Rights Issue: Eevia Health

- Aktiekurs

- N/A

- Bransch

- Bioactive Compounds

- Lista

- Spotlight Stock Market

- Emissionsvolym

- SEK 12.1m

- Teckningskurs

- SEK 0.09

- Teckningsperiod

- 28 jan - 11 feb

- Första handelsdag

- N/A

- Garanti- och teckningsåtagande

- 27%

AKTIE SEK 0.09

INVESTERING N/A

VALUATION SEK 6m

Unlocking Value Through a Strategic Turnaround

In Q4-24, Eevia Health Plc (publ) (“Eevia” or “the Company”) launched a transformational restructuring plan to become a specialized provider of high-margin, science-backed health solutions, focusing on gut, kidney, and urinary health. By divesting assets related to Retinari™ and berry extract manufacturing, Eevia aims to streamline operations, enhance profitability, and adopt a capital-light business model, leveraging the Company’s expertise in bioactive compounds. This turnaround plan allows investors to retain exposure to former operations without the financial risks of plant extract production. With a clear strategy set by the new and experienced board, Eevia is well-positioned to capitalize on the expanding gut health market and recover to profitable growth, thereby unlocking the underlying value within the Company. Overall, Analyst Group believes the ongoing rights issue presents an attractive entry point for investors at a Pre-Money valuation of SEK 6.0m.

Founded in 2017, Eevia Health specializes in the development of bioactive compounds, sustainably extracted from renewable plant materials to address global health challenges. The Company manufactures 100% organically certified plant extracts, sourcing raw materials primarily through wild harvesting from Finnish and Swedish forests. These extracts are supplied B2B as high-value ingredients to dietary supplement and food brands worldwide.

As an innovative player in a growing market, Eevia develops bioactive compounds with the potential to significantly impact human health. The Company operates a modern, green-chemistry production facility in Finland, leveraging a short and efficient value chain to enhance sustainability and cost efficiency.

In Q4-24, Eevia initiated a turnaround plan aimed at streamlining operations by divesting the Company’s assets related to the eye health compound, Retinari™, and manufacturing assets related to berry-based extracts. This strategic repositioning enables the Company to focus on higher-margin, science-backed health solutions, particularly in gut, kidney, and urinary health, while optimizing profitability and operational efficiency.

To understand the rationale behind Eevia’s strategic shift, it is essential to examine the Company’s recent history. Over the past years, Eevia has established itself as a specialist in berry extract manufacturing, forging partnerships with leading global brands and achieving notable advancements in berry extract production. The Company has developed a reputation for high-quality, organically certified extracts, catering to the growing demand for plant-based health solutions.

However, despite the expanding market for plant extracts, Eevia faced challenges in scaling operations profitably. Throughout 2023 and 2024, the Company navigated a range of internal and external headwinds, such as the temporary loss of the Company’s largest customer, a contamination crisis accentuated by analytical error by an external provider, supply chain constraints, market fluctuations, and limitations in relation to funding, which impacted growth and profitability.

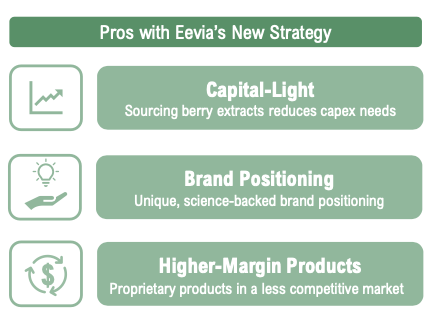

Capital-Light Business Model

With the planned divestments, Eevia will adopt a leaner operational structure, allowing Eevia to focus resources on the Company’s core business, science-backed ingredients. The asset-light model will eliminate direct ownership of production facilities, instead leveraging strategic sourcing and partnerships. This enhances flexibility, reduces capital expenditures, and optimizes cost efficiency, positioning the Company for sustainable, high-margin growth.

Broad Commercial Exposure

Eevia’s turnaround plan enables investors to retain exposure to the former business operations without the financial risk associated with plant extract production. As Eevia shifts toward a higher-margin, science-backed product portfolio, these divestments offer option value, providing additional potential upside if the legacy businesses perform well. This strategic realignment enhances financial flexibility, allowing Eevia to focus more efficiently on the Company’s core growth areas.

