Genetic Analysis is a Norwegian diagnostic company with more than 15 years of experience in research and product development within diagnostics of the human microbiome. The Company has developed the diagnostic platform GA-map® for the analysis of microbiomes. The platform provides cost-effective, standardized, and consistent results, forming the basis for diagnosing patients’ microbiomes. Test results are published directly via the Company’s cloud-based software, eliminating the need for additional resources to interpret the data. Genetic Analysis has been listed on the Norwegian Spotlight Stock Market since 2021.

Pressmeddelanden

Accelerates Growth in the U.S.

Genetic Analysis AS (”Genetic Analysis” or ”the Company”) has developed the GA-map®, a platform for diagnostic analysis of microbiomes — the collection of microorganisms in the body that support digestion, immunity, and overall health. The human microbiome market is growing fast, as its importance for health has been increasingly recognized, yet the field has so far lacked standardization. The GA-map® platform aims to standardize microbiome diagnostics, which is expected to generate high long-term sales growth with a CAGR of 39% from 2024-2028. With an applied EV/S multiple of 1.8x on 2027’s estimated sales of NOK 44.5m and a discount rate of 12.3%, a potential present value per share of NOK 1.11 (1.09) is derived in a Base scenario.

- Strong U.S. Development Drove Sales Growth

Genetic Analysis reported net sales of NOK 5.9m (4.4) in Q2-25, corresponding to a growth of 34% Y-Y, primarily driven by strong sales in the U.S., which grew 49%. Sales are assumed to have been affected by a weaker USD/NOK, implying that the underlying organic growth was even stronger in terms of number of sold reagent kits. Genetic Analysis continues the commercial rollout of the GA-map® platform by expanding the number of partner laboratories, which is expected to drive recurring reagent kit sales going forward and thereby support further growth.

- Gross Margin was Affected by Import Tariffs

The gross margin amounted to 73.7% (81.7%) during Q2-25, which was negatively affected by import tariffs in the U.S, adjusted for this the gross margin was similar to last year. This indicates that Genetic Analysis is experiencing an initial negative impact on profitability due to the tariffs. Consequently, we have revised our gross margin assumptions slightly downwards. However, operating expenses were lower than estimated, decreasing 33% Y-Y despite the sales growth. We have updated our estimates regarding OPEX downwards throughout the forecast period, offsetting the lower estimated gross margin and leaving our operating profitability estimates largely unchanged.

- Launch of GA-map® MHI GutHealth in the U.S.

After the end of Q2-25, Genetic Analysis announced the launch of the GA-map® MHI GutHealth as a Research Use Only (RUO) test in the U.S. Analyst Group views the test as a validation of the anticipated market shift towards a more diagnostic approach on the human microbiome market and in the long-term, the test is expected to be used clinically to follow-up on how individual patients respond to medication.

- Small Changes in Valuation Range

Following the Q2-report we have kept our sales estimates intact, with a slight downward revision on gross margin assumptions, offset by lower estimated OPEX, leaving only small adjustments in our valuation range.

6

Värdedrivare

3

Historisk lönsamhet

6

Ledning & Styrelse

6

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Laying the Ground for Profitable Growth

Genetic Analysis AS (”Genetic Analysis” or ”the Company”) has developed the GA-map®, a platform for diagnostic analysis of microbiomes. The GA-map® platform aims to standardize microbiome diagnostics, which is expected to generate high long-term sales growth with a CAGR of 39% from 2024-2028. Since our previous analysis update, we have raised our justified market cap for Genetic Analysis from approximately NOK 49m to around NOK 77m, considering the reduced financial risk following the capital raises as well as the launch of a consumer test in the Chinese market, which, according to Analyst Group, holds strong potential. However, given the estimated increase in the number of shares following the capital raises, the increase in terms of value per share is more modest. With an applied EV/S multiple of 1.8x on 2027’s estimated sales of NOK 44.5m and a discount rate of 12.4%, a potential present value per share of NOK 1.09 (1.0) is derived in a Base scenario.

- Temporary Slowdown in Sales Growth

Genetic Analysis net sales in Q1-25 amounted to NOK 2.4m (3.3), a decrease of 27% Y-Y. Genetic Analysis remains in an early stage of commercialization, and sales are expected to fluctuate between quarters based on activities and inventory levels at partners, as has historically been observed. After a strong Q4-24, with sales growth amounting to 63%, we expected a somewhat softer Q1-25, although sales were still a bit weaker than we had anticipated.

- Continued Strong Trend in Gross Margin

The gross margin amounted to 84% (77%) during Q1-25, which was attributable to the manufacturing improvement program and the dimishing low-margin instrument sales. Together with a decreasing operating cost base of -17%, this resulted in an improved EBITDA-result of NOK -3.1m (-4.2), despite the lower sales.

- Launch of a Consumer Test in China

In collaboration with Thalys, Genetic Analysis has launched a new microbiome test for the Chinese consumer market. The business model in the collaboration means that Genetic analysis will supply reagent kits to Thalys. While market growth is likely to attract competition, the GA-map® platform provides Genetic Analysis and Thalys with a distinct competitive edge through a diagnostic approach.

- Upward Revision of Valuation Range

Through the capital raises, we asses that the financial risk for the Company has decreased and that the proceeds will be sufficient until a sustainable positive cash flow is estimated to be reached in 2027. We have also raised our financial estimates following the launch of the consumer test in China, however offset by downward revisions based on the weaker-than-expected outcome in Q1-25. Taken together with the reduced financial risk, this results in a higher valuation range.

6

Värdedrivare

3

Historisk lönsamhet

6

Ledning & Styrelse

6

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Standardizing the Future of Microbiome Diagnostics

Genetic Analysis AS (”Genetic Analysis” or ”the Company”) has developed the GA-map®, a platform for diagnostic analysis of microbiomes — the collection of microorganisms in the body that support digestion, immunity, and overall health. The human microbiome market is growing fast, as its importance for health has been increasingly recognized, yet the field has so far lacked standardization. The GA-map® platform aims to standardize microbiome diagnostics, which is expected to generate high long-term sales growth with a CAGR of 39% from 2024-2028. With an applied EV/S multiple of 1.4x on 2027’s estimated sales of NOK 46.4m and a discount rate of 13.4%, a potential present value per share of NOK 1.0 is derived in a Base scenario.

