Björn Borg (”Björn Borg” or ”the Company”) published its Q1 report for 2024 on the 16th of May, 2024. The following are key events that we have chosen to highlight from the report:

- Revenues in line with our estimates (SEK 256.8m vs. 255.4)

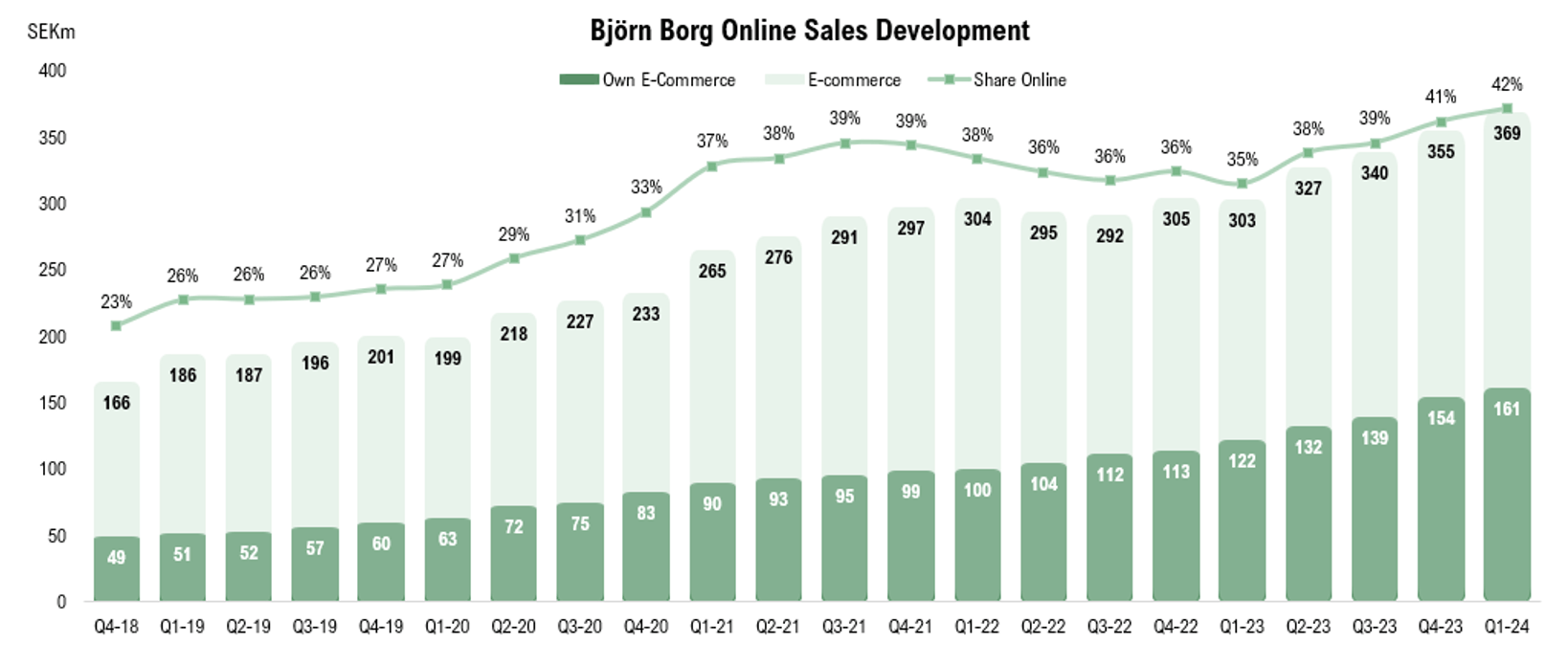

- E-commerce shows continued strong momentum, representing a 21% Y-Y growth

- Integrates footwear In-House

- Profitability fell short of our estimates

- Footwear integration puts pressure on the FCFF

Revenues Grew 10% Y-Y when Excluding Footwear Sales

Björn Borgs net sales came in at SEK 256.8m (246.9) in the Company’s first quarter of fiscal 2024, marking a Y-Y increase of 4.0% when factoring in currency effects, and 3.7% when excluding these effects. The outcome exceeded our estimates by a slight margin (SEK 255.4m or 0.5%). Looking at the product areas, sales from Sports Apparel witnessed a strong growth of 24% compared to the same period previous year, constituting 27% of total sales during the quarter. During Q1-23, the aforementioned share equaled 23%, showcasing that Björn Borg’s strategic shift in strengthening the perception as a sports fashion brand is bearing fruit. The Underwear area grew 9% Y-Y, where the solid development was attributed to both women’s and men’s underwear. During Q1-24, Björn Borg’s licensing partner for the footwear category went bankrupt, which had a significantly negative impact on the footwear sales, as evident by the sharp decline of 46% in sales. The decline mainly stemmed from disruptions in the supply chain and was further impacted by weak sales from the former partner. Worth highlighting is that sales increased by 10% when excluding footwear, which illustrates that Björn Borg has started the year of 2024 on a strong note, albeit the Company is facing short term headwinds with regards to the footwear area.

Reviewing the channel mix for the current quarter, it is notable that the Company’s Own E-commerce is continuing its strong momentum and gaining notable traction in the overall channel strategy. Sales from the Company’s E-commerce platform amounted to SEK 40.6m (33.4) in the first quarter, reflecting a solid 21% increase Y-Y. The performance of online sales maintained strong momentum, comprising 40% of total sales in Q1-24 and 42% LTM.

The graph below demonstrates the robust growth in own E-commerce since the end of year 2018, which, according to Analyst Group, indicates that activities to bolster brand awareness have yielded significant results throughout the years, thereby directing a growing inflow of traffic to the Company’s own homepage. The robust growth, despite the challenges faced by the general e-commerce sector in recent years, is a testament to Björn Borg’s strength.