Extensive and Growing Market

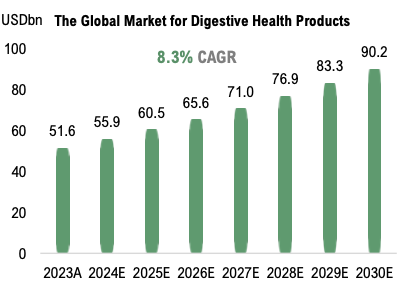

Medical professionals increasingly acknowledge the pivotal role of gut health in overall well-being. Eevia seeks to address the prevalent issues associated with gut dysbiosis by using high-strength bioactive blends that restore balance. The global gut health market, as estimated by Grand View Research, was valued at approx. USD 51.6bn in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 8.3%, reaching an estimated USD 90.2bn by 2030.

A shortage of foreign labor in Sweden and Finland disrupted the wild berry harvest in Q3-24, which led to increased raw material costs, impacting margins negatively. As much of the global market for berry-based extracts follows compendial standards, defined by official pharmacopeial monographs, Eevia faced difficulties competing on price with Asian manufacturers, producing similar extracts as Eevia. With a limited resources base, Eevia was unable to fund the necessary investments in the Company’s production facility to achieve higher yields and lower COGS, while Asian manufacturers have wide access to non-dilutive, state financed capital.

Recognizing the need for a more scalable and profitable business model, the Company initiated a strategic shift in late 2024, supported by new board members with vast industry expertise and experienced advisors. This shift represents a transformational opportunity, repositioning Eevia toward higher-margin, science-backed health solutions, with a primary focus on gut and microbiome health. This transition aims to enhance profitability, streamline operations, and align the Company with fast-growing consumer health trends, reducing reliance on price-sensitive standard extracts. As part of the streamlining initiatives, Eevia is planning on divesting assets to protect the value of market opportunities for Eevia’s shareholders.

At the core of this transformation is the commercialization of proprietary, scientifically validated products, including MaxBIOME™, a gut health formulation utilizing concentrated proanthocyanidins from berry extracts, leveraging Eevia’s existing products experience. Unlike conventional probiotic solutions, Eevia’s approach focuses on enhancing the gut environment to support beneficial bacteria rather than introducing new bacterial strains. Preclinical research has demonstrated promising results, why Eevia is seeking non-dilutive R&D funding of EUR 570k to conduct a clinical study, with early results expected in Q3-25. Being able to show study results and demonstrating the positive impacts on humans are a crucial component in positioning the brand and attracting customers. The Company plans to introduce MaxBIOME™ to the market in Q4-25, with initial commercial agreements anticipated during summer and early fall of 2025.

These bioactives are digested in the gut, filtered through the kidneys, and excreted in urine, where their metabolites may help balance the urinary microbiome. Positive findings support the early 2026 launch of Pro-URO™, a targeted, science-backed formulation for urogenital health.

The new business model shifts focus from raw materials to substantiated health solutions and could be explained as followed:

1) Conduct Clinical Studies – Validating the Solution

Eevia will conduct human studies to generate strong clinical data, establishing scientific credibility and validating the efficacy of the Company’s bioactive ingredient solutions.

2) Engage with Customer and Expand Market Reach

Leveraging the Company’s research-backed findings, Eevia will strategically engage with existing and prospective customers, many of whom Eevia is already in dialogue with. By aligning with customer needs and emphasizing evidence-based benefits, Eevia aims to strengthen the Company’s commercial relationships and brand positioning.

3) Source Extracts from Divested or External Suppliers

Rather than relying on in-house production for raw materials, Eevia will source key extracts from either the divested business unit or external suppliers. This approach reduces capital intensity, lowers operational costs, and increases supply chain flexibility.

4) Brand the Products Under the ”Eevia Brand”

The sourced extracts are incorporated into branded ingredients and finished products under the ”Eevia Brand”. This branding strategy allows the Company to maintain a premium market positioning, enhancing customer recog-nition and perceived value.

