Huddlestock is a WealthTech and TradeTech company that develops SaaS solutions for digitizing work processes for financial companies, custody banks, asset managers and retail trading venues. Huddlestock’s SaaS empowers the embedding of low-cost, efficient white-label trading and investment services, underpinning Huddlestock’s mission of delivering financial inclusion by democratizing access to capital markets. Through its expert professional services business, Huddlestock delivers strategic technology solutions and process automation for the financial services industry. Huddlestock is listed on Euronext Growth Oslo since November 2022.

Pressmeddelanden

Profitable Consulting Services and High Growth Potential Within IaaS

Huddlestock Fintech AS (“Huddlestock” or the “Company”) first quarter of 2024 demonstrated strong and solid profitability within consulting services, with an EBITDA margin of 26%. At the same time, Huddlestock possesses high growth potential within Investment-as-a-Service (“IaaS”) through a strong value proposition and expanded product offering, which has resulted in a solid pipeline of new prospects, expected to drive new deals and growth in the near future. This, combined with a stable outlook for the Professional Service division in 2024, justifies a high activity throughout the year 2024. Huddlestock is estimated to reach a revenue of NOK 116M in 2024, and based on an applied EV/S target multiple of 4.3x, a potential fair value of NOK 2.4 (2.4) per share is derived in a Base scenario.

- Increased Proportion of Recurring Revenues LTM

Huddlestock’s net revenues amounted to NOK 20.6M (16.6), representing a growth of 24% YoY and -9% QoQ. The YoY increase is primarily explained by the three acquisitions the Company made during 2023, while the QoQ decrease is attributed to the divestment of Huddlestock Solutions. Consequently, Huddlestock’s revenues amounted to NOK 89.2M LTM, indicating that Huddlestock has sequentially increased its revenue on an LTM basis, driven by acquisitions, but also new customers and expansion among existing customers within the IaaS, and extended new mandates within the consulting services. The proportion of recurring revenues related to the IaaS offering has also increased sequentially and amounts to 49% of the Company’s total revenue on an LTM basis, which Analyst Group highlights as a strong data point.

- Implemented Cost Plan Starts to Show Effects

During Q1-24, Huddlestock’s EBITDA amounted to NOK -3.8M (-2.4), which represents an increase YoY, but a significant decrease QoQ, where Huddlestock showed a negative EBITDA result of NOK 8M during Q4-23. The reduced EBITDA loss QoQ is a result of decreased operating expenses, where Huddlestock’s total operating expenses amounted to NOK 24.4M, representing a reduction of the cost base by NOK 6M QoQ. This reduction is partly explained by the implemented cost plan, which is starting to show effects. Additionally, the consultancy services showed good profitability during the quarter, which also contributed to a reduced EBITDA loss, with the business area demonstrating an EBITDA margin of 26%.

- Securing Financing Through a Convertible Loan

After the end of the quarter, Huddlestock secured necessary capital primarily in the short-term perspective, but also in the mid-term, through a convertible loan to existing shareholders of NOK 12M. With additional secured funding, Huddlestock is enabled to further execute on the roadmap to EBITDA positive and leverage the Company’s well-established position. With secured financing, Analyst Group estimates a strong market focus from H2-24, where we assess that Huddlestock will successfully drive new deals and growth going forward.

8

Värdedrivare

3

Historisk lönsamhet

8

Ledning & Styrelse

7

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Charting the Path to Profitable Growth in 2024

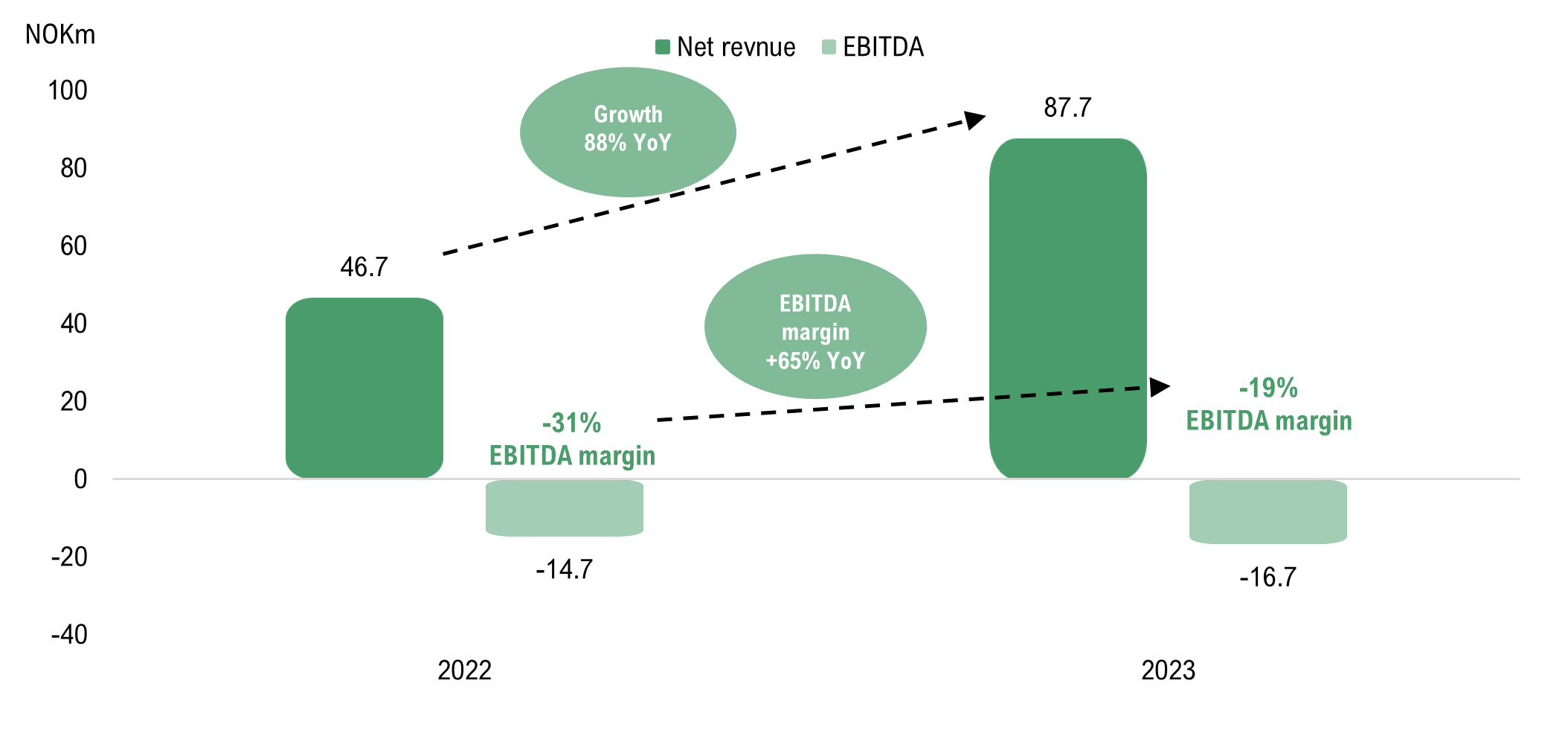

Huddlestock Fintech AS (“Huddlestock” or the “Company”) has demonstrated high growth of 88% throughout the full year of 2023 and expanded the Company’s focus on achieving profitable growth. The strong value proposition and expanded product offering within Investment-as-a-Service has resulted in increased recurring revenues and a solid pipeline of new prospects, expected to drive new deals and growth in the near future. This, combined with a positive outlook for the Professional Service division in 2024, justifies a high activity throughout the year 2024. Huddlestock is estimated to reach a revenue of NOK 141M in 2024, and based on an applied EV/S target multiple of 4.1x, a potential fair value of NOK 2.4 (2.9) per share is derived in a Base scenario.

