Rights Issue: Genetic Analysis

- Aktiekurs

- 0.9

- Bransch

- Medicinteknik

- Lista

- Spotlight Stock Market

- Emissionsvolym

- 7,1 MNOK

- Teckningskurs

- 0,86 NOK

- Teckningsperiod

- 5 - 16 juni

- Första handelsdag

- N/A

- Garanti- och teckningsåtagande

- 0 %

AKTIE 0,86 NOK

INVESTERING N/A

VALUATION 42,5 MNOK

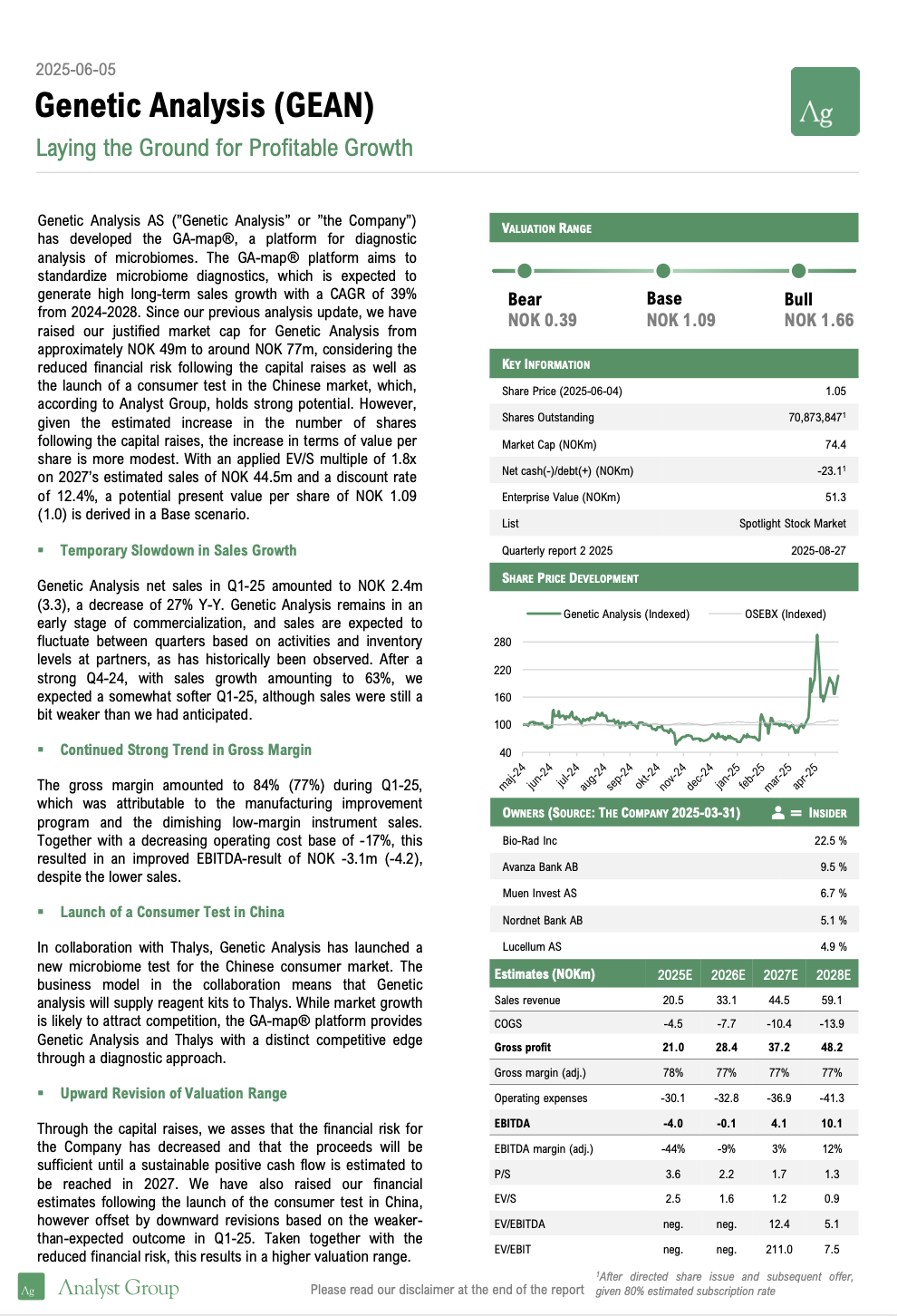

Genetic Analysis AS (”Genetic Analysis” or ”the Company”) has developed the GA-map®, a platform for diagnostic analysis of microbiomes. The GA-map® platform aims to standardize microbiome diagnostics, which is expected to generate high long-term sales growth with a CAGR of 39% from 2024-2028. Since our previous analysis update, we have raised our justified market cap for Genetic Analysis from approximately NOK 49m to around NOK 77m, considering the reduced financial risk following the capital raises as well as the launch of a consumer test in the Chinese market, which, according to Analyst Group, holds strong potential. However, given the estimated increase in the number of shares following the capital raises, the increase in terms of value per share is more modest. With an applied EV/S multiple of 1.8x on 2027’s estimated sales of NOK 44.5m and a discount rate of 12.4%, a potential present value per share of NOK 1.09 (1.0) is derived in a Base scenario.

Genetic Analysis is a science-based diagnostic company founded in 2008 that is a pioneer in the human microbiome field and has over 15 years of expertise in research and product development. The Company has developed the GA-map® technology platform for standardized and targeted microbiota analysis, a market that lacks a standardized diagnostic test. The platform includes various products and services to satisfy a wide range of use cases, ranging from diagnosing patients to Research-use-Only (RuO). The Company also has ongoing strategic product development to address the expected needs in the market, including a diagnostic tool for IBD and a rapid microbiome-based PCR test.

GA-map® Dysbiosis Test – Reproducible microbiome test

The GA-map® Dysbiosis Test is a CE-IVD-approved diagnostic tool for gut microbiota analysis, which serves as a complementary diagnostic tool for IBS, IBD, leaky gut syndrome, and other gut-related disorders. Using the GA-map® Analyzer software, it ensures quality-controlled result calculation. The test identifies microbiome imbalances by comparing samples to a validated reference, presenting findings through a Dysbiosis Index (DI) score, and a functional bacteria analysis. Results are standardized, reproducible, and available within 2–3 days.

GA-map® Discovery – A microbiota research assay