To support this transition, Eevia will recruit product, marketing, and sales personnel, enabling Eevia to gradually expand the Company’s market share in the global ingredient industry for scientifically substantiated ingredients. With a scientifically validated and branded product portfolio, Eevia aims to establish a unique brand position while operating without direct ownership of production facilities, facilitating a more streamlined and asset-light business model.

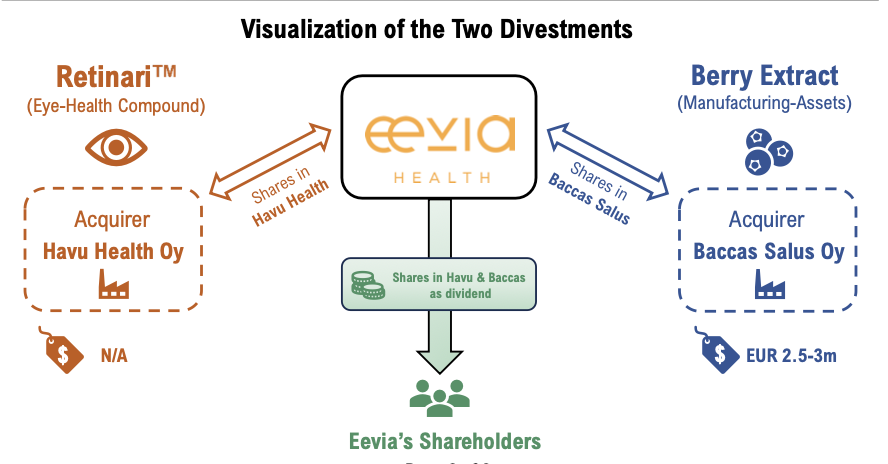

To protect the value of market opportunities for Eevia’s shareholders and to support the Company’s new strategic direction, a major restructuring of the Company’s balance sheet and P&L is planned. As part of this shift, two divestments are planned, involving Retinari™ and other wood-based product assets, as well as Eevia’s berry-based extract manufacturing assets. Although Eevia sees great potential within both of these segments, the Company’s currently lacks the necessary resources to commercialize and capitalize on the potential. Hence, by divesting these units to two separate start-ups, Eevia will streamline operations and reallocate resources toward the Company’s new core business, thereby creating a more capital-light and resource-effective business model.

The first planned divestments are for assets related to the prospective eye health compound, Retinari™, and other wood-based products. The buyer is a start-up, Havu Health Oy, founded by Eevia’s CTO Petri Lackman. Eevia will receive shares in Havu Health as compensation for the assets, which will be distributed to Eevia Health’s shareholders as a tax-free dividend following the rights issue.

Retinari™ is a potential game-changing prophylactic desiged to prevent the onset and progression of age-related macular degeneration (AMD), a progressive eye disease that damages the macula and leads to central vision loss, primarily affecting older adults. This is the most prominent and extreme commercial value option for Eevia, as over 200 million people are affected by AMD globally, with a rising demand for effective, convenient, and non-invasive solutions. Despite the significant commercial potential of Retinari™, Eevia currently lacks the resources to advance its development, as the time-to-market remains several years away and requires a process that includes safety studies and regulatory approvals before human use.

Havu Health Oy is in discussions with a Finnish venture fund for an equity investment and has recently submitted a EUR 700k grant application to Business Finland to finance the necessary safety studies. Additionally, Havu Health is preparing a EUR 2.5m grant application to the European Innovation Council’s Accelerator program, which would further accelerate the development process.

The second divestment concerns Eevia’s berry-based extract manufacturing assets, which will be sold to Baccas Salus Oy for EUR 2.5-3.0m, a startup focused on cost-efficient and sustainable berry extract production. Similar to the priorly mentioned divestment, Eevia will receive shares in Baccas Salus, which will be distributed to shareholders. A smaller fraction of the divestment will be paid in cash, which will be used to reduce Eevia’s debt.

As previously outlined, Eevia lacks the necessary resources to fully capitalize on commercial opportunities in berry extract manufacturing, particularly in securing the investments required to enhance the Company’s production facility for higher yields and lower COGS. However, Eevia possesses the technical expertise to optimize yields and reduce conversion costs, positioning itself as a low-cost, sustainable producer at scale, a vision that will be realized through the acquirer, Baccas Salus.

