Movinn A/S, founded in 2014, is one of Denmark’s leading providers of fully serviced and furnished apartments, which the Company rents out to large international companies who utilize them mainly for employees working abroad. Movinn also offers co-living and long-term furniture rental through the brand Collective yoyo. The Company is focused on tech, where several IT- and software systems have been developed inhouse, which helps to provide the best possible service to customers and create a scalable business model. Apart from the Danish market, Movinn has entered the Swedish market, with ambitions to expand to Germany.

Pressmeddelanden

Focus on Profitability

In Q4-23, Movinn A/S (“Movinn” or the “Company”) continued to be affected by high vacancy rates, which led to slightly lower profitability than estimated. Going into 2024, we expect the Company to focus on lowering the vacancy rate on the existing unit portfolio, thus improving profitability. Hence, we have lowered our expectations regarding growth in 2024, with estimated accelerated growth in 2025 and 2026 through, among other things, entering Germany and new markets in Sweden. With an estimated EBITDA of DKK 7.8m in 2024, an applied target multiple of EV/EBITDA 15x, and a discount rate of 10.1%, a net present potential value per share of DKK 5.6 (6.5) is derived in a Base scenario.

- Revenue Slightly Above our Estimates

Movinn’s revenue in Q4-23 amounted to DKK 21.1m (19.9), corres-ponding to a growth of 6% and 5% above our estimate of DKK 20.1m. The revenue per unit amounted to DKK 197k on the Danish units in 2023, which we see as strong given the high vacancy rates throughout the year, amounting to 14.5%. As vacancy rates are expected to decrease in 2024 through removing underperforming units and expected increased demand, we estimate a higher revenue per unit in 2024 as a catalyst for the estimated revenue growth of 9% for the full year.

- Entering the German Market is now Expected in 2025

Movinn is expected to monitor the current portfolio and focus on profitability through decreasing the vacancy rates in 2024, why we expect the Company to enter the German market in 2025. Hence, we estimate unit growth to accelerate in 2025, where Hamburg is expected to be the first targeted city in the country. Thereafter, in 2026, we estimate further accelerated unit growth through continued expansion in Germany as well as a launch of the 94-unit development in Copenhagen.

- New Technology Expected to Drive Profitability in 2024

The EBITDA result amounted to DKK -0.9m in Q4-23, compared to our estimate of DKK -0.3. Going into 2024, Movinn has downsized the Company’s organization and has continued to develop new technology to automate processes. In January 2024 Movinn launched direct booking on the website, which means that customers can make direct bookings and payments on the website from anywhere in the world at any time without involvement from Movinn’s staff. This is expected to decrease staff costs in 2024 and drive profitability.

- Updated Valuation Range

As Movinn’s profitability has been lower than estimated in 2023, we expect the Company to focus on increased profitability in 2024 through decreased vacancy rates. Hence, we have lowered our forecasts regarding unit growth and revenue growth in 2024, leading to an updated valuation range in all scenarios.

6

Värdedrivare

3

Historisk lönsamhet

8

Ledning & Styrelse

6

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Improved Profitability in Sight

Movinn A/S (“Movinn” or the “Company”) continued to demonstrate growth during the third quarter of 2023, amounting to 9% Y-Y. However, margins continue to be impacted by high vacancy rates, with the EBITDA margin (from operations) reaching 1.4%. The Company has taken measures to enhance profitability, which, combined with a more favorable macroeconomic environment, is expected to strengthen profitability starting from Q1-24. With an estimated EBITDA of DKK 8.9m in 2024, an applied target multiple of EV/EBITDA 15x, and a discount rate of 10.9%, a net present potential value per share of DKK 6.5 (7.5) is derived in a Base scenario.

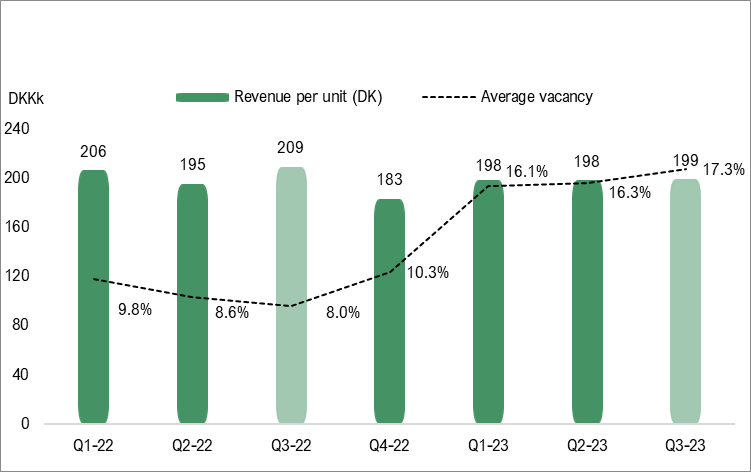

- Revenue per Unit Remains Robust in a Tough Market

Movinn’s revenue amounted to DKK 21.2m (19.4), corresponding to a growth of 9% and 4% below our estimate of DKK 22m. Aarhus and Odense continues to face challenges regarding demand, which translates to high vacancy rates on the Danish units, amounting to 17.3%, compared to the same period last year of 8%. However, the revenue per unit continues to remain strong, amounting to DKK 199k, which we anticipate will increase to DKK 205k in 2024, as vacancy rates decline, thereby contributing to stronger revenue.

- High Vacancy Rates Continues to Tear on Margins

EBITDA from operations amounted to DKK 0.3m, compared to our estimate of DKK 1.4m, corresponding to a margin of 1.4%. The high vacancy rates continues to affect margins as the variable costs, which mostly consists of rent paid to landlords, has risen in relation to revenue. Moreover, staff costs was slightly higher than estimated in Q3-23, owing to a rebuild within the sales organization during Q2-23, which also has affected the costs in Q3-23. Movinn has taken actions to improve profitability, including downsizing in Aarhus, where the Company will remove 13 of the 43 units from its portfolio that are underperforming, which is expected to improve vacancy rates and save costs. On a positive note, the Swedish market is performing well and is close to break-even, where the vacancy rate amounted to 3.6%, which indicates that Movinn is effectively managing demand in the Swedish market.

