ODI Pharma is a supplier of a wide range of medical cannabis products, based on dried flowers and consisting of different levels of THC and CBD. The Company sources the products from one of the largest suppliers in the world, Canadian Tilray. The products are then sold to ODI Pharma’s distributor Synoptis, part of the market leading pharmaceutical company in Poland, NEUCA, initially to the Polish market, who market and distribute products to pharmacies. The products are utilized for the treatment of conditions such as multiple sclerosis, chronic pain, and chemotherapy. ODI Pharma has been listed on the Spotlight Stock Market since 2020.

Pressmeddelanden

Increased Import Quota in Poland Set to Drive Growth in 2025

ODI Pharma AB:s (”ODI Pharma” or the ”Company”) past two quarters has been affected by import restrictions in Poland, which is now resolved, as the Polish government nearly doubled the import quota for medical cannabis for 2025, driven by a rapidly growing demand. As ODI Pharma is the exclusive supply partner to one of the leading pharmaceutical brands in Poland, the Company is expected to capitalize on this. With estimated net sales of SEK 85.3m by 2025/2026, an applied P/S multiple of 2.4x, and a discount rate of 13.7%, a potential present value per share of SEK 10.8 (12.3) is derived in a Base scenario.

- Increased Order Intake Paves the Way for Stronger Quarters Ahead

ODI Pharma’s net sales amounted to SEK 0m (0) during Q2-24/25. As the previous quarter, sales were affected by import restrictions set by the Polish government, where the import quota for medical cannabis for 2024 were initially set at 6 tons, which was reached with several months left of the year, leading to that the Polish government increased the estimated annual demand for cannabis, hence also the quota, by an additional 5.3 tons in October 2024. As the updated quota has been applied from January 2025, ODI Pharma’s sales in the past two quarters has been affected by the import restrictions. Following the updated quota from January 2025, ODI Pharma has experienced an increasing order intake, why we, in combination with the fact that ODI Pharma acts as the supplier to one of the leading pharmaceutical brands in the country, estimate strong revenue growth in 2025.

- Continues to Operate with a Tight Organization

The operating expenses amounted to SEK -2.4m (-1.8) during Q2-24/25, where the increase was attributable to costs for external service providers, where Analyst Group assumes that a main driver of the cost increase are the transaction-related costs for ODI Pharma’s rights issue conducted in December, hence a one-off cost. ODI Pharma continues to operate with a tight organization which the business model allows, paving the way for profitability as sales is expected to grow in the coming quarters.

- Updated Valuation Range

Following the Q2-24/25 report, we have made smaller adjustments of our financial forecasts, with an estimated later expansion to new markets as the primary reason. Moreover, we have increased our estimates regarding operational expenses slightly following the recruitments of Malcolm Allan to the board and Jan-Mark Edewaard as CEO, affecting the profitability forecasts somewhat. Moreover, the import restrictions that has affected ODI Pharma in the last quarters serves as a reminder of the Company’s dependence on government regulations, which, combined with the updated forecasts, results in a revised valuation range.

7

Värdedrivare

3

Historisk lönsamhet

7

Ledning & Styrelse

7

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Ready to Capitalize on Rapid Market Growth in Poland

ODI Pharma AB:s (”ODI Pharma” or the ”Company”) latest quarter was affected by import restrictions in Poland, which has been resolved after the quarters end, as the Polish government nearly doubled the import quota for medical cannabis for 2025, driven by rapidly growing demand. As ODI Pharma is the exclusive supply partner to one of the leading pharmaceutical brands in Poland, the Company is expected to capitalize on this rapidly increasing demand. With estimated net sales of SEK 96m by 2025/2026, and with an applied P/S multiple of 2.5x, a potential present value per share of SEK 12.3 (17.4) is derived in a Base scenario.

- Net Sales was Affected by Import Restrictions

ODI Pharma’s net sales amounted to SEK 0.1m (0.5) during Q1-24/25. Sales were affected by import restrictions set by the Polish government, where the import quota for medical cannabis in the country for 2024 were initially set at 6 tons, which was reached with several months left of the year, leading to that the polish government increased the estimated annual demand for cannabis, hence also the quota, by an additional 5.3 tons in October 2024. As the updated quota is expected to be applied from January 2025, ODI Pharma’s sales in Q1-24/25 as well as the upcoming Q2-24/25, is expected to be affected by the import restrictions. However, based on the rapid market growth, illustrated by the updated quota, and the fact that ODI Pharma acts as the supplier to one of the leading pharmaceutical brands in the country, we estimate strong revenue growth in the upcoming year.

- Rights Issue of SEK 4.1m to Leverage Market Potential

On October 30th, ODI Pharma announced that the Company intends to carry out a rights issue of SEK 4.1m before transaction costs. The net proceeds are expected to be used to strengthen the financial position through loan repayments, support continued expansion into new European markets, and further establish a strong presence in Poland. Based on a pre money valuation of SEK 49m, and the estimated sales growth ahead, based on a strong market growth in Poland and expansion to more countries, Analyst Group believes that the rights issue entails a great risk/reward for investors.