GA-map® Discovery is a Research-Use-Only (RuO) assay which expands Genetic Analysis focus on clinical research. Based on proprietary technology, it provides researchers with a user-friendly tool to identify bacterial profiles and validate exploratory findings through its built-in databases. With growing interest in microbiome research in clinical medicine and life sciences, more medical labs are adopting microbiome analyses for diagnostics and research, which solidifies GA-map® Discovery’s position in the market.

GA-map® Sample Collection Kit

The GA-map® Sample Collection Kit enables reliable at-home fecal sampling for nucleic acid analysis, preserving sample integrity. It includes a stabilizing buffer for storage up to 2 weeks at room temperature, 4 weeks refrigerated, and longer when frozen. CE-IVDR-approved, it is available for researchers, laboratories, and as an OEM product for commercial partners.

Service laboratory

Genetic Analysis service laboratory in Oslo offers complete microbiota profiling analysis for customers without the required instrumentation. Serving clients worldwide, the laboratory provides standardized, clinically validated microbiota assessments for all GA-map® assays.

GA-Map® Direct to Consumer

GA-map’s® DTC product, which has been developed in collarboration with Prokarimi AS, launched in August 2024. The test leverages the GA-map® platform’s validated microbiome testing technology, i.e., a diagnostic approach where the results are compared to a predetermined reference range, developed through clinically validated studies and with fast results.

GA-map® – Consumer Test in China

Genetic Analysis has collaborated with Thalys Medical Technology Group to develop a microbiome test for the Chinese market. launched in the consumer Health market in China. The test has now been launched and Thalys will use its independent and newly built Shanghai-based clinical lab Thalys (Shanghai) Medical Laboratory Co Ltd to further develop and distribute tests in China based on the GA-map® technology.

GA-map® Platform – Product Development Projects:

GA-map® IBD Dx

Genetic Analysis is developing a diagnostic tool to predict disease progression and treatment response in IBD, enabling personalized treatment. Supported by the Research Council of Norway, the project involves the University of Gothenburg and Akershus University Hospital. Clinical recruitment is nearly complete, with the aim to have an RuO version of the diagnostic test available by Q4-25.

GA-map® MHI GutHealth marker

Genetic Analysis, in collaboration with Ferring Pharmaceuticals, is developing a companion diagnostic test under a commercial agree-ment signed in December 2024, called GA-map® MHI GutHealth marker. The first Research-Use-Only (RuO) product is set for launch in Q2-25. The test aims to support clinicians with a rapid, microbiome-based tool for treatment monitoring and patient stratification.