- First Mover Advantage in a Growing Market

Recent advances in research have solidified the potential of the microbiome in therapeutics, which is expected to drive strong market growth. As microbiome-based therapeutics become available, the demand for reliable diagnostic tools is expected to increase simultaneously. Genetic Analysis is a pioneer and holds a first mover advantage within microbiome-based diagnostics through the GA-map® platform, making the Company well positioned to capitalize on the expanding market.

- Standardizing Microbiome Diagnostics With GA-map®

The microbiome testing market is currently characterized by non-standardized, research-based tests. Genetic Analysis aims to standardize microbiome diagnostics through the Company’s GA-map® platform, who are the first to develop a CE-IVD marked product for microbiome mapping. With standardized technology, analyses are expected to be performed more efficiently while creating improved conditions for accurate diagnostics. The GA-map® platform generates recurring sales of reagent kits with high gross margins, estimated to amount to 75-80%.

- Partnership Accelerates Commercial Momentum

Genetic Analysis collaboration with renowned Ferring Pharmaceuticals reflects the growing market focus on microbiome diagnostics. Together, the parties are developing a rapid PCR-based test that combines the GA-map® platform with Ferring’s biomarker, targeting patients with Clostridioides difficile infection. The test, set to launch as a Research Use Only-product in H1-25, is expected to streamline diagnostics and expand Genetic Analysis portfolio into a new therapeutic area, supporting the Company’s growth as microbiome-targeting drugs is set to become more widely available.

- Uncertain Timing of Diagnostic Market Shift

Genetic Analysis remains in an early stage of commercialization, and although a market shift toward increased focus on microbiome diagnostics is anticipated, the pace at which this transition occurs remains uncertain. A slower transition than expected could harm the Company’s growth outlook.

6

Värdedrivare

3

Historisk lönsamhet

6

Ledning & Styrelse

7

Riskprofil

Samtliga analyser av bolag från och med år 2020 betygssätts utifrån ett nytt betygssystem - Värdedrivare, Historisk Lönsamhet och Ledning & Styrelse sträcker sig från 1 till 10, där 10 är högsta betyg. Riskprofil sträcker sig från 1 till 10, där 10 är att anse som högst risk. Aktieanalyser av bolag publicerade innan 2020 har betygssatts utifrån en annan modell.

Analytikerkommentarer

Comment on Genetic Analysis Q2-report Report 2025

2025-08-27

Genetic Analysis AS (“Genetic Analysis” or the “Company”) published on August 27th the Company’s Q2-report for 2025.

The following are some key points that we have chosen to highlight in connection with the report:

- Strong sales growth through reagent kit sales in USA

- Improved EBITDA-result through solid gross margin and cost control

- Strengthened cash position though rights issues for further commercial investments

- Launch of GA-map® MHI GutHealth in the USA

Sales Growth of 34%

The net sales grew strongly in Q2-25, amounting to NOK 5.9m (4.4), corresponding to a growth of 34% compared to the same quarter last year. The growth is primarily driven by strong sales of reagent kits on the US market, which accounted for 73% of the total sales and growing 49% compared to the comparison quarter. Meanwhile, Europe showed a stable growth amounting to 11%. Moreover, the report states that Genetic Analysis continues the commercial rollout of the GA-map® platform by increasing the number of partner laboratories, which is expected to generate recurrent sales of reagent kits going forward, hence contributing to further growth.

The growth validates the ongoing increased global focus on microbiome diagnostics, as we have argued in our equity research reports for Genetic Analysis. The primary growth driver on the market is assumed to be advances in research, which have revealed the microbiome’s potential in therapeutics. As therapeutics become more readily available, the need for reliable diagnostic tools is expected to grow in tandem, both for selecting which patients that should receive treatment and for tracking therapeutic response over time, including the potential requirement for repeated dosing. Genetic Analysis has an established first mover advantage within microbiome-based diagnostics through the patented platform GA-map®, why the Company is in a strong position to capitalize on growing interest in microbiome-guided diagnostics.

During Q2-25, Genetic Analysis announced the launch of a microbiome test for the Consumer Health (D2C) market in China in collaboration with Thalys Medical Technology Group Corporation (“Thalys”). Thalys is considered to be a strong partner for the launch, with expertise in China’s healthcare ecosystem. The risk-reward profile is seen as attractive for Genetic Analysis in a business model where the Company supplies Thalys with reagent kits, while the partner is expected to be responsible for commercialization. Thalys is currently working on the product to fit local requirements, after which a broader launch is expected. Hence, the product is not assumed to have contributed significantly to the growth in Q2-25, but should rather be seen as an extra potential growth driver going forward.