Located in Kemijärvi, Lapland, Baccas Salus benefits from its proximity to key wild berry harvest areas, ensuring shorter supply chains, superior raw material freshness and quality, a reduced carbon footprint, and higher yields from more potent berries. Baccas Salus plans to establish a highly automated, energy-efficient greenfield manufacturing facility, integrating innovative process solutions that Eevia cannot implement in the Company’s current production site. These advancements include passive cooling leveraging Northern Finland’s climate, nitrogen-inert processing, and shorter processing times to preserve bioactive compounds, all of which will significantly lower both COGS and OPEX for finished products.

Apart from the assets that Baccas Salus will acquire from Eevia, the planned facility expansion requires an estimated EUR 2m investment in manufacturing assets, expected to be financed through loans and grants. An additional EUR 2m for new buildings is planned to be structured as off-balance sheet rental agreements. However, the financing is not yet secured, if in place by April 2025, the facility could become operational by the end of Q1-26.

This initiative enables Baccas Salus to operate under a lower-cost model, enhancing its price competitiveness with major Asian manufacturers while establishing a pathway to profitable growth in the compendial berry extract market.

With the divestments in place, Eevia will transition to a leaner operational structure, channeling resources into building the Company’s core business in branded, science-backed ingredients. Cash payments from the divestments, together with sales proceeds from the sale of products already in inventory (> EUR 1m at the end of Q4-24), and the proceeds from the planned rights issue, will result in a stronger financial foundation. Coupled with the new business model, where Eevia will operate without direct ownership of production facilities, instead relying on strategic sourcing and partnerships, will bolster a more capital-light strategy that will position the Company towards profitable growth. This asset-light approach enhances flexibility, reduces capital expenditures, and enables a unique brand position in the global nutraceutical and functional ingredient industry.

Worth highlighting is that achieving non-dilutive funding, both for Eevia’s clinical study regarding the gut health formulation, and the divesting units, are critical aspects of the turnaround plan’s success.

Eevia’s Rights Issue

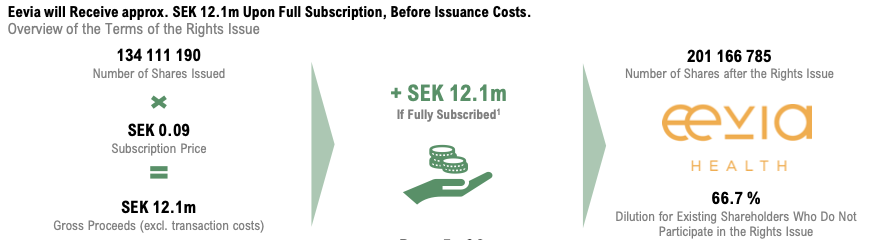

On 30th December 2024 Eevia announced the Company’s intention to execute a rights issue of approx. SEK 12.1m, before deduction of transaction related costs, with preferential rights for existing shareholders. The purpose is to fund Eevia’s strategic reorientation and turnaround plan, initiated on 7 October 2024, approved on 6 November, and re-endorsed on 12 December. The subscription price amounts to SEK 0.09 per share and EUR 0.0077 per share for shareholders through Euroclear Finland, reflecting a Pre-Money valuation of SEK 6m. All existing shareholders receive one (1) subscription right per share, where each right entitles them to subscribe for two (2) new shares. The subscription period runs from January 28 to February 11, 2025, in Sweden, while the corresponding period in Finland is from January 29 to February 13, 2025. The issue is secured in writing by external investors through top-down underwriting commitments covering 27%, from 100% down to 73%.

Background and Motives of the Rights Issue

In Q2-24, Eevia conducted a SEK 28.6m rights issue, but with a 60.2% subscription rate, it fell short by SEK 11.4m. Since then, the Company has prioritized cash flow management and optimized resource allocation.