- Strong Growth Due to High Business Activity…

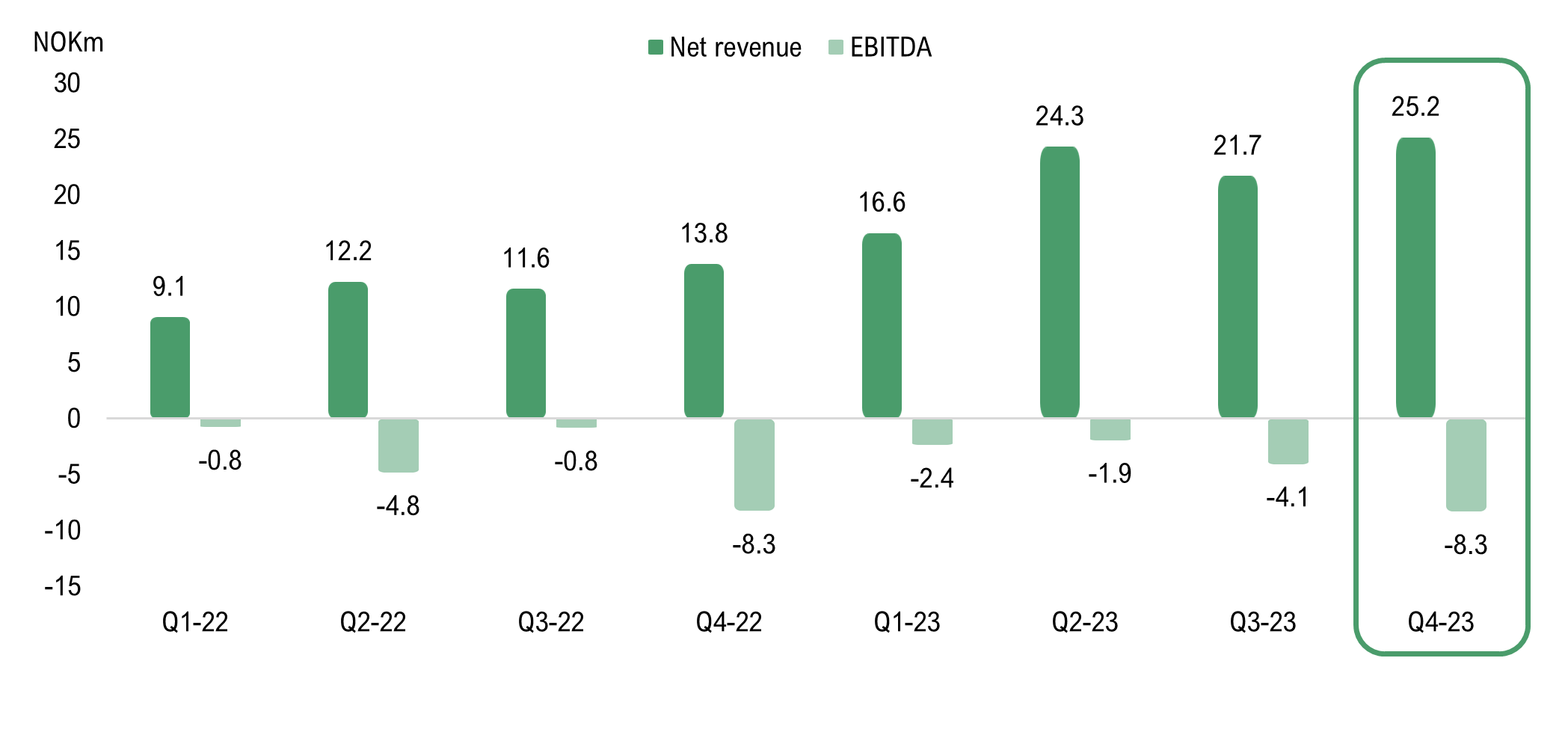

During Q4-23, Huddlestock achieved the Company’s highest recorded quarterly net revenue, amounting to NOK 25.2M (13.8), representing growth of 82% YoY and 16% QoQ. Despite the revenue increase primarily attributed to acquisitions, Huddlestock has also demonstrated organic growth through high business activity in both the Technology and Professional Service divisions. For the full year, 2023, Huddlestock demonstrates a net revenue growth of 88%, reaching approximately NOK 88M (47), with growth observed in both the Technology and Professional Service divisions.

- …but Increased Operating Losses During Q4-23

The EBITDA result was NOK -8.3M (-8.3) in Q4-23, which is in line with the corresponding period of the previous year. However, compared to the previous quarter (Q3-23), both EBITDA and EBIT results deteriorated by NOK 4.3M and NOK 15.7M, respectively. In comparison to Q3-23, Huddlestock reduced personnel costs by approximately NOK 3M, while other operating expenses and depreciation and amortization came in significantly higher than the previous quarter and above our expectations. However, Analyst Group assesses that the increase in other operating expenses and depreciation and amortization is due to Leif Arnold Thomas being the new CEO, with the quarterly report being his first, and thus conducting necessary write-downs and one-time costs to clean up the balance sheet and achieve the goal of profitable growth. Therefore, Analyst Group chooses not to place too much emphasis on the increased operating losses.

- We Extend the Forecast Period to 2026

Analyst Group has extended the forecast period to 2026, Huddlestock is expected to demonstrate a CAGR of 46% during the years 2023-2026, driven in part by strong new customer acquisition and expanded mandates. However, Huddlestock Solutions were divested in November, which is estimated to entail a financial impact during H1-24. In combination with slightly lower revenue than previous estimates, this has prompted us to make adjustments to our financial forecasts.

8

Värdedrivare

3

Historisk lönsamhet

8

Ledning & Styrelse

7

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Strategic Expansion and Recurring Revenue Surge

Huddlestock Fintech AS (”Huddlestock” or the ”Company”) has demonstrated a high business pace during the third quarter, continuing to execute on the Company’s stated strategy of achieving profitable growth. The strengthened offering within the Investment-as-a-Service has contributed to increased recurring revenues and a robust pipeline of new prospects, which, in combination with a strong value proposition, is expected to contribute to new deals and growth going forward. This, combined with a strong outlook for the Professional Financial division in 2024, justifies a high activity throughout the year 2024. Huddlestock is estimated to reach a revenue of NOK 172M in 2024, and based on an applied EV/S target multiple of 4.1x, a potential fair value of NOK 2.9 (3.2) per share is derived in a Base scenario.

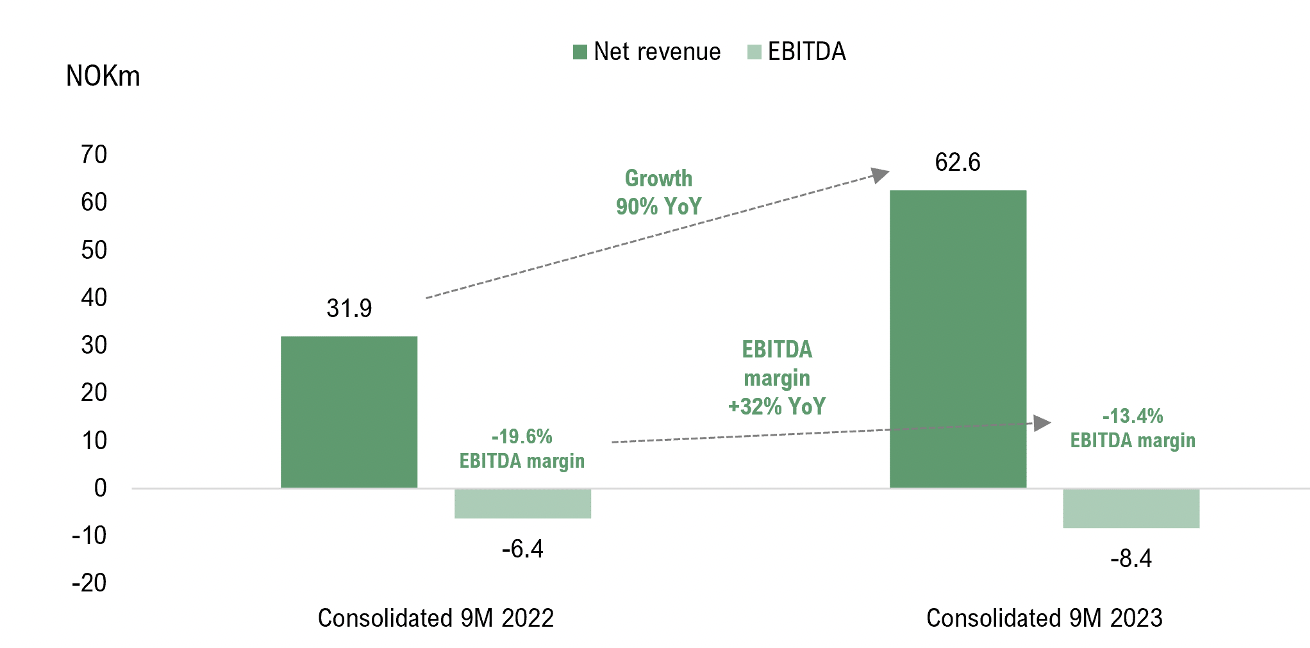

- High Revenue Growth YoY

During the third quarter of 2023, the net revenue amounted to NOK 21.7M (11.6), corresponding to a growth of 87% YoY. The revenue increase is partly explained by Huddlestock’s acquisitions, but also new customers and mandates within both the Technology and Professional Service division. Compared to the net revenue previous quarter (Q2-23), which amounted to NOK 24.3M, represents a decrease of 11%, attributed to seasonal effects within the Professional Service division. Looking at the first nine months of 2023 (Q1-Q3), consolidated revenue amounted to NOK 62.6M (32.9), corresponding to a growth of approximately 90%.

- Heading Towards a Positive EBITDA in year 2024

Huddlestock’s EBITDA result amounted to NOK -4.1M (-0.8) during Q3-23, indicating an increased EBITDA loss of NOK -3.0M YoY. Looking at 9M 2023 (Q1-Q3), the consolidated EBITDA result amounted to NOK -8.4M (-6.4), corresponding to an EBITDA margin of -13.4% (-19.6%), representing an improvement in EBITDA margin of 32% YoY. Huddlestock has thus delivered on its stated strategy towards profitable growth and is expected to maintain a strong focus on achieving a positive EBITDA result for the full year 2024.

- Updated Valuation Range

After the quarter’s end, Huddlestock has successfully completed a private placement, which has strengthened the working capital, which enables Huddlestock to execute on the Company’s growth opportunities. In addition, Huddlestock has conducted a divestment of Huddlestock Solutions to establish a strict focus on the Company’s technological offering, Investment-as-a-Service. Despite a stable quarter, which was in line with our expectations, this entails a financial impact, prompting us to make slight adjustments to our financial forecasts. Furthermore, the capital raising has brought in new capital along with an increased number of shares, which, in combination with the above, results in an updated valuation range in all three scenarios. However, there has been a slight multiple expansion within the Peer group, which has consequently affected our valuation in all three scenarios.

8

Värdedrivare

2

Historisk lönsamhet

8

Ledning & Styrelse

7

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Challenging Traditional Business Models in the Financial Market

Huddlestock Fintech AS (”Huddlestock” or the ”Company”) has during the second quarter 2023 significantly bolstered the Company’s offering by combining the offerings and integrated the capabilities of the acquired businesses, as well as further technological development. Huddlestock’s strong value proposition to providers of investment services is expected to contribute to new deals and business opportunities going forward. This, combined with a strong outlook for the Professional Financial division into 2024, justifies a strong outlook for both the full year of 2023 and 2024. Huddlestock are estimated to reach a revenue of NOK 179M in 2024, and based on an applied EV/S target multiple of 3.9x, a potential fair value of NOK 3.2 (3.2) per share is derived in a Base scenario.