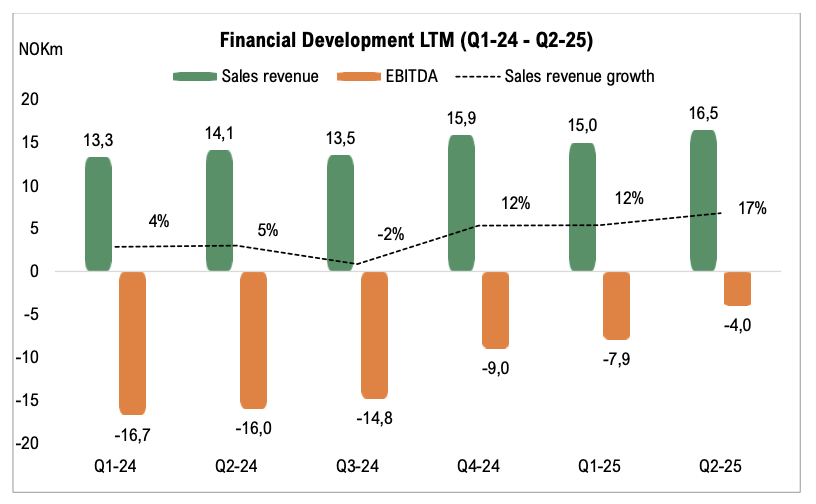

As we mentioned in our comment following Genetic Analysis Q1-report, when sales decreased by 27%, Genetic Analysis remains in an early stage of commercialization, and sales are therefore expected to fluctuate between quarters based on activities and inventory level at partners. As we now can summarize H1-25, the growth rate amounts to 8% and looking at the last twelve months (July 2024 – June 2025), the growth rate is at 17%, which has accelerated since Q1-24, showing a strong trend. Looking ahead, we see several growth drivers that is expected to further accelerate sales, including continued growth of reagent kits to laboratories, the D2C test in China and the recently launched GA-map® MHI GutHealth in the USA.

Import Tariffs Affected Gross Margin Negatively

The growth rate in the US comes in a macroeconomically turbulent quarter, with tariffs implemented, which also affected the COGS negatively by NOK 0.4m. As a result, the gross margin, adjusted for other operating income, decreased to 73.7% (81.7). When adjusting for the impact of tariffs, the gross margin was largely unchanged compared to the same quarter last year. Genetic Analysis has exited instrument sales in Europe, which is expected to have been a low-margin business, why the main contributor to revenues now are the high-margin reagent kits, leading to a stronger reported gross margin in the last one and a half year.

Continued Strong Cost Control

Genetic Analysis continued to show strong cost control during Q2-25, as operating expenses decreased 33% compared to the same period last year, amounting to NOK 5.1m (7.6), despite the growing revenues, showcasing impressive cost control and validation of the scalability in Genetic Analysis business model. The decrease is attributable to general cost savings and the fact that the IBD project is in a less costly phase. The increased revenues combined with the cost savings resulted in a positive EBITDA of NOK 0.5m, corresponding to a margin of 7.1%. When adjusting for other income, which amounted to NOK 1.3m during Q2-25 and primarily consists of research work and R&D grants, the EBITDA margin was slightly negative during the quarter.

Through estimated growing sales from reagent kits and new product launches, a high gross margin and strong cost control, we expect Genetic Analysis to be able to continue to strengthen profitability, even though results likely will fluctuate between quarters.

Strengthened Cash Position

During Q2-25, Genetic Analysis strengthened the cash position through a directed issue of NOK 12.8m and a following subsequent offering to existing shareholders, which provided gross proceeds of NOK 4.1m, corresponding to total gross proceeds of NOK 16.9m. As a result, the cash position increased to NOK 25m at the end of Q2-24, compared to NOK 10.7m at the end of Q1-25. As mentioned, Genetic Analysis operates with a lean cost base and is balancing new investments, leading to a FCF of NOK -0.3m in Q2-25. Through the strengthened cash position in the quarter as well as the positive trend in profitability, we asses the financial position for Genetic Analysis as strong and expects the Company to make balanced investments in commercial activities for the GA-map® platform, with an increased focus on the US market, which we consider a good strategic investment for the Company’s future growth.

Launch of GA-map® MHI GutHealth in the USA

After the end of Q2-25, Genetic Analysis announced the launch of the GA-map® MHI GutHealth as a Research Use Only (RUO) test in the USA. The launch will be carried out through a collaboration with Pangea Laboratory LLC (“Pangea”). In December 2024, Genetic Analysis first announced the collaboration with Ferring Pharmaceuticals to develop a new rapid microbiome diagnostic test, aiming to provide increased standardization in a quickly evolving field of microbiome life science. Analyst Group sees the collaboration with Ferring Pharmaceuticals as a validation of the anticipated market shift towards a more diagnostic approach on the rapidly growing human microbiome market, as the test initially is targeting patients with recurrent Clostridioides difficile (rCDI). The test will be launched as a Research Use Only (RUO) initially, but in the long-term, the test is expected to be used to follow-up on how individual patients respond to the Rebyota drug.

Analyst Group views the launch of GA-map® MHI GutHealth in the U.S. as a strategically important step for Genetic Analysis. While short-term financial impact may be limited due to a gradual sales ramp-up, the collaboration with Ferring Pharmaceuticals and the test’s application in addressing recurrent Clostridioides difficile infections underscore a strong long-term potential through a diagnostic approach on the human microbiome market. Moreover, we also asses the fact that Ferring has chosen GA-map® for this test is a validation of the platform.

In summary, Genetic Analysis delivered strong progress in Q2-25 with sales growth of 34%, primarily driven by strong demand for reagent kits in the U.S., validating the Company’s scalable business model and the growing global focus on microbiome diagnostics. The commercial rollout of the GA-map® platform through new partner laboratories, the launch of a consumer health test in China with Thalys, and the recent introduction of GA-map® MHI GutHealth in the U.S. provide multiple growth drivers going forward. Despite tariff-related headwinds temporarily affecting gross margins, underlying profitability remains supported by high-margin reagent kits and strong cost control, with operating expenses down 33% Y-Y, paving the way for further profitability improvements going forward.

We will return with an updated equity research report of Genetic Analysis.

Comment on Genetic Analysis Launch of GA-map® MHI GutHealth in the USA

2025-07-30

On July 29th, Genetic Analysis AS (“Genetic Analysis” or the “Company”) announced the launch of the GA-map® MHI GutHealth as a Research Use Only (RUO) test in the USA. The launch will be carried out through a collaboration with Pangea Laboratory LLC (“Pangea”), which will conduct the analyses in its CLIA-certified, CAP-accredited laboratory in Tustin, California, while Genetic Analysis will generate revenues through the sale of reagent kits.

Analyst Group’s View of the Launch

In December 2024, Genetic Analysis first announced the collaboration with Ferring Pharmaceuticals to develop a new rapid microbiome diagnostic test, aiming to provide increased standardization in a quickly evolving field of microbiome life science. The test, which has now been launched, combines Genetic Analysis’ GA-map® platform with Ferring’s Microbiome Health Index biomarker. The GA-map® MHI GutHealth test is expected to reduce processing time from weeks to hours, lowering costs, and enhance standardization in microbiome diagnostics.

