STENOCARE, founded in 2017, is a Danish pharmaceutical company who became the first company to receive permission to import, distribute as well as to cultivate and produce medical cannabis in Denmark in 2018. Today, STENOCARE sources its products from several international suppliers and distribute these to a growing number of international markets. The Company also has their own indoor cultivation facility in Denmark, which is strategically focused on meeting pharmaceutical standards. STENOCARE was listed on Spotlight Stock Market on October 26th, 2018 and is today listed on Nasdaq First North Growth Market Denmark since May 15th, 2020.

Pressmeddelanden

Time to Capitalize on STENOCARE 3.0

STENOCARE A/S (“STENOCARE” or the “Company”) is a medical cannabis trading company with products approved and available for patients in six countries. The Company has recently launched a premium product, Astrum oil, which Analyst Group sees as an important growth driver in the coming year, as it distinguishes STENOCARE from competitors, providing improved, uniform and faster uptake in the blood. The product became available to patients in three countries during Q1-25, Germany, Australia, and Norway. With estimated net sales of DKK 13.7m by 2027, an applied P/S multiple of 2.3x and a discount rate of 16%, a potential present value per share of DKK 0.55 (0.64) is derived in a Base scenario.

- Sales Affected by New Revenue Recognition Method

From Q1-25, STENOCARE are using a new revenue recognition method where revenue is recognized when products are sold to the end-user compared to previously, when revenue was recognized when products were sold to distributors. The new accounting policy affected gross sales negatively by DKK 0.5m, which amounted to DKK 0.8m (1.2). As highlighted in previous analysis, we see a successful commercialization of the Astrum oil as the most important growth driver in 2025 and beyond, which is now available in three countries since Q1-25.

- Stronger Cost Control than Expected

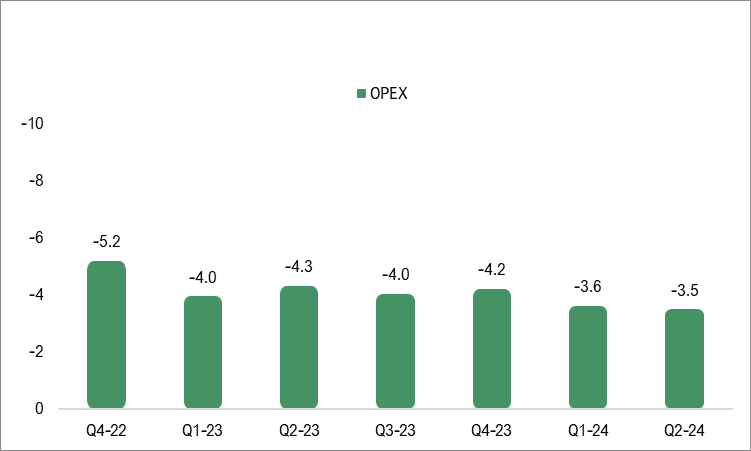

The operating expenses amounted to DKK 2.6m (3.6) in Q1-25, a decrease of 28% despite one-off non-recurring costs of DKK 0.8m attributable to the updated strategy with an exit from cultivation and the January capital raise. This validates the expected annual cost savings of approximately DKK 5m from the updated STENOCARE 3.0 strategy according to Analyst Group. We estimate that the burn rate will be reduced in the coming quarters through a combination of growing sales and decreasing cost base.

- Medical Cannabis Permanently Legal in Denmark

Medical cannabis has become permanently legal in Denmark through a new legislation that recently passed the Danish Parliament. This makes the country’s medical cannabis program permanent, effective January 1, 2026, when the current pilot program is scheduled to end. Analyst Group views this development as a positive for STENOCARE, as it establishes a clear framework for future operations in Denmark.

- Updated Valuation Range

We have made smaller adjustments to our forecasts following the Q1-report. The new revenue recognition method delays the realization of new sales, affecting the forecast for 2025 somewhat. On the other hand, the cost control was better than expected in the past quarter, adjusted for one-off costs, resulting in slightly improved margins in the forecast period. Nevertheless, the slightly slower estimated sales growth entails a small downward adjustment in our valuation range.

6

Värdedrivare

2

Historisk lönsamhet

7

Ledning & Styrelse

9

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

All Focus on Astrum

STENOCARE A/S (“STENOCARE” or the “Company”) is a medical cannabis trading company with products approved and available for patients in six countries. The Company has recently launched a premium product, Astrum oil, which Analyst Group sees as an important growth driver in the coming year, as it distinguishes STENOCARE from competitors, providing improved, uniform and faster uptake in the blood. The product became available to patients in three countries during 2025, Germany, Australia, and Norway. With estimated net sales of DKK 14.9m by 2027, an applied P/S multiple of 2.5x and a discount rate of 16%, a potential present value per share of DKK 0.64 (1.3) is derived in a Base scenario.

- Net Sales Amounted to DKK 1.3m in Q4-24

STENOCARE reported net sales of DKK 1.3m (1.3) in Q4-24, 21% above Analyst Groups estimate of DKK 1m. The Company continued to experience increased competition and a special situation in Denmark with a competing magistral product being supported with 85% patient subsidy from the Danish Medicines Agency. If the situation is solved during 2025, we see this, in combination with start of sales of the innovative Astrum oil as important sales growth drivers in the upcoming year.

- Additional Cost Savings Expected from Updated Strategy

The new STENOCARE 3.0 strategy states that the Company will focus on trading prescription-based medical cannabis and exit the production activities at STENOCARE’s own indoor cultivation facility. Hence, the Company is expected to be relieved of all related costs, including the significant long-term lease and equipment lease. This represents a financial obligation of approximately DKK 14m over the next six years and additional DKK 5m in annual operational costs. Through this updated strategy we estimate a decreasing cost base in 2025 and a shorter way to profitability, expected on an EBITDA level in 2027.

- The Financial Position Strengthened

STENOCARE’s cash balance at the end of Q4-24 amounted to DKK 1.4m and has been strengthened with estimated net proceeds amounting to DKK 7.9m from a rights issue in January. Based on an estimated decreasing cost base and growing net sales, we estimate that STENOCARE are financed for the remainder of 2025.

- Updated Valuation Range

We have updated our valuation scenario following the rights issue which meant an increased number of shares, thus dilution, however partly offset by a lower discount rate through a lower financial risk. Moreover, the exit from the Company’s cultivation activities has affected the long-term financial outlook as sales from the own cultivation facility had higher estimated margins. However, it enables a shorter path to positive results through cost savings in the coming years. Nevertheless, the updated forecast impacts our valuation range.

6

Värdedrivare

2

Historisk lönsamhet

7

Ledning & Styrelse

8

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Tough Market Conditions Hampers the Growth

STENOCARE A/S (“STENOCARE” or the “Company”) continues to experience tough market conditions in Denmark because of increased competition and higher subsidy from the Danish Medicines Agency on a competing product, which has affected sales. Moreover, sales in international markets has been slower than earlier expected, due to a more sluggish market. However, we still see growth opportunities in the coming years, primarily through STENOCARE’s new innovative premium product, Astrum oil. Nevertheless, the current market conditions has led us to update our financial forecasts of STENOCARE and with estimated net sales of DKK 15.6m by 2026, and with an applied P/S multiple of 2.5x, a potential present value per share of DKK 1.3 (4.0) is derived in a Base scenario. The updated valuation is a result of the updated forecasts as well as the increased financial risk.

- Gross Sales Amounted to DKK 1.1m in Q3-24

STENOCARE reported gross sales of DKK 1.1m (2.4) in Q3-24, corresponding to a decrease of 53%. Due to returns of expired products amounting to DKK 2m, as a result of lower demand than expected leading to expired products, net sales amounted to DKK -0.9m (0.2). The Company are experiencing increased competition and a special situation in Denmark with a competing magistral product being supported with 85% patient subsidy from the Danish Medicines Agency. We expect the challenges to remain throughout 2024 but see opportunities for growth in the long term, primarily through a successful launch of the Astrum oil.

- Operates With a Lean Organization

The operational expenses, excluding depreciation, amounted to DKK -3m (-4), corresponding to a decrease of 26%. Thus, we believe that STENOCARE is continuing to optimize the cost structure to reduce the Company’s burn rate, given the lack of sales acceleration so far, which we view positively on.

- Additional Funding Needed

STENOCARE’s cash balance at the end of Q3-24 amounted to DKK 0.1m and given that the Company are yet to show a positive cash flow, STENOCARE will need additional funding to keep the operations going and to leverage future growth opportunities. We assess that a capital raise through a new share issue is the most likely scenario, which, however, may occur under less favorable terms for existing shareholders given the recent weak share price performance.

- Updated Valuation Range

Considering the results during the first nine months of 2024 and the current tough market conditions both in Denmark, because of increased competition higher subsidy on a competing product, as well as in international markets, we have updated our financial forecasts. Given the updated forecasts, with lower growth and profitability, as well as a high financial risk, we have updated our valuation range in all scenarios.

6

Värdedrivare

2

Historisk lönsamhet

7

Ledning & Styrelse

8

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Delivers on Key Strategic Initiatives

STENOCARE A/S (“STENOCARE” or the “Company”) has executed on several strategically important milestones during H1-24, including approval of the balanced oil in Denmark and the launch of premium products in Australia and Germany. However, higher product price subsidy has increased competition from Magistrel products in Denmark, and the market growth has been slower than expected which has affected sales. This has led us to update our financial forecasts for STENOCARE and with estimated net sales of DKK 30.2m by 2026, and with an applied P/S multiple of 4x, a potential present value per share of DKK 4.0 (8.8) is derived in a Base scenario. The updated valuation is a result of the updated forecasts, a multiple contraction in the industry as well as an increase in shares outstanding from capital raises.

- Net Sales Amounted to DKK 0.7m in Q2-24

STENOCARE reported net sales of DKK 0.7m (1.7) in Q2-24, corresponding to a decrease of 57% Y-Y. Unfavorable market dynamics has impacted STENOCARE’s sales negatively where higher product price subsidy in Denmark has increased competition and resulted in price decreases. Moreover, sales in international markets have been slower than estimated as the integration of medical cannabis into the health care industry has been slower than estimated. However, STENOCARE has successfully made the planned strategic progress in several markets, which has laid the ground for future growth. Nevertheless, considering the current market conditions, we have updated our sales forecast downwards in this update.

- Operates With a Lean Organization

The operational expenses, excluding depreciation, amounted to DKK -3.5m (-4,3), corresponding to a decrease of 19%. Thus, we believe that STENOCARE is continuing to optimize the cost structure to reduce the Company’s burn rate, given the lack of sales acceleration so far, which we view positively.

- Launch of Next Generation Products

During Q2-24, STENOCARE announced the launch of the Company’s premium product, Astrum oil, which is expected to be available for patients in Australia and Germany from Q4-24. The Astrum oil offers several benefits which the industry have struggled with historically, including a higher, more uniform, and faster uptake in the blood. Analyst Group believes that the Astrum oil has the potential to revolutionize the industry and is expected to be an important sales driver from 2025.

- Updated Valuation Range

Considering the results in H1-24 and the current more unfavorable market conditions and a slower market growth than expected, we have updated our financial forecasts downwards in this update. As a result of the updated forecasts, a contraction in multiples for companies within the cannabis sector and an increase in outstanding shares due to exercise of TO2 warrants and a directed issue, we have updated our valuation range in all scenarios.