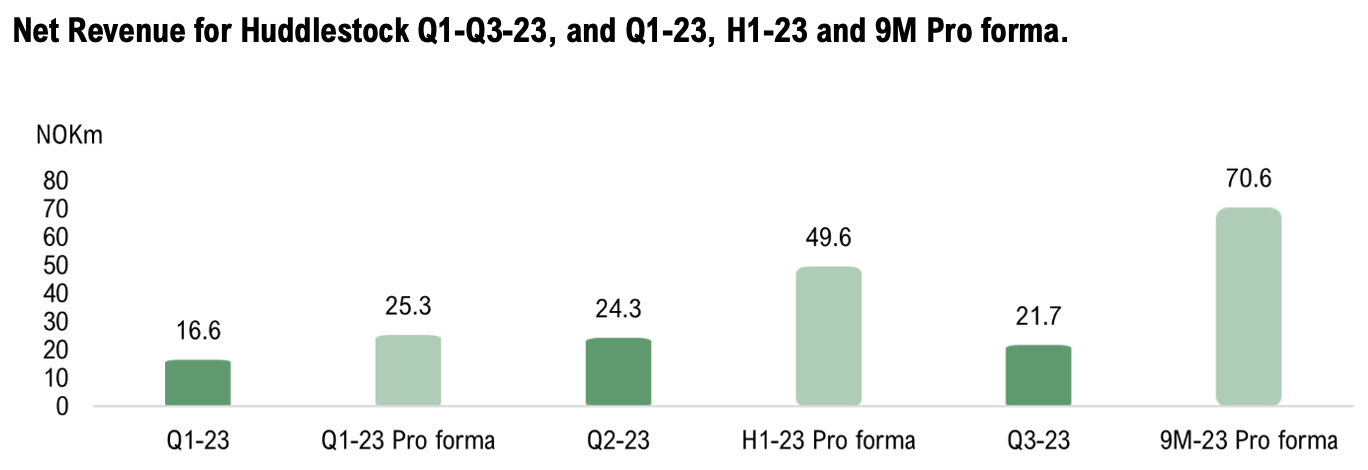

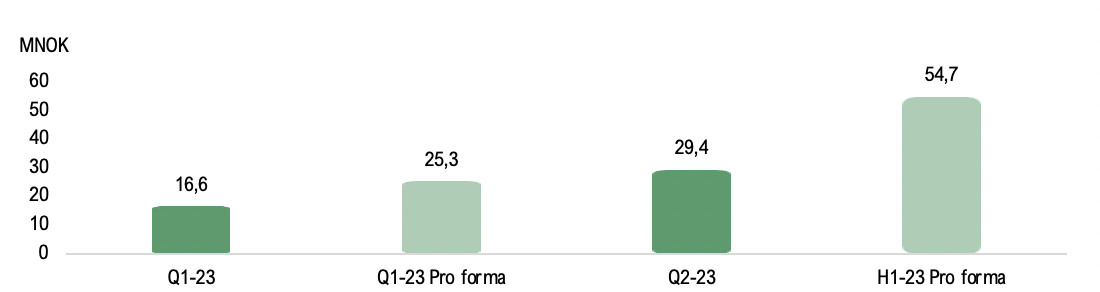

- Consolidated Net Revenues Amounted to NOK 29.4M

During the second quarter of 2023, the net revenues amounted to NOK 29.4M (12.2), corresponding to a growth of 140% Y-Y and 70% Q-Q (16.6). However, Huddlestock acquired and consolidated the companies Tracs Group, Dtech, and Bricknode during the year 2023, and thus, they are not included in the comparable periods. Compared to the pro forma revenues Q1-23, which amounted to NOK 25.3M, Huddlestock achieved a revenue growth of around 16%. The EBITDA result during Q2-23 amounted to NOK -1.8M (-4.8), while the EBIT result amounted to NOK -9.5M (-7.6), where the increase is mainly derived by an increase in depreciation and amortization by approximately NOK 4.8M.

- Strong Value Proposition in the Financial Markets

Huddlestock has during Q2-23 successfully completed several accretive acquisitions, including Tracs Group, Dtech, and Bricknode. By combining the offering and further developing the technology, Huddlestock has enabled the empowerment of their clients by delivering Investment as a Service, which constitutes of a unique end-to-end plug-and-play solution. Huddlestock’s offering enables a white-label solution that provides the client with, among other things, full control over the end clients’ holdings, trading and order management, safekeeping, and regulatory compliance. This, in combination with an end client user interface for online devices, constitutes a strong value proposition for providers of investment services, which is now poised to challenge more traditional solutions and business models.

- We Repeat our Valuation Range

Huddlestock has delivered a strong quarter with substantial growth. During H1-23, the consolidated net revenue amounts to NOK 45.9M (21.3), corresponding to a growth of 116%, while the proforma revenue totals NOK 54.7M. Meanwhile, we view positively the fact that Huddlestock has clearly outlined a cost reduction plan, expected to be executed in H2-23 and throughout 2024. All in all, we repeat our valuation range, where we still perceive that an investment in Huddlestock offers an attractive risk-reward proposition at current levels.

8

Värdedrivare

2

Historisk lönsamhet

8

Ledning & Styrelse

8

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Powering the Future of Investing

Huddlestock Fintech AS (”Huddlestock” or the ”Company”) is a Wealthtech and Tradetech company, acting as an innovative software provider with a leading expert professional services business, within the financial markets. Huddlestock possess a strong market position in the professional services business, with multiyear relationships within the Nordic financial market. Huddlestock also provides software to the financial market, offering innovative, compliant, and data-centric SaaS solutions across several verticals, including Wealthtech, Tradetech, and Investment services, among others. Huddlestock are estimated to reach a revenue of NOK 179M in 2024, and based on an applied EV/S target multiple of 3.9x, a potential fair value of NOK 3.2 per share is derived in a Base scenario.

- Capitalizing on Strong Underlying Market Growth

The rising adoption of cloud-based solutions, digitalization and increased investment are expected to drive the market growth on the global Core Banking Software (CBS) market. The global core banking software market is estimated to grow at a CAGR of 18.3%, with an estimated value of USD 40.7 billion by 2029. Huddlestock is a leading provider of investment and wealth management SaaS solutions and the Company’s services enables financial companies to digitize their operations and democratizing access to capital markets, why Huddlestock are expected to capitalize on the growing market demand.

- Significant Revenue Synergies Going Forward

Huddlestock has successfully completed several accretive acquisitions in 2023, including Tracs Group, Dtech, and Bricknode. The combined products and technologies from these companies are highly complementary to Huddlestock, providing a complete infrastructure for financial service operations, a regulatory umbrella, a full-service RegTech platform, and pension solutions. This creates a comprehensive end-to-end solution, with improved onboarding processes and a significantly shortened time to market. The coordination is expected to generate significant revenue synergies through leveraging upselling opportunities within the combined customer base, as well as by expanding the target market with the complete end-to-end solution.

- The Proportion of Recurring Revenues is Growing

Huddlestock’s revenue model is primarily based on two revenue streams: consulting services and the technology business. The consulting services is based on secured contracts for longer periods, providing good visibility in terms of earnings. Recurring revenues have historically accounted for a smaller portion of the total revenues, amounting to 16% during the full year of 2022. Through acquisitions and new clients, Huddlestock has increased the proportion of recurring revenues in Q1 and pro forma LTM. In Q2-23, Huddlestock secured three new clients with a combined Annual Recurring Revenue (ARR) of NOK 1.9M.

8

Värdedrivare

2

Historisk lönsamhet

8

Ledning & Styrelse

8

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Analytikerkommentarer

Comment on Huddlestock’s Technology Used in Stackby.me’s new Fund Trading app

2024-03-22

Huddlestock announced on Friday, March 22nd, that the company’s client Stackby.me will go live with a new app utilizing Huddlestock’s IP technology. The new app enables trading in Norwegian funds and is powered by technology from Huddlestock’s acquisition of the Swedish company Bricknode in 2023. Stackby.me’s current fund trading app is powered by Huddlestock through a third-party solution.

Stackby.me has been a client of Huddlestock, and their current fund trading app is powered by Huddlestock through a third-party solution. In Q3-23, Huddlestock announced that the company had signed a Letter of Intent (LOI) with Stackby.me regarding the integration of equity trading into Stackby.me’s investment app. Huddlestock announced on Friday, March 22nd, that the company will go live on April 4th with a new app utilizing Huddlestock’s own IP technology to enable trading in Norwegian funds. The technology enabling this extended customer collaboration is based on Bricknode technology.

Stackby.me’s app launch on April 4th, 2024, signifies that Bricknode technology has been adapted to Norwegian market requirements and is now ready to go live for an existing customer, one year after the acquisition. Fund trading in the new app represents the first functionality from Stackby.me powered by Huddlestock’s own IP technology. Following the LOI signed by Huddlestock in Q3-23 with Stackby.me regarding equity trading, the next step is to integrate stock trading functionality through the app, on which the two parties are already working on, further expanding the customer collaboration and enhancing Stackby.me’s current offering of investment products provided by Huddlestock.