Analyst Group sees the collaboration with Ferring Pharmaceuticals as a validation of the anticipated market shift towards a more diagnostic approach on the rapidly growing human microbiome market, as the test initially is targeting patients with recurrent Clostridioides difficile (rCDI). The Microbiome Health Index™ (MHI), developed by Ferring, is a clinically validated biomarker that quantifies the balance between pro-inflammatory and anti-inflammatory bacteria in the gut. Its relevance has been demonstrated in patients suffering from rCDI, which is eligible for treatment with Ferring’s Rebyota drug, the first fecal microbiota product approved by the FDA.

Through GA-map® MHI GutHealth, clinicians will be equipped with a rapid diagnostic approach for initial evaluation of microbiome dysbiosis, as well as longitudinal monitoring of therapeutic response during treatment. In the United States, recurrent Clostridioides difficile infection (rCDI) affects an estimated 500,000 individuals each year. Approximately 35% of primary CDI cases progress to recurrence, a condition linked to as many as 30,000 deaths annually, which demonstrates the need for functional diagnostics and medication, creating an attractive business opportunity for Genetic Analysis. The test will be launched as a Research Use Only (RUO) initially, but in the long-term, the test is expected to be used to follow-up on how individual patients respond to the Rebyota drug.

The test is now available for analysis at Pangea and is expected to drive growth for Genetic Analysis by adding a new product to the portfolio within a new disease area. While a significant financial impact is not anticipated in the coming quarters, as test sales are expected to scale gradually, we see substantial long-term potential in the recently launched test— particularly in terms of its future potential use in monitoring treatment outcomes following administration of microbiota-based therapies such as Rebyota.

In conclusion, Analyst Group views the launch of GA-map® MHI GutHealth in the U.S. as a strategically important step for Genetic Analysis. While short-term financial impact may be limited due to a gradual sales ramp-up, the collaboration with Ferring Pharmaceuticals and the test’s application in addressing recurrent Clostridioides difficile infections underscore a strong long-term potential through a diagnostic approach on the human microbiome market. With a clinically validated biomarker, increasing demand for standardized microbiome diagnostics, and expected future use in treatment monitoring, the launch positions Genetic Analysis to capture value in a growing and clinically relevant market segment.

Comment on Genetic Analysis Q1-report Report 2025

2025-05-28

Genetic Analysis AS (“Genetic Analysis” or the “Company”) published on May 27th the Company’s Q1-report for 2025.

The following are some key points that we have chosen to highlight in connection with the report:

- Decreasing sales but increasing number of laboratories with the GA-map® system installed

- Improved EBITDA-result through strong gross margin and cost control

- Rights issue to finance commercial investments

- Launch of a new consumer test in China

Lower Sales due to Inventory Level at Partners

The net sales in Q1-25 amounted to NOK 2.4m (3.3), corresponding to a decrease of 27% compared to the same quarter last year. The decrease is attributable to a decrease of 30% in sales of reagent kits, amounting to NOK 2.1m (3.0), while service revenue grew 10% to NOK 0.3m (0.26). During the quarter, sales were negatively impacted by inventory adjustments by partners. As Analyst Group has emphasized in our equity research report, Genetic Analysis remains in an early stage of commercialization, and sales are therefore expected to fluctuate between quarters based on activities and inventory level at partners. After a strong Q4-24, with sales growth amounting to 63%, we see it as natural with a somewhat softer Q1-25, although sales were still a bit weaker than we had anticipated. However, as Genetic Analysis is expected to grow over time, quarterly fluctuations are expected to decrease.

Moreover, it should be mentioned that Genetic Analysis has expanded the number of GA-map® system installations globally and continued the commercial expansion in early 2025. The Company further aims to increase the number of laboratories with the GA-map® system during the remainder of 2025. With the system installed at more laboratories, this is expected to generate growth in recurring revenues from reagent kits, which also has a high margin profile.

Strong Gross Margin and Cost Control Resulted in Improved Result

The gross margin amounted to 84% (77%) during Q1-25, which is an improvement both Y-Y and Q-Q, as the gross margin amounted to 83% in Q4-24. Genetic Analysis has exited instrument sales in Europe, which is expected to have been a low-margin business, why the main contributor to revenues now are the high-margin reagent kits. Moreover, the increased gross margin is attributable to the manufacturing improvement program, which we view positively on.

Operating expenses, excluding depreciation, amounted to NOK 6.7m (8.2), corresponding to a decrease of 17%, which emphasizes a continued strong cost control. The decrease in operating expenses was also attributable to the fact that the IBD project is in a less costly phase. As a result of the increased gross margin and decreased cost base, the EBITDA-result improved to NOK -3.1m (-4.2). Through the increased gross margin and decreased cost base, we estimate a margin expansion going forward with together with sales growth.

Directed Share Issue and Subsequent Offering to Strengthen the Financial Position

The cash position at the end of March amounted to NOK 10.7m and after the quarter’s end Genetic Analysis announced a placement of a directed issue of NOK 12.8m before transactions related costs of NOK 0.6m. The subscription price amounted to NOK 0.86 per share and consisted of 14,890,576 new shares, which equals a dilution effect of approximately 30% for existing shareholders.

The proceeds are intended to be used for commercial investments connected to the existing cooperation with Ferring Pharmaceuticals and other initiatives to increase the presence of the Company’s diagnostic platform GA-map®. Analyst Group considers the announced directed share issue as no major surprise, as we expect the Company to continue to invest in commercial activities for the GA-map® platform, with an increased focus on the US market, which we consider a good strategic investment for the Company’s future growth. Furthermore, we view positively on the decreased financial risk through a strengthened cash position. However, the directed issue results in a dilution effect of 30% for existing shareholders.