- Updated Valuation Range

Based on the Q1-24/25 report, where sales were affected by import restrictions, nevertheless below our expectations, we have updated our financial forecasts for ODI Pharma. Although import quotas have now been increased, the lower sales in the first quarter of the fiscal year, which is also expected for the upcoming quarter, still impact our full-year forecast. This also serves as a reminder of ODI Pharma’s dependence on government regulations, which, combined with the updated forecasts and the estimated additional outstanding shares following the rights issue, results in a revised valuation range.

7

Värdedrivare

3

Historisk lönsamhet

7

Ledning & Styrelse

5

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Continued Strong Momentum

ODI Pharma AB (”ODI Pharma” or the ”Company”) delivered another strong quarter during Q4-23/24 (broken fiscal year), further proving the collaboration with Synoptis as a game changer in terms of commercializing the Company’s products. For the upcoming fiscal year 2024/2025, where the collaboration agreement will be active for the full year, we estimate sales of SEK 69.1m, while reaching an EBIT margin of 9%, which makes ODI Pharma one of few companies in the cannabis sector delivering profitability. With estimated net sales of SEK 127m by 2025/2026, and with an applied P/S multiple of 2.6x, a potential present value per share of SEK 17.4 (17.4) is derived in a Base scenario.

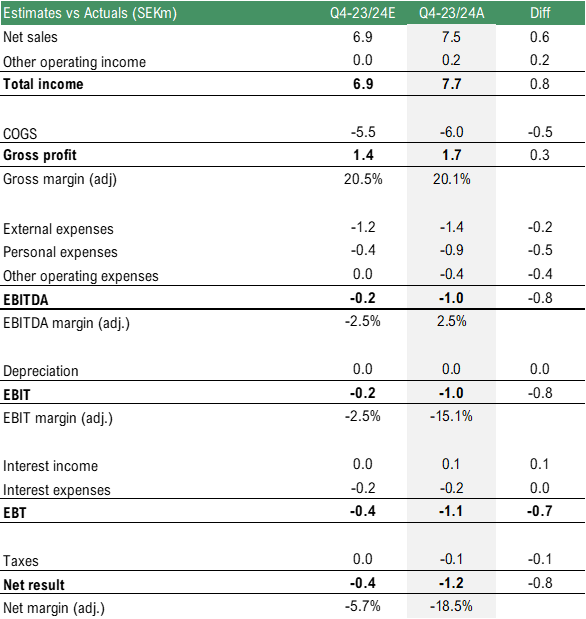

- Continued Growth

ODI Pharma delivered another strong quarter regarding sales, amounting to SEK 7.5m, 9% above our estimates of SEK 6.9m. The reported sales is expected to be primarily attributable to sales in the Polish market via the collaboration agreement with Synoptis Pharma, further validating the anticipated strong sales growth because of the agreement. We expect Synoptis strong market position in Poland, and other Eastern European countries, to continue to fuel growth over the upcoming fiscal year as the contract will be active for the full year.

- Stable Cost Base

Adjusted for a one-off cost of SEK 0.35m related to the sale of the Kandol brand which occurred in December 2023, the operating expenses amounted to SEK 2.3m, corresponding to an increase of 25%. The increased cost base is assumed to be attributable to shipping costs for the products sold, however Analyst Group reiterates the view of ODI Pharma’s scalable business model, where operating costs can be kept low even with a rapid increase in sales. For the upcoming fiscal year 2024/2025, we estimate an EBIT margin of 9%.

- Enters the Swiss Market

ODI Pharma has announced that the Company has completed a first small delivery of products to the Swiss market, which is a newly addressed geographical market. Analyst Group sees this as a strategic market entry since it is the first delivery of products outside the collaboration agreement with Synoptis, validating that ODI Pharma can expand to new markets outside of Eastern Europe for increased revenue diversification. Going forward, we see opportunities for ODI Pharma to enter additional new markets in Western Europe.

- Small Changes in our Valuation Range

As the report was largely in line with our expectations, we have only made minor adjustments in our financial forecasts. Taking these adjustments into account and considering a general multiple contraction among peers, we have made slight adjustments to our Bear and Bull scenarios while maintaining the derived valuation in the Base scenario.

7

Värdedrivare

4

Historisk lönsamhet

7

Ledning & Styrelse

6

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Starting 2024 with Significant Growth and Profitability

The third quarter was a breakthrough quarter for ODI Pharma AB (”ODI Pharma” or the ”Company”), with net sales amounting to SEK 13.9m and an EBIT margin of 11%, proving the significance of the collaboration with Synoptis Pharma and the scalable business model. ODI Pharma’s unique business model has resulted in the Company being, and expected to remain, one of the very few profitable companies in the cannabis industry. According to Analyst Group, this presents an attractive investment opportunity. With estimated net sales of SEK 127m by 2025/2026, and with an applied P/S multiple of 2.8x, a potential present value per share of SEK 17.4 (10.7) is derived in a Base scenario.