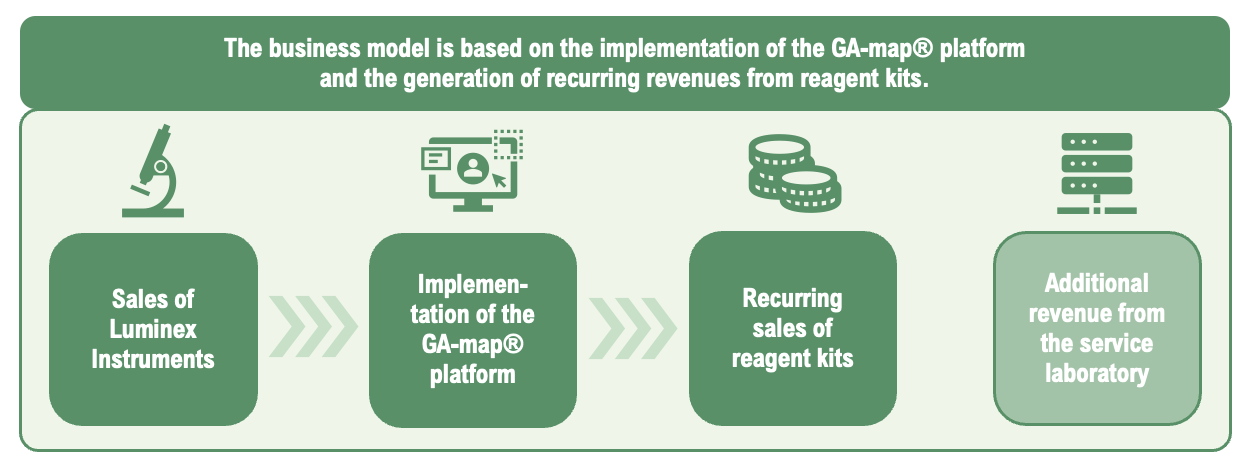

Genetic Analysis business model is based on the Company’s GA-map® platform, where today’s primary revenue driver is sales of reagent kits required to perform tests that serve as the basis for diagnosing patients’ microbiomes. As more laboratories adopt the user-friendly platform with immediate result publication through the Company’s cloud-based software, sales of reagent kits are expected to increase, generating recurring revenue streams for Genetic Analysis with high gross margins, estimated to amount to 75-85%.

A validation of the markets shift towards a more diagnostic approach is Genetic Analysis partnership with Ferring Pharmaceuticals, which constitutes of the development of a rapid microbiome-based PCR test, combining Genetic Analysis’ GA-map® platform with Ferring’s Microbiome Health Index biomarker. The GA-map® MHI GutHealth test is expected to reduce processing time from weeks to hours, lowering costs, and enhance standardization in microbiome diagnostics. Set for launch as a Research Use Only (RuO) product in Q2-25, Genetic Analysis holds exclusive commercialization rights without royalty or milestone obligations to Ferring. The test will initially target patients suffering from Clostridioides difficile infection (CDI), which is eligible for treatment with Ferring’s Rebyota drug, the first fecal microbiota product approved by the FDA. Hence, in the long-term, the test is expected be used to follow-up on how individual patients react on the Rebyota drug. This underscores the market shift towards diagnostics as more drugs within the human microbiome are approved. The launch, expected during H1-25, is expected to drive growth for Genetic Analysis by adding a new product to the portfolio within a new disease area.

The human microbiome has been referred to as a ”newly discovered organ” and in recent years research has emphasized the interplay between gut health and the immune system, highlighting its essential role in well-being. Moreover, several diseases have been linked to alterations in the composition and function of the microbiome. Given these insights, strong market growth is projected in the coming years. Global Market Insights estimates an annual market growth rate of 25.7% from 2024 to 2032, reaching a valuation of USD 6.5bn. The primary growth driver is expected to be advances in research, which have revealed the microbiome’s potential in therapeutics. As therapeutics become more readily available, the need for reliable diagnostic tools is expected to grow in tandem, both for selecting which patients that should receive treatment and for tracking therapeutic response over time, including the potential requirement for repeated dosing. Genetic Analysis has an established first mover advantage within microbiome-based diagnostics through the patented platform GA-map®, which was used to develop the first CE IVD-marked (In Vitro Diagnostic) product for mapping microbiomes, why Analyst Group argues that the Company is well positioned to capitalize on the expanding market.

