Björn Borg (”Björn Borg” or ”the Company”) published its Q2 report for 2024 on the 16th of August, 2024. The following are key events that we have chosen to highlight from the report:

- Impressive Net Sales Growth of 28,7 % Y-Y – Driven by the Footwear Category

- Continued Strong Momentum within Sports Apparel (43 % Growth Y-Y)

- The Wholesale Channel Reported Strong Growth Driven by Physical Wholesale

- Short Term Pressure on the Gross Margin

- Strong Cash Flow Generation

Footwear Showed an Impressive Growth of 199 % Y-Y

Björn Borgs net sales came in at SEK 213.2m (165.6) in the Company’s second quarter of fiscal 2024, marking a Y-Y increase of 28.7% when factoring in currency effects, and 28.3% when excluding these effects. The outcome exceeded our estimates by a wide margin (SEK 179.1m), where all product categories surprised positively in regards to growth. Examining the different product areas, the main growth driver was the footwear category, presenting an impressive growth of 199% Y-Y, a testament to Björn Borgs solid execution of integrating the footwear business in-house. Another major highlight in terms of product areas was the performance in Sports Apparel, which grew by 43% Y-Y, continuing the strong momentum from previous quarters. Additionally, the product category Bags presented a growth of 33% Y-Y, and Underwear, the largest contributor to sales, witnessed a growth of 6% compared to the same period last year.