Following the publication of the Q1-25 report, Genetic Analysis announced that the previously communicated subsequent offering towards shareholders who were not invited to participate in the directed issue, will go through. This is to give shareholders the opportunity to subscribe for new shares at the same subscription price as applied in the directed issue. Shareholders will have the right to subscribe for one new share for every six (6) existing shares held, at a subscription price of NOK 0.86 per share. The subsequent offering will, given full subscription, contribute with gross proceeds of NOK 7.1m, estimated net proceeds of NOK 6m, further strengthening the cash position.

Launch of a Consumer Test to the Chinese Market

On April 22nd, Genetic Analysis announced that the Company are launching a microbiome test for the Consumer Health (D2C) market in China in collaboration with Thalys Medical Technology Group Corporation (“Thalys”) which will be based on Genetic Analysis clinically validated microbiome test, the GA-map® Dysbiosis Test.

Analyst Group views Genetic Analysis initial launch in the vast and fast-growing Chinese market positively. Thalys is a strong partner for the launch, with expertise in China’s healthcare ecosystem. The risk-reward profile is seen as attractive for Genetic Analysis in a business model where the Company supplies Thalys with reagent kits, while the partner is expected to be responsible for commercialization. Although competition is expected to be intense given the appealing market growth, Genetic Analysis and Thalys are assessed to hold competitive advantages, primarily through the diagnostic approach utilizing the GA-map® platform.

To summarize, Genetic Analysis results during Q1-25 were somewhat weaker than expected, but where sales are expected to fluctuate between quarters as earlier mentioned. Analyst Group argues that nothing has changed in the long-term growth outlook, as the GA-map® system has been installed in an increasing number of laboratories and the beneficial market development is unchanged. Despite the decrease in sales, the strong gross margin and cost control resulted in an improved EBITDA-result.

We will return with an updated equity research report of Genetic Analysis.

Comment on Genetic Analysis Directed Share Issue of NOK 12.8m

2025-05-05

On May 5th, Genetic Analysis AS (“Genetic Analysis” or the “Company”) announced a placement of a directed issue of NOK 12.8m before transactions related costs of NOK 0.6m, which is conditional on approval from the annual general meeting on May 19th. The subscription price amounts to NOK 0.86 per share and is based on the average volume weighted trading price on Spotlight Stock Market the last 15 trading days up to and including April 24th, 2025. The directed rights issue consists of 14,890,576 new shares, which equals a dilution effect of approximately 30% for existing shareholders.

Analyst Group’s View of the Directed Issue

In our initiation analysis of Genetic Analysis, we emphasized that the Company remains in an early stage of commercialization and that earnings are expected to fluctuate between quarters, which means that the need for external capital to finance continued growth initiatives cannot be ruled out. Hence, the announced share issue comes as no major surprise, and the proceeds are intended to be used for commercial investments connected to the existing cooperation with Ferring Pharmaceuticals and other initiatives to increase the presence of the Company’s diagnostic platform GA-map®.

In December 2024, Genetic Analysis announced the partnership with Ferring Pharmaceuticals, which consists of the development of a rapid microbiome-based PCR test, combining Genetic Analysis GA-map® platform with Ferring’s Microbiome Health Index biomarker. Analyst Group views this as a validation of the platform and an indication of an expected market shift towards a more diagnostic approach, as the test is expected to be used to follow up on how individual patients respond to Ferring Pharmaceuticals Rebyota drug, the first fecal microbiota product approved by the FDA. Moreover, we anticipate that the proceeds will be allocated towards growth initiatives in the USA, as this is the largest microbiome market, partly due to a more advanced research and development culture, which is expected to create the largest growth opportunities for Genetic Analysis in that market. Hence, we believe the proceeds from the directed issue will be allocated in strategically important initiatives to drive the Company’s growth going forward.

Terms, Dilution and Investors in the Directed Issue

The subscription price of NOK 0.86 is based on the average volume-weighted trading price on Spotlight Stock Market during the last 15 trading days up to and including April 24th, 2025. As the share price has increased since April 24th, the subscription price means a discount of 59% compared to the closing price of NOK 2.12 on May 2nd. Through the directed share issue, existing shareholders will experience a dilution effect amounting to 30%.

The investors in the directed share issue are a limited number of existing shareholders, including members of the Board of Directors and the management team, where the latter accounts for 23% of the proposed directed issue, which instills confidence in the Board and management’s commitment to the Company. The remainder of the issue is subscribed by existing shareholders, including Genetic Analysis largest shareholder Bio-Rad Inc.

Subsequent Offering Towards Existing Shareholders who do not Participate in the Directed Issue

The Company intends to carry out a subsequent offer directed towards shareholders who were not invited to participate in the directed issue, in order to give them the opportunity to subscribe for new shares at the same subscription price as applied in the directed issue. The subsequent offering will be for subscription of shares totaling around NOK 6m. However, this issue is conditional on the directed issue being approved by the Annual General Meeting and on the existence of a significant gap between the subscription price and the observed trading price on Spotlight Stock Market, such that it justifies the expenses related to issuing the subsequent offering.

Receives Committed Grant Offer to Further Development of the Company’s Diagnostic Platform

Genetic Analysis also announced that the Company has received a committed grant offer from Innovation Norway related to further development of the Company’s diagnostic product related to Clostridium difficile. The grant amounts to NOK 1.125m and is conditional on the Company raising at least NOK 2.5m in proceeds from an equity offering, which will be fulfilled if the directed issue is approved.

Proposals for two new Board Members

Genetic Analysis also announced proposed changes to the Board, as the election committee has proposed the appointment of Mr. Morten Jurs as the new Chairman of the Board, and Mr. Ove Öhman as a new board member. The proposed change in leadership follows the decision by Dr. Jethro Holter, the current Chairman, to step down from his role and not seek re-election. Dr. Holter’s decision is a result of his new role as CEO of AdjuTec Pharma, which he wants to focus on full-time going forward.