- Updated Valuation Range

With the Q3-report presented, it is evident that Movinn continues to operate in a challenging market, especially in the Company’s secondary Danish markets Odense and Aarhus. We assess that Movinn is making the right move by downsizing underperforming markets and instead expanding in markets with stronger performance to increase profitability. However, it is expected that the high vacancy rates will persist into the beginning of 2024, resulting in a slightly lower revenue and profitability. In light of this, we have updated our financial forecasts for Movinn, which also leads to an adjusted valuation range for all three scenarios: Base, Bull, and Bear.

6

Värdedrivare

3

Historisk lönsamhet

8

Ledning & Styrelse

6

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Strong Revenues Despite a Tough Climate

During H1-23, Movinn A/S (“Movinn” or the “Company”) delivered revenues relatively in line with our expectations but with higher costs than estimated, as a result of lower demand leading to higher vacancy rates. The macroeconomic headwinds that have contributed to this outcome are anticipated to persist to some extent throughout 2023, gradually subsiding thereafter in 2024, which is estimated to result in an improved profitability thereafter. With an estimated EBITDA of DKK 10.4m in 2024, an applied target multiple of EV/EBITDA 15x, and a discount rate of 11.4%, a net present potential value per share of DKK 7.5 (10.2) is derived in a Base scenario.

- Challenging Market Conditions Affects the Performance

Movinn’s net revenue amounted to DKK 20.7m (17.8) in Q2-23, corresponding to a growth of 16% Y-Y, slightly below our estimate of DKK 22.5m. The Company is still experiencing a lower demand than expected due to the current macro-economic climate as well as several large clients ending projects in Odense, leading to project-related staff not being on assignment in the city. Going forward, we expect a continued challenging market in 2023, leading to higher vacancy rates, hence affecting profitability negatively. However, we expect demand to gradually improve from early 2024, which, in combination with Movinn’s new strategy of taking on larger projects, is expected to improve profitability.

- Continued Strong Revenue per Unit

The revenue per unit amounted to DKK 186k in H1-23, divided into DKK 198k on the Danish units and DKK 88k on the Swedish units, compared to DKK 178t in H1-22. The higher revenue per unit is a strong performance according to Analyst Group considering that vacancy rates were much higher in H1-23, 16.7% compared to 9.5% in H1-22. Hence, we expect, as vacancy rates are estimated to decrease from 2024, that Movinn can deliver a revenue per unit in the higher end of the Company’s guidance of DKK 180-225t.

- Updated valuation range

With the H1-23 report presented, it is evident that Movinn has performed below our expectations regarding profitability, which can be attributed to a lower-than-anticipated demand. Given the Company’s performance in the first half of the year, as well as the prospects concerning demand in the forthcoming quarters, we have revised our financial forecasts in this analysis update. However, we see the lower profitability in 2023 as an unusual event, as margins has been, and is expected to be, stronger than during 2023. Consequently, in this update, our potential value per share is derived with an EV/EBITDA multiple applied on 2024’s EBITDA compared to 2023’s EBITDA in previous updates, as this is considered to give a better view of Movinn’s fair value according to Analyst Group. As a result of this, in combination with the updated financial forecasts, we have adjusted our valuation range for all three scenarios: Base, Bull, and Bear.

6

Värdedrivare

4

Historisk lönsamhet

8

Ledning & Styrelse

6

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Stronger Quarters Ahead

Movinn has started the year of 2023 strongly regarding revenues, delivering above our expectations, but with a more challenging development on the cost side. Going forward, we expect costs to decrease in relation to revenues as demand improves, while revenues is expected to keep growing at a steady pace. This, together with the Company being expected to decrease its investments as a result of slower unit growth and taking on larger projects with more units at once, is expected to improve cash flows in the coming years. With an estimated EBITDA of DKK 11.4m in 2023, and with an applied target multiple of EV/EBITDA 16x, a potential fair value per share of DKK 10.2 is derived in a Base scenario.