- A Breakthrough Quarter

ODI Pharma delivered a breakthrough quarter in Q3-23/24 as net sales amounted to SEK 13.9m (0.0), the first significant sales in the Company’s history. The figures is a result of several successful deliveries of medical cannabis products to the partner Synoptis, a market leading pharmaceutical brand, which is also expected to drive continued sales growth.

- Proof of the Scalable Business Model

Despite the strong sales during the quarter, the cost base remained stable. ODI Pharma’s cost base is largely fixed, with shipping costs expected to be the largest variable cost. Given the remained low cost base during Q3 however, shipping costs are not expected to be significant. As a result of the stable cost base in combination with strong sales, ODI Pharma delivered an EBIT margin of 11% during the quarter, and we expect the Company to deliver strong cash flows going forward.

- A Profitable Medical Cannabis Company Creates a Unique Investment Opportunity

The medical cannabis industry is characterized by high investments required both to navigate the heavily regulated market and to invest in cultivation. Consequently, several companies in the industry struggle to demonstrate profitability. Within the applied peer group, only one company is profitable in terms of net results, highlighting the profitability challenges in the industry. ODI Pharma, however, has a different business model that does not involve investments in cultivation, thus creating a unique investment opportunity in medical cannabis as a profitable company.

- We Raise our Valuation Range

With the Q3-report presented, we have obtained evidence that the collaboration agreement with Synoptis Pharma is a game changer for ODI Pharma, as demonstrated by the strong sales. Additionally, the cost base remained low even during this scale-up, proving the scalability of the business model, according to Analyst Group. As a result, we believe that a revaluation of ODI Pharma is justified, and we have accordingly raised our valuation range in all scenarios.

7

Värdedrivare

3

Historisk lönsamhet

7

Ledning & Styrelse

6

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Ready to Become a Profitable Medical Cannabis Company

ODI Pharma AB (”ODI Pharma” or the ”Company”), a supplier of a wide range of medical cannabis products, has signed an exclusive agreement with Synoptis Pharma, part of the NEUCA group, a market leading pharmaceutical company in Eastern Europe, under which ODI Pharma is the exclusive supplier of medical cannabis products to Synoptis in 23 countries. The first product shipments have been completed and given a slim organization and scalable business model, ODI Pharma is expected to deliver profitable growth. With estimated net sales of SEK 127m by 2025/2026, and with an applied P/S multiple of 1.7x, a potential present value per share of SEK 10.7 is derived in a Base scenario.

- Sales have Begun

ODI Pharma have signed an exclusive collaboration agreement with Synoptis Pharma, part of the NEUCA group, which is a market leader in the wholesale distribution of pharmaceutical products in Eastern Europe. The agreement states that ODI Pharma becomes the exclusive supply partner for medical cannabis products to Synoptis in 23 countries. We expect Synoptis to label the products with their own brand in the future, as doctors are expected to choose to prescribe a well-known local brand ahead of other international brands, which is estimated to drive growth for ODI Pharma. Initial figures indicate revenues of SEK 13.5m in Q3-23/24, and we estimate total sales of SEK 20.1m in the full year 2023/2024.

- Scalable Business Model

In the agreement with Synoptis, ODI Pharma acts as an intermediary between the cultivator Tilray and the distributor Synoptis. Thus, ODI Pharma has no costs for the cultivation or production, nor any sales or marketing costs. This business model allows the organization to remain small and efficient while scaling, creating a scalable business model that paves the way for increasing margins at higher sales volumes.

- Early and Untapped Market

The Polish medical cannabis market has been held back historically as a result of lack of supply. As more product has been approved for sales, supply has been able to better meet the demand where 2023 was a breakout year regarding sales of medical cannabis as 4,600 kg of medical cannabis was sold in the country, compared to approximately 1,200 kg in 2022. Still, it is expected that many potential patients are not being treated with medical cannabis, paving the way for continued strong growth going forward.

- The European Market is Highly Regulated

The medical cannabis market is highly regulated, and it is difficult to get products approved for sales. Although ODI Pharma does not engage in any cultivation of medical cannabis, the Company is ultimately responsible for supplying Synoptis with the products and ensuring that they comply with the regulations in place in each market.

7

Värdedrivare

2

Historisk lönsamhet

7

Ledning & Styrelse

6

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Analytikerkommentarer

Comment on ODI Pharma’s Update on Poland’s Expanding Medical Cannabis Market

2024-12-04

On December 4th ODI Pharma provided an update regarding Poland’s expanding medical cannabis market. The market remains an important focus of the company’s strategy – recent regulatory changes, where Polish Główny Inspektor Farmaceutyczny (Chief Pharmaceutical Inspectorate or ”GIF”) increased the total amount of medical cannabis permitted to be imported into Poland from 6 tons to approx. 11.3 tons, indicates that the market is one of the fastest-growing and most exciting within medical cannabis in Europe.

ODI Pharma has an exclusive collaboration agreement with Synoptis Pharma, part of the NEUCA Group, a leading player in the country’s healthcare distribution sector. The agreement states that ODI Pharma will be the exclusive supply partner for medical cannabis products to Synoptis in 23 countries in Eastern Europe for a period of 5 years, with an additional optional 3.5-year extension. Through this agreement, ODI Pharma achieved net sales of SEK 22.4m and a positive net result in the fiscal year 2023/2024. Moreover, during the calendar year 2024, ODI Pharma reached its previously set goal of achieving a market share above 10%.