Analyst Group view on Huddlestock

“Stackby.me will go live with a new app empowered entirely by Huddlestock’s technological offering, signifying a shift away from a third-party solution for fund trading and now enabling trading in Norwegian funds through Huddlestock IP technology. This is made possible by Huddlestock’s earlier acquisition of Bricknode and signifies that now, one year later, the integrated technology has been adapted to Norwegian market requirements and is ready to go live for an existing customer. The extended customer collaboration demonstrates the company’s R&D capacity and underscores the company’s unique offering within Investment-as-a-Service, with the next step being the integration of stock trading functionality through the app, empowered by Huddlestock. Stackby.me showcases Huddlestock’s ability to grow with existing customers, where the customer agreement also is expected to expand when stock trading is incorporated into the app, in line with the LOI signed in the year 2023. Stackby.me is already an existing customer, demonstrating the revenue synergies Huddlestock can create through the company’s acquisition strategy. Although Huddlestock has not reported what the extended customer collaboration entails in financial terms, this demonstrates the company’s technological capacity and establishes the position as a unique provider of Investment-as-a-Service in the North European market, expected to have ripple effects and potentially serve as an important reference customer in the future, while the company has good opportunities to grow alongside the customer”, says the analyst at Analyst Group covering Huddlestock.

About Stackby.me

Stackby.me gives Norwegians easy access to investments, providing a platform that feels like social media, offering a more user-friendly and engaging investment system. The investment platform is targeting female investors and was founded on a vision to democratize the capital market knowing that women are underrepresented in all areas of finance.

Comment on Huddlestocks’s Q4-23 Report

2024-02-22

Huddlestock published on February the 22nd, the company’s quarterly report for the fourth quarter 2023. The following are some key financial metrics that we have chosen to highlight in connection with the report:

- Net Revenue amounted to NOK 25.2M (13.8) during Q4-23

- Net Revenue growth of 88% during the full year 2023

- Demonstrates a strong value proposition

- Improved EBITDA margin

Net Revenue Growth of 88% YoY During the Full Year of 2023

During the fourth quarter of 2023, Huddlestock’s net revenue amounted to NOK 25.2M (13.8), representing a growth of 82% YoY. Revenues for the corresponding period of the previous year (Q4-22) were NOK 13.8M, however the YoY revenue increase is primarily attributed to Huddlestock’s acquisitions of Tracs Group, Dtech, and Bricknode, which have been consolidated since Q2-23 and are thus not included in the comparison period. Therefore, the previous quarter (Q3-23) provides a more accurate comparison, despite seasonal effects within the Professional service division, as net revenues amounted to NOK 21.7M, resulting in a 16% QoQ revenue growth for the fourth quarter.

Huddlestock’s revenues are derived from the Company’s technological offering, consisting of recurring revenues from Investment-as-a-Service, and from the Professional service division, comprising consultancy revenues from the subsidiary Visigon. During the fourth quarter, Huddlestock’s revenues from the technological business division amounted to NOK 10.7M (2.7), thus growing by 294% YoY and 4% QoQ. Huddlestock’s revenues from the technological offering consist of recurring revenues, such as monthly licenses, Assets under Management (AuM), and transaction fees, hence, ARR can be estimated to be close to NOK 25M. Consequently, the recurring revenues from the Technological business division accounted for 42% of the total revenues during the quarter, in line with Analyst Group’s expectations.

In Q4-23, revenues from the Professional business division (Visigon) amounted to NOK 14M (10.2), representing a 37% YoY increase and 67% QoQ increase. Despite the QoQ increase partly explained by seasonal effects, revenues from Visigon were the highest recorded for a quarter, indicating high utilization and activity within the Professional business division. Additionally, Huddlestock divested Huddlestock Solutions, formerly F5 IT AS, carried out through a management buyout, completed at the end of November. The divestment was aimed at maintaining Huddlestock’s sharp focus on its core activity, being an Investment-as-a-Service offering, however, it still entails a financial impact, which Huddlestock managed to compensate through high activity during the quarter.

Looking at the full year 2023, Huddlestock’s consolidated revenues amounted to NOK 87.7M (46.7), representing a high growth of 88%. The revenue increase is primarily attributed to acquisitions, but revenue growth has also been driven by new customers, as well as expansion among Huddlestock’s existing customers within the Technology business division, and extended new mandates within the Professional service division. The full-year revenues constitute a strong performance, considering the divestment of Huddlestock Solutions in November, and are slightly below Analyst Group’s earlier estimate of NOK 92.6M. The recurring revenues (Pro forma) from the Technological business division for the full year 2023 amounted to NOK 41.9M (7.4), representing an annual increase of 566%. Revenues from the Professional service division (Visigon) amounted to NOK 44.1M (37), representing an annual increase of 19%.

Demonstrates a Strong Value Proposition and Enhances Prospects Going Forward

During the fourth quarter, Huddlestock has delivered on the company’s previously communicated focus and pipeline, wherein the company signed an agreement with Norse, who selected Huddlestock’s Investment-as-a-Service for the digitalization of project financing & customer onboarding. Norse is a part of Norse Gruppen, whose main businesses include securities trading, corporate finance, fund management, and real estate. Norse has chosen Huddlestock’s core broker technology to enable the digitalization of Norse’s project financing and customer onboarding within the customer’s Corporate Finance business. Revenues are of a recurring nature, based on a combination of license fees and basis points (BPS) of Assets under Management (AuM).

After the end of the quarter, in early January, Huddlestock announced that the company has signed a Letter of Intent (LOI) with Germany-based AVL Finanzvermittlung Beteiligungen (AVL), which we previously commented on here. The purpose of the LOI is to establish cooperation between Huddlestock and AVL to offer trading in all types of financial instruments, initially planned for the German market.

Additionally, after the end of the quarter, Huddlestock has extended the agreement with the company’s existing client Garantum Wealth Management, where Garantum also expands the agreement with Huddlestock to now include fund trading.

The agreement with Norse during the quarter, along with the LOI with AVL and the extended collaboration with Garantum after the end of the quarter, confirms Huddlestock’s strong value proposition and strengthens the company’s position, as well as the prospects, within Investment-as-a-Service.

Within Huddlestock’s operations in the Professional business division, which consists of consultancy assignments within the financial sector through the subsidiary Visigon, Huddelstock states in the interim report that Visigon has shown strong development during the year 2023. The strong development and high activity are evident in Visigon’s revenues amounting to NOK 51M, where the subsidiary also demonstrates a positive EBITDA margin of 13%. Going forward, Huddlestock also guides that the prospects within the Professional Business Division look stable for the year 2024, noting that Visigon’s mandates in consulting are relatively long-term, which increases the visibility and stability of revenues.

Improved EBITDA Margin of 65% YoY (Full year 2023)

During the fourth quarter of 2023, Huddlestock’s total operating expenses (including cost of materials/subcontractors) amounted to NOK 33.5M (20.7), compared to the previous quarter (Q3-23) of NOK 25.7M. Breaking down Huddlestock’s total operating expenses, it shows that the company’s personnel costs amounted to NOK 18.6M, representing a decrease of approximately NOK 3M compared to the previous quarter, while the company’s other operating expenses have increased by approximately NOK 12M, primarily expected to be explained by one-time costs related to the company’s acquisition activities during the year 2023. As a result, the EBITDA for the fourth quarter of 2023 amounted to NOK -8.3M (-8.3), in line with the previous year and Analyst Group’s expectations.

Looking at the full year of 2023, Huddlestock’s total operating expenses (incl. cost of materials/subcontractors) amounted to NOK 104.5M (61), representing an increase of NOK 43M in absolute terms, explained by Huddlestock’s acquisition of several companies and thus inheriting their cost structures. However, we can ascertain that Huddlestock’s total cost base has increased at a lower rate than its revenues, indicating that the company has successfully implemented cost synergies. The EBITDA result for the full year of 2023 amounted to NOK -16.7M (-14.7), corresponding to an EBITDA margin of -19%, compared to the previous year’s EBITDA margin of -31%, signifying that Huddlestock has improved its EBITDA margin by approximately 65%. With a high level of acquisition activity during the year 2023, Huddlestock has acquired Goodwill, which is amortized and increases the financial item of depreciation and amortization during the year 2023. Consequently, Huddlestock’s EBIT result amounts to NOK -79M (-30), where depreciation and amortization increased by NOK 48M during the year 2023 due to the amortization of developed technologies and goodwill from acquired companies. Overall, Analyst Group believes that Huddlestock has successfully implemented cost synergies and maintained stable cost control, evident in the fact that while Huddlestock increased the company’s revenues by 88%, the company’s cost base increased by 70% during the full year of 2023. Additionally, Analyst Group wants to emphasize that we estimate continued cost-saving measures expected to take further effect during the first half of 2024.

Huddlestock continues to maintain a strong focus on profitable growth, estimated to be achieved by building and executing on the company’s pipeline of profitable products, increasing internal efficiency, enhancing cost control, and increasing profitable revenues in the short term. Despite the increase in total operating expenses during the fourth quarter of 2023, we can see the company reducing personnel costs, indicating a decreased cost base adjusted for one-time costs during the quarter. During the year 2023, Huddlestock communicated both the high priority of increasing cost control and the goal of achieving a positive EBITDA and positive cash flow in 2024. As previously mentioned, Huddlestock has successfully implemented cost synergies, but Analyst Group assesses that the full effect of the cost savings has not yet been achieved and is expected to have a greater impact during 2024.

Financial Position

At the end of Q4-23, Huddlestock’s cash and equivalents amounted to NOK 9.7M, compared to NOK 6.5M at the end of September (Q3-23), representing an increase in net cash and equivalents of NOK 3.2M. The increase in cash and equivalents is explained by Huddlestock successfully completing a private placement of NOK 17.5M during the quarter. The capital raise was conducted to strengthen Huddlestock’s working capital and support the company’s growth opportunities in Germany, as well as expedite sales and onboarding activities related to new customers in the Nordic region. Regarding the net cash flow from operating activities from continuing operations, it amounted to NOK -16.6M for the full year of 2023, equivalent to an operational burn rate of approximately NOK 1.4M per month over the period. This operational burn rate can be compared to the first half of 2023 (Q1-Q2 2023), when the operational burn rate was approximately NOK 1.9M per month, indicating a significantly lower operational burn rate during the second half of 2023. Additionally, Huddlestock announces that one of the company’s key priorities going forward is to explore and identify long-term financing partners to support Huddlestock’s strategy and to maximize execution on the company’s strong position and product offering, which also includes potential non-organic growth, i.e., further acquisition activities.

