Björn Borg (” Björn Borg” or ”the Company”) published its Year-End report for 2023 on February 23, 2024. The following are key events that we have chosen to highlight from the report:

- Revenues amounted to SEK 197.6m (-3.4% lower than estimates) – Currency-neutral, net sales fell -3% Y-Y

- Own E-commerce amounted to SEK 45.8m, representing a 46% Y-Y growth

- Footwear Partner Enters into Restructuring

- Enhanced Channel Mix Boosted Higher-Than-Expected Margins

- Strong Cash Flow Generation Resulted in a Reduced Net Debt Position.

Own E-Commerce Grew 46% Y-Y

Björn Borg reported net sales of SEK 197.6m in the Company’s fourth quarter of fiscal 2023, marking a Y-Y decrease of 0.4% when factoring currency effects, and -3% when excluding these effects. The outcome fell short of our estimates (SEK 204.6m or -3.4%), primarily driven by lower-than-expected sales from the Sport Apparel (-5.4%) and Underwear business (-3.8%). Conversely, the development in the product category “Other”, exceeded our expectations (SEK 43m vs SEK 35m), where Analyst Group had estimated a carryover of the negative growth from the third quarter into the fourth quarter, but the actual development proved otherwise.

Given prevailing challenges such as high inflation and reduced purchasing power, the recorded negative growth in Q4 is not alarming, but rather viewed as a temporary setback by Analyst Group.