Going into 2025, the import quota has recently been raised by 88%, which demonstrates rapid market growth. Moreover, we estimate that ODI Pharma can increase its market share through Synoptis’s strong brand. We expect doctors and patients in Poland to prioritize a well-known local brand ahead of other international brands, which is therefore estimated to drive strong revenue growth for ODI Pharma.

Based on a conservative assumption that ODI Pharma reaches 12% market share of the 11.3 tons in 2025, this would correspond to sales amounting to approximately 1.4 tons. The market price for medical cannabis based on dried flowers in Poland is approximately EUR 13-16 per gram for patients when purchased at pharmacies.

ODI Pharma is currently conducting a rights issue, allowing investors to subscribe to shares at a price of SEK 3.22 per share, corresponding to a pre-money valuation of SEK 49m. Based on our estimate in the latest equity research update of SEK 95.7 million for the fiscal year 2025/2026, which spans July to June, this valuation corresponds to a P/S multiple of 0.5x, which Analyst Group considers to be low given ODI Pharma’s position as a supplier to a market-leading pharmaceutical brand in a rapidly growing market, coupled with a scalable business model expected to create conditions for improved profitability going forward. Given this, Analyst Group considers that the rights issue offers a compelling risk/reward opportunity for investors.

Comment on ODI Pharma’s Quarterly Report

2024-11-25

ODI Pharma published on November 22nd the company’s Q1-report for 2024/2025. The following are some key points that we have chosen to highlight in connection with the report:

- Net sales affected by import restrictions – stronger quarters expected ahead

- Continued stable cost base

- Rights issue of SEK 4.1m for continued expansion

Increased Import Quota is Expected to Accelerate Sales in the Coming Quarters

ODI Pharma’s Q1-report in the company’s broken fiscal year showed net sales of SEK 0.1m (0.5), which marked a notch in the growth curve. ODI Pharma’s most important growth driver is sales on the polish market through the market leading pharmaceutical brand Synoptis Pharma, part of the NEUCA Group. The polish market is reliant on imports to supply the rapidly expanding medical cannabis market, as cultivation is not allowed in the country. The import has historically been limited by a quota set by the polish government which determines how much can be imported each year. Going into 2024, the estimate of annual demand for cannabis for Poland, hence also the import quota, amounted to 6 tons, which can be compared to 4.6 tons sold during 2023. However, due to rapid growth in demand throughout the year, the quota was reached with several months left of the year, leading to that the polish government increased the estimated annual demand for cannabis in 2024, hence also the quota, by 5.3 tons or 88% in October 2024. This means that the updated quota amounts to approx. 11.3 tons for 2024.

As the news regarding the updated quota came in early October, ODI Pharma’s net sales in Q1-24/25 is expected to have been affected by prior import restrictions. Nevertheless, the increased quota is a clear sign of the rapid growth in the polish medical cannabis market, with the current quota amounting to a 142% growth compared to the amount sold in 2023. We expect ODI Pharma to capitalize on this as a supplying partner to one of the leading pharmaceutical brands in the country, resulting in accelerated growth in the coming year.

Solid Cost Control

ODI Pharma continues to operate with a slim organisation, with a low cost base as a result. The total operating expenses amounted to SEK 1.6m (1.3), corresponding to a growth of 24% Y-Y but a decrease of 40% Q-Q. Analyst Group believes that ODI Pharma continues to develop with a stable low-cost base, and we anticipate that this low-cost structure will be maintained even during scaling, given the company’s scalable business model.

Rights Issue of SEK 4.1m for Continued Expansion in the Polish Market

The cash flow from operations before changes in working capital amounted to SEK -1.5m, due to a positive effect from changes in working capital amounting to SEK 3.5m the operating cash flow amounted to SEK 2.1m. The cash position at the end of the quarter amounted to SEK 5m, an increase of approx. SEK 2.3m Q-Q. After the end of September, ODI Pharma announced that the company has resolved to carry out a rights issue of approximately SEK 4.1m before transaction costs, with an option for an over-allotment of an additional SEK 2.0m. The transaction-related costs are estimated to amount to a maximum of approximately SEK 0.9m, which would amount to 22% of the gross proceeds in the event of full subscription, which is deemed high.

The Q1-24/25 report showed that ODI Pharma are yet to reach a sustainable positive cash flow, which is expected to be the reason for the communicated rights issue. The import restrictions have hampered the company’s growth in the previous quarter, increasing the need for liquidity in the short term. Nevertheless, with the increased import licenses from the current quarter we asses that the expected revenue growth on the polish market and the scalable business model will be improving profitability, thereby projecting that ODI Pharma will be cash flow positive in 2025. Hence, the cash position at the end of September in combination with the proceeds from the rights issue is expected to be enough to finance the operations until sustainable positive cash flow has been reached.