In conclusion, Huddlestock has reported a quarter, and year, with high activity and strengthened market outlooks. It is clear that Huddlestock delivers total revenues of NOK 88M, driven by both acquired and organic growth. Huddlestock has developed in line with Analyst Group’s expectations for the full year 2023, demonstrating high business activity, with a new agreement with Norse during the quarter, as well as an LOI with AVL and an expanded collaboration with Garantum. Huddlestock has thereby strengthened its prospects as a B2B Investment-as-a-Service provider in the European market and also guides for stable prospects within the Professional Business Division. Additionally, Leif Arnold Thomas has assumed the role of the company’s new CEO as the company enters the next phase, aiming for profitable growth. Depreciations and other operating expenses were higher than in previous quarters, partly expected to consist of one-time items, as the quarter marks the first with Leif Arnold Thomas as the group’s new CEO. Therefore, Leif Arnold Thomas is expected to have made necessary write-downs during the quarter to clean up the balance sheet, which is common practice and viewed positively by Analyst Group in building a strong position to achieve profitable growth going forward.

We will return with an updated equity research report of Huddlestock.

Comment on Huddlestock’s New Letter of Intent

2024-01-10

Huddlestock announced on Thursday, January the 9th, that German Huddlestock GmbH has signed a Letter of Intent (LOI) with Germany-based AVL Finanzvermittlung Beteiligungen (“AVL”) to offer trading and investing in all types of instruments to German clients.

Huddlestock has signed a LOI with the aim of establishing cooperation between Huddlestock and AVL to offer trading in all types of financial instruments, initially planned for the German market. Through this collaboration, the parties intend to leverage their respective resources, expertise, and networks to create a platform for investing in financial products such as equities, investment funds, ETF:s, futures, and fixed income products. AVL will interface and be responsible for client relations with the end client, while Huddlestock will provide the technological, regulatory, and procedural infrastructure and services related to trading and investing. The LOI is expected to lead to a contractual cooperation agreement between the parties within a short period of time.

The anticipated final agreement is a cooperation agreement between Huddlestock and AVL involving the purchase and sale of financial instruments offered through Huddlestock’s cooperation partner, Baader Bank. Huddlestock’s expected revenue consists of a combination of retail fees and trading commissions.

Analyst Group view on Huddlestock

“The intended collaboration with AVL and the signing of an LOI are strategically significant, reconfirming Huddlestock’s presence in the German market, estimated to be a significant growth driver in the future. Additionally, it serves as validation for Huddlestock’s technology and Investment-as-a-Service offering, as AVL, a progressive and successful provider of investment services in the German market, chooses to collaborate with Huddlestock to expand the offering and reach new target groups. The German market, with approximately 12.9 million people owning shares, equity funds, or equity-based ETFs, along with the demand from banks, private banks, and online banks for a digital offering in trading and investing, presents significant opportunities for Huddlestock as an Investment-as-a-Service provider. Huddlestock has been present in the German market since 2019, including deliveries to, among others, Solaris Bank. Given a successful collaboration with AVL and the initiation of cooperation between Huddlestock and AVL, Huddlestock can penetrate the German market with an already established and successful player.´”, says the analyst at Analyst Group covering Huddlestock.

About AVL

AVL was founded in 1997 by Uwe Lange in Weinstadt near Stuttgart. Since then, AVL has successfully brokered products with an investment approach at favorable conditions through a digital offering. As an independent, owner-managed company based in Weinstadt near Stuttgart, AVL Finanzvermittlung is today one of the leading financial brokers in the discount segment, with more than 180,000 customer accounts, over 60,000 end customers, and an invested volume exceeding 2 billion euros.

Comment on Huddlestocks’s Q3-23 Report

2023-11-24

Huddlestock published on November 23, the company’s quarterly report for the third quarter 2023. The following are some key financial metrics that we have chosen to highlight in connection with the report:

- Net Revenue Amounted to NOK 21.7M (11.6)

- Strong value drivers going forward

- Improved EBITDA margin of 32% YoY

- Successful private placing

Net Revenue Growth of 87% YoY in the Third Quarter

During the third quarter of 2023, net revenues amounted to NOK 21.7M (11.6), representing an 87% YoY growth compared to the same quarter the previous year. This increase in revenue amounts to approximately NOK 10.1M in absolute terms YoY. The revenue increase is attributed partly to Huddlestock’s acquisitions of Tracs Group, Dtech, and Bricknode, which were successfully consolidated during Q2-23 and is thus not included in the comparative figure of Q2-22. Additionally, revenue growth has been driven by new customers, as well as expansion among Huddlestock’s existing customers within the Technology business division, and extended new mandates within the Professional Service Division. During the previous quarter (Q2-23), net revenue amounted to NOK 24.3M, reflecting a QoQ decrease of 11%. The QoQ revenue decline is explained by a seasonal effect within the Professional Service Division. For the first nine months of 2023 (Q1-Q3), Huddlestock’s consolidated revenues reached NOK 62.6M (32.9), corresponding to a growth of 90%. While the proforma revenue, incorporating the acquired companies Tracs Group, Dtech, and Bricknode from the beginning of the year, the net revenue amounts to NOK 70.6M (45.4), corresponding to a proforma growth of 56%.

Huddlestock’s revenue mix comprises recurring revenue from the company’s technological Business Division and income from projects within the Professional Service Division. During the third quarter of 2023, recurring revenues amount to NOK 10.1M (2.5), reflecting an impressive growth of 313%. In comparison to the preceding quarter (Q2-23), which constitutes a more representative benchmark due to acquisitions in 2023, recurring revenues have increased by 5.4% QoQ, which amounted to NOK 9.6M. The company’s recurring revenues generates from various recurring fees, such as monthly licenses, Assets under Management (AuM), and transaction fees, indicating that Huddlestock has secure and stable recurring revenues that simultaneously grow with its customers. While Huddlestock does not explicitly disclose specific SaaS metrics such as ARR, NRR, or GRR, Analyst Group assumes a very low churn rate, attributed to the high MOAT and business-critical services Huddlestock provides. Recurring revenues for the third quarter correspond to an ARR exceeding NOK 40M, and the company’s modular offering indicate an NRR exceeding 100%. During the third quarter, recurring revenues accounted for 47% of the group’s total revenues, marking an increase from 40% in the previous quarter. Summing up the first nine months of 2023 (Q1-Q3), recurring revenues amount to NOK 29.2M (4.7), demonstrating a high growth of 620%.

The revenues from the Professional Service Division are derived from consulting income within the financial market, where the company has clients such as SEB, Nordea, and the Danish central bank, to name a few. During the quarter, the business segment extended current mandates and secured new ones, with the company guiding towards a stable outlook, indicating a high utilization rate by the end of 2023 and into 2024. In the third quarter, revenues from the Professional Service Division amount to approximately NOK 11.5M (9.1), reflecting a growth of 26%. However, QoQ revenues have decreased by 21%, a decline attributed to seasonal effects, making the comparison less indicative of the overall performance.

High Business Activity and Strong Value Drivers Going Forward

After the quarter’s end, Huddlestock has demonstrated high business activity and strong momentum, signing two new clients in the month of October within the company’s technological Business Division, Investment-as-a-Service, as commented on here. The clients are within Wealth and Asset Management and Corporate Finance, consisting of Tind Asset Management and Norse Securities, showcasing the broad application of Huddlestock’s products and services within Investment-as-a-Service, and suggesting greater potential within the entire financial markets. Additionally, Huddlestock entered into a strategic partnership agreement with the Norwegian Block Exchange (NBX), where Huddlestock’s platform will provide investors access to various markets from traditional stocks to tokenized assets, while NBX’s secure digital asset exchange platform offers a safe and efficient way to trade digital assets.

Furthermore, in conjunction with the company’s conference call, Huddlestock reports having a strong pipeline of new prospects within Investment-as-a-Service, with significant prospects in the German, Norwegian, and Swedish markets. Despite high business activity during the initial months of Q4-23, Analyst Group assesses that Huddlestock has a good opportunity to continue delivering new deals, despite sales having a generally long sales cycle nature. Investment-as-a-Service and the growth opportunities the company has within this segment, especially in the German and Nordic markets, constitute clear and strong value drivers going forward.

Improved EBITDA Margin of 32% YoY (Consolidated 9M 2023)

Considering the total operating expenses (incl. cost of materials/subcontractors), these amounted to NOK 25.7M (12.4) during the third quarter of 2023. In the preceding quarter, the total operating expenses amounted to NOK 26.2M, representing a decrease of NOK 0.5M and in comparison, to proforma Q1-23 (31.3) the decrease amounts to NOK 5.5M. Huddlestock has continued to demonstrate effective cost control and execution of previously stated cost synergies since the acquisitions were completed. The consolidated EBITDA result during the third quarter amounted to NOK -4.1M (-0.8), indicating an increased EBITDA loss of NOK -3.0M YoY. The consolidated EBIT result for the quarter amounted to NOK -20.1M (4.4), where the increase in depreciation and amortization is particularly explained by accounting write-downs from the acquisitions, having no impact on the company’s cash flow.