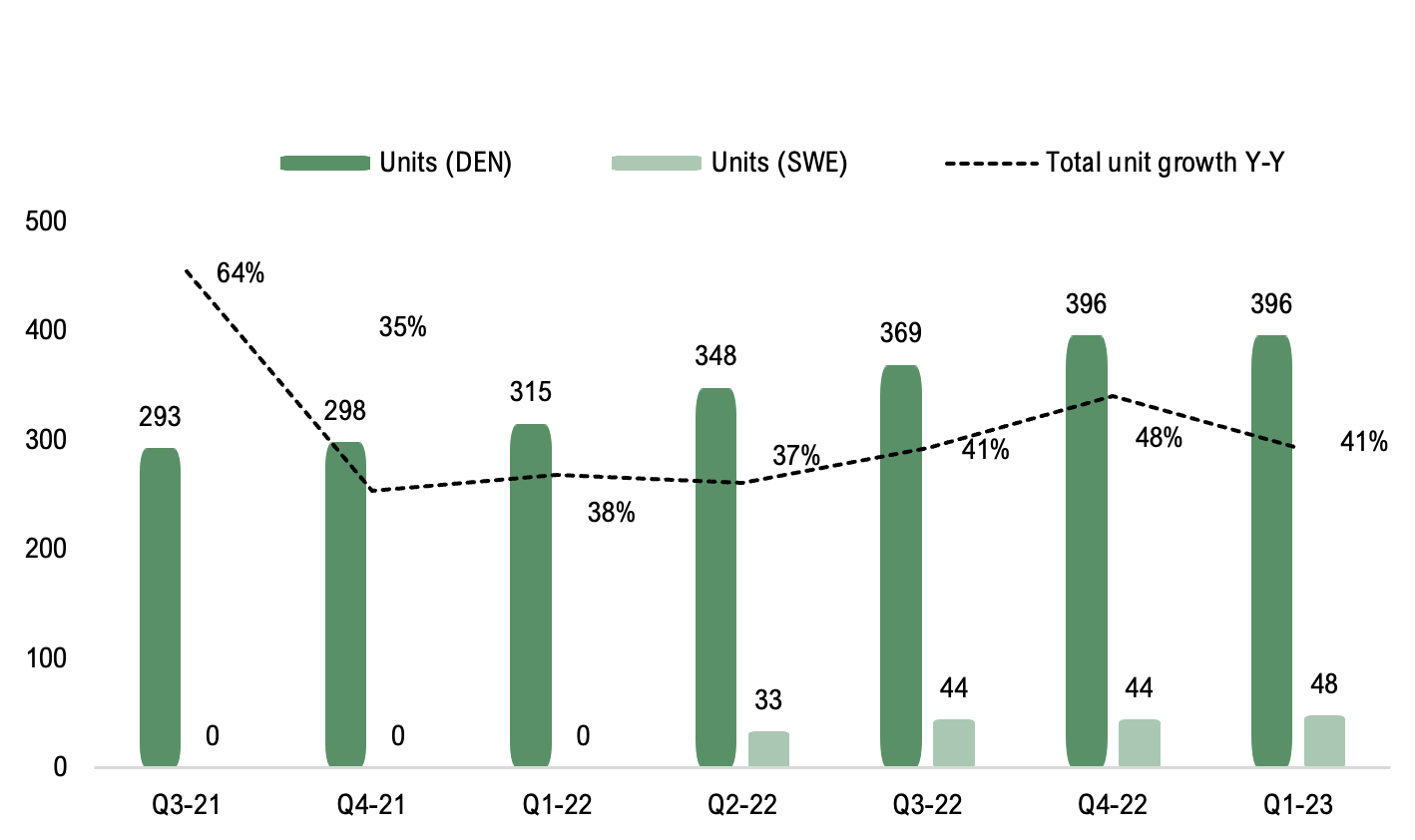

- Delivered Strong Revenue per Unit

During Q1-23, vacancy rates were high, amounting to 16.1% on the Danish units and 27.9% on the Swedish units. This was a result of a decrease in demand, due to natural seasonal patterns, but also macroeconomic factors. Despite this, Movinn delivered a revenue per unit of DKK 198t and DKK 83t for Danish and Swedish units respectively, compared to Analyst Groups estimates of DKK 192t and DKK 90t for the full year 2023. When vacancy rates comes down, which is expected in the coming quarters as demand improves, we estimate that Movinn can deliver a revenue per unit in the higher end of the Company’s guidance of DKK 180-225t, why we have updated the revenue per unit in our model to amount to DKK 212t and DKK 100t for the Danish and Swedish units respectively in 2023, leading to a higher total revenue.

- Higher Costs Than Expected…

The variable costs in Q1-23 amounted to DKK 16.1m, which was higher compared to our estimates (13.9) and the same period last year (11.9). We expect the costs to come down in relation to revenue in the coming quarters as macroeconomic factors improve and demand increases, leading to increased margins.

- … but Positive Signs in the Cash Flow Statement

Movinn showed a slower unit growth in Q1-23 than during 2022, which was expected and according to plan. Movinn is expected to take a step back in unit growth during 2023, hence decrease investments and improve the cash flow. During Q1-23, the cash flow statement showed less investments in both furniture and security deposits as a result of slower unit growth, why we estimate a positive cash flow for the rest of 2023 where a stronger bottom-line result is expected through lower costs.

- Our Valuation Range Stands

As a result of the revenue and revenue per unit being higher than expected and costs also being higher than expected, we have updated our forecasts slightly. However, Movinn is, according to Analyst Group, developing in the right direction, why we repeat our valuation range in all scenarios.

6

Värdedrivare

4

Historisk lönsamhet

8

Ledning & Styrelse

4

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

An Undervalued PropTech Company

Since the IPO in 2021, Movinn (”Movinn” or the ”Company”) has showed a strong revenue growth of 31% in the last year, while being profitable on an EBITDA level with an EBITDA of DKK 4.8m, corresponding to a profit margin of 7% (LTM). Despite great fundamental performance, the stock has dropped 36% since the IPO, corresponding to a current valuation of DKK ~92m, creating an investment opportunity according to Analyst Group. Movinn is expected to decrease the investments needed to add new units from 2023 and onwards, leading to improved cash flow and ROIC, as well as growing the Company’s profitability as a result of the inhouse developed IT-infrastructure. With an estimated EBITDA of DKK 11.3m, and with an applied target multiple of EV/EBITDA 16x, a potential fair value per share of DKK 10.2 is derived in a Base scenario.

- Capitalizing on Strong Market Trends

Many western countries are currently experiencing a shortage in skilled labor force, why foreign workforce is growing in demand. In Germany, a country with the second most expats in the world, the government are currently planning to reform its immigration legislation to make it easier for third country nationals to work in Germany. Movinn is expected to capitalize on this as the Company’s main customers are companies who needs accommodations for employees.

- A Leading PropTech Company

Movinn has developed an IT-infrastructure consisting of a management system, which secures automation and efficiency in sales, a booking platform and an access system inhouse, which helps the Company provide quality service and maintain a slim organization. Due to the IT systems, a lot of the processes, such as real time availability on the website, rental contracts and key handovers, are automated. This enables the total need of additional employees to grow at a slower pace than revenues, which proves the scalability in the business model, owing to Movinn’s IT systems.