Strategic Key Recruitments to Leverage on the Market Potential

Finally, several key recruitments within management and the board have taken place in recent months. Malcolm Allan has been appointed to the board, bringing extensive experience from the global cannabis market, including his current role as Vice President at Tilray Brands Inc, which also shows ODI Pharma’s supplier Tilray’s commitment to ODI Pharma’s business model. Furthermore, Jan-Mark Edewaard has been appointed as the new CEO, starting in January. Jan-Mark brings over 25 years of financial and operational experience, having led complex projects across various industries. Analyst Group believes that both appointments possess relevant experience to contribute to the company’s upcoming growth initiatives in the European medical cannabis market.

To summarize, Analyst Group sees the Q1-results as a notch in the growth curve, as a result of import restrictions in the polish market, which has been resolved after the quarter. Going forward, we expect momentum to pick up for ODI Pharma, as the polish market experiences rapid growth, which ODI Pharma is expected to capitalize on through the collaboration agreement with Synoptis Pharma, a market leading pharmaceutical brand in the polish market.

We will return with an updated equity research report of ODI Pharma.

Comment on ODI Pharma’s Announcement of Rights Issue

2024-10-31

ODI Pharma announced on October 30th that the company has resolved to carry out a rights issue of approximately SEK 4.1m before transaction costs, with an option for an over-allotment of an additional SEK 2.0m. The issue is expected to be approved at an extraordinary general meeting on November 19, 2024.

Existing shareholders have preferential rights to subscribe for one (1) new share for every twelve (12) shares held at a subscription price of SEK 3.22 which is almost the same price as the share was trading at before the announcement, amounting to SEK 3.2, and therefore does not represent a discount. Given full subscription, the total number of shares will increase by 1,268,333 shares, from 15,220,000 shares to 16,488,333 shares, corresponding to a dilution effect of approximately 7.7% for shareholders who choose not to participate in the rights issue. However, shareholders who choose not to participate in the rights issue can partially compensate themselves for the financial dilution effect by selling their subscription rights.

In the case of oversubscription ODI Pharma can also decide to utilize an over-allotment to raise up to approximately additional SEK 2.0m, which would increase the number of shares with an additional 621,118, corresponding to a dilution effect of approximately 3.6%, calculated on the number of shares in the company after the Rights Issue has been fully subscribed. The transaction-related costs are estimated to amount to a maximum of approximately SEK 0.9m, which would amount to 22% of the gross proceeds in the event of full subscription, which is deemed high.

The net proceeds, amounting to SEK 3.2m given full subscription and maximum transaction-related costs, are intended to be used for continued expansion in the Polish market as well as for entry into a new market in 2025.

Analyst Group’s view of the Rights Issue

ODI Pharma’s cash position amounted to SEK 2.6m at the end of June 2024 and in our latest equity research report after the company’s Q4-report in august we deemed it important for ODI Pharma to generate a positive cash flow going forward given the cash position. Given the announcement of the rights issue, we see it as a sign that the company has yet to reach a sustainable positive cash flow. However, given the size of the rights issue, amounting to SEK 4.1m in gross proceeds, which is expected to be enough to finance the operations until positive cash flow, we asses that the expected revenue growth on the polish market and the scalable business model will be improving profitability, thereby projecting that ODI Pharma will be cash flow positive in 2025.

ODI Pharma’s revenue growth is attributable to the polish market where the company has a collaboration agreement with Synoptis Pharma, part of NEUCA, a leading pharmaceutical brand in Poland. Earlier in October, the limit of the import of medical marijuana to Poland increased from the previous 6 tons with an additional 5.3 tons to 11.3 tons as a result of increased demand. The figures can be compared to 2023 with total sales of approximately 2.6 tons, which underscores the rapid growth the market is currently in. We expect ODI Pharma to capitalize on this as a supplying partner to one of the leading pharmaceutical brands in the country, resulting in accelerated growth as well as, given a scalable business model, positive cash flow.

In summary, Analyst Group assesses that the proceeds from the issue will be sufficient until positive cash flow is achieved, which we expect will be driven by continued expansion in the rapidly growing Polish medical cannabis market. Additionally, we view it positively that the issue is carried out without a discount to limit dilution effects, and that it is supported by subscription commitments from major existing shareholders Volker Wiederrich and Niclas Kappelin, covering 49% of the issue equivalent to SEK 2m, which instills confidence.