Looking at the nine-month period in 2023 (Q1-Q3), the consolidated EBITDA result amounted to NOK -8.4M (-6.4), corresponding to an EBITDA margin of -13.4% (-19.6%). Compared to the same period the previous year, the consolidated EBITDA margin has improved by 32% YoY. However, a more accurate comparison is pro forma for the first nine months of 2023, where the EBITDA result amounted to NOK -10.5M (-8.4), corresponding to an EBITDA margin of -14.8% (-18.3%) and indicating an EBITDA margin improvement of 23% YoY.

Huddlestock has a strong focus on continuing to demonstrate high growth, while also achieving a positive EBITDA and positive cash flow in 2024. In conjunction with the report, the company highlights a roadmap to achieve a positive EBITDA result for the full year 2024. This includes, among other things, a strict focus on Investment-as-a-Service, prioritizing the most financially attractive deals, ensuring that product development deliveries support the positive EBITDA objective for 2024, and maintaining a focus on cost/benefit through effective cost control. Given that Huddlestock has already executed on several stated cost synergies from the acquisitions, with the effects of some of these synergies expected to fully materialize in 2024, and has demonstrated a reduced cost base in 2023, along with possessing high scalability in the business model, Analyst Group estimates that Huddlestock will achieve a positive EBITDA result for the full year 2024, particularly with continued acquisition of new customers.

Financial Position and Completed Private Placement

At the end of Q3-23, Huddlestock’s cash and equivalents amounted to NOK 6.5M, compared to NOK 10.8M at the end of June (Q2-23), corresponding to a net change in cash of – NOK 4.3M. Regarding the net cash flow from operating activities from continuing operations, it amounted to NOK -13.6M during the first nine months of 2023, equating to an operational burn rate of NOK 1.5M per month over the period. In comparison with the first half of 2023 (Q1-Q2 2023), the operational burn rate was approximately NOK 1.9M per month, signifying a significant improvement during the third quarter of 2023. Subsequent to the quarter’s end, Huddlestock successfully completed a private placement, raising NOK 17.5M in gross proceeds, as commented on last week, read the comment here. The private placement strengthens Huddlestock’s working capital and supports the company’s growth opportunities in Germany, as well as expediting sales and onboarding activities related to new customers in the Nordic region.

In conclusion, Huddlestock has delivered a stable quarter, where revenue and operating results align closely with Analyst Group estimates. Recurring revenues constitute an increasing portion of the total revenues, which, however, during the quarter is a result of a seasonally weaker effects from the Professional Business Division. Huddlestock maintains a strict focus on Investment-as-a-Service, as confirmed by the divestment of Huddlestock Solutions, formerly F5 IT AS, carried out through a management buyout during the quarter. The company has also during the quarter signed a Letter of Intent with Stack by.me and went live with Garantum Wealth Management, followed by two new clients in Investment-as-a-Service and a new strategic partnership after the quarter’s end. Thus, Huddlestock demonstrates high business activity and continues to take operational steps towards becoming a European B2B Investment-as-a-Service provider. With a strengthened financial position after the end of the quarter, Huddlestock can advance its position in the German and Nordic markets, where the company already holds a strong position and currently has a robust pipeline of new prospects.

We will return with an updated equity research report of Huddlestock.

Comment on Huddlestock’s Private Placing

2023-11-16

Huddlestock announced on Monday, November 13th, that the company has successfully completed a private placement, raising NOK 17.5M in gross proceeds through the allocation of 14,583,333 new shares at a price of NOK 1.2 per share, equivalent to a discount of 19% from the closing price on November 10th (NOK 1.48). Each investor in the private placement will also receive, at no additional cost, 0.5 unlisted warrants per issued and allocated share, with a strike price of NOK 1.80 exercisable from registration and until 12 months after registration, amounting to an additional issuing volume of approximately NOK 13.1M.

On Friday, November 10th, Huddlestock announced its intention to carry out a private placement of new shares targeting both Norwegian and international investors. The application period ran from November 10, 2023, at 16:30 to November 13, 2023, at 08:00. In the private placement, Huddlestock was contemplating offering new shares with gross proceeds of a minimum of NOK 10M and a maximum of NOK 15M.

On Monday, November 13th, Huddlestock announced the successful completion of the Private Placement, wherein the company raised NOK 17,500,000 in gross proceeds. This was achieved by allocating 14,583,333 new shares at a price of NOK 1.20 per share. Each investor received, at no additional cost, 0.5 unlisted warrants per issued share. The warrants have a strike price of NOK 1.80 and can be exercised from registration until 12 months after registration. Following the registration of the private placement, Huddlestocks share capital will amount to NOK 350,507,343, divided into 184,477,549 shares.

The purpose of the private placement was to support growth plans in Germany and expedite sales and onboarding activities related to new customers in the Nordic region.

Analyst Group’s View on the Private Placement:

Throughout the fall Huddlestock has demonstrated high business activity and a strong momentum, including securing two clients for its technological offering, Investment-as-a-Service, within both Wealth and Asset Management and also Corporate Finance. Additionally, Huddlestock entered into a strategic partnership agreement with the Norwegian Block Exchange (NBX), where Huddlestock’s platform will offer investors access to various markets from traditional stocks to tokenized assets, while NBX’s secure digital asset exchange platform provides a safe and efficient way to trade digital assets.

Analyst Group views positively on the fact that Huddlestock has swiftly and effectively executed a capital raising, achieving higher gross proceeds than initially announced and at a relatively low discount, given the current market conditions and risk appetite, which indicates a high interest in Huddlestock. Furthermore, it should be noted that individuals in the board and management have participated in the capital raise, where CEO John E. Skajem, Vision Invest Stavanger AS, a company closely related to Chairman of the Board Øyvind Hovland, and Zolo Konsult AS, a company closely related to CFO Anders Peinert, have collectively been allocated 450,000 shares. Analyst Group views this positively, instilling confidence in the ability to create shareholder value going forward.

The company is expected to strengthen its shareholder base and working capital, which is necessary to fully execute on the growth opportunities Huddlestock possesses, both in the German market and within the Nordic region. Furthermore, the company has the option to raise an additional NOK 13.2 million through the warrants by the end of 2024, consequently reducing the risk of further external capital raising in the future. Moreover, the Analyst Group considers the warrants to be attractively priced (strike price of NOK 1.80), increasing the likelihood of being in the money within 12 months, given Huddlestock’s high activity and position with clear value drivers for the future, potentially leading to a significantly higher stock price.

Comment on Huddlestock’s New Client Norse

2023-10-18

Huddlestock announced on Tuesday, October the 17th, that Norse Securities AS (“Norse”) has selected Huddlestock’s Investment-as-a-Service for digitalization of Project Financing & customer onboarding.

Huddlestock has signed Norse, which is a part of Norse Gruppen, Norse Gruppen’s main businesses are within securities trading, corporate finance, fund management and real estate. Norse has chosen Huddlestock’s core broker technology to enable the digitalization of Norse’s project financing and customer onboarding within the customer’s Corporate Finance business. Through modules within Huddlestock’s Investment-as-a-Service offering that Norse will utilize, Norse can increase efficiency and digitalization within the project financing and customer onboarding client area. Implementation with Norse will start in the first quarter of 2024 (Q1-24). The revenues from the agreement are of a recurring nature and are based on a combination of license fees and basis points (BPS) of Assets under Management (AuM).

Earlier in the month of October (October 2nd), Huddlestock also announced that a Norwegian asset manager has selected Huddlestock Investor Services for nominee depot, management of shareholder registers, as well as customer and tax reporting. The implementation with the Norwegian asset manager commenced during the month of October. The revenues from the agreement are of a recurring nature as well and are based on a combination of license fees and basis points (BPS) of Assets under Management (AuM).

The agreement with both Norse and the Norwegian asset manager within Huddlestock’s Investment-as-a-Service is strategically significant as it both confirms the high market demand for the company’s technological offering, Investment-as-a-Service, and demonstrates the broad value within the company’s products and services.

Analyst Group view on Huddlestock

“During the month of October, Huddlestock signed two clients within the company’s technological offering, Investment-as-a-Service, which is considered a strong achievement. The clients are within Wealth and Asset Management and Corporate Finance, demonstrating the wide range of use of Huddlestock’s products and services within Investment-as-a-Service, and also implying a greater potential within the entire financial markets. The revenues from the agreements are based on recurring income, where the revenues are combined from fixed recurring income, derived from license fees, and variable recurring income, derived from basis points (BPS) from Assets under Management (AuM). With the agreement with Norse, Huddlestock strengthens its client portfolio by adding another customer in the Corporate Finance segment, this time in the Norwegian market. This further confirms the company’s cross-selling opportunities within the Huddlestock Group. We repeat our expectation of rising sales going forward, with two new clients within the month of October and a growing ARR from 2024 and beyond. We therefore also repeat our valuation range based on our financial forecast for 2024, why Huddlestock, at current levels, still trades at a very attractive risk/reward ratio.”, says the analyst at Analyst Group covering Huddlestock.

Comment on Huddlestocks’s Q2-23 Report

2023-08-25

Huddlestock published on August 24, the company’s quarterly report for the second quarter 2023. The following are some key financial metrics that we have chosen to highlight in connection with the report:

- Huddlestock has developed a strong value proposition

- Net revenue amounted to NOK 29.4M – strong revenue growth

- Initiation of cost reduction program

- Financial position and burn rate

Analyst Group view on Huddlestock

During the first half of 2023, Huddlestock has successfully completed the acquisitions of the companies Dtech, Bricknode, and Tracs Group. The combined offering that Huddlestock has developed represents a unique end-to-end solution that empowers Investment-as-a-Service. Huddlestock’s B2B offering is tailored to a broad target group within the financial market, ranging from wealth and asset managers to savings platforms and corporate pension providers, to mention a few. Huddlestock’s offering enables a comprehensive white-label solution that provides the client with, among other things, full control over the end clients’ holdings, trading and order management, safekeeping, and regulatory compliance. This, in combination with an end client user interface for desktop and smartphones, constitutes a strong value proposition for providers of investment services.