6

Värdedrivare

2

Historisk lönsamhet

8

Ledning & Styrelse

8

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

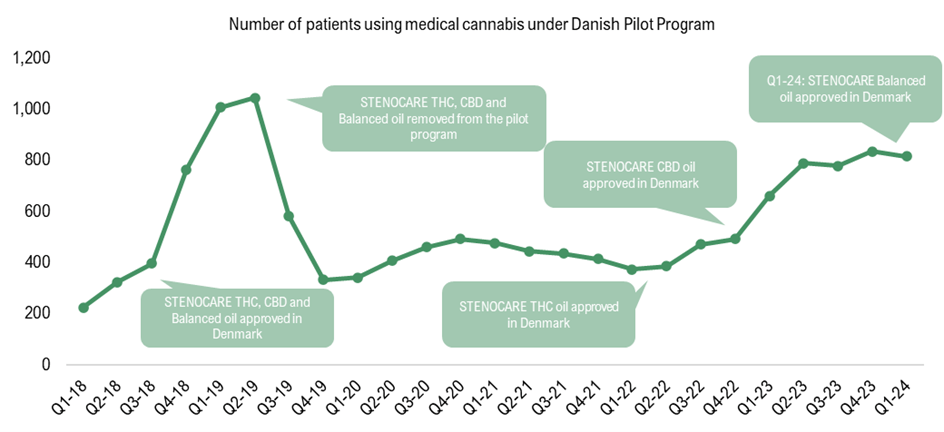

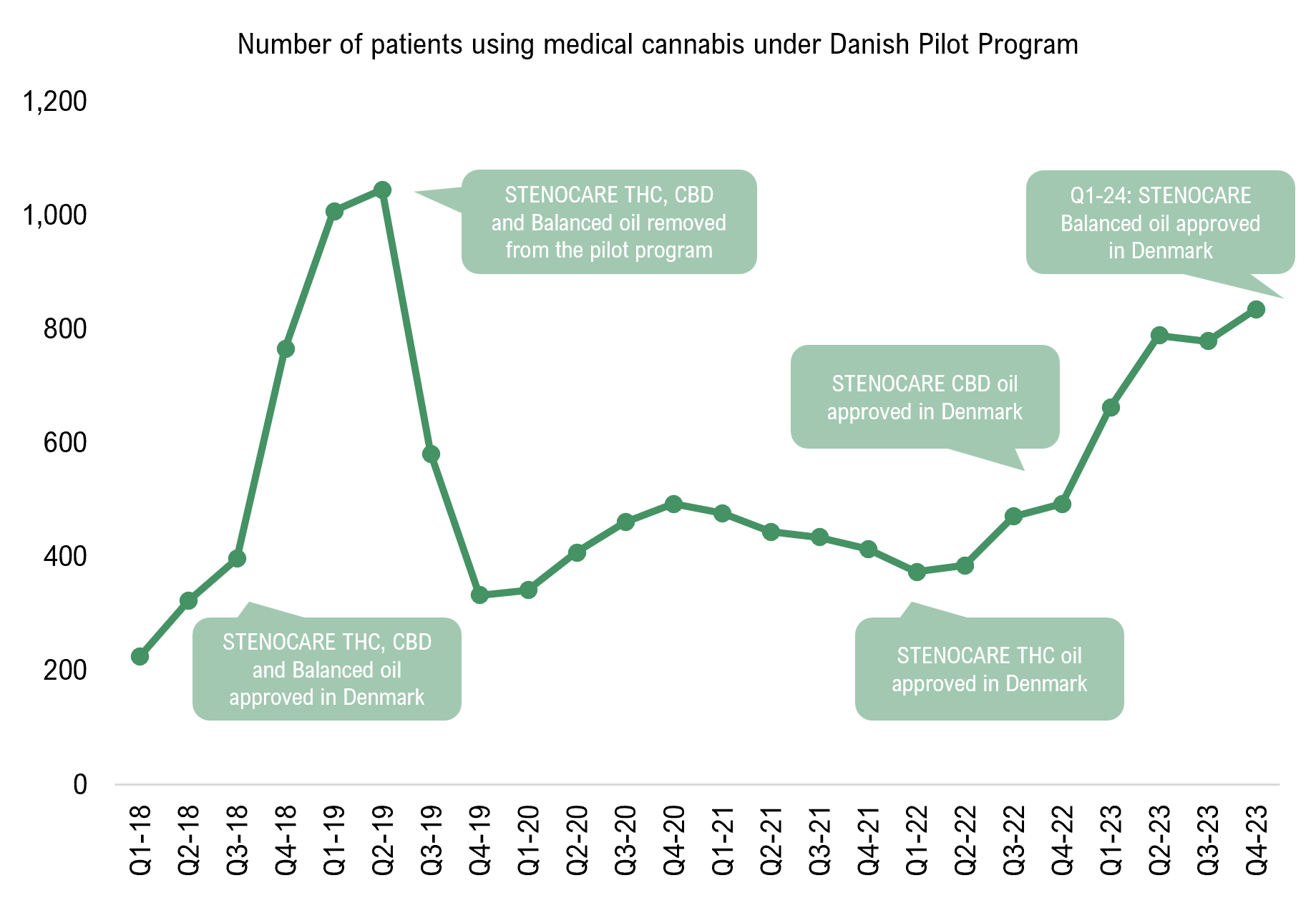

New Products Paves the way for Further Patient Growth

With a new THC/CBD medical cannabis oil approved, which is ready for sales under the Danish pilot program, STENOCARE A/S (“STENOCARE” or the “Company”) has regained the position as the only provider of all three essential oil products under the program; a THC oil, CBD oil, and the new THC/CBD oil. The last time STENOCARE had all three products approved in Denmark back in 2018/2019, the Company reported net sales of DKK 4.3m in Q1-19 with a positive net result. STENOCARE are now back in the same situation in Denmark, and with products approved in five additional markets. With estimated net sales of DKK 66.6m by 2026, and with an applied P/S multiple of 4.5x, a potential present value per share of DKK 8.8 (8.8) is derived in a Base scenario.

- Net Sales Amounted to DKK 1.2m in Q1-24

STENOCARE reported net sales of DKK 1.2m (0.8) in Q1-24, corresponding to a growth of 43% compared to Q1-23. The gross sales, excluding product returns, amounted to DKK 1.4m. With the figures for Q1-24 presented, STENOCARE still has a way to go to reach our estimate of net sales of DKK 16.5m in 2024. However, STENOCARE’s sales fluctuate between quarters as the Company delivers products in large bulks and we expect stronger sales in the coming quarters as sales of the two newly approved products on the Danish and Australian market will be included.

- Operates With a Lean Organization

The operating expenses decreased by 7% in Q1-24 to DKK -4.5m, compared to DKK -4.8m in Q1-23, while the cost base compared to Q4-23 decreased by 12% from DKK -5.1m. Thus, STENOCARE continues to operate with a good cost control towards the estimated break even by the end of 2024.

- German Legalization Enables more Prescriptions

During Q1-24, Germany legalized cannabis for recreational use. Moreover, the country also declassified cannabis as narcotics, something that is expected to simplify the process for more doctors to prescribe medical cannabis and ease the way for patients to obtain a prescription. This is expected to further support the growth of the German medical cannabis market, which is already the largest in Europe with approximately 230,000 patients. STENOCARE entered the German market in Q4-23, and we expect strong sales growth in 2024.

- We make Small Adjustments in our Valuation Range

With reported net sales of DKK 1.2m in Q1-24, we still see possibilities for STENOCARE to reach our revenue estimate of DKK 16.5m in 2024 through sales of the two newly approved products on the Danish and Australian market, as well as sales growth on the German market. Hence, we are keeping our financial forecasts for STENOCARE, as well as a largely unchanged valuation range, with small adjustments in our Bear and Bull scenario.