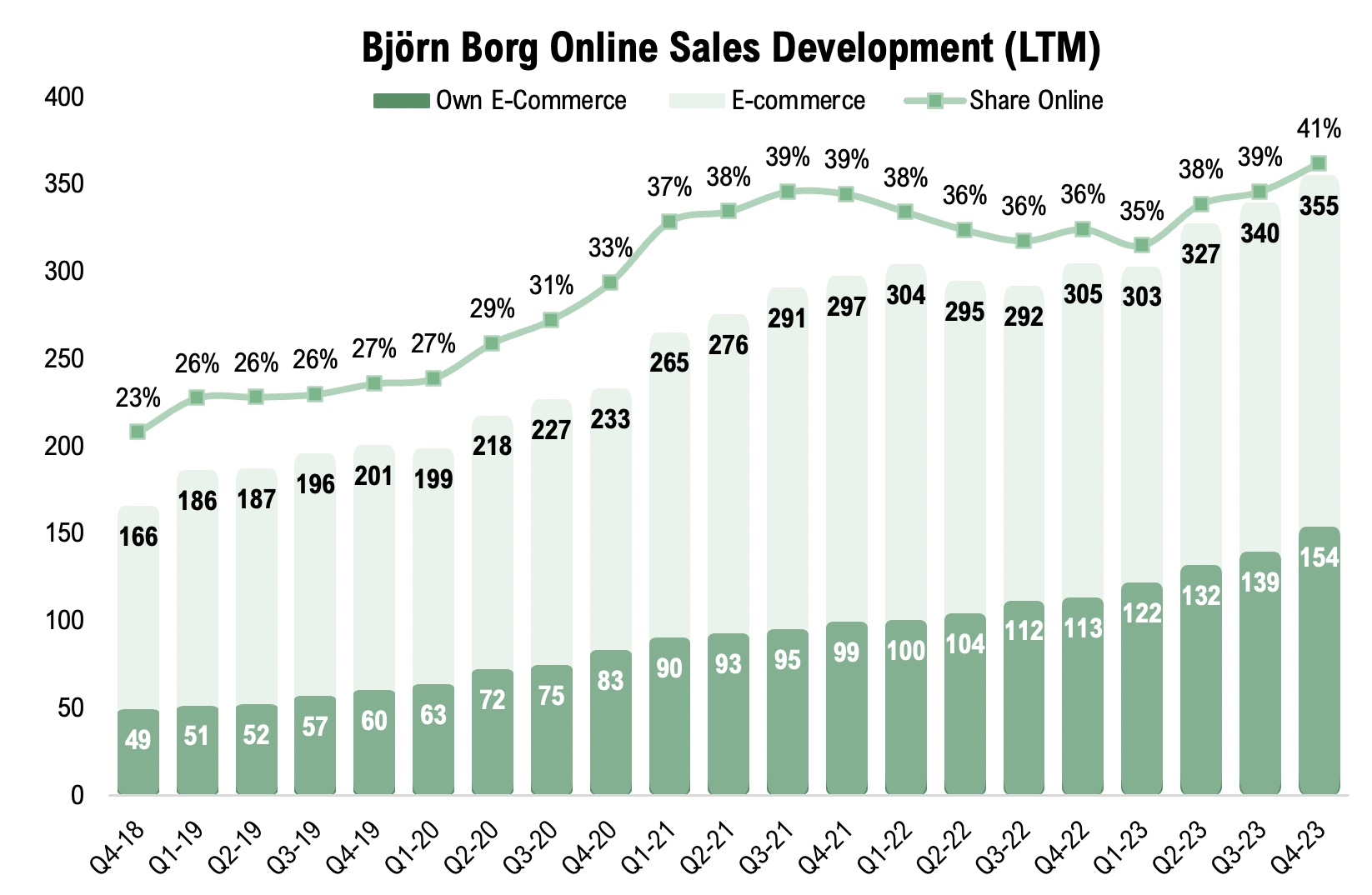

Examining the current quarter’s channel mix, it’s noteworthy that the Company’s Own E-commerce is gaining significant traction in the overall channel strategy. Sales from the Company’s E-commerce platform amounted to SEK 45.8m in the fourth quarter, reflecting a robust 46% Y-Y increase and surpassing our forecasts by a substantial margin (SEK 34.6m).

The online sales performance concluded 2023 on a more robust note than anticipated, with online sales comprising 47% of total sales in the fourth quarter and 41% for the full fiscal year 2023, surpassing our projections of 39% for both Q4-23 and the entire fiscal 2023. This indicates potential for upward adjustments in the updated research report, as Björn Borg’s significant marketing investments have yielded even greater brand strength and online market penetration than initially predicted.

In the graph below, we can clearly see how consistent the growth in own E-commerce has been since the end of Q4-18, despite previous and current challenges, indicating that made investments on marketing has spurred increased activity within Björn Borg own homepage and strengthened the brand, according to Analyst Group.

On the other hand, the Q4 report underscores the ongoing challenges faced by Björn Borg’s distributors, characterized by elevated inventory levels and diminishing household consumption. We anticipate sustained weakness in this sales channel in the forthcoming quarter.

In terms of sales geography, the Netherlands and Belgium outperformed expectations, partially attributable to the stronger performance in Own E-commerce. Meanwhile, the Swedish market maintained its positive momentum, registering a Y-Y growth of 7% in the fourth quarter and 8% for the full fiscal year 2023. However, other Nordic markets displayed a mixed performance, with Finland experiencing a 6% decline compared to the previous year, while Denmark witnessed a noteworthy 24% Y-Y increase.

Björn Borg’s Footwear Partner Enters into Restructuring

Shortly before the Q4-report, Björn Borg announced that its partner for the footwear business, Serve&Volley, has entered restructuring. For Björn Borg, the financial effect in the short term is limited, as orders placed for the spring collection are currently in Europe, ready to be delivered to customers. In the press release, Björn Borg revealed that the Company had, before this event, initiated a strategic review regarding overtaking the footwear operations under own authority. As the distribution of footwear is already an integrated part in the Nordic business (Sweden, Finland, and Denmark), Analyst Group believes that the probability for Björn Borg to overtake the footwear business is high. The financial impact of this transition would, according to Analyst Group, all else equal, result in a higher working capital need, in terms of increasing inventory and account receivables, for the end of 2024 and onwards. At the same time, the Company would get re-access to the markets that previously were omitted to Serve&Volley, resulting in higher footwear sales volumes in its own authority. However, it’s worth noting that Björn Borg previously received royalties on sold footwear, yielding 100% margins. Therefore, while the net effect on a percentage basis may appear negative, the move to bring the footwear business under its own authority has resulted in a positive absolute impact.