Genetic Analysis’ business model is based on implementing the GA-map® platform at customer sites, primarily laboratories that conduct tests to diagnose human microbiota. To perform these tests, an instrument from Luminex is required, which is already widely used in laboratories globally. However, Genetic Analysis acts as a distributor of these instruments in all markets outside of Europe, where Luminex handles sales directly. Additionally, reagent kits that Genetic Analysis provide are required to conduct tests; these are sets of chemicals that react with biological samples to establish a diagnosis. As consumables, they contribute to recurring revenue, and the test results are then automatically generated through the Company’s cloud-based software, the GA-map® Analyzer.

Genetic Analysis’ largest product today is the Dysbiosis Test reagent kit, a clinically validated and CE-IVD approved diagnostic test designed for use in molecular laboratories. Through the Company’s software, the Dysbiosis Index (DI) score is calculated, where each sample result is converted into an easy-to-understand report. Each time a laboratory conducts tests, these reagent kits are required, generating recurring revenue for Genetic Analysis once the platform has been installed in a lab. Furthermore, the reagent kits are expected to have a high gross margin, which amounted to 80% for the Company in 2024 when 83% of sales were derived from reagent kits.

Finally, Genetic Analysis also has a business segment that offers services, primarily related to the Company’s own laboratory, where tests are performed for customers without the appropriate instrumentation. In such cases, the Company charges a fee for the conducted tests.

The most important strategic initiative for Genetic Analysis to drive growth in the short term is to get the GA-map® platform installed at more laboratories, thereby generating recurring sales of reagent kits. The sales strategy includes distribution through selected partners and the Company’s own sales department. A new distribution model was finalized in 2023, under which trusted partners sell GA-map® products directly to laboratories, ensuring global reach and facilitating logistics solutions. This means, among other things, that Genetic Analysis has discontinued instrument sales in the European market, where sales are now handled by the manufacturer Luminex, as instrument sales generate lower margins. It should also be noted that many laboratories already have the required Luminex instrument installed, which Genetic Analysis can target through distributors and the Company’s own sales force, eliminating the need to sell the instrument.

Moreover, Genetic Analysis has several ongoing development projects scheduled to launch, constituting an additional strategic initiative to drive growth. The development projects include GA-map® IBD Dx, addressing disease progression and treatment response in IBD, GA-map®–China, a microbiome test for the Chinese market that was recently launched, and GA-map® MHI GutHealth, a rapid microbiome-based PCR test. These projects aim to utilize the Genetic Analysis platform to add new revenue streams for the Company, and regarding the IBD and MHI GutHealth markers, the first Research-use-Only (RuO) products are expected to launch during 2025.

In the long term, there is additional potential to drive growth by launching new products based on the GA-map® platform in new disease areas. Genetic Analysis may collaborate with partners in research and development to advance existing, or new, versions of the GA-map® for use in other disease areas, including for example type 2 diabetes and colorectal cancer.

Analyst Group estimates growing revenues in the coming years through recurring sales of reagent kits, an introduction of GA-map® MHI GutHealth test in H1-25, steadily growing service sales, and sales of instruments in USA and Asia. This is estimated to result in a revenue CAGR of 39% during the years 2024-2028, corresponding to revenues amounting to NOK 59m in 2028, while gradually improving profitability to 12% EBITDA margin in 2028. With an applied EV/S multiple of 1.8x on 2027’s estimated sales of NOK 44.5m, and a discount rate of 12.4%, a potential present value per share of NOK 1.09 is derived in a Base scenario.

The analyses, documents, or other information originating from AG Equity Research AB (hereinafter ’AG’) are prepared solely for informational purposes, intended for broad distribution, and do not constitute investment advice. The information contained in the analyses is based on sources, data, and statements from individuals that AG considers reliable. However, AG does not guarantee, either expressly or implicitly, the accuracy, completeness, or correctness of such information. All forecasts and estimates presented are inherently subjective assessments that involve a degree of uncertainty and should therefore be interpreted with caution. AG provides no assurance that any projections or estimates will be realized.

Accordingly, any investment decisions made on the basis of material issued by AG or by persons affiliated with AG shall be made independently and at the sole discretion of the investor. The analyses, documents, and information provided by AG are intended to serve as one of several tools to support investment decision-making. Investors are strongly advised to consult additional sources of information and to seek advice from a qualified financial advisor prior to making any investment decisions.

AG expressly disclaims any and all liability for any loss or damage of whatever nature that may arise from the use of material originating from AG. Readers should assume that Analyst Group has received remuneration for the preparation of this material.

Nordnet and Avanza have not participated in the preparation of the offering and act solely as recipients and administrators of subscription applications.