6

Värdedrivare

2

Historisk lönsamhet

8

Ledning & Styrelse

7

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

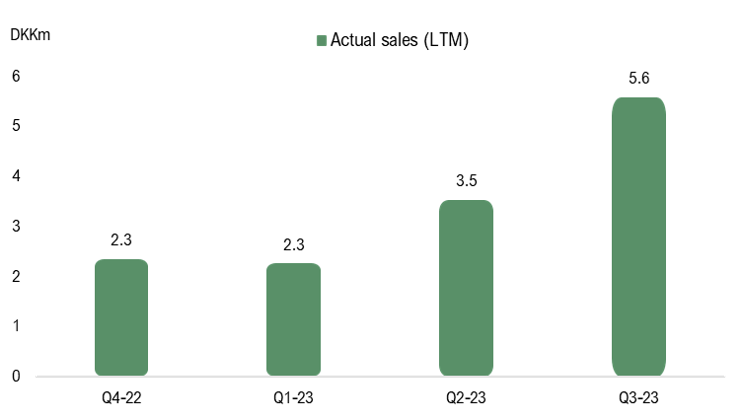

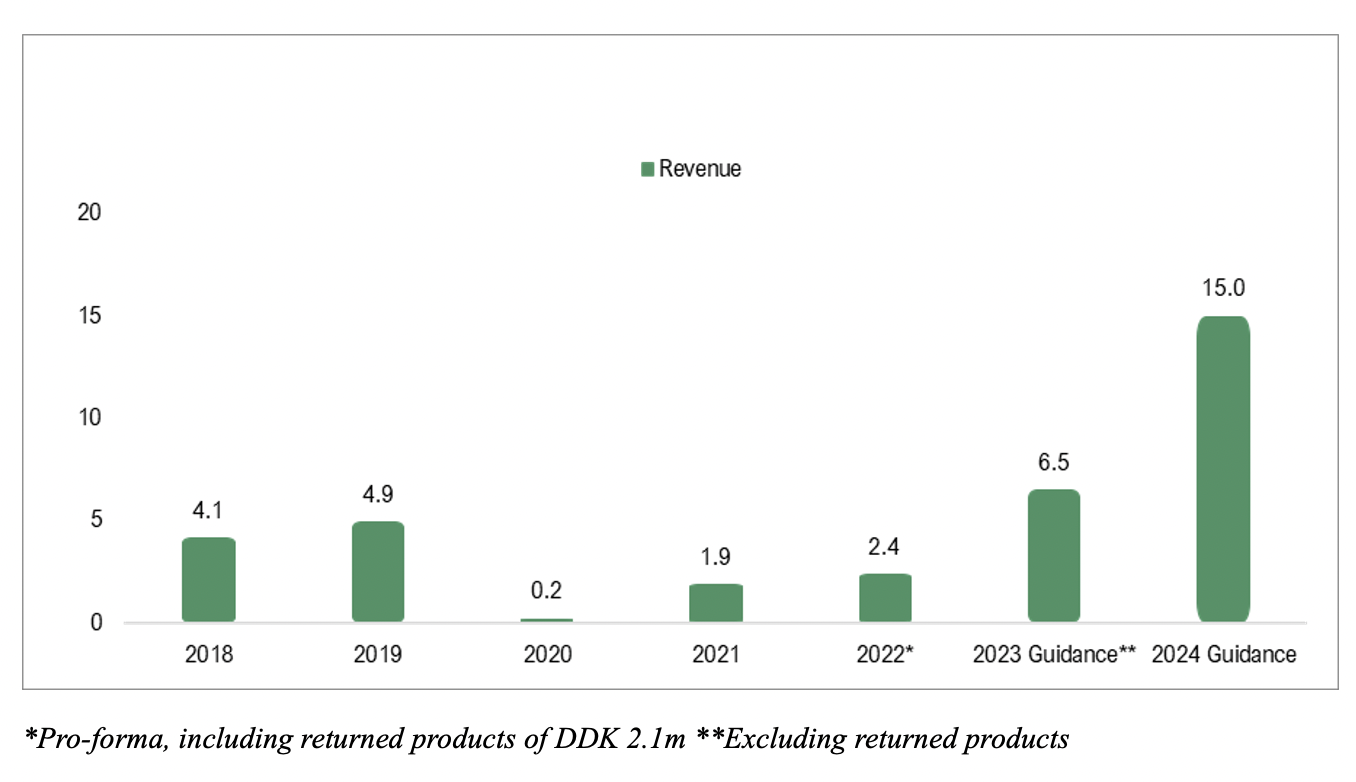

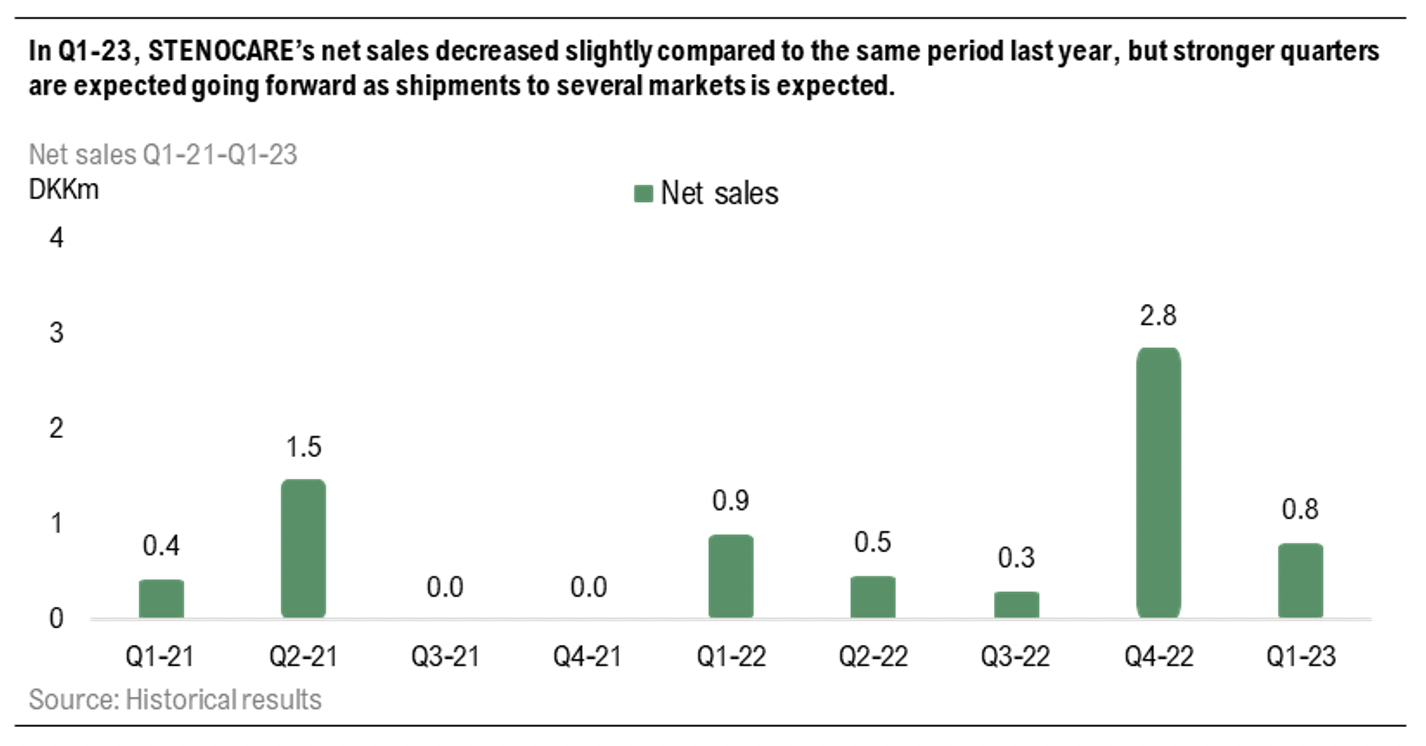

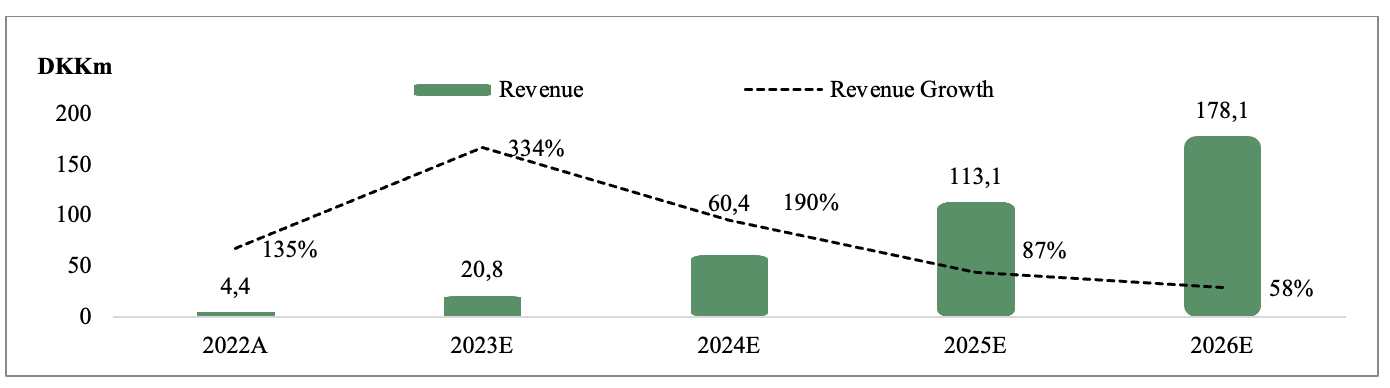

An Exciting Year Ahead

During 2023 STENOCARE delivered record in gross sales amounting to DKK 6.9m, corresponding to a growth of 18%, in combination with a decreasing cost base. For 2024 we estimate net sales of DKK 16.5m driven by, among other things, new products in Australia and Denmark as well as introduction of the first product in Germany, resulting in a positive EBITDA-result at the end of the year. With estimated net sales of DKK 66.6m by 2026, and with an applied P/S multiple of 5x, a potential present value per share of DKK 8.8 (9.4) is derived in a Base scenario.

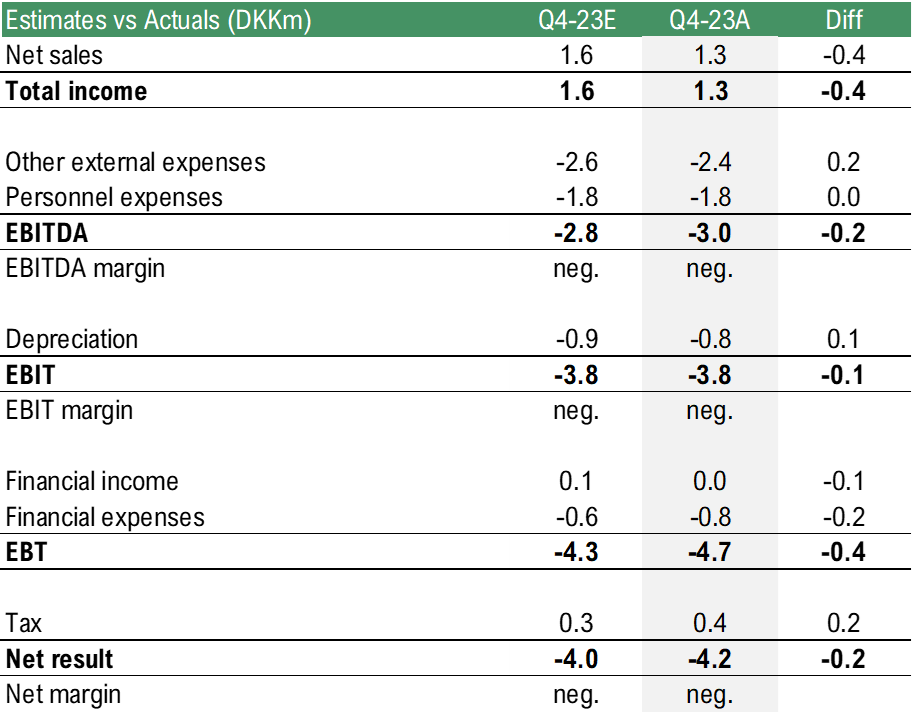

- Gross Sales Amounted to DKK 1.7m in Q4-23

STENOCARE reported net sales of DKK 1.3m (2.8) in Q4-23, corresponding to a decrease of 56% compared to Q4-22. As mentioned in earlier updates, STENOCARE’s sales will fluctuate between quarters and in Q4-22, STENOCARE had a large delivery to Norway, which should be taken into consideration when comparing. Moreover, gross sales amounted to DKK 1.7m, where the difference from net sales is attributable to a product return from Norway. We expect returns of this size to be a one-off occasion and procedures to avoid similar situations has been implemented. Hence, we expect minor differences between gross sales and net sales going forward.

- The Balanced oil Obtains Approval in Denmark

After the Q4-report, STENOCARE announced that a balanced oil, called “THC/CBD Olie STENOCARE”, has obtained approval from the Danish Medicines Agency. STENOCARE now has regained the position of being the sole provider of all three essential oil products; THC-oil, CBD-oil and a balanced oil. Historically, the balanced oil has represented +50% of the Company’s sales, why we see this as an important driver of sales growth in the coming years.

- Continues to Operate With a Stable Cost Base

Operating costs amounted to DKK -5.1m in Q4-23, compared to DKK -4.9m in the preceding quarter, why STENOCARE continues to develop with a stable cost base. After the refinancing agreement in January 2024, the cash position is estimated at DKK 6.6m. We estimate STENOCARE to be break even on an EBITDA level at the end of 2024, where the existing cash position is estimated to be enough to reach that point.

- Updated Valuation Range

The Q4-report was relatively in line with our expectations, why we only make minor adjustments to our forecasts and reiterate our valuation range in terms of market cap. However, following the capital injections from warrants of series TO1 and the directed rights issue, the value per share is affected, which is just a technical adjustment. Moreover, we believe that STENOCARE has progressed in the right direction over the year with increasing gross sales, we consider that the risk in the Company has slightly decreased. Therefore, we have adjusted the discount rate from 30% to 25%. Overall, this results in an updated valuation range for all three scenarios.

6

Värdedrivare

2

Historisk lönsamhet

8

Ledning & Styrelse

7

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Strong Patient Growth in Denmark

The number of patients continued to grow strongly during Q3-23 for STENOCARE A/S (“STENOCARE” or “the Company”) which resulted in actual sales of DKK 2.3m. The reported net sales amounted to DKK 0.2m but included a large product return from Norway of DKK 2.1m, which we consider as a one-of occasion. Adjusted for the product return, EBITDA amounted to DKK -1.7m, the best in a quarter since Q1-19 and we estimate STENOCARE to reach break-even by the end of 2024. With estimated net sales of DKK 66.6m by 2026, and with an applied P/S multiple of 5x, a potential present value per share of DKK 9.4 (10.2) is derived in a Base scenario.

- Actual Sales Amounted to DKK 2.3m in Q3-23

The reported net sales of DKK 0.2m was affected by a return of products from Norway amounting to DKK 2.1m, which was delivered in Q4-22. Excluding the product return, sales in Q3-23 amounted to DKK 2.3m (0.3), corresponding to a growth of 686% Y-Y, albeit from low levels. The large product return is not desirable, but we expect returns of this size to be a one-off occasion. Excluding the large return from Norway, STENOCARE continues to grow through strong patient growth in Denmark.