Enhanced Channel Mix Supported a Strong Gross Margin…

During Q4-23, the Company achieved a gross margin of 56.8% (when including FX-effects) and 56.2 % when excluding currency effects, which was higher than estimated (54.1%). This strong performance can be attributed to ongoing efforts to reduce discounts and optimize the channel mix, with a notable contribution from the expanding share of Own E-commerce.

Looking ahead, continued investments in marketing and other brand-enhancing activities are expected to further bolster the company’s online presence, particularly through Own E-commerce. Analyst Group forecasts a continued increase in online sales, laying the groundwork for sustaining a gross margin in the range of 55-57%. This outlook remains resilient even as the Sport Apparel segment, which typically carries lower margins, is projected to account for a larger share of revenues in the future.

… as well as the Operating Result

For the fourth quarter, Björn Borg reported an operating result (EBIT) of SEK 20.2m, corresponding to an EBIT margin of 10.2%. Adjusting for currency tailwinds in the quarter, the operating result amounted to SEK 19m, corresponding to a currency-neutral EBIT margin of 9.6%. This outcome exceeded our expectations (SEK 11.5m) by 64%. Apart from the factors that positively influenced the gross margin, such as the aforementioned factors, the better-than-expected result was mainly attributed to lower other external costs (SEK 53m compared to SEK 57m) than estimated, as well as somewhat lower personnel costs (SEK 34m compared to SEK 35m). The quarter’s channel mix played a role in this deviation from our estimates, alongside with reduced reserves for doubtful accounts receivables.

The quarter’s profitability thus came as a positive surprise, indicating that Björn Borg has gained stronger momentum within its Own E-commerce than previously anticipated as of the end of 2023. Moving forward, we are inclined to adjust our estimates regarding the channel mix, which is likely to support a stronger operating result than previously forecasted.

Strong Cash Conversion during the Quarter

In the fourth quarter, Björn Borg tends to free up a significant portion of its working capital, which also was the case for Q4-23. The company generated SEK 126.5m in free cash flow (FCFF) during Q4-23, with a substantial portion attributed to a reduction in working capital amounting to approximately SEK 106m. Although inventory increased by SEK 34m, reaching 21.1% of net sales for the quarter, this aligns with the Company’s established business cycle and was largely consistent with our estimates. It’s typical for Björn Borg’s inventory levels to peak in the second and fourth quarters, while reaching their lowest points in the first and third quarters.

The cash flows generated in the fourth quarter surpassed projections, underscoring a high level of efficiency in working capital management. This bodes well for the upcoming quarters, particularly amidst an increasingly uncertain macroeconomic environment.

Moreover, the Company significantly reduced its debt position in Q4, primarily driven by robust cash conversion during the quarter. This enabled Björn Borg to repay its overdraft facility of SEK 104m. Consequently, the net debt position (including leasing liabilities) stood at SEK 56m at the end of Q4-23, down from SEK 180m in the previous quarter. This implies a solid and healthy financial position moving forward.

Another favorable aspect highlighted in the report, particularly from a shareholders’ perspective, was the Board’s proposal to increase dividends to SEK 3.00 for fiscal year 2024. This marks a significant 50% increase from 2023, amounting to a total of SEK 75.4m. This move underscores the Company’s confidence in its balance sheet and its commitment to returning value to shareholders.

Notably, the proposed dividend for the next fiscal year exceeded our forecasts, which initially was estimated toSEK 2.30. Originally, a distribution of SEK 3.00 was expected to occur in 2025, making this announcement a positive surprise for investors.

Concluding remarks about the report

In conclusion, Björn Borg’s performance in Q4-23 underscores its continued robust growth trajectory within Own E-commerce, signaling that investments in marketing and brand enhancement initiatives have yielded tangible results. Despite prevalent macroeconomic challenges such as inflation, increased interest rates, and geopolitical uncertainties, Analyst Group believes that Björn Borg has effectively navigated these obstacles, as evidenced by the stronger-than-expected operating result.

Moving forward, monitoring the performance of the Company’s distributors, and tracking organic growth will be crucial factors. While sales growth may have fallen short of estimates, Analyst Group was impressed by the notable improvement in operating results during the quarter. As a result, upward adjustments tied to profitability are anticipated in the upcoming Equity Research Report.

We will return with an updated equity research report of Björn Borg.