Comment on ODI Pharma’s Quarterly Report

2024-08-29

ODI Pharma published on August 29th the company’s Q4-report for 2023/2024, which showed a continued strong momentum. The following are some key points that we have chosen to highlight in connection with the report:

- Another strong quarter – net sales amounted to SEK 7.5m (0.0)

- Continued stable cost base

- Stable financial position

- Enters the Swiss market to diversify geographically

Continued Strong Momentum

The Q4-report marked another strong quarter for ODI Pharma where the net sales amounted to SEK 7.5m (0.0) in Q4-23/24, 9% above Analyst Group’s estimates of SEK 6.9m. The increased sales are assumed to be mainly attributable to, like in the previous quarter, the collaboration agreement with Synoptis Pharma and sales on the polish market. Moreover, ODI Pharma are actively seeking more European markets to diversify the geographical footprint. The collaboration agreement with Synoptis Pharma includes 23 countries in Eastern Europe, why Analyst Group believes that there are still strong growth opportunities within the framework of the collaboration. Additionally, ODI Pharma completed a first product delivery to the Swiss market at the end of the fourth quarter, which is considered a strategically important milestone. Therefore, Analyst Group believes there is still ample room for growth, both through increased sales in the Polish market and through geographic expansion. The company’s competitive advantage is assumed to be Synoptis strong brand in Eastern Europe, where we expect Synoptis to sell the products under its own brand. Doctors and patients in Poland are anticipated to prioritize a well-known local brand over other international brands, especially as the pricing for the products is expected to be similar.

The gross margin, adjusted for other operating income, amounted to 20.1%, in line with our expectations of 20.5%. The operating expenses, excluding depreciation, amounted to SEK 2.7m (1.9), corresponding to an increase of 44%. The operating expenses was affected by a one-off cost of SEK 0.35m related to the sale of the Kandol brand which occurred in December 2023. Adjusted for this one-off cost, the operating expenses amounted to SEK 2.3m, corresponding to an increase of 25%. The increased cost base is assumed to be attributable to shipping costs for the products sold. Nevertheless, Analyst Group reiterates the view of ODI Pharma’s scalable business model, where operating costs can be kept low even with a rapid increase in sales. Moreover, the business model is asset light with limited or no investments needed, which is expected to lead to a good cash conversion ratio.

Adjusted for the one-off cost of SEK 0.35m, the EBIT result amounted to amounted to SEK -0.6m. With the scalable business model, we expect the estimated sales growth to lead to improved and positive results going forward, in combination with a good cash conversion ratio. Below is a summary of the quarterly results and a comparison with our estimates.

Stable Financial Position

The cash position at the end of the quarter amounted to SEK 2.6m, compared to SEK 5.9m at the end of the previous quarter. The cash flow during Q4-23/24 was affected by a negative development in net working capital of SEK 4.2m. Given that we estimate a positive result and cash flow in the upcoming fiscal year, in combination with the asset light business model with no estimated investments needed, we see ODI Pharma’s financial position as solid. Additionally, the company has no long-term debt on the balance sheet, which allows for financing through loans if needed.

New Strategic Market Entry to Switzerland

At the end of the quarter, ODI Pharma announced that the company has completed a first delivery of products to the Swiss market, a new market for ODI Pharma. The delivery is the first one outside of the collaboration agreement with Synoptis Pharma, which includes 23 countries in Eastern Europe, why it marks an important strategic milestone for ODI Pharma and in line with the company’s goal to widen the company’s market footprint and adapt to changing market dynamics. Analyst Group views positively on the entry to the Swiss market which marks a first step in this direction to increase revenue diversification and hence the reliance on the agreement with Synoptis.

To summarize, Analyst Group sees the results as further proof of concept regarding the collaboration with Synoptis as a game changer for ODI Pharma in terms of scaling up sales and commercializing the company’s products. We expect the scale up to continue throughout the upcoming fiscal year, thus resulting in substantial growth, further supported by geographical expansion, with a positive result and cash flow because of the scalable and asset light business model.

We will return with an updated equity research report of ODI Pharma.

Comment on ODI Pharma’s Strategic Market Entry to Switzerland

2024-06-26

ODI Pharma announced on June 25th that the company has completed a first delivery of products to the Swiss market, a new market for ODI Pharma. The delivery will be made to the leading medical cannabis provider in Switzerland and will be facilitated through ODI Pharma’s Swiss subsidiary.

The delivery is the first one outside of the collaboration agreement with Synoptis Pharma, which includes 23 countries in Eastern Europe, why it marks an important strategic milestone for ODI Pharma and in line with the company’s goal to widen the company’s market footprint and adapt to changing market dynamics. This first order to the Swiss market is a first step towards a wider market engagement, even though it is less significant in terms of order value.

The Swiss Medical Cannabis Market

Switzerland has one of the oldest medical cannabis schemes and most developed CBD industries, but patient numbers have remained low as access has been limited and costs has remained high. However, from august 2022 cannabis for medical purposes, classed as containing more than 1% THC, was reclassified from a ‘prohibited narcotic’ to a ‘controlled substance’. Before the change, patients were required to apply to the government for an exceptional license to get access to medical cannabis. With the reclassification, any physician with the correct operating license can prescribe medical cannabis and permits from the government are no longer required. After the change, the Swiss market has returned to growth after several years of a declining number of patients, and Statista estimates that sales of medical cannabis will grow by approximately 8.3% in 2024, reaching USD 24.6m.

