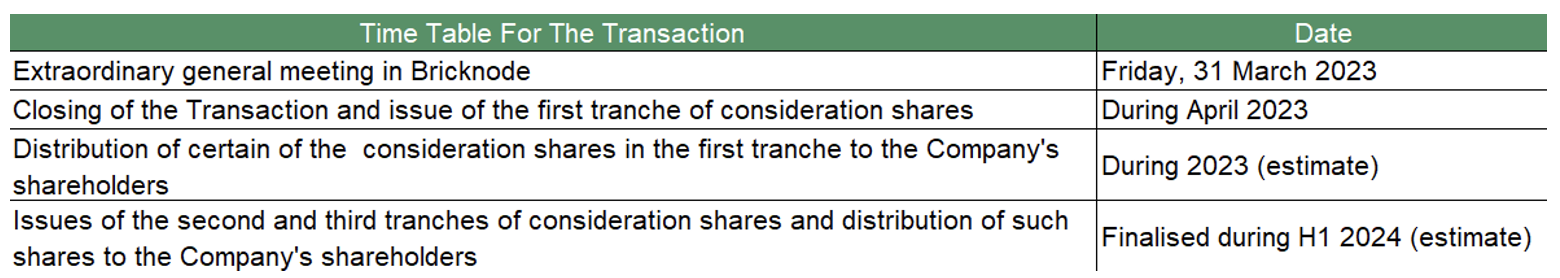

- The consideration shares will be issued in the separate and subsequent tranches of shares in order for the Company not to hold more than 9.9% of the capital or votes in Huddlestock on each occasion, which would trigger a need for regulatory filings and approvals.

- The first tranche of 19,000,000 consideration shares will take place on completion of the transaction, which is expected to occur in April 2023. The first tranche of shares is intended to be used to repay lenders and finance the operations of the Company, while the shares which are not used for these purposes are intended to be distributed to the Company’s shareholders during 2023.

- The second and third tranches (of additional 19,000,000 respectively 3,138,911 consideration shares in Huddlestock) is intended to be distributed to the shareholders of Bricknode and are estimated to be received no later than during the first half of 2024. However, no resolutions to distribute consideration shares have been made and any future resolutions will need to be resolved upon by separate general meetings.

- The current intention is to finally liquidate Bricknode once material assets are distributed to shareholders, which entails a delisting of Bricknode. The board may also assess the possibility to carry out a reverse takeover, whereby an unlisted company acquires Bricknode’s listing spot at First North Growth Market.

Huddlestock in Brief

Huddlestock is a provider of innovative technology and professional investor services. In 2022, Huddlestock Group delivered consolidated revenues of NOK 46.1 million, +97% YoY, after including F5 IT since the acquisition the 1st of May 2022. The EBITDA was NOK -14.0 million, as the group is scaling up the organization and continuing to invest in their technology suite, adding talent and preparing for growth in future client deliveries. Pro forma revenues for the full year of 2022 were NOK 61.6 million +48% YoY. Huddlestock’s shares are listed on Euronext Growth Oslo.

Purpose Of the Transaction

The purpose of the transaction is a strategic move for both Bricknode and Huddlestock, where Bricknode’s investment operations software and technology combining with Huddlestock’s trading technology and investment banking license create a leader in wealth-tech solutions. Together with Huddlestock, Bricknode forms a strong group of companies with over SEK 80 million in annual revenue on a pro forma basis (based on FY2022 figures). The transaction is expected to generate significant cost synergies and an accelerated revenue growth from both upselling opportunities amongst the combined customer base and an expanded target market with the complete end-to-end solution.

Interview with Bricknode’s co-CEO Stefan Willebrand

You’ve announced that Huddlestock acquires all of Bricknode’s operational assets, could you give us a brief summary of the transaction with Huddlestock?

The acquisition is a strategic move for both companies, offering substantial synergies. Bricknode has continuously evaluated various strategic and structural alternatives to drive growth and maximize shareholder value, and we believe this transaction will provide accelerated growth and significant value for Bricknode and Huddlestock’s shareholders.

The Transaction is subject to approval of a general meeting in Bricknode on 31 March 2023. Shareholders in Bricknode representing approx. 68% of the shares and votes have committed to vote in favor of the approval of the transaction, which is then expected to complete in April 2023.

The consideration of 41,138,911 shares in Huddlestock corresponds to a value of the Subsidiaries of approx. SEK 107 million using a reference price of 2.6 NOK per share for Huddlestock.

Bricknode and Huddlestock expects to have significant synergies and together have the possibility to creating a unique European fintech company. What do you see as the key benefits of joining forces with Huddlestock?

We will be able to achieve significant cost synergies and accelerated revenue growth as a result of the deal. In 2022, Bricknode launched an initiative to establish its own securities company in order to meet demand from its customers to operate under the regulatory umbrella of an authorised firm. Huddlestock owns licenced securities companies that will enable us to provide this offering instantly, in addition to real-time trading capabilities. Huddlestock has a broad customer network with offices in several European countries that will provide upsell opportunities and faster expansion across different regions.

The combined offering of Bricknode and Huddlestock creates a true end-to-end solution for our customers, with technology that’s been developed over the course of 13 years. That can’t be replicated easily and gives us a major competitive advantage.

The deal structure is based on consideration shares in Huddlestock which will be issued in three separate tranches of consideration shares, can you briefly give us the background to this deal structure?

Consideration shares in Huddlestock are being issued in three tranches to ensure the company does not hold more than 9.9% of the capital or votes in Huddlestock on each occasion, which would trigger a need for regulatory filings and approvals.

It is our intention to distribute the majority of the consideration shares to Bricknode shareholders without undue delay following receipt of each tranche.

As an investor and shareholder in Bricknode, this deal highlights and actualize the underlying value in Bricknode, as well as giving an opportunity to participate in this promising journey together with Huddlestock. What can an investor in Bricknode expect from this transaction going forward?

We will be aiming to capitalize fairly quickly on the revenue synergies identified, where our combined solution can benefit existing customers of both companies. At the same time, we will be able to communicate the value of our joint proposition to an expanded market throughout Europe and beyond. Bricknode has already demonstrated the broad use cases for its software across the capital markets with customers in new segments recently being signed. The transaction paves the way for us to expand our reach even further and establish ourselves as a market leader.