Due to market challenges and unsuccessful non-dilutive funding efforts, Eevia initiated a strategic turnaround, approved by the Board on November 6th. The plan focuses on scientifically validated, higher-margin health solutions, particularly in gut and related health areas. The new products, including MaxBIOME™ (gut health), ProURO™ (urinary health), and ProRENIS™ (kidney health), will build on existing offerings to enable a more profitable product mix. This shift is estimated to mitigate challenges in compendial products, increase revenue, improve margins, reduce costs, and establish a more sustainable path towards profitable growth.

As part of the streamlining process, Eevia is restructuring the Company’s P&L and balance sheet through two planned divestments. The first involves assets related to Retinari™ and wood-based products, which will be sold to Havu Health Oy, a new start-up where Eevia will receive shares that will be distributed as dividends to shareholders.

Havu Health will pursue non-dilutive funding and equity investments to commercialize Retinari™, and subject to consent, Eevia may also sell additional wood-processing assets in 2025. A potential price for Retinari™ and the wood-processing assets has not yet been communicated.

The second divestment concerns assets related to berry-based extract manufacturing, with a communicated price of EUR 2.5-3.0m. The acquirer is Baccus Salas Oy, another start-up in which Eevia will receive shares, which will then be distributed to shareholders as a tax-free dividend. Both divestments depend on securing non-dilutive funding, which is also crucial for financing Eevia’s planned clinical studies on gut health.

In parallel, Eevia is negotiating with creditors to extend unsecured debt maturities and secure consent for the divestments, allowing proceeds to be used for debt reduction. The turnaround plan assumes a favorable repayment structure by end of January 2025, supporting a stronger liquidity position. To further stabilize finances, Eevia will use proceeds from divestments, sale of products already in inventory (>EUR 1m by the end of Q4-24), and the proceeds from the ongoing rights issue.

Following this restructuring, Eevia will transition into a specialized ingredient provider, focusing on IP-protected health solutions in gut, kidney, and urinary health (post-menopausal women). Eevia will expand the product, marketing, and sales teams, thereby aiming to strengthen the Company’s position in the global branded ingredient market, while adopting a capital-light model without direct production facilities.

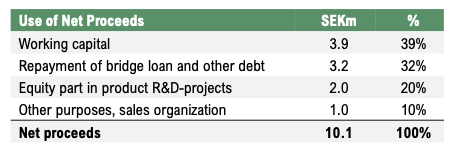

Use of Proceeds

Upon full subscription, Eevia will receive approx. SEK 12.1m before deducting transaction costs of SEK 1.9m, including SEK 0.4m for underwriters. The net proceeds will be allocated as follows:

Apart from the global gut health market, which is the core of Eevias new strategy, a glance of the markets in which the divestments are exposed to are included, as the divestments will allow investors to retain exposure to the Company’s former business operations.

The Global Gut Health Market

Medical professionals increasingly acknowledge the pivotal role of gut health in overall well-being. Eevia seeks to tackle the prevalent issues associated with gut dysbiosis, a condition that disrupts this balance. The global gut health market, as estimated by Grand View Research, was valued at approx. USD 51.6bn in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 8.3%, reaching an estimated USD 90.2bn by 2030.

Most gut health supplements on the market today aim to modulate the gut microbiota by introducing new elements:

- Probiotics: Live bacteria added to the gut to improve balance.

- Prebiotics: Nutrients that ”feed” beneficial bacteria already present.

- Postbiotics: Compounds produced by bacteria that can support gut health.

These approaches work by attempting to alter the gut’s microbial composition – essentially adding ”new players” to the gut ecosystem. However, they often face challenges such as poor bacterial survival rates during digestion, variable effectiveness, and high manufacturing costs. Eevia takes a fundamentally different approach by instead of adding bacteria, Eevia uses concentrated proanthocyanindins, natural antioxidants derived from berries, to support and nourish the beneficial bacteria already present in the gut. This method focuses on improving the environment of the gut itself, making it more hospitable for good bacteria and less favorable for harmful ones.