- Continues to Operate With a Stable Cost Base

Operating costs amounted to DKK 4.9m in Q3-23, compared to DKK 5.2m in the preceding quarter, why we believe STENOCARE continues to develop with a stable cost base. The EBITDA amounted to DKK -1.7m, adjusted for the returned products, which is the best result since Q1-19 and a step towards the estimated break-even by the end of 2024.

- TO 1 is Important for the Liquidity

STENOCARE’s cash positions amounted to DKK 5m at the end of Q3-23 and based on an estimated burn rate of DKK -0.7m per month, STENOCARE would be financed until early Q2-24, everything else equal. However, the cash position could be strengthened by DKK 3.7-7.8m in gross proceeds through exercise of warrants of series TO 1 in December, with an exercise price between DKK 3.21-6.70. It should also be noted that the Company has convertible bonds maturing on January 1st, 2024, of DKK 7m. However, these can be refinanced or extended, which would delay the maturity, or converted to equity at a share price between DKK 10.89 to 12.13.

- Updated Valuation Range

With figures for Q3-23 presented and an updated guidance from STENOCARE, we have updated our financial forecasts. We have lowered our expectations in international markets as the ramp-up in sales has been slower than estimated. However, we still see continued strong growth in Denmark, break-even at the end of 2024 and a big potential in the Company’s international markets. In this update, we have also switched target year for our valuation to 2026, as STENOCARE is expected to have reached a larger part of the Company’s potential, which, in combination with the updated forecasts results in an updated valuation range in all scenarios.

6

Värdedrivare

2

Historisk lönsamhet

8

Ledning & Styrelse

7

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Long-term Sales Drivers are Intact

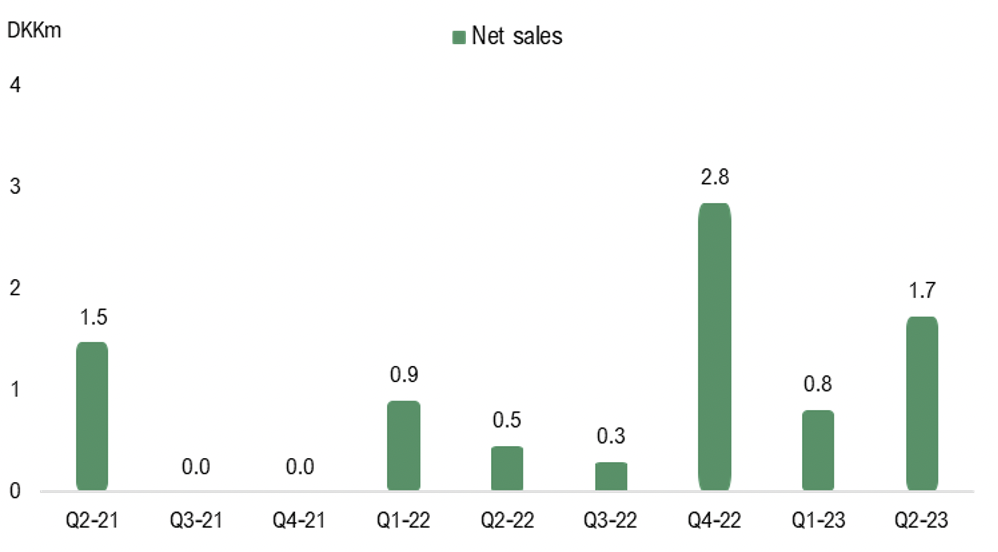

In Q2-23, STENOCARE delivered a sales growth of 279% Y-Y, amounting to DKK 1.7m with a stable cost development. However, sales growth was under our expectations due to a delay from agencies regarding approval of new products as well as slower sales than expected in international markets. The delay is expected to affect sales growth for the rest of 2023 as STENOCARE’s balanced oil is expected to obtain approval in the end of 2023. This, in combination with other sales drivers such as entering the German market in Q2-23 and a potential launch of the Company’s premium products, is expected to accelerate sales growth from 2024. With estimated net sales of DKK 59.2m by 2025, and with an applied P/S multiple of 5x, a potential present value per share of DKK 10.2 (13.9) is derived in a Base scenario.

- Slower Sales Growth due to Delays from Agencies

STENOCARE’s net sales amounted to DKK 1.7m (0.5) in Q2-23, corresponding to a growth of 279% Y-Y. The development in sales is below our expectations and is, among other things, attributable to a delay from medicinal agencies regarding approving the Company’s products, for instance a balanced oil on the Danish market, which needs approval again as STENOCARE has a new supplier compared to when it was commercially active in 2018/2019. This product has historically represented +50% of the sales volume, why we expect sales growth to accelerate once the new balanced oil is approved, expected in the end of 2023.

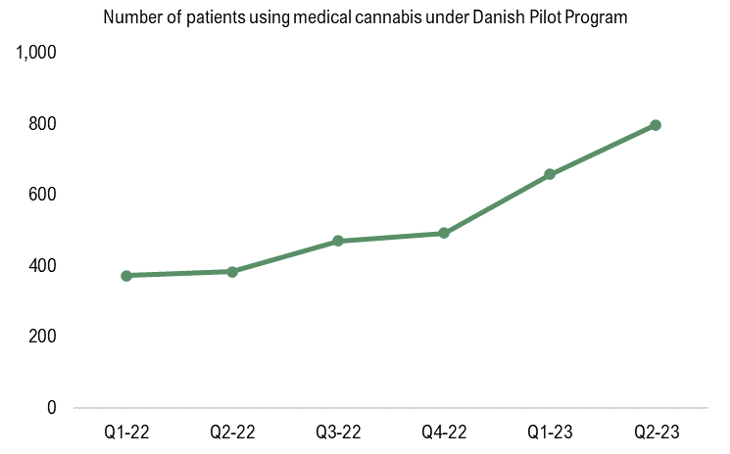

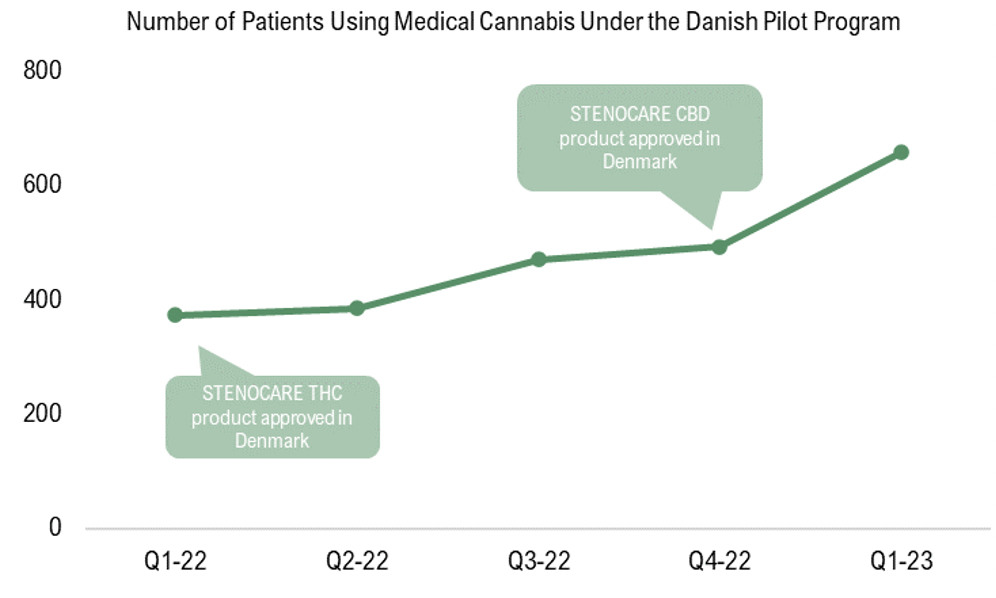

- Growth in Prescriptions in Denmark

Despite the balanced oil being delayed, data from the Danish Medicines Agency shows that there has been a growth in the number of patients using medical cannabis since the Company obtained approval for their THC oil (early 2022) and CBD oil (early 2023) respectively. No other oil product has been approved in this period, why we assume that the patient growth is primarily attributable to STENOCARE’s products entering the market, something that is expected to accelerate further when the balanced oil obtains approval.

- Updated Valuation Range

As the figures for the first half-year of 2023 is now presented, STENOCARE’s net sales have developed below our expectations. This, in combination with a delay in approval for the balanced oil, which will affect the Company for the rest of 2023, has resulted in an update of our financial forecasts and valuation range in all scenarios. However, we see several growth drivers that are expected to materialize during 2024, including a ramp up in sales in the newly entered German market and a potential launch of the Company’s own premium products, why we still estimate strong revenue growth going forward. In connection with this, we have switched target year for our valuation, why a P/S multiple is applied on 2025 years estimated sales, as STENOCARE is expected to have reached a larger part of the Company’s potential. However, we still see, given today’s share price, that an investment in STENOCARE invites to an attractive risk reward.

6

Värdedrivare

2

Historisk lönsamhet

8

Ledning & Styrelse

7

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Entering the Largest Market in Europe

With the Q1-report presented, it is clear that STENOCARE A/S (“STENOCARE” or the “Company”), has laid the groundwork for future scale-up, for instance through entering a new market, launching an IT-platform for online clinics as well as selecting a partner to produce the Company’s premium products. Sales is expected to fluctuate from quarter to quarter due to products being shipped in large quantities, why we expect stronger revenues in the coming quarters than the DKK 0.8m presented in Q1-23. With estimated net sales of DKK 60.4m by 2024, and with an applied P/S multiple of 5.5x, a potential present value per share of DKK 13.9 (21.4) is derived in a Base scenario.

- Entering the German Market

STENOCARE has obtained approval for a new product in Germany, which is by far the largest market for medical cannabis in Europe, with estimated sales of EUR 1bn by 2027, compared to EUR 2.2bn for Europe in total. Given the German markets size, this also entails more competition, where STENOCARE’s competitive advantage is expected to be that the Company’s product will be reimbursed by insurance companies, which is not the case for all products.

- Decrease in Sales – Improvement Expected Ahead

STENOCARE’s net sales during Q1-23 amounted to DKK 0.8m (0.9), a decrease of 10% compared to Q1-22. Given that sales is expected to fluctuate from quarter to quarter due to bulk deliveries and that STENOCARE delivered products to five markets in Q4-22, we do not attach great importance to this and estimates stronger sales in the coming quarters.

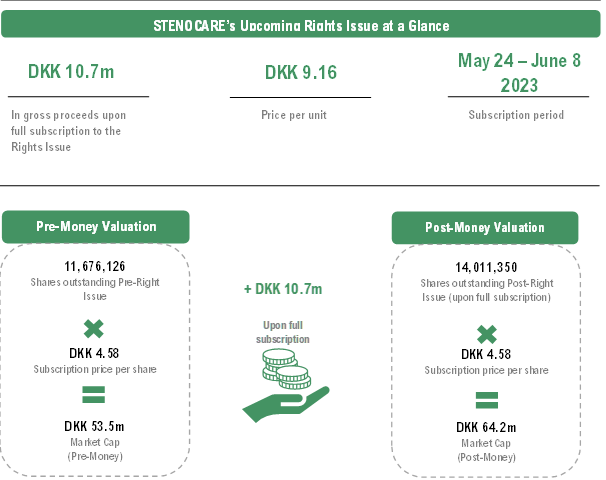

- Capital Injection Intensifies the Growth Focus

During June 2023, STENOCARE raised DKK 10.7m in gross proceeds through a unit rights issue which was oversubscribed. The funds will be used to further scale the core business and complete the indoor cultivation facility, something that we expected the Company to complete without further capital injections, hence, the investments needed for this appears to be higher than we estimated. However, we believe that the capital injection puts STENOCARE in a greater position to scale up sales by obtaining approvals in new markets and increase commercial efforts in current markets as well as strengthening the balance sheet, why we believe the Company is in a good position to deliver strong revenue growth going forward.