Net revenue growth 140% Y-Y and 77% Q-Q

During the second quarter of 2023, the net revenues amounted to NOK 29.4M (12.2), corresponding to a growth of 140% compared to the same quarter the previous year. During the previous quarter (Q1-23), the net revenue amounted to NOK 16.6M, reflecting a substantial growth of 77% Q-Q. This increase in revenue corresponds to approximately NOK 12.8M in absolute terms Q-Q. It is important to note, however, that Huddlestock has acquired the companies Tracs Group, Dtech, and Bricknode during the year 2023, and thus, they are not included in the comparable periods. When compared to the Proforma revenue for Q1-23, which amounted to NOK 25.3M, Huddlestock achieves a revenue growth of around 16%. For the first half of the year, Huddlestock’s consolidated revenues amounted to NOK 45.9M (21.3), corresponding to a growth of 116%, while the proforma revenue totals NOK 54.7M.

Huddlestock’s revenue can be derived from two main business areas: the Professional Service Division and recurring revenue from the Technology Business Division. Turning our attention to the recurring revenue from the Technology Business Division, which amounted to NOK 10.7M during the second quarter of this year, and in comparison to the previous quarter’s proforma figures, the recurring revenue reached NOK 9.5M. This represents a growth of approximately 13%. For the first half of the year Huddlestock’s proforma recurring revenues from the Technology Business amounted in a total of NOK 20.2M. As for the Professional Service Division, Huddlestock reports that several mandates have been extended throughout the period, and the outlook indicates a high capacity utilization with visibility extending until the year 2024. Taken together, we can conclude that both business areas have maintained a strong pace during the quarter, contributing to the growth achieved in this period.

Net revenue for Huddlestock Q1- and Q2-23, Q1-23 Pro forma and H1-23 Pro forma.

During the quarter, Huddlestock successfully consolidated the operations of Dtech, Bricknode, and Tracs Group into Huddlestock. Concurrently with this consolidation, Huddlestock has achieved operational advancements, including the successful product launch during the second quarter 2023 with a Swedish client. The client has more than 60.000 end-clients and is digitally processing approximately 15.000 trades per day through Huddlestock’s system. The fact that Huddlestock has gone live with the client marks a significant milestone for the company, simultaneously demonstrates the growth potential with the new customers, where Huddlestock generates revenues for example through monthly licenses, Assets under Management (AuM), as well as transaction fees. Furthermore, Huddlestock’s sales team has transitioned to a unified CRM system, which has improved efficiency and the combined prospects expands the sales pipeline. The group can now execute on sales synergies, such as cross-selling and engage with all of the Company’s prospects. After the end of the quarter, Huddlestock signed a Letter of Intent (LOI) regarding equity trading with Stack by.me. Stack by.me is a Norwegian provider of an investment app that can be likened to social media. The platform currently offered by Stack by.me to its numerous clients is a Software-as-a-Service (SaaS) solution operated by Huddlestock and will continue to be supported by Huddlestock Investor Services.

EBITDA result amounted to NOK -1.8M during Q2-23

The consolidated EBITDA result during the second quarter amounted to NOK -1.8M (-4.8), corresponding to a decreased EBITDA loss of NOK -3.0M Y-Y. The consolidated EBIT result during the quarter amounted to NOK -9.5M (7.6), corresponding to an increased EBIT loss of NOK 1.8M, which is derived by an increase in depreciation and amortization by approximately NOK 4.8M. As mentioned earlier, it should be noted that completed acquisitions were not consolidated in the comparable period of the previous year, making the comparison somewhat misleading. However, when comparing EBITDA and EBIT results on a proforma basis for Q1-23, which amounted to NOK -6.0M and NOK -14.3M respectively, Huddlestock’s EBITDA and EBIT results have improved by NOK 4.1M and NOK 4.9M respectively.

In terms of total operating costs (including cost of materials/subcontractors), they amounted to NOK 31.2M, reflecting a decrease of NOK 0.1M compared to proforma Q1-23 (31.3), while it should be noted that revenues in the same comparison have increased by approximately 16%. Thus, the interim report serves as evidence that Huddlestock has successfully consolidated the newly acquired companies, all the while maintaining effective cost control.

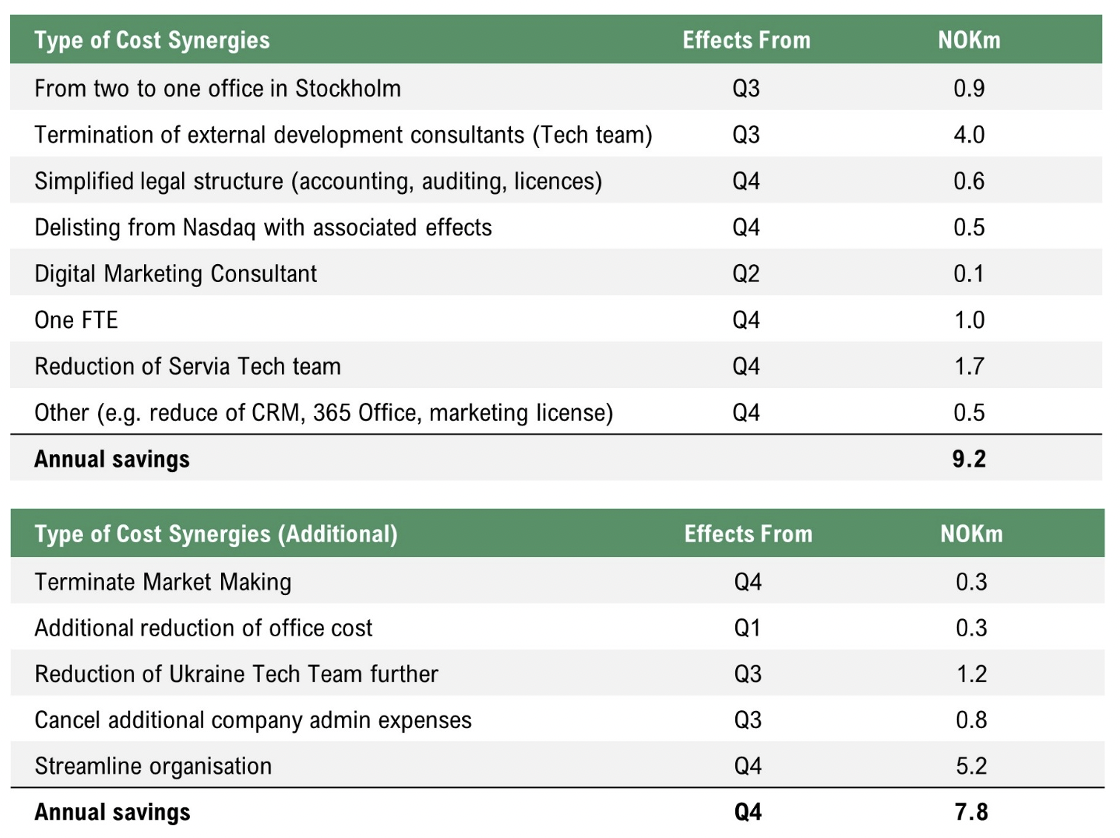

Huddlestock presented in both the report and the conference call a cost reduction program, enabled in part by cost synergies among the acquired operations and built upon the previously communicated cost synergy initiatives. The first part of the cost reduction program was initiated during the second quarter, before the summer, which Huddlestock anticipates will yield an impact of approximately NOK 9.2M in cost savings starting from Q3-23. Huddlestock has also initiated an additional part of the cost reduction program, estimated to amount to NOK 7.8M, with effects expected to materialize in the early part of year 2024. Below outlines Huddlestock’s cost reduction program and the additional part, detailing the nature of the intended savings, the expected date implemented effects from, and the corresponding sum.

At the end of Q2-23, Huddlestock’s cash and equivalents amounted to NOK 10.8M, compared to NOK 1.7M at the end of March (Q1-23), corresponding to a net change in cash of + NOK 9.1M. The increase in cash and equivalents during the quarter can be attributed to a capital injection of NOK 5M from Njord Group AS, as well as from the acquisition of subsidiaries, net of acquired cash. As for the net cash flow from operating activities from continuing operations, it amounted to NOK -11.6M during the first half of 2023, equating to an operational burn rate of NOK 1.9M per month over the period.

In conclusion, we are of the opinion that Huddlestock has progressed well operatively and has successfully consolidated the acquired companies during the second quarter, considering both the net revenue growth and the development of the total operating costs. Analyst Group views the developments during the quarter positively, as well as the initiation of the cost reduction program, which is anticipated to gradually be materialized in the figures over the upcoming quarters. Furthermore, Huddlestock holds a strong position with a robust prospect pipeline, significant upcoming product deliveries in both 2023 and 2024, and stable prospects for Visigon (part of the Professional Service Division). These factors are expected to drive growth in the other half of 2023. It should be noted, however, that the forthcoming quarters are projected to be somewhat weaker, attributed to seasonal effects, a point emphasized by Huddlestock’s CEO, John E. Skajem, during the conference call.

We will return with an updated equity research report of Huddlestock.