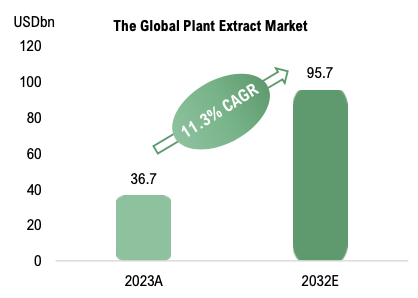

Plant Extract Market

Through the divestment of manufacturing assets of berry-extracts to Baccas Salus Oy, investors will gain exposure to the plant extract market and proanthocyanidins (PACs), which is anticipated to experience substantial growth in the coming decade. According to Global Market Insights, the global plant extract market was valued at approx. USD 36.7bn in 2023 and is estimated to show a CAGR of 11.3% from 2024-2032, reaching an estimated USD 95.7bn by 2032.

The plant extract market is driven by growing consumer awareness of the health benefits of plant-based medicines, as more individuals seek natural, healthier alternatives. Additionally, the increasing use of natural extracts in cosmetics, fueled by demand for clean-label and eco-friendly products, is further boosting market growth. Expanding R&D activities and the rising popularity of functional and convenience foods also contribute to the growing use of extracts in the food and beverage industry.

Market for Age-Related Macular Degeneration (ADM)

Through the divestment of assets related to the prospective eye health compound Retinari™ to Havu Health Oy, investors will gain indirect exposure to the growing AMD market, which is fueled by substantial unmet medical needs and increasing demand for effective solutions.

The global age-related macular degeneration (AMD) market is estimated to experiencing solid growth. In 2023, the AMD market was valued at approx. USD 10.8b and is projected to reach USD 17.8b by 2030, reflecting a CAGR of 8.2% from 2024 to 2030.

This growth is driven by factors such as an aging global population, increased awareness and early diagnosis of AMD, and advancements in treatment options. AMD currently affects over 200 million individuals worldwide, a number that is expected to rise with an aging population and increased life expectancy. This growing prevalence underscores the urgent need for innovative and accessible treatments.

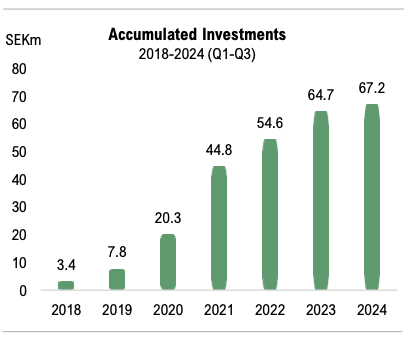

Analyst Group assesses that it is possible to derive a potential value for Eevia by estimating an underlying value based on the Company’s production facility, associated manufacturing assets, the development of the prospective eye health compound Retinari™, and the structural capital that Eevia has built over time. A potential valuation scenario is conducted using a cost-based approach, derived from the accumulated investments made by Eevia. We consider 2018 as the starting year, marking the Company’s expansion of production capacity in response to growing market demand.

The total investments made since then can be viewed as an illustrative total cost of developing Eevia’s production infrastructure, Retinari™, and the Company’s structural capital. This could also be interpreted as the minimum amount a third party would need to invest to independently develop similar production capabilities and an eye health compound with comparable prospects to Retinari™. However, not all past investments may have been value-creating, but this approach still provides a relevant benchmark for assessing the potential intrinsic value.

Between 2018 and 2024, Eevia has invested approx. EUR 5.8m (SEK 67m) in intangible and tangible assets, as reflected in the accumulated cash flow from the Company’s investing activities. Of this amount, around EUR 1m has been allocated to the development of Retinari™, while the majority has been directed toward enhancing production capabilities at the Kauhajoki facility in Finland. Notably, these investments have been funded primarily through external capital, as the Company has predominantly generated negative operating cash flow during this period.

The accumulated investment of SEK 67m implies a Post-Money per-share value of SEK 0.3. Applying a 30% discount to account for potential non-value-creating investments, the adjusted accumulated investment amounts to approx. SEK 47m, which remains significantly higher than the Pre- and Post-Money valuations of SEK 6m and SEK 18m, respectively.

Sum-of-the-Parts (SOTP)

Another way to assess the potential value of Eevia is through a Sum-of-the-Parts (SOTP) methodology, incorporating both the ”New Eevia” and the divested assets related to Retinari™ and berry-extract manufacturing. The planned divestments allow investors to retain exposure to Eevia’s former business operations without assuming the financial risk associated with production facilities. As Eevia transitions to a science-backed, higher-margin product portfolio, these divestments provide option value, offering potential upside if the legacy businesses perform well.