- Less Investments is Expected to Drive Cash Flow

During the last years, the number of units have grown from 179 at the end of Q3-20 to 440 at the end of 2022. While this has driven the revenue growth, a lot of investments have been made in connection to unit growth, such as furniture and cash deposits. Going forward, Movinn is expected to decrease the investments needed when adding a unit, by renting apartments that are already furnished, as well as replacing security deposits with rental guarantees, which is expected to improve ROIC and cash flow.

- Trading at an Unmotivated Discount

Since the IPO in November 2021, Movinn’s stock has fallen ~36%, despite the Company delivering fundamentally. Today, Movinn is valued at EV/EBITDA 9.1x on our 2023 estimated EBITDA, which Analyst Group consider to bee too low, given Movinn’s growth prospects, low net debt and expected positive cash flow around the corner.

6

Värdedrivare

4

Historisk lönsamhet

8

Ledning & Styrelse

3

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Analytikerkommentarer

Analyst Group’s Comment on Movinn’s Q3-report

2023-11-03

Movinn published on November 3rd the company’s Q3-report for 2023. The following are some key points that we have chosen to highlight in connection with the report:

- Revenues relatively in line with expectations

- High vacancy rates continue to affect margins

- Lower investments expected to improve cash flow as demand increases

Revenues Relatively in Line With our Estimates

Movinn’s revenue in the third quarter amounted to DKK 21.2m (19.4), corresponding to a growth of 9% Y-Y but 4% below our estimate of DKK 22m. Movinn continues to face weaker demand, especially in Aarhus and Odense, which affects the vacancy rates, hence also revenues. The average vacancy rate amounted to 17.3% on the Danish units, compared to 16.3% in Q2-23 and 8% in the same quarter last year, which has a negative impact on revenues. As a result of changed market conditions Movinn are now downsizing in Aarhus where the company will remove 13 of the 43 units from its portfolio that are underperforming, which is expected to improve vacancy rates and save costs. On a positive note, the vacancy rate on the Swedish units were low, amounting to 3.6% compared to 23.5% in the last quarter and was close to break-even on an EBITDA level.

Moreover, the revenue per unit remains robust despite the tough market climate, amounting to DKK 199k for the Danish units, in line with last quarter, and DKK 108k for the Swedish units, up from DKK 88k in the last quarter. By Movinn taking action to address high vacancy rates, such as removing underperforming units in Aarhus, combined with the expectation of improving macroeconomic factors in 2024, we estimate that vacancy rates will decrease in the future. Consequently, this will result in higher revenue per unit, which is expected to reach the upper end of Movinn’s guidance range of DKK 180-225k per unit. This is anticipated to drive revenue growth without the necessity for Movinn to add additional units to its portfolio.

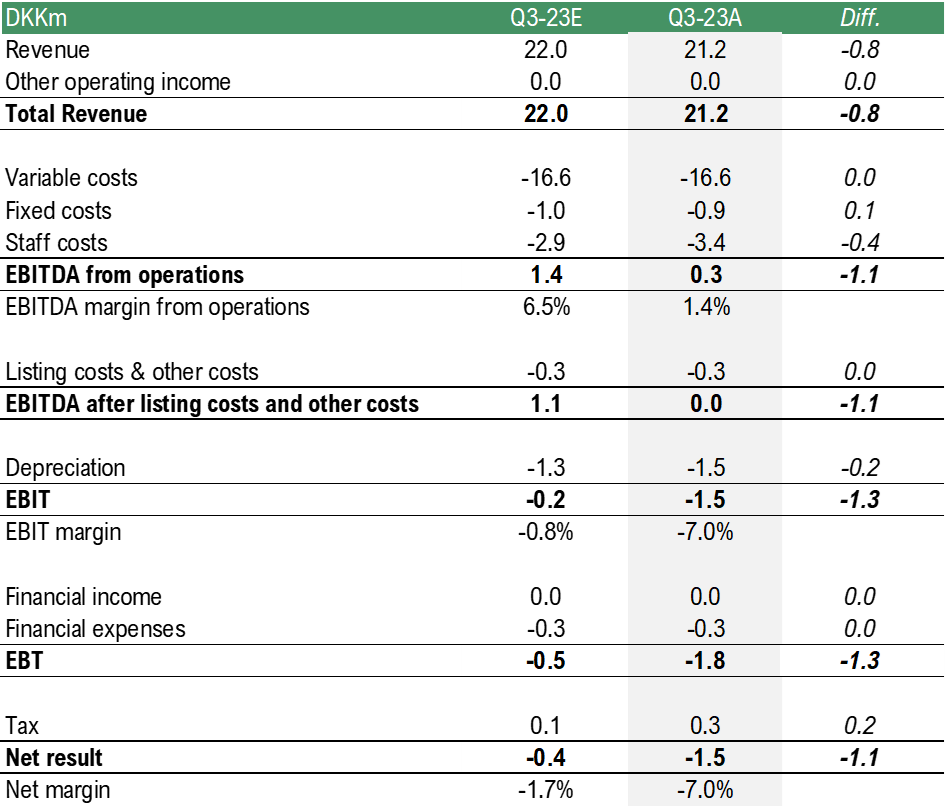

EBITDA From Operations Slightly Below our Estimates

Movinn’s cost base was relatively in line with our expectations but with slightly higher staff costs than estimated, which is expected to be a result of a rebuild within the sales organization during Q2-23, which also has affected the costs in Q3-23. EBITDA from operations amounted to DKK 0.3m, corresponding to a margin of 1.4%, compared to our estimate of DKK 1.4m. The difference is primarily attributed to the slightly lower revenue and higher staff costs compared to our estimate. The table below shows a complete comparison between our estimates and the result during the quarter.