Mar

Interview with Huddlestock’s CEO Leif Arnold Thomas

Sep

Interview with Huddlestock’s CEO John E. Skajem

Aktiekurs

N/A

Värderingsintervall

2024-06-07

Bear

0,7 NOKBase

2,4 NOKBull

3,6 NOKUtveckling

Huvudägare

2023-05-01

Comment on Huddlestocks’s Q1-24 Report

2024-05-30

Huddlestock published on May the 30th, the company’s quarterly report for the first quarter 2024. The following are some key financial metrics that we have chosen to highlight in connection with the report:

Net Revenue Growth of 24% YoY

During the first quarter of 2024, Huddlestock’s net revenue amounted to NOK 20.6M (16.6), representing a growth of 24% YoY and a decrease of 9% Q-Q, as the revenue in the previous quarter (Q4-23) amounted to NOK 22.6M. The YoY revenue increase is primarily supported by three acquisitions (Tracs Group, Dtech, and Bricknode), which were consolidated in Q2-23. It should also be noted that the revenue comparison has decreased as the comparison period includes the operations of Huddlestock Solutions (formerly F5IT), which was divested through a management buyout completed at the end of November 2023. In terms of the Last Twelve Months (LTM), Huddlestock’s revenue amounts to NOK 89.2M, indicating that Huddlestock has sequentially increased its revenue on an LTM basis, compared to the revenue for the full year 2023 of NOK 85.2M or NOK 53.7M at the same time the previous year. The LTM revenue increase is likewise primarily attributed to Huddlestock’s acquisitions of Tracs Group, Dtech, and Bricknode, despite the divestment of Huddlestock Solutions. However, revenue growth has also been driven by new customers, as well as expansion among Huddlestock’s existing customers within the Investment-as-a-Service offering (“IaaS”),and extended new mandates within the consulting services. Consequently, the proportion of recurring revenues related to the IaaS offering has also increased sequentially and amounts to 49% of the Company’s total revenue on an LTM basis. Analyst Group views it as a strong performance to have sequentially increased revenues on an LTM basis and that the share of the revenue base from recurring revenues from the IaaS offering constitutes an increasingly larger portion of the Company’s total revenue, making up approximately 50% on an LTM basis.

Huddlestock’s revenue mix is derived from recurring revenues from Investment-as-a-Service (IaaS) and project-based revenues from consulting services. The recurring revenues within the IaaS offering are based on monthly licenses, assets under management (“AuM”) or assets under administration (“AuA”), and transaction fees, where the IaaS offering provides access to investment tools and expertise without the need for extensive infrastructure or in-house resources. Revenues from IaaS are thus driven by the number of B2B customers and product offering, where a strong and expanded product offering contributes to a high net revenue retention rate (“NRR”), but is also fundamentally impacted by the stock market development. Within consulting services, Huddlestock offers customized strategic and technical solutions assisting clients in improving their operations, where revenues are project-based and generally build on multiyear relationships with large multinational institutions, with technology implementation within the whole financial market driving revenues within this business area.

During Q1-24, recurring revenues from IaaS accounted for 39% of the Company’s total revenue for the quarter, amounting to approximately NOK 8M, compared to 19% during the same period the previous year (Q1-23), which amounted to approximately NOK 3M, thus showing a growth of approximately 155%, primarily explained by the three acquisitions but also sequentially impacted by the divestment of Huddlestock Solutions. Consequently, revenues from consulting services accounted for 61% of the Company’s total revenue, amounting to approximately NOK 12.6M, compared to approximately NOK 13M during the same period the previous year. It should also be noted that, when compared to the previous quarter, revenues from each revenue stream showed a similar distribution, with recurring revenues from IaaS accounting for 39% and project-based revenues from consulting services accounting for 61%. However, it should be added that revenues from consulting services are affected by seasonal effects, leading to somewhat fluctuating revenues on a quarterly basis.

Thus, we conclude that Huddlestock has shown a solid start to 2024, with a growth of 24% YoY and sequential growth on an LTM basis with a continued increase in the proportion of recurring revenues from IaaS, which Analyst Group highlights as a strong data point from the report. However, the growth rate for the quarter is somewhat lower than Analyst Group’s estimate, which is partly explained by the divestment of Huddlestock Solution. Overall, the quarter shows that Huddlestock’s consulting services demonstrate good and stable profitable revenues, with revenues from this business area being relatively in line with the previous year, while the IaaS business consists of recurring revenues and represents a growing part of the company’s total revenue. Revenues from IaaS are estimated to have been affected by the divestment of Huddlestock Solutions but are still expected to show underlying growth due to the new customers Huddlestock signed during the full year of 2023. Analyst Group also considers this business area to be a significant and important growth driver going forward, possessing high growth potential due to the large serviceable market in the Nordic region and additional upside potential in the German market, where Huddlestock signed an LOI with AVL in January 2024, which we commented on here.

Implemented Cost Plan Starts to Show Effects

During the first quarter of 2024, Huddlestock’s total operating expenses (including cost of materials/subcontractors) amounted to NOK 24.4M (19), noting that the acquisitions have also resulted in a larger total cost base in the YoY comparison. Compared to the previous quarter (Q4-23), Huddlestock has reduced the cost base, as the total operating expenses amounted to NOK 30.6M, corresponding to a decrease of NOK 6M, and compared to Q3-23, total operating expenses decreased by approximately NOK 1.3M, which then amounted to approximately NOK 25.7M. The reduced cost base QoQ is particularly attributed to decreased other operating expenses, which decreased by NOK 7.4M, but also a reduction in the company’s largest cost item, personnel costs, which decreased QoQ by approximately NOK 1.5M. In total, Huddlestock’s EBITDA result during the first quarter of 2024 amounted to NOK -3.8M (-2.4), which represents an increase YoY, explained by the acquisitions and the increased cost base in the company, but a significant decrease QoQ, where Huddlestock showed a negative EBITDA result of NOK 8M during Q4-23. Additionally, it should be noted that the consultancy services show good profitability during the quarter, where Huddlestock highlights that the business area demonstrates an EBITDA margin of 26%, which is estimated to amount to approximately NOK 3.3M given that revenues from the business area amounted to approximately NOK 12.6M during the quarter. However, it should be noted that Huddlestock has not historically reported revenues and EBITDA results for each business area separately.

Overall, Analyst Group is of the opinion that Huddlestock has successfully implemented cost synergies and maintained stable cost control, which is a result of the implemented cost plan starting to show effects and is evident in the QoQ comparison where total operating expenses decreased by NOK 6M. At the same time, Huddlestock highlights that the company continues to execute on the roadmap to an EBITDA-positive result, which is based on a continued focus on recurring IaaS sales, continued profitable growth within consultancy services, increased efficiency and enhanced structures, as well as continued focus on cost control and cost reduction. Analyst Group therefore assesses that Huddlestock will continue to focus on reducing the cost base, where the full effect of the cost savings is estimated to be realized in H2-24, while we highlight the high growth potential within the IaaS business, as well as a solid utilization rate within consultancy services, which we consider to position the company well to achieve a neutral EBITDA result for the full year of 2024.

Securing Financing in the Short- and Mid-Term Perspective

At the end of Q1-24, Huddlestock’s cash and equivalents amounted to NOK 9.9M, compared to NOK 10.2M at the end of December (Q4-23), representing a decrease in net cash and equivalents of NOK 0.3M. During the quarter, the net cash flow from operating activities from continuing operations amounted to NOK -7M, equivalent to an operational burn rate of approximately NOK 2.3M per month over the period. However, the quarter was negatively affected by changes in working capital, and the net cash flow from operating activities before changes in working capital amounted to NOK -4M during the quarter, equivalent to a burn rate of approximately NOK 1.4M per month over the period, which is in line with the average of the previous year. As a result of increased debt of NOK 9M during the quarter, the cash balance is relatively unchanged compared to the end of the previous quarter.

In line with Huddlestock’s previous communication that the company’s key priorities going forward are to explore and identify financing alternatives, to support Huddlestock’s strategy and to maximize execution on the company’s strong position and product offering, Huddlestock has secured additional funding through a convertible loan to existing shareholders of NOK 12.5M after the quarter. On May 29, after the end of the quarter, Huddlestock announced that the company has successfully completed a private placement of convertible debt, raising NOK 12.5M, securing financing in the short and mid-term. The convertible loan carries an interest rate of 10% and the conversion date is set for 18 months from the date of settlement of the private placement (May 30, 2024), meaning the convertible loan matures in December 2025, with a conversion rate of NOK 1 per share in the company. Additionally, it should be noted that several members of the company’s management and board participated in the private placement of the convertible loan, including Willebrand Group AB, associate of board member Stefan Willebrand, which subscribed for NOK 200K, Untie Group AB, associate of board member Stefan Willebrand and board member Erik Hagelin, which subscribed for NOK 600K, and Investor Relations and Corporate Development Officer John Egil Skajem, who subscribed for NOK 150K.

Analyst Group views positively that Huddlestock has secured financing in the short to mid-term, which also enables Huddlestock to further execute on the roadmap to EBITDA positive and maximize execution on the company’s strong position to achieve high growth. Securing financing also indicates strong confidence from existing shareholders, and we view positively that several members of the company’s management and board participated in the private placement of convertible debt, which instills confidence in creating shareholder value moving forward.

In conclusion, Huddlestock has reported a solid quarter, showing YoY growth primarily explained by acquisition activity, while also driven by new customers and extended mandates. However, revenues decreased by 9% QoQ, primarily explained by the divestment of Huddlestock Solutions. At the same time, we see that Huddlestock has executed on the implemented cost plan, thereby reducing the cost base by NOK 6M QoQ, which also contributes to a reduced EBITDA loss QoQ. After the quarter, Huddlestock secured necessary capital primarily in the short-term perspective, but also in the mid-term perspective, enabling Huddlestock to execute on the company’s well-established position and to drive growth. In addition, the interim report demonstrates the good profitability in consultancy services, which we view positively, while Huddlestock possesses strong growth potential in IaaS. We emphasize the importance of Huddlestock continuing to execute on the implemented cost plan and the roadmap towards EBITDA positive to ensure a sustainable gowth path while seizing opportunities going forward, particularly within the IaaS offering.

We will return with an updated equity research report of Huddlestock.