Analyst Group’s View of the Market Entry

In our equity research report on ODI Pharma, we stated that the company is dependent of the collaboration agreement with Synoptis, which poses a risk in the event that the agreement is terminated for any reason. Additionally, ODI Pharma can expand to new markets, such as Western Europe, on their own, which is expected to be a long term strategic objective for the company. The entry on the Swiss market marks a first step in this direction to increase revenue diversification and hence the reliance on the agreement with Synoptis. Moreover, the Swiss market is expected to grow and is also seen by industry experts as a candidate to be the next European country to legalize cannabis for recreational use. Although this is not a market addressed by ODI Pharma, it is expected that such a development could increase the general acceptance of cannabis, which could, in turn, benefit the medical market and sales of ODI Pharma’s products.

Since the delivery is made to the leading medical cannabis provider in Switzerland, we expect the business model to be similar to the collaboration with Synoptis Pharma, i.e., that ODI Pharma acts as an intermediary between the supplier and the distributor, while also outsourcing costs such as product shipping. This means that the costs associated with the Swiss expansion are expected to be low and that ODI Pharma is estimated to be able to keep a low cost base going forward, paving the way for improved profitability as the company scales up in various markets. Although the Swiss market is not initially expected to contribute significantly financially, we see potential for higher sales volumes going forward.

How Analyst Group sees ODI Pharma as an investment

The third quarter was a breakthrough quarter for ODI Pharma, with net sales amounting to SEK 13.9m and an EBIT margin of 11% during the company’s broken fiscal year, proving the significance of the collaboration with Synoptis Pharma and the scalable business model. ODI Pharma’s unique business model has resulted in the company being, and expected to remain, one of the very few profitable companies in the cannabis industry. According to Analyst Group, this presents an attractive investment opportunity. With estimated net sales of SEK 127m by 2025/2026, and with an applied P/S multiple of 2.8x, a potential present value per share of SEK 17.4 is derived in a Base scenario.

Comment on ODI Pharma’s Quarterly Report

2024-05-30

ODI Pharma published on May 30 the company’s Q3-report for 2023/2024, which showed a strong financial development. The following are some key points that we have chosen to highlight in connection with the report:

- Reported net sales of SEK 13.9m (0,0) – significantly higher than any other previous quarter

- Proof of a scalable business model – the EBIT margin amounted to 11%

- Stable financial position

A Breakthrough Quarter

The Q3-report showed a breakthrough quarter for ODI Pharma as the net sales amounted to SEK 13.9m (0,0), the first significant sales figures in the company’s history. The sales growth is attributable to the exclusive collaboration agreement with Synoptis Pharma, under which ODI Pharma is the exclusive supply partner for Synoptis in 23 countries. As a market leading pharmaceutical brand in Poland as well as all over eastern Europe, Analyst Group expects Synoptis Pharma to have an ambitious growth plan in these countries regarding medical cannabis, which we expect ODI Pharma to continue to capitalize on by being the exclusive supply partner. Moreover, as we currently are two months into Q4-23/24, we expect that the strong momentum has continued into the current quarter, leading to a robust start of the last quarter in ODI Pharma’s fiscal year.

Given that the orders for ODI Pharma are expected to have significant individual value, the revenue may vary between upcoming quarters. In other words, sales could be affected in a particular quarter depending on whether a major sale occurs in the last week of that quarter or in the following week, thus being recorded in the next quarter. Following the breakthrough quarter in Q3-23/24, we anticipate somewhat lower revenue in the upcoming fourth quarter, albeit with significantly higher sales compared to previous quarters. However, in the long term, we foresee continued sustainable and stable growth, with quarterly fluctuations diminishing as ODI Pharma continues to expand.

Proof of the Asset-Light Scalable Business Model

Despite the large ramp-up in sales during the quarter, the cost base remained stable, demonstrating scalability. The total operating expenses during the quarter amounted to SEK 1.2m, which was a decrease from the previous quarter where the operating costs amounted to SEK 1.8m. However, the cost base increased by 26% Y-Y. Nevertheless, we view this development as evidence of ODI Pharma’s scalable business model, where operating costs can be kept low even with a rapid increase in sales. With a reported gross margin of 20% and with a stable cost base, ODI Pharma managed to report an EBIT margin of 11% in the quarter as well as a profit margin of 9%. Once again, we see this as evidence of a functioning business model where ODI Pharma operates as an intermediary between the producer and the distributor, Synoptis Pharma. According to Analyst Group, this positioning creates the conditions necessary to deliver continued profitability in the future.

The cash position amounted to SEK 5.9m at the end of Q1-24 compared to SEK 6.5m at the end of Q4-23. The cash position was affected by a negative development in net working capital as well as paid interest, regardless ODI Pharma had trade receivables amounting to SEK 7,4m at the end of the quarter, which is expected to be converted to cash. We expect ODI Pharma to repay an outstanding loan of EUR 350,000 over the coming quarters to reduce interest expenses and strengthen the balance sheet, which is anticipated to be achieved through organically generated cash flow.

To summarize, Analyst Group sees the results of the report as proof of that the collaboration agreement with Synoptis is a game changer for ODI Pharma in terms of scaling up sales and commercialize the company’s products. Moreover, the stable cost base in the quarter is seen as a proof of concept of the scalable business model, where ODI Pharma is expected to be able to keep the cost base low while creating a rapid scaling up of sales.