Analyst Group considers the newly proposed board members to have relevant experience to drive Genetic Analysis continued focus on further commercializing the GA-map® platform. Moreover, the proposed new board members are subscribers in the directed rights issue, as Morten Jurs will subscribe for NOK 0.3m and Ove Öhman will subscribe for NOK 0.5m, which instills further confidence.

In conclusion, Analyst Group considers the announced directed share issue as no major surprise, as we expect the Company to continue to invest in commercial activities for the GA-map® platform, with an increased focus on the US market, which we consider a good strategic investment for the Company’s future growth. However, given that the subscription price is based on the average volume-weighted trading price up to and including April 24th, the directed issue is made at a discount of 59% compared to the closing price of NOK 2.12 on May 2nd, as the share price increased between April 24th and the announcement of the directed share issue. Existing shareholders who do not participate in the directed share issue are intended to be offered the opportunity to subscribe for shares at the same price as the directed issue, NOK 0.86, in a subsequent offering. Nevertheless, the directed issue results in a dilution effect of 30% for existing shareholders.

Comment on Genetic Analysis Launch of a Consumer Test to the Chinese Market

2025-04-22

On April 22nd, Genetic Analysis AS (“Genetic Analysis” or the “Company”) announced that the Company are launching a microbiome test for the Consumer Health (D2C) market in China in collaboration with Thalys Medical Technology Group Corporation (“Thalys”). The test is based on GA’s clinically validated microbiome test, the GA-map® Dysbiosis Test, but specifically adapted to suit the Chinese market, with additional tests expected to be launched by Thalys based on the Genetic Analysis platform in the future.

Analyst Group’s View of the Launch

In January 2022, Genetic Analysis announced the collaboration with Thalys to evaluate and develop innovative diagnostic solutions for the rapidly growing human microbiota market in China. The recently announced launch of a consumer test marks the first step of the collaboration between Genetic Analysis and Thalys, with additional tests expected to be launched by Thalys based on the Genetic Analysis platform in the future. As previously announced in the initial collaboration agreement from 2022, Thalys will distribute the tests via its new Independent Clinical Lab (ICL) in Shanghai, while Genetic Analysis will supply the partner with reagent kits.

The launch establishes the Company’s first commercial presence in the large and fast-growing Chinese market. Additionally, the business model of providing Thalys with reagent kits and proprietary software is assessed as low risk while providing potential for high margins. The reagent kits are expected to have a high gross margin, Analyst Group estimates the Company’s gross margin on reagent kits to fluctuate between 75–80 % in the coming years. As revenue will be generated based on the number of tests sold, while Genetic Analysis is not required to make any additional financial investments as part of the collaboration, the launch enables a low risk business model while having the potential to generate significant revenue, given a successful launch.

The Chinese D2C microbiome testing market is expanding rapidly and, depending on the source, the market is expected to grow from USD 50–80m in 2023 to USD 200–300m in 2030, corresponding to a CAGR of 20–30 %. Growing recognition of the microbiome’s vital role in human health is a key driver of China’s consumer microbiome testing market, and advances in e-commerce and digital health platforms have made these services more accessible and scalable. Combined with increased interest in personalized wellness, these factors are accelerating market adoption.

However, the recent increase in consumer testing has raised concerns regarding reliability, as many consumer tests are not regulated in the same way as laboratory-based diagnostics, thus providing high variability in results. Through the GA-map® platform, the Company’s DTC product is expected to address several of the current challenges in the consumer market, as the platform features validated microbiome diagnostic technology that compares results to a predetermined reference range developed through clinically validated studies. At the same time, it remains user-friendly and delivers fast results. User-friendliness is further enabled through Thalys’ mobile software, where customers may easily subscribe, pay, and view report results on their mobile devices.

In conclusion, Analyst Group views Genetic Analysis’ initial launch in the vast and fast-growing Chinese market positively. Thalys is considered to be a strong partner for the launch, with expertise in China’s healthcare ecosystem. The risk-reward profile is seen as attractive for Genetic Analysis in a business model where the Company supplies Thalys with reagent kits, while the partner is expected to be responsible for commercialization. Although competition is expected to be intense given the appealing market growth, Genetic Analysis and Thalys are assessed to hold competitive advantages, primarily through the diagnostic approach utilizing the GA-map® platform.

About Thalys Medical Technology Group Corporation

Thalys Medical Technology Group is a Chinese healthcare company specializing in diagnostic testing and laboratory solutions for hospitals. Founded in 1998 in Tianjin and listed on the Shanghai Stock Exchange since 2016, the company has grown into a major provider of integrated IVD (in vitro diagnostics) services. Thalys operates across more than 200 cities in China, supplying products and solutions to around 2,000 hospitals and 200 hospital laboratories. Its services range from supplying diagnostic reagents and lab automation systems to offering full medical supply chain management.

Thalys also owns and operates Thalys MedLab (TML), a high-tech, third-party medical testing laboratory based in Shanghai. TML offers a wide variety of diagnostic and precision medicine testing services to hospitals, research institutions, and pharmaceutical companies. The lab collaborates with international partners in cutting-edge technologies, including single-cell analysis and microbiome diagnostics. Thalys MedLab combines clinical application with scientific research, playing an active role in advancing precision diagnostics in China.

Analyst Group Initiates Equity Research Coverage and Comments on Genetic Analysis Q4-24 report

2025-02-27

Analyst Group initiates equity research coverage on Genetic Analysis AS (“Genetic Analysis” or the “Company”), which includes equity research coverage with, among other things, equity research reports with quarterly updates, comments on press releases and CEO interviews.

About Genetic Analysis

Genetic Analysis is a Norwegian diagnostic company with more than 15 years of experience in research and product development within diagnostics of the human microbiome. The Company has developed the diagnostic platform GA-map for the analysis of human microbiomes. This platform provides cost-effective, standardized, and consistent results, forming the basis for diagnosing patients’ microbiomes. Test results are published directly via the Company’s software, eliminating the need for additional resources to interpret the data.