- Updated Valuation Range

With the Q1-report presented, we are repeating our forecasts in a Base and a Bull scenario, however slightly more conservative estimates are made in a Bear scenario. Moreover, we have seen a multiple contraction among peers since our latest update, which results in a lower valuation multiple for STENOCARE in all scenarios. This, together with the capital injection from the unit rights issue and directed issue for debt conversion, which entailed an increase in outstanding shares, results in an updated valuation range in all scenarios.

6

Värdedrivare

2

Historisk lönsamhet

8

Ledning & Styrelse

6

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Capitalizing on the Growing Cannabis Market

After entering three new markets in 2022, STENOCARE delivered products to a total of five countries during Q4-22, leading to net sales amounting to DKK 2.8m. This is the best revenues presented since Q1-19, before the resolved issues with STENOCARE’s former supplier, CannTrust, started. The Company has 11 products approved in these five countries and are expected to continue the geographical expansion. Operating on a market with strong expected growth due to further deregulations throughout Europe, Analyst Group believes that the Company is in a great position to deliver strong revenue growth going forward. With estimated net sales of DKK 60.4m by 2024, and with an applied P/S multiple of 7x, a potential present value per share of DKK 21.4 (21.4) is derived in a Base scenario.

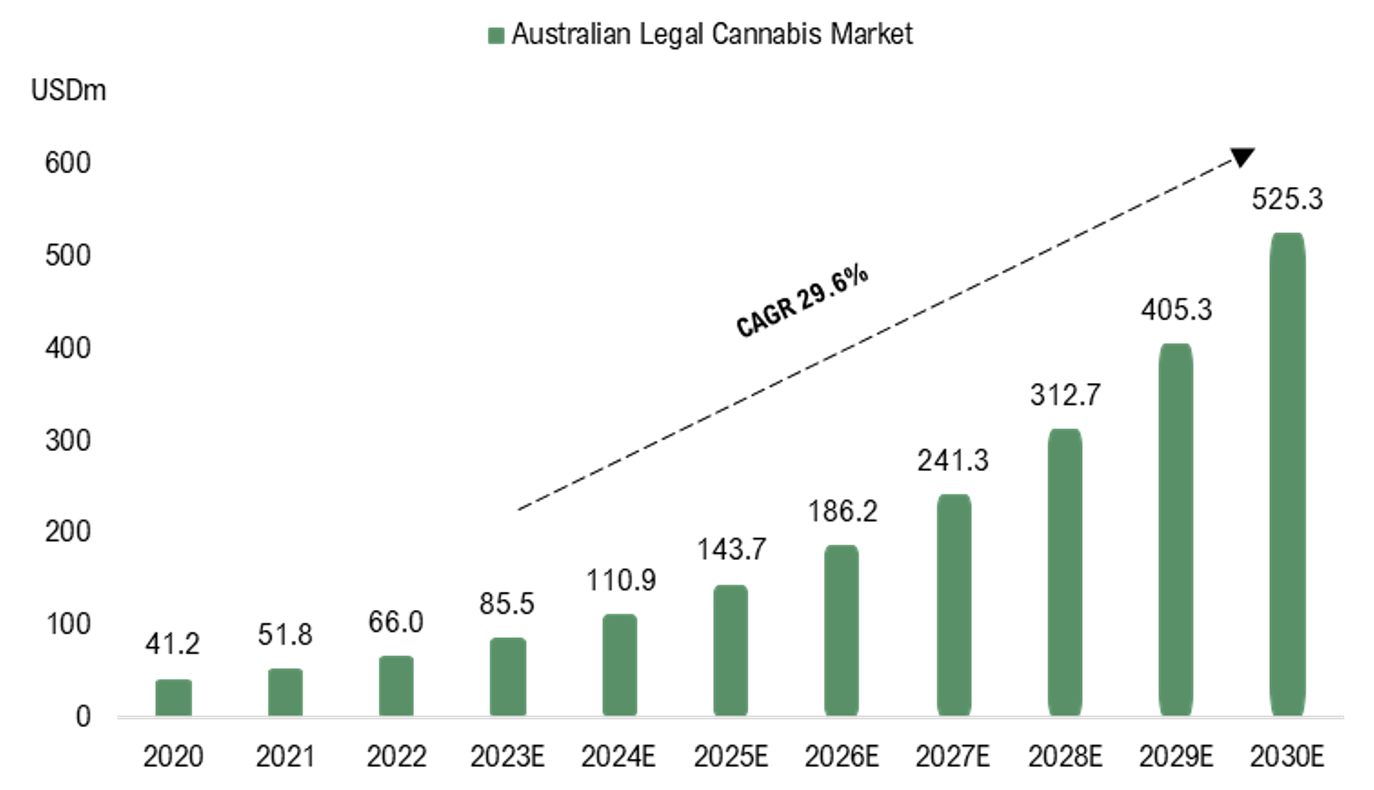

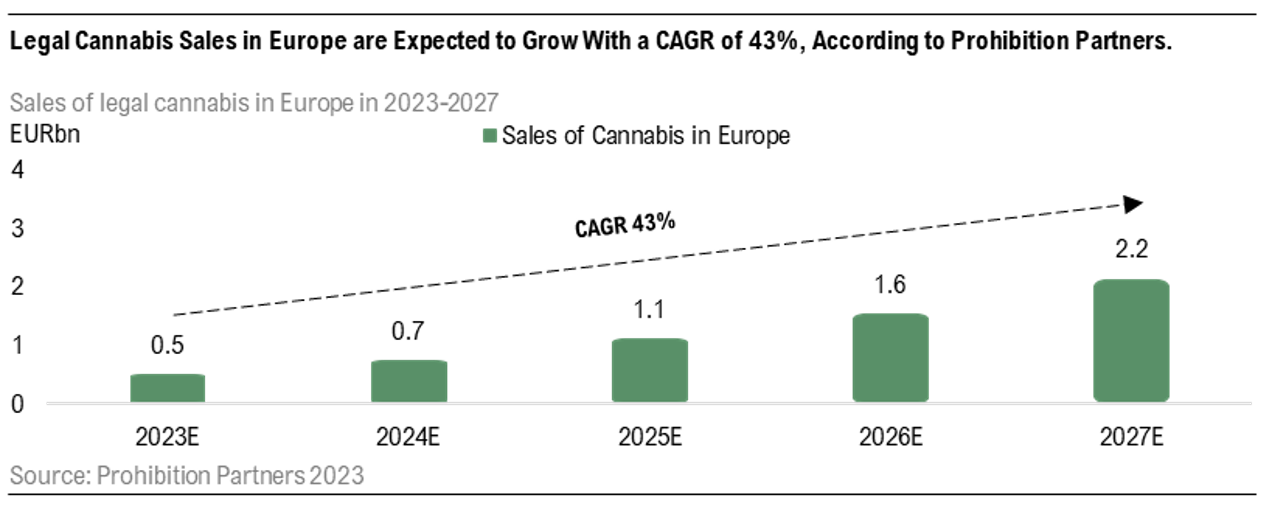

- Further Legalization can Expand the Market

The European cannabis market has an exiting year ahead, with a potential legalization of adult use1 in Germany as a highlight. Such a legalization is expected to act as a catalyst for more countries to ease regulations and create a broader acceptance towards medical cannabis, which would create further market growth. Legal cannabis sales in Europe are expected to grow with a CAGR of 67% until 2025, amounting to EUR 3.2bn, driven by legalization of both medical and adult use. Accordingly, STENOCARE is expected, in the long run, to capitalize on the continued deregulation on the European market.

- Adapting to the Current Market and Regulations

STENOCARE is now the sole supplier of full spectrum medical cannabis oil products in Denmark, Norway and Sweden, which Analyst Group sees as a result of the Company’s competence in relations to regulations and delivering quality products, by using indoor cultivation facilities rather than green houses. Going forward, we see this as a crucial factor to operate within the highly regulated European market. Furthermore, STENOCARE has designed its logistical procedures according to the Company’s distribution partners, which is delivering in larger quantities. This is expected to lead to fluctuation in sales, while being a competitive advantage for STENOCARE.

- Launch of Premium Products Ahead

STENOCARE’s premium products, which are expected to be launched during 2024 are using a targeting lymphatic absorption technology that enable an enhanced uptake of the drug in the blood, regardless of food intake as well as a faster effect. Given that these products are approved, STENOCARE is expected to have a unique product on the market compared to current alternatives, leading to accelerated sales.

- Our Valuation Range Stands

The year-end report was in-line with our expectations, why we repeat our revenues forecast and valuation range. However, slight adjustments has been made regarding the cost development in the forecasts.

6

Värdedrivare

2

Historisk lönsamhet

8

Ledning & Styrelse

6

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

The Pharmaceutical Approach

After several years of work ensuring a good supply chain and getting products approved on five different markets, STENOCARE is now ready to launch 11 full spectrum medical cannabis oil products in five regulated countries. Operating in an industry with strong expected growth and considering the future launch of STENOCARE’s own premium products, which are expected to have several benefits compared to competing products, Analyst Group estimates exponential revenue growth going forward. With estimated net sales of DKK 60.4m by 2024, and with an applied P/S multiple of 7x, a potential present value per share of DKK 21.4 is derived in a Base scenario.

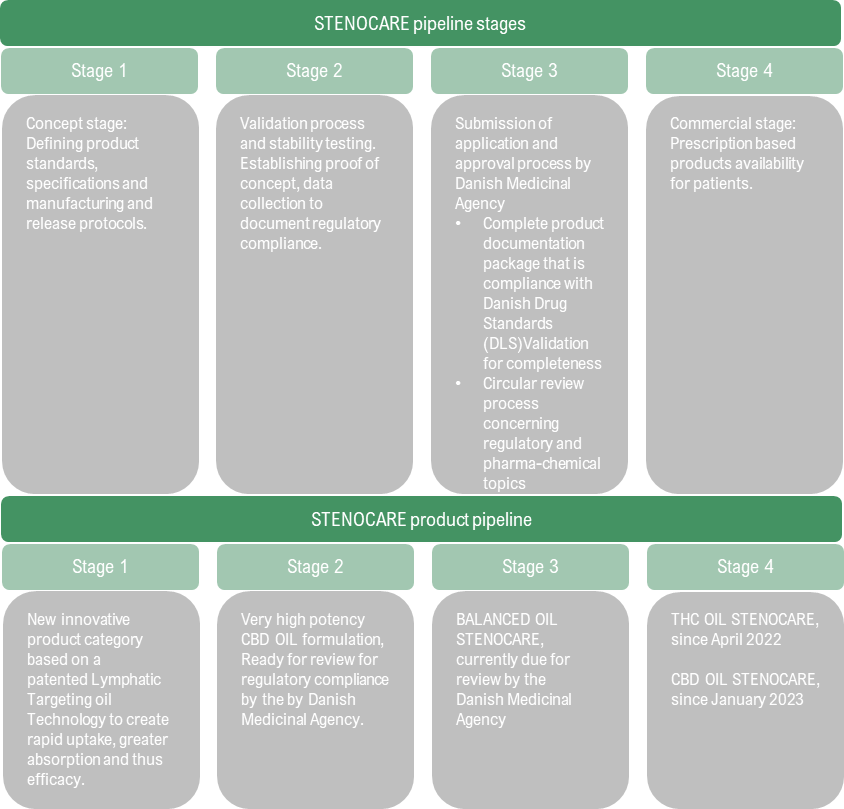

- A Cannabis Company With a Pharma Attitude

Since the Danish Pilot Program, enabling doctors to prescribe medical cannabis, started on January 1st, 2018, STENOCARE is the only player on the market getting medical cannabis oil products approved by Danish authorities. This is, according to Analyst Group, a result of the Company’s ability to manage regulations and deliver quality products, for example through using indoor cultivation facilities rather than green houses. Going forward, we see this as a crucial factor to operate within the highly regulated European market.