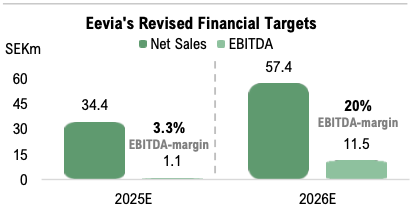

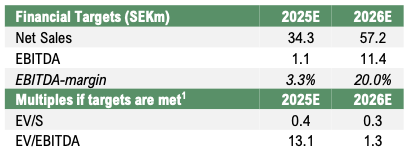

Given Eevia’s revised financial targets and announced turn-around plan, the current valuation multiples – based on the Post-Money valuation of SEK 18m – is deemed attractive, particularly as the Company shifts toward a higher-margin, asset-light business model. While Eevia still has much to prove with the new strategy, it is worth noting that the Company historically has reported sales in line with or exceeding the 2026E target, as demonstrated by the sales figures for 2021–2023 (EUR 4.9–6.7m).

Eevia has not yet disclosed a potential price for the Retinari™ assets, but using a cost-based approach, the accumulated development investments amount to approx. EUR 1m. The communicated price for the berry-manufacturing assets is in the range of EUR 2.5–3.0m. Adopting a conservative stance, estimating that Eevia could divest the Retinari™ assets at 50% of accumulated development costs and the berry-extract assets at the lower end of the stated range, this would result in a potential combined divestment value of EUR 3.0m, equivalent to SEK 34.4m. This does not factor in the potential value of the “New Eevia”, which, if the Company performs in line with or close to the financial targets, could offer an additional substantial upside to the potential valuation.

Eevia has not yet disclosed a potential price for the Retinari™ assets, but using a cost-based approach, the accumulated development investments amount to approx. EUR 1m. The communicated price for the berry-manufacturing assets is in the range of EUR 2.5–3.0m. Adopting a conservative stance, estimating that Eevia could divest the Retinari™ assets at 50% of accumulated development costs and the berry-extract assets at the lower end of the stated range, this would result in a potential combined divestment value of EUR 3.0m, equivalent to SEK 34.4m. This does not factor in the potential value of the “New Eevia”, which, if the Company performs in line with or close to the financial targets, could offer an additional substantial upside to the potential valuation.

In conclusion, Eevia presents a compelling investment opportunity, driven by the Company’s turnaround plan, which focuses on a novel solution for the growing gut health market while implementing a capital-light business model centered on science-backed, high-margin products. Additionally, investors participating in the rights issue gain exposure to the option value of the two divestments, offering potential upside if the legacy businesses perform well. All together, Analyst Group views an investment in Eevia, at a Pre-Money valuation of SEK 6.0m in conjunction to the rights issue, as an attractive Risk/Reward.

Dessa analyser, dokument eller annan information härrörande AG Equity Research AB (vidare AG) är framställt i informationssyfte, för allmän spridning, och är inte avsett att vara rådgivande. Informationen i analyserna är baserade på källor och uppgifter samt utlåtanden från personer som AG bedömer vara tillförlitliga. AG kan dock aldrig garantera riktigheten i informationen. Alla estimat i analyserna är subjektiva bedömningar, vilka alltid innehåller viss osäkerhet och bör användas varsamt. AG kan därmed aldrig garantera att prognoser och/eller estimat uppfylls. Detta innebär att investeringsbeslut baserat på information från AG eller personer med koppling till AG, alltid fattas självständigt av investeraren. Dessa analyser, dokument och information härrörande AG är avsett att vara ett av flera redskap vid investeringsbeslut. Investerare uppmanas att komplettera med ytterligare material och information samt konsultera en finansiell rådgivare inför alla investeringsbeslut. AG frånsäger sig allt ansvar för eventuell förlust eller skada av vad slag det må vara som grundar sig på användandet av material härrörande AG. Läsare kan anta att Analyst Group har mottagit ersättning för att framställa detta material.

Nordnet eller Avanza har inte varit part i framtagandet av erbjudandet, utan mottar och administrerar endast ansökningar om teckning.