We will return with an updated equity research report of ODI Pharma.

Maj

Interview with ODI Pharma’s Chairman of the Board Volker Wiederrich

Aktiekurs

1.48

Värderingsintervall

2025-03-07

Bear

1,9 SEKBase

10,8 SEKBull

13,1 SEKUtveckling

Huvudägare

2024-12-23

Comment on ODI Pharma’s Quarterly Report

2025-03-03

ODI Pharma AB (“ODI Pharma” or the ”Company”) published on February 27th the company’s Q2-report for 2024/2025. The following are some key points that we have chosen to highlight in connection with the report:

Increased Import Quota is Expected to Accelerate Sales in the Coming Quarters

ODI Pharma’s Q2-report in the Company’s broken fiscal year showed net sales of SEK 0m (0). As Analyst Group stated in our last equity research report on ODI Pharma, sales have been affected by import restrictions set by the Polish government, where the import quota for medical cannabis in the country for 2024 initially were set at 6 tons, which was reached with several months left of the year. This led to that the polish government increased the estimated annual demand for cannabis, hence also the quota, by an additional 5.3 tons in October 2024.

However, the updated quota is applied from January 2025, why sales were affected during the second quarter. Nevertheless, during the first months of 2025, ODI Pharma has experienced an increased order intake following that the import quota has been raised, why we expect stronger quarters ahead.

Runs a Lean Organization Towards Profitability

The EBIT result amounted to SEK -2.3m (1.1), where the comparison periods result was positively affected by the sale of the skincare brand kandol. Total operating expenses amounted to SEK -2.4m (-1.8), an increase of 31%. Most of the operational expenses was attributable to external expenses amounting to SEK 2.2m, which was affected by costs for external service providers. Analyst Groups assumes that a main driver of the cost increase are the transaction-related costs for ODI Pharma’s rights issue conducted in December.

ODI Pharma continues to operate with a tight organization which the business model allows, paving the way for profitability as sales is expected to grow in the coming quarters. However, the strategic recruitments of Malcolm Allan to the board and Jan-Mark Edewaard as CEO is expected to increase operational expenses. During the calendar year 2024, ODI Pharma’s personal expenses amounted to SEK 1.6m, which underlines the tight organization. The recruitments are expected to increase personal expenses by approximately SEK 1m in 2025. Nevertheless, Analyst Group believes that both appointments possess relevant experience to contribute to the Company’s upcoming growth initiatives in the European medical cannabis market.

Financial Position Strengthened Through Rights Issue

The cash position at the end of December amounted to SEK 5.4m, compared to SEK 5m at the end of September and was strengthened through a rights issue with net proceeds of SEK 1.6. With the import restrictions gone and the new raised import quota in Poland for 2025, we expect sales to increase and, with the low cost base, ODI Pharma to show profitability. With an asset light business model, where earnings and cash flow are expected to correlate well, Analyst Group currently assess the cash position to be sufficient, but highly dependent on a scale up in sales.

New Market Restrictions Not Expected to have Effect on ODI Pharma’s Sales

The Polish medical cannabis market has shown strong growth since 2017, albeit from low levels. Nevertheless, 2023 was a breakout year, when approximately 4,600 kg of medical cannabis was sold in the country, compared to approximately 1,200 kg in 2022 and 400 kg in 2021. For 2024, the demand for medical cannabis was estimated at approximately 6,000 kg at the beginning of the year, which also set the import quota for the year. However, due to high demand, the quota was reached with several months remaining in the year, prompting a near doubled quota for 2025 to approximately 11,300 kg – this figure reflects the Polish government’s estimation of annual demand for medical cannabis. Consequently, the market remains in a phase of strong growth with increasing demand, which ODI Pharma is expected to capitalize on.

However, the rapid market growth has raised concerns from Poland’s Ministry of Health regarding non-medical use following many prescriptions from online clinics. Since November 2024, new regulations which states that private clinics can no longer offer remote consultations for cannabis prescriptions, and that national health physicians only can provide remote consultations and prescriptions for patients who have previously had an in-person consultation.

Nevertheless, Analyst Group do not expect the new regulations to have any effects on ODI Pharma’s business, as the Company’s business model does not rely on online clinics. Even though the overall market growth is expected to slow down, as already seen in prescription numbers which has decreased from 68,000 in October to 28,000 in December 2024, this is expected to harm competitors and make ODI Pharma gain market share. The Company has an exclusive collaboration agreement with Synoptis Pharma, part of the NEUCA group, a market leader in the wholesale distribution of pharmaceutical products in Poland and has approx. a 30% market share in all pharmaceutical sales in Poland, which is why we view the news positively from ODI Pharma’s perspective.

To summarize, Analyst Group views the second quarter as a transitional period, where sales were limited by import restrictions that have been lifted after the turn of the year. Going forward, we expect momentum to pick up for ODI Pharma, as the polish market experiences rapid growth, which ODI Pharma is expected to capitalize on through the collaboration agreement with Synoptis Pharma, a market leading pharmaceutical brand in the polish market.

We will return with an updated equity research report of ODI Pharma.