Lower Investments Expected to Improve Cash Flow as Demand Increases

The cash flow from operations amounted to DKK 1m in Q3-23 compared to DKK 0.2m in the same period last year and DKK 0.4m in Q2-23, where the improvement was attributable to a stronger development regarding working capital. Movinn continues to withhold investments in new units as a result of weaker demand and high vacancy rates, which improves the cash flow from investments compared to Q3-22, something that is expected to continue until vacancy rates decreases. Going forward, as demand is expected to increase and contribute to a stronger operating margin, the lower investments is expected to improve Movinn’s free cash flow. However, Movinn continues to invest in tech development to further automate the company’s sales efforts and be less dependent on sales staff, hence improving the scalability of the business model.

To summarize, Movinn delivered a report relatively in line with our expectations both regarding top-line and bottom-line performance in a tough market. The high vacancy rates are expected to remain in Q4-23, hence affecting both revenue growth and margins. However, the company’s efforts to improve bottom-line metrics, with more controlled growth, i.e. larger projects, and removal of underperforming units, is expected to decrease vacancy rates in H1-24, which is estimated to result in stronger financials.

We will return with an updated equity research report of Movinn.

Analyst Group Comments on Movinn Expands to Ludvika

2023-09-22

Movinn announced on September 21st, that the company launches a third Swedish market in the city of Ludvika. To begin with, there will be a soft launch of five units, which are expected to be launched on the 15th of October. Subsequently, it will be possible for Movinn to expand with additional units depending on the market reception. Ludvika is an important market due to the current limited supply of corporate housing and its high demand.

“Ludvika is a smaller city with about 15,000 citizens with a strong corporate history. The largest employer in the area is the Japanese multinational electronics company Hitachi who has 2,700 employees in Ludvika with a large portion of foreign workers, which is thought to be one of the reasons for the shortage in corporate housing in the city. The fact that Movinn is doing a soft launch of fewer units is expected to limit the vacancy rates and enable the company to continuously assess the market and only add new units based on demand. Moreover, Movinn will be able to manage the units from the subsidiary Movinn Sverige’s base in Stockholm, which, in combination with the company’s PropTech systems that automates several processes including bookings, rental contracts and customers getting access to the apartments, will ease the management of the new units.

We also would like to highlight a quote from the Managing Director in Movinn Sverige who says ‘We are also showing the strategically important clients that when they call, Movinn answers’. This indicates, according to Analyst Group, that one of Movinn’s larger clients has required corporate housing in Ludvika, which suggests that demand is currently higher than supply, something that is expected to lead to low vacancy rates as well as building a good relationship with a strategically important client”, says the analyst at Analyst Group covering Movinn.

How Analyst Group sees Movinn as an investment

During H1-23, Movinn delivered revenues relatively in line with our expectations but with higher costs than estimated, as a result of lower demand leading to higher vacancy rates. The macroeconomic headwinds that have contributed to this outcome are anticipated to persist to some extent throughout 2023, gradually subsiding thereafter in 2024, which is estimated to result in an improved profitability thereafter. With an estimated EBITDA of DKK 10.4m in 2024, an applied target multiple of EV/EBITDA 15x, and a discount rate of 11.4%, a net present potential value per share of DKK 7.5 (10.2) is derived in a Base scenario.

Comment on Movinn’s Q2-report

2023-08-25

Movinn published on August 25th the company’s Q2-report for 2023. The following are some key points that we have chosen to highlight in connection with the report:

- Revenues slightly below our estimates

- Costs relatively in line with our expectations

- Lower investments expected to improve cash flow as demand increases

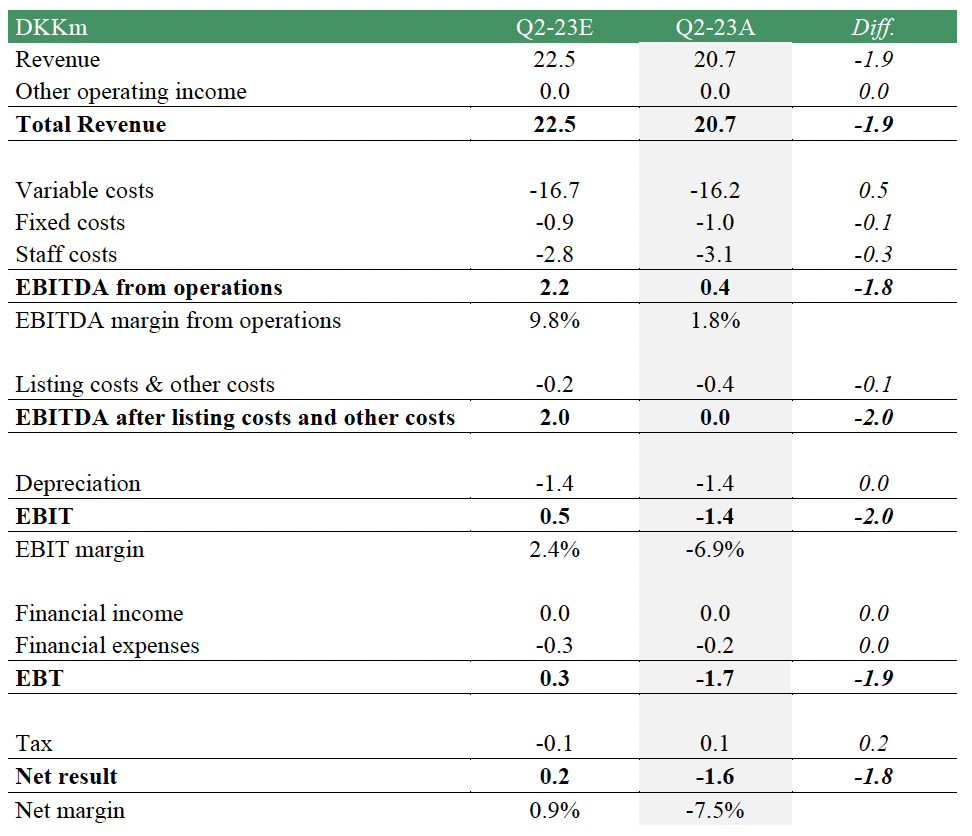

Revenues Slightly Below our Estimates

Movinn’s revenue amounted to DKK 20.7m (17.8) in Q2-23, corresponding to a growth of 16% Y-Y but 8% below our estimate of DKK 22.5m. We estimated that demand would be stronger during the second quarter due to the seasonal pattern where Q2 historically has been the strongest quarter. However, demand has continued to be slightly weaker than we expected due to an ongoing challenging macroenvironment. The weaker demand is especially attributable to the company’s two markets Aarhus and Odense, which represents approximately 33% of Movinn’s Danish portfolio, where there is currently an oversupply of apartments in Aarhus due to a high construction activity and some of Movinn’s clients have had several large projects finished in Odense at the same time, meaning that project-related clients was no longer on assignment in the city. The weaker demand is expected to continue throughout the year, which is likely to result in an update in our revenue forecast for 2023. However, the macroeconomic challenges are expected to ease during 2024, with increased demand as a result, which, in combination with that Movinn is expected to enter new markets such as Germany and Stockholm, is estimated to drive the growth in the coming years, why we still see the long-term growth-case being intact.

The revenue per unit amounted to DKK 186k in Q2-23, divided into DKK 198k on the Danish units and DKK 88k on the Swedish units, which was in line with Q1-23. The vacancy rates were also similar to the previous quarter, amounting to 16.3% on Danish units and 23.5% on Swedish units, corresponding to an average vacancy rate of 16.7% for Movinn. Analyst Group maintains that the revenue per unit remains robust, especially regarding the Danish units, considering the elevated vacancy rates driven by weaker demand. As the vacancy rates trend towards more normal levels, around 10%, through increased demand, an increase in revenue per unit is anticipated to further ascend to the upper end of the range of Movinn’s guidance of DKK 180-225k per unit.

Costs Relatively in Line With our Expectations

Movinn’s cost base was in line with our expectations in Q2-23, corresponding to an EBITDA from operations DKK 0.4m and EBITDA margin of 1.8%, compared to our estimate of DKK 2.2m and 9.8% EBITDA margin, where the difference largely is attributable to the fact that the revenue was lower than estimated. However, except from weaker demand, thus resulting in higher vacancy rates, Movinn was affected by slightly higher staff costs than anticipated, connected to hiring new staff within marketing and sales, as well as parting ways with several HQ staff members, expected to affect staff costs both in Q2 and Q3-23, but after that result in a better efficiency within the organization, leading to better profitability. Moreover, Movinn’s strategy of taking on larger projects, hence lowering the costs for adding new units, is expected to improve profitability going forward. An example of this new strategy is that the company has signed a long term lease agreement with AG Gruppen on a 94 unit development in Copenhagen. Such projects are anticipated to drive the profitability of the company in the future. The table below shows a complete comparison between our estimates and the result during the quarter.

Lower Investments Expected to Improve Cash Flow as Demand Increases

The cash flow from operating activities amounted to DKK 0.4m during the second quarter, compared to DKK -0.8m in Q1-23, where the improvement was attributable to a stronger development regarding working capital. Moreover, Movinn continues to decrease the company’s investments, in line with the strategy of a more controlled growth and focus on profitability. Going forward, as demand is expected to increase and contribute to a stronger operating margin, the lower investments is expected to improve Movinn’s free cash flow. Furthermore, when entering the German market, which is expected in 2024, Movinn is expected to replace security deposits with rental guarantees, which is expected to decrease investments further, hence contributing to improved ROIC and cash flow.

To summarize, Movinn delivered revenues slightly below our estimates due to demand being lower than expected, among other things as a result of the current macroeconomic environment, which also resulted in vacancy rates remaining at high levels, contributing to a slightly weaker bottom-line performance than estimated. However, despite the high vacancy rates, the revenue per unit remained strong, which indicates a strong revenue per unit as demand improves. Going forward, we expect an improved cash flow and ROIC through lower investments and increased demand.

We will return with an updated equity research report of Movinn.

Analyst Group Comments on Movinn’s Long Term Lease Agreement

2023-08-16

Movinn announced on August 14th, that the company (as operator and tenant) has signed a long-term lease agreement with AG Gruppen (as developer and owner) on 94 unit development in Copenhagen, Denmark (“the development”). The property is conceptually planned to have serviced apartments, a wellness area and shared workspace. The property lease and operations will be placed in a separate subsidiary fully owned by Movinn A/S and the commercial launch date is expected to be in late 2025 / early 2026.

The development is located within walking distance to the beach and short commute to the city center as well as the airport alike and will consist of a mix of studio, 1-bed and 2-bed apartments – each fully furnished and fitted with kitchen space as well as bathrooms. The development will have a full wellness area in the basement and in the ground floor there will be a shared workspace and meeting rooms for residents to use on request as the general concept is to create a holistic concept where guests and residents can combine health, wellness, working and living under one roof.

The commercial launch date is expected to be in late 2025 / early 2026 and as AG Gruppen will be the developer as well as owner, the lease agreement will not have any financial impact for Movinn in 2023 and 2024. The project is projected to generate annual revenues of DKK 20-22m as well as EBITDA of DKK 3-5m once commercialized and mature, measured in 2023-prices.