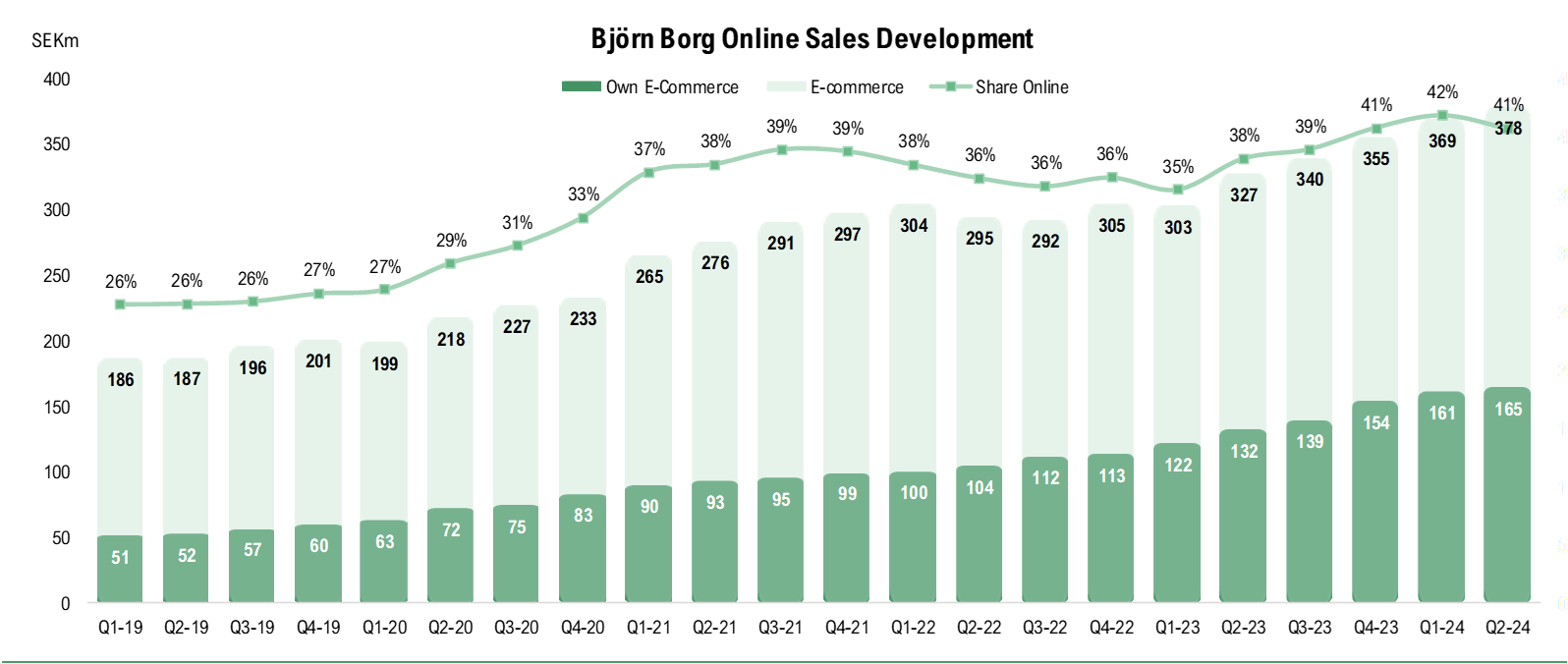

Upon reviewing the channel mix for Q2-24, the Company’s largest channel, wholesale, grew by an impressive 50% Y-Y, where the main contribution within the channel stems from physical wholesale, which increased by 72% Y-Y. Additionally, external e-tailers witnessed a growth of 20% compared to the same quarter last year, contributing positively to the strong growth within wholesale. The Company’s Own E-commerce increased by 9% Y-Y, which is a slowdown in growth rate compared to the last few quarters, where the Y-Y growth has varied in the range of approx. 20-50%. The somewhat slower growth pace is attributed to the increased focus on full-price sales, thereby reducing the sale rate on the Company’s Own E-commerce platform. Analyst Group believes that the growth within Own E-com is robust in the light of the reduced discounts, which shows that customers are willing to pay full price for the high quality products and the strong brand.

The graph below illustrates the growth in Own E-commerce since the end of 2018. This strong growth, despite the challenges faced by the broader e-commerce sector in recent years, attests to Björn Borg’s resilience and strength, and serves as a testament to the success of the initiatives aimed at boosting brand awareness.

Concerning sales geography, all markets performed well during Q2-24, with some geographies showing remarkable growth. The net sales in the Netherlands witnessed an impressive growth of 53% Y-Y, followed by robust growth of 42% and 40% Y-Y in Belgium and Sweden, respectively. Other important markets such as Germany, Finland and Denmark demonstrated double digit growth, while other smaller markets remained on par with the same period last year.

Short Term Factors Hampers the Gross Margin

During Q2-24, the Company achieved a gross margin of 51.8% (when including FX-effects) and 52.3% when excluding currency effects, which was lower than estimated (56.1%). The gross margin exhibited a decrease from 55.6% in Q2-23 and a decrease from the previous quarter (Q1-23), when the gross margin amounted to 53.3%. The lower gross margin mainly stems from currency effects, increased freight costs as well as one-off discounts linked to the integration of the footwear business, as the Company took over an orderbook of footwear late in the season. Analyst Group perceives the declining gross margin as a temporary issue, and that the Company has great potential to increase the profitability level going forward, for instance as Own E-com grows and thereby constitutes a larger fraction of the total sales.

Looking further down the P&L, Björn Borg reported an operating result (EBIT) of SEK 9.5m (8.1) for the second quarter, corresponding to an EBIT margin of 4.5%. Adjusting for currency headwinds in the quarter, the operating result amounted to SEK 10.3 (7.8), corresponding to a currency-neutral EBIT margin of 4.8%. This outcome fell short of our estimates (SEK 13.1m), where the largest deviation to our estimates, apart from the net sales and COGS, was attributed to the increased marketing spend, as reported in the other external costs (SEK 58.2m compared to estimated SEK 43.7m).

Strong Cash Flow Generation and Solid Financial Position

Björn Borg generated SEK 117.3m (74.9) in free cash flow (FCFF) during the second quarter, primarily due to a reduction in working capital, which amounted to approx. SEK 112m. The FCFF generated during Q2-24 aligns with the typical seasonal pattern observed in the industry, where Björn Borg tends to free up a substantial portion of working capital in Q2 and Q4, and, conversely, working capital generally gets tied up during Q1 and Q3. The FCFF LTM of SEK 74.6m, which provides a more representative illustration of the underlying cash flow generation, shows a substantial increase compared to the same period last year where the FCFF amounted to SEK 48.3m, a consequence of the stronger operating performance as well as efficient working capital management.

During the quarter, Björn Borg reduced the Company’s debt position from SEK 175m at the end of Q1-24 to SEK 145m at the end of June, primarily due to repayment of the overdraft facility. Taking into account the cash position of SEK 9.4m at the end of Q2-24, the net debt stands at 135m, and SEK 51m when excluding leases and deferred tax liabilities. With the current EBITDA LTM of SEK 136.5m, the net debt/EBITDA ratio equals 0.99x (including leasing liabilities and deferred tax liabilities) and approx. 0.38x when excluding the abovementioned, indicating a continued healthy financial position moving forward.

Concluding Remarks About the Report

In conclusion, Björn Borg’s Q2 report demonstrates the successful integration of the footwear category, evident by the remarkable 199% Y-Y growth within the footwear segment and 29 % Y-Y growth for the Company as a whole. The Sport Apparel category also maintained its strong momentum during the quarter, with a solid increase of 43% Y-Y. While the gross margin faced pressure due to currency headwinds, elevated transportation costs, and one-off discounts tied to the footwear business, Analyst Group assesses that the factors contributing to the hampered gross margin are of transitory nature. The Q2 results highlight Björn Borg’s agility in adapting to market conditions and underscore the effectiveness of the Company’s brand-enhancement initiatives. Additionally, the substantial growth potential within the footwear segment could further help to change the perception of Björn Borg as a sports fashion brand, serving as an important growth driver ahead.

We will return with an updated equity research report of Björn Borg.