- A new Market With big Potential

The medical cannabis market in Europe is still in its early days, although more countries are legalizing. Legal cannabis sales in Europe are expected to grow with a CAGR of 67% until 2025, amounting to EUR 3.2bn, driven by continued legalization of both medical and adult use.2 STENOCARE is expected to capitalize on these market trends through increased patient prescriptions, contributing to increased sales, driven by the health care industry having a greater acceptance of the benefits compared to competing treatments.

- Launch of Premium Products

STENOCARE is developing their own premium products, which are expected to solve several well-known product deficiencies that other industry players struggle with. The premium products is using a targeting lymphatic absorption technology, that enable an enhanced uptake of the drug in the blood, regardless of food intake as well as a faster effect. Given that these products are approved, STENOCARE is expected to have a unique product on the market compared to current alternatives.

- Highly Regulated Market

Today, STENOCARE has 11 products approved in five regulated countries. A critical factor going forward is to obtain the necessary approvals to import and sell on new markets, which is a challenge. However, STENOCARE has a strong track record of entering new markets, which we see as a clear Proof of Concept.

6

Värdedrivare

2

Historisk lönsamhet

8

Ledning & Styrelse

6

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Analytikerkommentarer

Comment on STENOCARE ASTRUM 10-10 Oil Being Approved for Reimbursement in Germany

2025-04-04

On April 4th, STENOCARE announced that the innovative ASTRUM 10-10 has obtained for approval for reimbursement in Germany through major health insurance providers. Starting in April 2025, approximately 14 million insured individuals will be eligible for 100% reimbursement when treated with ASTRUM 10-10.

Analyst Group’s View of the News

On the global medical cannabis market, whether patients pay for STENOCARE’s medical cannabis products out-of-pocket or receive subsidies from local governments or insurance providers varies significantly between markets. The differing subsidy structures may result in varying prescription rates, as patients in countries with higher subsidies are more likely to purchase STENOCARE’s products.

In the German market, the products are not subsidized by the government; however, certain products are reimbursed by insurance providers. This reimbursement structure is expected to increase patient access. STENOCARE’s first product available in Germany, AD 10-10 STENOCARE Extrakt, was reimbursed by insurance providers, and as of April 2025, the Astrum oil is also approved for reimbursement.

The Company’s premium product, Astrum oil, is regarded as a key growth driver for the year ahead. The product differentiates STENOCARE as a first mover in the next generation of medical cannabis, offering improved, uniform, and faster uptake in the bloodstream.

Germany represents the largest medical cannabis market in Europe, with total expected sales of EUR 1bn in year 2027. Therefore, sales of Astrum oil in the German market are viewed as a critical factor for revenue expansion over the coming years. The secured reimbursement by two of the leading German health insurance providers, Techniker Krankenkasse and AOK Rheinland, makes approximately 14 million individuals eligible for coverage, marking a significant milestone toward realizing the anticipated growth.

In conclusion, Analyst Group identifies Astrum oil as the primary growth driver in the upcoming year, as it differentiates the Company from competitors through superior absorption and product consistency. The reimbursement approval from major health insurance providers for the Company’s Astrum oil is viewed as a pivotal step toward accelerating product growth in the largest European market.

Comment on STENOCARE’s Q4-report Report 2024

2025-02-27

STENOCARE A/S (STENOCARE or the “Company”) published on February 27th the Company’s Q4-report for 2024. The following are some key points that we have chosen to highlight in connection with the report:

- Sales above guidance and our estimates

- Astrum oil is now available in three countries

- The result was affected by a special item – operational EBITDA better than our estimates

- Strengthened financial position through a rights issue after the end of Q4-24

Sales Above Our Estimates and Astrum Oil Available in Three Countries

The gross sales amounted to DKK 1.5m (1.7) in Q4-24, corresponding to a decrease of 17 % but 17% above guidance of DKK 1.2m. Net sales, including product returns, amounted to DKK 1.3m (1.3), which was 21% above Analyst Groups estimate of DKK 1.0m.

As Analyst Group has previously stated, we see the company’s premium product Astrum oil as an important growth driver in the coming year, as it distinguishes STENOCARE from competitors as a first mover in the next generation of medical cannabis, providing improved, uniform and faster uptake in the blood. The product became available to patients in three countries during 2025, Germany, Australia, and Norway, which is why sales in Q4-24 only reflect STENOCARE’s other product range.

The Result was Affected by a one-off Special Item

The EBITDA result amounted to DKK -15.1m and was affected by a special item amounting to DKK 13.1m attributable to the exit of the Company’s cultivation facility. In November, STENOCARE announced the STENOCARE 3.0 Strategy, which states that the Company will focus on trading prescription-based medical cannabis sourced from suppliers and exit the production activities at STENOCARE’s own indoor cultivation facility. While STENOCARE will not receive any payment for transferring the production facility, the Company will be relieved of all related costs, including the significant long-term lease and equipment lease. This represents a financial obligation of approximately DKK 14m over the next six years registered in the balance sheet and additional DKK 5m in annual operational costs, which will no longer weigh on the Company. To summarize, there are no cash proceeds from the exit but DKK 13.1m of long-term lease commitment related to exit of the cultivation facility are included as costs in special items during Q4-24.

Adjusted for the special item, the EBITDA result amounted to DKK -2.0m (-3.0), which was better than Analyst Group’s estimate of DKK -2.5m. The cost base continues to decrease as STENOCARE are operating with a lean organization, personnel expenses amounted to DKK 1.1m (1.8), corresponding to a decrease of 41%. With the exit from the cultivation, expected annual operational costs savings of DKK 5m will be made, why we estimate a continued decreased cost base in 2025 compared to 2024. Below is a summary of our estimates vs the outcome excluding the special item amounting to DKK 13.1.

German Cannabis Import Surged in Q4, but Political Pressure Builds on Flourishing Medical Market

Germany imported a record amount of cannabis during Q4 and for the full year 2024 medical cannabis import more than doubled to 70 tonnes, up from 32 tonnes in 2023. The growth comes from the implementation of the Cannabis Act (CanG) on April 1st, 2024, which legalized cannabis for adult use, where cannabis also was removed from the list of narcotics, something that is expected to have simplified the process for more doctors to prescribe medical cannabis and ease the way for patients to obtain a prescription. STENOCARE has had a product approved in Germany since Q4-23, but given the Company’s sales in 2024, STENOCARE’s growth in the country is assumed to have been absent.

A large portion of the market growth has been driven by the rapid expansion of telemedicine clinics, which has raised concerns that the ease of access to medical cannabis has allowed individuals who do not actually require medication to gain access to medical cannabis. In the German election on February 23rd, Christian Democratic Union (CDU), received the most seats in Germany’s federal election, a party that has previously pledged to abolish the previous government’s cannabis law. However, it remains unclear whether this would mean rolling back the changes to medical cannabis, namely removing it from the list of narcotics, which has driven the recent boom in the market, as well as whether CDU will have a majority to go ahead with its intention.

Nevertheless, STENOCARE focuses on prescription based medical cannabis and has long focused on educating doctors on potential applications. Since January 2025, Astrum Oil has been available to German patients, and we expect the product’s benefits to drive sales to patients in need of medical cannabis treatment, regardless of political initiatives that may hinder overall market growth.

The Financial Position Strengthened

The cash balance amounted to DKK 1.4m at the end of Q4-24, however after the end of Q4-24 STENOCARE announced the outcome of the conditional rights issue which was conducted in January 2025. The rights issue will provide STENOCARE with estimated net proceeds amounting to DKK 7.9m. The proceeds are expected to be used for commercial activities linked to the company’s existing product portfolio, as well as servicing the convertible loan of DKK 2.8m with interests and instalments.

We expect STENOCARE’s burn rate to decrease going forward because of the exit from cultivation activities as well as increased sales of the Astrum Oil, which is seen as an important growth driver, given that it distinguishes STENOCARE from competitors as a first mover in the next generation of medical cannabis. Based on this, we estimate that STENOCARE are financed for the remainder of 2025.

To summarize, STENOCARE delivered a report where sales were above guidance and our estimate, as well as an operational EBITDA result, excluding special items, that was above our expectations. The medical cannabis market has proven challenging to penetrate, partly due to high competition and partly due to widespread skepticism toward cannabis among prescribing doctors. STENOCARE is therefore expected to place greater focus on educating doctors about the benefits of medical cannabis treatment, thereby driving growth, where we see the Astrum Oil as an important growth driver as it distinguishes STENOCARE from competitors as a first mover in the next generation of medical cannabis.

We will return with an updated equity research report of STENOCARE.

Comment on the outcome of STENOCARE’s Conditional Rights Issue

2025-01-22

On January 22nd, STENOCARE announced the outcome of the conditional rights issue, which was subscribed to approximately 37.7%. Moreover, guaranteed commitments from Exelity AB amounting to 7.3% will be activated to achieve a subscription rate of 45%, which will provide STENOCARE with DKK 9.1m in gross proceeds in order to execute on the STENOCARE 3.0 strategy.

Analyst Group’s View of the Outcome

The rights issue will provide STENOCARE with DKK 9.1m in gross proceeds and with estimated transaction-related costs amounting to DKK 0.9m and guarantor compensation of DKK 0.3m, the estimated net proceeds amount to DKK 7.9m. With the new STENOCARE 3.0 strategy the company is transforming into a trading company, focusing on distribution of prescription-based medical cannabis and hence exiting production activities, the proceeds are expected to be used for commercial activities linked to the company’s existing product portfolio, which consists of 13 approved products in six countries. STENOCARE has already established key assets (regulatory, supply chain, commercial, partnerships), that will be the foundation for the new strategy. The medical cannabis market has proven challenging to penetrate, partly due to high competition and partly due to widespread skepticism toward cannabis among prescribing doctors. STENOCARE is therefore expected to place greater focus on educating doctors about the benefits of medical cannabis treatment, thereby driving growth.

We see the company’s premium product Astrum oil as an important growth driver in the coming year, as it distinguishes STENOCARE from competitors as a first mover in the next generation of medical cannabis, providing improved, uniform and faster uptake in the blood. During 2024, STENOCARE announced that the Astrum oil has been approved for sales in three countries, Australia, Germany and Norway, which we see as the most important growth driver, particularly as Australia and Germany are two of the largest medical cannabis markets globally. Furthermore, STENOCARE is expected to receive approvals in additional markets going forward, since the company has a strong track record of market approvals.