“At the end of Q1-23, Movinn had a total of 444 units in five markets, of which 280 in Copenhagen, why adding 94 more units is a large project. This is in line with Movinn’s strategy to take on larger projects in order lower its costs in connection with adding new units, as larger contracts are expected to be easier to negotiate, as well as a lower cost for maintenance as more units are in the same building, something that is estimated to lead to lower variable costs in relation to revenues.

The projected annual revenues of DKK 20-22m once commercialized in 2026 implies, given the middle of the interval, an annual revenue per unit of approximately DKK 223t, compared to the company’s guidance of DKK 180-225t in annual revenue per unit and Analyst Groups estimate of DKK 215t for the Danish units in 2026, when the units are expected to be commercialized. Regarding the projected EBITDA of DKK 3-5m annually, this implies, given the middle of the interval, an EBITDA margin of 19%, which is in line with the company’s guidance of a long-term EBITDA margin above 15% and slightly higher than Analyst Groups estimate of 18% in 2026. Thus, the development is expected to generate a high revenue per unit as well as a high margin compared to existing units, which is estimated to translate into improved cash flow for Movinn in the long run”, says the analyst at Analyst Group covering Movinn.

Analyst Groups Comment on Movinn’s Q1-report

2023-05-04

Movinn published on May 4th the companys Q1-report for 2023. The following are some key points that we have chosen to highlight in connection with the report:

- Revenues slightly above our estimates

- Higher costs than expected – but better efficiency is expected going forward

- Positive signs in the cash flow statement – better cash flow expected in the coming quarters

Revenues slightly above our estimates

Movinn’s revenue amounted to DKK 20.6m during the first quarters, close in line with our estimates of DKK 20.2m. The revenue growth amounted to 27% compared to the same period last year, when the revenue amounted to DKK 16.2m. The revenue growth compared to last year is a result of Movinn’s strong unit growth during 2022, which is now materializing in sales. Furthermore, the revenue per unit amounted to DKK 198t on the Danish units and DKK 83t on the Swedish units, which can be compared to DKK 183t and DKK 20t respectively for the full year 2022. Analyst Group estimates the revenue per unit on the Danish units to DKK 192t and for the Swedish units to DKK 90t for the full year 2023. As we expect the revenue per unit to increase successively over the year because of new units maturing, we believe that the first quarter results regarding revenue per unit were strong and above what we expected. The strong revenue per unit was achieved despite the higher-than-expected vacancy rates of 16.1% on the Danish units and 27.9% on the Swedish units, why we estimate the revenue per unit to increase even further when demand improves, and vacancy rates decreases to more normal levels. Demand is expected to improve in the coming quarters due to the natural seasonal pattern where the second and third quarters are usually stronger for Movinn, as well as through a well-diversified client portfolio.

Regarding unit growth, Movinn grew its unit portfolio by four new units during the first quarter, which were added on the Swedish market. A slower unit growth was expected as the company focuses on fully integrating units that was added during 2022, hence increasing bottom line performance and cash flows. Furthermore, Movinn is currently going through a change in strategy, taking on larger projects, i.e., projects with more units at once, meaning more units will be added at the same time compared to several smaller units in different locations as has been the case in the past. This strategy is expected to lead to lower costs going forward, as larger contracts are easier to negotiate and maintenance of units in the same building is more efficient, but also that unit growth will fluctuate more between quarters. Moreover, Collective yoyo, Movinn’s brand for furniture rental was launched during the quarter. Even if the brand is new and stands for a minor part of the revenue share (1%), we see positive on this as it adds an additional revenue stream for the company, as well as activating the furniture on the balance sheet. Analyst Group estimates that Collective yoyo will increase its revenue share going forward.