In regards to the sales geography, the Netherlands, Germany and Denmark showed good progression, with growth of 10%, 14% and 6%, respectively. However, other Nordic markets exhibited contrary performances, with sales in Sweden and Finland declining Y-Y, entirely attributed to the weak development in the footwear area.

Björn Borg Integrates Footwear In-House

In February, Björn Borg announced that its distribution partner for footwear, Serve&Volley, has entered into restructuring. Shortly thereafter, on March 11th, Björn Borg announced plans to fully integrate the footwear product category into its own operations. This integration means that the Company will handle the design, product development, and distribution of footwear in all markets. Apart from enabling Björn Borg to enhance control over quality, innovation and design, the integration will create synergies with other product categories in distribution. Since the distribution of footwear is already integrated in Sweden, Finland, and Denmark, and considering Björn Borg’s extensive experience in developing and manufacturing high-performance products in underwear, sportswear, and bags, Analyst Group believes that the Company possesses all the necessary prerequisites to leverage the strong brand and achieve significant growth within the footwear segment. The risk of the Company’s former licensee adversely affecting Björn Borg’s sales and delivery opportunities is evident, and Björn Borg’s assessment is that this could negatively impact EBIT for 2024E by up to SEK 5m where we estimate a result of SEK 126m for the full year. Although the first quarter demonstrates that transitioning from a licensing model to in-house integration can negatively impact operating results in the short term, Analyst Group believes that the long-term net effect will be positive, and that the footwear business could serve as a solid growth engine in the coming years.

Lower Profitability Development than Expected

During Q1-24, the Company achieved a gross margin of 53.3% (when including FX-effects) and 53.1% when excluding currency effects, which was lower than estimated (55.8%). The gross margin increased from 52.2% in Q1-23 but exhibited a decline from the previous quarter (Q4-23), when the gross margin amounted to 56.8%. The improvement Y-Y was primarily attributed to greater profitability within the wholesale business, as well as reduced discounts within the direct sales to consumer. Analyst Group estimated a stronger gross margin development in the first quarter, expecting a more significant impact from the robust performance of Own E-Commerce, which has a higher profitability profile compared to other sales channels.

Moving forward, the Company is expected to further strengthen its online presence through continued investments in marketing and other activities that enhance brand visibility, particularly via Own E-commerce. Analyst Group forecasts a sustained rise in online sales, which is projected to set the stage for a gross margin within the range of 55-57% range in the coming years.

Björn Borg reported an operating result (EBIT) of SEK 33.5m (31.4) for the first quarter, corresponding to an EBIT margin of 13%. Adjusting for currency tailwinds in the quarter, the operating result amounted to SEK 32.7 (33.6), corresponding to a currency-neutral EBIT margin of 12.7%. This outcome fell short of our expectations (SEK 46.7m), and the worse-than-expected result was primarily attributed to higher other external costs (SEK 60m compared to SEK 54m) than estimated, as well as higher personnel costs (SEK 37m compared to SEK 34m).

The Integration of the Footwear Business Increased the Capital Tie-up During Q1-24

The Company tends to tie up a significant portion of its working capital in the first quarter, which was also evident in Q1-24, but the quarter was heavily impacted by the integration of the footwear business in-house. Björn Borg generated SEK -107.7m (-29.8) in free cash flow (FCFF) during Q1-24, primarily due to an increase in working capital, which amounted to approximately SEK 129.9m. Thus, cash flow from operating activities in Q1 amounted to SEK -103.2m (-27.1). Given the nature of the industry, Björn Borg normally experiences fluctuations in working capital, with the most significant change in accounts receivable and accounts payable during the first and third quarters. However, the significant deterioration compared to the previous year is explained by a higher capital tie-up, attributed to the short-term headwinds following the integration of the footwear business, as the distribution partner went bankrupt. Analyst Group had not anticipated such a large impact from the integration of the footwear business. At the same time, we emphasize that this is a short-term effect, which, as previously mentioned, we expect to result in a positive net effect in the longer term.

Looking at FCFF for the last twelve months (LTM), which usually provides a more representative view of the underlying cash flow generation as it smooths out the seasonal variations and sharp quarterly swings, Björn Borg generated SEK 58.8m in FCFF LTM, representing a decrease of 28% compared to the same period last year, where the decrease is also attributed to the negative impact from the integration of the footwear business.

Given the current EBITDA LTM of SEK 135.1m and a net debt position of SEK 175.4m at the end of March, the net debt/EBITDA ratio stands at 1.25x (including leasing liabilities), and 0.95x when excluding leases. Consequently, Björn Borg increased the Company’s debt position in Q1, primarily due to short-term interest-bearing liabilities, as a result of the negative FCFF created by the high capital tie-up in the quarter.

Despite the high capital tie-up, Analyst Group considers that Björn Borg has built up a solid and healthy financial position, where the Company’s debt position increased to SEK 175m (146) and SEK 136m (98) excluding leasing liabilities, which is an increase both Y-Y and Q-Q.

Concluding Remarks About the Report

In conclusion, Björn Borg delivered a Q1 report that came in line with our estimates regarding top-line but fell short of our estimates in terms of profitability. However, the development during the quarter further demonstrates the Company’s strong momentum within Own E-Commerce, which exhibited strong growth. Furthermore, Analyst Group is pleased to see the solid progress within the Sports Apparel area, illustrating that the strategy to transition consumer perception from an underwear brand to a sports fashion brand has yielded notable results.

While the footwear business put short term pressure on the sales, Analyst Group believes that the product area carries substantial potential in the long term, and that the Company’s previous experience in developing and manufacturing high-performance products in underwear, sportswear, and bags, will pave the wave for a promising performance within footwear sales.

We will return with an updated equity research report of Björn Borg.