In addition to the commercial activities, part of the net proceeds is expected to be used for servicing the convertible loan of DKK 2.8m with interests and installments. Going forward, as STENOCARE has decided to exit its production activities, substantial cost savings are expected going forward, equivalent to DKK 4m annually in 2025 for personnel and other expenses, as well as long-term lease and equipment lease amounting to DKK 14m over the next six years. This is expected to reduce the company’s burn rate going forward and contribute to a shorter path toward achieving positive cash flow.

Considering challenging market conditions, where many smaller companies face difficulties in raising capital under favorable terms, Analyst Group considers the outcome of the rights issue reasonable.

Subscription Rate and Dilution

The rights issue was subscribed to approximately 37.7%, including the pre-subscription commitments and compensation free guarantees of 7.4%. As a result, guarantor commitments of 7.3% will be activated to achieve a subscription rate of 45%, corresponding to 18,191,248 new shares and STENOCARE will receive DKK 9.1m in gross proceeds. Transaction related costs are estimated at DKK 0.9m plus guarantor compensation of DKK 0.3m, which results in estimated net proceeds of DKK 7.9m.

As mentioned, the total number of shares will increase by 18,191,248 new shares, from 20,212,497 shares to 38,403,745 shares, why the dilution effect for shareholders who did not participate in the rights issue amounts to approximately 47.4%.

In summary, we view the outcome of the rights issue as reasonable, given the current market climate. We expect STENOCARE to utilize the net proceeds, in addition to repaying the loan, to scale up sales, including education on the benefits of the new innovative Astrum oil. After several sales-challenging years for STENOCARE, partly due to a more sluggish market than expected, it is critical for the company to prove the company’s ability to increase sales in different markets. We see the new wholehearted focus on becoming a distributor, and the benefits of Astrum oil, as important factors for achieving this success.

Comment on STENOCARE’s Announcement of a Conditional Rights Issue of up to DKK 20.2m

2024-12-20

On December 18th, STENOCARE announced that the company has resolved a rights issue of up to DKK 20.2m at a subscription price of DKK 0.5. The capital increase is conditional upon a minimum of a total subscription rate of approximately 45 percent, providing the Company with approximately DKK 9.1m before deduction of transaction related costs. STENOCARE has received legally binding written pre-subscription commitments and compensation free guarantees from management and existing shareholders of DKK 1.5m, corresponding to approximately 7.4% of the total Rights Issue.

The rights issue will offer existing shareholders two subscription rights for each share held, with each right enabling the purchase of one new share at a price of DKK 0.5. The subscription period runs from January 7 to January 20, 2025, and the offering is contingent upon a minimum subscription of 18,191,248 shares, equivalent to approximately 45% of the issue, which would provide STENOCARE with approximately DKK 9.1m in gross proceeds before deduction of transaction-related costs estimated at DKK 0.9m. If fully subscribed, the company will raise DKK 20.2m before transaction costs, which are estimated at DKK 1.7m, leaving net proceeds of DKK 18.5m.

The proceeds will be used to fund commercial activities, including the launch of STENOCARE’s innovative ASTRUM 10-10 medical cannabis product in key markets like Australia, Germany, and Norway. The company’s new strategy, STENOCARE 3.0, focuses on becoming a trading entity, ceasing its in-house cultivation to reduce costs significantly. This pivot is expected to save approximately DKK 14m in lease obligations and DKK 4m annually in operating costs. Additionally, the proceeds will be used to service the convertible loan of DKK 2.8m with interests and installments.

Analyst Group’s view of the Rights Issue

Analyst Group has previously highlighted STENOCARE’s strained financial position in earlier updates, where a share issue was regarded as the most likely scenario. The company has also communicated that it has been exploring various financing options, making the announced rights issue no significant surprise. However, the weak stock performance during the last months, which is likely affected by the uncertainty regarding the financial position, and the current financial market environment for capital raises is resulting in a substantial stock dilution of 67% given full subscription for shareholders who chooses not to subscribe, which is not a positive aspect for the shareholders in the short term. Going forward, the proceeds are necessary for STENOCARE to execute on planned commercial activities with the launch of the Astrum oil in several markets seen as the most important growth driver. Given that the net proceeds are expected to be used for commercial activities, except the repayment of debt of DKK 2.8m, the capital raise is expected to strengthen the revenue outlook for the company.

As the STENOCARE 3.0 strategy focuses on becoming a trading company and exit from cultivation activities, we expect a significantly decreased cost base going forward, which is why more focus and capital are expected to be directed toward increasing sales of the products that STENOCARE currently has on the market, comprising 13 products across six countries. The medical cannabis market has proven challenging to penetrate, partly due to high competition and partly due to widespread skepticism toward cannabis among prescribing doctors. STENOCARE is therefore expected to place greater focus on educating doctors about the benefits of medical cannabis treatment, thereby driving growth.

Furthermore, STENOCARE addresses the challenges of high competition and the stigma among doctors regarding medical cannabis with its Astrum oil product. This innovative and patented product is expected to improve the uptake in the blood and deliver a uniform uptake in the blood across individuals and regardless of food consumption, unlike other medical cannabis products. Historically, doctors have encountered challenges when prescribing medical cannabis to patients due to the body’s metabolism, which significantly reduces the uptake of cannabinoids. Astrum oil thereby facilitates decision-making for doctors and differentiates STENOCARE from its competitors, making the product a key growth driver for the company.

In summary, the announced rights issue was anticipated; however, given the weak share price and challenging market conditions for capital raising, it results in a dilution effect of 67% for shareholders who choose not to participate, assuming full subscription. With a subscription price of DKK 0.5 per share, this corresponds to a pre-money valuation of DKK 10.1m. Considering the opportunities associated with an increased commercialization focus on Astrum oil, which is expected to drive expansion into additional markets, Analyst Group views the announced rights issue as an attractive investment opportunity.

Comment on STENOCARE’s Approval for a new Medical Cannabis CBD100 oil

2024-12-17

On December 17th, STENOCARE announced that the company has received approval for a new product in Denmark, CBD100, which has a high concentration of CBD active ingredients (100 mg/ml). This makes STENOCARE the only supplier to offer a CBD100 oil product in Denmark.

With the CBD100 oil product added to the portfolio, STENOCARE’s portfolio consists of four products approved for sales in Denmark, including a lighter CBD-oil, a THC-oil and a balanced oil, which solidifies the company’s position as a leading supplier in the country, which recently formally agreed on permanent legalization of medical cannabis.

The new product, CBD100, has a higher concentration of CBD, which targets patients who need higher dosages in its treatment. CBD can be used as a treatment for a range of symptoms, including chronic pain, anxiety, stress, and nausea experienced by cancer patients during treatments, thereby addressing several significant and widespread symptoms affecting numerous patients. The new CBD oil provides doctors in Denmark with an additional option for treating these symptoms, as STENOCARE becomes the sole supplier of medical cannabis oil products with such a high concentration of CBD, which, according to Analyst Group, constitutes a competitive advantage.

STENOCARE has a strong track record of getting products approved in several markets, both highly regulated and markets with lower barriers to entry, which the approval of the CBD100 oil product further solidifies. This is expected to be beneficial in the company’s new strategy, aiming to be a leading trading company for medical cannabis products with broad range of products to reach more patients and hence deliver growth in sales.

In summary, we view positively on the news of the approved CBD100 oil product, as it further solidifies STENOCARE’s position as a leading supplier in Denmark and provides an additional option for doctors and patients in Denmark, as this is the only medical cannabis oil product with this concentration of CBD, which is seen as a competitive advantage.

Comment on that STENOCARE’s Astrum Oil has been Approved for Sales in Norway

2024-12-02

STENOCARE announced on December 2nd that the company’s premium product, the Astrum oil, has been approved for sales on the Norwegian market. The product is expected to have several benefits compared to the medical cannabis oil available today, including a higher, more uniform, and faster uptake in the blood. The product, Astrum 10-10 oil Stenocare, with 10 mg/ml THC and 10 mg/ml CBD, is expected to be available for patients in Norway within the next 30 days.

The Benefits of the Astrum Oil

Today, doctors encounter challenges when prescribing medical cannabis to patients due to the body’s metabolism, which significantly reduces the uptake of cannabinoids to approximately 15%. This results in only a variable and often minimal portion of the cannabinoids being actively delivered to the body with therapeutic effect, meaning an inconsistent uptake of the active ingredients into the blood. Additionally, the absorption by the body varies from person to person and depending on whether the medication is taken before or after food consumption. This variability leads to unpredictable effects and complicates the doctors’ ability to prescribe the correct dosage.

STENOCARE’s new Astrum oil addresses all of these problems as it is based on a new innovative oil technology. In H2-22, STENOCARE released a study in dogs, showing that the Astrum oil improves the uptake in the blood with a factor of 2.6 compared to a reference MCT-oil product in the market. Moreover, the Astrum oil delivers a uniform uptake in the blood across individuals and regardless of food consumption. Lastly, the Astrum oil improves the time from dosing to full effect from 2-4 hours to just 1 hour, an important step to help patients manage their medical problems.

Analyst Group’s View of the Approval

With the launch of the Astrum oil, which has previously been approved in Australia and Germany, we see STENOCARE as a first mover in next generation medical cannabis oil products. STENOCARE are dependent on doctors prescribing the company’s products and considering the advantages of the Astrum Oil, we expect doctors to appreciate the new product. The Astrum oil is expected to be a more predictable medical cannabis product, helping doctors to prescribe the correct dosage.

As we see the Astrum oil as the most important value driver, we view positively on the approval since it further proves the need. Moreover, the launch on the Norwegian market increases the availability of the product for patients and facilitate for doctors. However, the Norwegian market is significantly smaller than the German and Australian markets, both in terms of number of addressable patients due to lower population and since it is a highly regulated market, where it remains difficult to obtain access to medical cannabis, with many patients that are thought to turn to the black market instead.

Furthermore, STENOCARE has historically encountered challenges with the highly regulated Norwegian market. In Q4-22, STENOCARE made the first shipment of full spectrum medical cannabis oil products to the company’s Norwegian partner, Apotek 1, for sales in the Norwegian market. However, the management of the pain centers (hospitals) unexpectedly decided to hold back the budget for treatment with all cannabis-based products, which hampered sales and consequently led to product expiration. As a result, products worth of DKK 2.1m were returned to STENOCARE. However, we expect that STENOCARE has implemented new procedures to secure the largest possible assurance of sales to patients prior to delivery to all new markets in the future. The updated procedures are expected to reduce the risk of similar large volume expirations going forward.

Nevertheless, the approval once again demonstrates STENOCARE’s ability to secure product approvals in highly regulated markets. The company has thus reaffirmed its capacity to obtain approvals across all types of markets, which we regard as a strength for future expansion into additional markets with Astrum oil.

In summary, Analyst Group views positively on STENOCARE’s approval of the Astrum oil in the Norwegian market even though the market is expected to have a significantly smaller financial impact than the approval on the German and Australian, due to the higher regulated market as well as the smaller population, hence the number of addressable patients. Nevertheless, it demonstrates the ability to secure product approvals in highly regulated markets, which we view as advantageous for the continued expansion of Astrum oil and is expected to make the product available for more patients, which we see as the most important growth driver for STENOCARE going forward.

Comment on STENOCARE Shifting Strategy to Focus on Trading and Exit from Production

2024-11-27

STENOCARE announced on November 26th the STENOCARE 3.0 Strategy, which means that the company will focus on trading prescription-based medical cannabis sourced from suppliers and exit the production activities at STENOCARE’s own indoor cultivation facility. The decision is based on prolonged and uncertain approval timelines with the Danish Medicines Agency, which creates difficulties in establishing a reliable timeline for the facility’s approval. This exit will eliminate approximately DKK 18m in cost obligations over the next six years.