Higher costs than expected – but better efficiency is expected going forward

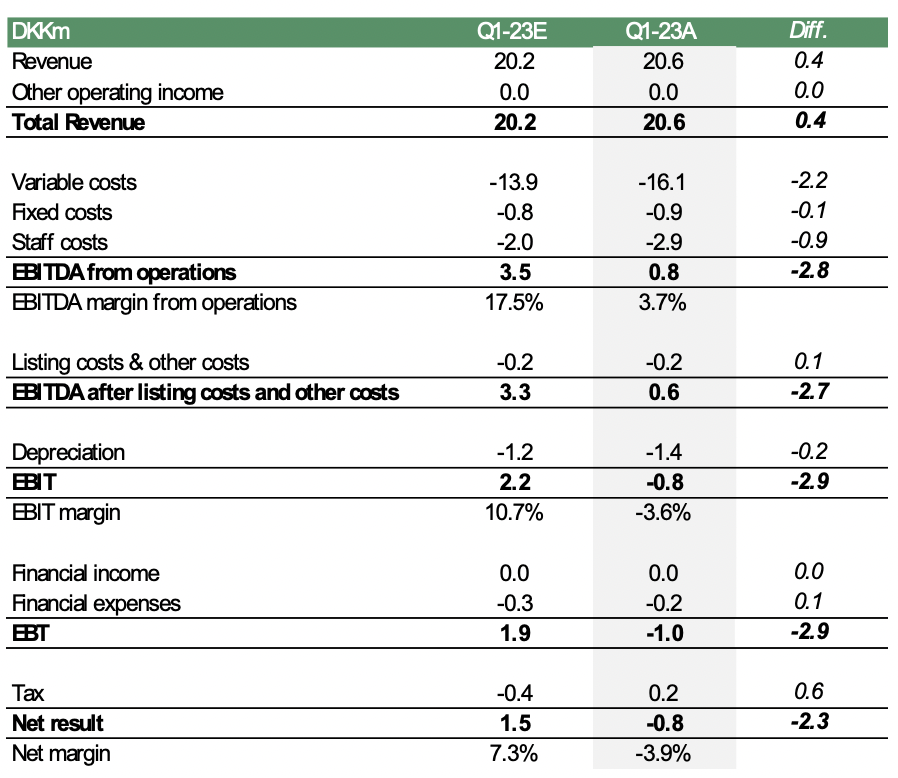

The variable costs in Q1-23 amounted to DKK 16.1m, which was higher compared to our estimates (13.9) and the same period last year (11.9). The higher costs are a result of changes in the organization and processes to sustain future growth. However, Analyst Group expects the variable costs to decrease in relation to revenues going forward, primarily driven by the company taking on larger projects going forward, leading to a better negotiation position as well as better efficiency in maintenance. Furthermore, Analyst Group expects that macroeconomic factors, such as continued decreased inflation and energy prices, will decrease Movinn’s cost base going forward. On a positive note, the Swedish subsidiary is approaching break-even and is expected to contribute with a positive EBITDA from operations at the end of the year. EBITDA from operations amounted to DKK 0.8m for the first quarter, compared to our estimates of DKK 3.5m. The table below shows a complete comparison between our estimates and the result.

Positive signs in the cash flow statement – better cash flow expected in the coming quarters

The cash flow from operating activities amounted to DKK -0.8m, compared to DKK 0.4m during the same period last year, where the decrease is attributable to the higher costs during Q1-23. However, regarding the cash flow from investing activities, we can see a decrease in investments in fixed assets as well as security deposits, which is assumed to be due to fewer units being added. Going forward, as costs are expected to decrease, hence contributing to an increased EBIT, we expect a positive effect on the cash flow going forward through the decreasing investments. Furthermore, when entering the German market, which is expected in 2024, Movinn is expected to replace security deposits with rental guarantees, which is expected to decrease investments further, hence contributing to improved ROIC and cash flow.

To summarize, Movinn delivered a first quarter with slightly higher revenue than expected, where a strong revenue per unit was the largest contributor, despite a higher-than-expected vacancy rate. Going forward, when demand is expected to improve and vacancy rates drop, we estimate that this will result in a higher revenue per unit. Regarding costs, the variable costs and staff costs were higher than expected, but where we see improvement going forward as the macroeconomic situation improves, as well as the company taking on larger projects.

We will return with an updated equity research report of Movinn.

Aktiekurs

N/A

Värderingsintervall

2024-03-27

Bear

1,2 DKKBase

5,6 DKKBull

7,9 DKKUtveckling

Huvudägare

2024-03-22

Comment on Movinn’s Annual Report

2024-03-22

Movinn published on March 22nd the company’s Annual Report for 2023. The following are some key points that we have chosen to highlight in connection with the report:

Continued Robust Revenue per Unit – Paves the way for Revenue Growth in 2024

Movinn’s revenue in the fourth quarter amounted to DKK 21.1m (19.9), corresponding to a growth of 6%, 5% above our estimate of DKK 20.1m. The company has faced challenges throughout 2023 regarding demand, primarily in Odense and Aarhus, which has affected the vacancy rates amounting to 15% for the full year compared to 13.5% in 2022. It should be noted that Movinn added 142 new units in 2022, affecting the vacancy rates negatively. Regarding the Danish units, the vacancy rate was 14.5% in 2023 compared to 10.3% 2022. Despite the higher vacancy rates, the revenue per unit has remained robust throughout the year, which continued in the fourth quarter as the revenue per unit amounted to DKK ~197k. As we have stated in previous updates, we see revenue per unit at these levels as strong given the high vacancy rates, paving the way for higher revenue per unit, hence revenue growth, as vacancy rates is expected to decrease. We expect Movinn to focus on lowering the vacancy rates in 2024 where the company has removed 13 units in Aarhus that was underperforming. Moreover, we expect the overall demand for Movinn’s units to accelerate throughout 2024 as a result of an improved macroeconomic environment, which is expected to drive revenue growth.

EBITDA Result Slightly Below our Estimates

The EBITDA result amounted to DKK -0.9m in Q4-23, compared to our estimate of DKK -0.3 and Q4-22’s result of DKK -1.3m. A contributing factor to the lower-than-expected EBITDA result, despite better revenue than estimated, was higher than expected staff costs. Going into 2024, Movinn has downsized the organization, which is expected to decrease the staff cost in the coming years. The company has continued to invest in technology development and in January 2024 Movinn launched direct booking on the website including real-time availability, dynamic pricing based on the length of the desired stay, secure verification of clients and digital sign agreements as well as instant payment. This means customers can make direct bookings and payments on the website from anywhere in the world at any time without involvement from Movinn’s staff. The new technology is expected to decrease the costs regarding sales staff. In total, the staff costs are expected to decrease by DKK 1.6-1.8m in 2024, which, in combination with DKK 1.6-1.8m in savings from downsizing the portfolio in Aarhus, is estimated to improve the EBITDA result for Movinn in 2024.

Improved Cash Flow Important for the Liquidity

The cash position at the end of 2023 amounted to DKK 7m, compared to DKK 9.1m at the end of Q3-23. With interest-bearing liabilities amounting to DKK 22.2m, the net debt amounts to DKK 15.2m. With a dwindling cash position, as depicted in the graph below, we see it as crucial for Movinn to strengthen profitability in 2024, thereby generating positive cash flow to avoid potential external capital injections.

To summarize, Movinn’s 2023 showed quite high vacancy rates amounting to 15%, as a result of a decrease in demand due to an overall challenging macroeconomic environment, which was also accelerated by an oversupply of units in Aarhus and several large projects from customers cancelled or completed at the same time in Odense. In 2024, we expect vacancy rates to come down through an overall increase in demand, the downsizing of underperforming units in Aarhus and the new sourcing strategy regarding adding new units through larger projects. The lower vacancy rates are expected to drive the revenue growth in 2024 through a higher revenue per unit, and in combination with a lower cost base, this is expected to improve Movinn’s profitability in 2024.

We will return with an updated equity research report of Movinn.