The business model includes recurring revenues from the sales of reagent kits and software to laboratories, as well as revenue from services offered by the Company’s service laboratory for users who do not have the necessary instrumentation for analysis. The Company’s current operations focus on the EU, the US, and Asia.

Three Reasons as to Why Genetic Analysis is an Attractive Investment:

User-Friendly and Efficient Platform Enables Growth Opportunities

The microbiome testing market is currently characterized by non-standardized, research-based tests. Through standardized technology, routine analyses are expected to be performed more efficiently while also providing improved conditions for an accurate diagnosis of the microbiome. Genetic Analysis aims to change this with the Company’s GA-map platform. The Company is the first to develop a CE IVD-marked (In Vitro Diagnostic) product for mapping microbiomes. GA-map is considered user-friendly and offers an automated comparison against a predefined microbiome within a ”healthy range,” while test results are published directly via the Company’s software, eliminating the need for additional resources to interpret the data.

A Platform Strategy Driving Recurring and Growing Revenues

Genetic Analysis’ business model is based on the Company’s GA-map platform, where the primary revenue driver today is sales of reagent kits required to perform tests that serve as the basis for diagnosing patients’ microbiomes. As more laboratories adopt the platform because of the user-friendliness with immediate result publication through the Company’s software, sales of reagent kits are expected to increase, generating recurring revenue streams for Genetic Analysis with high gross margins, amounting to ~83% in Q4-24. During 2024, sales of the reagent kits GA-map Dysbiosis Test grew 37%, which we see as proof of the potential with Genetic Analysis business model starting to materialize. Moreover, Q4-24 marked a breakthrough quarter for Genetic Analysis regarding profitability, being the first positive EBITDA result in the Company’s history, amounting to NOK 0.4m.

Increasing Interest in the Role of Microbiome in Health and Disease Drives Strong Market Growth

The human microbiome has been referred to as a ”newly discovered organ,” and in recent years, research has emphasized the interplay between gut health and the immune system, highlighting its essential role in human well-being. Moreover, several diseases have been linked to alterations in the composition and function of the microbiome. Given these insights, strong market growth is projected in the coming years. Global Market Insights estimates an annual market growth rate of 25.7% from 2024 to 2032, reaching a valuation of USD 6.5bn by the end of the forecast period. The primary growth driver is expected to be advances in research, which have revealed the microbiome’s potential in therapeutics, particularly for the treatment of infectious diseases, metabolic disorders, and immune-related conditions.

Genetic Analysis patented platform GA-map was used to develop and commercialize the first clinically validated and CE-IVD approved test for microbiome analysis, the GA-map Dysbiosis Test. The Company also has several patent families covering platform technology, algorithms and profiles related to treatment outcome. More players in the microbiome field are expected to seek clinically validated solutions with CE-IVD approval, given the attractive opportunities presented by market growth. However, Genetic Analysis holds a first-mover advantage, as the GA-map Dysbiosis Test is well-documented with more than 50 peer-reviewed publications and over 70 clinical studies, which Analyst Group considers a strong competitive advantage and validation of the platform.

Genetic Analysis published the Company’s interim report for the fourth quarter of 2024 on February 26, 2025.

Below are some highlights of the report:

- New sales record – net sales reached NOK 6.2m

- The EBITDA result amounted to NOK 0.4m, the first quarter with a positive result

- New collaboration with Ferring Pharmaceuticals to develop a new rapid microbiome diagnostic test

- Stable financial position

Strong Growth and new Sales Record

Genetic Analysis sales amounted to NOK 6.2m during Q4-24, corresponding to an increase of 63% compared to the same period last year. The Company’s core product, the GA-map Dysbiosis Test kits sales constituted of approx. 71% of sales, reaching NOK 4.4m during Q4-24, corresponding to a 49% growth. The majority of the remaining 29% came from sales of testing services, which is assumed to be sales from Genetic Analysis own service laboratory. Sales from services amounted to NOK 1.7m (0.8), corresponding to a growth of 115%.

For the full year 2024, sales amounted to NOK 15.9m (14.1), corresponding to a growth of 12 %. During 2024, Genetic Analysis executed a new strategy in which the Company has discontinued instrument sales, which instead is handled by the manufacturer. As a result, sales from instruments amounted to NOK 0.1m (1.5) during 2024. This strategic shift is partly due to instrument sales being a low-margin business, and as the focus shifts towards 2025, only a minimal portion of instrument sales remains in the comparative figures. Combined with the strong sales momentum across other product categories in Q4-24, this creates favorable conditions for accelerated growth and profitability in 2025 according to Analyst Group.

First Quarter with Positive EBITDA Result

Q4-24 marked an important milestone as the first quarter with a positive EBITDA result, amounting to NOK 0.4m. However, it should be noted that other income, which includes research work and grants, amounted to NOK 1.2m, adjusted for this, the EBITDA result amounted to NOK -0.8m. The discontinuation of instrument sales strengthened the gross margin, amounting to 83.1% compared to 57.7% in the comparison period. With the new strategy we expect the gross margin to stabilize at this higher level going forward.

Moreover, the operating expenses amounted to NOK 7.2m (11.5), corresponding to a decrease of 37%, which strengthened the result. The decreasing cost base is attributable to the fact that one of the development projects, GA-map IBD Dx, is in a less costly phase, as well as that cost saving has been made. With strong sales growth, an increasing gross margin and decreased cost base, we see good potential for Genetic Analysis to improve results in the upcoming year compared to 2024.

Genetic Analysis and Ferring Pharmaceuticals to Launch Rapid Microbiome-Based PCR Test

At the end of Q4-24, Genetic Analysis and Ferring Pharmaceuticals announced a partnership to complete the development of a rapid microbiome-based PCR test, combining Genetic Analysis’ GA-map platform with Ferring’s Microbiome Health Index biomarker. This test aims to reduce processing time from weeks to hours, lower costs, and enhance standardization in microbiome diagnostics. Set for launch as a Research Use Only (RuO) product in H1-25, Genetic Analysis holds exclusive commercialization rights without royalty or milestone obligations to Ferring. The project is funded by Ferring, Genetic Analysis, and Innovation Norway.