When the legalization of medical cannabis began in Europe in 2017, quality and legal requirements were established to mirror pharmaceutical standards, why STENOCARE deemed it crucial to control the entire value chain to ensure the highest possible product quality. However, the indoor cultivation facility has been delayed, and there is still no clear timeline for approval from the Danish Medicines Agency. At the same time, the production facility involves high costs and is capital-intensive, prompting STENOCARE to discontinue production. In-house production has proven to be too capital-intensive for smaller players in the market, leaving only larger companies able to sustain a fully integrated value chain, a trend that is expected to continue over the next year.

STENOCARE’s current financial position is assumed to have influenced the decision, as the cash balance at the end of Q3-24 amounted to DKK 0.1 million, a plan for the company’s future funding is expected to be announced soon. While STENOCARE will not receive any payment for transferring the production facility, the company will be relieved of all related costs, including the significant long-term lease and equipment lease. This represents a financial obligation of approximately DKK 14m over the next six years, which will no longer weigh on the company. Furthermore, STENOCARE will achieve annual savings of approximately DKK 4m in production staff and operating costs during 2025.

STENOCARE has signed a conditional agreement with Hedemann Løvstad Ejendomsselskab ApS (HLE) to end the lease contract for the cultivation facility. As part of this agreement, ownership of production equipment will be transferred to HLE, but the agreement is conditional upon STENOCARE’s success in raising capital.

According to Analyst Group, the discontinuation of production is a positive development for STENOCARE’s financial position, which is currently strained. Despite the company’s historical investments in the facility, substantial cost savings is to be expected in the coming years. Furthermore, we believe that the company’s key growth and value drivers remain intact, primarily via the innovative ASTRUM oil, which is approved for sale in Australia and Germany as of now, furthermore the sale of prescription-based medical cannabis oil products in six countries. Among these, Denmark, Australia, and Germany are considered the most promising markets, despite the current challenges in Denmark stemming from increased competition and a unique situation involving a competing magistral product subsidized at 85% for patients by the Danish Medicines Agency, compared to STENOCARE’s 50%. As a result, STENOCARE is focusing on transitioning into a trading company, where there is greater growth opportunities and improved profitability.

Comment on the Danish Health Minister’s Decision to Propose a Permanent Legalization of Medical Cannabis

2024-11-20

Medical cannabis has been legal in Denmark under a pilot program since 2018 during a trial period that was set to expire in December 2025. However, on November 19th, the Danish Health Minister invited political parties to discuss the permanent legalization of medical cannabis in Denmark, where STENOCARE has three medical cannabis oil products approved for sale. The intention of the government is to proceed with the legalization.

The government in Denmark is proposing to make the pilot program permanent and has invited political parties to discuss the matter. According to a press release from the Minister for Interior and Health, this is based on a new evaluation which shows that the number of redeemed prescriptions has increased significantly and is now at its highest level since 2018. According to The Minister of Interior and Health, Sophie Løhde, many patients has benefitted from the treatment of medical cannabis, for instance cancer patients who may suffer from severe nausea after chemotherapy treatment, or people with multiple sclerosis who may experience severe pain.

The potential permanent legalization will enable continued treatment with medical cannabis for patients and provide clarity regarding the future of the industry in the country.

Analyst Group’s view of the impact on STENOCARE

Analyst Group views this as positive news for STENOCARE, a leading supplier of medical cannabis products to the Danish Pilot Programme since 2018. With potential permanent legalization, a clear future will be established for STENOCARE in the country, further justifying investments in new products. For instance, the company’s innovative new product, Astrum oil, which according to Analyst Group has the potential to revolutionize the industry, has been approved in Australia and Germany, and we now see Denmark as the next potential market for the product.

The Danish market has been STENOCARE’s home market and its most important in terms of sales historically, as the company is expected to have a strong brand among doctors in the country. Hence, we see good potential for STENOCARE to grow in the market, even though a special situation with a competing magistral product, which is supported by an 85% patient subsidy from the Danish Medicines Agency, is expected to hamper sales growth in the short term.

In summary, legalization eliminates a source of uncertainty for STENOCARE, paving the way for continued investments in the country, which is one of the company’s most important markets.

Comment on STENOCARE’s Q3-Report 2024

2024-11-06

STENOCARE published on November 5th the company’s Q3-report for 2024. The following are some key points that we have chosen to highlight in connection with the report:

- Continued challenging market affected sales

- A decreased cost base to adapt to the slower sales

- Additional funding needed to leverage market potential

Challenging Market Conditions Continued During Q3-24

The gross sales amounted to DKK 1.1m (2.4) in Q3-24, corresponding to a decrease of 53 %. Net sales were affected by returns of expired products amounting to DKK 2m, leading to net sales amounting to DKK -0.9m (0.2). The expired return products is assumed to be primarily attributable to the Danish market, where the company are experiencing increased competition and a special situation with a competing magistral product being supported with 85% patient subsidy from the Danish Medicines Agency, compared to STENOCARE’s 50%. This has led to slower sales than expected as well as expired products being returned to the company. STENOCARE are exploring various avenues to address this situation, including a dialogue with the medicines agency but the situation is unchanged and expected to affect the company throughout the rest of 2024.

Additionally, STENOCARE had products returned from UK and Norway, delivered in Q3-23, due to expiry, indicating that demand has been lower than expected in these countries as well. This is anticipated to be due to that the integration of medical cannabis into clinical practice has not progressed as rapidly as was anticipated a few years ago as well as increased competition.

STENOCARE has long addressed the increasing competition by initiating the development of a new, innovative product, now named Astrum Oil, which has been approved for sale in Australia and Germany. The product is expected to have several benefits compared to the medical cannabis oil available today, including a higher, more uniform, and faster uptake in the blood. With this launch, we see STENOCARE as a first mover in next generation medical cannabis oil products, why we see that the company can gain an advantage against competitors. The product is expected to be available for patients from Q4-24.

In summary, there are several short-term sales challenges, however, given the advantages of the company’s innovative Astrum Oil, STENOCARE is still considered to have strong potential for substantial revenue growth in the longer term.

Additional Cost Savings in a Tough Market

The operational expenses amounted to DKK 3m (4), corresponding in a decrease of 26%. Cost of goods sold is included in the external expenses and due to the lower gross sales in Q3-24 compared to last year, the cost of goods sold has decreased, explaining part of the decrease. Additionally, we believe that STENOCARE has continued to optimize the company’s cost structure to reduce the burn rate, given the lack of sales acceleration so far, which we view positively on.

Plan to Adress the Capital Requirements for Future Growth Expected

STENOCARE’s cash position amounted to DKK 0.1m at the end of Q3-24 and the company stated in the Q3 report that the plan for future funding of the company will be announced soon. During Q3-24 the cash flow from operating activities amounted to DKK -1.9m and was positively affected by DKK 2.2m through change in working capital. The main explanation for the positive effect is the increase in the item “Other payables”, where we could see a similar effect in Q3-23, when STENOCARE also had product returns. The effect was later reversed in Q4-23, why we expect this to have a similar negative effect on the cash flow in the upcoming fourth quarter.

As mentioned in our previous updates regarding STENOCARE, the company will need to secure additional funding to enable future growth initiatives such as the launch of Astrum oil. We consider the most likely option to be a capital raise, however, given the recent weak stock performance, such a capital raise could incur under unfavourable conditions for existing shareholders.

To summarize, STENOCARE continues to experience challenges regarding market conditions through increased competition, higher subsidy on a competing product in Denmark and an overall slower market growth than expected, which has affected sales. We expect these challenges to remain in the short term but consider the company’s Astrum oil as a potential strong sales driver in the longer term given the advantages of the product for industry. STENOCARE continues to optimize the cost base to adapt to the current market but will need additional funding going forward, where we expect a plan regarding the future capital requirements to be announced soon.

We will return with an updated equity research report of STENOCARE.

Comment on STENOCARE’s Updated Guidance for 2024

2024-10-14

STENOCARE announced on October 14th that the company has updated the sales guidance for 2024, from gross sales of DKK 6-8m, which are now expected to amount to DKK 4.5m. STENOCARE is also exploring various financing opportunities to meet both short-term and long-term capital needs.

The primary reason for the updated guidance is the unfavorable market conditions that were mentioned in connection with the Q2 report in August, which persisted throughout Q3 and led to lower sales than anticipated. The unfavorable market conditions mentioned include a decrease in product prices and increased competition due to higher product price subsidies on magistral products in Denmark, which has not been resolved during Q3-24. Additionally, the company has experienced returns on expired products amounting to approximately DKK 2m, which were initially delivered to meet expected demand and will affect the Q3 results.

Analyst Group’s view

As mentioned in connection with the Q2 report, STENOCARE entered 2024 with several potential growth drivers, including the balanced oil approved in Denmark, a new product in Australia, and entry into the German market. However, these have not delivered the expected growth, even though the company has successfully made the planned strategic progress in these countries. This is believed to be due to the integration of medical cannabis into clinical practice not progressing as rapidly as anticipated a few years ago. Moreover, market conditions in Denmark have impacted sales in the country and resulted in product returns. Gross sales are expected to amount to DKK 1.1m, and with product returns of DKK 2m, this implies negative net sales of approximately DKK -1m in Q3-24. STENOCARE has revised the company’s logistical supply principles together with local pharma distributors to minimize the future risk of product returns in the Danish market.

In our latest equity research report, we had estimated net sales of DKK 6m for 2024. Considering the updated guidance as well as the product returns of DKK 2m, we expect to lower this estimate in connection with our next update following the Q3 report. Nevertheless, STENOCARE is expected to deliver the new premium Astrum oil to both Germany and Australia in Q4, which is expected to offer several benefits compared to the medical cannabis oil available today, including higher, more consistent, and faster absorption into the bloodstream. With this launch, we see STENOCARE as a first mover in next-generation medical cannabis oil products, which we believe will give the company a competitive advantage. The Astrum oil is expected to become an important sales driver going into 2025.

Lastly, STENOCARE is considering a range of financing options to address the company’s capital needs in both the short and long term, with more details expected to be announced soon. In our analysis following the Q2 report, we mentioned that we believe STENOCARE will need to secure additional funding, most likely through a capital raise, to enable future growth initiatives such as the launch of Astrum oil. However, given the recent weak stock performance, such a capital raise could incur under unfavorable conditions for existing shareholders.

Comment on STENOCARE’s Q2-report Report 2024

2024-08-22

STENOCARE published on August 21st the company’s Q2-report for 2024. The following are some key points that we have chosen to highlight in connection with the report:

- Financial development during the period

- Launch of premium products ahead of plan

- Financial position and burn rate

Sales Lower than Expected due to Unfavourable Market Dynamics Concerning Pricing and Reimbursement Principles

STENOCARE’s net sales amounted to DKK 0.7m (1.7), corresponding to a decrease of 57% compared to Q2-23, which was below Analyst Group’s expectations. The lower than anticipated sales are, among other things, a result of a decrease in product prices and increased competition due to higher product price subsidy in Denmark, as well as slower sales in international markets. STENOCARE had several growth drivers going into 2024, including the balanced oil approved in Denmark, a new product in Australia and entering the German market, which has not delivered growth as expected, even though the company has successfully made the planned strategic progress in these countries. This is anticipated to be due to the integration of medical cannabis into clinical practice has not progressed as rapidly as was anticipated a few years ago.