The test will initially target patients suffering from Clostridioides difficile infection (CDI), which is a new disease area to target for the GA-map platform. The launch, expected during H1-25, is expected to drive growth for Genetic Analysis by adding a new product to the portfolio within a new disease area for the Company, along with the aforementioned advantages. The collaboration with Ferring Pharmaceuticals is also part of Genetic Analysis’ strategy to establish strong partnerships in order to reduce the need for independent financing of similar projects.

Strengthened Cash Position and Improved Result Instills Confidence in the Financial Position.

The cash balance at the end of Q4-24 amounted to NOK 13.4m, compared to NOK 11.4m at the end of Q3-24. The strengthened cash position is primarily attributable to a slight increase in liabilities as well as a decrease in receivables and inventory, affecting the cash position positively. Genetic Analysis’ results in Q4-24 instill confidence that profitability is progressing in the right direction, and with this in mind, we consider the financial position to be stable. However, it is important to emphasize that Genetic Analysis remains in an early phase of the Company’s commercialization, which entails uncertainties regarding future revenue generation. As a result, the cash position will continue to be a key factor for investors to monitor going forward.

In summary, Analyst Group believes Genetic Analysis delivered a breakthrough quarter during Q4-24, delivering sales growth of 63% and a positive EBITDA result. We see this as evidence that the updated strategy, with the discontinuation of instrument sales, is leading to improved profitability in the business model. We also see potential for Genetic Analysis to further enhance the Company’s financial performance in 2025.

Analyst Group will follow up with an equity research report on Genetic Analysis.

Aug

Interview with Genetic Analysis CEO Ronny Hermansen

Jun

Interview with Genetic Analysis CEO Ronny Hermansen

Apr

Interview with Genetic Analysis CEO Ronny Hermansen

Aktiekurs

0.9

Värderingsintervall

2025-09-05

Bear

0,338NOKBase

1,11 NOKBull

1,71 NOKUtveckling

Huvudägare

2025-06-30

Comment on Genetic Analysis Launch of GA-map® MHI GutHealth Reagent kit

2025-09-24

On September 24th, Genetic Analysis AS (“Genetic Analysis” or the “Company”) announced the launch of the GA-map® MHI GutHealth Reagent kit as a Research Use Only (RUO), which makes the test available for Luminex xMAP® users globally. The test provides an advanced tool for measuring antibiotic-induced microbiome imbalances and has been validated for recurrent Clostridioides difficile infection (rCDI).

Analyst Group’s View of the Launch

In December 2024, Genetic Analysis first announced the collaboration with Ferring Pharmaceuticals to develop a new rapid microbiome diagnostic test, aiming to provide increased standardization in a quickly evolving field of microbiome life science. The test, which has now been launched, combines Genetic Analysis’ GA-map® platform with Ferring’s Microbiome Health Index biomarker. The GA-map® MHI GutHealth test is expected to reduce processing time from weeks to hours, lowering costs, and enhance standardization in microbiome diagnostics. Initially, the test will be used for rCDI patients to assess microbiome imbalances and monitor treatment effects during microbiome restoration.

On July 29th, the Company announced the launch of the test in the USA through a collaboration with Pangea Laboratory LLC (“Pangea”), where the test is available for analysis in Pangea’s laboratory. Through today’s launch, the test will be available for Luminex xMAP® users globally as the test utilizes the unique Luminex xMAP® technology for targeted and effective multiplex analysis. Luminex instruments s already widely used in laboratories globally.

Hence, the business model for Genetic Analysis regarding the test follows a similar structure as other products in the Company’s portfolio, which is to implement the GA-map® platform at customer sites, primarily laboratories that conduct tests to diagnose human microbiota and uses Luminex instruments. To perform tests, reagent kits from Genetic Analysis are required, which is the primary revenue source for the Company and as consumables, they contribute to recurring revenue with a gross margin of around 80-85%, paving the way for a scalable business model.

As we have previously emphasized, Analyst Group sees the collaboration with Ferring Pharmaceuticals as a validation of the anticipated market shift towards a more diagnostic approach on the rapidly growing human microbiome market, as the test initially is targeting patients with recurrent Clostridioides difficile (rCDI). The Microbiome Health Index™ (MHI), developed by Ferring, is a clinically validated biomarker that quantifies the balance between pro-inflammatory and anti-inflammatory bacteria in the gut. Its relevance has been demonstrated in patients suffering from rCDI, which is eligible for treatment with Ferring’s Rebyota® drug, the first fecal microbiota product approved by the FDA.

Through GA-map® MHI GutHealth, clinicians will be equipped with a rapid diagnostic approach for initial evaluation of microbiome dysbiosis, as well as longitudinal monitoring of therapeutic response during treatment. In the United States alone, recurrent Clostridioides difficile infection (rCDI) affects an estimated 500,000 individuals each year. Approximately 35% of primary CDI cases progress to recurrence, a condition linked to as many as 30,000 deaths annually, which demonstrates the need for functional diagnostics and medication, creating an attractive business opportunity for Genetic Analysis.

As mentioned in our comment on the initial launch of the test together with Pangea on July 29th, the test is expected to drive growth for Genetic Analysis by adding a new product to the portfolio within a new disease area. While a significant financial impact is not anticipated in the coming quarters, as test sales are expected to scale gradually, we see substantial long-term potential in the recently launched test— particularly in terms of its future use in monitoring treatment outcomes following administration of microbiota-based therapies such as Rebyota®.

In conclusion, Analyst Group views the launch of GA-map® MHI GutHealth as a strategically important milestone for Genetic Analysis, adding a high-margin, recurring revenue product within a new disease area. The collaboration with Ferring Pharmaceuticals validates the growing shift toward a diagnostic approach in the rapidly expanding microbiome market. Although the financial impact is expected to be gradual in the near term, the test addresses an unmet need in diagnostics of recurrent Clostridioides difficile infections, positioning Genetic Analysis for substantial long-term growth and market penetration.